Week in review

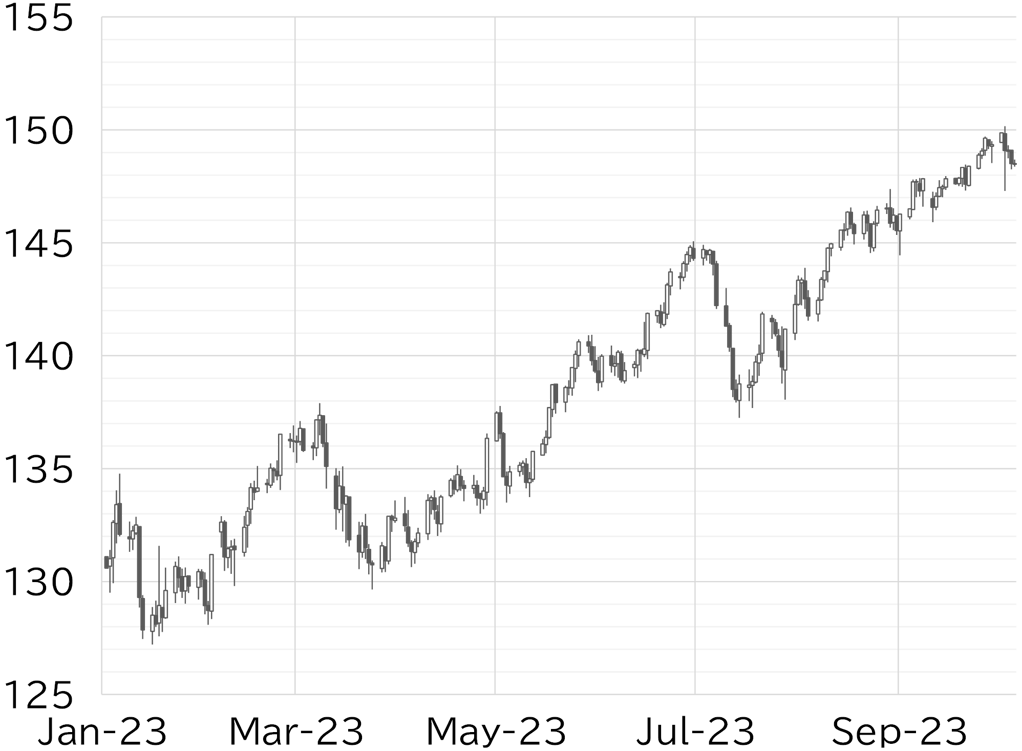

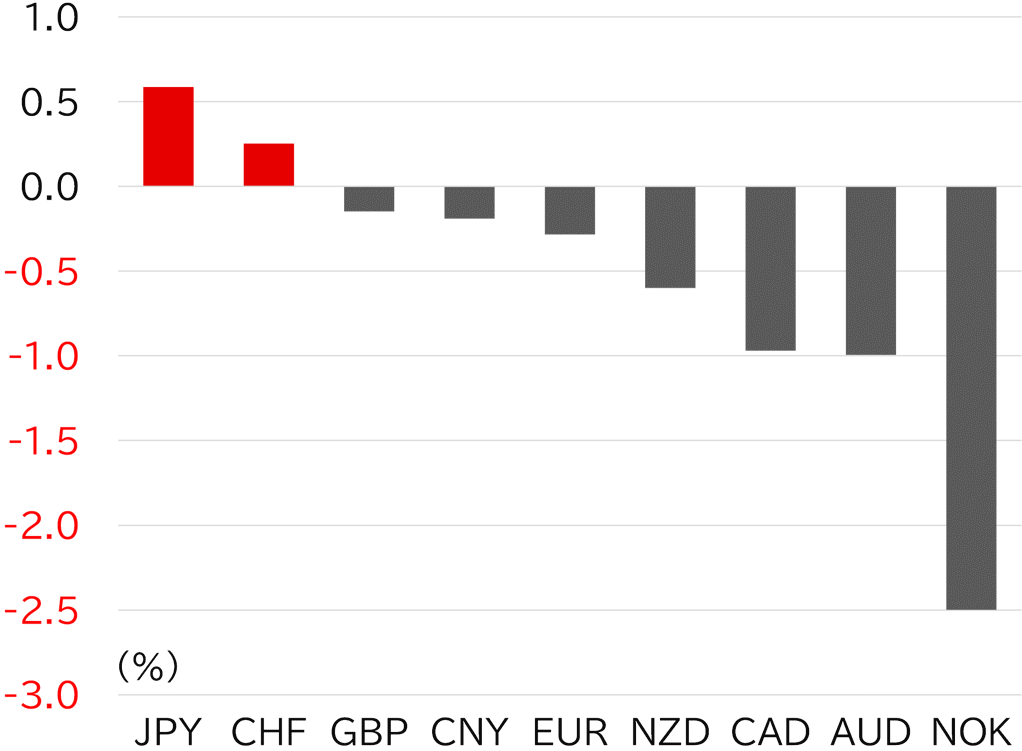

The USD/JPY opened the week at 149.52. The dollar started the week strong after the US Congress averted a government shutdown by passing a stopgap spending bill on Friday, and the USD/JPY continued to move slightly beyond 149.5. Concerns of intervention by Japanese authorities held back upside, but the USD/JPY slowly approached 150 as the US ISM Manufacturing Index beat market expectations, supporting a rise in UST yields and dollar strength across the board. The pair briefly fell to around 149.5 in European trading hours on 3 October, but the US job openings and labor turnover survey for August announced in US trading hours showed job openings sharply above expectations, and the USD/JPY rose past 150. It reached a high 150.16 then tumbled to a low of 147.30, before swiftly recovering to the 149 level in choppy trading. It ultimately settled around 149, remaining top-heavy on 4 October, perhaps because traders were wary of volatility. The dollar weakened during European time on the same day, and the USD/JPY gradually fell to below 148.5 on the morning of 5 October. It briefly rebounded to the low-to-mid 149 level after that but fell back to the 148 level on continued dollar softness and was trading around 148.5 at the time of writing this report on 6 October (Figure 1). The decline in cross-yen rates was also notable because the dollar weakened from mid-week after starting strong across the board early on. The yen was therefore the strongest G10 currency for the week, a position it has not been in for some time (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00 JST on 6 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00 JST on 6 October

Source: Bloomberg, MUFG

Rise in UST yields accelerates, then peaks

The rise in UST yields and the dollar accelerated at the start of the week due to relief after the US Congress managed to pass a stopgap spending bill. The 10y UST yield rose 28bp from the start of the week through to 4 October, and USD/JPY broke past 150 temporarily. Euro weakness against the dollar triggered speculation that the EUR/USD could move to parity. However, the rise in UST yields temporarily halted, partly because Kevin McCarthy was ousted as House Speaker after the stopgap spending bill was passed, and also due to comments by hawkish Federal Reserve Bank of Cleveland President Loretta Mester who said that the recent rise in long-term rates could impact monetary policy decisions. We see the possibility that this could put a question mark on a rate hike at the FOMC meeting at the start of November. In addition, US share prices, which were already soft, declined further and the price of oil fell sharply. The dollar turned weaker amid these conditions.

Japanese authorities have issued more frequent and increasingly stringent warnings to check the gradual rise in the USD/JPY amid a strong dollar. Finance Minister Shunichi Suzuki said he had no comment regarding the volatility on 3 October, but Vice Finance Minister for International Affairs Masato Kanda said an accumulation of one-way movements and a very large movement within a certain period of time could be considered excessive volatility, and that the 20 yen slide against the dollar since the start of the year would be taken into account. In other words, it appears the authorities are not just focused on volatility. This comment was made immediately after the USD/JPY touched 150, meaning this could be a psychologically high hurdle.

Hard to see a change in direction at this point

Upcoming focal points include US employment data for September, Fed Governor Christopher Waller's speech, and the US CPI for September on 12 October. Fed Chair Jay Powell's speech on 19 October will likely provide some indication of the Fed's plans at the November FOMC, and while he will not say anything definitive, the CPI data should provide clues. Naturally, we think it is too early to conclude that the market has changed course based on the halt in the rise in UST yields and the dollar turning softer from the second half of the week. However, a rate hike could be seen as unnecessary given that the PCE core deflator is slowing faster than the Fed had expected and with the tightening effect of the rise in long-term interest rates to date.

Meanwhile, next week will see a pickup in communication between authorities in various countries, including the annual meetings of the World Bank and IMF, as well as the meeting of G20 Finance Ministers and Central Bank Governors. Recently, authorities in emerging countries, mainly in Asia, have announced interventions in the foreign exchange market to defend their currencies against the dollar. In contrast, Japanese authorities have repeatedly talked about cooperation with overseas authorities in addressing the weak yen. Based on last year's experience, we see the possibility that some kind of agreement will be reached, even behind closed doors, which could result in changes in the monetary and currency policies of the countries involved.

In addition, Japan's long-term interest rates rose to 0.80% this week. Some might say it is too far of a stretch to say the 1.00% fixed-rate purchase operation, which BOJ Governor Kazuo Ueda positioned as a backstop, is now in sight. However, Japan's long-term interest rates continued to rise, especially in the second half of the week, even after the rise in US interest rates stopped. This question is whether this reflects a gradual increase in expectations for the BOJ to change its monetary policy due to changes in the environment, including exchange rates. In any case, speculation about the BOJ's monetary policy meeting and Outlook Report at the end of October is increasing. We think the BOJ will probably have to revise up the inflation outlook in the Outlook Report at the least, and some observers expect the upper-limit of fixed-rate purchase operations to be increased. Governor Ueda is expected to speak at the G20. We should be on the alert for headline risk, including preview reports.

Forecast range

USD/JPY: 147.00 - 150.50