Implications of DM banking stress for EM banks

Macro focus: We have been receiving a number of questions from investors on EM banks, given apprehensions surrounding potential contagion from DM banking stress. We address these by examining cross-border exposure of EM banks in this week’s report, given the central from international bank lending has historically played as a drive for growth and capital flows. Our examination signals that due to limited EM cross-border bank exposure, increased DM banking stress would more likely transmit to EM through FX and financial market volatility on a first order basis (than explicitly through tighter lending standards).

FX views: The performance of EM currencies has been mixed over the past week although there has been a clear pick-up in EM FX volatility that has risen back towards YTD highs. The worst performers have been the MXN, HUF and the BRL, while the CNY, THB, CLP and ZAR managed to post small gains v/s USD.

Trading views: The performance of EM currencies has been mixed over the past week although there has been a clear pick-up in EM FX volatility that has risen back towards YTD highs.

Week in review: Inflation in Russia continued to fall for the second month of 2023, Inflation in Egypt increased from 25.9% y/y in January to 32.0% y/y in February. The National Bank of Poland (NBP) left its policy rate unchanged at 6.75%, Finally,

Week ahead: In the week ahead, Russia is set to keep rates on hold (7.50%), inflation in Poland for February is set to rise, whilst February inflation in Israel is estimated to fall.

Forecasts at a glance: Fundamental obstacles facing the complex in H1 2023 are profound. This makes the EM space a difficult investment proposition until we see the end of the current rate hiking cycle, the US dollar weakening and the Chinese economy rebounding – all of which we anticipate by H2 2023 (see here).

Core indicators: EM securities attracted USD22.9bn in February according to IIF data, continuing the positive momentum at the beginning of the year.

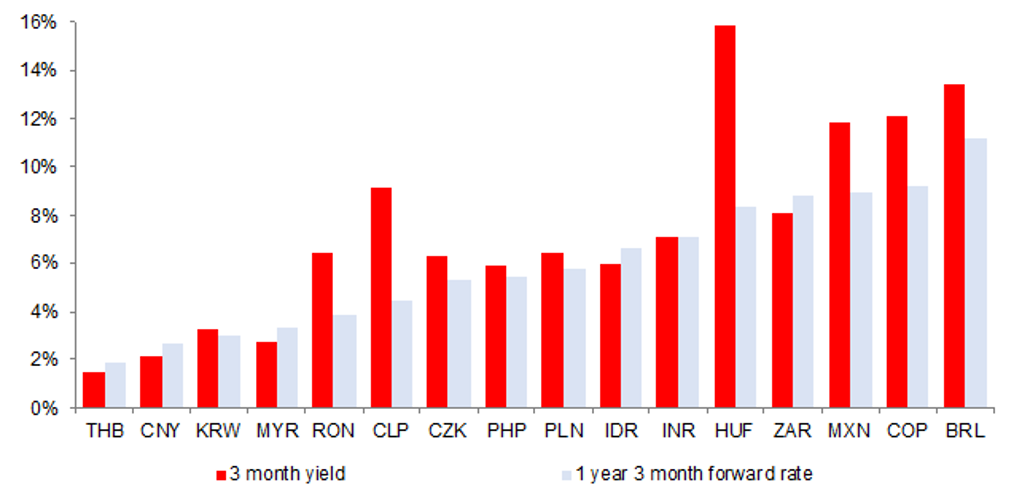

CHART OF THE WEEK: INTEREST RATE SWAPS SIGNAL EASIER EM POLICY

EM 3 MONTH YIELD VS 1 YEAR 3 MONTH SWAP RATE (%)

Source: Bloomberg, MUFG Research