Please download PDF using the link above for the full report

Key points:

- The significant temporary tariffs cuts reflect that both countries recognize the importance of trades between them. Look ahead, actual progress of negotiations in next 90 days will matter for market performance. Non-tariff barriers, such as, market access, investment and exports restrictions and etc., would be focuses as well, and they are equally challenging.

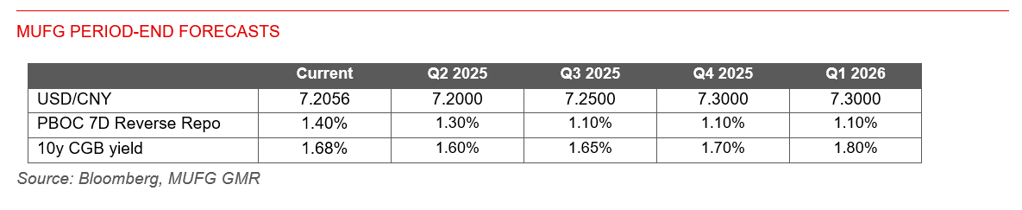

- We revise our Q2 forecast for USD/CNY lower to 7.2, and expect 7.25 for Q3 and 7.3 for Q4. In the very near-term, the pair could edge below 7.2, however, with a total 41% tariffs implemented on China exports to US, Chinese real economy likely softens more noticeably in coming months, and in turn weigh on the CNY.

Event:

On 12 May afternoon, the US and China issued a joint statement after the economic and trade meeting in Geneva held over the 10-11 May. According to the statement, both parties agreed to temporarily lower the tariffs (announced since 2 April) on each other’s goods, for an initial period of 90 days, effective by 14 May.

US will reduce the combined 145% tariffs (levied since the beginning of Trump’s second term) on China’s goods to 30%, including the 20% tariffs tied to fentanyl, while China will reduce the 125% tariffs on US goods to 10%. And China would also suspend or remove the non-tariff countermeasures taken against the US since 2 April.

Comments:

- The magnitude of the temporary tariffs cuts was larger than what market widely expected. The 1.6% rise of Hong Kong stock HSI index, 1.1% rise of the US dollar (DXY index) and 1.3% rise of the Brent crude oil all indicated a positive take of the markets on the statement.

- Today’s large reductions on tariffs mean that both parties recognized that prior levels of tariffs were irrational, as 145% and 125% tariffs are equivalent to trade embargo, unbearable for both sides in the long-run. “Neither side wants a decoupling…we do want trade. We want more balanced trade”, said by Scott Bessent.

Looking forward, actual progress in tariffs negotiations in next 90 days will be key.

- We see room for two countries to give a play to their respective comparative advantages so to reduce some trade imbalances. China-US bilateral trades are highly complementary, the top five categories of China exports to US in 2024 were electrical and mechanical equipment and their parts, machinery and equipment and parts, furniture, toys and plastic products, accounting for a 57.2% share to total China exports to US. While the top five categories of goods China imported from US were mineral fuels, machinery and equipment and parts, electrical and mechanical equipment and their parts, optical instruments, and soybeans and other oil-containing kernels, accounting for a 52.8% of total US exports to China. There are potential purchasing deals there.

- China has been insisting that US cancels all unilateral tariffs that violate WTO commitments before negotiations. China may show certain flexibility in negotiations, however given the still large wedges in positions or stances between two parties, a smooth process of future negotiations seems unlikely. US maintained the 20% tariffs on China tied to fentanyl, and China's two rounds of retaliatory measures against fentanyl tariffs remained as well, including China’s export control of tungsten, tellurium, bismuth, molybdenum, and indium-related items on 4 February. China's export control measures on antimony, gallium, germanium, etc. were introduced last year. Scott Bessent said that the tariff reduction announced does not apply to sectoral tariffs (e.g., steel and aluminium), and that the tariffs applied on China during Trump 1.0 remain in place. China is against such tariffs.

- There could be additional sectoral or industry tariffs from US, relating to pharmaceuticals, semiconductors and etc. Bessent said that the US and China have identified five or six strategic industries and supply vulnerabilities such as pharmaceuticals and steel, where US will seek supply chain independence and reliable supply from allied countries.

- Out of the 30%, the significant part of 20% tariffs on China is tied to fentanyl. It is China’s stance that the US's use of fentanyl as an excuse to impose trade restrictions on China will not help solve the problem, this was mentioned in the White Paper entitled “China's Position on Certain Issues in China-US Economic and Trade Relations” published on 9 April. According to the White Paper, in 2023, China exported a total of 9.766 kilograms of fentanyl drugs, mainly to South Korea, Vietnam, Malaysia, Philippines in Asia; Chile, Panama, Colombia, Paraguay in Latin America; and Poland, Germany, France and other countries in Europe. No fentanyl drugs of any variety or dosage form have been exported to North America. Should this statistics be clarified with the US, it may suggest potential dial-back of related tariffs.

- Key areas not specifically mentioned in today’s statement but tough for future negotiations, are China’s rare earth export restrictions to US, and China’s demands of US lifting of exports/investment restrictions to China and etc. US control in high-tech fields such as semiconductors and AI is still deadlocked.

Implication for USD/CNY: With today’s updated tariffs, the average tariffs that US imposes on imports from China would be 41% in total, taking into account the existing 11% tariff before Trump’s second term. For the near term, the positive sentiment could reduce some pressure on CNY, US dollar’s potential gain on US-China trade deal optimism and reduced possibility of a US economic stagflation / mild recession, would limit the degree of CNY’s strength against the US dollar.

We revise our Q2 forecast for USD/CNY lower to 7.2, and expect 7.25 for Q3 and 7.3 for Q4. In the very near-term, the USD/CNY can edge lower than 7.2. With a total 41% tariffs implemented on China exports to US, China’s exports likely worsen in May and ahead. The weaker real economic performance likely weighs on the currency.