- The Bank of England continues to build towards a pivot on rates with some significant shifts at yesterday’s meeting further opening the door to the first cut. In particular, the hawkish contingent on the MPC has now stopped pushing for further tightening and Governor Bailey has hinted at expectations for a more benign inflation outlook. However, policymakers will probably want to retain a degree of flexibility with still-elevated wage pressures continuing to provide some pause for thought despite generally favourable data developments in recent weeks.

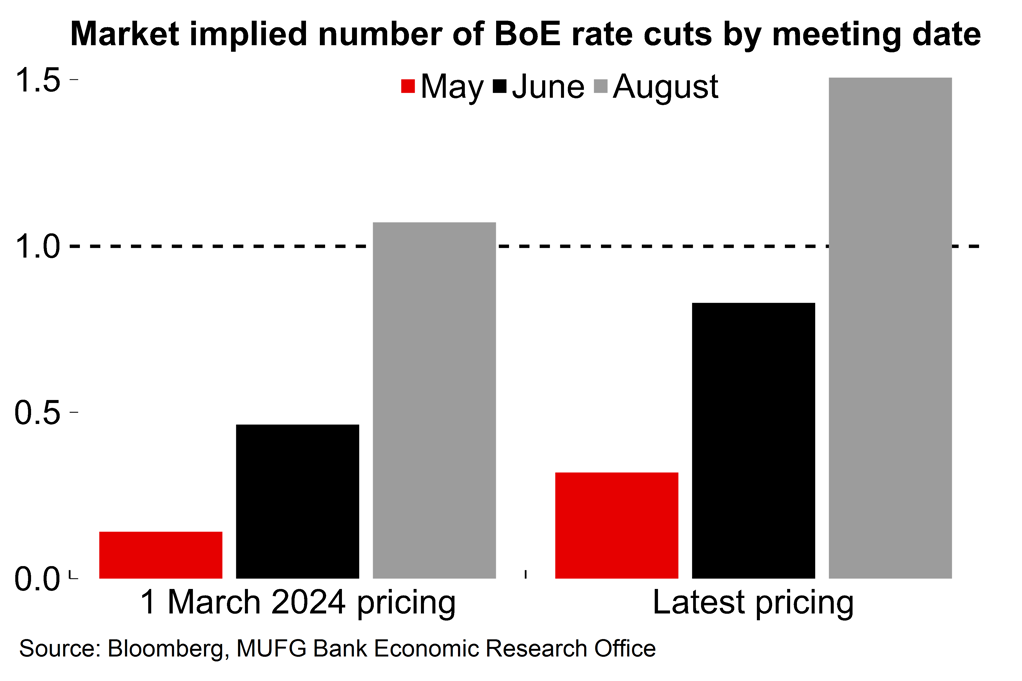

- This week’s PMI data continued to paint a picture of general stabilisation in the euro area, but there are further signs that the conditions may be there now for better growth from Q2. Sentiment in the euro area continues to be supported by peripheral countries, with weakness in France and Germany continuing to act as a brake on overall euro area activity.

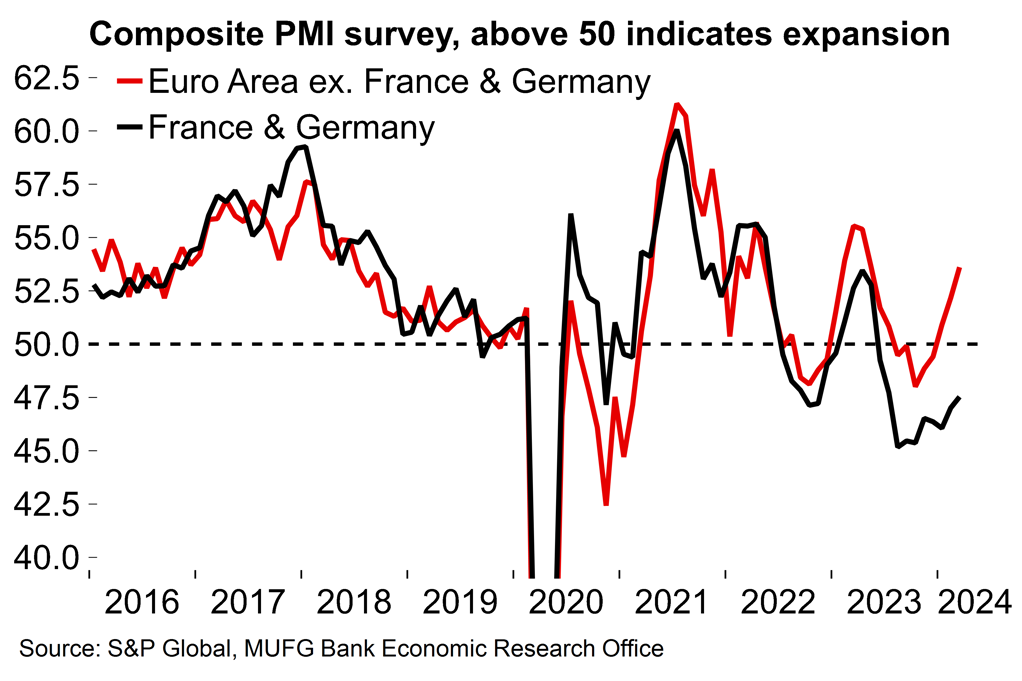

- Next week will be fairly quiet on the data front ahead of the Easter break. Some national inflation data and further survey evidence for March will be the focus.

BoE Review – A less fragmented MPC shifts closer to the pivot

The BoE continues to gradually lay the foundations for a policy pivot. At the February meeting there was an acknowledgement that the next move on rates would be downward. The minutes of yesterday’s meeting further opened the door to a rate cut by noting that “the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level”.

This sort of subtle shift in communication is to be expected as policymakers move towards easing policy. The vote split was more interesting. In February, the nine-strong MPC was notably divided: there was a three-way split in the vote with two members voting for a hike, and another for a cut. The hawkish pair has now given up pushing for further tightening (the vote was 8-1 with the same dissenter calling for a cut). This suggests a less fragmented MPC which is increasingly confident that the current policy stance is working and that inflation is converging sustainably towards target.

The shift comes on the back of a string of mostly favourable data for the BoE, with news on labour market slack broadly positive from a monetary policy perspective as highlighted in our preview of the meeting (see here). Data this week has shown that inflation in February fell to 3.4% – slightly below both the BoE’s forecast and market expectations.

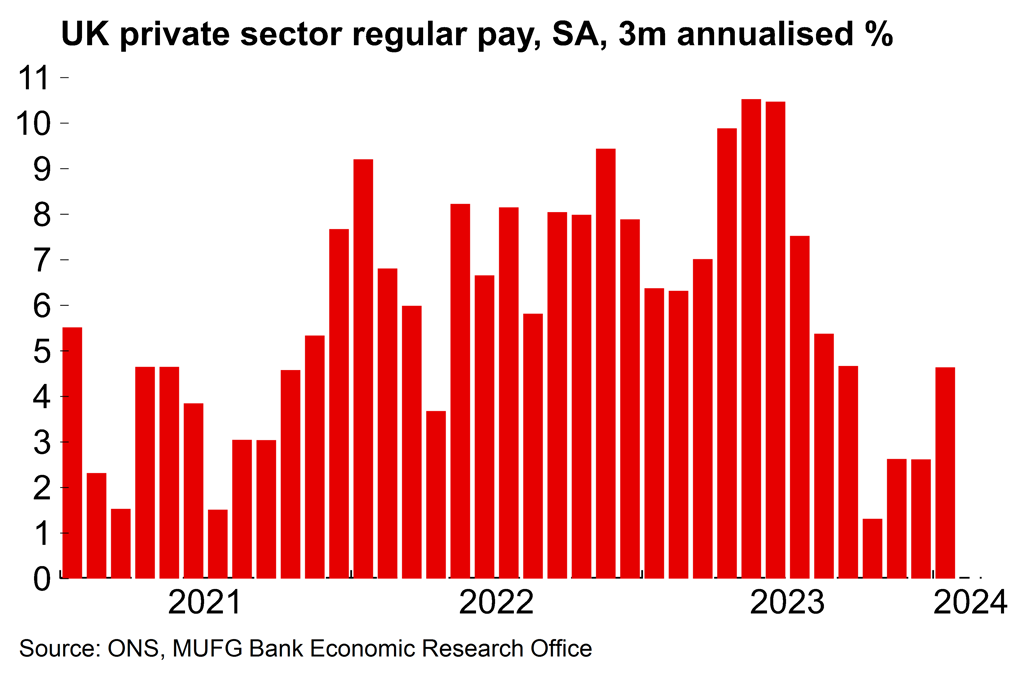

So the question is now one of timing. Prior to this week’s meeting market pricing suggested that it was a 50-50 call between June and August for the first rate cut. That has since shifted with 21bp of cuts now priced in for the June meeting – and now 9bp for the May meeting. That comes after Governor Bailey said in a later interview that the BoE may take “another view” on the path ahead for inflation when it updates its projections in May. The current numbers, from February, showed the BoE’s expectation that headline inflation would dip below target in Q2 when household energy costs fall – before moving back up later in the year due to more persistent underlying price pressures. Our view is that inflation will prove to be less sticky down the line, and there seemed to be a hint from Bailey that the BoE’s May numbers could be more benign.

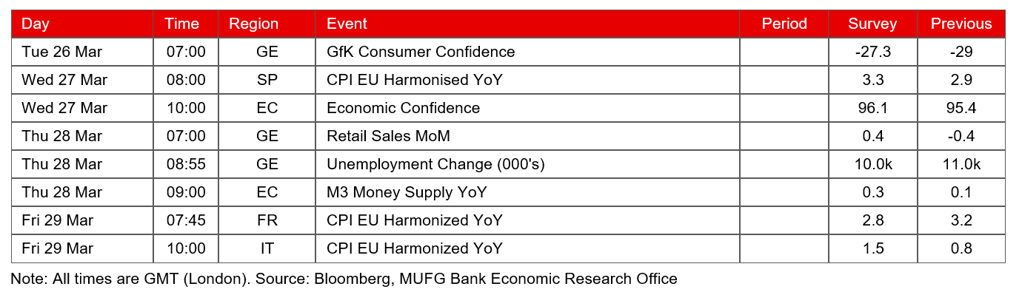

We still think that a majority of MPC members will want more concrete evidence that the key indicators at this point in the disinflation process, namely wage growth and services inflation, are cooling before starting to ease policy. Pay growth remains significantly higher than the 3% or so that would be consistent with the 2% inflation target, and the 10% increase to the minimum wage will add some extra fuel to the fire in April. Many mobile and broadband contracts will also increase in April by the December rate of CPI plus 3.9pp (i.e. 7.9%) which will boost the overall rate of services inflation.

So, while overall headline inflation is set to fall sharply in April on the back of the lower household energy price cap, there are also some factors which could increase underlying inflation pressures. The details of the April CPI report therefore seem especially significant, and the figures will not be released until 22 May – after the BoE’s 9 May meeting.

For that reason, we think that May remains too early for the pivot, even if the new inflation projections are more constructive. The hawks may have given up pushing for further tightening – but it’s another question entirely whether they will be comfortable with rate cuts given elevated wage pressures.

Overall, the BoE is probably content with its current holding pattern (Bailey seemed to suggest that he’s broadly comfortable with market pricing for two or three rate cuts this year). On the timing of the pivot, policymakers will likely want to retain a degree of flexibility. To our minds, the macro data still points to a close call between June and August for the first move but we agree that the BoE’s shift this week now seems to suggest that an earlier move is more likely.

Chart 1: There have been some recent signs that pay growth momentum may have increased

Chart 2: Market expectations for an earlier pivot have risen since yesterday's meeting

The German economy continues to act as a brake on overall euro area activity

The overall euro area composite PMI has steadily improved since Q4 last year and, at 49.9 in March, is now on the cusp of moving back into expansion territory. The economy is gradually gaining some momentum as real income growth recovers and monetary easing moves closer (the ECB will be content to see the survey continuing to suggest some moderation in selling price expectations). We are still tracking Q1 GDP at 0.0% Q/Q but survey data is now suggesting that the conditions are there for the euro area economy to return to growth in Q2.

That said, the story of divergence between core and peripheral euro area countries remains (Chart 3). There was further weakening in the French numbers, both for services and manufacturing, although national survey numbers also released this week painted a slightly better picture.

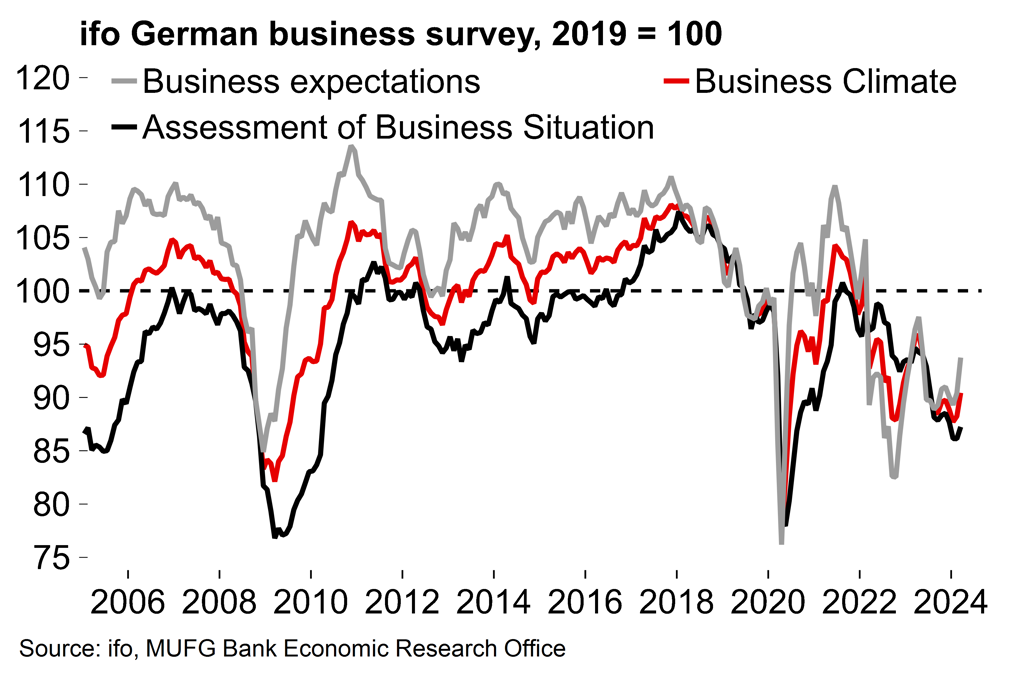

Meanwhile, the German composite PMI did improve (from 46.3 to 47.4) but remains at a weak level, with the manufacturing component slipping back to just 41.6. There was some better news in the form of the reliable ifo survey with the expectations component improving notably in March. The overall business climate index is now at an 8-month high. Nonetheless, the level is still low by historical standards (Chart 4).

As we wrote back in January (here), it’s been hard to current conditions supporting a meaningful turnaround in German manufacturing output, especially in the absence of a significant global upswing – which is not our base case (see here). The Bundesbank stated this week that it expects another GDP contraction in Q1 (see here) which would leave the German economy in a technical recession. We currently expect annual average growth of just 0.2% this year in Germany – and a weak start to the year means that risks to that figure could be skewed to the downside.

Chart 3: A two-speed euro area economy?

Chart 4: German sentiment remains at a weak level

Week ahead – Limited data releases with national inflation figures the focus

It’s set to be a fairly quiet week in terms of data ahead of the Easter break. There will be preliminary March inflation data for France, Italy and Spain but the first estimate for the euro area as a whole will not be released until the following week.

There will also be some more survey data in the form of the European Commission’s Economic Sentiment Indicators. These get less attention than the PMIs but do contain useful information and have a reasonable relationship with GDP growth.

Key data releases and events (week commencing Monday 25 March)