- Macro views: The ECB is set to deliver another 25bp cut this week, which would bring the deposit rate to 2.0%. We expect little change to the guidance with policymakers clearly keen to preserve optionality amid still-heightened uncertainty. Nonetheless it’s clear that the disinflation process has been bolstered by FX and energy price developments. In terms of underlying pressures, services inflation has been stubbornly high but wage data points to lower prints through the year. We expect that the ECB’s updated projections will show inflation undershooting the target across a large part of the horizon.

- Against that background we still see a terminal rate of 1.50% in the absence of negative shocks. But with rates now around neutral, the bar for further cuts is likely to be higher and we expect the ECB may slow the pace of easing. A shift to cuts at quarterly projection meetings (September, December) looks most likely to our minds, but a precautionary move in July before the summer break shouldn’t be entirely ruled out.

- FX views: A 25bp cut is fully priced for this week which suggests little rates and FX reaction. Hence the tone of Lagarde’s press conference outlining policy guidance will be key for near-term euro reaction. Even if guidance proves a little more dovish than expected, we doubt euro selling would be sustained beyond a very near-term knee-jerk reaction. Given guidance may also be balanced by hints a slower pace of rate cuts ahead, we do not expect this meeting to trigger any large moves in rates or FX.

Macro view: The reinforced disinflation process paves the way for more easing, but the bar for further cuts will be higher

Guidance | Staying flexible: The ECB is expected to continue its easing cycle at this week’s meeting with another 25bp cut – the eighth in this cycle. This would take the deposit rate to 2.0%, the midpoint of the range of ‘neutral’ estimates (1.75 – 2.25%) published by the ECB earlier this year (see here).

We don’t expect any significant changes in the ECB’s guidance at this meeting – i.e., it will take a “data-dependent” and “meeting-by-meeting” approach, without any pre-commitment to a particular rate path. Essentially, flexibility will remain the order of the day given the lack of clarity around the outlook.

Has uncertainty decreased from the “exceptional” levels cited by the ECB in April? Yes, in the sense that the US government’s de-escalation with China revealed some limits to its tariff agenda. But US trade policy vis-à-vis the EU still seems far from a stable equilibrium and there is little clarity around the path ahead for the various factors relevant to the ECB (e.g. the extent of the demand shock, EU retaliation and FX ).

Last week, the US Court of International Trade ruled that the US government cannot justify its reciprocal tariff plans under emergency economic powers (IEEPA) legislation. That ruling has now been paused by the US Court of Appeals and the US government has indicated it will look for the Supreme Court to overturn it. If that fails, there may be various ways to sidestep the decision (see here).

The initial court ruling came after headlines suggested that EU-US trade negotiations had accelerated after Trump’s threat of 50% tariffs on the EU. But the landing zone for an agreement remains small and it now seems less likely, to our minds, that the EU will be bounced into a bare-bones deal while the US government contends with domestic legal challenges.

That may also influence the EU’s retaliation plans. The initial court ruling does not apply to so-called Section 232 tariffs on cars, steel and aluminium. Trump has since announced that the tariff rate steel and aluminium will be doubled to 50% as of this Wednesday. As it stands, the EU will impose countermeasures to the original 25% US tariffs on metals (announced in March) on 14 July, and there will of course be fears that such a move could trigger tit-for-tat escalation.

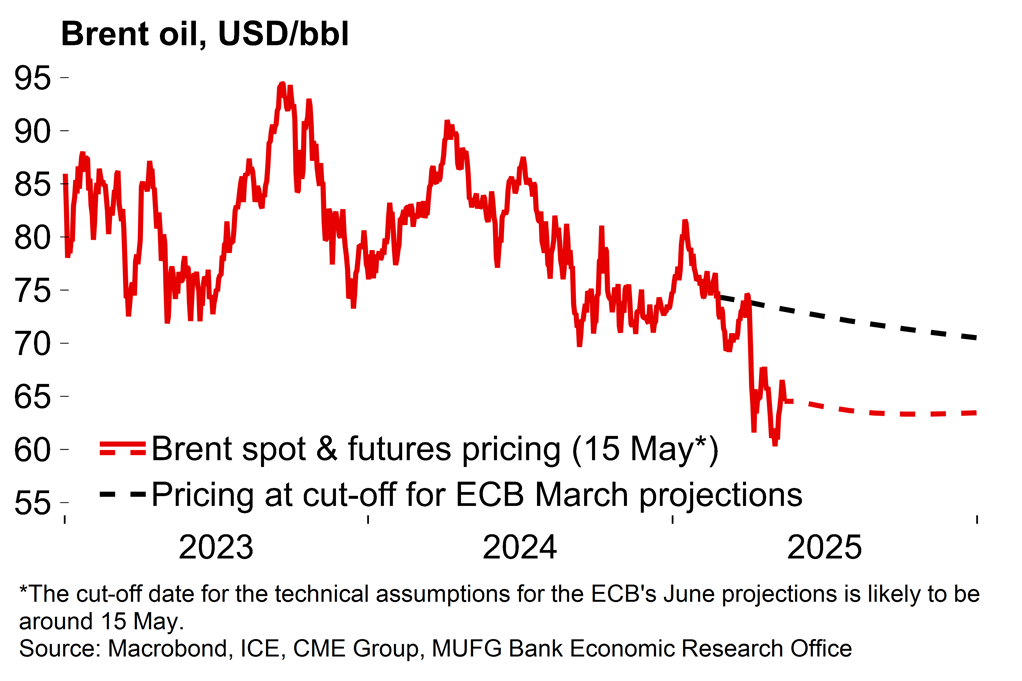

Lower energy pricing supports the disinflation process…

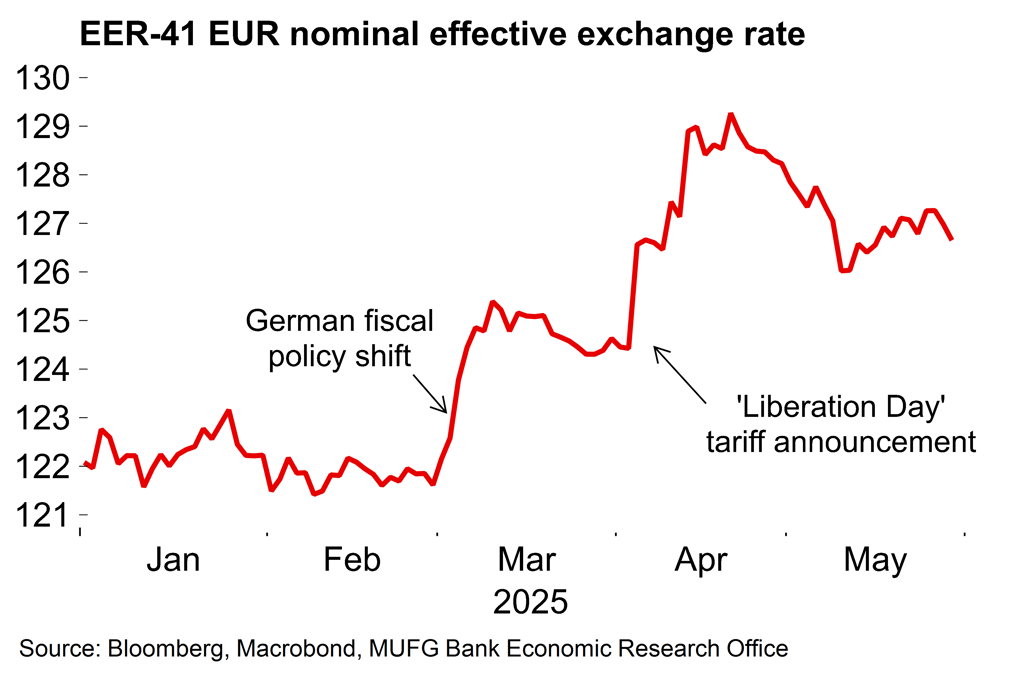

…as does the stronger euro

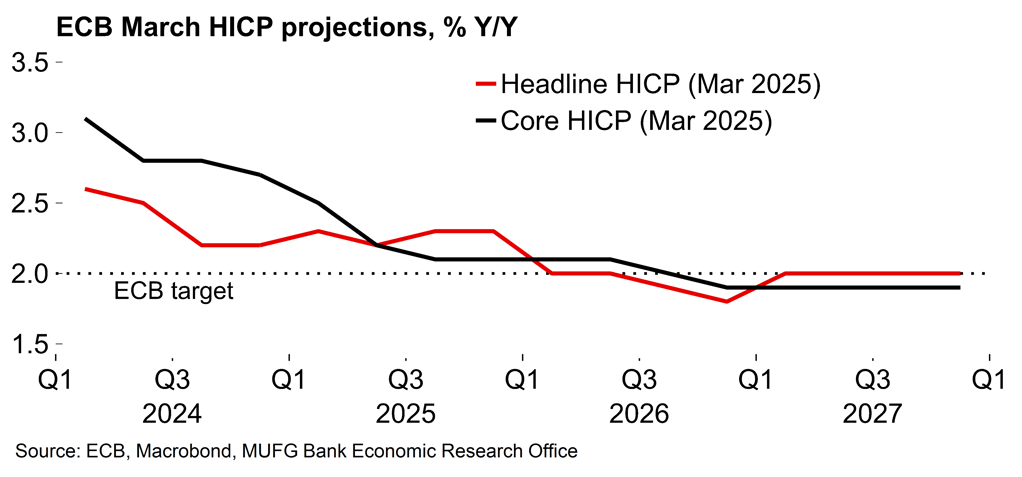

Projections | A lot has changed since March (or has it?): The ECB’s March projections showed both core and headline inflation at or below target from Q3 2026. Changes in the conditioning assumptions (stronger FX, cheaper energy) point to meaningfully lower headline numbers in the updated figures, and an undershoot is possible as soon as late-2025. But core pressures have been slightly stronger-than-expected over the near term and so there may only be minor adjustments there. Depending on the ECB’s interpretation, the shift in German fiscal policy (as well as the wider shift to greater European defence spending) may also support both the core numbers and GDP further ahead in the projection horizon.

On growth, a lot has changed since March – yet the 2025 growth figure (0.9%) actually still looks valid after the economy started the year strongly. Of course, part of that is due to trade distortions. The expenditure breakdown of Q1 German GDP (here) pointed to a clear boost from US front-loading in anticipation of tariffs, which recent survey data suggests may have continued into Q2. A subsequent reversal in H2 will likely weigh on growth and that points to a weaker carryover effect into the 2026 annual average figure.

Given the lack of clarity around the profile and composition of new German fiscal support, it’s unclear how the announcement, which wasn’t incorporated in the March numbers, will be factored into the ECB’s new euro area growth projections. But the previous number for 2026 (1.2%) is not far from our current estimate (1.1%) and, despite everything that has happened since March, we don’t anticipate significant shifts in the updated growth projections.

The updated projections are likely to show an earlier headline undershoot

Inflation outlook | Cooling wage growth bodes well for better services figures: If there is still one reason for the ECB to hold off from declaring victory on inflation it is the services component, which has been at 3.5% or higher since June 2022. The April figure surged to 4.0% after a lower March print on the back of distortions around the timing of Easter. Tomorrow’s release for May will be a more ‘normal’ print and a sub-3.5% reading is very conceivable after lower numbers in the national CPI prints for France, Italy and Germany last week.

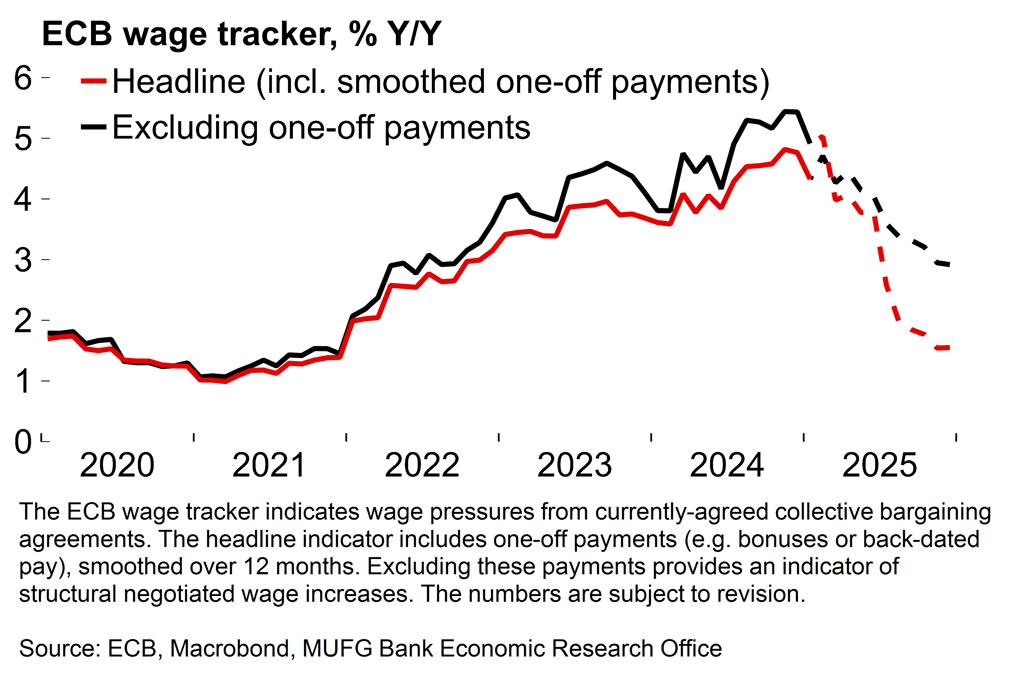

Looking ahead, we expect a general trend of easing services price pressures through the year. Business surveys suggest that heightened global uncertainty is actually affecting services sentiment more strongly than manufacturing. More fundamentally, the evidence continues to point to lower wage pressures in the euro area – in particular, the ECB’s negotiated wage growth numbers which have fallen sharply since the turn of the year. Persistent trade uncertainty seems likely to weigh on business investment and confidence, reinforcing disinflationary pressures and the lagged effects of monetary policy. It is also increasingly clear that lower profits have helped to buffer the impact of higher wage growth following the 2021-22 inflation surge, limiting the pass-through to prices. It’s hard to see that trend reversing given the weak demand backdrop.

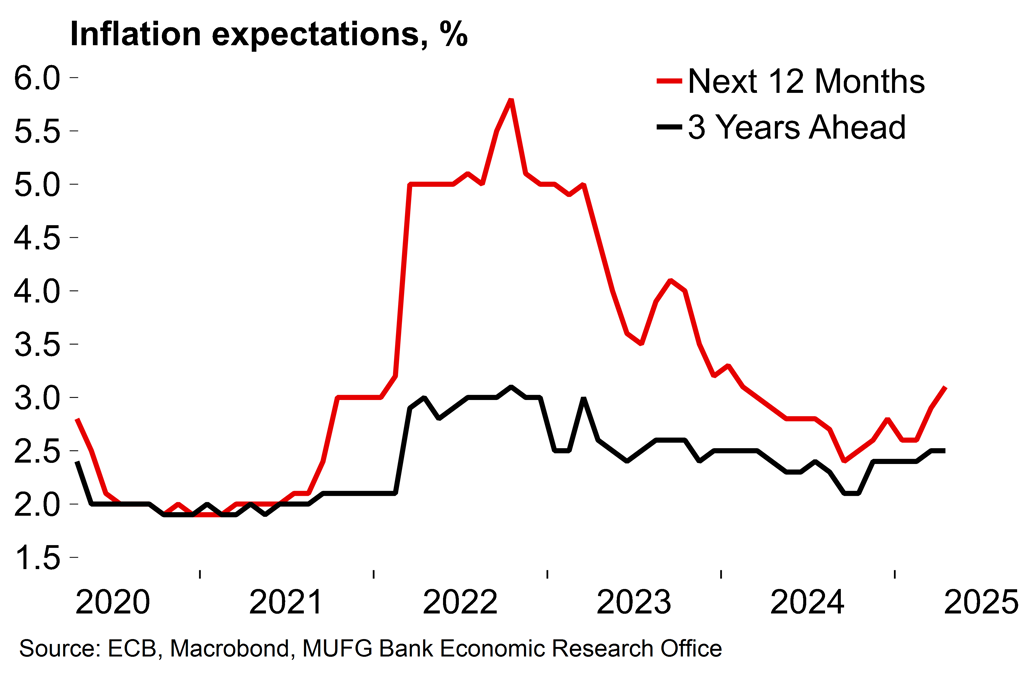

We also doubt that the ECB will be especially troubled by last week’s rise in near-term consumer inflation expectations (its year-ahead gauge has climbed from 2.6% in February to 3.1% in April) given the likelihood of lower headline numbers over coming months and that the fact that the three-year-ahead figure, which is less volatile, remains at 2.5%.

Policy outlook | More cuts to come, but at a slower pace: ECB president Lagarde predictably pushed back on the usefulness of assigning labels to the monetary policy stance after the last meeting in April, but chief economist Philip Lane seems to have fewer qualms about doing so. In an interview last week he said that “rates below 1.5 per cent are clearly accommodative” and that going there “would only be appropriate in the event of more substantial downside risks to inflation, or a more significant slowdown in the economy”.

Our view is that the bar for further cuts will seem higher once rates have reached the generally accepted neutral mark of 2%. We still see the terminal rate at 1.5% given the range of disinflationary pressures in the euro area, but expect that there could be a slower pace of cuts ahead. After the string of back-to-back cuts, we think there will now be a shift to a quarterly easing path at projection meetings (i.e. September, December). A July cut shouldn’t be ruled out at this stage, however. It’s a long gap between meetings over the summer and there will be arguments to ease policy on an insurance basis ahead of the break.

Wage pressures appear to be cooling sharply in 2025…

…but household inflation expectations have risen

Markets view: EUR well supported by factors beyond rate spreads

ECB policy update itself unlikely to prompt big FX move: With US dollar sentiment set to remain poor, the euro is likely to continue to be a key beneficiary. Hence, we doubt the ECB meeting this week will trigger any lasting appetite to sell the euro. While the ECB may well communicate greater confidence in achieving its inflation goal and publish inflation forecasts that are lower than before, any dovishness associated with that could be offset by hints of greater caution now that the policy stance has reached neutral. That message will help provide support for the euro and offset any selling appetite related to greater confidence on achieving the inflation goal and lower inflation forecasts.

There is also likely to be a degree of caution in the communication from the ECB given the elevated level of uncertainty. With EU-US trade negotiations ongoing and with the risk of a US tariff going live in July of either 20% or 50% which would have growth and monetary policy implications. Nonetheless, our sense currently is that ECB policy deliberations will have less of influence on the euro and broader US dollar sentiment will be of greater importance. Trade policy uncertainty, bond investors’ concerns over fiscal policy and an overvalued US dollar will continue to provide support for EUR/USD over the coming weeks and months. ECB President Lagarde stated last Monday (here) that there was currently a “window of opportunity” for the euro to take on a greater role as a reserve currency. We would expect President Lagarde to be asked about this speech and it’s likely Lagarde will repeat her comments which will be a signal of welcoming potential euro appreciation ahead.