Key Points

Please click on download PDF above for full report

- The Bank of Thailand (BoT) cut its benchmark policy rate by 25bps at 1.50% in August, in line with our and market expectations. The Monetary Policy Committee (MPC) voted unanimously in favour of the rate cut. This marks a shift towards a more accommodative policy stance, reflecting concerns about a prolonged economic slowdown into early 2026 amid trade headwinds and weakness in domestic demand. The central bank is also concerned about the potential impact of US transhipment tariffs, which could affect trade flows and undermine domestic industrial production.

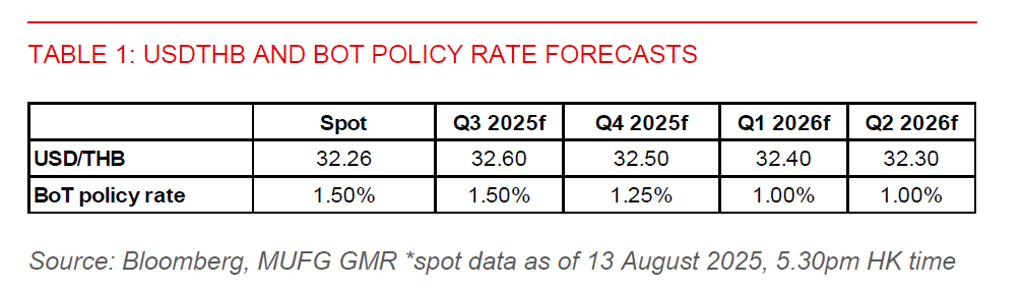

- We expect the Bank of Thailand (BoT) to lower its benchmark rate to 1.00% by Q1 2026, implying two additional 25bps cuts - one each in Q4 2025 and Q1 2026. Headline inflation remains negative, credit growth is subdued, and downside risks to growth persist amid higher US tariffs. While the BoT retains room to ease further, it has cautioned that the marginal effectiveness of additional rate cuts may be limited. The Thai King has endorsed Vitai, an advocate for rate cuts and former president of the Government Savings Bank, as the next BoT governor, with his term beginning in October.

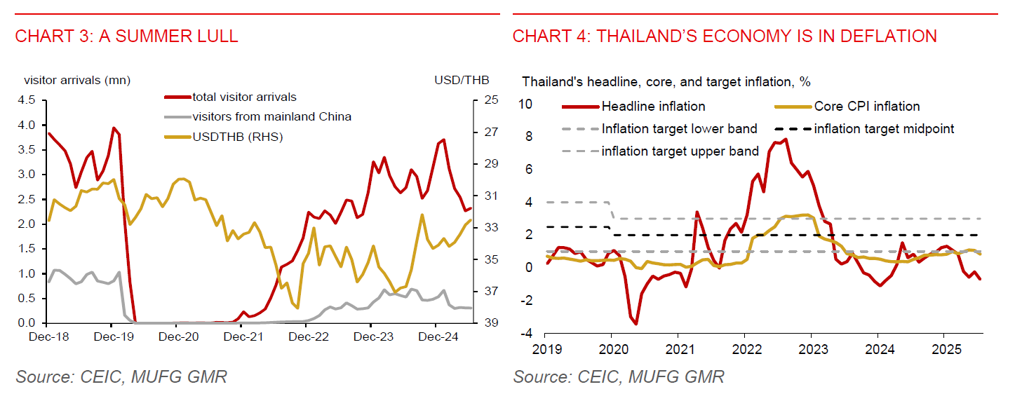

- The Thai baht has showed limited reaction to the widely expected policy rate decision, while markets have also been hesitant to price in domestic political risks or the recent Thai-Cambodia cross-border conflict, which has since entered a ceasefire. The outlook for the baht remains mixed. While potential Fed rate cuts in September could support baht appreciation, further BoT easing is likely to offset these gains, keeping the currency stable in the near term. We maintain our USD/THB forecast at 32.50 by end-2025.

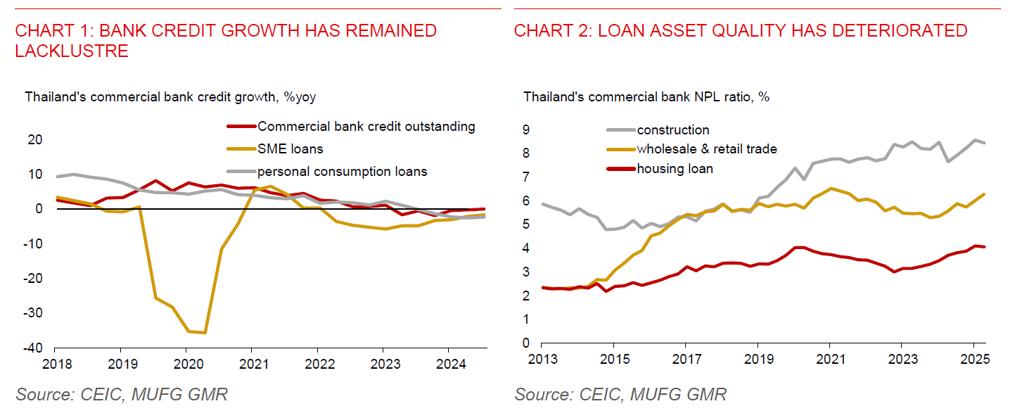

- Thailand’s GDP growth will likely slow to 2.2% this year and next. The frontloading of goods exports to the US, which supported H1 growth, is expected to fade. Tourist arrivals softened to 16.7 million in H1 2025, down from 17.5 million a year earlier. Commercial bank credit growth remained weak in Q2, rising just 0.1% y/y after five consecutive quarters of contraction.

- Weakness in commercial bank credit growth was particularly evident in SME loans, which contracted by 1.6%yoy, and personal consumption loans, which fell by 2.3%yoy. Notably, SME lending has been in decline since Q1 2023, while personal consumption loan growth has now contracted for four straight quarters, underscoring persistent credit headwinds. Loan quality has also deteriorated, particularly in housing loans and the wholesale & retail trade sector. Of note, the non-performing loan (NPL) ratio for housing loans has edged above the COVID-era peak of 4%, signalling rising stress in household debt servicing. Meanwhile, the credit quality of SME loans remains weak, with no clear signs of normalization to pre-pandemic levels.

- On trade, the US imposed a 19% tariff on Thai goods effective August 7, down from the previously announced 36%, but still higher than the 10% rate implemented in April. Sectors that could be more impacted include machinery, vehicle parts, rubber, and apparels. A phased removal of tariff barriers for 90% US goods may also lead to increased competition for domestic firms. However, the 19% tariff rate aligns with tariffs on other major ASEAN economies, helping preserve Thailand’s relative export competitiveness. As part of the US-Thailand agreement, Thailand has committed to reduce 70% of its US$46 trillion trade surplus over five years by increasing imports of US energy, agriculture, and aircraft. While this may pressure Thailand’s goods trade balance, strategic sourcing and supplier diversification could help partially mitigate the impact.