Week in review

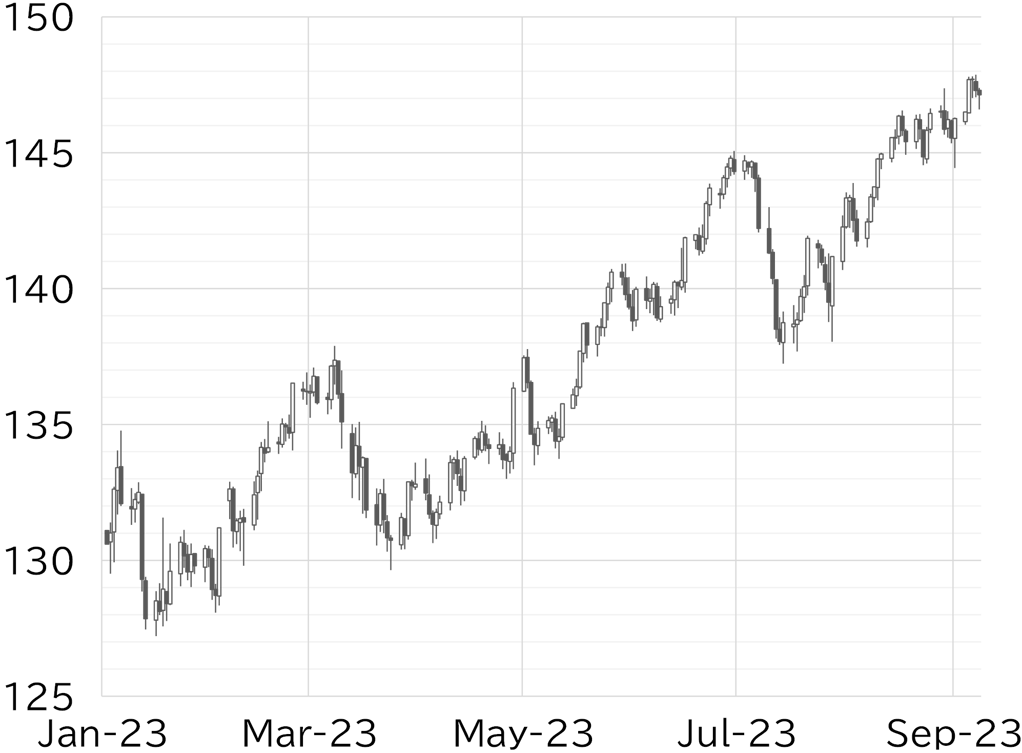

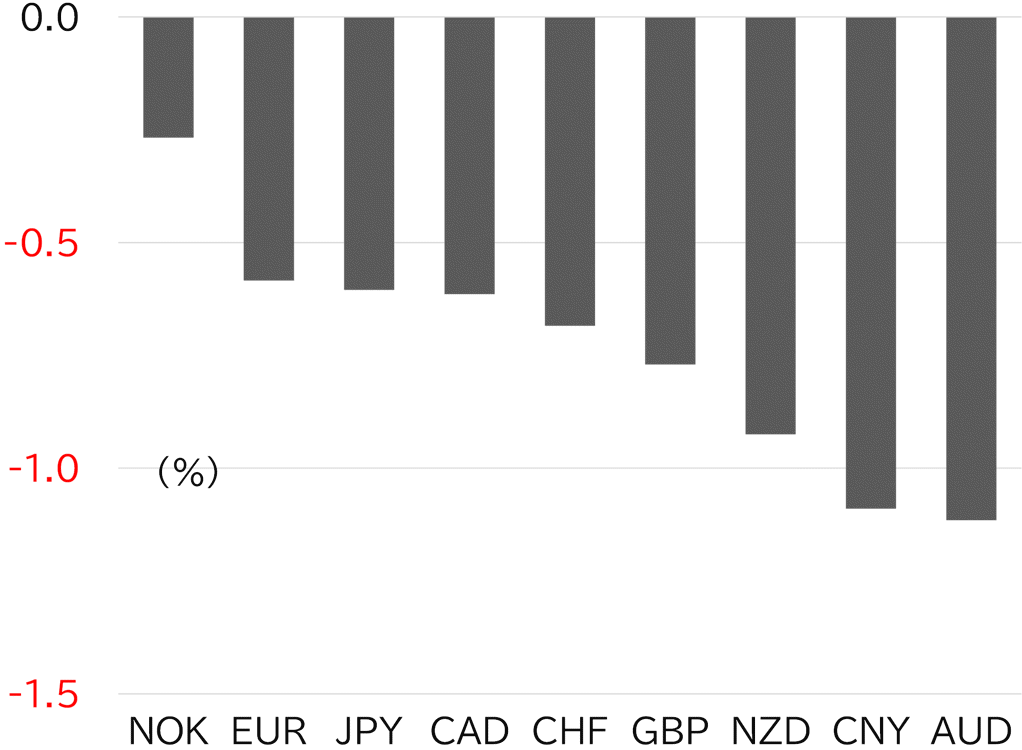

The USD/JPY opened the week at 146.08. The market moved slowly during Tokyo trading hours on 4 September (which was a holiday in the US), and the USD/JPY remained in the lower 146 range. It rose to around 146.50 after trading in European hours kicked off but did not move significantly. However, the dollar strengthened across the board when UST trading resumed on 5 September, because USTs were sold (meaning yields rose) in response to US employment data released on Friday (1 September). The USD/JPY also rose intermittently in Tokyo trading hours, rising above 147 around the time the Europeans entered the market. Oil prices rose further after Saudi Arabia decided to extend its oil output cuts, which also helped to strengthen the dollar. The USD/JPY continued its climb, breaking past the 29 August high and moving above 147.50. Vice Finance Minister for International Affairs Masato Kanda's warnings of government intervention early morning on 6 September worked to curb the rise in the USD/JPY. The pair did not lose significant ground but remained directionless around the 147-level due to renewed concerns that the Japanese authorities were ready to stop the yen from falling further. However, UST yields rose after the ISM non-manufacturing index announced on the same day beat market expectations, and the USD/JPY rose to a high for the week of 147.87 on the morning of 7 September in Tokyo trading hours, although it fell back before reaching JPY148. The USD/JPY fell to as low as around 147 for a time as the rise in UST yields was curbed, then briefly fell to the upper 146-level on the morning of 8 September. It was trading below 147.50 at the time of writing this report (Figure 1). This week, the dollar strengthened almost across the board, especially on 5 September after the US holiday. The yen was relatively strong among G10 currencies this week, despite the USD/JPY rising to the highest point since November 2022. The yen has actually strengthened against currencies such as the Australian dollar, partly due to the AUD's strong connection with the Chinese yuan, which weakened (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 8 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 8 September

Source: Bloomberg, MUFG

Senior Fed officials signal rate hike pause in September

This week saw a flurry of remarks from senior Fed officials, including Fed Governor Christopher Waller on 5 September and NY Fed President John Williams on the 7th. Waller said recent economic news will allow the Fed to "proceed carefully" and that "there's nothing that is saying we need to do anything imminent anytime soon," suggesting the FOMC may skip a rate hike in September. However, he was less definitive about the need for further hikes, saying "we have to wait and see" if current trends such as slowing inflation continue. Governor Williams also hinted at a pause, saying that monetary policy was having the expected effects, but that it was "an open question" as to whether further rate hikes were needed. We see these remarks essentially as advance notice ahead of the blackout period before the FOMC which starts from this weekend. This has worked to pause the rise in UST yields and dollar strength ahead of the weekend. However, the CPI for August, retail sales, and other economic indicators will be announced next week, and these will be key for the Fed's monetary policy decisions due to its data dependent stance. We do not expect such data to change the trend of the foreign exchange market unless the results differ significantly from market forecasts given the FOMC meeting is scheduled for the following week, and the focus of the FOMC has shifted to whether the Fed will raise rates and the forecast of the rate cuts in 2024 which is expected to be shown in the dot plot. Naturally, now that expectations of prolonged monetary tightening are emerging due to the improvement in the US economy and the recent rise in oil prices, if economic indicators exceed expectations, the dollar is likely to strengthen and this would overshadow risk to the downside.

Japanese authorities take more stringent tone

Meanwhile, tensions have been rising again in Japan following Vice Finance Minister for International Affairs Masato Kanda's verbal intervention. Kanda said "looking at underlying moves, speculative action or activity that cannot be explained by fundamentals can be observed" and "we won't rule out any options if speculative moves persist." Furthermore, at a press conference after the Cabinet meeting on 8 September, Finance Minister Shunichi Suzuki said "the government is closely monitoring developments in the currency market with a heightened sense of urgency." The authorities in Japan are taking an increasingly stringent tone in their communication. With the dollar strengthening across the board and diplomatic events such as this weekend's G20 meeting underway, we think this suggests moves to improve the environment are making progress. In any case, we expect the remarks to discourage further yen selling to some extent. Meanwhile, BOJ board members Hajime Takata and Junko Nakagawa spoke this week. This means that five of the nine policy board members, starting with Deputy Governor Shinichi Uchida, have spoken following the monetary policy meeting in July. Overall, they all saw an upside risk to inflation, and a consensus seems to have formed that monetary policy should start to be normalized once a solid rise in wages has been confirmed. However, opinions differed on the conditions for lifting negative interest rates, and this does not seem to be specifically on the agenda, even though the prospect is on the horizon. Such statements did not prompt the foreign exchange market to expect the disparity between domestic and overseas monetary policy to narrow, and the yen has continued to sell. In addition, crude oil prices have been rising recently. We expect Japan's trade balance to worsen as the value of imports rises if prices remain at this level or rise further. We also see the risk of yen selling picking up steam in anticipation of such real demand.

Forecast range

USD/JPY: 146.00 - 149.00