- It’s been a busy week for the UK economy with the government’s Spending Review sandwiched between key data on the labour market, activity and trade.

- On growth, GDP contracted by 0.3% M/M in April, marking the weakest monthly performance since October 2023 and indicating a likely sharp deceleration in Q2. The contraction was driven by a reversal in trade dynamics and domestic distortions. Potential seasonal adjustment issues and the usual volatility of monthly data mean these numbers shouldn’t be overinterpreted, but it’s no surprise to see activity losing steam after the unsustainably fast start to the year.

- Looking ahead, we expect flat or slightly positive growth over Q2 as a whole, supported by modest improvements in sentiment as the drag from trade uncertainty reduces. Our full-year GDP forecast remains unchanged at 1.2%.

- There were few surprises in the Spending Review statement with health and defence the main beneficiaries, as expected. In terms of the bigger picture, the UK’s fiscal outlook remains fragile, and minimal headroom under the current framework still points to tax hikes in the Autumn Budget if growth disappoints or external shocks emerge.

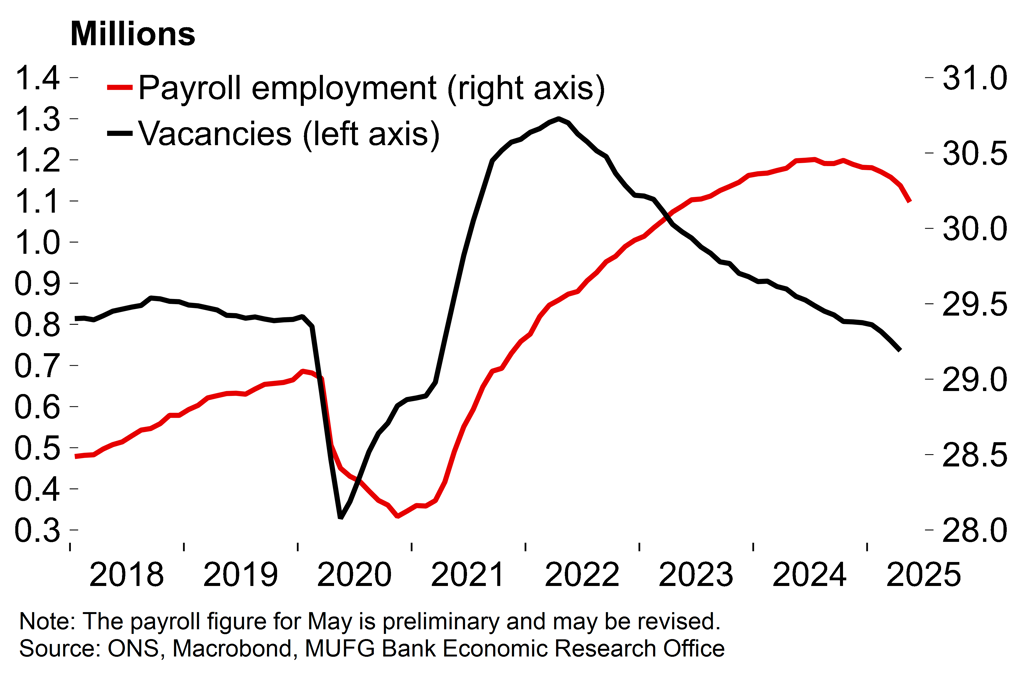

- On the monetary policy front, recent labour market data points to growing slack, with a dovish mix of falling payroll employment, declining vacancies and easing wage growth. This reinforces our expectations that the BoE will extend its now well-established quarterly easing cycle in August (and indeed beyond), although there is now a risk that higher energy prices will delay the overall disinflation process.

UK growth has quickly petered out with trade distortions and domestic factors weighing on activity

The UK economy contracted by 0.3% M/M in April. That is the worst single month rate since October 2023 and points to a sharp slowdown in quarterly growth after the strong start to the year. As always, these monthly numbers come with the caveat that they are volatile and prone to revision. That is especially relevant as this release was affected by various external and domestic distortions.

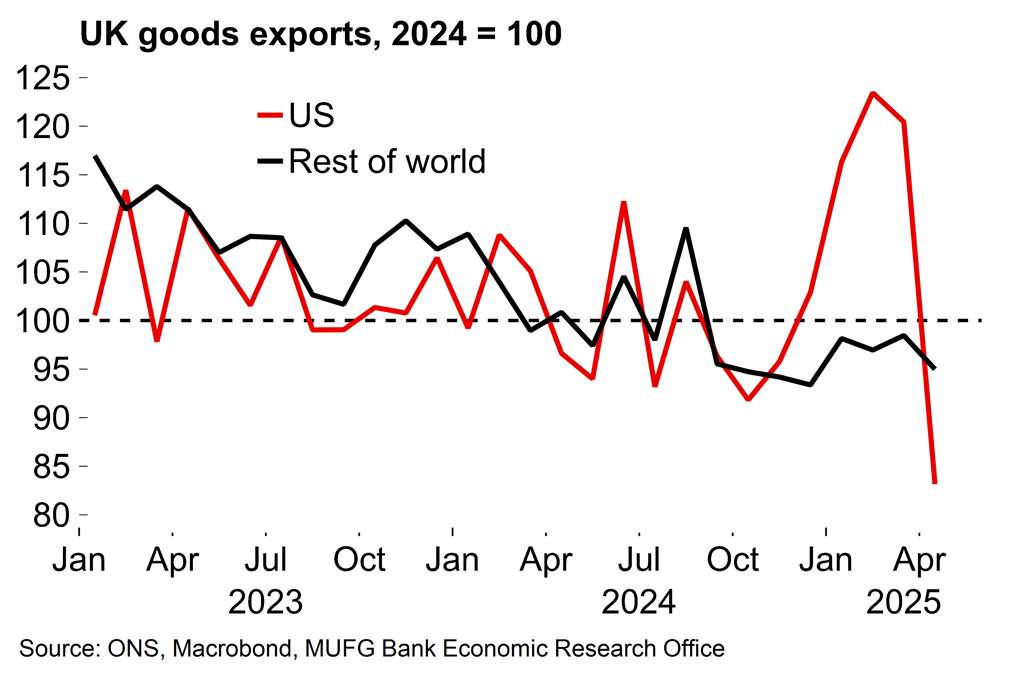

First, there was very clear evidence that the boost from US frontloading of imports ahead of tariffs has now reversed. UK goods exports were down 2.7bn in April, which included a 2.0bn fall in exports to US after four consecutive monthly increases previously. Overall, manufacturing fell 0.9% M/M in April, driven by a sharp fall in transport equipment (-5.2%).

Domestically, legal activities declined (-10.2% M/M) after the rush to get ahead of stamp duty increases. There was also a plunge in new car registrations (-10.4% Y/Y) following changes to vehicle excise duty. Excluding motor vehicles, retail increased 1.3% M/M, however, but that was likely flattered by the weather (it was the UK’s sunniest April on record). There was likely a weather-related boost from construction (0.9% M/M) as well.

Meanwhile, as we’ve highlighted previously (see here), UK activity data has shown a pattern of strong growth at the beginning of the year which then fades over subsequent quarters. The ONS pushed back against claims of residual seasonality, but the recurring trends in the data suggest that some seasonal adjustment issues may remain (possibly relating to lingering distortions around firms’ pricing behaviour from the pandemic and the subsequent inflationary surge).

In terms of the outlook, it’s never wise to read too much into the UK’s single month GDP figures and there was clearly even more noise than usual in the April release. But a slowdown in Q2 should certainly not be a surprise after the unsustainably fast start to the year. On a quarterly basis, an unchanged profile from here would see flat growth (0.0% Q/Q) in Q2. Our base case is that the economy will eke out a small positive growth figure overall, however. After signs of a small improvement in business and consumer sentiment since April, domestic demand may just about offset the likely sizeable drag from net trade. For the year as a whole we still see growth at 1.2%.

Is there a pattern? UK growth momentum is starting to fade again

Payback time – the boost from US frontloading of imports is now reversing

The fiscal situation remains precarious

There were no major surprises in this week’s spending review announcement with the broad envelopes already known and defence/health swallowing up the majority of new spending, as expected. The key point on UK fiscal policy is that the headroom against the government’s main fiscal rule, which was introduced only last October, is extremely slim at just £9.9bn. That precarious fiscal position hasn’t changed since the Spring Statement in March (our take here) with a slightly more dovish UK rates outlook offset by a tougher global growth situation post-Liberation Day. That still leaves the government hostage to fortune between now and the Autumn Budget.

As my colleague noted yesterday, the move in gilt yields on Wednesday was unrelated to the Spending Review and everything to do with the weaker US inflation data. It’s plausible that could reverse in coming months if there is a lagged effect of tariff increases on prices – the UK will remain exposed to global developments.

Domestically, the OBR’s annual growth forecast for 2026 looks decidedly optimistic at 1.9% (MUFG: 1.3%) and we expect a downgrade in the projections used for the Autumn Budget, which could erase all of the government’s fiscal leeway. As a result, the OBR’s interpretation of various policy shifts – e.g. the government’s focus on house building, the increase in defence spending, as well as the recent trade agreement with the EU – will carry a lot of salience. The fiscal multipliers around the hefty increase in defence capex, for example, are unclear. Unlike infrastructure, it won’t all be spent domestically but, longer-term, there could be positive R&D spill-overs to wider UK industry.

Any boost to productivity would be very welcome with the risk that the OBR may substantially downgrade its assumptions continuing to loom large over the UK fiscal outlook. In March, the OBR warned that if productivity continues to grow at just 0.3% annually – rather than returning to the 1.3% trend – the current budget would swing from a projected 0.3% surplus to a 1.4% deficit of GDP by 2029-30. The stakes, therefore, are certainly high. To our minds, it’s not clear that there were enough policy shifts in this week’s spending review to reassure the OBR on the outlook.

As things stand, our assumption is that the chancellor will be forced to implement at least some tax rises in the autumn, but there’s not a great deal of low-hanging fruit after officials were scrambling around for revenue in October. In the event of unfavourable OBR judgements and/or external developments, there is a clear risk that the government could be forced to revisit its pre-election red lines on major tax changes in order to restore a meaningful buffer.

Labour market slack is building up

This week also saw the release of the latest official UK jobs data. Again, a caveat – the official Labour Force Survey numbers still carry a health warning amid a low response rate. (Last week it was also acknowledged that an error overstated the April CPI rate by 0.1pp – the ONS continues to avoid covering itself in glory). Nonetheless, the broad picture from the LFS is consistent with the range of other indicators which suggest that there is now some labour market slack building up in the UK.

Significantly, payroll employment fell by 115,000 in April on an annual basis, with the early indications for May suggesting there could be a much sharper fall to come. The broad-based decline in vacancies across sectors has also continued, with the overall number now below the Q1 2020 level.

Wage growth also eased markedly. Private sector regular pay growth slipped from 5.5% Y/Y to 5.1% in the three months to April. That is already below the BoE’s Q2 projection from last month (5.2%). Given the direction of travel and weak-ish demand backdrop, a significant undershoot now looks likely.

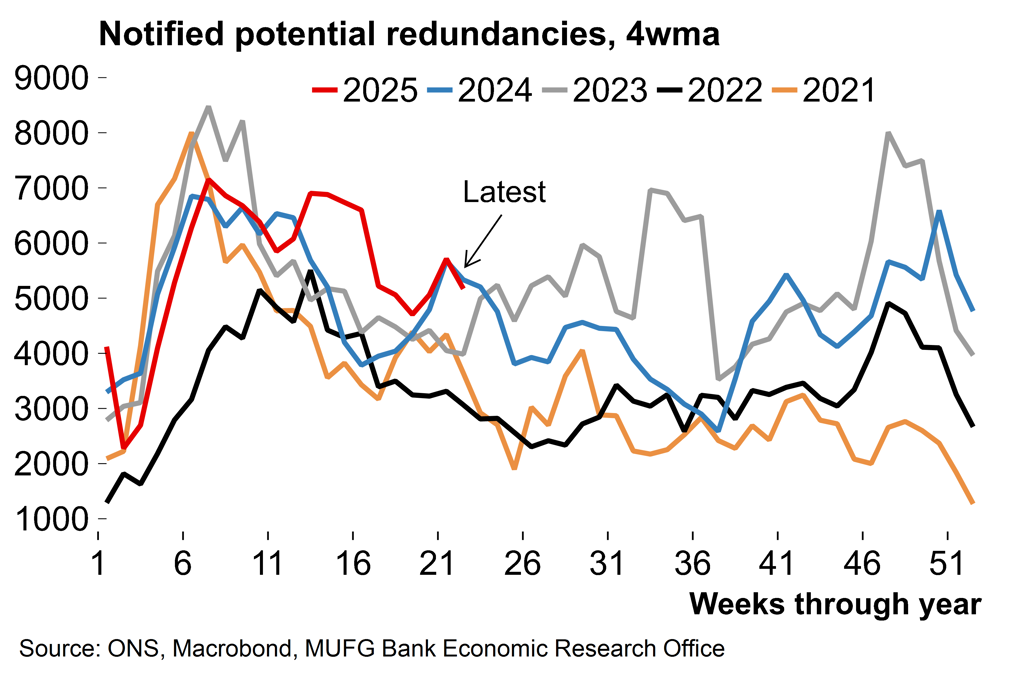

So, for the BoE, there’s no doubt that recent domestic data has been dovish. But the labour market seems to be cooling rather than collapsing, with weekly redundancy data reassuring in that regard. Firms wishing to make 20 or more redundancies must notify the government and the numbers seem to have settled after distortions around April tax changes. The significance of lower-than-expected pay growth figures for some policymakers may also be partially outweighed by concerns that the surge in energy prices following Israel’s air strikes against Iran could delay the broader disinflation process.

We will release our full preview of the upcoming BoE meeting, where policy is set to be left unchanged, early next week. We continue to expect that the BoE will extend its well-established quarterly easing cycle in August (and indeed into 2026).

Both employment and vacancies continue to fall

No alarm bells yet from redundancy notification data