Taking stock of the speed and scope of disinflationary pressures across EMs

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

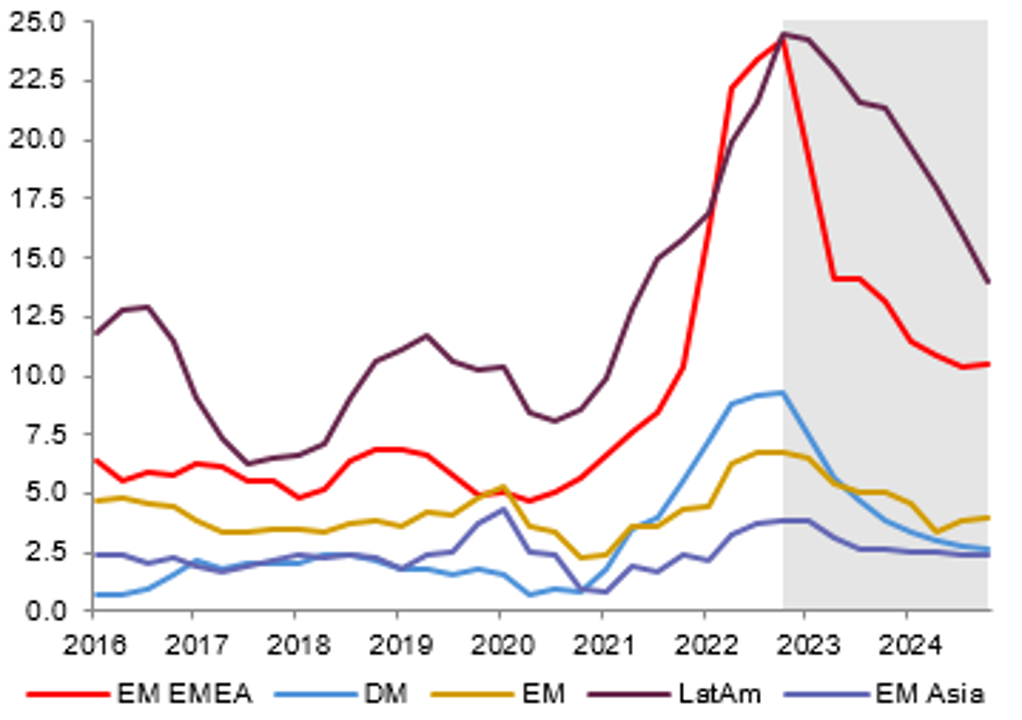

Macro focus: The disinflationary narrative in EMs has borne some setbacks in

recent weeks, causing markets to reassess the speed and scope of the fall in

consumer prices. While there are challenges in EM economies where fiscal policy

is loose, where exchange rates are weak or where wage growth remains elevated,

the broad EM disinflationary trend remains intact. Indeed, three month annualised

core inflation rates are falling almost uniformly across the EM complex. Yet,

although disinflation is a core theme in EMs, we believe the slow pace of

deceleration in core inflation is likely to bias EM central banks towards erring on the

side of caution on rate cuts this year, leaving real ex-ante policy rates elevated

across EMs – a core proposition that will offer support to capital flows

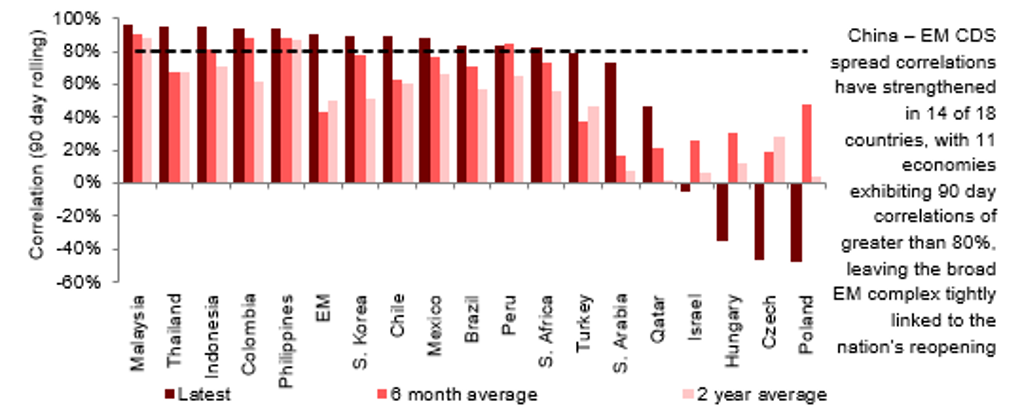

FX views: We continue to have faith that EM FX is through the worst and that the

top-down picture in 2023 is slowly changing for the better. The broad USD trend

could shift once the Fed ends its hiking cycle, mitigating volatility and improving the

outlook for EM FX. Also, China re-openings optimism provides a strong tailwind.

Week in review: Turkey cut its key rate by 50bp to 8.50%, Saudi Arabia’s trade

balance continues to narrow. Israel delivered a hawkish surprise of a 50bp hike to

4.25%. Finally, Russian real GDP contracted by 2.1% in 2022.

Week ahead: In the week ahead, we get the rate decision in Hungary (MUFG and

consensus: unchanged at 13.00%), Turkey inflation for February (MUFG: 55.8% y/y;

consensus: 55.7% y/y) and PMIs across the region for February.

Forecasts at a glance: Fundamental obstacles facing the complex in H1 2023 are

profound. This makes the EM space a difficult investment proposition until we see

the end of the current rate hiking cycle, the US dollar weakening and the Chinese

economy rebounding – all of which we anticipate by H2 2023 (see here).

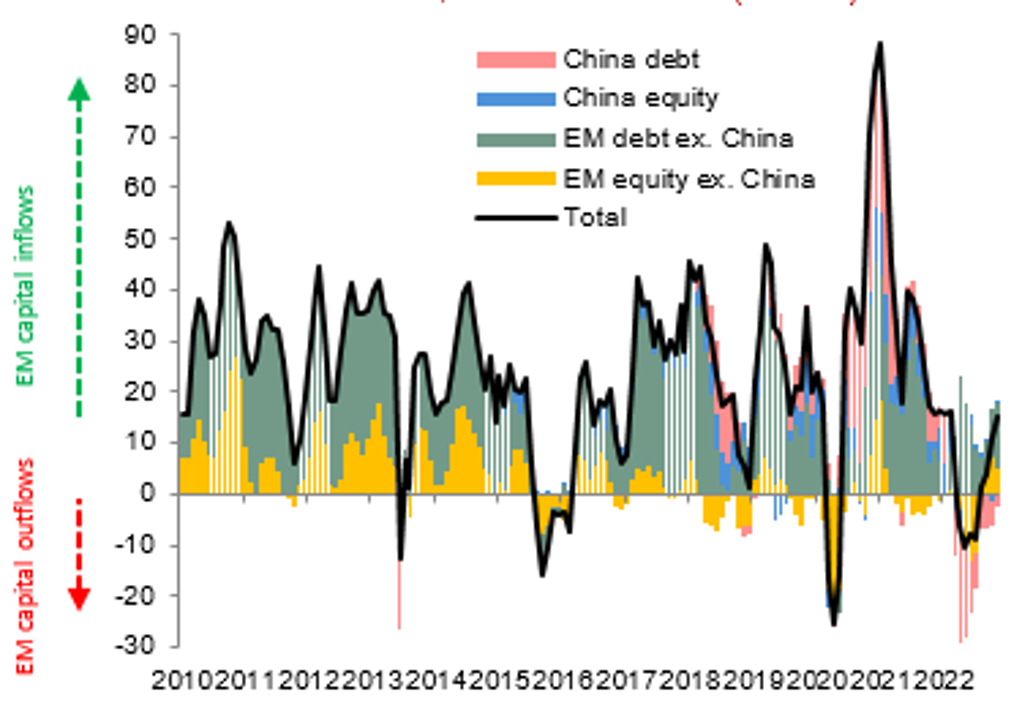

Core indicators: Investors decreased their exposures to EMs for the first time in

five weeks (USD-1.2bn) on a strong non-farm payrolls and hawkish Fed comments.

CHINA – EM CDS SPREADS CORRELATIONS (90 DAY ROLLING)

Markets are reassessing the speed and scope of the fall in consumer prices

The broad EM disinflationary trend remains intact. Indeed, three month annualised core inflation rates are falling almost uniformly across EMs.

The slow pace of deceleration in core inflation is likely to bias EM central banks towards erring on the side of caution on rate cuts this year, leaving real ex-ante policy rates elevated across EMs – a core proposition that will offer support to capital flows

Macro focus

Taking stock of the speed and scope of disinflationary pressures across EMs

The disinflationary narrative in EMs has borne some setbacks in recent weeks, causing markets to reassess the speed and scope of the fall in consumer prices. While there have been some hurdles of late, inflation is certainly no longer the same kind of shock to the EM system that it was for most of 2022. This is most evident by examining the way inflation surprises have moderated in recent months. Though benign inflation surprises are not the same as benign inflation, albeit the mindset impact of negative inflation surprises can be akin to declining inflation. It’s not only inflation surprising to the downside, but inflation itself appears increasingly well-behaved and our conviction stands that headline and core inflation data broadly peaked in Q4 2022 on an aggregative EM basis.

While there are challenges in EM economies where fiscal policy is loose (Brazil and Hungary), where exchange rates are weak (Egypt and Colombia) or where wage growth remains elevated (Israel and Romania), the broad EM disinflationary trend remains intact. Indeed, three month annualised core inflation rates are falling almost uniformly across EMs. The message with headline inflation is both decisive, in the sense that annualised inflation rates are now close to levels prevailing before the 2021 surge and widespread, in that there are no exceptions to the story of declining headline inflation momentum. As far as core inflation is concerned, there is more stickiness than is the case with headline inflation – principal rationale before

Overall, disinflation remains intact across the EM complex. However, we believe that the slow pace of deceleration in core inflation is likely to bias EM central banks towards erring on the side of caution on rate cuts this year, leaving real ex-ante policy rates elevated across EMs – a core proposition that will offer support to capital flows (see here). Such higher real ex-ante policy rates in EMs makes intuitive sense since we do not envisage any reason for equilibrium real interest rates to have declined in any considerable way just because of the COVID shock. However, one pertinent question is whether inflation ends up settling at levels higher than target because the underlying dynamics of global inflation appear to be more adverse than they were in a more globalised world. The positive news is that – up to a certain extent – higher than target inflation could be forgiven by the market. Case in point is Mexico, wherein the Central Bank of Mexico has had difficulties for a decade to get inflation towards the 3% target. This suggests that – within limits – a central bank can simultaneously fail to manage consumer prices, yet seeming to succeed.

EM CAPITAL FLOWS TO M, 3 MONTH AVERAGE (USD BN)

HEADLINE CPI INFLAITON FOR DM, EMS AND EM REGION (% Y/Y)

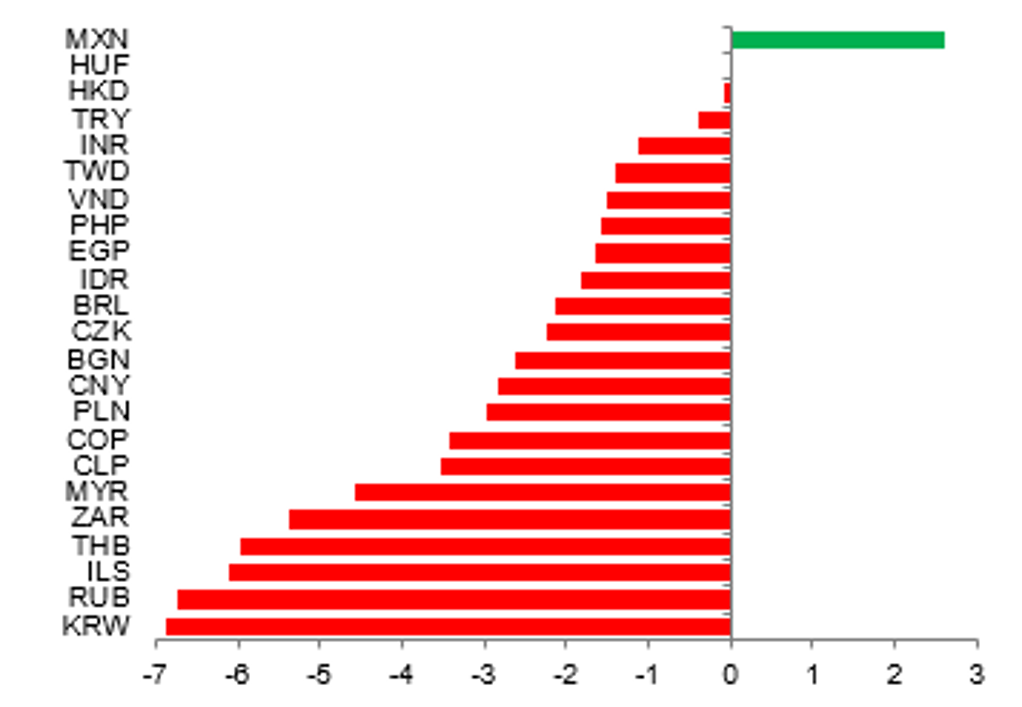

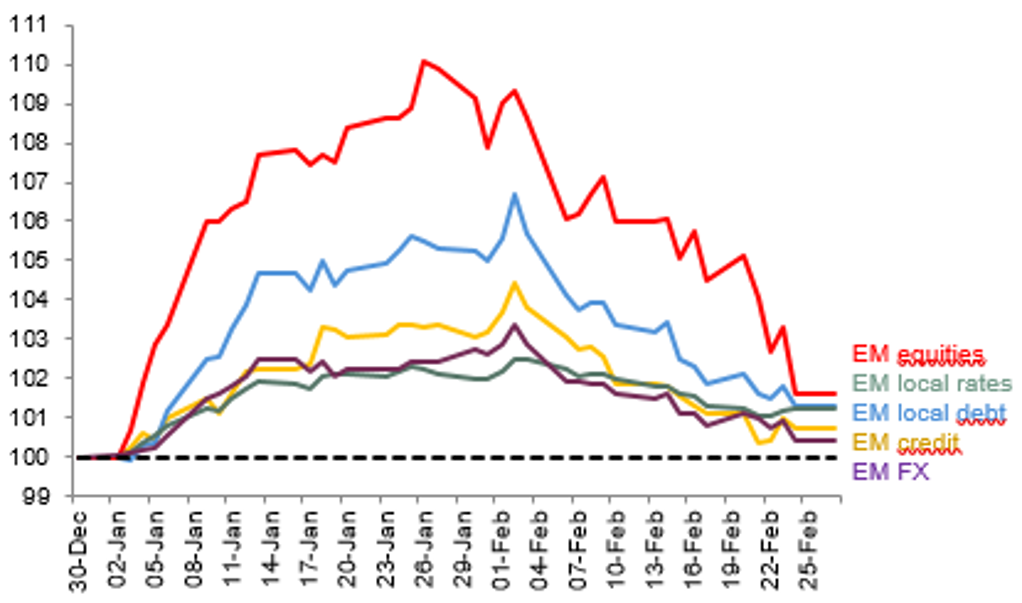

In February 2023, EM FX price action has been reminiscent of the “US rates up, USD stronger” period of 2022

Out of the currencies that have weakened the most over the last month, we remain constructive on EM Asia FX

Important for EM FX investors to find EM longs that can weather periods of USD resurgence and also provide a carry buffer

FX views

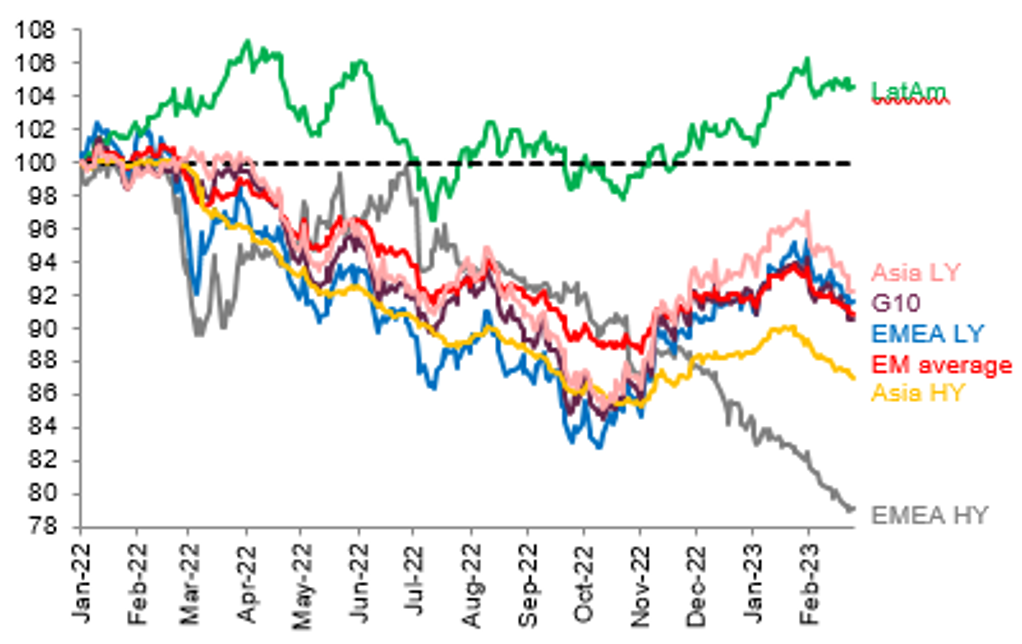

“US rates up, USD up” environment for EM FX to navigate in February 2023

In February 2023, EM FX price action has been reminiscent of the “US rates up, USD stronger” period of 2022 with MXN continuing to show US rate resilience, whereas the US rate-sensitive ZAR, COP and KRW are among the worst performers month-to-date. While there are some similarities between February 2023 and 2022, there are also some important differences. On the one hand, on the back of its close links to US demand, and thus MXN is a good long for a longer US cycle. In February, MXN has markedly outperformed where it should have traded given recent FX sensitivities to G9 FX and key global market variables. Yet, the relative outperformance of crosses like HUF and CLP speaks to the importance of improving growth outcomes (in Europe and China, respectively), and not just rates, in driving relative FX performance this year.

Out of the currencies that have weakened the most over the last month, we remain constructive on EM Asia FX, which should find support from an improving external balance picture and reliable link to Chinese growth expectations in coming months. In the case of ZAR, while the budget presented last week was better-than-expected, we believe the combination of near-term downside risks to growth and a relatively lower carry buffer will lead to ZAR underperformance relative to its peers. Meanwhile, COP has outperformed its peers in recent sessions, however, there is merit on remaining patient on COP at the current juncture given the increasing domestic policy uncertainty.

All in all, historical USD peaks suggests that, while the USD may have peaked in 2022, its path towards further weakness may be bumpy and so it remains important for EM FX investors to find EM longs that can weather periods of USD resurgence and also provide a carry buffer. We continue to have faith that EM FX is through the worst and that the top-down picture in 2023 is slowly changing for the better. The broad USD trend could shift once the Fed ends its hiking cycle, mitigating volatility and improving the outlook for EM FX. In addition, a successful China re-opening optimism provides a strong tailwind for EM FX. In that context, as we highlighted in our 2023 outlook, EM high-yielding currencies like MXN and BRL can each eventually outperform their peers (see here). Given the historical and economic context in Brazil, the sensitivity of the BRL to shifting perceptions of policy and institutional risks is understandable, and while Brazil has been key to bring inflation down most successfully, its pole position is not guaranteed without vigilance of monetary policy.

EM FX PERFORMANCE AGAINS THE USD (YEAR-TO-DATE, %)

EM REGIONAL FX VERSUS THE USD (REBASED 1 JAN 2022 = 100)

Highest level of EM capital inflows in January 2023 in two years

Recent repricing of US monetary policy is weighing on near term sentiment across EMs

Turkey resumes easing, cutting rates by

Week in review

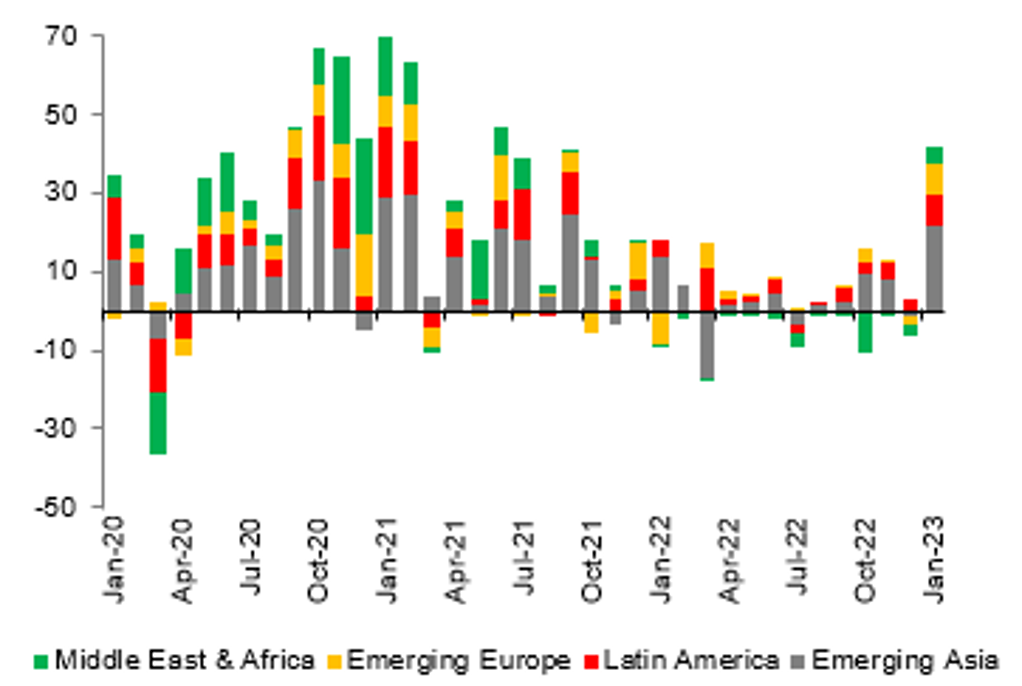

EM capital flows: increasing exposure to EM equities, outflows from bonds

EM securities attracted USD66bn in January 2023 – the largest single monthly inflow levels since January 2021 – on the back of a slowdown in DM interest rate hikes and a more favourable outlook that has allowed a number of EMs (especially in the MENA and EM Asia regions) to go back to issue fresh debt in international capital markets. Going forward, EM dollar-debt returns should rebound in 2023, yet if US financial conditions tighten meaningfully, spread losses could outpace duration gains. Fed tapering has the potential to tighten US financial conditions this year, with EM credit spreads following suit.

Last week witnessed another week of negative returns for EM risk assets. Moreover, last week’s FOMC meeting minutes for February did very little to change this bleak mood, even though policymakers agreed that the cumulative effect of rate hikes had begun to moderate inflation pressures. Meanwhile, following the latest repricing of rate hikes in the US, market expectations for federal funds rate seems have reached to the levels that are in line with the Fed's DOTS median in 2023.

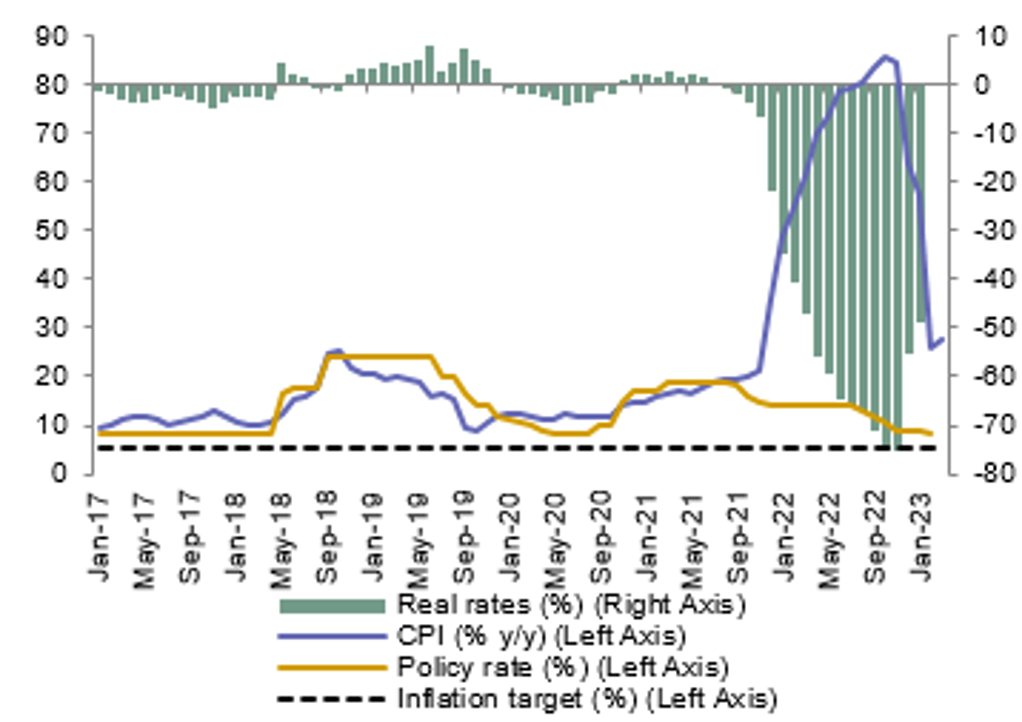

Turkey: CBRT cuts rates by 50bp to 8.50%, citing the need to support the recovery

The Central Bank of Turkey (CBRT) cut its key rate by 50bps to 8.50%. We had anticipated a 200bp cuts (consensus 100bps in easing). The smaller cut than expected may likely be motivated by the intention to extend the duration of the cutting cycle over a longer period of time until the May 2023 elections. In the statement, the policymakers said that the recent earthquakes are likely to impact production, consumption, employment, and expectations in the near term, but that the tragedy would not have a permanent impact on the performance of the economy in the medium term. The statement did not include any analysis on how near-term inflation dynamics might be affected. The forward-looking guidance was changed to say that after today's "measured" rate cut, the current policy stance is “adequate” to support the recovery. However, the policymakers also said that it has now become even more important to keep financial conditions supportive. Despite the rate cut, the net funding by the CBRT, which is a better indicator of the policy stance than rates under Turkey’s heterodox monetary framework, has actually declined since the earthquake. Hence, we regard

EM DEBT MONTHLY FLOWS BY REGION (USD BN)

EM EQUITIES, FX, RATES, CREDIT AND DEBT (1 JANUARY 2023 = 100)

Saudi Arabia’s trade surplus is narrowing on lower oil revenues

Israel surprises with a 50bp rate hike to 4.25% , and we expect another 25bp increase on 3 April

Russian economic growth contracts by 2.1% in 2022 – further details to be released in the upcoming months

Saudi Arabia: trade balance continues to narrow on lower oil prices – but still healthy

Saudi Arabia’s monthly trade surplus reached USD12.3bn in December 2022 – the lowest since August 2021. The trade balance has declined since the peak of May 2022 when the surplus was about twice as large as in December. The strong first half of the year resulted in a wide annual trade surplus of USD222bn. The recent decline was linked to lower oil prices which impacted both the hydrocarbon balance and non-oil exports as several oil related products.

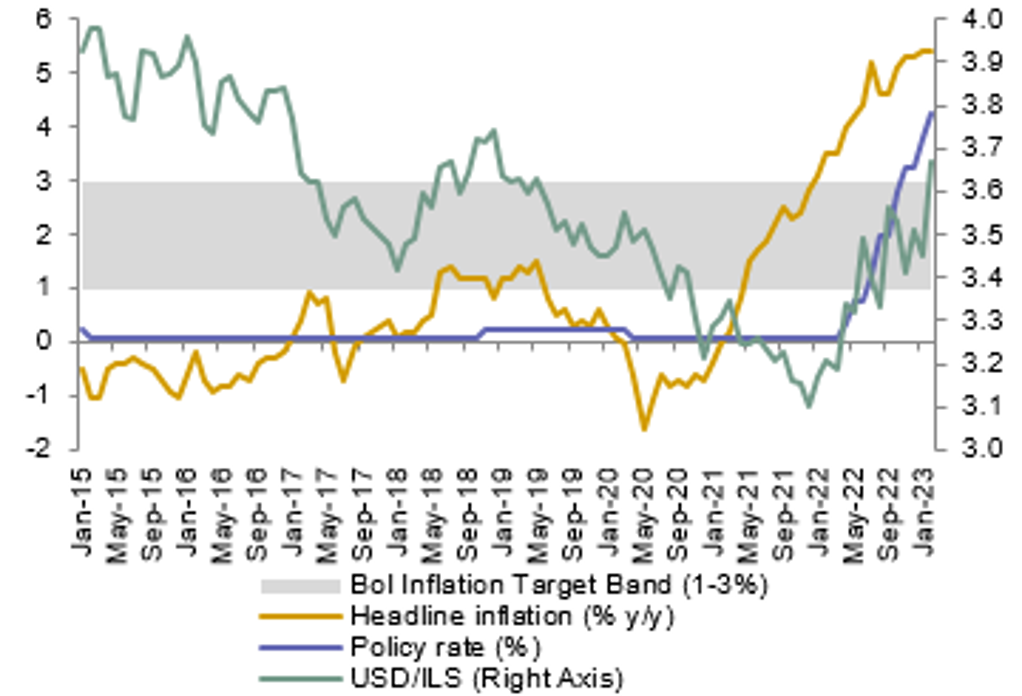

Israel: BoI delivers a hawkish surprise of a 50bp hike to 4.25%

The Bank of Israel (BoI) delivered a hawkish surprise by raising its policy rate by 50bp to 4.25%, against our (and consensus) expectations of a smaller 25bp hike. The decision follows relatively hawkish data from last week, with inflation edging higher in January against expectations of a decline, as well as a relatively strong GDP growth print for A4 2022. In addition, the Israeli Shekel (ILS) has also been under significant depreciation pressures recently, with the ILS recently testing its weakest levels versus the USD and the Euro over the past two years. Going forward, whilst we anticipate inflation to be close or at its peak with a declining path this year, we anticipate an additional 25bp rate hike at the next policy meeting given the recent ILS depreciation.

Russia: real GDP contracts by 2.1% in 2022

According to the Rosstat flash estimate, Russian GDP contracted by 2.1% in 2022, above the Central Bank of Russia’s (CBR) estimate published last week, and closer to the IMF’s recently updated estimate of 2.2%. On our estimates, this suggests a contraction of around 3.3% y/y, in Q4 2022, following a slowdown of 3.7% y/y in Q3 2022. The release does not include the expenditure and value-added breakdown, which are due to be published in the upcoming months; hence, the contributions to growth from different components are not straightforward to detect at present.

TURKEY INFLATION (% Y/Y), POLICY (NOMINAL AND REAL) RATES (%)

ISRAEL INFLATION (% Y/Y), POLICY RATES (%) AND USD/ILS

Hungary to keep rates on hold at 13.00%

Inflation in Turkey is expected to decline from 57.7% y/y in January to 55.8% y/y in February on base effects

PMIs for EM EMEA will be released in February

Week ahead

Hungary: MNB to keep rates on hold at 13.00%

The National Bank of Hungary (MNB) will meet on 28 February, and in line with consensus, we expect the Council to leave the base rate unchanged at 13.00%. The core focus for the meeting will be on any guidance or active decision regarding the emergency policy measures that were introduced back in October 2022, which resulted in the MNB raising the overnight rates to 18.0%. The backdrop for introducing these measures was significant depreciation pressures on the Hungarian Forint (HUF), which was beginning to pose financial stability risks. However, the HUF has now stabilised and has been on an appreciation trend since then

Turkey: inflation to mildly ease in February on base effects

Turkstat will release its February 2023 inflation estimate on 3 March. We expect headline inflation to decline from 57.7% y/y in January to 55.8% y/y (consensus: 55.7% y/y), primarily on base effects. As evidenced by the strong January inflation print, which surprised expectations significantly to the upside, underlying price pressures in Turkey remain disconcertingly high, and have likely worsened due to the earthquake. Whilst we expect robust base effects to drive inflation lower going forward, we view the pace of this decline will be slower than expected before. The disaster’s inflationary impact will likely come from potential supply chain problems, higher prices for construction materials and rising food and rent inflation as well as the loosening we expect from higher government spending.

PMIs for February: EM EMEA PMIs to be released for February

The EM EMEA aggregate PMI continued to increase in January, albeit only slightly from 51.4 to 51.5, broadly in line with the region’s long-term average (51.0). The average PMI across the CEE-3 rose from 47.2 to 48.1, with gains in the Czech Republic (from 42.6 to 44.6) and Poland (45.6 to 47.5), offset by a fall in the Hungarian PMI from high levels (59.3 to 55.0). Elsewhere in the region, the Turkish PMI rose from 48.0 to 50.1 (note that this pre-dated the earthquake). Across Sub-Saharan Africa, the PMI rose moderately in Ghana (from 47.0 to 47.2) and Kenya (51.6 to 56.0) whereas it declined by 1.1pts in Nigeria to 53.3. The composition was more mixed across the MENA region, as the Qatari PMI fell by 3.9pts to contractionary territory (at 45.7), while the PMI in Saudi Arabia rose further from already high levels (from 56.9 to 58.2).