Seasonal COVID pressures had prompted many euro area governments to increase restrictions even before the emergence of Omicron. The new variant could pave the way for more widespread measures. The picture may begin to look increasingly stagflationary – extra measures would drag on GDP and mean that inflation could be higher for longer. However, euro area economy has shown that it can bounce back quickly and this is likely to remain the case. We would see no reason to expect a higher degree of long-term economic scarring at this stage, even if it is to be another tough winter.

COVID restrictions were being tightened even before Omicron

It is still very unclear how severe the Omicron variant will prove to be for the euro area economy. Initial data from South Africa suggests that it is more transmissible but we don’t know if it causes more or less severe symptoms than Delta or if existing vaccines can provide the same degree of protection.

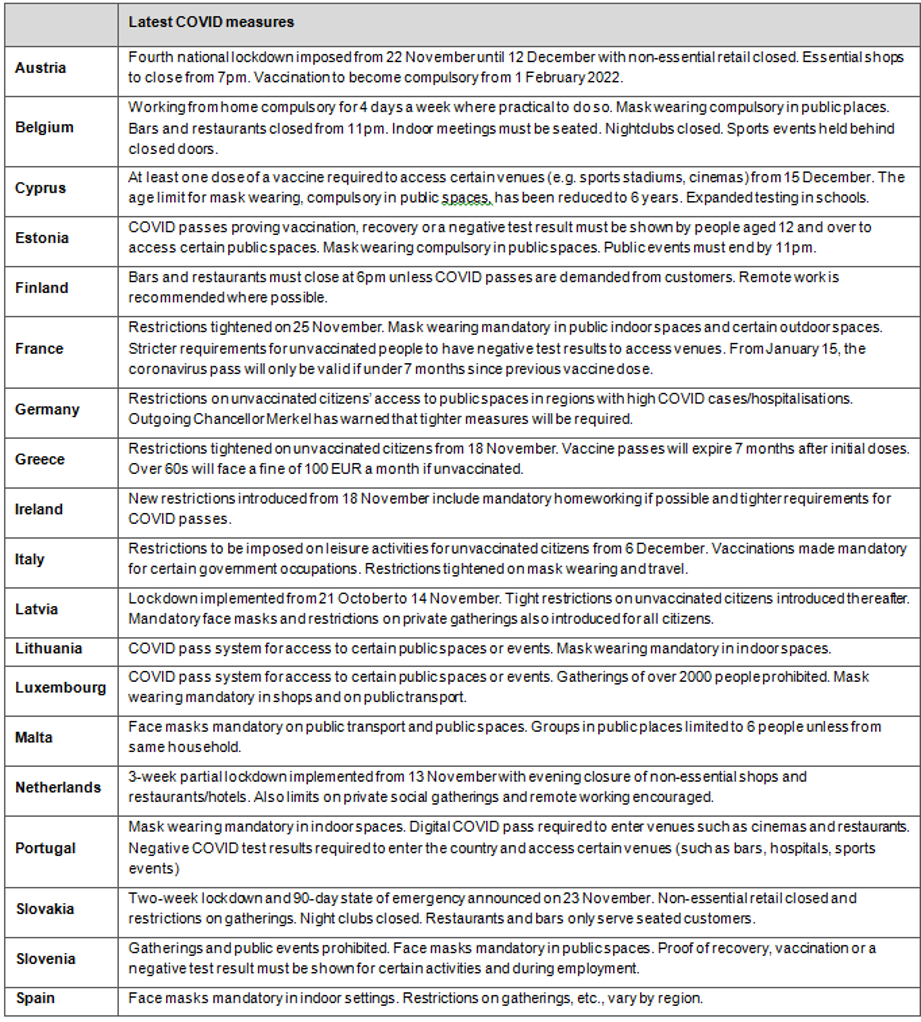

However, many euro area governments had been ratcheting up COVID restrictions even before the emergence of Omicron, with caseloads in some countries increasing rapidly as we enter the northern hemisphere winter months. Austria and the Netherlands have implemented full or partial lockdown measures last month. Other governments have introduced stricter requirements for unvaccinated people and measures such as restrictions on gatherings and new rules on mask wearing (see Table 2 at the end of this document). Despite this, current measures across the euro area remain less stringent than at the start of this year (see chart below right).

COVID CASES HAVE REACHED ALL-TIME HIGHS IN MANY COUNTRIES

Source: ECDC, MUFG Bank Economic Research Office

RESTRICTIONS HAVE BEEN TIGHTENED BUT REMAIN LOOSER THAN AT THE START OF THE YEAR

Source: Oxford COVID-19 Government Response Tracker, MUFG Bank Economic Research Office

The new variant may or may not compound the seasonal spread of the virus. It could be weeks before we have reliable data on the effects of Omicron across a broad range of population groups. In the meantime, the emergence of a new variant could give political cover for governments to act, perhaps especially in the case of those that had previously been reluctant to tighten measures. The implementation of stricter measures in Austria and the Netherlands had been met with anti-lockdown protests but other governments may now find greater acceptance for a ‘safety first’ approach given the uncertainty around the new variant.

In an indication of how seriously the threat is being taken, policymakers have already acted quickly to implement travel restrictions to block flights from South Africa and neighbouring countries. These may buy a little time but it’s almost certainly too late to prevent community spread of Omicron: as of Wednesday the variant had already been detected in eight euro area countries.

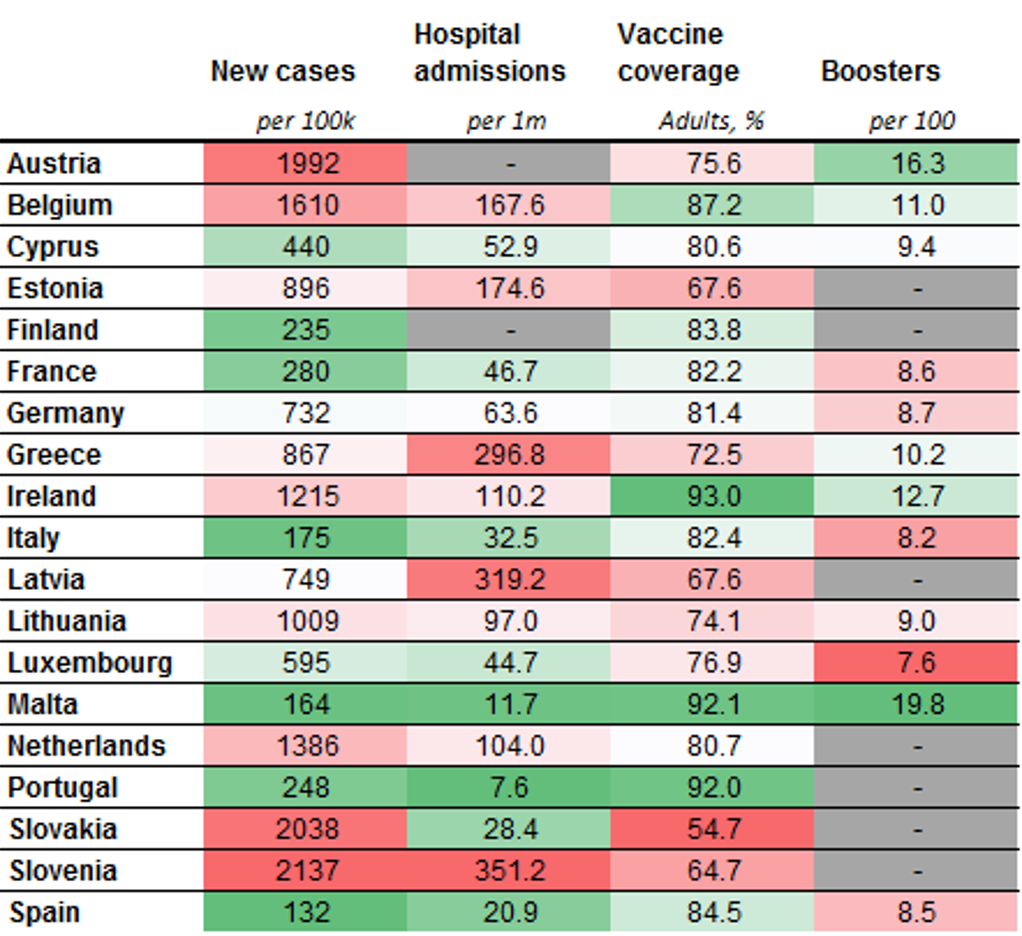

TABLE 1:THE CURRENT SITUATION VARIES ENORMOUSLY BY COUNTRY

Source: Our World in Data, ECDP, MUFG Bank Economic Research Office

Stagflation risks set to move into greater focus

It’s still far too early to assess the direct threat to the economy from Omicron. But we know that, while the effect of restrictions on the economy has weakened over time as measures become much more targeted, lockdown measures remain hugely significant for GDP figures. If Omicron does indeed compound the seasonal spread of COVID and prompt tighter national measures then this will be reflected in the Q4 figures. Of course, any GDP projection at this stage should be taken with a very large pinch of salt. For what it’s worth, we are currently pencilling in growth of around 0.5% Q/Q in the euro area as a whole, which would be a significant slowdown from 2.2% Q/Q in Q3 this year. Governments had already been implementing tighter restrictions and we expect measures will continue to be expanded over coming weeks. The already-announced expansion of travel restrictions, and household caution around the increased possibility of further restrictions in the future, will drag on the recovery of the tourism industry. Countries such as Austria, with a large travel sector geared towards winter sports, look particularly exposed.

With euro area inflation reaching 4.9% in November and European gas prices now rising again amid a cooler than usual start to the winter, the implementation of any new restrictions would also increase stagflation concerns. As well as potentially contributing to slower growth in Q4, the emergence of Omicron could lead to higher inflation for longer. Supply bottlenecks, which had been showing some tentative signs of easing, could increase again if Omicron leads to factory closures and worker absence. There could also be a rotation from services consumption back towards goods, which are more sensitive to supply-chain problems and have shown considerably higher rates of inflation in recent months.

The good news is that the euro area economy has shown that it can bounce back quickly from restrictions. GDP is now just 0.5% below its pre-pandemic level and the macroeconomic impact of COVID waves has diminished each time as measures have become more targeted and households and businesses have learnt how to adjust. We see no reason at this stage to assume that another round of lockdown measures, if implemented, would increase the degree of economic scarring over the long term. After GDP growth of 5% this year, our latest forecast is for a figure of 3.7% in 2022, with a significantly lower carryover from Q4 2021 than we had previously assumed. But the rebound effect is set to remain relevant in H2 2022 and we expect that a similar level of GDP to our previous forecasts will be reached by 2023.

LOCKDOWN MEASURES HAVE BECOME MORE TARGETED TOWARDS CURTOMER-FACING SECTORS

Source: Eurostat, MUFG Bank Economic Research Office

FEW SIGNS YET THAT HOUSEHOLDS ARE BECOMING VOLUNTARILY MORE CAUTIOUS

Source: Google, Oxford COVID-19 Government Response Tracker, MUFG Bank Economic Research Office

Pressure on governments to speed up booster programmes

It’s unclear how households will react to this latest wave. Even in the absence of government restrictions, individuals may voluntarily change behaviour to reduce infection risks. Mobility data had shown some signs of this during previous lockdowns, but this is the first COVID wave since widespread vaccination coverage has been reached. The picture is very different to that of this time last year and vaccinated individuals, especially those that have had a recent dose, may be less voluntarily cautious about attending restaurants, etc., than was the case previously. However, vaccine coverage varies enormously by euro area country, ranging from just 55% of adults in Slovakia to over 90% in Ireland, Malta and Portugal (Table 1 above). It is the number of COVID hospitalisations that drive lockdown decisions so the threat to GDP is greatest in countries with low vaccination rates.

Omicron has also brought the waning immunity of vaccines into sharp focus. Progress on booster shots has been relatively slow so far (see comparison with the UK below). This is set to speed up. Governments are now reducing the recommended gap between second and third doses and will tighten restrictions on those who have not had a recent dose. In France, for example, the COVID pass (which allows access to various public places) will expire for adults have not received a booster seven months after the second dose.

HOSPITALISATIONS ARE INCREASED IN SOME COUNTRIES BUT RATES REMAIN RELATIVELY LOW

Source: Our World in Data, MUFG Bank Economic Research

EURO AREA COUNTRIES LAG BEHIND THE UK ON BOOSTER SHOTS

Source: Our World in Data, MUFG Bank Economic Research

Three Omicron scenarios

To reiterate, it’s too early to say what the effect of Omicron will be on the euro area economy. While it increases the risk of a tough winter, it may be some weeks before the picture becomes clear. At this stage, we are considering broad scenarios:

1) Moderate scenario: The variant is more transmissible than Delta but causes less severe illness and so the effect on hospitalisations is broadly similar. Some further restrictions are implemented but these are mostly focused on hospitality and travel industries. GDP slows in Q4 2021 and Q1 2022 but then rebounds as restrictions are lifted once seasonal pressures fade in the spring. Governments step up the pace of booster programmes. There is only a minimal increase in long-term economic scarring. (This is our base case at this stage).

2) Downside scenario: Omicron is significantly more transmissible than Delta and the protection from current vaccines proves to be much lower. With a sharp increase in hospitalisations, governments implement strict national lockdowns. At the same time, the degree of policy support is more limited as concerns around fiscal sustainability increase. Long-term economic scarring increases with unemployment rates remaining persistently high.

3) Upside scenario: While more transmissible, Omicron only causes mild symptoms for those that are vaccinated. It outcompetes other variants and allows governments to dismantle COVID restrictions in 2022. Life returns to ‘normal’, albeit with regular booster shots, and booming confidence supports consumption and investment. GDP returns towards its pre-COVID trend.

TABLE 2 : COVID MEASURES CURRENTLY IN PLACE IN EURO AREA COUNTRIES

Source: Government websites, Reuters, Bloomberg, national news sources, MUFG Bank Economic Research Office