To read a full report, please download PDF

Modest USD rebound is unlikely to last

FX View:

The US dollar has staged a modest rebound over the past week supported by the scaling back of more dovish Fed policy expectations. One final 25bps hike has been fully priced into the current tightening cycle. However, we doubt that there is much scope for US rates to keep moving higher from here with US growth and inflation surprising to the downside. It stands in contrast to further upside surprises for growth and inflation outside of the US. The developments make us more confident that the Fed will pause their hiking cycle ahead of the BoE and ECB. The BoJ will hold the first policy meeting under new Governor Ueda in the week ahead. Ahead of the meeting, the BoJ has dampened expectations for a shift in YCC policy settings that has contributed toward JPY underperformance so far this month. Political developments in Japan are expected to garner more market attention in the week ahead and have the potential to alter BoJ policy expectations.

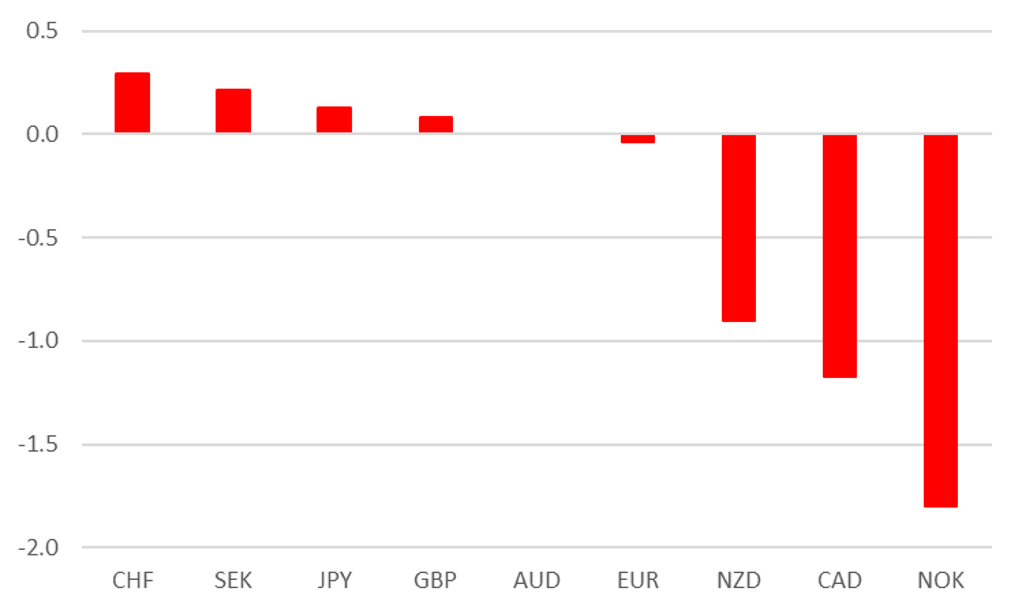

G10 COMMODITY CURRENCIES UNDERPERFORM

Source: Bloomberg, 14:00 GMT, 21st April 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long EUR/USD trade idea, and are maintaining a short USD/JPY trade idea. We have closed a short USD/CAD trade idea.

JPY Flows:

The Balance of Payments statistics for February were released last week by the MoF and the trade account of the BoP revealed a notable improvement, with the deficit shrinking from JPY 3,182bn in January to JPY 604bn in February. The investment income surplus continues to run at levels larger than the trade and services deficit ensuring Japan has maintained an overall current account surplus.

FX Positioning:

The latest IMM weekly positioning data covering the week to 11th April revealed that Leveraged Funds increased long USD positioning for the second consecutive week. The total net long USD position increased to 77,374 contracts which was the largest long position since early June of last year.

FX Views

JPY: Japan politics in focus ahead of BoJ policy meeting

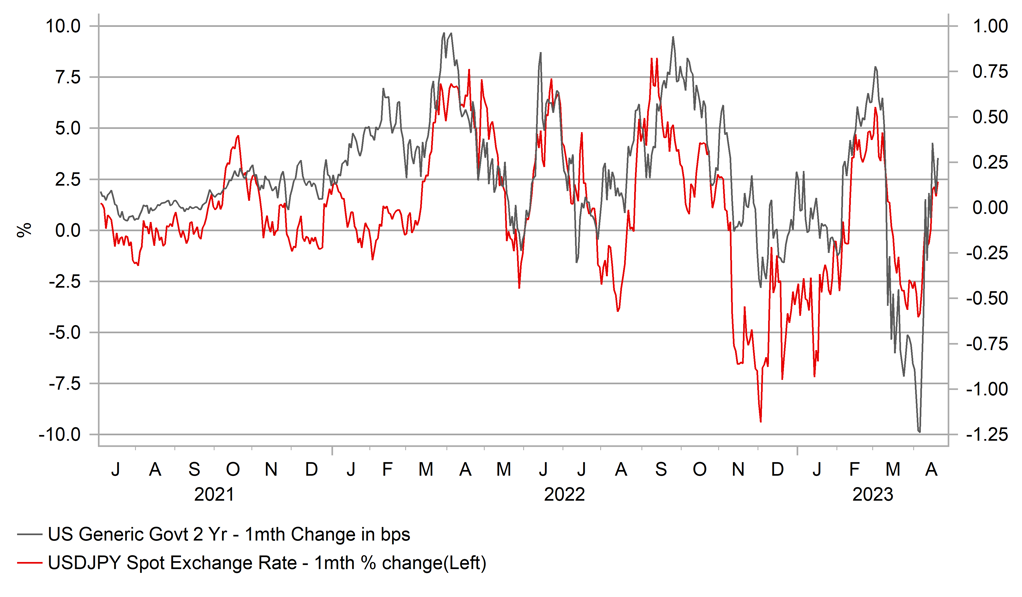

USD/JPY remains close to highs not seen since mid-March when US rates were declining on the back of US banking sector concerns. The recovery of USD/JPY reflects the stronger conviction of a May rate hike by the FOMC and weaker conviction on rate cuts by year-end. We believe this has been more about Fed communication rather than any evidence of strong economic data. Before the FOMC meeting though we will have the BoJ meeting next Friday – a key meeting given it is Governor Ueda’s first. Two elements of this meeting are worth watching. Firstly, the BoJ will also release its latest GDP and inflation forecasts with next week’s release including the first estimates for 2025. An inflation projected range that has 2.0% within it would be one condition likely required for the BoJ to change its monetary stance. Secondly, the guidance in the latest statement still includes a bias to lower rates further. Now under new leadership, it might be the right time to adjust this guidance given the shift in fundamentals no longer mean a bias to the downside is appropriate. While this would likely lead to a knee-jerk reaction, beginning a new tenure with credible communication will be beneficial in the long-run.

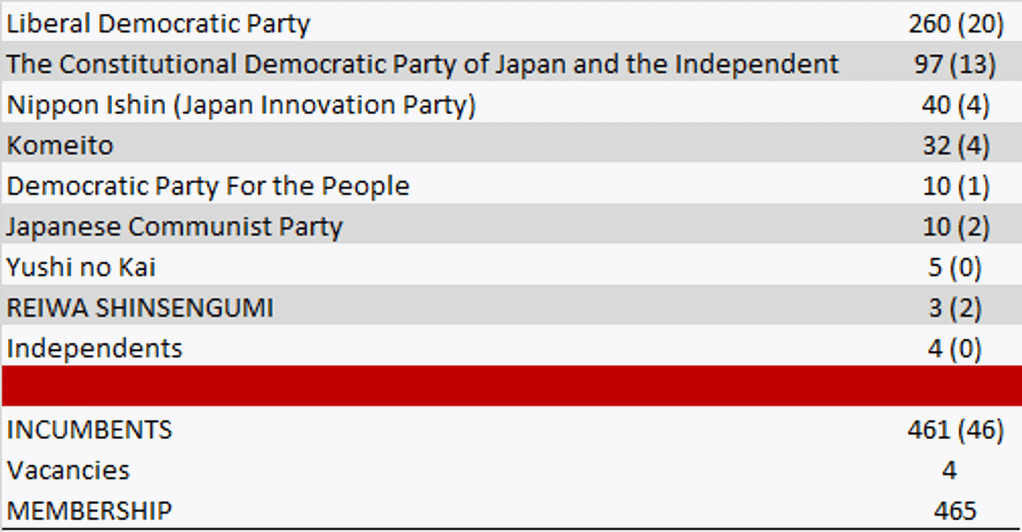

Five by-elections will take place on Sunday in Japan. Four for the Lower House of the Diet and one for the Upper House. PM Kishida survived a failed assassination attempt last weekend while campaigning and while his cabinet’s national approval ratings have jumped in recent polling, the polling in the specific prefectures point to close elections. The LDP are hoping to win in three of the five elections but polling since where last weekend’s attack took place show the Nippon Ishin no Kai candidate slightly ahead. Success for Nippon Ishin in the recent local elections point to positive momentum for the party with the third largest seat number in the Lower House. Defeat there on Sunday along with two other possible defeats may raise fears over gains for Nippon Ishin if a general election was called. It still seems more likely than not that PM Kishida will call and snap election before the current Diet session ends on 21st June. The current Diet runs until the end of October 2025 while Kishida’s term as LDP leader ends in September 2024. A snap election victory would give Kishida a mandate and strengthen his hold on the party. It would also fuel speculation in the market of a bolder shift away from the economic and monetary policies of ‘Abenomics’.

A snap election, if called, will likely alter the speculation on the timing of a change in YCC. The consensus is for a change at the meeting on 16th June but if an election will take place after that, a delay until July is possible. We still expect BoJ speculation to persist with hints of change possible next week, which will help support JPY.

US 2YR YIELD REBOUND KEY FOR USD/JPY BOUNCE

Source: Bloomberg, Macrobond & MUFG GMR

CURRENT DIET POLITICAL PARTY SEAT COMPOSITION

Source: Bloomberg, Macrobond & MUFG GMR

USD: Changes in relative growth & inflation are moving against USD

The USD has staged a modest rebound over the past week after the dollar index hit a year to date low last Friday at 100.79. The USD has derived support from the scaling back of more dovish expectations for Fed policy. The rate market has moved to fully pricing in one more 25bps hike from the Fed in the current tightening cycle, and is now only fully pricing in one 25bps rate cut by the end of this year. It has resulted in the two-year UST yield climbing from a low of 3.55% late last month to a recent high of 4.28%. However, the scope for US yields to continue moving higher from here should prove more limited. Recent comments from New York Fed President Williams signalled that he would be comfortable with the Fed delivering just one more hike then pausing their hiking cycle. At the same time, the incoming economic data flow continues to signal an increasing risk of sharper slowdown/recession for the US economy that will open the door for rate cuts later this year. The Conference Board’s leading index has contracted for twelve consecutive months now and recorded its largest monthly decline in March since the worst point of the COVID shock back in April 2020. In contrast, the growth outlook has been improving outside of the US. Economic growth in China surprised significantly to the upside in Q1, and leading economic indicators in Europe including the PMI surveys for April have signalled that downside risks to growth continue to ease at the start of this year.

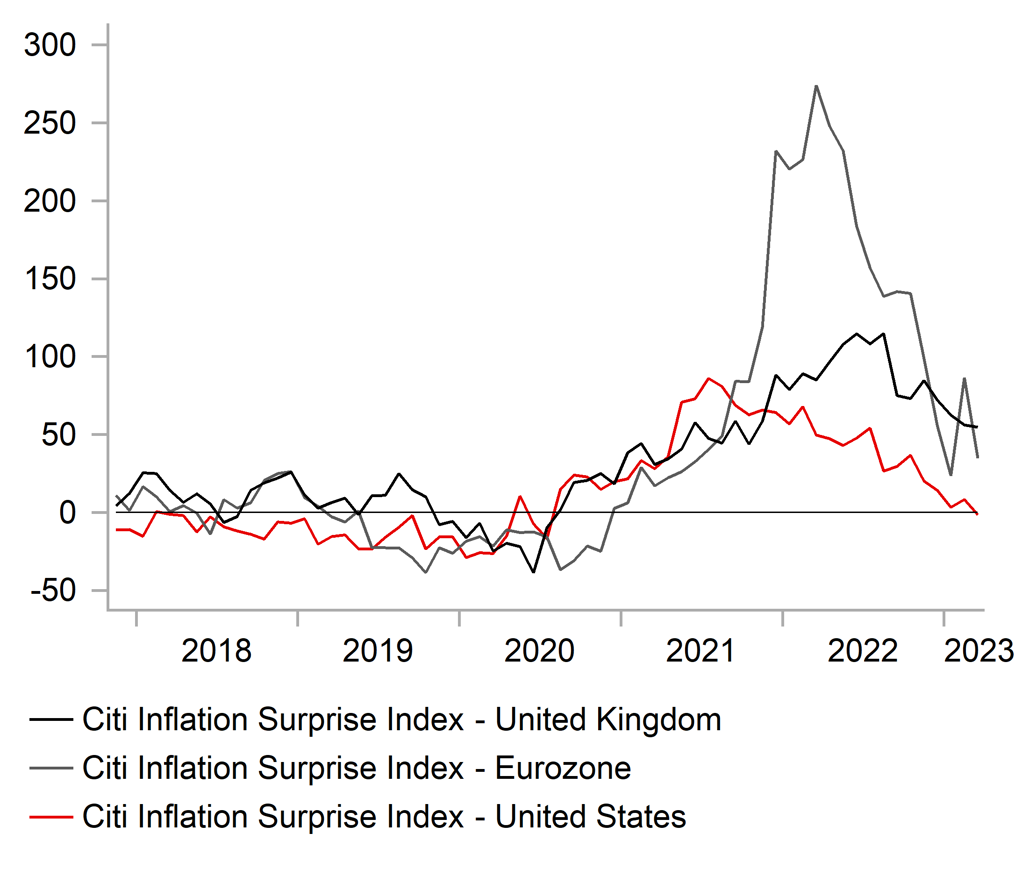

Alongside the relative deterioration in the US growth outlook, there has also been more evidence recently of disinflationary pressures in the US compared to in Europe that favours the Fed pausing their hiking cycle ahead of the BoE and ECB. Inflation and wage growth proved much stronger than expected in the UK over the past week reinforcing expectations for the BoE to deliver another 25bps hike next month and have lifted expectations for the terminal rate closer to 5.00%. Similarly, in the euro-zone the latest CPI report revealed that core inflation and food inflation rose to fresh cyclical highs in March. Recent comments from ECB officials including Chief Economist Lane have even left the door open to another larger 50bps hike next month. The release of the ECB’s bank lending survey on 2nd May could prove pivotal in determining the size of the hike. We see room for short-term yield spreads to keep moving against the USD in the near-term. The main risk to that view in the week ahead will be the release next Friday of the latest US Employment Cost Index for Q1.

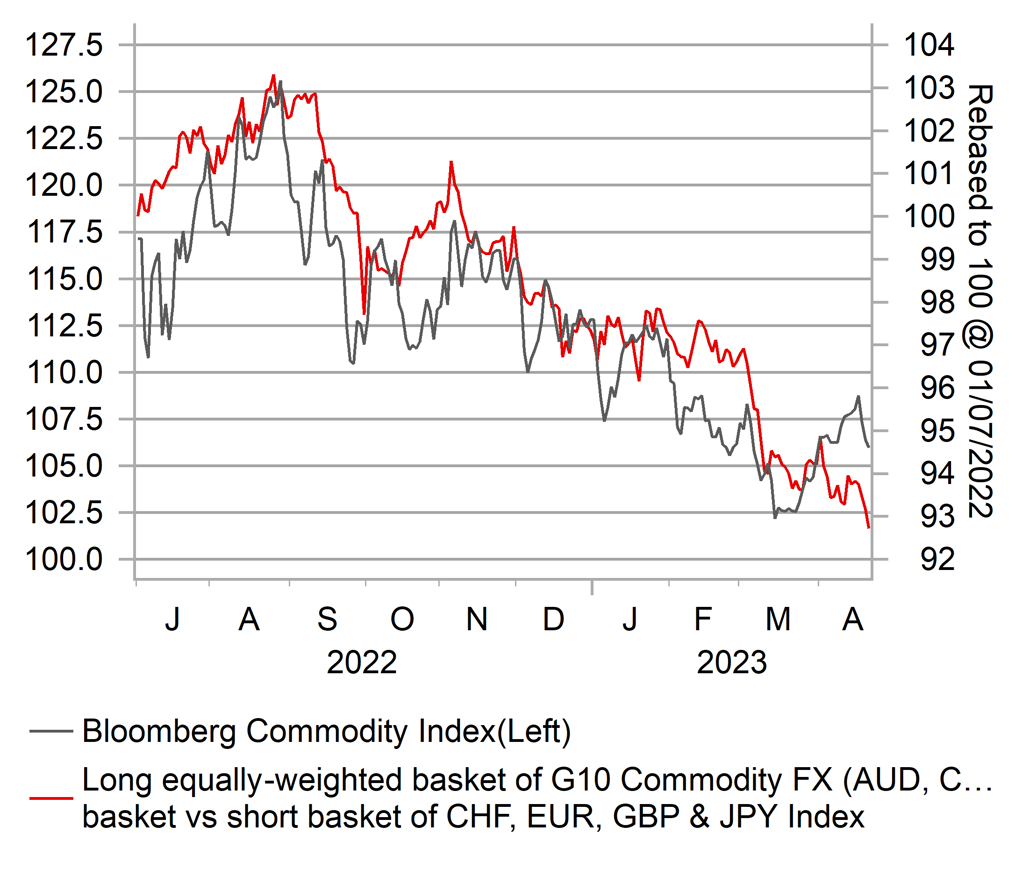

In these circumstances, we still expect the USD weaken further against other major currencies despite the recent modest rebound. Growth concerns are though helping to prevent the USD from weakening against G10 commodity currencies

INFLATION CONCERNS HAVE EASED MORE IN US

Source: Bloomberg, Macrobond & MUFG

G10 COMMODITY FX CONTINUES TO UNDERPERFORM

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

04/24/2023 |

09:00 |

German IFO Business Climate |

Apr |

-- |

93.3 |

!! |

|

EUR |

04/24/2023 |

09:35 |

ECB's Villeroy speaks |

!! |

|||

|

GBP |

04/25/2023 |

07:00 |

Public Sector Net Borrowing |

Mar |

-- |

15.9b |

!! |

|

USD |

04/25/2023 |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Feb |

-- |

-0.4% |

!! |

|

USD |

04/25/2023 |

15:00 |

New Home Sales |

Mar |

630k |

640k |

!! |

|

USD |

04/25/2023 |

15:00 |

Conf. Board Consumer Confidence |

Apr |

104.1 |

104.2 |

!! |

|

AUD |

04/26/2023 |

02:30 |

CPI YoY |

1Q |

6.9% |

7.8% |

!!! |

|

SEK |

04/26/2023 |

07:00 |

Unemployment Rate SA |

Mar |

-- |

7.6% |

!! |

|

SEK |

04/26/2023 |

08:30 |

Riksbank Policy Rate |

-- |

3.00% |

!!! |

|

|

EUR |

04/26/2023 |

13:00 |

ECB's Guindos Speaks |

!! |

|||

|

USD |

04/26/2023 |

13:30 |

Advance Goods Trade Balance |

Mar |

-$89.5b |

-$91.6b |

!! |

|

USD |

04/26/2023 |

13:30 |

Durable Goods Orders |

Mar P |

1.0% |

-1.0% |

!! |

|

SEK |

04/27/2023 |

07:00 |

GDP Indicator SA MoM |

Mar |

-- |

-1.0% |

!! |

|

NOK |

04/27/2023 |

07:00 |

Retail Sales W/Auto Fuel MoM |

Mar |

-- |

0.2% |

!! |

|

USD |

04/27/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

04/27/2023 |

13:30 |

GDP Annualized QoQ |

1Q A |

2.0% |

2.6% |

!!! |

|

USD |

04/27/2023 |

15:00 |

Pending Home Sales MoM |

Mar |

-- |

0.8% |

!! |

|

JPY |

04/28/2023 |

00:30 |

Jobless Rate |

Mar |

2.5% |

2.6% |

!! |

|

JPY |

04/28/2023 |

00:30 |

Tokyo CPI YoY |

Apr |

3.3% |

3.3% |

!! |

|

JPY |

04/28/2023 |

Tbc |

BOJ Policy Meeting |

!!! |

|||

|

EUR |

04/28/2023 |

06:30 |

France GDP QoQ |

1Q P |

-- |

0.1% |

!!! |

|

EUR |

04/28/2023 |

07:45 |

France CPI EU Harmonized YoY |

Apr P |

-- |

6.7% |

!!! |

|

CHF |

04/28/2023 |

08:00 |

KOF Leading Indicator |

Apr |

-- |

98.2 |

!! |

|

EUR |

04/28/2023 |

09:00 |

Germany GDP SA QoQ |

1Q P |

-- |

-0.4% |

!!! |

|

CHF |

04/28/2023 |

09:00 |

SNB's Thomas Jordan Speak on AGM |

!! |

|||

|

EUR |

04/28/2023 |

10:00 |

GDP SA QoQ |

1Q A |

-- |

-- |

!!! |

|

EUR |

04/28/2023 |

13:00 |

Germany CPI EU Harmonized YoY |

Apr P |

-- |

7.8% |

!!! |

|

USD |

04/28/2023 |

13:30 |

Employment Cost Index |

1Q |

1.1% |

1.0% |

!!! |

|

CAD |

04/28/2023 |

13:30 |

GDP MoM |

Feb |

-- |

0.5% |

!! |

|

USD |

04/28/2023 |

13:30 |

PCE Core Deflator YoY |

Mar |

4.5% |

4.6% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- One of the main events in the week ahead will be the BoJ’s latest policy meeting next Friday. It will be the first BoJ policy meeting under the leadership of new Governor Ueda. Market expectations for a further shift YCC policy settings as soon as this month have diminished recently. New Governor Ueda has signaled that current policy settings remain appropriate, and news reports over the past week have suggested that the BoJ is likely to wait until later this year to make further adjustments to policy settings in light of the near-term impact from the loss of confidence in the banking system. Market attention is then more likely to focus on any potential signals over the timing of further policy changes. The BoJ will release their latest economic forecasts including the inflation projection for FY2025 that is expected to show inflation closer to their 2.0% target. There has also been speculation that the forward guidance could be adjusted to remove the reference to lowering rates if required.

- The Riksbank is expected to deliver another larger 50bps hike in the week ahead lifting its policy rate up to 3.50%. The Riksbank will be concerned by the large upside surprise from core inflation recently that was 1.4ppts higher than their forecast for March.

- The main economic data releases in the week ahead include: i) the latest PCE deflator and Employment Cost Index reports from the US and ii) the latest GDP reports from euro-zone economies for Q1. The reports will be scrutinized closely to assess if upside risks from inflation in the US continue to ease in the near-term. Wage growth appears to have slowed since late last year despite continued tightness in the US labour market. Euro-zone economies are expected to have narrowly avoided falling into recession although growth remains weak at the start of the year