To read the full report, please download the PDF above.

Middle East Daily

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd. and MUFG Securities plc

A member of MUFG, a global financial group

Middle East Daily

COMMODITIES / ENERGY

Oil extends slide as supply glut fears deepen ahead of OPEC+ meeting. Oil prices extended losses, as concerns over a growing global supply glut outweighed optimism from a recent US-China trade truce. Brent crude fell toward USD64/b, while WTI hovered around USD60/b. markets are bracing for the upcoming OPEC+ meeting, where members are expected to approve a modest 137,000b/ production increase, continuing a gradual return of previously curtailed capacity. The group has already restored around 2.2 million b/d ahead of schedule but now appears more cautious amid signs of oversupply. The IEA warned that the oil market could face a record surplus in 2026, deepening bearish sentiment. Despite improved trade relations between US and China, the US did not raise the issue of Russian oil sales with China, while Venezuela briefly drew attention as reports surfaced potential US action against Maduro-linked military targets.

Gold wavers as traders balance trade truce and rate outlook. Gold hovered near USD4,000/oz as traders digested the US-China trade truce, which offered short-term strategic rivalry. After rising 2.4% in the previous session, bullion slipped as much as 0.8% today, weighed by waning expectations of further Fed rate cuts and continued outflows from gold-backed ETFs, which saw six straight days of declines. While prices have fallen nearly 9% from their record high above USD4,380/oz earlier in October, the metal remains up more than 50% YTD, supported by strong central-bank purchases and persistent demand from investors seeking protection against economic and geopolitical risks. The World Gold Council reported a 28% q/q increases in central bank buying in Q3, highlighting gold’s enduring appeal despite short-term volatility.

MIDDLE EAST - CREDIT TRADING

End of day comment – 30 October 2025. Post FED the UST curve sold off 10bp across tenors setting up the trading day. Initially cash prices didn't reacted too much, partly the well-known price stickiness in EM from total return holdings, partly as many parts of the market have still a short base. However during the morning spread sellers and ETF outflows pressured prices with a sell/buy ratio of 2:1. In the afternoon with UST coming off the lows, flows became more two way again, but sellers still outstripped buying by 3:2 on the overall day. The long end is still trading strong compared to the 5-10y area. QATAR 50s for example traded last at 91.50 unch/-7bp with other bonds in the long generically 0.25pt lower and 5bp tighter in sovgns. Quasi sovgn bonds are dictated by their respective technicals and we saw a wide range of daily spread changes, MUBAUH belly was for sale in 30s-34s maturities 31s closed -0.25pt/-4bp. Against this long end bonds remained well bid trading unch/-7bp. Fins and corps were on the quiet side today. After big UST moves it usually takes 2/3 days for prices/spreads to normalise. However we still had a stronger day today against wider credit markets in DM as technicals remain strong for GCC.

MIDDLE EAST - MACRO / MARKETS

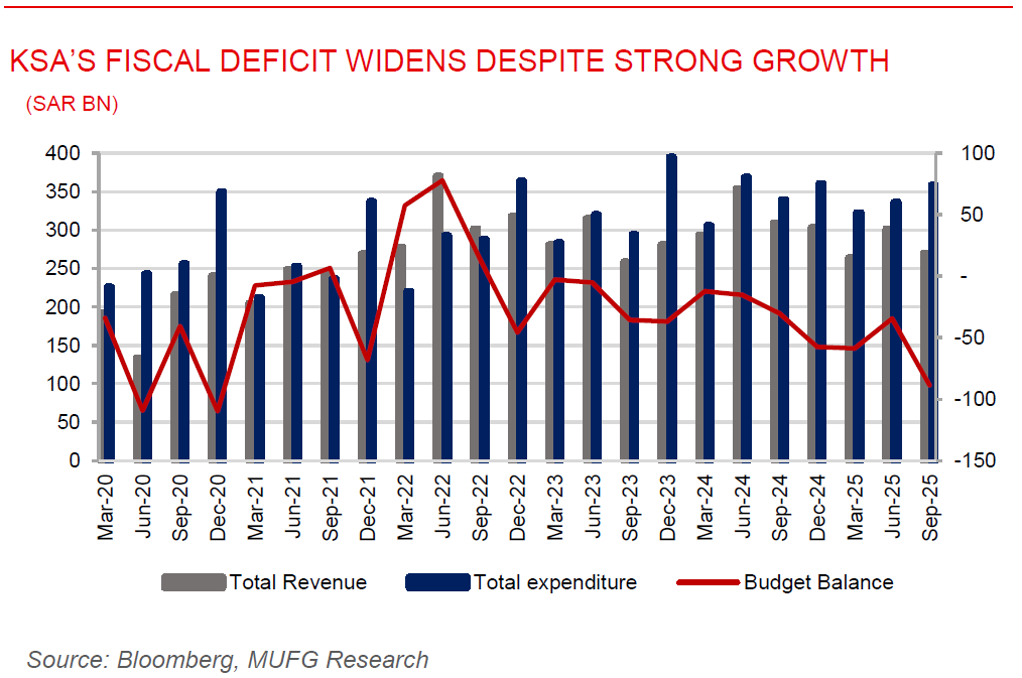

Saudi Arabia’s fiscal deficit widens despite strong growth. Saudi Arabia’s budget deficit widened sharply to SAR88.5bn (USD23.6bn) as lower oil prices and increased government spending placed renewed pressure on public finances. According to the Ministry of Finance, oil revenue fell to about USD40bn from just under USD51bn a year earlier, while non-oil revenue remained flat at roughly USD31.7bn, underscoring the challenges of diversifying income sources despite progress under Vision 2030. The government now projects a 2025 fiscal deficit equal to 5.3% of GDP, more than double the previously estimated 2.3%, citing rising expenditure linked to large-scale diversification and infrastructure projects, as well as subdued energy receipts. Brent are trading below USD70/b, well below the fiscal breakeven prices of USD92.3/b. although lower oil prices continue to strain fiscal balances, rising output and solid non-oil activity have lifted overall economic momentum, with preliminary figures from the General Authority for Statistics showing that Saudi GDP expanded 5% y/y in the Q3 2025, marking the strongest pace of growth since early 2023 and reflecting the Kingdom’s continued efforts to sustain growth even amid tightening fiscal conditions.

Egypt broadens VAT framework to strengthen fiscal sustainability. Egypt’s Ministry of Finance issued two decrees amending the VAT law’s executive regulations and clarifying tax treatment for construction contracts active after Law No. 157 of 2025. The reforms expand deductible inputs to include financial, construction, and administrative expenses, and extend VAT payment suspensions on imported or locally sourced production lines. These updates align with Egypt’s IMF-backed $8 billion reform program, aimed at boosting efficiency, transparency, and revenue. The government also broadened VAT coverage to sectors like construction, crude oil, and alcohol, targeting a 20.8% rise in VAT revenues to EGP 967.9 billion in FY 2025/26 as part of efforts to strengthen fiscal sustainability and advance Vision 2030 goals.