Taking stock of Turkey’s new cabinet – what comes next

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

Following his re-election on 28 May, President Erdogan appointed a new cabinet that includes a new Vice President (Cevdet Yilmaz), Minister of Treasury and Finance (Mehmet Simsek) and a central bank governor (Hafize Gaye Erkan). All three are known to have conventional views. We believe these appointments signal within the administration that monetary and fiscal policy adjustments are essential and that such adjustments need to be anchored on market-based policymaking. As such, in our view the incoming economic management team is likely to have increased flexibility to restore credibility to put the economy back on a more sustainable trajectory. We expect the most immediate step will be a gradual normalisation of monetary policy with an increase in the one-week repo rate from 8.50% to 20% when the central bank meets on 22 June, and thereafter reach levels that imply positive real rates by year-end, as we had catalogued recently (see here).

FX views

It has been another mixed week for EM FX performance. ZAR extends strong rebound while BRL, COP & MXN hit fresh year to date highs vs. USD. In contrast, the TRY continues to adjust sharply lower.

Trading views

This week has large event risk but without a pick-up in vol carry, trades should continue to do well.

Week in review

The Dubai PMI reading for May slowed to 55.3 from the eight-month high of 56.4 registered in April. South Africa's economy expanded by 0.4% q/q supported by domestic demand gains and despite the marked deterioration in energy supply. Poland kept rates on hold (6.75%) with a relatively dovish communication. Russia also kept rates on hold (7.50%) but strengthened its hiking bias. Finally, Nigerian president Tinubu suspended the central bank governor Emefiele following “the ongoing investigation of his office and the planned reforms in the financial sector of the economy”, raising the likelihood of a near-term Nigerian Naira (NGN) adjustment.

Week ahead

This week, we have inflation data for May in Romania (MUFG 10.2% y/y; consensus 10.2% y/y), Israel (MUFG 5.0% y/y; consensus 5.0% y/y) and the final print for Poland (MUFG 13.0% y/y; consensus 13.0% y/y). Beyond EMs, this week will be dominated by DM central bank rate meetings for the Fed, ECB and Bank of Japan.

Forecasts at a glance

Whilst EMs continue to grapple with much the same themes at the turn of the year, we view the outlook as a tale of two halves in 2023. A fading boost from reopenings, a global manufacturing cycle downturn and tighter financial conditions are lumpy headwinds that will weigh on EM prospects in the first half of 2023. However, China’s zero COVID policy exit, the eventual end of rate hikes and a US dollar peak, all offer significant tailwinds to the EM complex in the second half of 2023 (see here).

Core indicators

According to IIF data, monthly inflows to EM assets totalled USD10.4bn in May – USD6.9bn in form of equities and USD3.5bn in form of debt.

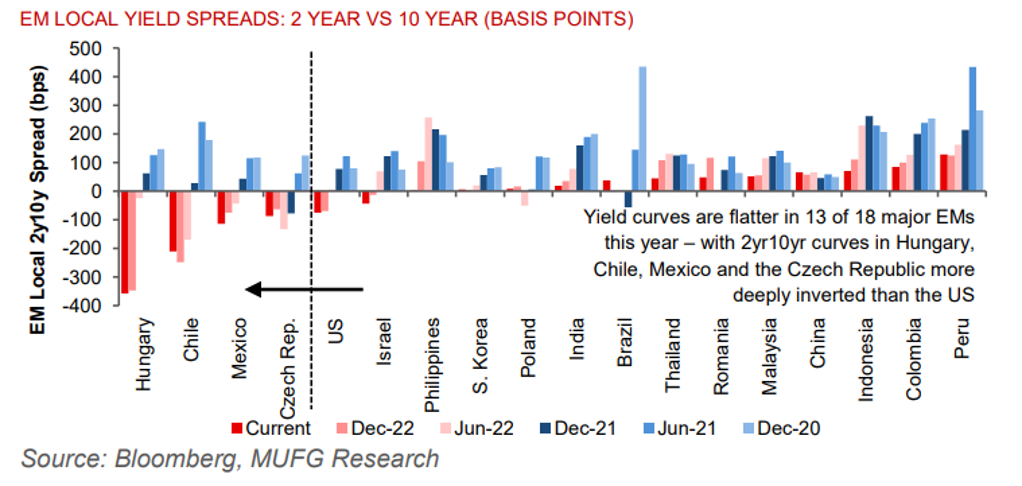

CHART OF THE WEEK: EM ECONOMIES MUST COPE WITH FLATTER CURVES