To read a full report, please download PDF

USD extends advance ahead of ECB meeting

FX View:

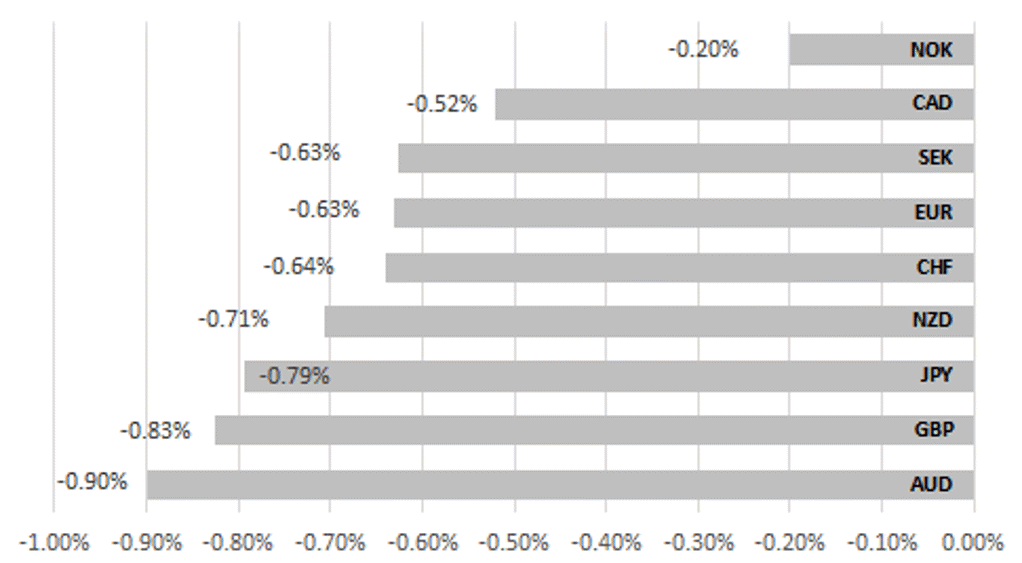

The USD has continued to strengthen over the past week for the eighth consecutive week as measured by the dollar index. It has been an impressive run for the USD that has benefitted from the improving cyclical outlook for the US economy at a time when the outlook for growth in China and Europe has deteriorated. It has resulted in USD/CNY hitting its highest level since 2007. With USD/JPY also moving closer to last year’s high above the 150.00-level, Japanese officials have signalled a heightened risk of intervention to provide more support for the JPY. In the UK, BoE officials have signalled that they are closer to the end of their hiking cycle weighing down on the GBP. The main risk events in the week ahead will be the release of the latest US CPI report for August, ECB policy meeting and China activity data for August. While we expect the ECB to leave rates on hold, it is a close call and a final hike could provide a temporary lift for the EUR.

USD STRENGTHENS ACROSS ALL OF G10 THIS WEEK

Source: Bloomberg, 11:45 BST, 8th September 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a long USD/SEK trade idea.

Short-term Regression Modelling:

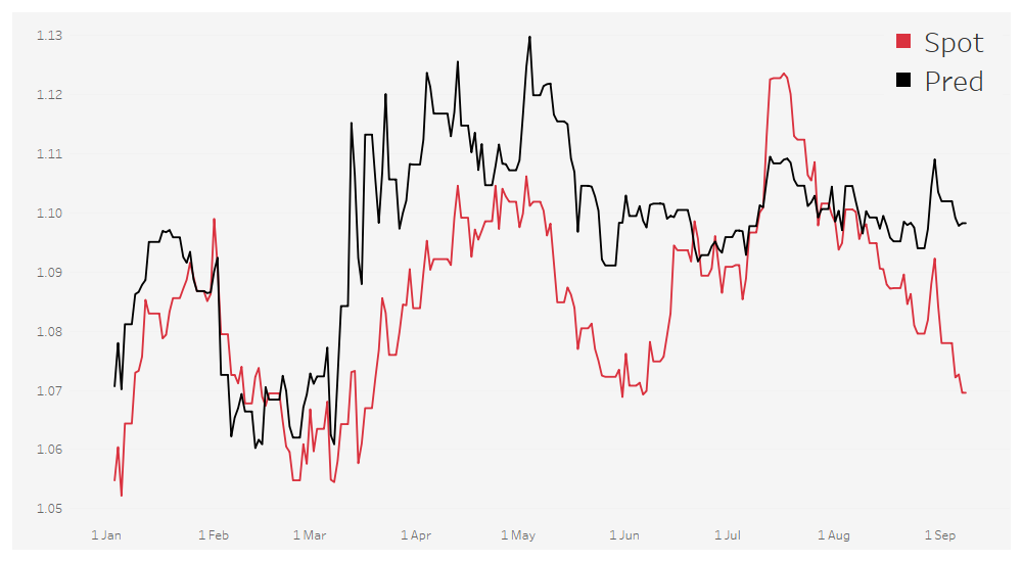

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR short-term regression models. We identify a further divergence in the relationship between EUR/USD and fair value where our short-term regression model calculates a -2.61% under-valuation of spot. While USD/JPY remains overvalued at 3.63% and GBP/USD undervalued at -3.23%.

JPY Flows:

The MoF weekly cross-border flow data released yesterday revealed a week of subdued buying of foreign bonds by Japanese investors. The greater activity was in foreign equities with Japan investors buying the largest total since the beginning of 2023.

FX Views

BoE moving toward a pause

The US dollar remains stable close to recent highs with some signs perhaps of some fading momentum after a long run of gains. A close tonight at these levels will make this the eighth consecutive week of US dollar gains – the longest run of weekly gains in nine years. The Bloomberg’s USD index has had its longest weekly run of gains since it was created in 2005. The RSI for DXY on a weekly basis has tipped just over the 70-level indicating potential exhaustion. It’s the first time the RSI has moved over 70.0 since September last year when the dollar hit its cyclical high. Next week it will be all eyes on China as USD/CNY continues to break higher. The move though has been orderly but a lurch higher would certainly be a catalyst for further dollar gains which may see Tokyo forced into the market to stem a break above the 150.00-level.

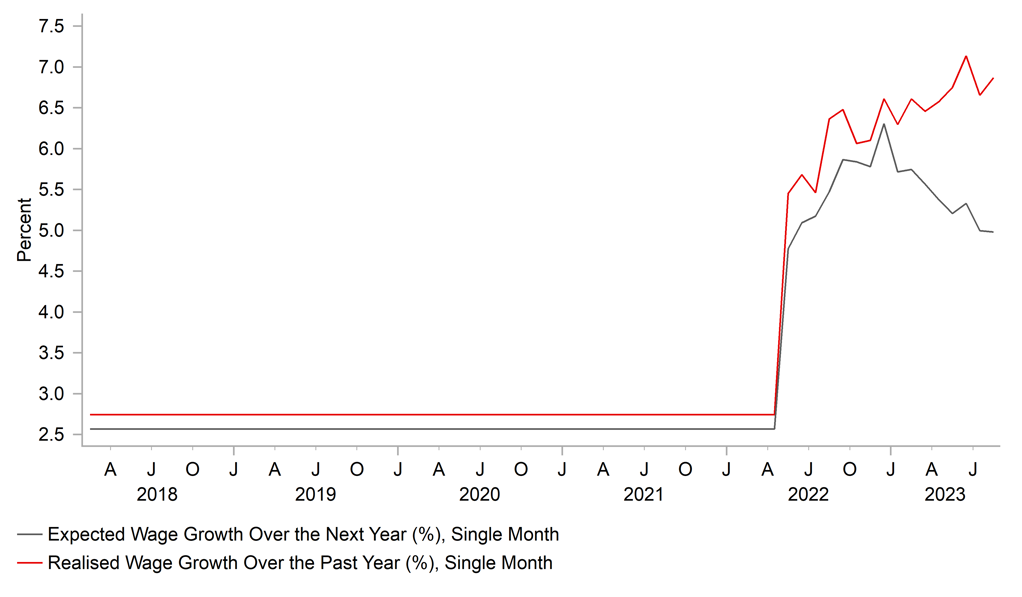

The ECB meeting will be the key event next week (see below) and there’ll be some focus on the UK too with the key labour market data released on Tuesday. Today, the Recruitment & Employment Confederation released its data revealing that demand for full-time labour index fell to 38.9, the fastest pace of decline in three years. It was the 11th consecutive drop. While finding labour remains an issue, the REC index on supply increased for the sixth consecutive. Pay still increased but the pace of increase matched the lowest since March 2021. That was backed up by the Indeed Wage growth index which slowed for the third consecutive month in July. While wage growth remains very high, for the BoE any evidence of slowdown at this juncture given it is a lagging indicator will be reassuring for the BoE.

Currently we expect the BoE to hike one more time to 5.50%. However, rhetoric this week is perhaps indicative of a more dovish communication at the September meeting. Governor Bailey suggested we are close to the peak while Chief Economist Huw Pill recently highlighted the benefits of hiking less to allow for a longer peak. The OIS market is now not fully priced for a hike this month. A weaker jobs report next week followed by a favourable CPI report the day before the BoE meeting could see market pricing on a hike fade further still.

GBP is along with AUD the worst performing G10 currency this week. A sharp drop in yields this week has played a role as pricing on another hike is pared back. We currently still expect a hike but weak key data into the meeting could see conviction on a hike undermine GBP performance further over the short-term.

BOE YEAR-AHEAD WAGE GROWTH SLOWING NOTABLY

Source: Bloomberg, Macrobond & MUFG GMR

RATE CUTS PRICED FOR 2024 COULD INCREASE AGAIN

Source: Bloomberg, Macrobond & MUFG GMR

Will the ECB’s upcoming policy meeting turn the tide for EUR/USD?

The EUR is on course to record its eighth consecutive week of losses against the USD. After hitting an intra-day high of 1.1276 on 21st July, EUR/USD fallen to an intra-day low this week of 1.0686. It is the longest run of weekly losses for the EUR against the USD since the week ending 18th July 2014 until the week ending 5th September 2014. A period when the EUR was weakening sharply in response to the ECB adopting negative interest rates and moving closer to implementing quantitative easing. The recent weakening of the EUR has been mainly evident against the USD while it has held up better against other G10 FX. The EUR has weakened sharply against the USD by almost -5.0% since 18th July, but by more modestly against the CAD (-1.0%), CHF (-0.9%) and GBP (-0.4%). The EUR has even strengthened further against the SEK (+3.8%), AUD (+1.7%), NZD (+1.7%) NOK (+1.5%) and JPY (+1.1%)

The price action highlights that the recent move lower for EUR/USD has been mainly driven by the stronger USD leg rather than broad-based EUR weakness. Our correlation analysis reveals that EUR/USD has had the strongest correlations amongst G10 FX to US rates over the past month both at the short (2YR UST yield) and long end (10YR UST yield) of the curve. The 2-year UST yield has increased by almost 20bps since the 18th July peak for EUR/USD and the 10-year UST yield by around 45bps. The improvement in the growth outlook for the US as investor optimism over a soft landing has continued to build has been an important driver of higher US yields and stronger USD over the summer. After growth of around 2% in the 1H of this year, this week’s ISM services survey has provided another positive signal that growth is likely to pick-up as well in Q3 driven by stronger consumer spending.

In contrast, yields in the euro-zone have risen by less than in the US over the same period. The 2-year German government bond yield has risen by around 2bps since 18th July and the 10-year German bond yield by around 25bps. It has resulted in yield spreads between the euro-zone and US moving back to levels from late last year/early this year when EUR/USD was adjusting higher from trading between 1.0000 and 1.0500 into the current trading range between 1.0500 and 1.1000. Our short-term valuation model that takes into yield spreads alongside other important fundamental drivers such as equity market performance and energy prices is currently consistent with EUR/USD continuing to trade in the current range between 1.0500 and 1.1000.

EUR IS HOLDING UP BETTER EXCLUDING USD

Source: Bloomberg, Macrobond & MUFG GMR

EUR/USD SELL-OFF OVERDONE?

Source: Bloomberg, Macrobond & MUFG GMR

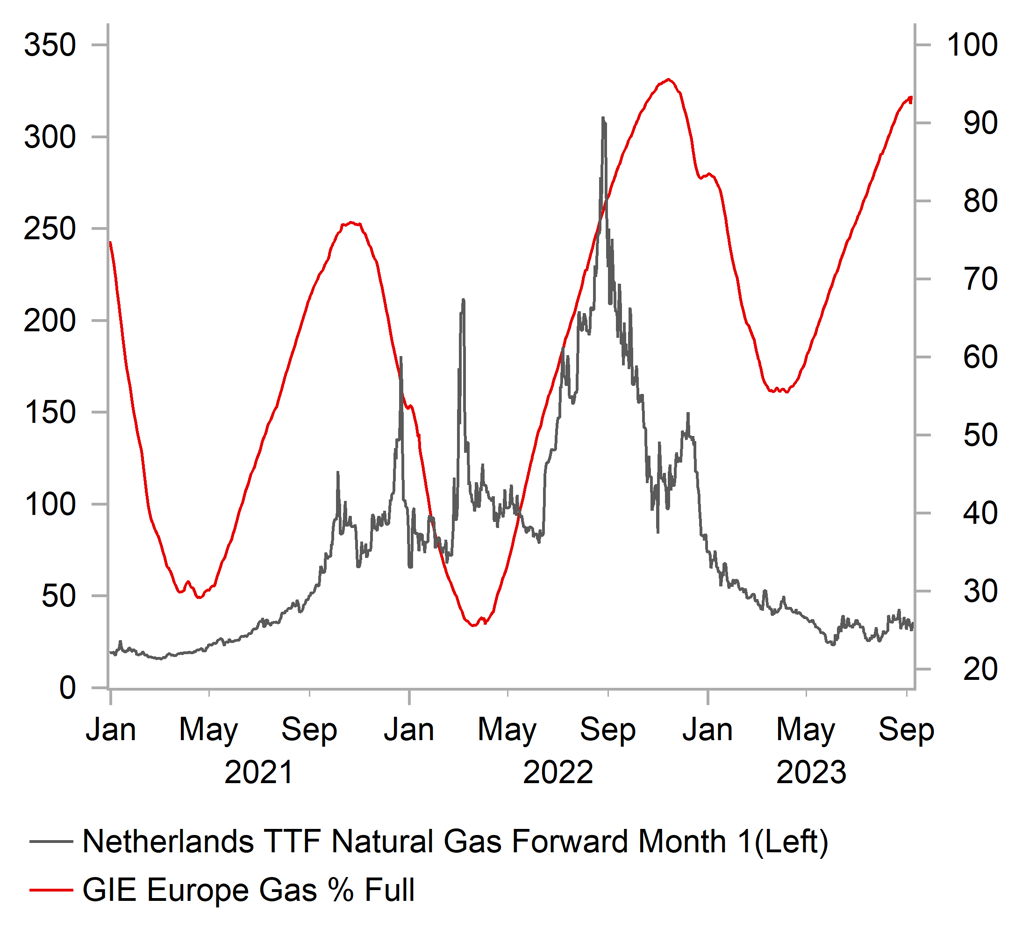

The main event risks in the week ahead for EUR/USD will be: i) the release of the latest US CPI report for August on 13th September and ii) the ECB’s upcoming policy meeting on 14th September. Ahead of those events both the US and euro-rate markets are expecting the Fed and ECB to leave rates on hold this month. However, next week’s ECB policy decision is a much closer call than for the Fed. As ECB Governing Council member Knot warned this week, the euro-zone rate market “maybe” underestimating the likelihood of a hike next week. Other ECB officials have described the upcoming policy decision as “open”. The euro-zone rate market is currently pricing in around 9bps of hikes for next week. While we have been expecting the ECB to leave rates on hold since their policy meeting in July, we acknowledge that there is a material risk that the ECB delivers one final rate hike to lift the deposit rate to a peak of 4.00%. With inflation still elevated and energy prices picking back up again recently, the ECB might decide to take out some insurance against higher inflation by hiking next week despite the deteriorating growth outlook in the euro-zone. The jump in European natural gas prices this morning following the announcement of a partial strikes by Chevron workers in Australia highlights that the cost of energy in Europe is now more sensitive to external developments. It could disrupt supply that accounted for 7% of the world’s LNG supply last year according to Bloomberg. One important factor that should help to dampen potential energy price disruption for European economies is that countries have successfully built up storage levels ahead of the winter that are currently 93% full. In comparison to last year, gas storage levels were running around 10ppts lower.

A decision to raise the policy rate next week would help to lift the EUR but it is likely to prove short-lived. Firstly, we expect the ECB to express more confidence that the rate hike cycle is close to an end and that the priority going forward will be to emphasize that keeping rates at higher levels for longer will be more important to bring down inflation. Secondly, the EUR will struggle to stage a rebound against the USD while market participants are focusing on the marked divergence in the growth outlook between the euro-zone and US economies in the near-term. The recent weak data flow from the euro-zone has increased the risk of the euro-zone contracting again in Q3 at a time when the US economy is gaining upward momentum. It follows weaker growth in the euro-zone during the 1H of this year after GDP was revised lower to 0.1%Q/Q in Q2. Economic data in the euro-zone has been surprising to the downside since May so the weak growth outlook should now be better priced into the EUR after weakening against the USD for the last eight consecutive weeks.

In these circumstances, we expect EUR/USD to continue to fall back towards the bottom of this year’s trading range between 1.0500 and 1.1000. An ECB hike next week would give the EUR only a temporary lift. It is consistent with our updated view (click here) for the USD to trade at stronger levels through the rest of this year.

EURO-ZONE IS BETTER PREPARED AHEAD OF WINTER

Source: Bloomberg, Macrobond & MUFG GMR

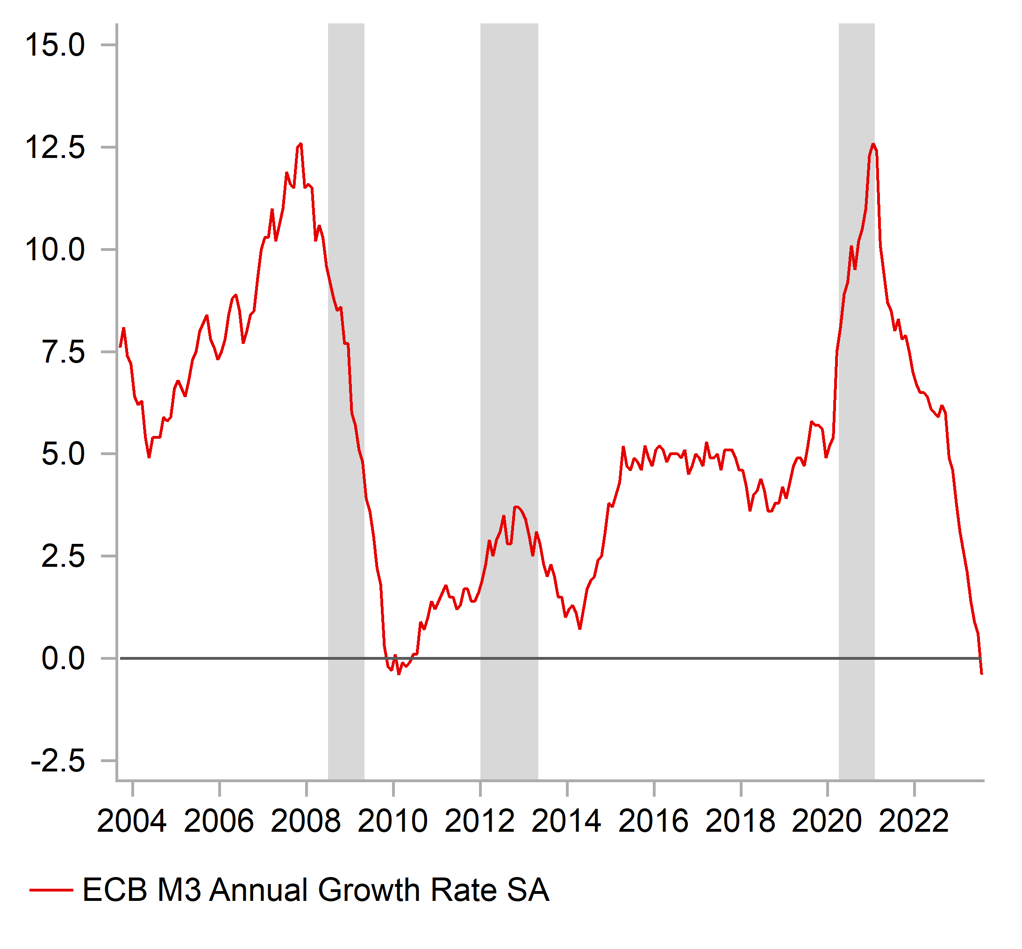

WEAK MONEY SUPPLY GROWTH

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

|

NOK |

09/11/2023 |

07:00 |

CPI YoY |

Aug |

-- |

5.4% |

|

GBP |

09/11/2023 |

09:00 |

BoE Chief Economist Pill speaks |

|||

|

EUR |

09/11/2023 |

09:00 |

Italy Industrial Production MoM |

Jul |

-- |

0.5% |

|

NZD |

09/12/2023 |

02:00 |

Pre-Election Economic and Fiscal Update |

|||

|

GBP |

09/12/2023 |

07:00 |

Average Weekly Earnings 3M/YoY |

Jul |

-- |

8.2% |

|

GBP |

09/12/2023 |

07:00 |

Employment Change 3M/3M |

Jul |

-- |

-66k |

|

NOK |

09/12/2023 |

07:00 |

GDP Mainland MoM |

Jul |

-- |

0.0% |

|

EUR |

09/12/2023 |

10:00 |

ZEW Survey Expectations |

Sep |

-- |

- 5.5 |

|

USD |

09/12/2023 |

11:00 |

NFIB Small Business Optimism |

Aug |

-- |

91.9 |

|

GBP |

09/13/2023 |

07:00 |

Monthly GDP (MoM) |

Jul |

-- |

0.5% |

|

EUR |

09/13/2023 |

10:00 |

Industrial Production SA MoM |

Jul |

-- |

0.5% |

|

USD |

09/13/2023 |

13:30 |

CPI YoY |

Aug |

3.6% |

3.2% |

|

GBP |

09/14/2023 |

00:01 |

RICS House Price Balance |

Aug |

-- |

-0.53 |

|

AUD |

09/14/2023 |

02:30 |

Employment Change |

Aug |

23.8k |

-14.6k |

|

JPY |

09/14/2023 |

05:30 |

Industrial Production MoM |

Jul F |

-- |

-2.0% |

|

SEK |

09/14/2023 |

07:00 |

CPI YoY |

Aug |

-- |

9.3% |

|

EUR |

09/14/2023 |

13:15 |

ECB Deposit Facility Rate |

-- |

3.75% |

|

|

USD |

09/14/2023 |

13:30 |

Retail Sales Advance MoM |

Aug |

0.2% |

0.7% |

|

USD |

09/14/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

|

|

USD |

09/14/2023 |

13:30 |

PPI Final Demand YoY |

Aug |

-- |

0.8% |

|

EUR |

09/14/2023 |

13:45 |

ECB President Lagarde Holds Press Conference |

|||

|

CNY |

09/15/2023 |

02:20 |

1-Yr Medium-Term Lending Facility Rate |

2.50% |

2.50% |

|

|

CNY |

09/15/2023 |

03:00 |

Industrial Production YoY |

Aug |

3.8% |

3.7% |

|

CNY |

09/15/2023 |

03:00 |

Retail Sales YoY |

Aug |

3.0% |

2.5% |

|

CNY |

09/15/2023 |

03:00 |

Property Investment YTD YoY |

Aug |

-8.9% |

-8.5% |

|

EUR |

09/15/2023 |

10:00 |

Labour Costs YoY |

2Q |

-- |

5.0% |

|

USD |

09/15/2023 |

14:15 |

Industrial Production MoM |

Aug |

0.2% |

1.0% |

|

USD |

09/15/2023 |

15:00 |

U. of Mich. Sentiment |

Sep P |

69.5 |

69.5 |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main event in the week ahead will be the ECB’s latest policy meeting. ECB officials have signaled over the past week that the upcoming policy decision is open and have not provided strong guidance either in favour of another 25bps hike or a pause. We are sticking to our forecast for the ECB to leave rates on hold that we adopted after the July policy meeting when the ECB signaled rates had risen to sufficiently restrictive levels. However, we believe it is a closer call than current euro-zone rate market pricing (9bps of hikes in September). We expect weak growth, money supply and bank lending surveys to make the ECB more cautious over the need for further hikes alongside tentative evidence that services inflation has peaked. The updated economic projections could help to tip the balance although the inflation forecasts are not expected to change significantly.

- The main economic data releases in the week ahead will be: i) the latest US CPI report for August, ii) UK labour market report for July, and iii) month activity data from China for August. Headline inflation is the US is expected to pick-up in August for the second consecutive month after falling sharply to a low of 3.0% in June. However, the report is expected to reveal that core inflation continues to run at a slower pace for the third consecutive month. Building evidence of slowing core inflation has reduced pressure on the Fed to keep hiking rates.

- In the UK, the latest labour market report will be important for finalizing market expectations for the next MPC meeting on 21st After average weekly earnings growth hit a fresh high last month, market participants will watching closely to see if there is any relief for the BoE in the week ahead.

- Market attention over the loss of growth in China has attracted more market attention over the summer. The latest monetary activity data (retail sales, IP, FAI & property investment) for August is expected to show some modest improvement after much weaker than expected growth in July but is unlikely to significantly alleviate growth concerns.