- Macro view: The BoE is set to keep rates unchanged at this week’s meeting, and we don’t expect any shifts in the guidance. But this could be one of the more interesting ‘pause’ meetings in the cycle after recent data showed a shift toward softer labour market conditions and weaker growth momentum. Most notably, private sector pay growth has slowed and payroll employment appears to be falling.

- The dovish implications of this may be tempered somewhat by external developments. Since May, trade risks have eased and geopolitical developments are now pushing up energy prices. Against that background, the BoE will likely remain keen to preserve optionality and stress that policy is not on a pre-set path.

- However, recent domestic data has opened the door to some subtle shifts in messaging after a somewhat hawkish tone last time out. The vote split may also reflect greater confidence in the underlying disinflation process. We have pencilled in a 6-3 vote in favour of a hold. That would be a shift from the 8-1 split at the last ‘pause’ meeting in March and bolster expectations that the MPC as a whole will be comfortable extending its quarterly easing cycle through the rest of the year and beyond.

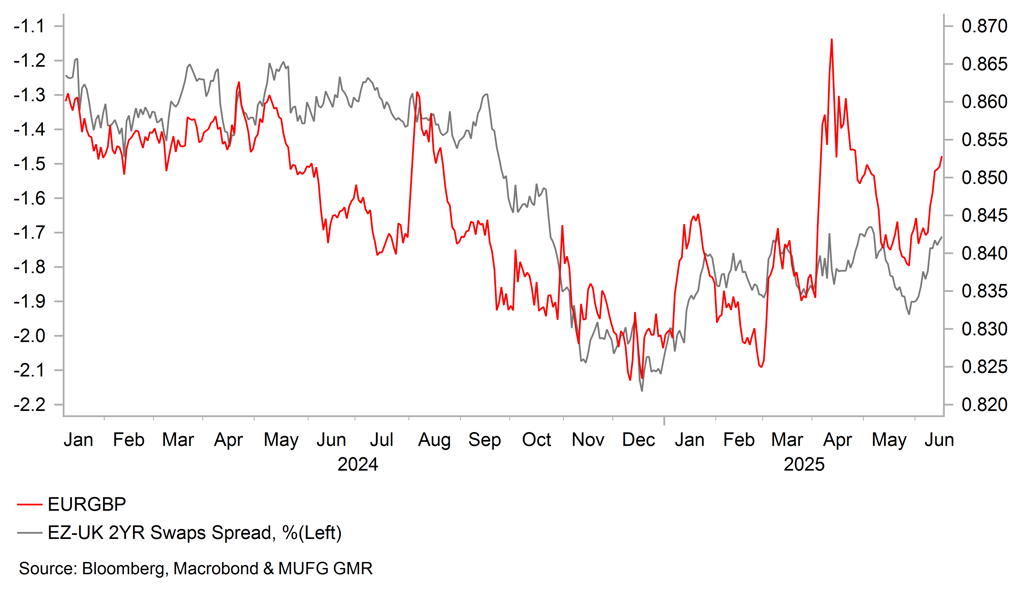

- FX view: The GBP has been trading on a softer footing heading into this week’s MPC meeting. EUR/GBP is currently on track to record its sixth consecutive higher daily closing price while cable’s upward momentum has stalled just below the 1.3600-level.

- If the MPC votes 6-3 to leave rates on hold with three dissents in favour of a another cut it should provide a trigger for the GBP to weaken further. However, the scale of GBP sell-off would be curtailed if there is no significant change in tone or guidance.

Macro view: Quarterly rate cuts remain the most likely path ahead

The dovish implications of looser labour market data are offset to an extent by external developments on trade and energy prices

The Bank of England is set to keep rates unchanged at 4.25% at this week’s policy meeting. We expect the guidance (“a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate”) will also be unaltered.

But this has the potential to be one of the more interesting ‘pause’ meetings in the BoE’s now well-established cycle of quarterly cuts at projection meetings. Policymakers will weigh up the implications of recent domestic data, which seems to show an increase in labour market slack, with somewhat more hawkish external developments since May.

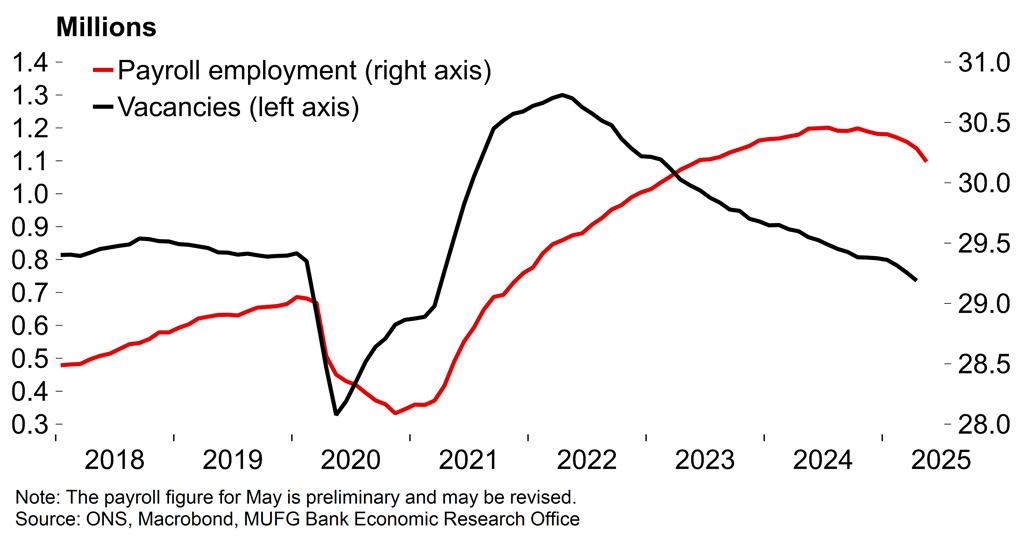

On the data front, figures last week showed private sector regular pay growth slipped from 5.5% Y/Y to 5.1% in the three months to April. That is already below the BoE’s Q2 projection from last month (5.2%). Given the direction of travel and weak-ish demand backdrop, a chunky undershoot now looks likely. There was also a plunge in the initial HMRC payroll employment estimate for May (-109k). These numbers tend to be heavily revised (and there is an upward bias to changes in subsequent estimates) but the figures will certainly have raised some eyebrows on the MPC with job losses broad-based across sectors. Earlier this month, Governor Bailey acknowledged that the BoE is “putting more weight” on these employment numbers given the health warning that still comes with the official LFS numbers amid low response rates.

Monthly GDP also contracted by 0.3% in April, the sharpest fall since October. As we wrote here, it’s not wise to read too much into that single-month figure amid various distortions and some possible seasonal adjustment issues. But it’s logical that the economy has lost momentum after the fast start to the year, which was flattered by US frontloading distortions. Forward-looking survey evidence is consistent with muted underlying growth momentum.

Slack is opening up in the UK labour market

External developments since May could provide a counter to these dovish domestic signals. Trade uncertainty (without which some MPC members may not have voted for the May cut) has decreased. The UK-US deal was first announced after the last BoE meeting and there has subsequently been a US-China truce as well. Of course, uncertainty remains elevated, and perhaps it’s less likely that countries will be bounced into quick deals while the US contends with domestic legal issues around tariffs. But some MPC members may now judge that the downside risks to demand from trade policy have diminished since May.

And then we have geopolitical developments in the Middle East. At the time of writing, spot oil prices are fluctuating around 10-15% higher than the BoE’s conditioning assumptions used for the May projections. If maintained, higher oil prices would reinforce the upcoming bump in headline inflation (the BoE sees rates rising from 2.8% in Q1 to 3.5% in Q3 this year). In terms of underlying pressures, policymakers will likely find some solace in inflation expectations – the DMP year-ahead gauge edged down to 3.0% in May – but these may be less well-anchored after recent shocks, especially in the context of headline CPI moving back above 3% this year.

We don’t expect any significant change in tone or guidance, but the vote split may indicate that at least some MPC members are becoming more confident in the domestic disinflation process

Regarding messaging, energy price developments will probably be acknowledged in the statement but the BoE will stop short of making any clear interpretation at this early stage. There is already an emphasis on flexibility and a meeting-by-meeting approach with monetary policy “not on a pre-set path”. There is no obvious need to reinforce that. There could still be a small change of tone elsewhere in the statement after the somewhat hawkish May meeting (our take on that can be found here), perhaps through some acknowledgement of the dovish labour market developments, but this is likely to be subtle. It’s probably too early to place huge weight on one single labour market release at this stage given the reliability issues (in the LFS) and likelihood of revision (with the HMRC numbers).

So we believe that any shift in thinking is more likely to be apparent through the vote split. At the last pause in March, the split was 8-1 with just one dissenter (arch-dove Dhingra) voting for a cut. At this meeting, we have pencilled in a 6-3 vote split with Dhingra and Taylor, both of who voted for a 50bp cut last time out, joined by an internal member in calling for a cut. That could be Ramsden, who was a dissenter at the 6-3 split in favour of a hold in December, or Breeden. Breeden is interesting – she has voted with the majority since joining the MPC in November 2023, but has sounded relatively dovish in recent public appearances. At last month’s Treasury Select Committee appearance, she said she would have voted for a cut even in the absence of trade uncertainty. Her focus seems to be on domestic developments and the labour market, and indeed she mentioned the HMRC employment data as an alternative to the official LFS numbers.

On the policy outlook, we continue to expect that the quarterly easing cycle will be extended through the rest of the year (i.e. cuts in August and November). That’s close to current market expectations, with two more cuts almost fully priced now for 2025. We think the easing cycle will continue into next year – we see a terminal rate of 3.25%.

Markets view: GBP weakening in anticipation of dovish BoE update

Higher hurdle for BoE to trigger further dovish repricing

The GBP has been trading on a softer footing heading into this week’s MPC meeting. EUR/GBP is currently on track to record its sixth consecutive higher daily closing price while cable’s upward momentum has stalled just below the 1.3600-level. The next important resistance levels for EUR/GBP are located between 0.8600 and 0.8700. The recent GBP weakening trend was triggered by the release of the soft UK labour market on 10th June which has prompted a dovish repricing of the BoE rate cut expectations. The UK rate market has subsequently moved to more fully price back in another 25bs rate cut from the BoE in August. Those expectations have been reinforced as well by evidence of payback economic weakness early in Q2 after the UK economy expanded strongly in Q1. Even the trade deal agreed just finalized between the UK and US to dampen disruption for the UK economy from President Trump’s tariffs has failed to reverse the weakening trend for the GBP ahead of this week’s MPC meeting. While the pick-up in geopolitical tensions in the Middle East poses downside risks for the GBP, it is hard to argue strongly that it has been one of the main drivers of recent GBP weakness when other high beta G10 currencies such as the NOK, CAD, AUD and NZD have outperformed since last Thursday.

In light of these developments, market participants will be watching closely for any dovish signals from the BoE at this week’s MPC meeting to support the recent dovish repricing. One clear dovish signal would be a more divided vote to leave rates on hold. If the MPC votes 6-3 to leave rates on hold with three dissents in favour of a another cut it should provide a trigger for the GBP to weaken further. However, the scale of GBP sell-off would be curtailed if there is no significant change in tone or guidance indicating that the BoE remains comfortable to maintain the current quarterly pace of rate cuts. The UK rate market is already almost fully priced for two further 25bps cuts by year end. It would still leave rates in the UK amongst the highest on offer amongst G10 currencies. FX volatility has also eased over the last couple of months providing a more supportive backdrop to rebuild carry trades and providing support for the GBP. The main risk for a bigger GBP sell-off in the near-term would be a more disruptive outcome for financial markets and the global economy from escalating tensions in the Middle East.

Rate spreads between EZ & UK have narrowed but remain wide