Key Points

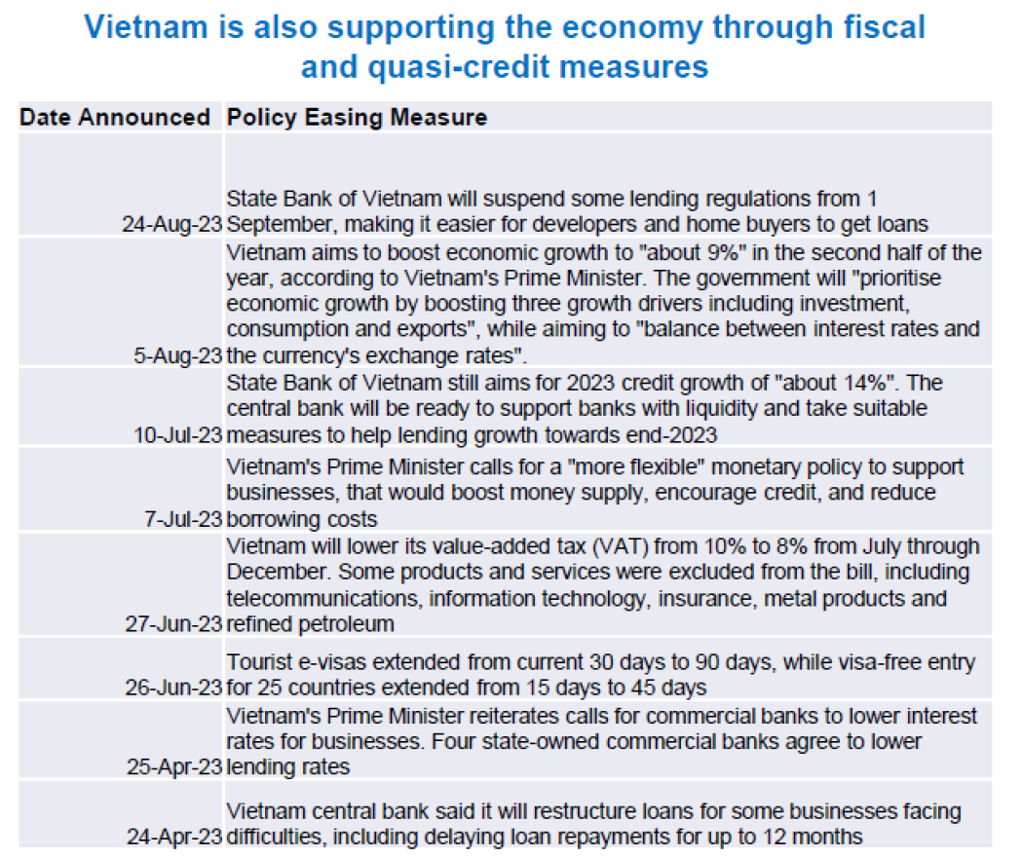

- We raise our USDVND forecasts to 24,300 in 3m and 24,000 in 12m, up from 23,650 and 23,500, implying some underperformance against Asian currencies.

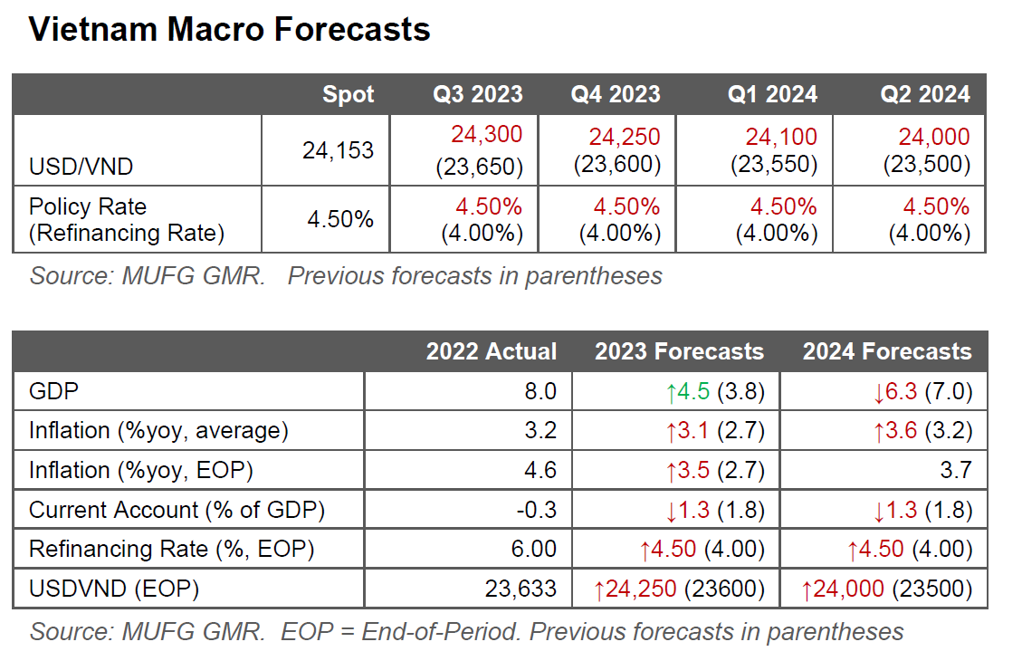

- The balance of risks now tilt towards front-loaded moderate weakness in VND, especially with RHS FX hedging costs and domestic rates as low as they are.

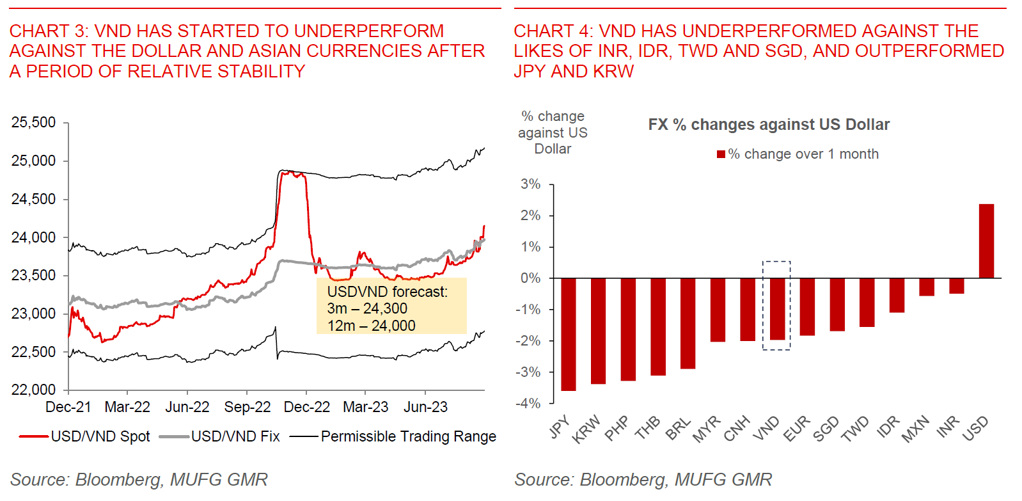

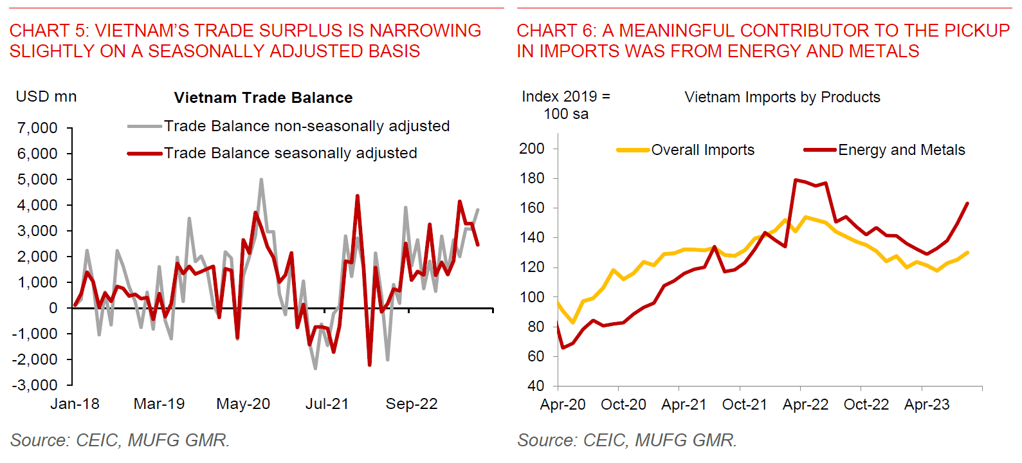

- What’s changed relative to our forecasts are two factors. First, imports seem to have picked up at a faster pace than we expected, driven by stronger demand and import prices for oil and metals. Second, inflation has also accelerated recently, pushing down real interest rates.

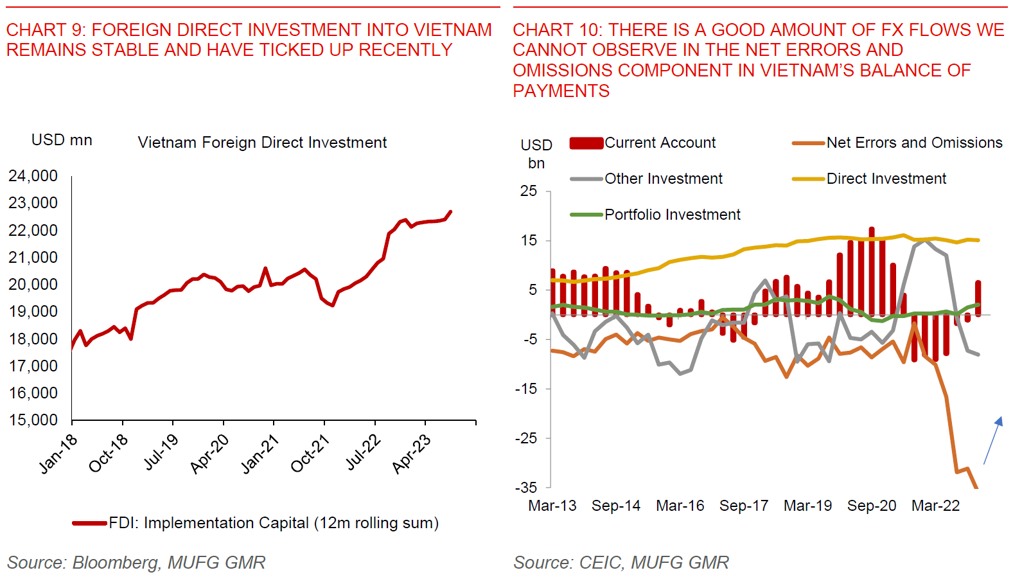

- It’s nonetheless important to stress we do not expect sustained sharp VND weakness akin to what we saw in 2022. First, we expect the Fed to pause and cut rates into 2024, allowing the US Dollar to weaken. Second, commodity prices are more stable compared with the period immediately after the Russia-Ukraine conflict. Third, the recent pickup in Vietnam’s imports and inflation is unlikely to sustain meaningfully, partly because we assume oil prices remain stable while domestic demand and investment activity improves only gradually. Fourth, Vietnam’s FX flows should remain supportive with steady FDI, tourism recovery and reversal of domestic capital flight, albeit with a smaller trade surplus.

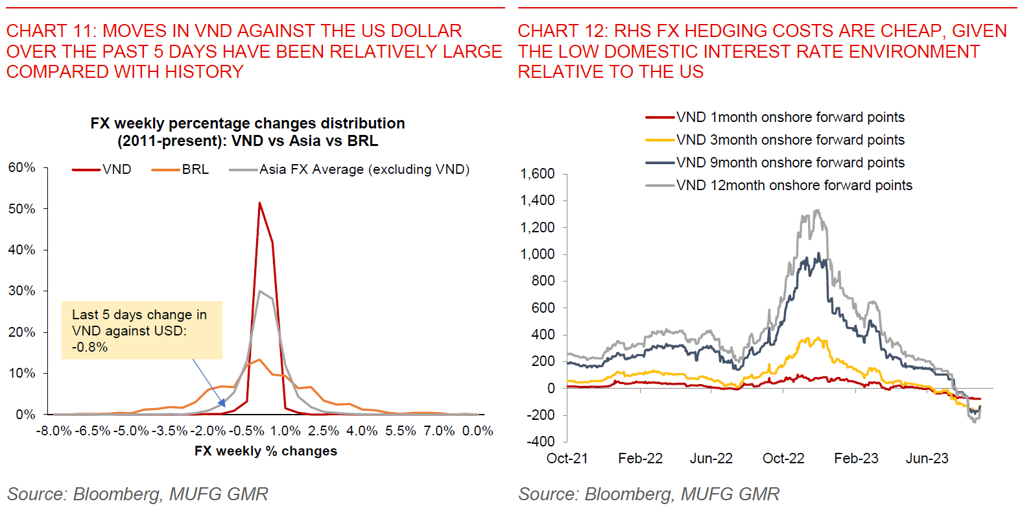

- The caveat is there is a good chunk of FX flows we cannot measure, and there is a possibility that capital outflows have picked up again. If that is the case, risks for our VND FX forecasts will skew weaker.

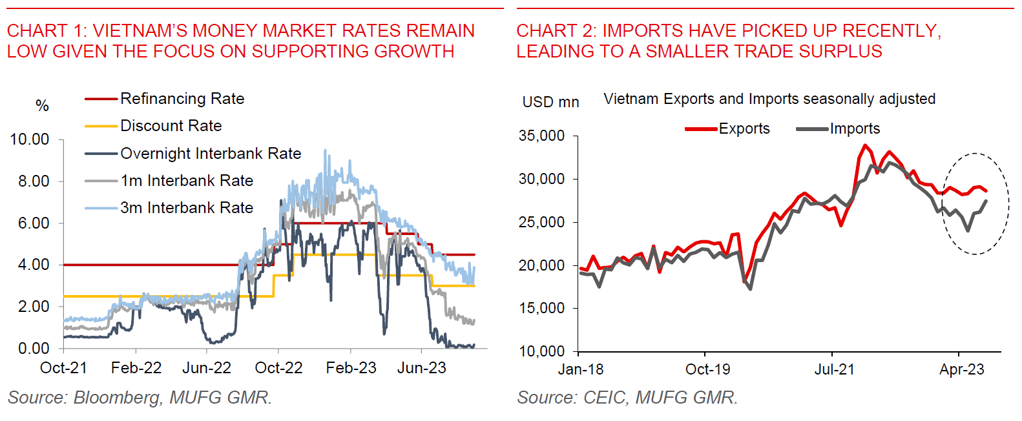

- We now expect SBV to keep its refinancing rate on hold to maintain FX stability (from a 50bps cut), but to maintain money market rates at low levels.

VND has started to underperform recently: USDVND recently broke past the 24,000 level, and in a key change relative to the past few months, has started to underperform against Asian currencies such as INR, IDR, TWD and SGD from a period of relative stability. It has nonetheless done better than the likes of JPY, KRW, and PHP, while performing in line with CNH so far (Charts 3 and 4). The moves over the past 5 days of -0.8% have nonetheless been anomalous relative to USDVND’s history, falling closer to the 2nd percentile in terms of weekly changes (Chart 11).

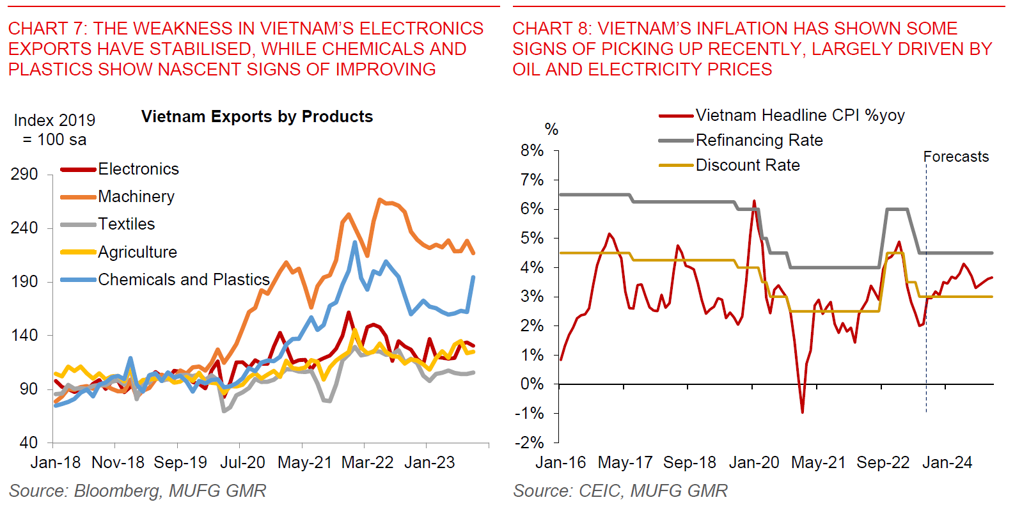

Narrowing trade surplus provides less support for FX: From a macro perspective, we have been expecting VND to remain stable against the US Dollar given the decent picture for FX flows and macro stability, which helps offset the current low domestic interest rate environment. What’s changed recently is that the trade surplus is narrowing somewhat from elevated levels after accounting for seasonal factors (see Charts 2 and 5 above). When looking at the details of the recently released trade data for August, a large part of the import pick-up can be attributed to energy, petroleum and metals, driven by both volumes and price increases, and to a smaller extent agriculture imports (see Chart 6 above). The good news is that exports have remained quite stable in level terms in aggregate, with weakness in key products such as electronics, machinery and textiles stabilising, while chemicals and plastics exports are showing some nascent signs of picking up (see Chart 7 below).

Vietnam’s CPI Inflation showing signs of accelerating recently to 3%yoy: Another factor that has weighed on VND at the margin has been rising inflation. Latest estimates for August inflation shows some pickup in inflation momentum, with CPI rising by 0.7% mom seasonally adjusted, up from 0.5%mom previously. When looking at the details, the good news is that most of the pickup can probably be attributed to energy-related pricing, with transportation CPI rising to -0.3%yoy from -9.3%yoy the previous month, while the housing component (which includes electricity) rose to 7.1%yoy from 6.5%yoy. Overall, core and underlying inflation is trending down gradually to 4%yoy in August from 5.2%yoy at the start of the year.

Domestic interest rates to remain low with the focus on supporting growth: Notwithstanding the recent pickup in inflation and rise in VND FX volatility, we continue to expect domestic interbank rates to remain low, given the government’s focus to support economic growth. We nonetheless remove our forecast for a 50bps cut in the refinancing rate, given the recent pickup in VND weakness. We continue to expect authorities to support economic growth through a combination of lowering lending rates (and as such narrowing bank margins), increasing credit availability through banks, and also fiscal stimulus.

VND supported by FX flows, weaker US Dollar, and stable commodity prices, partly offsetting low domestic rates: It’s important to stress that we do not expect sustained sharp VND weakness akin to what we saw in 2022 as we head into next year, and our base case forecasts reflect that view. First, we expect the Fed to pause and cut rates into 2024, allowing the US Dollar to weaken. Second, commodity prices are more stable compared with the period immediately after the Russia-Ukraine conflict. Third, the recent pickup in Vietnam’s imports and inflation is unlikely to sustain meaningfully, partly because we assume oil prices remain stable while domestic demand and investment activity improves only gradually. Fourth, Vietnam’s FX flows should remain supportive with steady FDI, tourism recovery and reversal of domestic capital flight, albeit with a smaller trade surplus.

Risks to our VND forecasts skew weaker if capital outflows resume: The caveat is there is a good chunk of FX flows we cannot measure and observe, and there is a possibility that capital outflows have picked up again. The net errors and omissions component in the balance of payments swung to more than a US$30bn deficit last year, and almost by definition, is not measurable by official sources (see Chart 10 below). If capital outflows intensify, the risks for our VND FX forecasts could skew weaker through 2024.