- The BoE is likely to leave rates unchanged at 4.0% at its November meeting. We expect a somewhat dovish hold following the downside surprise on September CPI and further signs of cooling wage pressures, which are likely to be reflected in the updated projections. The vote is again likely to show considerable division on the MPC. We have pencilled in a 6-2-1 split with three dovish dissenters, including one calling for a larger 50bp cut.

- While recent data has been generally soft, it’s probably not quite weak enough for the BoE to continue its cut-hold pattern after communications have pointed to a slowdown in the pace of easing. There is a substantial amount of data still to come before year-end and officials are likely to want more confirmation that inflation is now on a sustained downward path. It also seems prudent to wait for clarity on upcoming Budget measures. We maintain our call for the next cut in December, and then see rates falling to 3.25% next year.

- This meeting will also see some notable communication changes stemming from the Bernanke review. The introduction of comments from individual MPC members in the minutes has clear potential to shape expectations around the pace and timing of future easing. With well-defined hawkish and dovish camps, the views of moderate members (and governor Bailey in particular) will be a key focus.

We continue to expect the next move will be in December

The BoE has gradually cut rates at its quarterly projection meetings from a peak of 5.25% to 4.00% currently, but the last move was extremely finely balanced (see here). Communications since then have suggested that a shift to a slower pace of easing is the likely compromise to acknowledge hawkish concerns about inflation persistence. Recent data, despite being generally soft, does not seem enough for policymakers to agree on extending the projection meeting cut cycle in November and we expect that the BoE will leave rates unchanged. Inflation is still well above target and a cautious BoE will likely be reluctant to declare that the UK is out of the woods despite the recent downside surprise on CPI. We maintain our call for the next cut to be in December (see here). There will be plenty of data between now and then to confirm the signals from both the latest inflation numbers and other UK data which has generally come in on the dovish side relative to the BoE’s expectations.

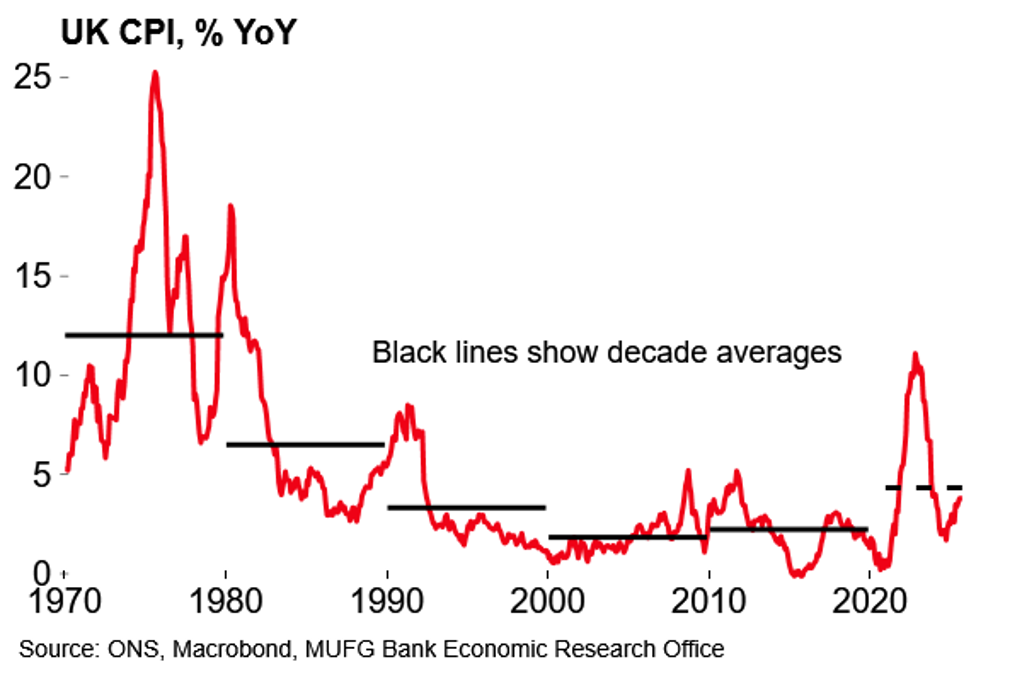

The main development has been the September CPI release which saw the headline rate remaining unchanged at 3.8% rather than peaking at 4.0% as expected. Upward base effects from energy were offset by a downward shift in food inflation (see here). Underlying pressures also continued to gradually ease. The BoE’s measure of services inflation excluding indexed and volatile components eased to 3.9%, the lowest rate since 2022.

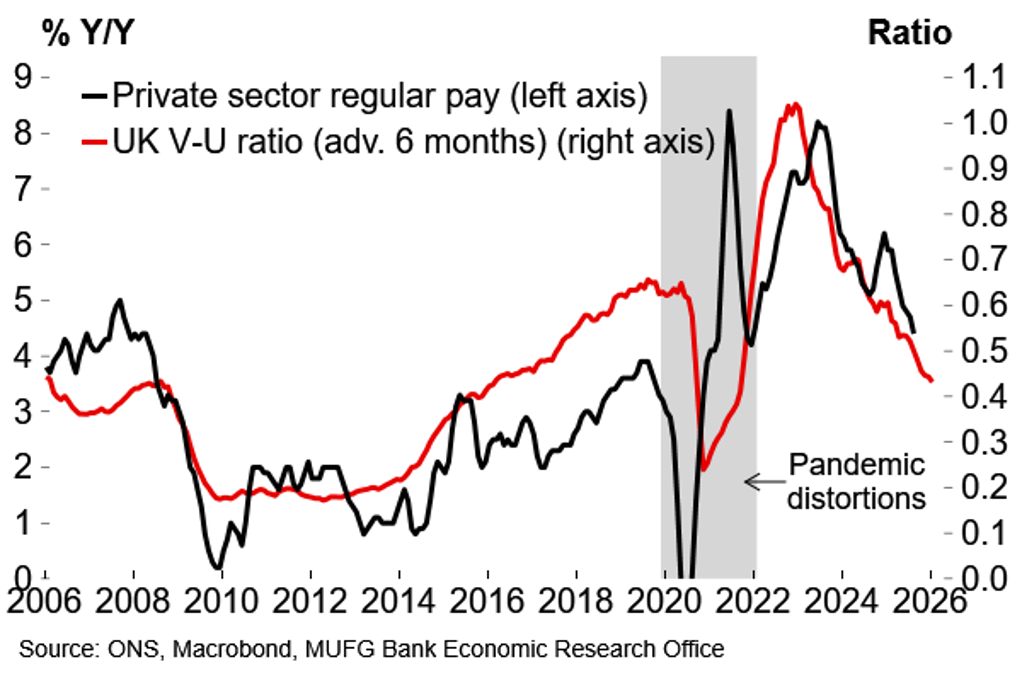

There have also been clearer signs of progress on wage pressures. One of the key wage metrics for officials, private sector regular pay growth, is set to undershoot the BoE’s projections after falling 0.3pp to 4.4% in August. At the same time, labour market slack continues to emerge, albeit at a more gradual pace, with payroll employment edging lower and vacancies decreasing. On the activity side, we noted at the time that the BoE’s expectation at the last meeting for 0.4% Q/Q growth in Q3 looked optimistic. With monthly estimates now available to August we are tracking a figure of just 0.2%, despite decent retail sales figures for September, which would confirm the slowdown from H1.

Pay growth is likely to continue to ease...

...but the long-term picture on CPI highlights the case for caution

But we do not think the data has been soft enough to force a continuation of quarterly cuts just yet, for several reasons. Firstly, it would mean backtracking on recent communications after officials, including governor Bailey, have strongly hinted that the pace of easing was likely to slow after the division in August. Second, we think it makes sense to wait to see if further data confirms the benign September inflation print – there will be two more CPI releases, as well as two labour market reports, between the November and December meetings. Policymakers will also have a better steer on 2026 annual pay settlements by year-end.

And then, thirdly, we also suspect that policymakers will want visibility on fiscal policy changes at the Budget (26 November) to see if there are any obvious distortive/inflationary policies after last year’s employer NICs increase. As well as fiscal changes, the government’s upcoming decision on the minimum wage will be significant. Reports have suggested that the government is considering an increase of around 4% next April, which would certainly be more tolerable from a monetary policy perspective after the 6.7% increase this year.

Given all that, there seems enough reason to hold fire for now – even if the likely direction on rates remains downwards. Our base case is that the BoE will leave rates unchanged in a dovish hold which leaves the door wide open to a cut in December. The core guidance (“a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate” and monetary policy not being on a “pre-set path”) still seems valid and will likely survive unchanged. However, apart from emphasising that the onus will be on the data, we don’t expect that the BoE will be minded to push back much against increased market expectations for a December move. The updated forecasts (i.e. a lower inflation profile) and discussion of the balance of risks will likely leave the door open for another cut before year-end in the absence of an upside surprise in October/November CPI numbers. Further ahead, we continue to expect a terminal rate of 3.25% next year.

Bailey remains key on a divided MPC

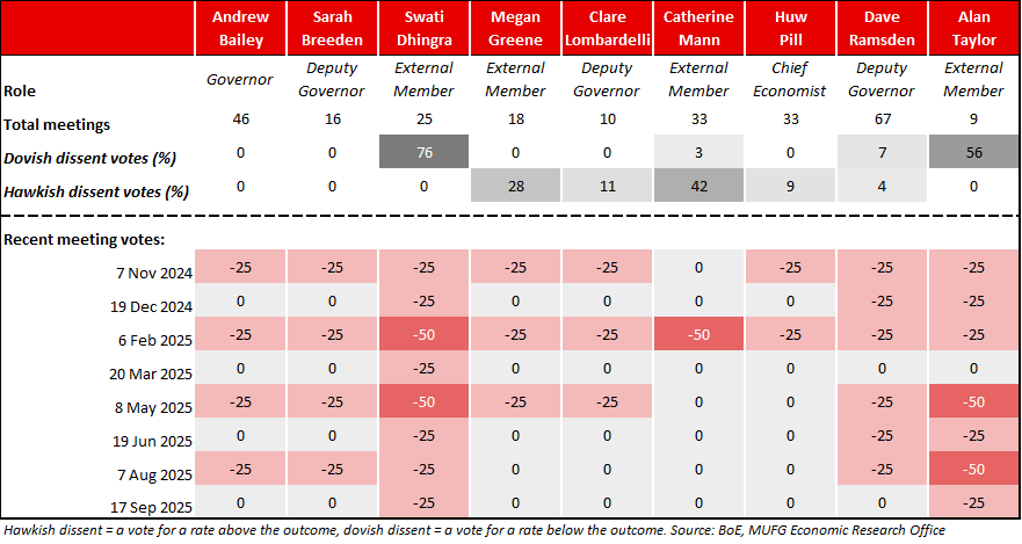

In terms of the vote split, the MPC is plainly divided into established hawkish and dovish camps around a more passive centre. There is a three-strong dovish contingent (Taylor, Dhingra and, with less conviction, Ramsden). All three are likely to vote for a cut at this meeting. We have pencilled in a 6-2-1 vote split with three dissenters for a rate cut with Taylor voting for a larger 50bp move.

After recent developments the balance of risks is tilted towards a closer vote, and a November cut cannot be entirely ruled out. The BoE has been happy to spring surprises this year and the argument would be that if more cuts are coming, why wait? Governor Bailey’s view is critical. He has communicated that the likely direction remains downwards but that it is a question of timing. We suspect Bailey’s vote would likely be mirrored by Breeden given that she has always voted with the governor. So a 5-4 vote split in favour of a cut is certainly not inconceivable. As we noted above, food inflation fell sharply in September, from 5.1% to 4.5%. This development certainly weakens the main hawkish argument around the risk of a large and persistent upward effect on household inflation expectations from rising food prices. But, again, we think it will make sense to wait for further data for confirmation, especially with volatility in food inflation not unusual. As Bailey said last month, the UK is not “out of the woods yet” with respect to inflation risks and a lot more will be known by December.

There will also be some notable changes at this meeting following last year’s Bernanke review, which may well provide more clarity. Chief Economist Huw Pill said that the BoE will update the Monetary Policy Report format from this meeting to cover “the wider range of perspectives and inputs considered by the MPC”. More significantly, the accompanying minutes will now provide space for each member to set out their individual monetary policy views. This could certainly help to shape rate cut expectations given the division on the MPC. Assuming policy is left unchanged next week, the views of more moderate voters (i.e. Bailey, Breeden) will be a particular focus when gauging the likelihood of a December cut.

Lastly, on the updated projections, we expect the general profile for inflation will remain unchanged but there will be some marking-to-market downward after the latest inflation print and lower energy pricing. Of course, there is an obvious shelf life issue – measures announced at the upcoming Budget could quickly render some of the projections outdated, so the usual comparisons with outturn data until February will probably be less relevant.

BoE MPC - Summary of recent votes