Key Points

Please click on download PDF above for full report

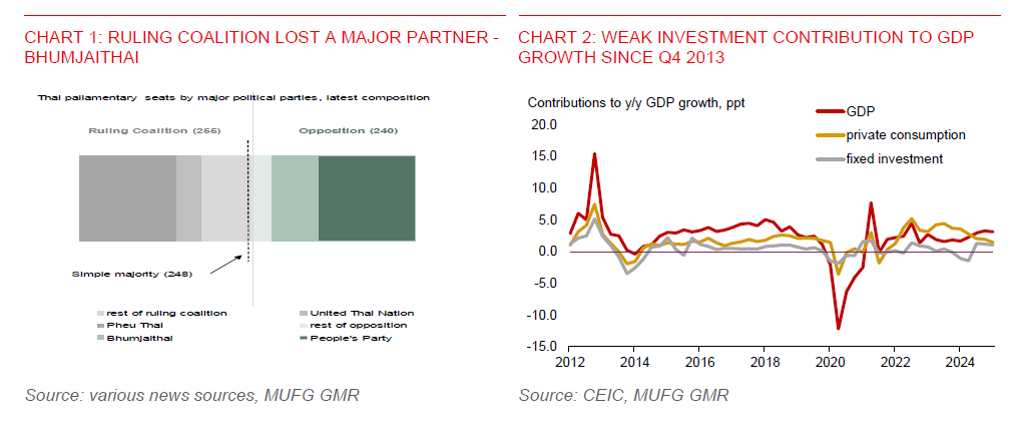

- Thailand is facing fresh political troubles again, following a leaked phone call between Thai Prime Minister Paetongtarn and former Cambodian PM over cross-border disputes. In the call, Paetongtarn criticized the military for escalating border tensions. This has led to the Bhumjaithai party – with 69 parliamentary seats – to withdraw from the ruling coalition. This has seriously weakened the government, which now holds 255 seats, only slightly higher than the slim majority of 248 (Chart 1). The remaining 9 political parties have signalled their intention to remain in the ruling coalition, while the Constitutional Court has stepped in to suspend Paetongtarn from her duties, and she has 15 days to respond to the court order.

- Political instability hurts business confidence, with the policy landscape constantly being redefined by leadership turnover. In Thailand, we see multiple leadership shifts over the years, brought about mostly by court interventions for various reasons. There was also a military coup in 2014. Since the 2013 political crisis, the impact on growth and investments is clear. Economic growth has weakened, while investment has contributed less to GDP growth (Chart 2).

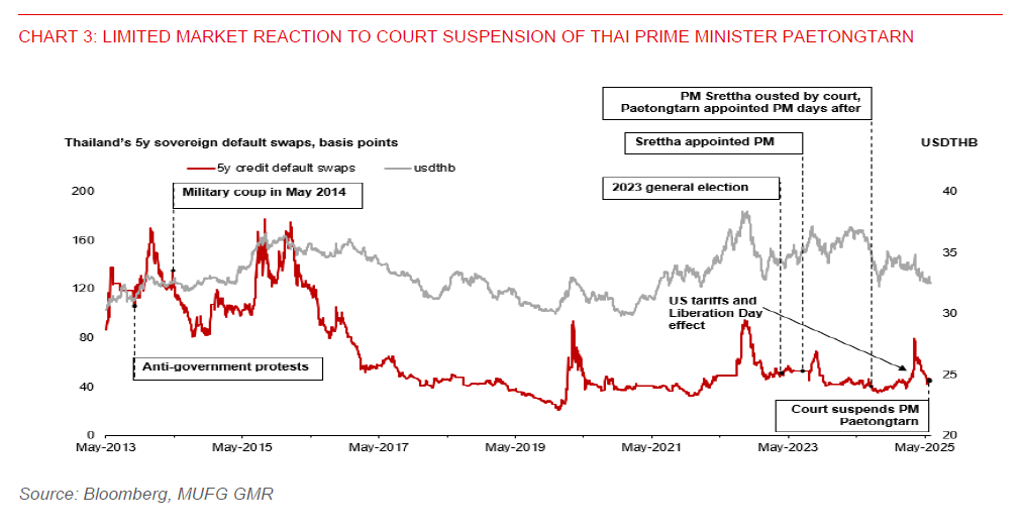

- Markets have not factored in a significant increase in political risk premium. The Thai baht has been resilient, with limited market reaction to the court suspension of the PM (Chart 3). There has been limited market reaction in the sovereign credit default swaps market, similar with the period seen when former PM Sretta was removed by the court. Similarly, there has not been pricing in of political risk premium in both the onshore and offshore forwards markets for the shorter-term tenors.

- For now, we think the risk of a military coup is low. But given the volatile nature of Thai politics, the situation can still de-escalate sharply and quickly, which makes hedging against left-tail risks a viable consideration.

- To gauge the economic impact if the political situation worsens further, we can draw insights from the 2013-2014 political crisis as a worst-case scenario. During the anti-government protests in Q4 2013, investment fell 6% quarter-on quarter, worsening the slowdown that began in 2012 (Chart 4). Consumer confidence was a negatively affected. The impact on tourism also started to show in the following months as protests escalated. Visitor arrivals were down by about 30% compared to “normal” times. And only 89% of the budget was disbursed in FY 2014, the lowest in years due to the political turmoil (Chart 5).

- Persistent political instability and policy uncertainty have eroded Thailand’s attractiveness as an FDI destination. Today, Thailand’s share of total ASEAN FDI was just 4.7%, about 60% drop from its share in Q4 2013.

- The latest bout of political instability has unfortunately emerged at a time when economic growth is already under pressure from multiple fronts. Monthly activity data for April indicates a slowdown in both consumption and investment (Chart 6). Domestic credit growth remains subdued, and while the decline in credit to SME manufacturers has become smaller, it continues to show muted momentum (Chart 7).

- The Bank of Thailand will likely cut rates further in H2, given rising risks to growth. It held rates in June to preserve policy space, but maintained a dovish tone, noting the need to stay accommodative to support the economy. Headline inflation turned negative in April and May, giving ample room for rate cuts.

- The BoT could also become more aggressive with rate cuts. There will be a new BoT governor after 30 September, when the term of current governor ends. Finance Minister Pichai has said that the next BoT governor has to address the issue of abnormal baht strength. We think one potential measure is to lower the policy rate much more. The two shortlisted finalists for the role are Vitai, president of the Government Savings Bank, and Roong Mallikamas, deputy governor for financial institutions stability at the BoT.

- The Thai baht has been resilient so far, finding support in a weaker USD and elevated gold prices. However, the upside risks for USDTHB could become significant if political tensions escalate to levels seen in the 2013-2014 crisis. During the 2013-2014 crisis, USDTHB rose by about 6% within 1-2 months, while Thai equities fell about 15% as global funds exited the market.