To read a full report, please download PDF

Recent USD strength to be tested

FX View:

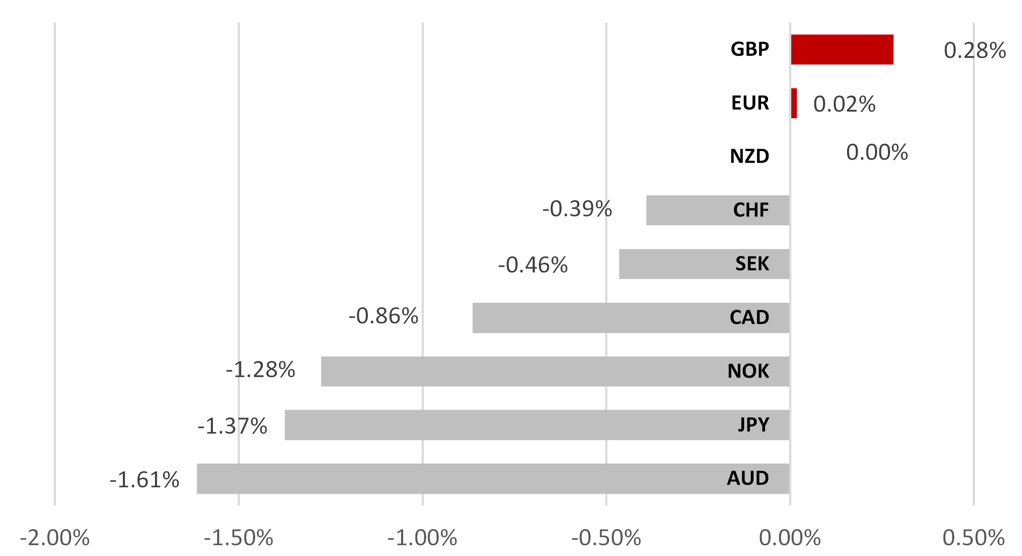

The US dollar has strengthened versus nearly all of G10 this week with USD/JPY sharply higher today after Governor Ueda’s dovish first BoJ policy meeting. We remain sceptical of the recent recovery of the dollar proving sustained and see prospects for weakening economic activity and the expected pause from the FOMC as testing this move stronger for the dollar. Wage data today in the US was slightly stronger than expected while the core PCE inflation was as expected which has reinforced expectations that the hike next week will be followed by a pause. The pricing of Fed rate cuts by year-end will be determined primarily by labour market data and hence the jobs data next Friday will be key for the markets. We expect the ECB to hike by 25bps but unlike the Fed will not be in a position to signal a pause which is why rate spreads have widened in favour of EUR and should help reinforce EUR/USD support.

USD REBOUNDS VERSUS MOST OF G10

Source: Bloomberg, 14:00 GMT, 21st April 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long EUR/USD trade idea and our short USD/JPY trade idea despite today’s large post-BoJ rebound.

JPY Flows:

The weekly cross-border flow data from the MoF revealed renewed selling of foreign bonds by Japanese investors last week by the biggest total since last October. The four-week buying of Japanese equities by foreign investors hit a huge JPY 4.65trn, a record total in the series back to 2001. The “Warren Buffett” effect was one factor after his announcement of increased investments in Japan.

FX Correlation Trees:

This week we extend our correlation tree analysis to include the strength of groupings and inter-relationships visualised by our clusters. We identify German 2YR bonds and UK 2YR Gilts as uncommonly strongly correlated (0.78) and reflect on potential FX implications.

FX Views

USD: FOMC communication will be key

The key events next week will be the FOMC meeting and then the nonfarm payrolls report on Friday. The dollar has weakened in April versus the core G10 currencies – CHF and EUR – but has performed better against the higher beta global growth sensitive currencies like AUD, NZD, NOK and CAD. Anticipation of some signal of a pause after next week’s 25bp hike is high and therefore it is unlikely that the dollar will weaken notably on that outcome being realised. The most likely form of communication to signal a pause will be the removal from the statement the FOMC view “that some additional policy firming may be appropriate” and will likely be replaced by something like “future adjustments to the target range will be determined by information and incoming economic data”. A bolder more confident signal of a pause could mention being “patient” in assessing the impact of the policy tightening to date but that kind of signal would likely be accompanied by strong descriptions of credit tightening slowing growth and the labour market softening and while we believe that’s the likely near-term economic scenario, it may be viewed as premature by the FOMC to signal that strongly the scope for an unconditional pause.

If as expected the FOMC statement signals the prospect of a pause, the press conference will likely then be more focused on the prospect of recession and therefore the willingness of the FOMC to ease its monetary stance. The March statement made reference to tighter credit conditions that were set to “weigh on economic activity, hiring and inflation”. Will the FOMC hold that view more firmly at this meeting? Confidence in the regional banking sector has not really improved and Fed liquidity support for banks has picked up again in recent weeks. The minutes from the last meeting indicate the Fed staff now expect a recession. That will surely get a lot of attention in the press conference. We would expect Powell to play down the implications of that and emphasise the need to keep rates higher for longer. Much of the easing has been removed from market pricing now but the market bias is likely to maintain some cuts by year-end especially given the Fed own expectations of a recession and the ongoing uncertainty over the health of the regional banking sector.

We are not convinced this current rebound of the US dollar will persist. If the FOMC meeting plays out as above, the NFP data on Friday could be the market-moving event next week. The labour market is softening and we should see evidence of that in slower NFP and wage growth. Growth is then set to weaken further and points to this bounce for the dollar fading going forward.

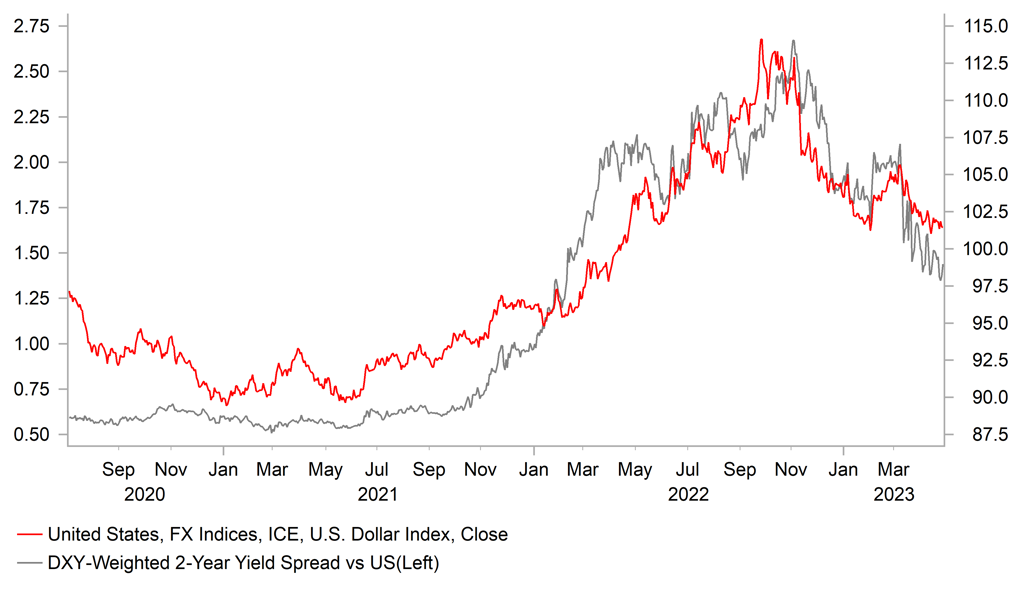

US-G10 2YR YIELD SPREAD TO WEIGH ON USD

Source: Bloomberg, Macrobond & MUFG GMR

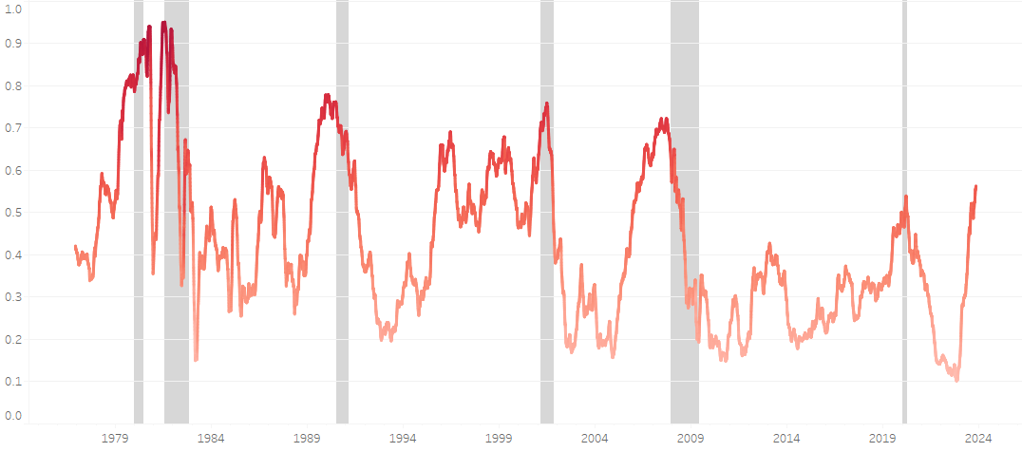

MUFG RECESSION PROBABILITY HIGHEST SINCE GFC

Source: Bloomberg & MUFG Calculations

EUR: Will ECB policy update derail the EUR’s upward momentum?

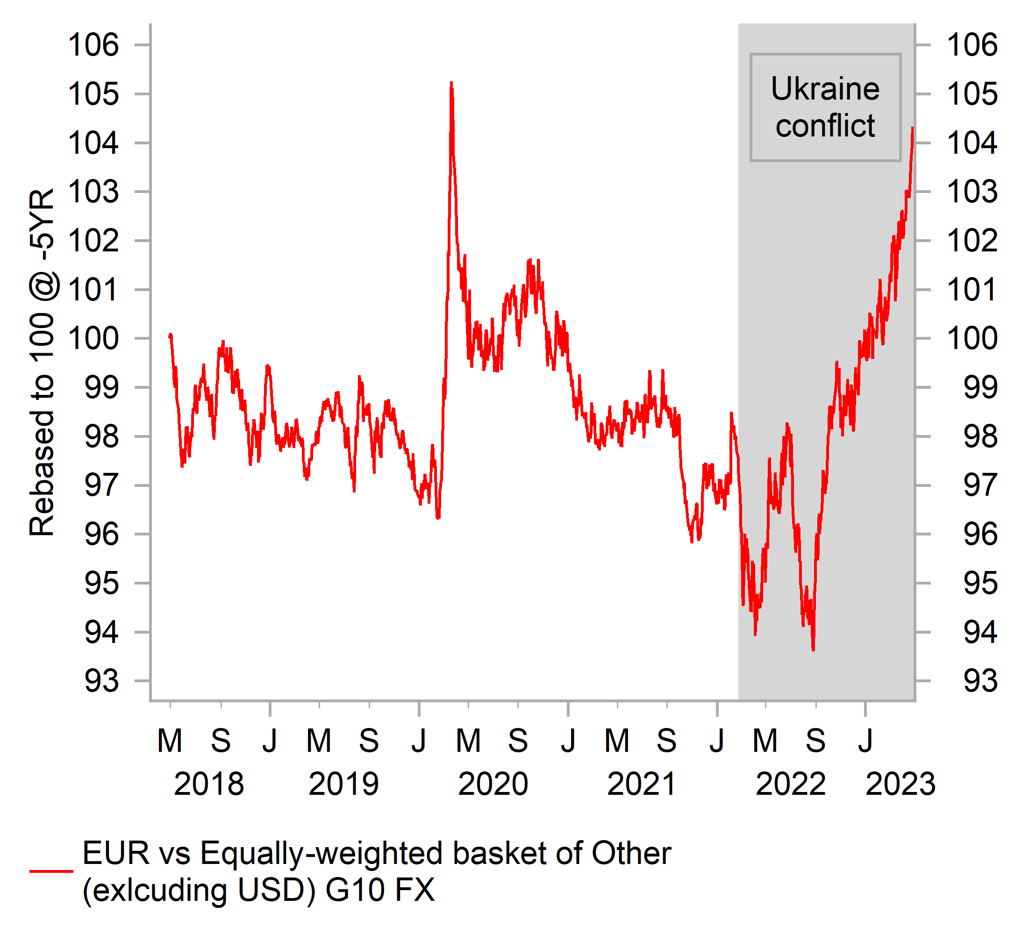

The EUR has continued to outperform over the past week ahead of the ECB’s upcoming policy meeting next week. The EUR alongside the GBP and CHF have been one of the three best performing G10 currencies of so far this year. Over the past week, the EUR hit fresh year to date highs against the USD, JPY, AUD, NZD, NOK and CAD. It has resulted in the EUR rising to its highest level against our equally-weighted of other G10 currencies since the peak of the COVID crisis in March 2020. The EUR has now strengthened significantly by around 11.5% on average against other G10 currencies since the low point in August of last year when the negative impact of the Ukraine conflict/terms of trade shock weighed down heavily on the EUR. Recent price action highlights the EUR still has strong upward momentum giving us confidence that it will continue to strengthen further in the near-term.

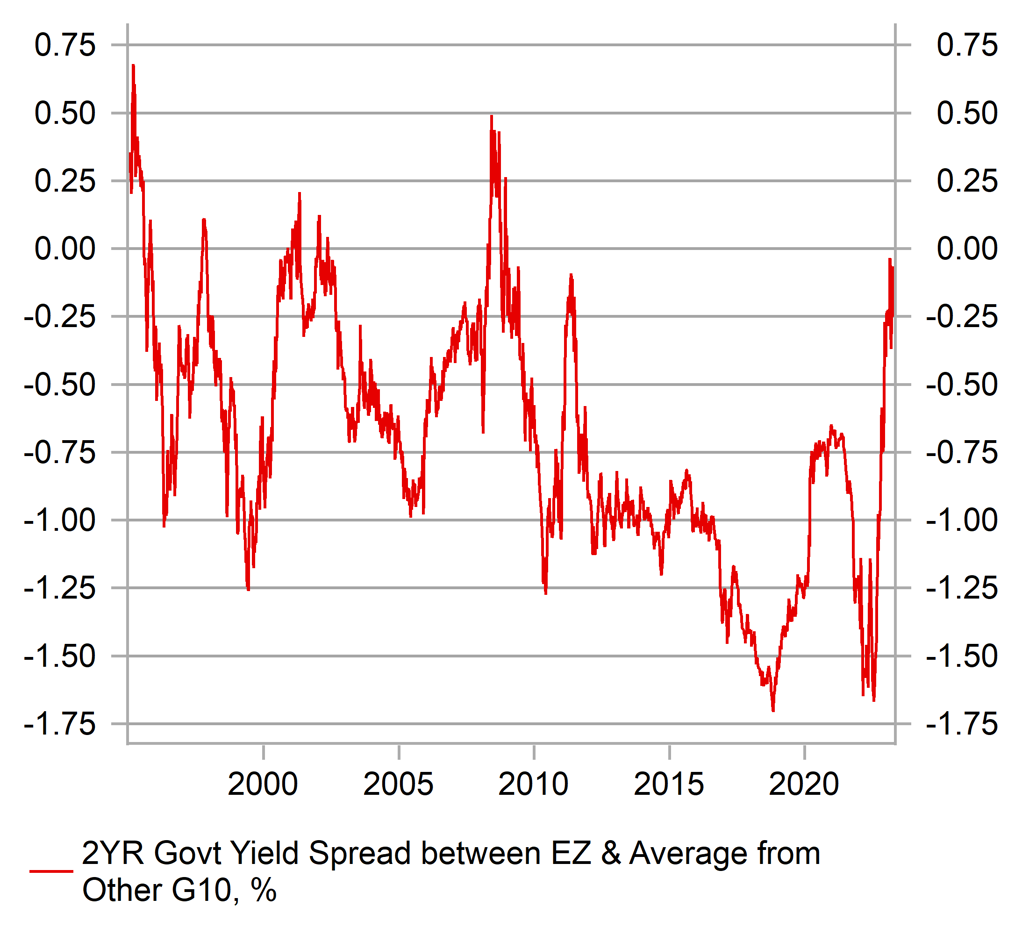

The key EUR-specific event risk in the week ahead will be the ECB’s latest policy update. We are not expecting the ECB’s latest policy update to trigger a reversal of the EUR’s current upward momentum. The EUR has benefitted from the upward adjustment in euro-zone yields since the summer of last year. Heading into next week’s policy meeting, the euro-zone rate market is expecting the ECB to deliver a 25bps rate hike, and then to keep hiking rates through the rest of this year until the deposit rate reaches a peak of 3.75% by September. The ECB’s aggressive rate hiking cycle since last summer has resulted in yield spreads narrowing significantly between the euro-zone and the rest of the G10 bond markets on average to levels not seen for over a decade (chart 2). Next week’s ECB policy update is unlikely to materially alter the more supportive yield spread set up for the EUR. If the ECB steps down the pace of hikes by delivering a smaller 25bps hike as expected, we expect the forward guidance to signal more hikes are still needed this year.

The euro-zone rate market could even be underpricing the risk of more front-loaded hikes given ECB policymakers have recently left open the possibility of delivering another larger 50bps hike next week. ECB officials have signalled that the release of the euro area bank lending survey on Tuesday will be important is assessing how much credit conditions have tightened and dampened the need for further hikes. The latest euro-zone GDP data released today revealed softer growth at the turn of last year but it has been offset by surveys pointing to stronger than expected growth momentum at the start of Q2. After stripping out the sharp reversal in energy prices, food and core inflation measures in the euro-zone remain uncomfortably strong for the ECB.

In these circumstances, we continue to favour a stronger EUR and maintain our long EUR/USD trade idea. We are not expecting the ECB’s policy update to materially alter support from higher yields for a stronger EUR.

STRONG UWPARD MOMENTUM CONTINUES FOR EUR

Source: Bloomberg, Macrobond & MUFG

YIELDS SHIFTED SIGNIFICANTLY IN FAVOUR OF EUR

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

04/30/2023 |

02:30 |

Manufacturing PMI |

Apr |

51.4 |

51.9 |

!!! |

|

CNY |

04/30/2023 |

02:30 |

Non-manufacturing PMI |

Apr |

56.7 |

58.2 |

!!! |

|

USD |

05/01/2023 |

15:00 |

Construction Spending MoM |

Mar |

0.2% |

-0.1% |

!!! |

|

USD |

05/01/2023 |

15:00 |

ISM Manufacturing |

Apr |

46.8 |

46.3 |

!!! |

|

AUD |

05/02/2023 |

05:30 |

RBA Cash Rate Target |

3.6% |

3.6% |

!!! |

|

|

EUR |

05/02/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Apr F |

-- |

45.5 |

!! |

|

EUR |

05/02/2023 |

09:00 |

M3 Money Supply YoY |

Mar |

-- |

2.9% |

!! |

|

EUR |

05/02/2023 |

09:00 |

Euro Area Bank Lending Survey |

!!! |

|||

|

GBP |

05/02/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Apr F |

-- |

46.6 |

!! |

|

EUR |

05/02/2023 |

10:00 |

CPI Estimate YoY |

Apr |

-- |

6.9% |

!!! |

|

AUD |

05/02/2023 |

12:20 |

RBA's Lowe-Speech |

!!! |

|||

|

USD |

05/02/2023 |

15:00 |

JOLTS Job Openings |

Mar |

-- |

9931k |

!! |

|

USD |

05/02/2023 |

15:00 |

Durable Goods Orders |

Mar F |

-- |

3.2% |

!! |

|

NZD |

05/02/2023 |

23:45 |

Employment Change QoQ |

1Q |

-- |

0.2% |

!!! |

|

AUD |

05/03/2023 |

02:30 |

Retail Sales MoM |

Mar |

0.2% |

0.2% |

!!! |

|

EUR |

05/03/2023 |

10:00 |

Unemployment Rate |

Mar |

-- |

6.6% |

!! |

|

USD |

05/03/2023 |

13:15 |

ADP Employment Change |

Apr |

145k |

145k |

!! |

|

USD |

05/03/2023 |

15:00 |

ISM Services Index |

Apr |

51.8 |

51.2 |

!!! |

|

USD |

05/03/2023 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.3% |

5.0% |

!!! |

|

|

USD |

05/03/2023 |

19:30 |

Fed Chair Powell Press Conference |

!!! |

|||

|

NOK |

05/04/2023 |

09:00 |

Deposit Rates |

-- |

3.0% |

!!! |

|

|

EUR |

05/04/2023 |

09:00 |

HCOB Eurozone Services PMI |

Apr F |

-- |

56.6 |

!! |

|

GBP |

05/04/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Apr F |

-- |

54.9 |

!! |

|

EUR |

05/04/2023 |

13:15 |

ECB Deposit Facility Rate |

-- |

3.0% |

!!! |

|

|

USD |

05/04/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

05/04/2023 |

13:45 |

ECB President Lagarde Press Conference |

!!! |

|||

|

AUD |

05/05/2023 |

02:30 |

RBA-Statement on Monetary Policy |

!! |

|||

|

CHF |

05/05/2023 |

07:30 |

CPI YoY |

Apr |

2.7% |

2.9% |

!! |

|

EUR |

05/05/2023 |

07:45 |

France Wages QoQ |

1Q P |

-- |

0.7% |

!! |

|

EUR |

05/05/2023 |

10:00 |

Retail Sales MoM |

Mar |

-- |

-0.8% |

!! |

|

CAD |

05/05/2023 |

13:30 |

Net Change in Employment |

Apr |

-- |

34.7k |

!!! |

|

USD |

05/05/2023 |

13:30 |

Change in Nonfarm Payrolls |

Apr |

175k |

236k |

!!! |

|

USD |

05/05/2023 |

13:30 |

Average Hourly Earnings MoM |

Apr |

0.3% |

0.3% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The week ahead will be important for the FX market. The key events will be the latest policy updates from the Fed, ECB and RBA. We expect the Fed to deliver one more 25bps hike next week but to signal more strongly that they are seriously considering pausing their hiking cycle to assess the impact on the US economy from tightening financial conditions. We also expect the RBA to signal that they are happy to pause their hiking cycle by leaving rates on hold at 3.60% next week for the second consecutive policy meeting. There is clearer evidence now that inflation peaked at the end of last year in Australia and slowed more quickly than expected at the start of this year. In contrast to the Fed and RBA policy updates, we expect the ECB deliver a more hawkish policy signal by indicating that they still have more work to do to combat upside inflation risks. We expect the ECB to step down the pace of hikes by delivering a 25bps hike next week but there is a material risk of one final 50bps hike.

- At the same time, there are number of top tier economic data releases in the week ahead including: i) the latest non-farm payrolls report for April, ii) ISM surveys for April, and iii) the latest euro-zone CPI report for April. Leading indicators have been displaying more evidence of labour market weakness recently which have raised the risk of softer NFP reports in the coming months. Headline inflation in the euro-zone has slowed sharply at the start of this year as the inflationary impact from higher energy prices has reversed. Inflation pressures from food prices and core measures have though remained comfortably high keeping pressure on the ECB to tighten policy further while the euro-zone economy has proven more resilient than expected.