- The BoE cut rates again, as expected, but the extension of the quarterly easing cycle hides plenty of division at the MPC. Two members voted for a larger cut and two judged that current policy setting is appropriate.

- Crucially, the guidance (“careful” and “gradual”) was left unchanged. As it stands, we continue to expect that the current quarterly easing cycle will be extended through the year. That seems to be the path of least resistance, although policymakers emphasised uncertainty and the need for flexibility, leaving the door open to further cuts if conditions change.

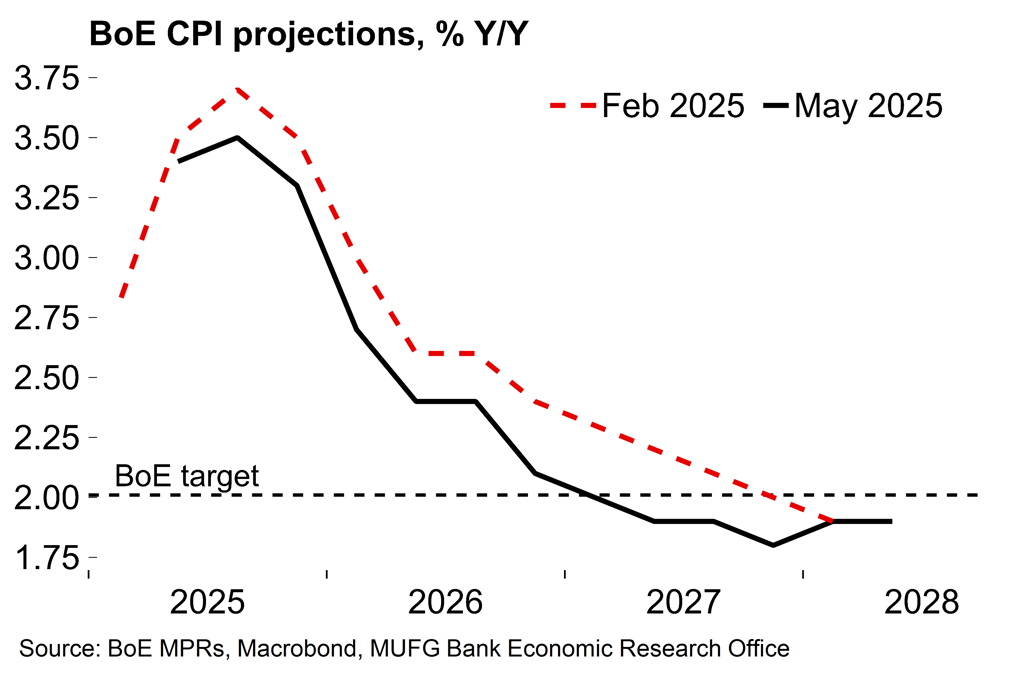

- The BoE downgraded its inflation forecasts, largely on the back of energy pricing, but upgraded its 2025 growth figures after the economy has started the year on a firming footing.

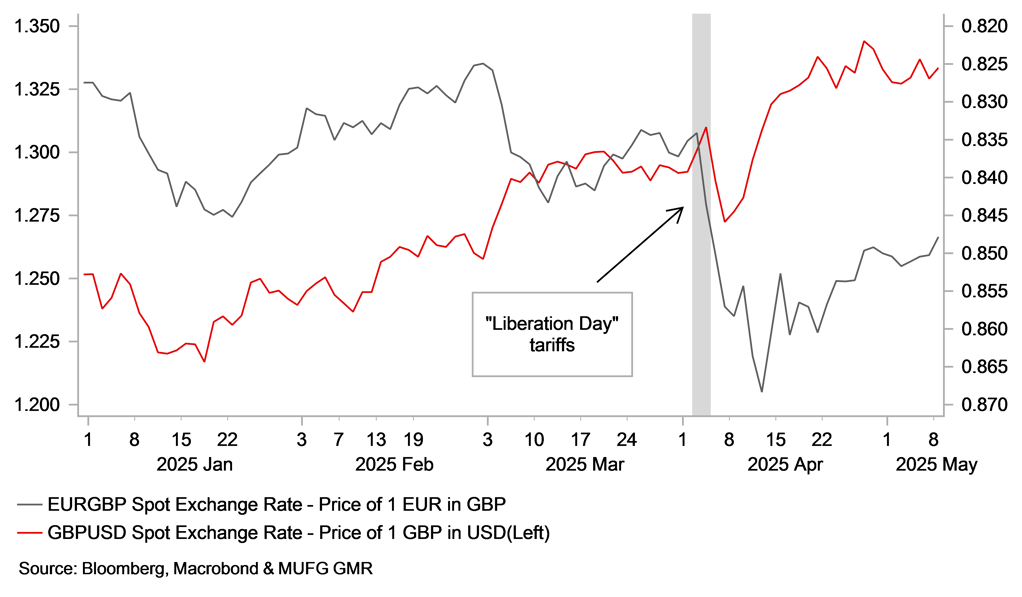

- The GBP has strengthened driven by the paring back of BoE rate cut expectations & investor optimism over a US-UK trade deal.

Macro view

Still “careful” and “gradual” – but the MPC seems deeply divided about risks surrounding the outlook

The Bank of England cut rates again, to 4.25%, as expected. This extended the gradual easing cycle with a fourth move at consecutive projection meetings. But the extent of the divergence in views at the MPC was laid bare with a three-way vote split – two members voted for a larger (50bp) cut and two voted to leave policy unchanged. We expected an 8-1 vote with all members in favour of a cut (see preview here).

Crucially, the BoE left the wording of its guidance unchanged, which was in line with our expectations. It was again noted in the statement that policy would need to “remain restrictive” and that there would be a “gradual and careful” approach to withdrawing restraint. While there were few signs of any dovish pivot to tee up a move at the next meeting in June, there’s a clear intention to stay flexible. The BoE understandably emphasised uncertain backdrop, noting “heightened unpredictability in the economic environment” and that monetary policy is “not on a pre-set path”. That leaves the door open to an acceleration in easing if required.

That said, it was interesting to note the suggestion in the statement that it might have been “finely balanced” whether a majority would vote for another cut at this meeting in the absence of US trade policy disruption. Combined with the surprise of two members voting against further easing, this looks like a slightly hawkish overall outcome.

All told, given the clear divergence in views, we assume that the path of least resistance is to continue along the well-established path of quarterly cuts at projection meetings, with the next move to come in August.

Faster growth, lower inflation – and it seems there is more good news on tariffs

The updated projections show a lower peak for inflation after the fall in energy pricing (the conditioning assumptions have a 14% lower oil price and 18% lower gas price year relative to the February numbers). The numbers now show inflation reaching target in Q1 2027. On tariffs, the MPR noted both upside and downside risks to inflation, but it seems to us that there is a broad assessment at the BoE that trade disruption will be ultimately disinflationary.

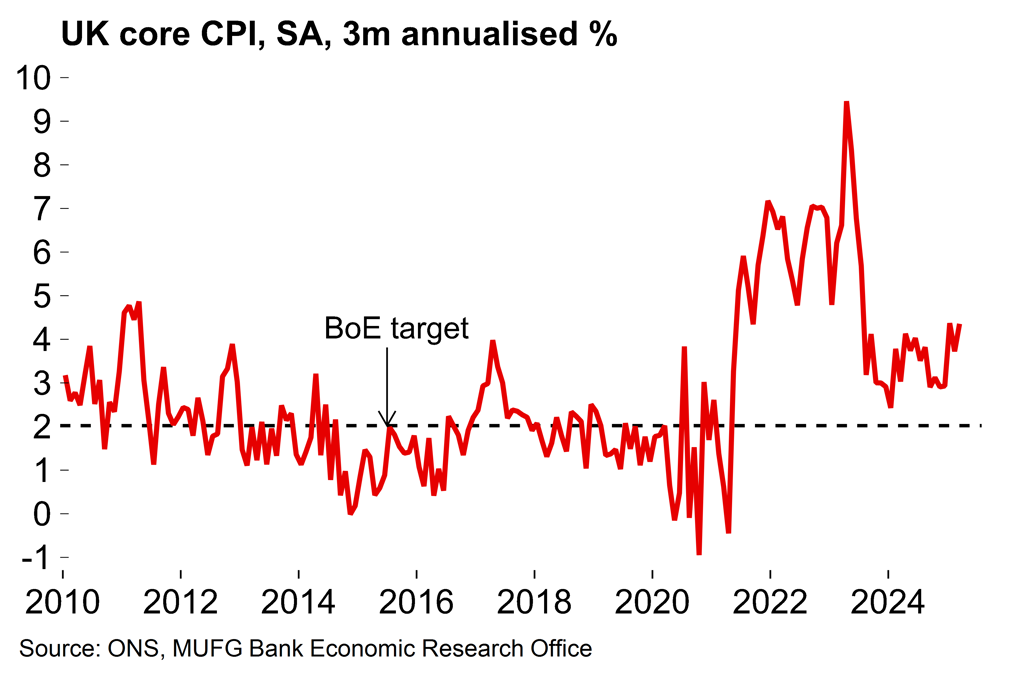

As highlighted in our preview, we see various reasons to remain cautious around domestic price pressures. The key April CPI report, which will incorporate a range of developments e.g. increases to minimum wage and employer national insurance contributions, is due 21 May. With added distortions from the late timing of Easter, we suspect some policymakers will want to see how the dust settles on those in subsequent prints before changing tack.

On growth, this year’s projection was revised up after the economy’s strong start to 2025. The BoE’s assessment of Q1 growth (0.6% Q/Q) is now in line with our current estimate. Indeed, the BoE’s annual growth projections (1.0% in 2025 and 1.25% in 2026, with the latter revised lower) now match our projections from April (see here).

A lower peak for inflation and faster return to target…

…but surveys are pointing to increased price pressures

Lastly, the US-UK trade deal (“full and comprehensive” according to Trump) is certainly relevant to the BoE. While the UK economy as a whole is not especially exposed to US goods demand directly, a reduction in tariff rates will support business sentiment, provided it’s seen as credibly durable. That may limit possible second-round effects from heightened uncertainty on the labour market.

Taking a wider view, the UK is more exposed to US demand for its services exports and hence vulnerable to a sharp US slowdown/recession scenario. The US outlook might improve if this initial trade deal marks the start of broader de-escalation on tariff policy by the US administration. Indeed, Bailey expressed hopes that the agreement “would be the first of many”.

Markets view

GBP lifted by UK-US trade optimism & paring back of expectations for back-to-back BoE rate cuts

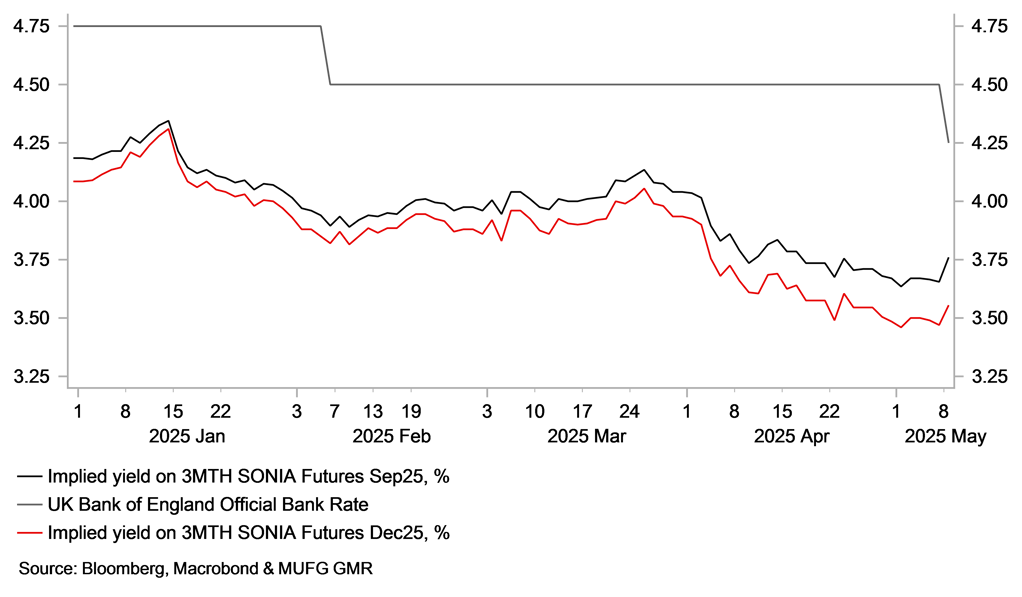

The GBP has strengthened after today’s MPC meeting helping to lift cable back above 1.3350 and reversing most of the losses since yesterday’s hawkish FOMC policy meeting (click here). Similarly, EUR/GBP has dropped back below the 0.8500-level. The GBP has been boosted by the scaling back of expectations for faster BoE rate cuts in the near-term which adds to upward momentum from earlier today triggered by reports that the UK is the first country to sign a trade agreement with the US to potentially water down 25% tariffs on autos, steel & aluminium. The UK rate market is now pricing in only around 6bps of cuts for the next MPC meeting on 19th June compared to around 15bps prior to today’s MPC meeting.

Market participants have been encouraged to scale back expectations for back-to-back rate cuts after the BoE decided to stick to guidance for “gradual” quarterly rate cuts which makes it more likely for the BoE to deliver the next rate cut at the 7th August MPC meeting. The decision to stick to the current quarterly pace of rate cuts reflects a lack of clarity over the inflationary impact of recent trade policy developments. While the BoE noted that “it was possible that the ultimate net effect of these developments could be materially more disinflationary for the UK than the baseline forecast”, they also acknowledged that “it was also possible that the effect could be slightly inflationary in the longer term”. Instead, the BoE preferred to emphasize that “it was too early to conclude” over the what period and to what degree different economic effects could materialize.

The heightened uncertainty over the outlook resulted in a more divided vote at today’s MPC meeting. The vote split still favours further rate cuts with 5 MPC members voting for a 25bps cut, 2 for a larger 50bps cut and only 2 voting to keep rates on hold. For the 2 MPC members who voted to leave rates on hold they noted that the UK rate market has already moved to price in around 40bps of additional easing reducing the need for a rate cut today. Overall, we still believe that the BoE has left the door open to faster rate cuts during the 2H of this year if it becomes more evident that the trade shock is proving more disinflationary for the UK economy potentially including weakness in the UK labour market in the coming months. A view that is still shared by the UK rate market which continues to expect the BoE to deliver more easing this year than two further 25bps hikes at the August and November MPC meetings. There are currently around 63bps of cuts priced in by the 18th December MPC meeting.

GBP is recovering lost ground against EUR

Paring back BoE rate cut expectations