To read a full report, please download PDF

USD corrects into possible government shutdown

FX View:

The USD has corrected weaker at the tail-end of this week. After a record ten-consecutive week run of dollar strength, a correction was becoming more and more likely. The 10-year UST bond yield correction lower from its intra-day cyclical high yesterday was one catalyst for the move but month-end flows can always be an influence which could imply the correction may be brief. The extent of a government shutdown, if it happens from Sunday, will likely shape sentiment at the start of next week. The good news on inflation today will help contain yields as well with the ‘supercore’ PCE inflation m/m rate falling from 0.5% to 0.1%. Euro-zone inflation was also weaker. Given these dynamics very short-run risks suggest scope for this USD sell-off to extend, although further into Q4 we still see scope for dollar strength to remerge.

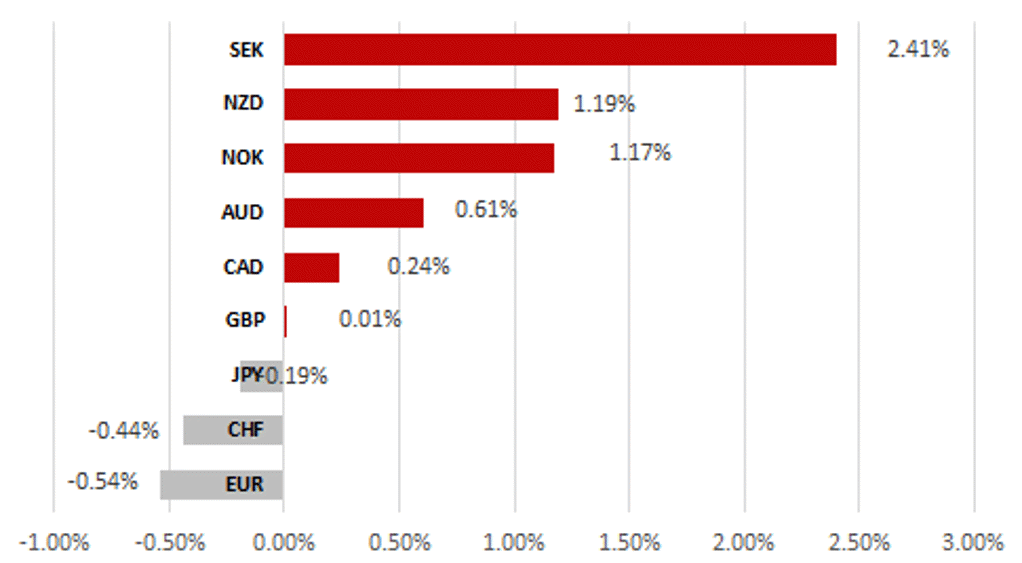

RIKSBANK PURCHASES FUEL SEK OUTPERFORMANCE

Source: Bloomberg, 13:00 BST, 29th September 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are closing our long USD/SEK trade idea, and short GBP/CAD trade idea.

JPY Flows:

The sector-by-sector cross border flows from Japan revealed an increase in foreign bond buying by Japanese Life Insurance companies with signs that Japan demand for UST bonds is improving given the move higher in yields. However, there will likely be limits to that given the unattractive returns when the cost of hedging is incorporated.

Short Term Regression Modelling:

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR short-term regression models. We identify a continued divergence in the relationship between GBP/USD and fair value where our short-term regression model calculates a -5.85% under-valuation of spot. While USD/JPY remains overvalued at 3.16% and EUR/USD undervalued at -4.05%.

FX Views

Will a government shutdown hurt the dollar?

The US dollar has reversed sharply since yesterday and from a technical perspective is not surprising. At the some point a correction was likely given the dollar strength had become stretched. Last week marked ten consecutive weeks of DXY gains and on an RSI-basis DXY had breached the 70-level by the most since the peak for the US dollar last September before we had the sharp correction lower. We maintain that the high from last year will prove the high of the cycle. On an REER measure, the dollar last year reached the highest level since Q4 1985 underlining our view that the dollar had reached extreme over-valued levels. The speed of the correction lower in Q4 last year also underlined that fact. We have argued more recently that a window of dollar strength will persist through to year-end before dollar weakness emerges on a more sustained basis next year. We maintain that view.

Developments are moving quickly as we approach the deadline and the possible start of a shutdown on Sunday. Four appropriation bills out of the twelve were passed in the House but are not expected to clear the Senate leaving this shutdown potentially much larger than in 2018-19. In that shutdown five bills had been passed (different bills to this time in the House) and 850k workers were impacted and 350k were furloughed. Recent estimates indicated between double and triple that furlough total would be the figure for this shutdown but that could change and we really will only know next week to what extent this shutdown will be larger versus 2018-19. Obviously, the larger the total impacted if a shutdown does take place, the bigger the potential market impact.

What we have seen of late is the strengthening of the correlation between the dollar and the 10-year yield at the expense of the 2-year yield. Normally, the 2yr yield correlation with EUR/USD is stronger but this has shifted to a marginally stronger correlation with the 10-year. There will be no supply pressuring yields upwards until 10th October and shutdown concerns could help stabilise yields at lower levels, thus taking away some positive momentum for the dollar. The evidence of subsiding inflation (PCE data; EZ CPI today) will add to the potential for lower yields.

This USD weakness could extend further over the short-term but we remain sceptical on this being a sustained turnaround. The move looks technical and month-end flows could be influencing price action. Yields remain supportive for the dollar and the “higher for longer” narrative will only be questioned once the US data turns weaker.

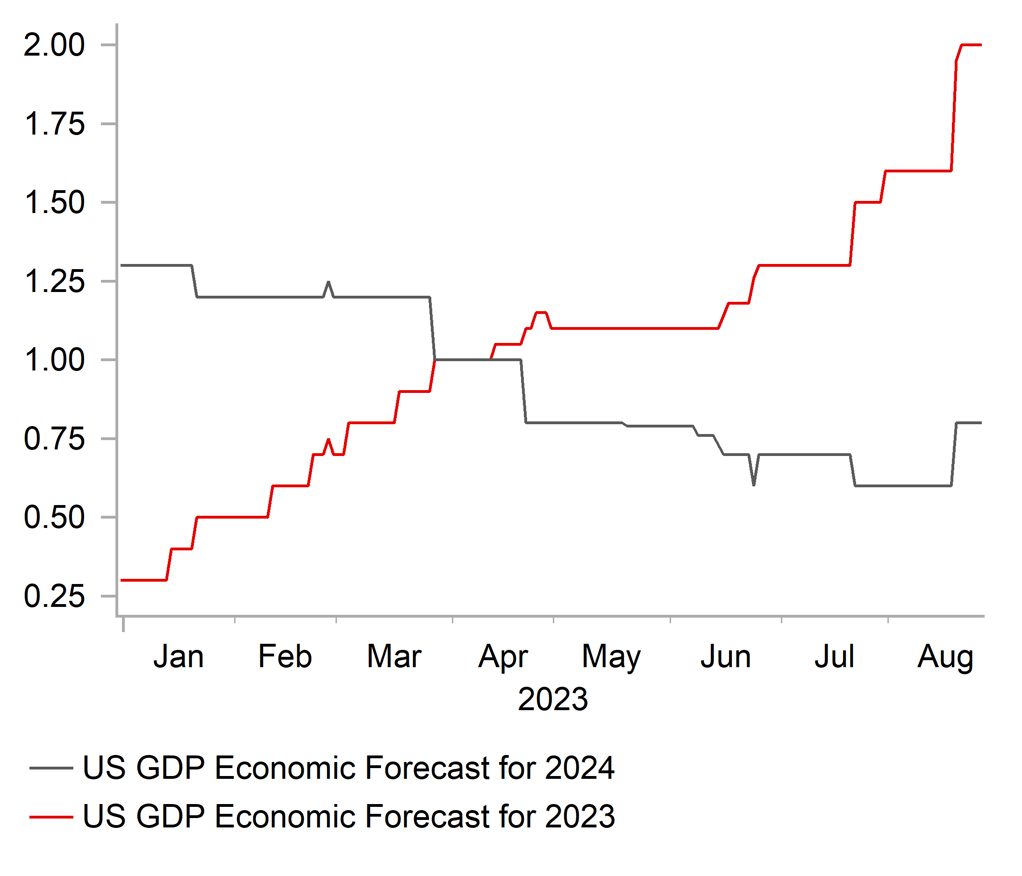

US GDP FORECASTS FOR 2023 ARE BEING REVISED UP

Source: Bloomberg, Macrobond & MUFG GMR

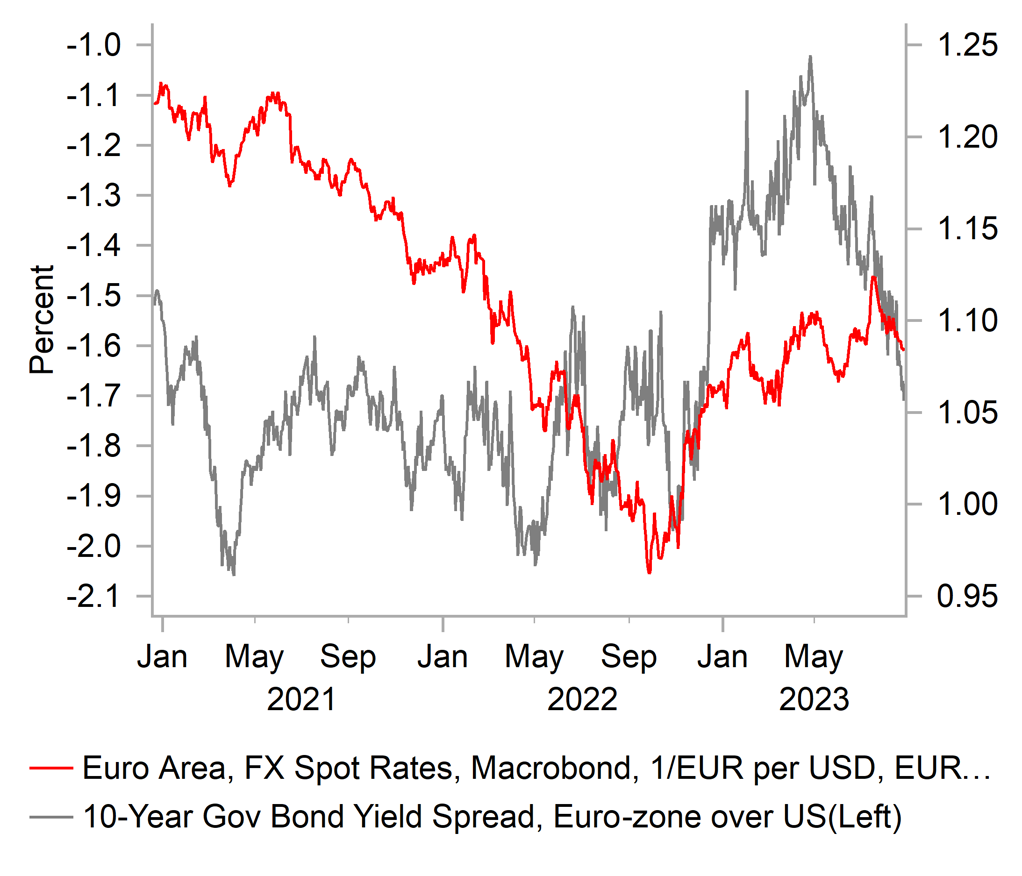

YIELD SPREADS MOVING BACK IN FAVOUR OF US

Source: Bloomberg, Macrobond & MUFG GMR

AUD & NZD: Weakening trends reversing ahead of RBA & RBNZ policy meetings

The NZD has been one of the best performing G10 currencies in September (+1.1% vs. USD) when it has outperformed alongside other commodity currencies. After hitting a low at 0.5859 on 5th September, the NZD/USD rate hit a high today of 0.6049 as the pair threatens to break out above the narrow trading range between 0.5900 and 0.6000 that has been in place since the middle of August. It follows the heavy sell-off that took place through the 2H of July and 1H of August after NZD/USD hit a peak of 0.6412 on 14th July. The recent strength of the NZD and ongoing weakness in the JPY has lifted NZD/JPY to a new cyclical high above the 90.000-level. A level it has only briefly traded above over the last three decades before correcting sharply lower.

The high beta commodity currencies of the AUD and NZD have outperformed recently even as there has been deterioration in global investor risk sentiment. MSCI’s ACWI global equity index has declined by 7% since the start of August. Both have benefitted more from the recent rebound in commodity prices that is helping to improve Australia’s and New Zealand’s terms of trade. Investor optimism over a softer landing for the global economy has helped to ease downward pressure on commodity currencies. Furthermore, there have been some tentative signs that policy stimulus measures in China are starting to provide more support growth. The release of the latest China PMI surveys for September will be released over the weekend. The AUD and NZD would be booster further if business confidence improves for the second consecutive month.

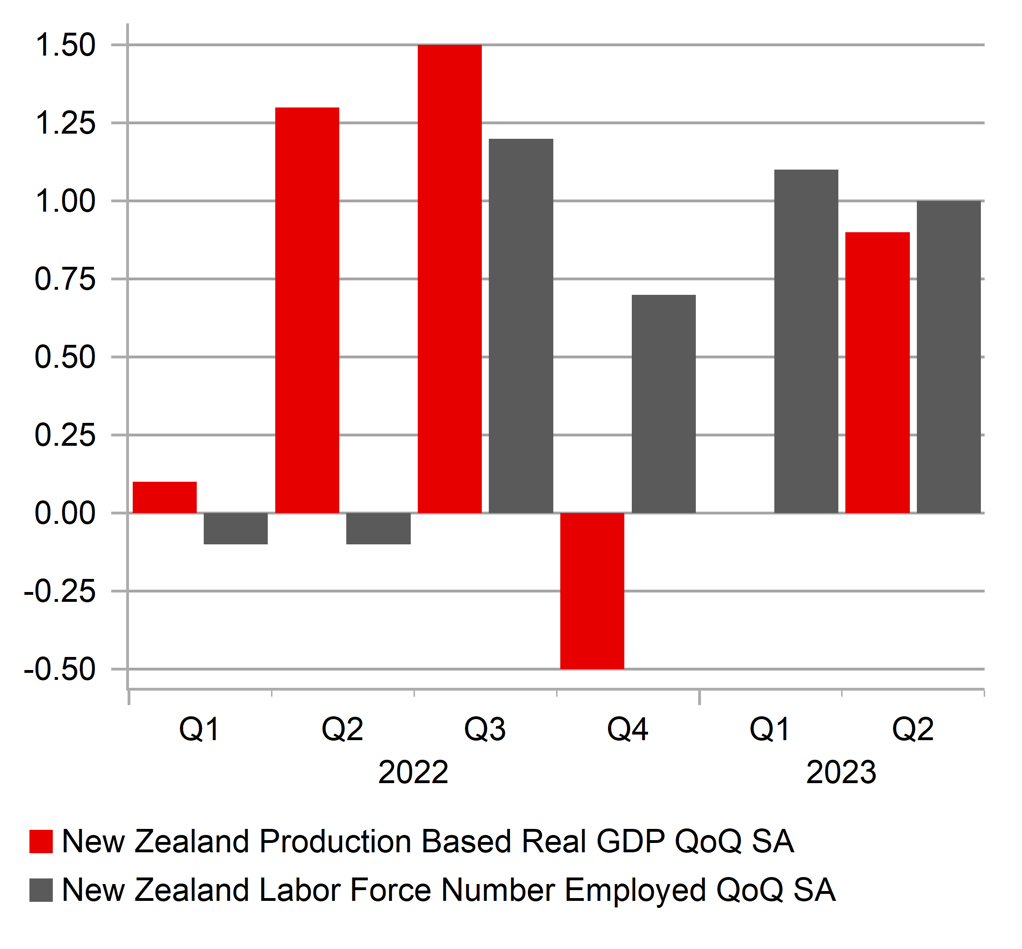

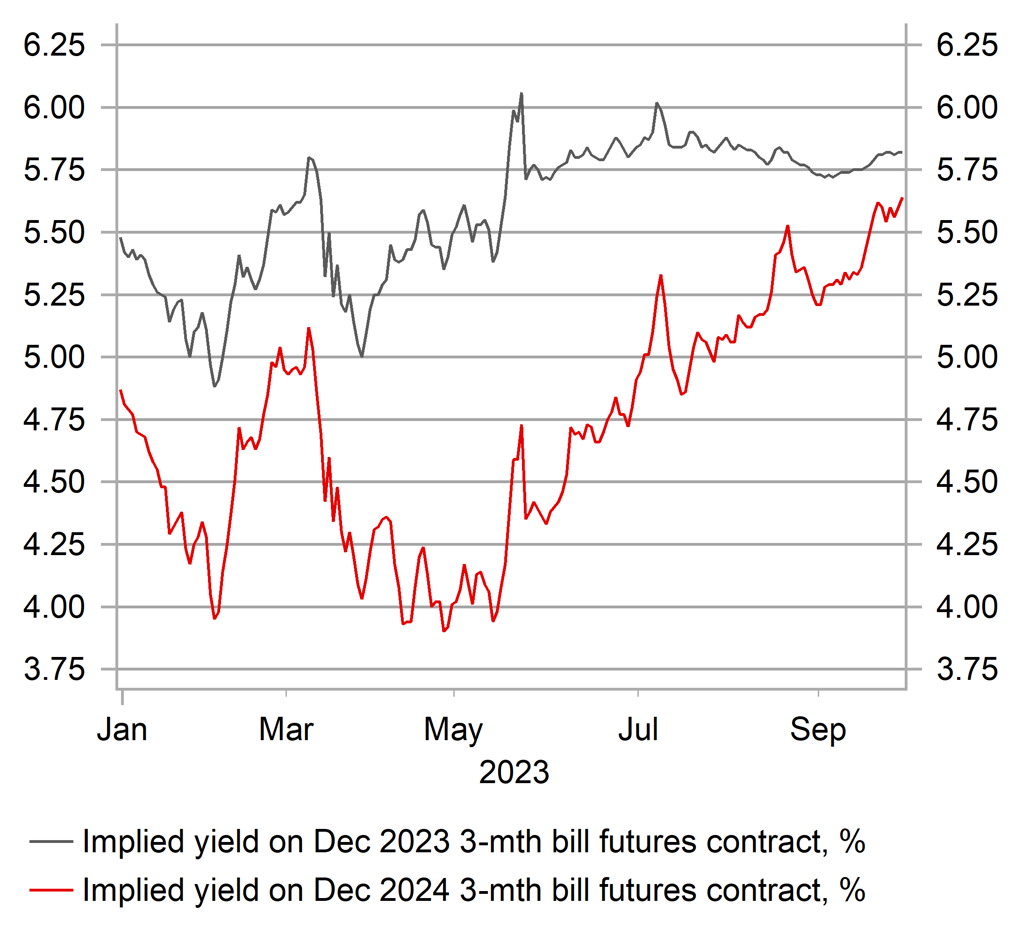

Domestic developments have also become more favourable recently especially for the NZD. It was widely thought that New Zealand’s economy had fallen into recession in the first half this year but that has now been proven to be mistaken. New Zealand’s economy has held up much better than expected . It expanded strongly by 0.9% in Q2 while the marginal contraction of -0.1% in Q1 was revised away as well to show flat growth. It leaves GDP growth more consistent with strong employment growth recorded over the same period. The unexpected resilience of the economy to higher rates has triggered a sharp hawkish repricing of the outlook for the RBNZ’s policy rate similar to the recent adjustment in the US rate market. The New Zealand rate market has moved to price in a higher probability of at least one further hike at the November policy meeting, and sharply scaled back expectations for rate cuts next year. The implied yield on the December 2024 three-month bill futures contract has increased by around 43bps so far this month which takes the cumulative upward adjustment to around 175bps since April. The RBNZ’s updated policy guidance next week is expected to provide a more hawkish signal that opens the door to resuming rate hikes.

In these circumstances, we believe there is room for the NZD to strengthen further in the week ahead. The RBNZ is expected to adopt a more hawkish policy stance in response to the unexpected resilience of the New Zealand economy.

NEW ZEALAND ECONOMY IS PROVING RESILIENT

Source: Bloomberg, Macrobond & MUFG GMR

RBNZ RATE CUTS HAVE BEEN PRICED OUT

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

09/30/2023 |

02:30 |

Manufacturing PMI |

Sep |

50.1 |

49.7 |

!!! |

|

CNY |

09/30/2023 |

02:30 |

Non-manufacturing PMI |

Sep |

51.6 |

51.0 |

!!! |

|

JPY |

10/02/2023 |

00:50 |

Tankan Large Mfg Index |

3Q |

6 |

5 |

!! |

|

SEK |

10/02/2023 |

08:30 |

Riksbank Minutes |

!! |

|||

|

EUR |

10/02/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Sep F |

-- |

43.4 |

!! |

|

GBP |

10/02/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Sep F |

-- |

44.2 |

!! |

|

EUR |

10/02/2023 |

10:00 |

Unemployment Rate |

Aug |

-- |

6.4% |

!! |

|

USD |

10/02/2023 |

15:00 |

ISM Manufacturing |

Sep |

47.8 |

47.8 |

!! |

|

USD |

10/02/2023 |

16:00 |

Fed Chair Powell speaks |

!!! |

|||

|

AUD |

10/03/2023 |

04:30 |

RBA Cash Rate Target |

4.1% |

4.1% |

!!! |

|

|

EUR |

10/03/2023 |

07:10 |

ECB's Lane Speaks |

!!! |

|||

|

CHF |

10/03/2023 |

07:30 |

CPI YoY |

Sep |

-- |

1.6% |

!! |

|

EUR |

10/03/2023 |

13:45 |

ECB's Villeroy speaks |

!! |

|||

|

USD |

10/03/2023 |

15:00 |

JOLTS Job Openings |

Aug |

8900k |

8827k |

!! |

|

NZD |

10/04/2023 |

02:00 |

RBNZ Official Cash Rate |

5.50% |

5.50% |

!!! |

|

|

EUR |

10/04/2023 |

09:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

EUR |

10/04/2023 |

09:00 |

HCOB Eurozone Services PMI |

Sep F |

-- |

48.4 |

!! |

|

GBP |

10/04/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Sep F |

-- |

47.2 |

!! |

|

EUR |

10/04/2023 |

10:00 |

Retail Sales MoM |

Aug |

-- |

-0.2% |

!! |

|

USD |

10/04/2023 |

13:15 |

ADP Employment Change |

Sep |

150k |

177k |

!! |

|

USD |

10/04/2023 |

15:00 |

Factory Orders |

Aug |

0.2% |

-2.1% |

!! |

|

USD |

10/04/2023 |

15:00 |

ISM Services Index |

Sep |

53.4 |

54.5 |

!!! |

|

EUR |

10/05/2023 |

10:45 |

BOE's Broadbent & ECB's Lane Speak |

!!! |

|||

|

USD |

10/05/2023 |

13:30 |

Trade Balance |

Aug |

-$65.3b |

-$65.0b |

!! |

|

USD |

10/05/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

10/06/2023 |

00:30 |

Labor Cash Earnings YoY |

Aug |

-- |

1.3% |

!!! |

|

EUR |

10/06/2023 |

07:00 |

Germany Factory Orders MoM |

Aug |

2.5% |

-11.7% |

!! |

|

CAD |

10/06/2023 |

13:30 |

Net Change in Employment |

Sep |

-- |

39.9k |

!!! |

|

USD |

10/06/2023 |

13:30 |

Change in Nonfarm Payrolls |

Sep |

163k |

187k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The US is facing another government shutdown next week if Congress is unable to pass financing legislation by the end of September.

- The release of the latest PMI surveys from China for September will capture market attention at the start of next week. The surveys revealed a most improvement in business confidence in August. If there is evidence of a further improvement in September it would provide more reassurance that stimulus measures are helping to provide more support for growth in Q3 and heading into year end.

- The RBA (Tues) and RBNZ (Wed) hold their latest policy meetings in the week ahead. The RBA and RBNZ are both expected to leave rates on hold. Market participants are expecting the RBA to leave the door open for one more hike later this year/early in 2024. The RBNZ has already paused their rate hike cycle but speculation has increased recently that they too could deliver at least one more hike after stronger GDP data revealed that New Zealand’s economy has not fallen into recession.

- The main economic data releases from Japan will be the latest Tankan survey for Q3 and labor cash earnings report for September. Further evidence of strengthening wage growth is required to give the BoJ more confidence that higher inflation can be sustained, and to encourage a shift away from current loose policy settings.

- The release of the latest labour market reports from the US and Canada are expected to reveal more evidence of weaker labour demand. US employment growth has slowed to an average of 150k/month over the last three months to August. Similarly, employment growth in Canada has slowed over the last four months to August to an average of 9k/month. However, the slowdown is not yet sufficient to encourage the BoC and Fed to end their hiking cycles, and encourage market expectations for lower rates next year.