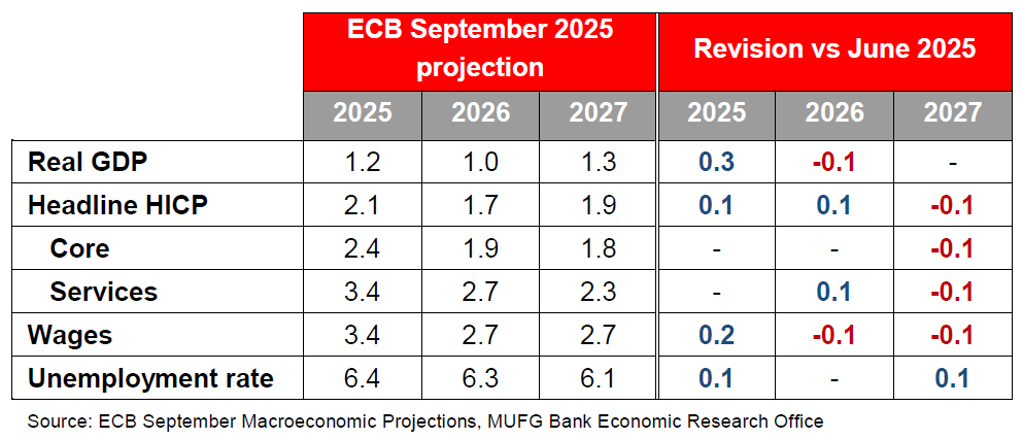

- The ECB left its policy rate unchanged at 2.00% today, as was widely expected. There were no changes to the guidance. The updated projections showed upward revisions to growth and inflation this year, reflecting recent releases, but there is an undershoot on headline and core inflation in 2027 (at 1.9% and 1.8% respectively). The initially dovish market reaction to this was more than reversed in the press conference. In a hawkish intervention, Lagarde downplayed the significance of the projected inflation undershoot and said that “the disinflationary process is over”.

- The bar for further easing has seemingly been raised and market participants have pared back rate cut expectations this year (only 5bp are priced at the time of writing). But we think policymakers might have jumped the gun in declaring the disinflation process is over and we still see some room for further easing. Services inflation is trending down, wage indicators have softened, and euro appreciation could amplify disinflation. Political uncertainty in France and fresh trade tensions remain downside risks. For now, we maintain our call for a December cut.

Lagarde has raised the bar for further easing

The ECB left rates unchanged at 2.00%, as expected, in what was said to be a unanimous decision. The statement was short and the key guidance was left unchanged: “data-dependent”, “meeting-by-meeting” and without any pre-commitment to a particular rate path.

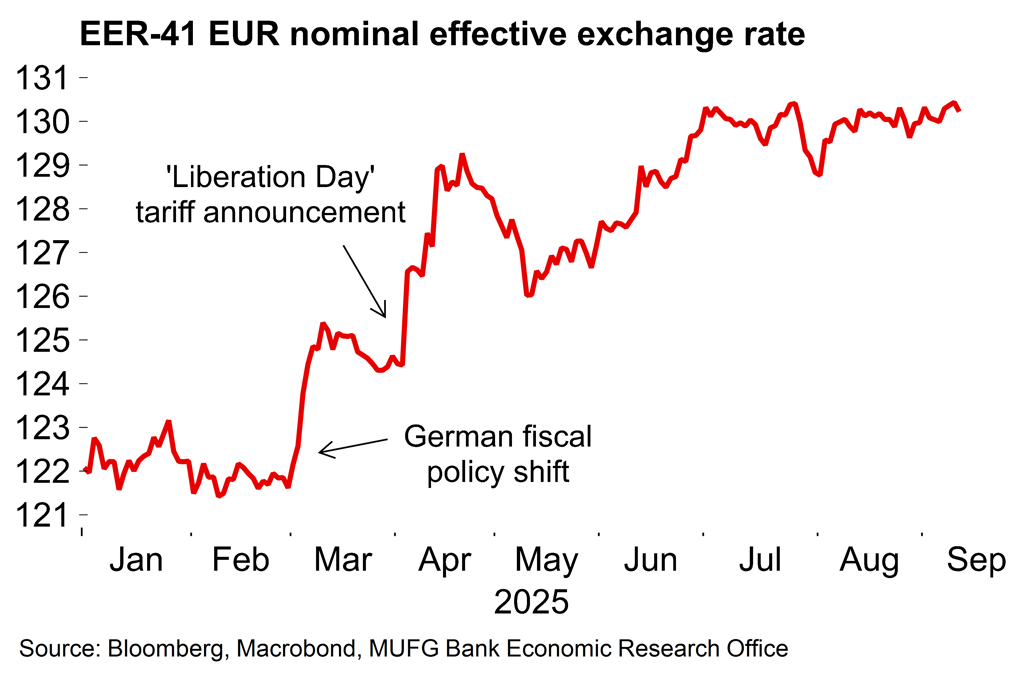

The assessment of the inflation outlook was said to be “broadly unchanged”. The ECB raised its GDP and HICP numbers for 2025. Growth is now seen at 1.2% (in line with our current number) and headline inflation at 2.1%. This update essentially reflects recent data releases rather than any fundamental shift in thinking. Further ahead the profile remains broadly unchanged, although core and headline inflation were revised lower (to 1.8 and 1.9% respectively in 2027), apparently on the back of euro strength.

There was a disconnect between the neutral/slightly dovish statement and projections (the euro fell back slightly before the US CPI release) and the press conference. We thought Lagarde might play it with a straight bat. Instead, she came out swinging by declaring that “the disinflationary process is over” and then saying that officials did not want to “over-engineer” on policy. The ECB president also pushed back on the significance of the small inflation undershoot in 2027 (headline HICP was revised down from 2.0 to 1.9%) by suggesting there was little change in the unrounded numbers.

So, while the door is not completely closed to further rate cuts, the hawkish Q&A from Lagarde has raised the hurdles for more easing. Market participants have duly pared back expectations for another move this year. Only 5bp of cuts are now priced by year-end.

In a good place right now, but we still see scope for further easing

Lagarde talked about the “good place” a lot once more. Over the summer, inflation has edged higher (2.1% in August), the EU has swallowed an agreement to reduce downside risks around US tariffs, and survey data has, broadly speaking, stabilised at levels consistent with moderate growth ahead. The ECB now sees risks to growth as balanced rather than tilted to the downside as was the case previously.

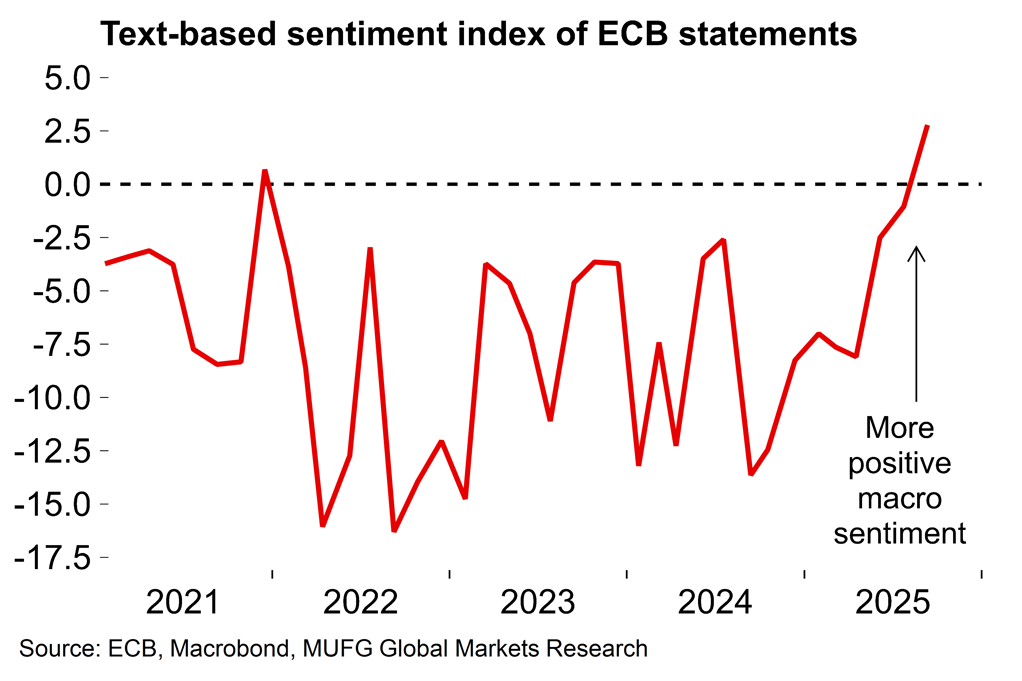

Indeed, our text-based index of sentiment (using a bag-of-words model across various macro themes e.g. inflation, consumer dynamics, activity and the labour market) has turned positive for the first time since November 2021 (see chart below).

Against that backdrop, the deposit rate is at the central estimate of neutral and inflation is hovering around target, and the economy has held up relatively well in the face of tariffs and related uncertainty. Officials seem content with the apparent soft landing from the 2021-22 inflation shock and are clearly comfortable with markets not fully pricing in another cut this year.

But we do question whether the current ‘good place’ mindset means that policymakers risk becoming too static and backward-looking. While the hurdles for more easing are certainly higher and the onus is firmly on the doves, our expectation is that the case will for be gradually bolstered by various factors over coming months. We still see some scope for further easing at the next projection meeting on 18 December.

On inflation, the services rate is now trending downwards: after being stuck around 4%, rates have now eased from 4% at the end of last year to 3.1% in August. Forward-looking wage indicators suggest that pressures will continue to ease. The ECB has duly downgraded its wage growth projections to 2.7% in both 2026 and 2027.

Euro strength is also likely to reinforce the disinflation process. With increased expectations around US rate cuts and concerns around Fed independence, our FX team have raised their EUR/USD forecasts and see a 6.8% advance in EUR/USD by mid-2026, even with further ECB easing expected to come.

There are also various sources of downside risk to sentiment and activity. Lagarde was not drawn into commenting on French political uncertainty, unsurprisingly, but developments could move into even sharper focus. It will be a narrow path for the new PM to win support for a budget, even if Bayrou’s austerity package is watered down. On trade, the immediate US tariff risks may have been reduced but it will remain an uneasy equilibrium, as we noted after the initial agreement was announced.

All told, we see plenty of reasons to doubt Lagarde’s declaration that the disinflation process is over. While today’s messaging was hawkish, we do not believe that the ECB has entirely closed the door on future easing. For now we stick with our call for another move in December, but admittedly with less conviction.

The ECB is more comfortable with the macro backdrop

Euro strength is set to support further disinflation