Summary

The BOJ voted to make the YCC more flexible at its monetary policy meeting in July. The permissible range of ±0.5% was changed to a reference point and it raised the yield for conducting fixed-rate purchase operations in principle on every business day to 1.0%. The move can be seen as essentially ending the YCC policy or a de facto interest rate hike. However, the Bank has kept its easing measures in place and has denied that it is moving to normalize policy. The decision appears to have been made with an eye to curbing yen weakness, but although it resulted in higher long-term interest rates, it did not erode confidence in yen selling. Meanwhile, the dollar looks poised to weaken with the Fed in the final phase of its rate hike cycle, and yen selling based on real demand in Japan is losing momentum. We therefore do not expect a significant break above the end-June high of 145.

July in review

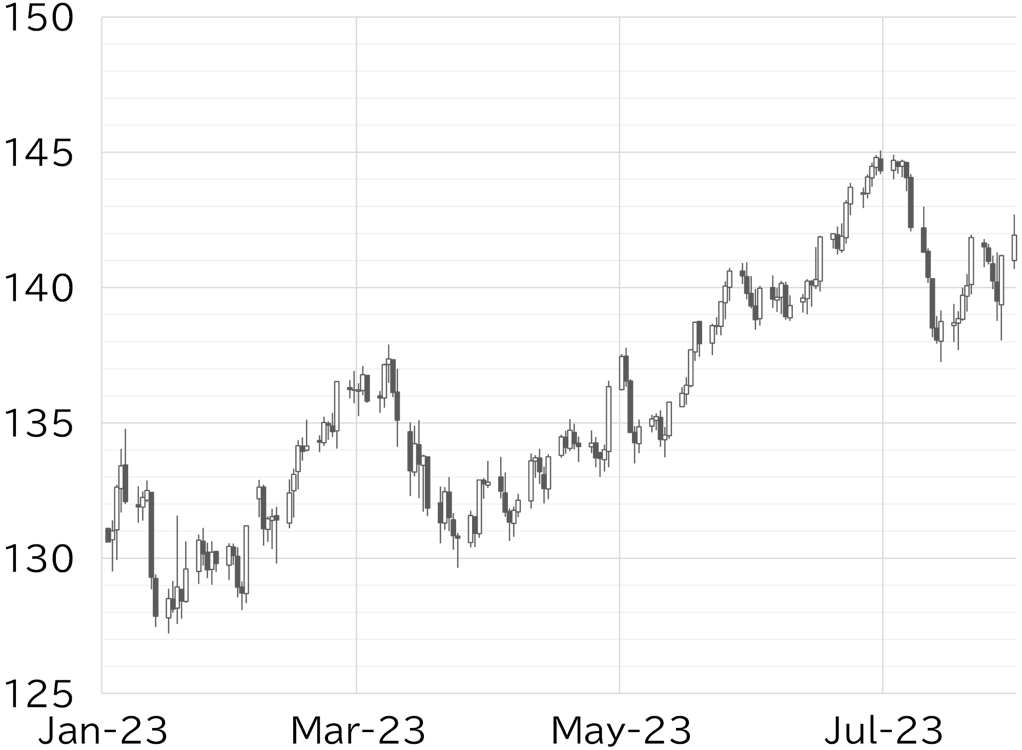

The USD/JPY opened the month at 144.41. It touched 145 at the end of June, then lost momentum as a lower-than-expected US PCE deflator result softened the dollar's strength. The USD/JPY faced downward pressure on 6 July amid a fall in the Nikkei Average and other Asian stocks and briefly fell in the 143 level. On 7 July, comments by BOJ Deputy Governor Shinichi Uchida reported in the media raised expectations that the Bank could move to adjust its policy settings. This was followed by a disappointing US nonfarm payrolls report, and the USD/JPY declined to the 142 level. On 10 July, the pair rebounded to above 143 in Tokyo trading hours, supported by yen selling by Japanese investors. However, the USD/JPY fell back to the 141 level as US rates declined after a New York Fed survey showed a decline in expected inflation. The pair plummeted to below 138.50 on 12 July as lower than expected headline and core US CPI growth accelerated dollar selling. The USD/JPY continued to test 137 through to 14 July, but its decline halted after the University of Michigan survey showed an upswing in expected inflation. The USD/JPY then rebounded to just below 140 through 19 July because BOJ Governor Kazuo Ueda's comments at the meeting of G20 finance ministers and central bank governors held on 18 July were interpreted as dovish. After European investors started trading on 21 July, Reuters, Bloomberg, and other overseas media outlets reported that the BOJ was likely to keep policy on hold at the upcoming monetary policy meeting. The yen weakened rapidly in response, and the USD/JPY rose to nearly 142. However, the pair unwound some of the sharp gains ahead of the BOJ, Fed, and ECB policy meetings, and fell back to the 140 level on 25 July. It declined to the 139 level on 26 July as FOMC decision was in line with market expectation and Fed Chair Jay Powell's press conference was not as hawkish as had been feared. US rates rose and the dollar strengthened on 27 July on the back of stronger-than-expected 2Q US real GDP growth, and the USD/JPY recovered to above 141. However, it then declined to the upper 138 level after the Nikkei Shimbun published an article a day before the BOJ policy decision that indicated the Bank would revise its policy settings by flexibly managing interest rates. The BOJ revised its YCC policy on 28 July. After this, the USD/JPY fluctuated between 138-141, but remained at the 139 level after European investors entered the market. It climbed to around 141 in US trading hours as expectations for an economic recovery pushed up share prices and resulted in dollar and yen selling. At the time of writing this report on 31 July, the USD/JPY lost its sense of direction at around 141, but the yen weakened due the BOJ's extraordinary buying operations with a rise in long-term yields to 0.6%. The USD/JPY rose to the 142 level (Figure 1).

Short-term dollar weakness temporarily peaks out

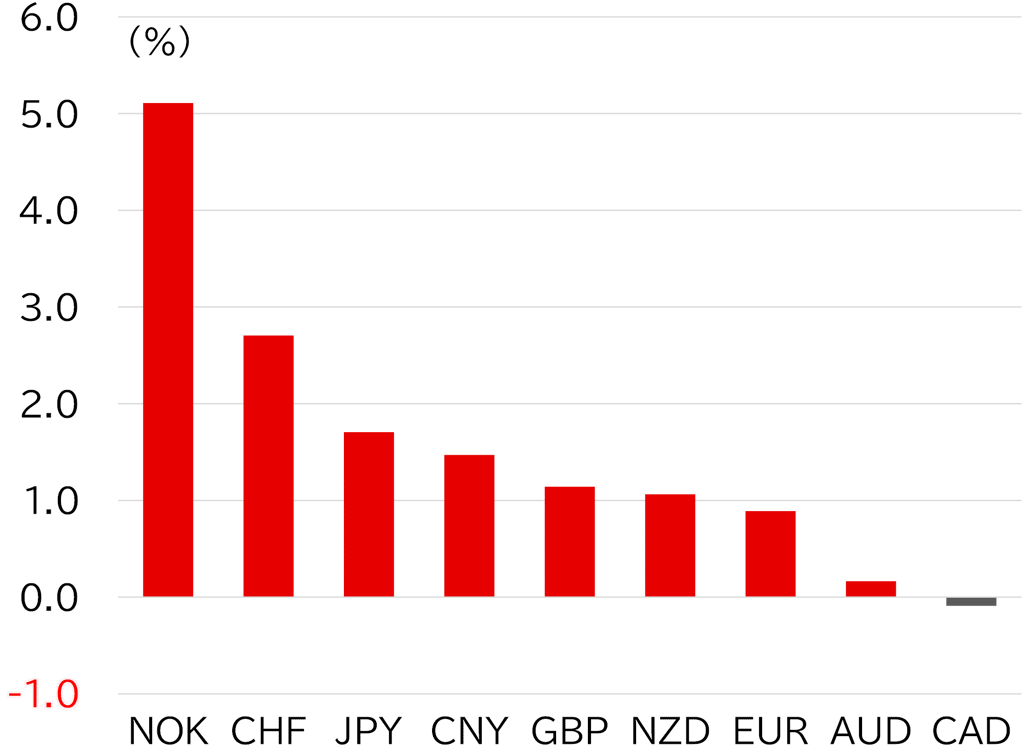

The dollar weakened almost across the board in July, softening through to the middle of the month before starting to recover. The dollar index shows the pace of decline accelerated from the start of July, falling below 100 for the first time since April last year after the reverse CPI shock on 12 July. It declined by nearly 4% during this period of half a month. It rebounded toward the end of July and recovered to above 101.5 after the FOMC. Even so, the dollar was generally weak among G10 currencies. On the other hand, the yen regained lost ground, helped by the weaker dollar. Deputy Governor Uchida's interview on 7 July and the Yomiuri article reporting an upward revision of the price outlook in the outlook report acted as a steppingstone for this. However, the tide changed as the dollar recovered and Governor Ueda's remarks after the G20 on the 18th were seen as dovish.

Articles published by overseas news outlets on the morning of 21 July (London time) suggesting that the BOJ would maintain its monetary policy settings were mistakenly perceived as a "leak" from the BOJ, accelerating the weakening of the yen. The yen rebounded after the Nikkei Shimbun reported on policy revisions just ahead of the meeting, but the BOJ's decision was confusing and has yet to dislodge the yen-selling momentum.

FIGURE 1: USD/JPY (DAILY)

Note: As at 14:00 JST on 31 July

Source: EBS, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD IN JULY

Note: As at 14:00 JST on 31 July

Source: Bloomberg, MUFG

Fed had said two more hikes this year

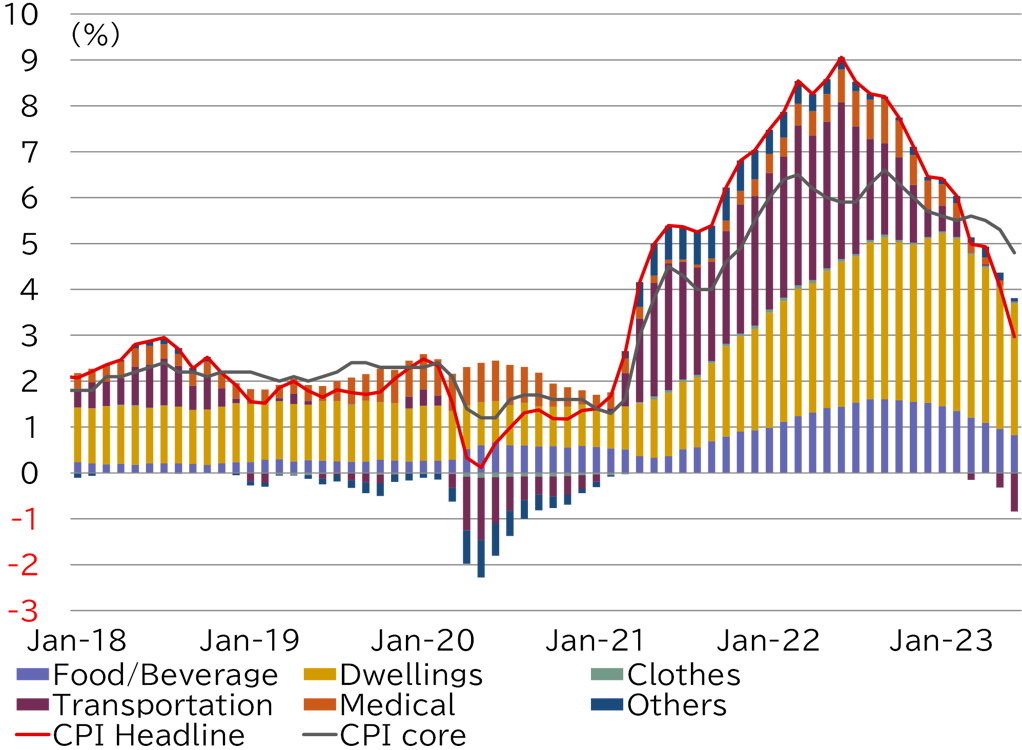

The US CPI for June showed a steady slowdown in inflation for each item (Figure 3). Both the headline and core inflation rates were lower than market expectations and were labelled a "reverse CPI shock." The details of the CPI report also seem to have roiled the Fed. It probably welcomes a curbing of inflation, but the details suggest that inflation is decelerating at a faster pace than the Fed had forecast in June. For example, Fed Governor Christopher Waller gave a speech on 13 July in which he suggested the Fed could raise rates in both July and September. However, his comments may have been intended to restrain growing expectations in the financial markets of an early halt to rate hikes. At the subsequent FOMC meeting, the Fed raised rates by 25bp as it had hinted at in advance, and the target for the federal funds rate was set at 5.25%-5.50%. However, the statement only slightly revised up the economic assessment and Fed Chair Powell also left the door open to another rate hike in September. This was pretty much business as usual and not as hawkish as had been feared following Waller's comments. Powell said that rate hikes would depend on incoming data, but that even a reverse CPI shock cannot be judged based on a single data set. The dot plot in the SEP projections for June now show just one more rate hike within the year, but Powell did not give any definitive answer on when or if the Fed would make such a move. After the CPI report, (in other words, before the FOMC meeting), the FF interest rate futures market priced in a final rate hike in July, followed by more than five rate cuts over 2024. The market has slightly revised expectations for rate cuts next year, but still prices in no more hikes in 2023. The Fed has kept the door open to another rate hike this year, and this gap in the outlook is likely to remain open ahead of the summer holidays.

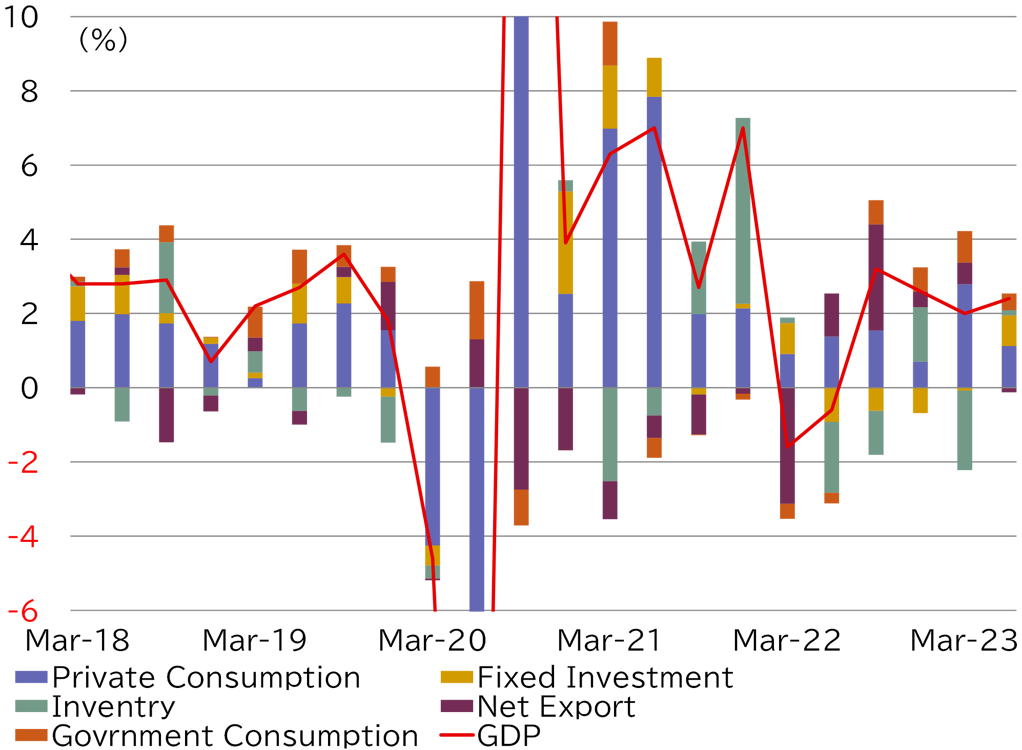

The biggest event in August would normally be the Fed Chair's speech at the Jackson Hole economic symposium. However, the event may not be in sharp focus this year. The Fed is unlikely to be able to suggest a new direction given the widely shared view that it is set to raise rates one more time this year and then cut rates in 2024. Market attention is already focused on the FOMC in September and November. The Fed's decision will hinge on employment and price data. In addition, when looking at exchange rates, there is currently more interest in the economy itself than in the outlook for monetary policy. The Fed is also more confident in this regard, and fears of a recession have receded considerably. Real GDP growth in 2Q, announced on 27 July, also exceeded market expectations (Figure 4). Expectations for the bottoming out of the economy are prompting a rise in stock prices and a recovery in risk tolerance. This suggests a move to dollar selling (and yen selling) in the foreign exchange market. We expect dollar-selling sentiment to persist unless a series of indicators disappoint expectations. The question is whether monetary policy will become a theme again after the Jackson Hole symposium in September.

FIGURE 3: US CPI (YOY)

Source: Bureau of Labor Statistics, MUFG

FIGURE 4: US REAL GDP GROWTH RATE

Source: US Department of Commerce, MUFG

Maintaining YCC likely to give sense of security for selling yen

In Japan, the BOJ under Governor Ueda has finally moved to revise its policy settings. Specifically, it set the target of long-term interest rates for its yield curve control (YCC) policy to be near zero but repositioned the fluctuation range of ±0.5% as a reference point that can be flexibly adjusted. In addition, it raised the rate at which it will offer to purchase 10y JGBs on every business day in principle from 0.5% to 1.0%.

These measures mean long-term interest rates will be allowed to exceed 0.5%, making the ±0.5% range, which the Bank had strictly adhered to so far, a mere formality. At a press conference, Governor Ueda explained that he did not expect long-term interest rates to reach 1% in the near future, and that the 1.0% yield for conducting the operations was a precautionary measure. This move has effectively abolished the YCC. Furthermore, given the expansion of the allowable fluctuation range in December last year was evaluated as a "de facto interest rate hike," it should not be surprising that these new measures will be seen in the same way. Even so, the Bank nominally positioned the move as increasing the flexibility of YCC. This is probably due to the risk of crossing the line of no return if the Bank declares it is normalizing policy, despite the official stance that the price stability target is yet to be achieved. Governor Ueda was also careful to explain that this measure is not a move toward normalization.

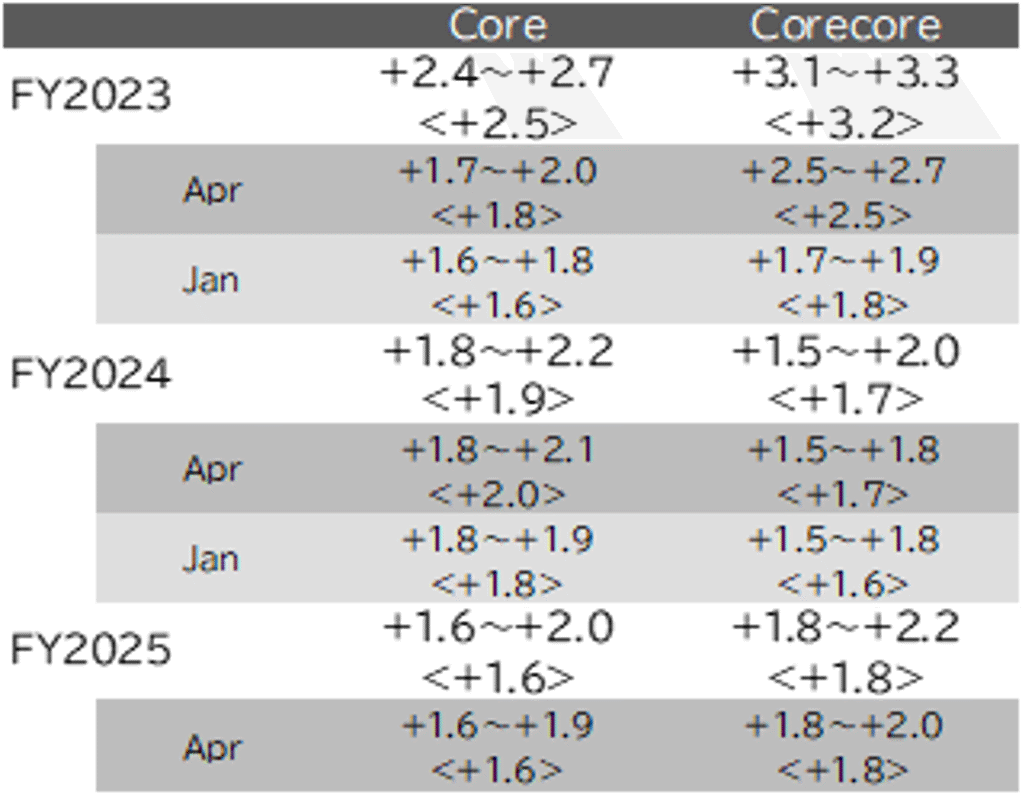

We had expected the outlook report to show an upward revision of the inflation outlook through FY25, confidence in achieving the price stability target, and the end of the YCC. However, although the report showed signs of bullishness in many areas, including prices, the outlook for prices did not reach the price stability target level (Table 1). The report therefore concluded that there was still a long way to go to reach the price stability target. In light of this, the BOJ's statement on monetary policy explained the move to increase the flexibility of YCC as follows: "strictly capping long-term interest rates could affect the functioning of bond markets and the volatility in other financial markets. Such effects are expected to be mitigated by conducting yield curve control with greater flexibility." In this regard, the governor was asked at his press conference about "other financial markets" as a countermeasure against the foreign exchange market (that is, the depreciation of the yen). In response, Governor Ueda reiterated the general view that monetary policy does not target the exchange rate and explained that the purpose was to reduce volatility in financial markets, including the exchange market. This suggests the decision was made with an awareness of a heightened sense of crisis at the MOF and other government bodies to curb the yen's slide.

However, in that respect, it is hard to say that this presentation was a success. This decision is extremely difficult to understand for anyone other than some market participants who are familiar with BOJ literature, and the Bank's true intentions have not been fully conveyed (Table 2). In short, it would appear that the Bank has essentially moved to normalize policy but has maintained its extraordinary easing measures. At least, that would probably be the reaction if the BOJ's wording were to be taken literally. In addition, this decision should mean the BOJ will not have to consider revising monetary policy for some time (until the results of next fiscal year's spring labor offensive can be seen to some extent), making it hard to expect the yen to strengthen in anticipation of changes in BOJ policy. The Nikkei Shimbun's report on policy revisions ahead of the BOJ's decision lessened the sense of surprise, acting to absorb the impact of the yen's appreciation. In any case, the move should have been intended to curb the weakening of the yen, but it appears that the yen is likely to remain soft at the least. Even if the Bank had some intention to address the weakening yen, the target of monetary policy is interest rates. It therefore conducted an extraordinary buying operation on 31 July when long-term yields rose past 0.6%. The yen weakened in response, and the USD/JPY rose past the level before the preview article was published ahead of the monetary policy meeting. Naturally, the yen may have weakened simply due to supply/demand factors at the end of the month, but I think we can at least conclude that this move was not in line with the Bank's plan.

TABLE 1: OUTLOOK REPORT INFLATION FORECASTS

Source: BOJ, MUFG

TABLE 2: MONETARY POLICY STATEMENT ON CONDUCT OF YCC

Conduct of yield curve control

The Bank will continue to allow 10-year JGB yields to fluctuate in the range of around ±0.5 percentage points from the target level, while it will conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations. The Bank will offer to purchase 10y JGBs at 1.0% every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted. In order to encourage the formation of a yield curve that is consistent with the above guideline for market operations, the Bank will continue with large-scale JGB purchases and make nimble responses for each maturity by, for example, increasing the amount of JGB purchases and conducting fixed-rate purchase operations and the Funds-Supplying Operations against Pooled Collateral.

Note: We have added the underlines

Source: BOJ, MUFG

Lower risk of excessive yen weakening or strengthening

As discussed earlier, the currency market is already leaning towards a weaker dollar. Also, as noted in last month's report, yen selling based on real demand as seen in 2022 has fallen away. The trade balance in June turned into surplus, albeit slightly. We therefore do not expect the USD/JPY to rise past 150. However, as of writing this report, the weakening of the yen suggests that we cannot write off another sharp move higher like the rise to 145 at the end of June.

Of course, the government will probably remain on alert to further yen weakening. The Nikkei Shimbun article which reported on the BOJ's policy revisions quoted a government source as saying that the yen weakening to beyond 140 is clearly excessive. We expect moves by the authorities to curb yen depreciation and ultimately concerns of currency intervention to hold the USD/JPY ceiling in check. In addition, the BOJ may be thinking of quietly doing away with the idea of the ±0.5% reference point now that it has essentially dismantled YCC. However, it may officially end YCC in the near future if it cannot hold back the yen from weakening further and is forced to clearly show a change in policy. In any case, we see room for the yen to weaken and the USD/JPY climb to around the end-June high of 145.

In the US, we expect the Fed's interest rate hike cycle to end this year and a shift to rate cuts in 2024, while in Japan, the BOJ is moving to normalize policy and we expect it to consider further policy changes around the time that the results of next fiscal year's spring labor negotiations are revealed. We therefore maintain our forecast for a weaker dollar and a stronger yen. However, looking at the Japanese side of the equation, the BOJ has not even nominally ended the YCC, and instead just changed the wording of the policy, making it difficult to expect a sharp strengthening of the yen. Based on these factors, we have slightly revised our forecast range for the USD/JPY.

QUARTERLY FORECAST RANGE AND PERIOD-END FORECAST

|

Aug-Sep 2023 |

Oct-Dec |

Jan-Mar 2024 |

Apr-June |

|

|

USD/JPY |

135.0~146.0 |

133.0~144.0 |

131.0~142.0 |

129.0~140.0 |

|

Period-end forecast |

138.0 |

136.0 |

134.0 |

132.0 |

Our forecast range estimates the high and low for each quarter. The period-end forecast is our forecast for USD/JPY at 17:00 New York time at the end of each quarter.