To read a full report, please download PDF

USD challenges post-a-debt-ceiling deal

FX View:

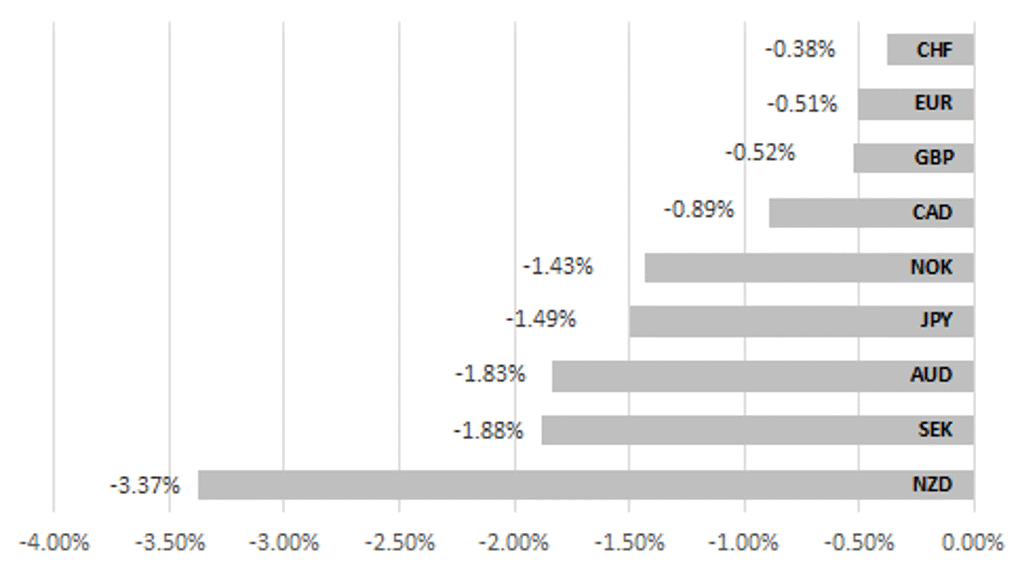

The US dollar has strengthened against all G10 currencies this week as Fed rate hike expectations continue to increase which incorporates also the building optimism that the debt ceiling deal will shortly be announced. We didn’t expect to see such a large jump in short-term rates in the US (2yr note yield +90bps from low-point in early May) and the move will provide the dollar with support over the short-term. If a debt ceiling deal is agreed then its back to the markets being more data-led and hence the US data next week culminating with the jobs report will be key. Market conditions could be more volatile going forward beyond a debt ceiling deal given an estimated USD 1 trillion worth of T-bill issuance through to end-September that could undermine bank liquidity and renew uncertainties over the US banking sector. The dollar would likely weaken versus core G10 in such circumstances.

USD GAINS ACROSS ALL OF G10

Source: Bloomberg, 14:00 GMT, 26th May 2023 (Weekly % Change vs. USD)

Trade Ideas:

We have closed our short USD/NOK position and after a bad run of late due to this US dollar rally we will remain flat this week allow the political shenanigans to play out in Washington before reassessing how to best express our fundamental views going forward.

JPY Flows:

This week we provide an update on the higher frequency Japan cross-border flows which revealed that in the week to last Friday Japan investors were buyers of foreign bonds while the very strong demand for Japan equities continued with now around JPY 7 trillion worth of equities purchased by foreign investors in just the last seven weeks.

IMM Positioning:

The latest IMM weekly positioning data covering the week to 16th May revealed that Leveraged Funds have not yet embraced the USD’s recent rebound.

FX Views

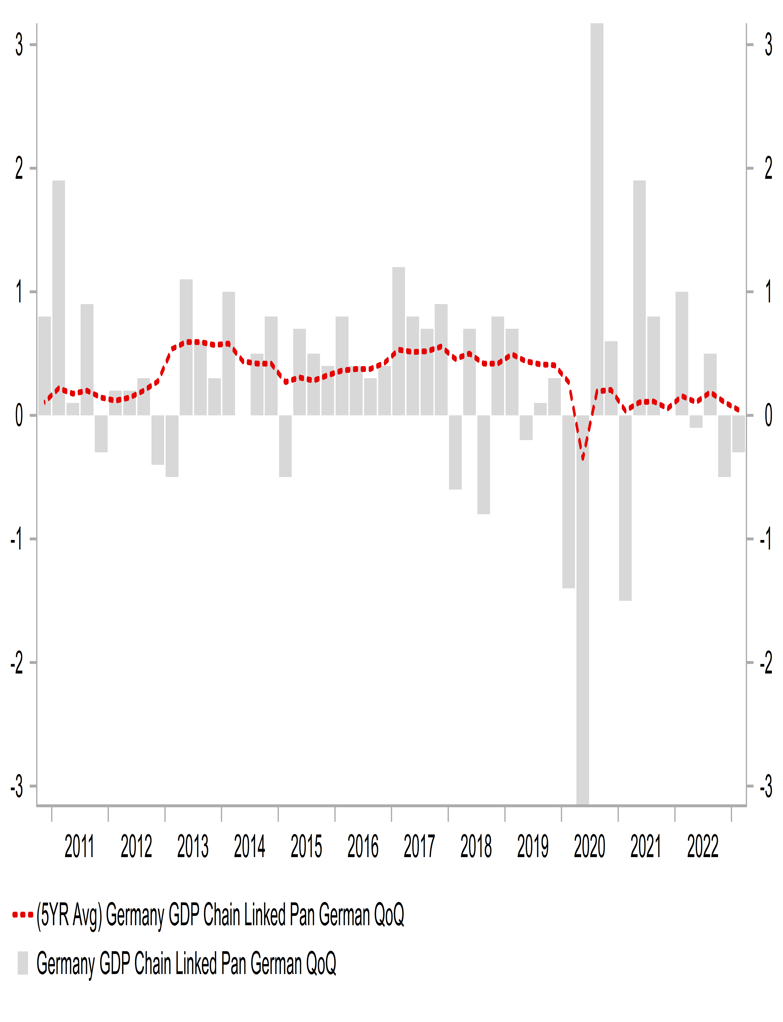

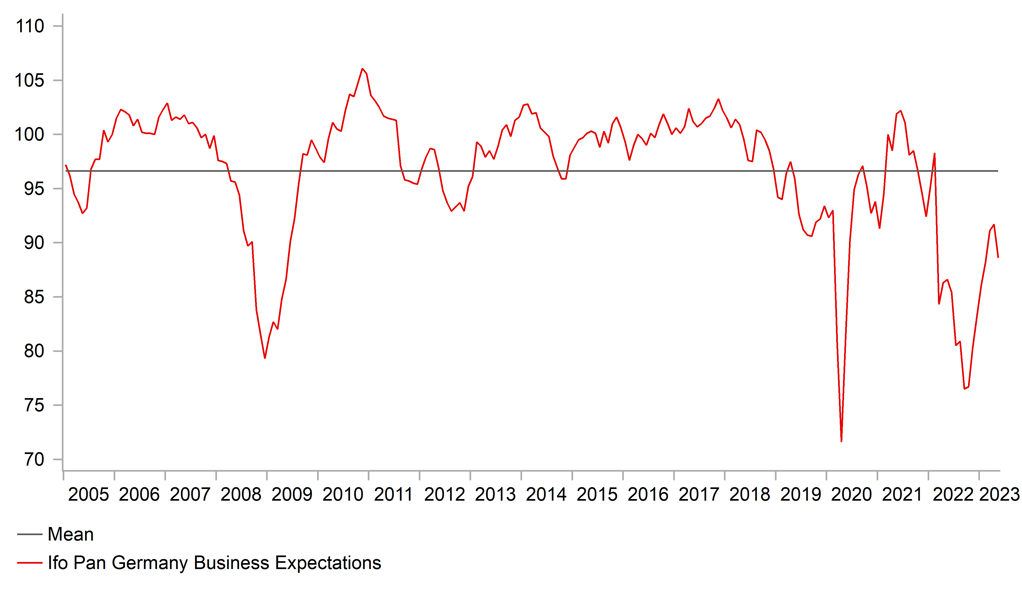

EUR: Limits to this move lower

This week we released an ad hoc FX Focus piece highlighting 10 reasons why the dollar is set to weaken (here) and admittedly one of those factors – relative macro – has turned less supportive of US dollar weakness although we maintain that this reflects more about the past than what lies ahead. This week we got confirmation that Germany fell into technical recession in the first quarter with -0.3% real GDP contraction in Q1 following -0.5% in Q4. The primary driver of this weakness was household consumption which contracted by 1.2% Q/Q in Q1, which followed a downwardly revised 1.7% contraction in Q4. Government spending also fell sharply, by 4.9% in Q1. These three components will turn in the coming quarters and hence the probability of a pick-up in growth is high. Growth will still be subdued and nothing to celebrate but momentum is now a little more positive. Germany’s GfK Consumer Confidence index increased to -24.2, the eighth straight month of increase. A European Commission document reported by the FT today revealed that natural gas demand this year will drop by more than what’s imported from Russia which if achieved could put further downward pressure on prices. The turnaround in natural gas prices and the improved purchasing power of consumers is the primary supportive factor for growth going forward and will support growth in Germany over the coming quarters.

Admittedly, there are some concerns over growth in Germany over the medium-term. Export growth was muted in Q1 at just 0.4% after a decline of 1.3% in Q4. Germany will have a far stronger competitor in the auto sector going forward with data from China confirming it is now the official top auto exporter in the world. Some of the natural gas demand decline is forced – demand destruction – and that leaves Germany, which was more dependent on Russian natural gas than other countries, with a potentially longer period of adjustment. After two quarters of contraction, German real GDP is back below the pre-covid level, joining the UK and Japan.

But better consumption growth driven by rising real incomes will be the primary factor supporting growth over the coming few quarters and the GDP data from Germany reinforces that belief. The surge in 2yr yields in the US this month (over +90bps) does not reflect strong US economic data and indeed we continue to expect an ongoing deceleration in US economic activity (factors laid out below in our 2nd FX View piece) and hence short-term rates will be under renewed downward pressure over the coming weeks/months. The 2yr yield is up about 40bps in Germany over the same period which helps explain the EUR/USD move lower. Two further rate hikes by the ECB remains priced which at a minimum are highly likely to be delivered.

SUBDUED GERMAN GDP GROWTH

Source: Bloomberg, Macrobond & MUFG GMR

GERMAN IFO BUNSINESS CLIMATE INDEX STILL WEAK

Source: Bloomberg, Macrobond & MUFG Research

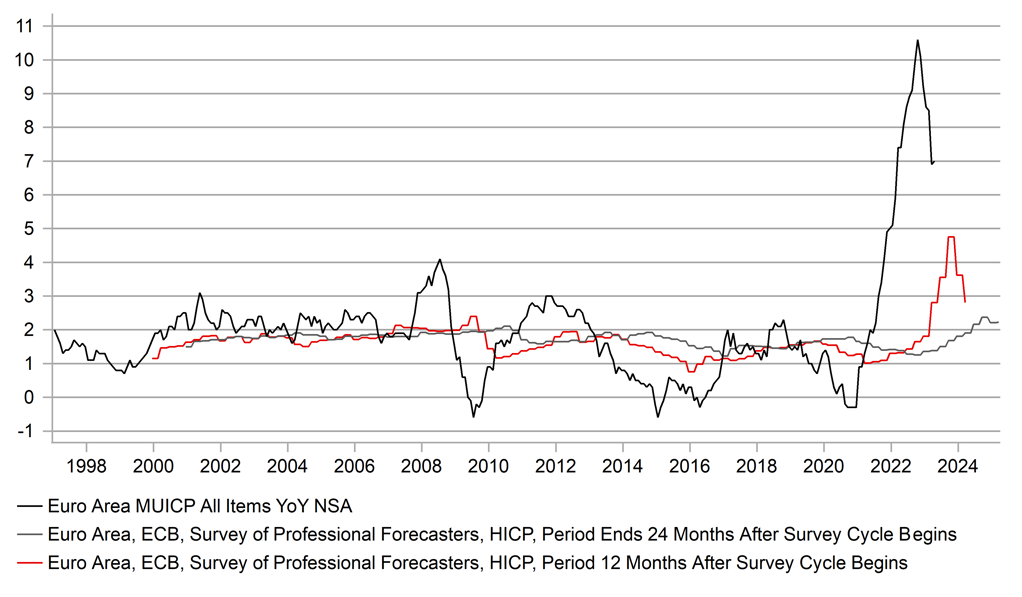

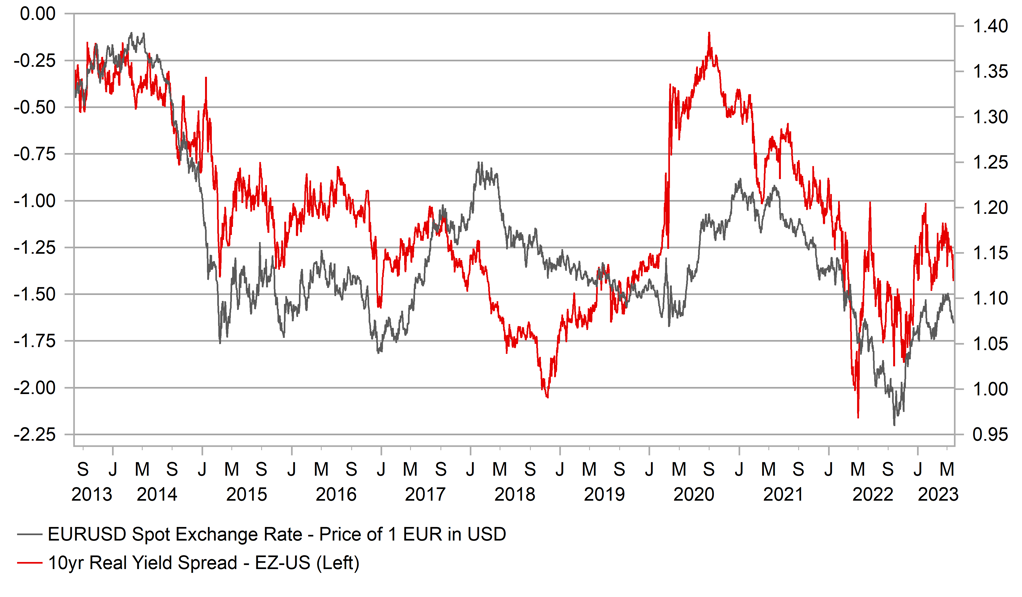

We also anticipate an improvement in the inflation outlook to unfold in the euro-zone over the coming months. From a real yield perspective that will provide support for EUR/USD given, like other central banks, the ECB will be slow to reverse course and start cutting rates (we maintain the Fed will cut before the ECB). More recent inflation data in the euro-zone has shown some stickiness in part due to food price inflation being stronger than anticipated and in part due to the strength of services inflation. The result has been a rebound in the 10yr breakeven rate in Germany. US declines in annual CPI began earlier and has been a little larger. US headline CPI is down 4.2ppts versus 3.6ppts in the euro-zone. Breakeven rates on 10yr are now actually higher in the euro-zone than in the US, which historically is an unusual status. We suspect that will revert to the more normal status going forward.

While ECB guidance has been very clear – there will be a least two more rate hikes, possibly three – the inflation outlook remains favourable as was outlined in a speech by Philip Lane this week. The ECB’s chief economist expressed confidence of a turn in inflation but admitted that “we are not quite there yet”. But in highlighting the view the inflation will return to target in “a timely manner” he highlighted a number of specific factors. Firstly, through the ECB’s Corporate Telephone Survey there was evidence that corporate profit margins are set to shrink which is a marked difference from the previous quarter. Secondly, labour force developments have been favourable relative to the long-term trend and increased labour supply will help dampen upside wage inflation risks. The demand for corporate and household loans have declined and hence credit conditions are conducive to an easing in domestic-demand driven inflationary pressures. Finally, measures of momentum in inflation have turned lower for all categories apart from services inflation.

So the level of real yields should begin to pick up again in the euro-zone relative to the US. The ECB is likely to vote for rates hikes at the next two meetings even as inflation shows signs of easing which should be EUR supportive. The primary risk to the view comes on the US side and if economic activity shows limited signs of further slowdown, there are risks of further declines in EUR/USD. Also, a worse than expected global backdrop could see manufacturing activity in Germany influence the broader economy more than expected. But we maintain our assumption that growth in Germany and the euro-zone shows some modest rebound which will contrast to the deceleration in US economic activity as we move toward recessionary conditions by year-end.

ACTUAL EZ CPI VS PROFESSIONAL FORECASTERS

Source: Bloomberg, Macrobond & MUFG Research

10YR REAL YIELD SPREAD VS EUR/USD

Source: Bloomberg, Macrobond & MUFG Research

USD: Support for USD from rising US yields should prove short-lived

The USD has continued to strengthen over the past week resulting the dollar index moving back up towards the top of its year to date trading range between 100.50 and 105.50. It has been the longest period (three weeks) of dollar gains since February when the dollar index closed higher for four consecutive weeks before it reversed course in the following months. One important similarity between the two periods of USD strength this year has been that they have both been supported by hawkish repricing of Fed rate hike expectations. In February to early March the 2-year US Treasury yield rose by just over 105bps as it hit a cycle high of 5.08% on 8th March. So far in May the 2-year UST yield has increased by around 90bps.

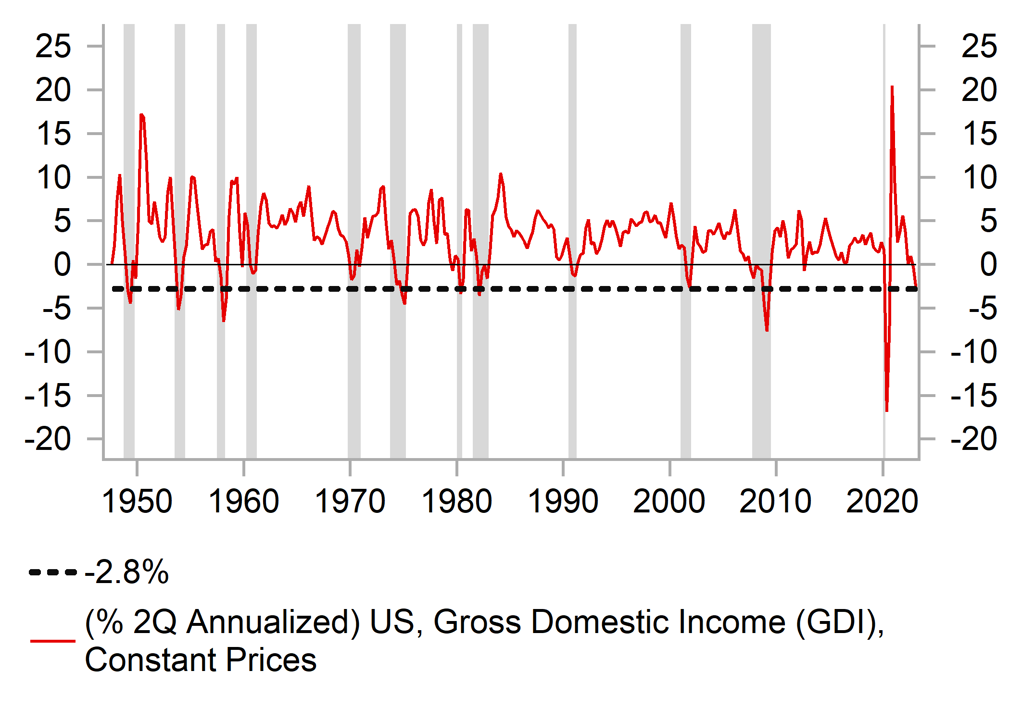

The hawkish repricing of Fed rate hike expectations has resulted in the US rate market pricing back in one more hike (24bps by July), and scaling back cuts for later this year (-10bps by December). Similar to in February, we are not expecting this move higher in US yields and the USD to be sustained. With US growth and inflation set to slow further and rates already at more restrictive levels at close to 5.00%, the balance of risks is titled to the downside for yields. The US economy was already weak even before the full impact of tightening monetary policy and credit conditions becomes evident. Gross domestic output (GDO) which is an average of gross domestic product (GDP) and gross domestic income (GDI) contracted again in Q1 by annualized rate of -0.5%. It was the second consecutive quarter of contraction and the fourth out of the last five. GDI growth has been particularly weak over the last 2 quarters contracting by an annualized rate of -2.8%. Going back to the early 1950’s, GDI has never contracted to that extent over a similar period without the US economy falling into recession. Some researchers have found that GDI improves our ability to recognise recessions.

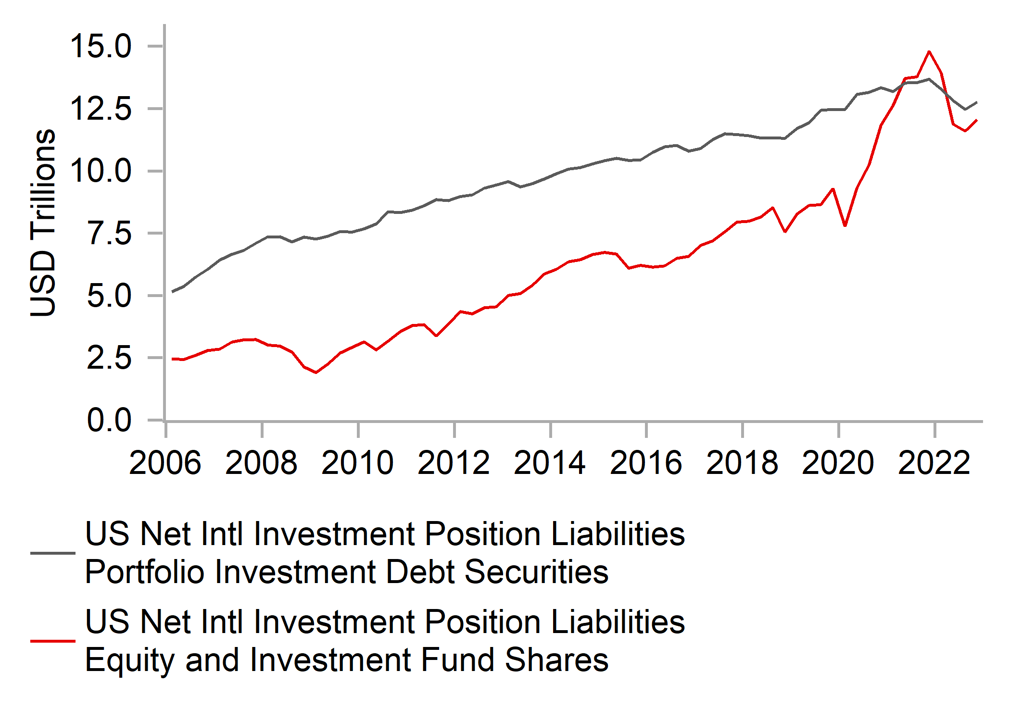

One sector of the US economy that has attracted more positive investor attention recently has been the technology sector relating specifically to breakthroughs in artificial intelligence (AI). The value of Nvidia’s share price has jumped sharply following a blow out sales forecast that came in 50% above analyst expectations as it benefits from demand for its AI processors. It is helping the share prices of US tech companies to rebound following last year’s heavy sell-off when the Nasdaq lost almost 40% of its value. While it is still early days, a pick-up in equity inflows into the US could help to provide support for the USD although recent history was not favourable. The US equity market outperformed after the COVID shock resulting in a marked increase in the value of US equities held by foreigners. The US international investment liability relating to equity holdings increased by around USD7 trillion between Q1 2020 and Q4 2021. However, the dollar index declined by around 3% over the same period.

In these circumstances, we remain unconvinced that the recent USD strength will be sustained and are waiting for the opportunity to re-establish short positions (click here).

US ECONOMY HAS BEEN WEAK

Source: Bloomberg, Macrobond & MUFG

FOREIGN HOLDINGS OF US EQUITIES HAVE SURGED

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SEK |

05/30/2023 |

07:00 |

GDP QoQ |

1Q |

-- |

-0.5% |

!! |

|

CHF |

05/30/2023 |

08:00 |

GDP QoQ |

1Q |

-- |

- |

!! |

|

CAD |

05/30/2023 |

13:30 |

Current Account Balance |

1Q |

-- |

-$10.64b |

!! |

|

USD |

05/30/2023 |

15:00 |

Conf. Board Consumer Confidence |

May |

99.5 |

101.3 |

!! |

|

AUD |

05/31/2023 |

00:00 |

RBA's Lowe-Testimony |

!! |

|||

|

JPY |

05/31/2023 |

00:50 |

Industrial Production MoM |

Apr P |

-- |

1.1% |

!! |

|

AUD |

05/31/2023 |

02:30 |

CPI YoY |

Apr |

-- |

6.3% |

!!! |

|

CNY |

05/31/2023 |

02:30 |

Manufacturing PMI |

May |

49.2 |

49.2 |

!!! |

|

CNY |

05/31/2023 |

02:30 |

Non-manufacturing PMI |

May |

-- |

56.4 |

!!! |

|

EUR |

05/31/2023 |

07:45 |

France GDP QoQ |

1Q F |

-- |

0.2% |

!! |

|

EUR |

05/31/2023 |

08:55 |

Germany Unemployment Change (000's) |

May |

-- |

24.0k |

!! |

|

EUR |

05/31/2023 |

09:00 |

ECB Financial Stability Review |

!! |

|||

|

EUR |

05/31/2023 |

09:30 |

ECB's Visco Speaks |

!! |

|||

|

EUR |

05/31/2023 |

13:00 |

Germany CPI EU Harmonized YoY |

May P |

-- |

7.6% |

!!! |

|

CAD |

05/31/2023 |

13:30 |

Quarterly GDP Annualized |

1Q |

-- |

0.0% |

!!! |

|

USD |

05/31/2023 |

13:50 |

Fed's Collins & Bowman speak |

!! |

|||

|

GBP |

05/31/2023 |

14:15 |

BoE’s Mann speaks |

|

|

|

!! |

|

USD |

05/31/2023 |

15:00 |

JOLTS Job Openings |

Apr |

-- |

9590k |

!!! |

|

JPY |

06/01/2023 |

00:50 |

Capital Spending YoY |

1Q |

-- |

7.7% |

!! |

|

EUR |

06/01/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

May F |

-- |

44.6 |

!! |

|

GBP |

06/01/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

May F |

-- |

46.9 |

!! |

|

EUR |

06/01/2023 |

10:00 |

Unemployment Rate |

Apr |

-- |

6.5% |

!! |

|

EUR |

06/01/2023 |

10:00 |

CPI Estimate YoY |

May |

-- |

7.0% |

!!! |

|

EUR |

06/01/2023 |

12:30 |

ECB Account of May 3-4 Meeting |

!! |

|||

|

USD |

06/01/2023 |

13:15 |

ADP Employment Change |

May |

150k |

296k |

!! |

|

USD |

06/01/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

06/01/2023 |

13:30 |

Unit Labor Costs |

1Q F |

6.3% |

6.3% |

!!! |

|

USD |

06/01/2023 |

15:00 |

Construction Spending MoM |

Apr |

0.2% |

0.3% |

!! |

|

USD |

06/01/2023 |

15:00 |

ISM Manufacturing |

May |

47.0 |

47.1 |

!! |

|

USD |

06/02/2023 |

13:30 |

Change in Nonfarm Payrolls |

May |

175k |

253k |

!!! |

|

USD |

06/02/2023 |

13:30 |

Average Hourly Earnings MoM |

May |

0.3% |

0.5% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main focus in the week ahead will be ongoing talks between Congressional leaders as they seek reach a compromise deal to extend or suspend the US debt ceiling. The so called x-date could come as early as 1st June although the government could still have some further wiggle room into early June.

- The other main focus in the week ahead will be the latest updates on the health of the US labour market. The release of the latest JOLTS job openings report for April (Wed), until labour costs for Q1 (Thurs) and non-farm payrolls report for May will be scrutinized closely for further evidence that employment and wage growth have eased at the start of this year. Evidence of sharper slowdown in employment growth would dampen speculation over further Fed rate hikes and encourage expectations for rate cuts later this year. In contrast, market participants would be encouraged to price in a higher probability of another 25bps Fed rate hike in June if employment growth continues to remain strong.

- The other economic data releases that could capture market attention in the week ahead include: i) the latest PMI surveys from China for May, and ii) latest CPI reports from Australia for April and the euro-zone for May. Inflation has been easing recently in both Australia and the euro-zone. The RBA is viewed as being closer to pausing their hiking cycle and could soon follow in the footsteps of the RBNZ who brought an end to their hiking cycle this week. We still expect the ECB to deliver a couple more 25bps hikes in June and July despite the notable downward revision to growth in Q1.