- The UK economy made another flying start to the year with 0.7% Q/Q growth, the fastest rate since Q1 2024. Growth was supported by net trade and a notable uptick in business investment. The release gives a strong signal that the economy has started the year with useful momentum. However, we suggest some caution in overinterpreting the numbers – the recent pattern of firm Q1 growth fading away over the rest of the year suggests that there could be some issues with seasonal adjustment.

- We expect UK growth to cool in coming quarters as tariff front-loading effects fade, global demand softens and wider uncertainty remains a drag. The prospect of tough fiscal measures in the autumn could increasingly weigh on sentiment, as it did last year, if the government mishandles the messaging again.

- Still, it’s encouraging that the UK seems to have entered this period of uncertainty from a position of relative strength. Recent data suggests that consumer resilience is likely to continue into Q2 and government spending is set to provide additional support. We are now tracking 2025 annual average GDP growth at 1.2%, up from 1.0% in April.

Strong investment supported a fast start to the year

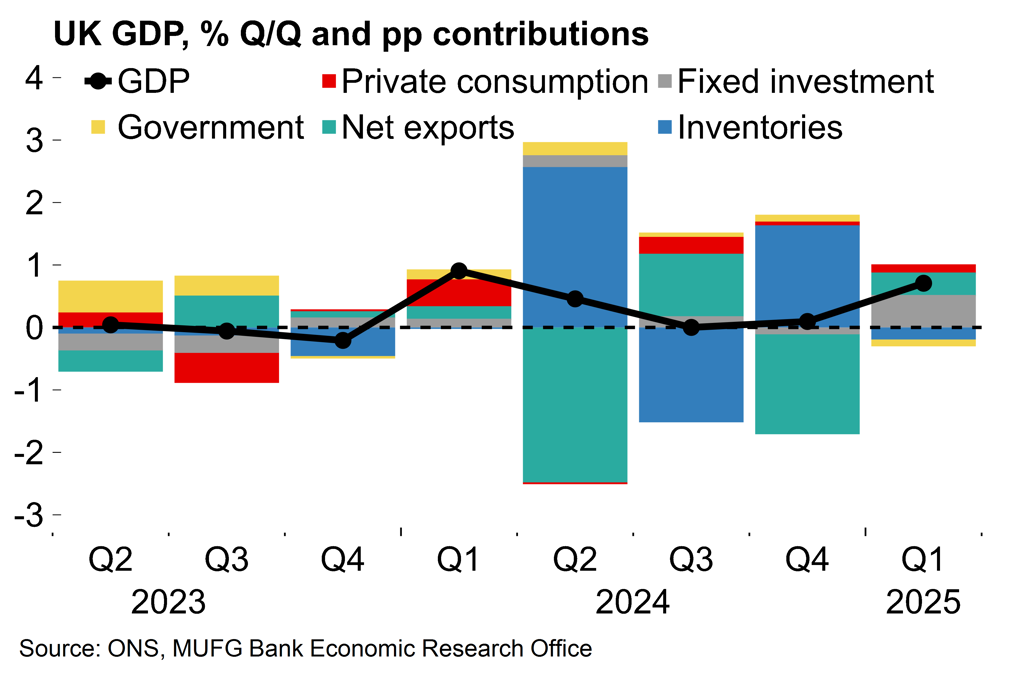

The UK economy made another flying start to the year with growth of 0.7% Q/Q, the fastest rate since Q1 2024. There was plenty of good news. In terms of expenditure contributions, fixed investment (+0.52pp) and net trade (0.36pp) were the key drivers, with some additional support from household expenditure (+0.12pp).

The most surprising element of today’s data was the 5.9% Q/Q surge in business investment. These numbers are volatile and prone to revision, but it is an encouraging sign after years of underinvestment which dates back to the EU referendum. The driver is unclear but higher employment costs (the 6.7% increase in the minimum wage and rise in employer national insurance costs from April) could have incentivised some rotation from labour to capital. The BoE’s easing cycle is also supportive for capital spending.

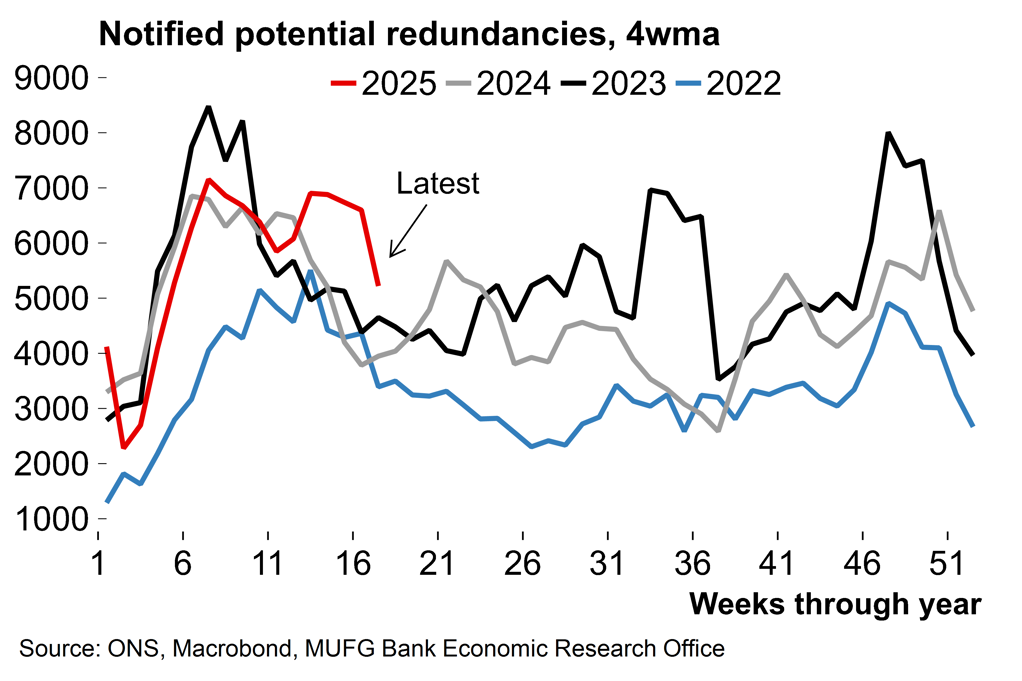

Household consumption continues to expand moderately. While the recovery in real incomes is continuing, the saving ratio has moved above the long-term average and consumer confidence remains muted. This week’s data also showed that the UK labour market continues to weaken gradually, with payroll employment down more than 100k over the last 12 months. This probably reflects a range of factors: government policy, the BoE’s restrictive monetary policy stance and global uncertainty around tariffs.

Today’s release also showed that government consumption dipped in Q1 (-0.5% Q/Q) which surprised us after the government’s expansionary first Budget (see here). Measures announced then were only marginally pared back in the Spring Statement (see here) and we continue to expect that higher government current spending through the rest of the year will support activity.

On trade, there was a temporary boost from frontloading of US demand, as expected. Exports to the US increased for four consecutive months to March with a 2.4bn GBP rise in Q1.

Fixed investment was the main driver of Q1 growth

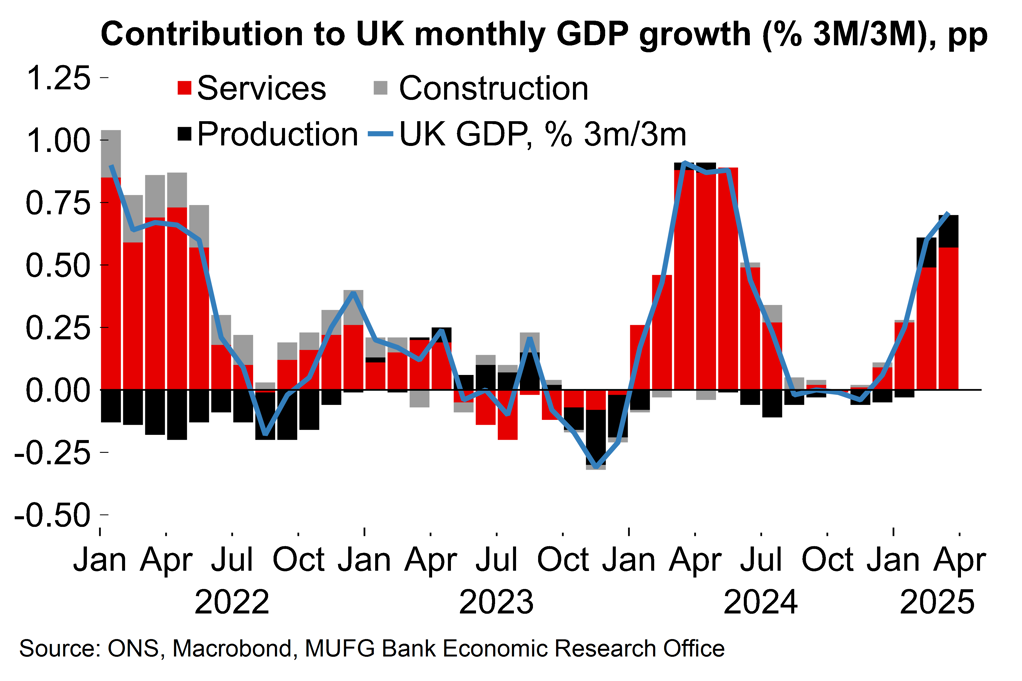

Another strong start to the year (is there a pattern...?)

Too good to be true? Growth seems to be following the same pattern...

Before getting too carried away, we recommend exercising some caution when interpreting these Q1 figures. UK data have shown a recent pattern of strong growth at the beginning of the year which then fades over subsequent quarters. Although the ONS pushed back this week against claims of residual seasonality (see here), the recurring trends in the data suggest that some seasonal adjustment issues may remain, possibly relating to lingering distortions from the pandemic and the subsequent inflationary surge. On an annual basis, the economy grew by 1.3% – not a blockbuster figure, but still a reasonably healthy rate.

Slower growth ahead – but recent news has been more encouraging

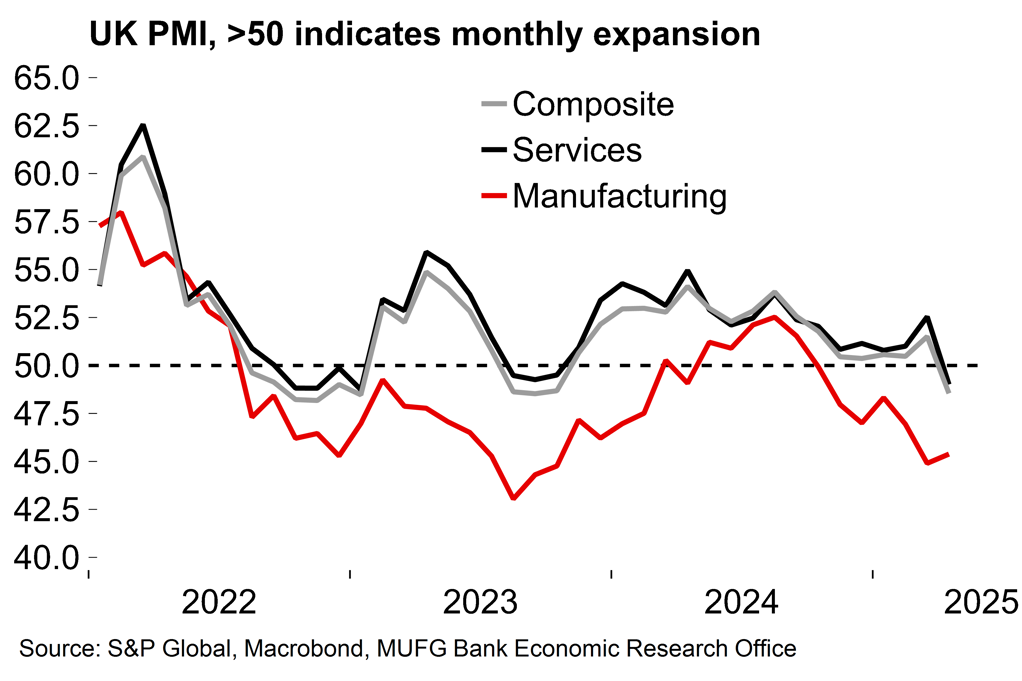

We remain relatively optimistic about the UK outlook but nevertheless expect that strong Q1 growth will be a short-lived spurt. The temporary boost from US frontloading will reverse in Q2. US tariffs plus related uncertainty around global growth prospects will clearly provide an additional headwind, with signs of that already seen in the weak April PMIs.

But the near-term outlook looks better. Q2 GDP growth is set to be supported by some momentum in the March figure (+0.2% M/M) and signs of resilient consumer spending despite the slowing labour market. BRC data showed retail sales growth of 7.0% Y/Y in April, which looks healthy even when accounting for the late Easter this year.

More broadly, lower energy pricing has improved the inflation outlook which extends the scope for the real wage recovery to continue. Recent survey data does suggest that the household saving ratio, which increased by 3.6pp during 2024, may at least be stabilising now.

On trade, we continue to emphasise that the UK’s direct exposure to US goods demand is relatively modest. Goods exports to the US accounted for just 2% of GDP in 2024, and only 4% of firms identified US tariffs as their primary source of uncertainty in the April DMP survey. Nonetheless, we stress that while the UK-US deal is narrow in scope and certainly no game changer, it at least reduces some uncertainty around potential shifts in US policy vis-à-vis the UK.

Wider risks remain around US demand for services, where UK exports are equivalent to ~5% of GDP. In that context, recent signs of a broader US trend toward tariff de-escalation have to be seen as a welcome development. The US economy continues to show signs of a cyclical slowdown, which seems likely to be compounded by broader policy volatility. But the seemingly reduced likelihood of abrupt tariff changes may help mitigate downside risks to both US and, indirectly, UK growth.

Only limited evidence so far that higher employer NICs is weighing on employment

The recent news flow could support a recovery in sentiment after clear weakness in the April numbers

Domestic UK policy uncertainty could become increasingly relevant. As noted above, government consumption is likely to become a more reliable growth driver through the rest of the year. But protracted speculation around fiscal measures certainly weighed on UK activity ahead of last year’s budget and there’s a risk that officials could make the same communication mistakes again. We continue to expect that the government will be forced to pare back its spending plans or raise some taxes at the Autumn Budget in order to comply with its fiscal rules. While today’s GDP figure was clearly stronger than the OBR was expecting back in March (0.2% Q/Q), the subsequent quarters of firmer growth this year (all 0.4% Q/Q) appear optimistic.

In terms of the overall outlook, we think that the economy is in reasonable shape to navigate this period of uncertainty. In April we set out our initial post-'Liberation Day' forecasts (here) which put UK GDP growth at 1.0% in 2025. After today’s data we are now tracking growth at 1.2%, which would be a small improvement on the 2024 figure and a good result considering the range of external and domestic headwinds. We will publish our full global forecast update at the end of the month.