- The Bank of England left rates unchanged yesterday, as expected, but shifts in the statement language have kept the possibility of a summer rate cut alive despite another disappointing services CPI print. We think that officials have a clear easing bias now and are actively looking for confirmation that underlying price pressures are easing. After the pre-election blackout period ends, policymakers may use speeches to attempt to reduce the current focus on services inflation rates or firm up guidance around the timing of the first cut, which we still expect in August.

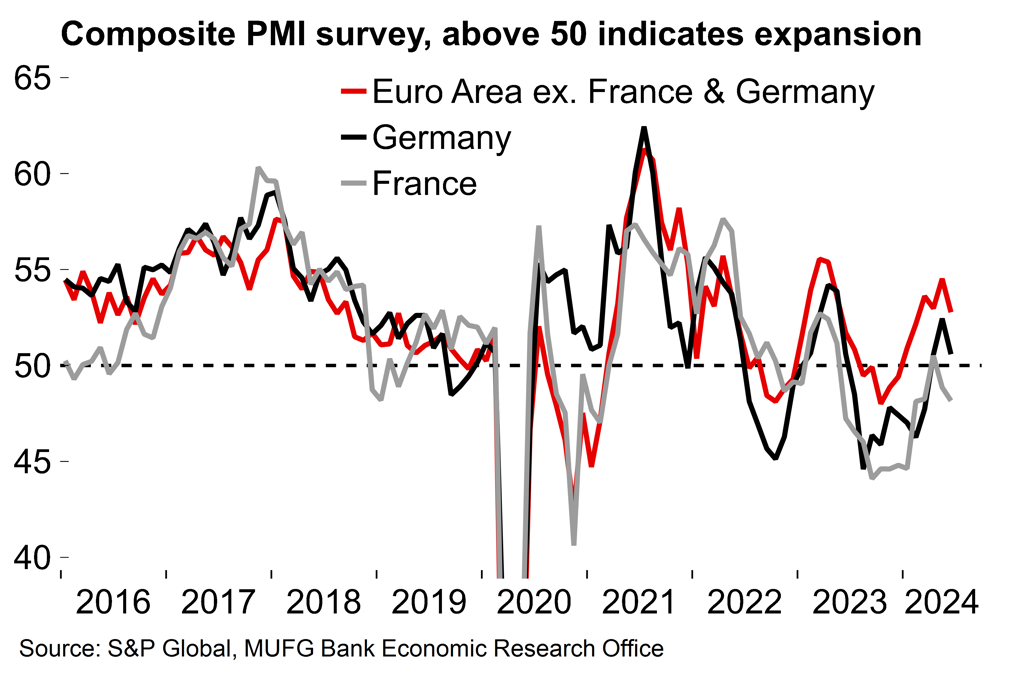

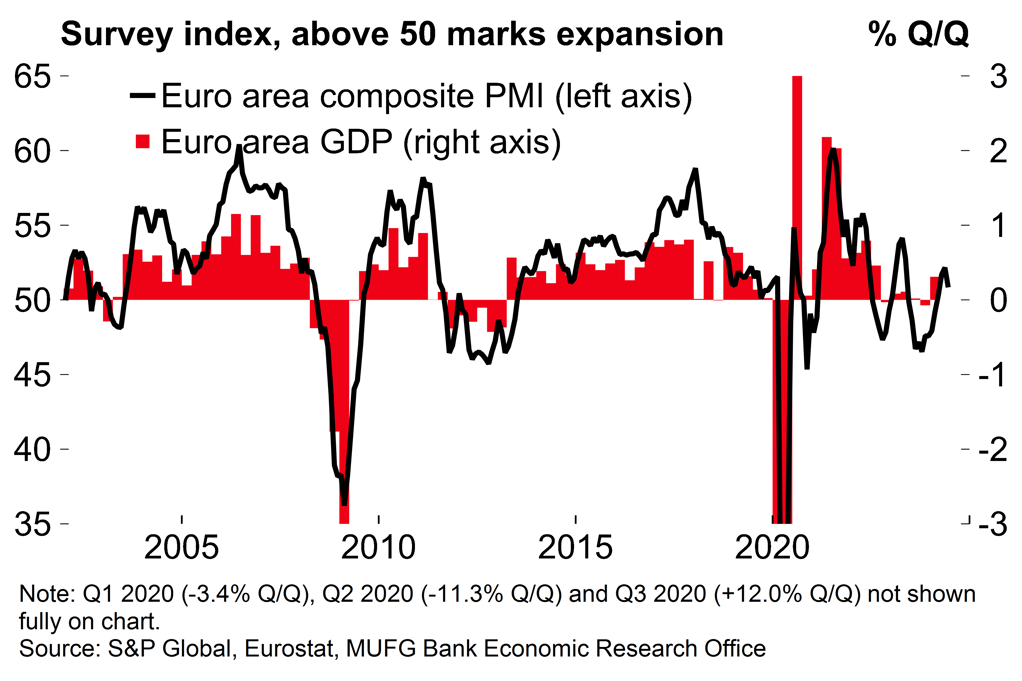

- After reasonable euro area growth at the start of the year, today’s flash PMIs served as a reminder that it’s likely to be a steady rather than spectacular recovery. Both the services and manufacturing components lost steam in June, possibly reflecting the recent increase in political uncertainty in France. However, we continue to track euro area Q2 GDP at 0.2% Q/Q. That would be a slight slowdown on the pace seen in the previous quarter – but a return to some sustained growth would still be welcome after the extended period of stagnation seen last year.

**We have just released our mid-year global macro update – see here**

BoE review: A summer rate cut remains in play despite sticky services inflation

The BoE left rated unchanged with the vote split maintained at 7-2. However, policymakers didn’t just sit on their hands ahead of the UK election is in just two weeks’ time. Instead, some significant shifts in the statement language were introduced which have kept the possibility of a summer rate cut alive.

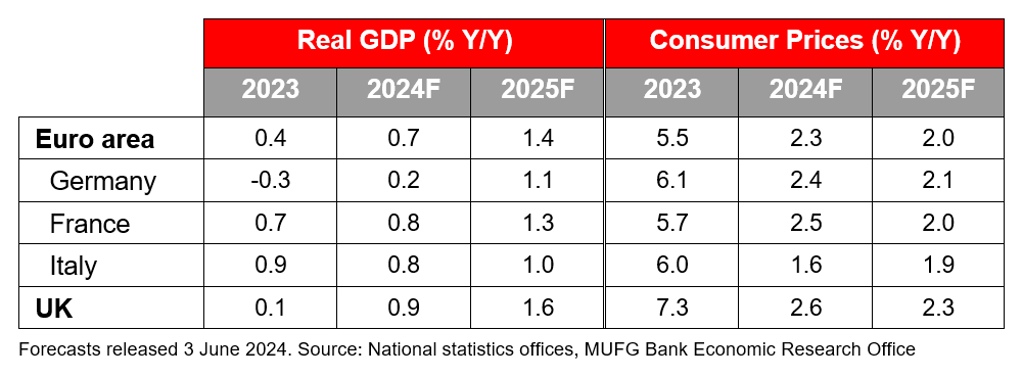

At its previous meeting in May, the BoE opened the door to cutting rates but emphasised that it would depend on the data, and the news since May has been decidedly mixed. This week’s inflation figures showed the headline rate bang on target at 2%. However, services inflation at 5.7% did little to dispel concerns about the persistence of underlying price pressures. With nominal pay growth still at a similar rate, there is still plenty of data providing uncomfortable reading from a monetary policy perspective.

Against that background, and with the UK election looming, officials might have been tempted to essentially sit this meeting out and offer little change to the language from May. That was not the case. In what looks a significant intervention, the statement explicitly highlighted the August forecast round, noting that MPC members will “consider all of the information available” (this brought to mind the ECB’s efforts earlier in the year to highlight that important data would be released before the June meeting, at which they duly proceeded to cut rates). The statement also noted that the “collective steer from a range of indicators of aggregate pay growth has continued to ease”, while the minutes noted that the decision was “finely balanced”. These changes looked like a deliberate effort to push back on the shift in market pricing towards autumn for the initial rate cut.

To our minds there is a clear easing bias now. After the pre-election blackout period ends, policymakers may use speeches to firm up guidance around the timing of the first move, perhaps by providing more colour on the BoE’s reaction function to reduce the focus on services inflation prints. That said, we think that the 7-2 vote split belies a degree of division on the MPC. Some members will still have lingering concerns about the persistence of underlying inflation pressures. But as a whole the BoE may well be mindful that a year is a relatively long time for rates to be maintained at their peak in a cycle (and at a 16-year high). There may also be some concern that headline inflation is likely to edge above the target rate again later in the year as the drag from energy starts to fade and offsets improving core numbers. Given that potential communication challenge, officials may want to get the ball rolling on rate cuts before the autumn. We continue to think that the path could clear for a first cut in August.

Chart 1: Headline inflation is back to target – but the services component remains a concern

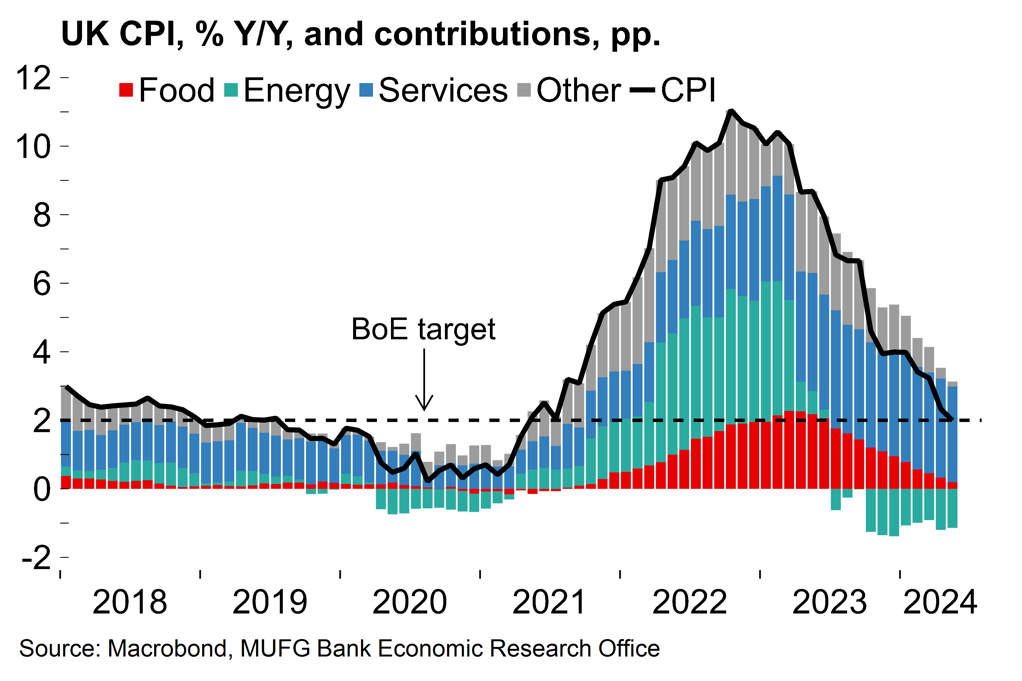

Chart 2: Household inflation expectations seem fairly well-anchored now

Softer euro area PMIs – but no need to panic

Today’s flash PMIs for June were notably weaker than expected, raising some questions about the strength of the euro area recovery. The composite figure fell from 52.2 to 50.8 with softer numbers in both the services and manufacturing sectors. Geographically it was also a broad-based slowdown – the figures for Germany, France and the rest of the euro area all softened.

While not a great batch of numbers, we would stress that the euro area composite gauge remains above the breakeven mark of 50 and is consistent with positive growth again in Q2. We continue to track a rate of 0.2% Q/Q.

Our suspicion is that any boost to sentiment from the widely-anticipated ECB rate cut this month seems to have been more than offset by adverse political developments. The survey data was collected during the 12-19 June period and is likely to reflect the sharp increase in uncertainty following the announcement of the snap French parliamentary election on 9 June (see here). Last week also saw the EU announce that it is looking at imposing additional tariffs on Chinese electric cars of up to 38%, to which China responded by announcing a probe into imports of pork from the EU. The prospect of an escalating Sino-European trade war may well have further weighed on manufacturing confidence with the output PMI falling to 46.0, a six-month low.

However, services activity is still at a solid-enough mark of 52.6 and consumer conditions are set to continue to improve as real incomes recover. As we’ve noted previously (e.g. here), while household spending is set to support activity, it’s likely to be a case of moderate recovery this year rather than a rapid rebound. Monetary policy is set to remain in restrictive territory for some time despite the ECB now having made the initial cut. Indeed, while policymakers will have been encouraged to see both input and output prices ease in today’s PMI data, the numbers remain well above the pre-2021 average. That supports our view that it will be a gradual easing cycle, against a backdrop of growth at around potential rates.

Chart 3: Signs that euro area growth momentum has slowed

Chart 4: The PMI is still consistent with a small Q2 expansion

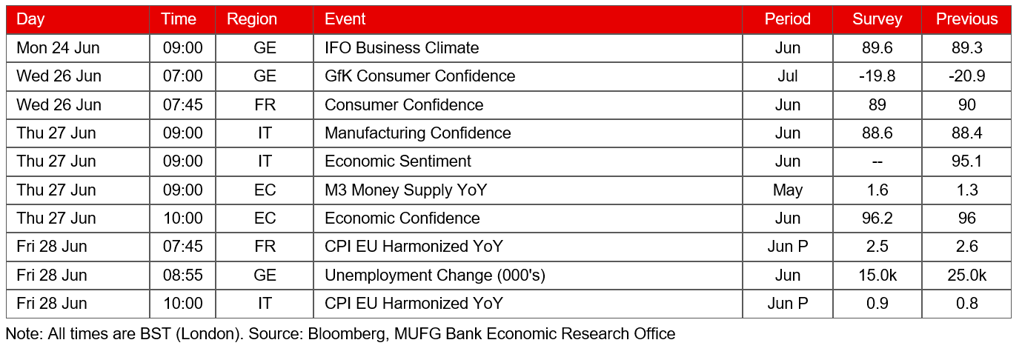

Next week: Further survey data and a first look at June inflation

Turning to next week, a range of further survey evidence on the euro area economy will be released, including the European Commission’s economic sentiment gauge and the reliable German ifo survey. Attention will focus on whether or not these support the signals of slowing activity from the PMIs this week, as well as the extent of any jitters around the political situation in France. There will also be the first national inflation prints for June in some countries (France, Italy, Spain) which are likely to show further easing in price pressures.

Key data releases and events (week commencing Monday 24 June)

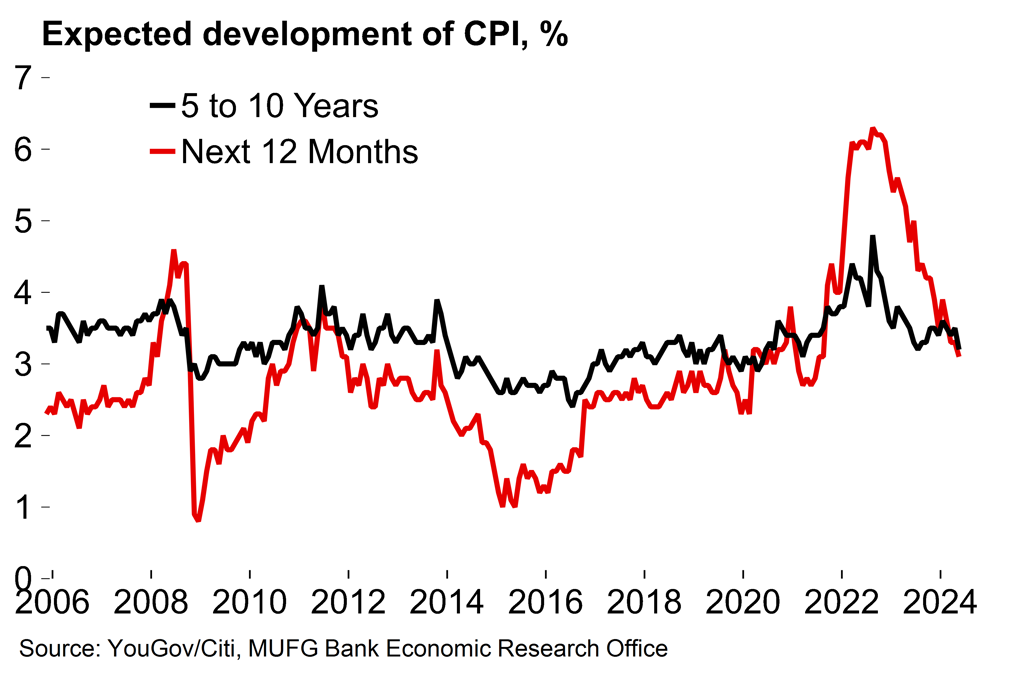

MUFG European Macro Outlook: Key points

- The euro area economy expanded by 0.3% Q/Q in the first quarter of the year, with all the major national economies growing at a faster-than-expected rate. The UK economy started the year strongly (0.6% Q/Q). While we look for slower growth rates in Q2, the recent uptick in momentum may well mark an inflection point after an extended period of stagnation. Broader growth conditions are set to continue to improve over coming months as real incomes recover and central banks start to ease policy.

- Nonetheless, it’s likely to be a case of moderate recovery this year rather than a rapid rebound. Business surveys have reinforced that message. The ECB followed through with its well-signposted cut in June, but the relatively hawkish tone suggested that policymakers remain wary about the inflation outlook. Monetary policy is set to remain in restrictive territory for some time. Meanwhile, many governments will need to make fiscal consolidation efforts after expansive spending in recent years, and structural pressures are set to continue to weigh on European manufacturing. The sudden increase in political risk following the announcement of a snap parliamentary election in France is also likely to weigh on sentiment. For these reasons we do not see growth sustainably exceeding potential this year or next. We expect average growth of 1.4% in the euro area in 2025 and 1.6% in the UK.

- Despite recent upside surprises in monthly inflation figures we expect that the disinflation process will reassert itself in H2 this year. Forward-looking survey indicators point to easing price pressures, household inflation expectations are well-anchored and there are mounting signs of increased slack in labour markets. We expect annual average euro area headline inflation will ease from 2.3% in 2024 to 2.0% next year. We expect a similar path in the UK, albeit with rates remaining slightly higher (2.3% in 2024).