Evaluating EM exposures to US debt ceiling angst

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

With a few weeks to go until the US debt limit deadline, we evaluate potential risks across the EM complex. Our examination does not assess the probability or the explicit impact of a potential debt ceiling stand-off – rather we assume the risk is principally centred around growth downside and gauge which EMs may lead and lag. Whilst there is not an abundant set of historically analogous periods to map (the 2011 downgrade of US sovereign credit is likely the most comparable episode), the evidence suggests that the EM performance in relation to US growth risks are broadly unambiguous. That is, large exporters and DM-sensitive markets, such as Poland, Hungary, Mexico, South Korea and Taiwan tend to underperform. Meanwhile, well-buffered balance sheet EMs, namely the GCC markets and most EM Asian economies, are well insulated.

FX views

The USD has continued to rebound against EM currencies over the past week, triggered by the ongoing correction higher in US yields and paring back of optimism over the strength of the economic recovery in China. The US economic data flow has surprised to the upside as well, encouraging the US rate market to scale back expectations for rate cuts later this year from around 75bps back towards 50bps. Fed Chair Powell did though dampen expectations for another hike at the next FOMC meeting on 14 June. The outperformance of LatAm currencies at the start of this year could also be tested by the paring back of optimism over the strength of economic recovery in China. In EMEA, HUF carry trades have been hit by comments from Hungarian Foreign Minister Szijjarto pledging to block further aid to Ukraine – the confrontational stance from the Hungarian government could further delay the release of EU funds, and may deter the NBH from easing policy further at this week’s policy meeting.

Week in review

Moody’s upgraded the government of Oman’s issuer and long-term senior unsecured ratings to Ba2 from Ba3 and maintained the positive outlook, reflecting improvements in debt affordability metrics. Saudi Arabia has raised USD6bn from the sale of sukuk in two tranches: (i) a USD3bn six-year tranche at 80 bps over US Treasuries and (ii) another USD3bn in 10-year notes at 100 bps over US Treasuries. The Central Bank of Egypt (CBE) left its benchmark rate remains unchanged as expected at 18.25%, owing to cooling inflation. Dubai’s inflation cooled in April (down 1ppt to 3.3% y/y), whilst Saudi Arabia’s April consumer prices was unchanged at 2.7% y/y in April. Finally, CEE flash Q1 2023 GDP estimates indicate recovery from lows registered at the end of 2022.

Week ahead

This week, Turkey will hold its presidential runoff on 28 May between the two candidates who won the largest shares of votes in the first round, the incumbent People Alliance’s Recep Tayyip Erdogan and the opposition Nation Alliance’s Kemal Kilicdaroglu. Separately, we will have rates decisions in Israel (MUFG and consensus: +25bp to 4.75%), Hungary (MUFG and consensus: on hold at 13.00%), South Africa (MUFG and consensus: +50bp to 8.25%) and in Turkey (MUFG and consensus: on hold at 8.50%). Beyond EMs, we will continue to monitor US releases, especially given recent comments from Fed Chair Powell emphasising the FOMC’s commitment to bringing inflation closer to target, but also noting that the “policy rate may not need to rise as much as it would have otherwise to achieve our goals” in the context of tightening credit conditions.

Forecasts at a glance

Whilst EMs continue to grapple with much the same themes at the turn of the year, we view the outlook as a tale of two halves in 2023. A fading boost from reopenings, a global manufacturing cycle downturn and tighter financial conditions are lumpy headwinds that will weigh on EM prospects in the first half of 2023. However, China’s zero COVID policy exit, the eventual end of rate hikes and a US dollar peak, all offer significant tailwinds to the EM complex in the second half of 2023 (see here).

Core indicators

According to IIF data, there was portfolio outflows to the tune of USD0.4bn and USD0.2bn from EM equities and EM bonds, respectively, last week.

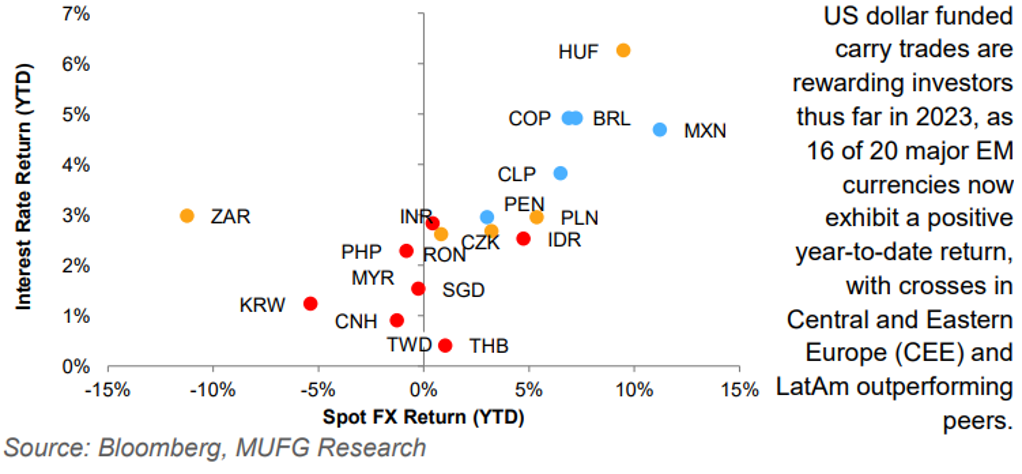

CHART OF THE WEEK: US DOLLAR DRIVES CARRY RETURNS ACROSS EM’S

EM FX SPOT VS INTEREST RATE RETURN (USD)