To read a full report, please download PDF

USD turnaround dependent on FOMC

FX View:

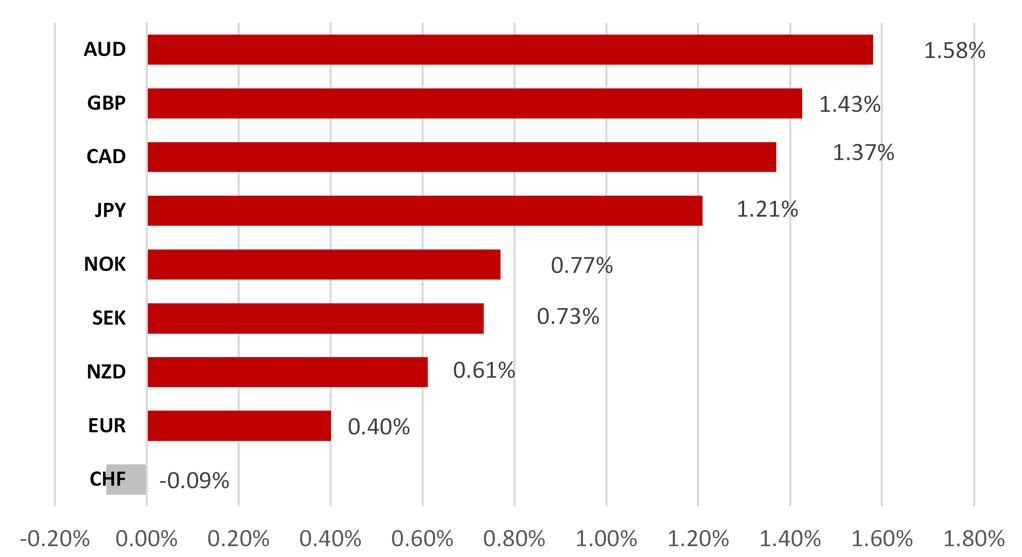

The dollar turned weaker yesterday into the US jobs data today but the nonfarm payroll gain came in well above expectations and the gain of 339K is enhanced to 432K when the past upward revisions are included. With other elements softer (household employment -310k; unemployment rate higher; AHE growth weaker) we assume the FOMC will stick with a plan signalled to the markets to pause in June (a hawkish skip is another way to put it perhaps). A pause in any description should see the dollar soften but the strength of today’s report will mean a higher level of uncertainty and hence notable dollar selling is unlikely. The debt ceiling uncertainty of behind us but the debt profile for the US is horrible and that is set to become a gradually bigger issue for the markets. Nearer term we have the Bank of Canada and RBA meetings next week with both expected to hold although there’s a greater risk of a surprise hike by the RBA.

USD TURNAROUND AS FED PAUSE SPECULATION REVIVED

Source: Bloomberg, 12:30 GMT, 2nd June 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long AUD/NZD trade idea.

JPY Flows:

This week with no official MoF data monthly data releases to assess we take a deeper dive into the FDI flows abroad from Japan. This flow remains a substantial source of yen selling and according to JETRO data amounted to USD 175bn in 2022. The breakdown shows the US was the top destination with no obvious slowdown evident despite the plunge in the value of the yen.

Short Term Fair Value Modelling:

This week saw greater divergence between spot and our fair value model. Monitoring the relationship between GBP/USD fundamentals and spot, our model calculates a 1.13% overvaluation of spot. Current mis-valuation lies between the upper quartile and maximum of the typical distribution..

FX Views

USD: Ignoring the elephant in the room

Last night the Senate passed the agreement reached to suspend the debt ceiling through until 1st January 2025, just beyond the next presidential elections. With the usual ability to finance government after the debt ceiling is in place gives the US about two years before we arrive another potential flash-point with the debt ceiling. The outcome certainly could have been a lot worse. A deal might not have been reached until much closer to the deadline that was estimated to be 5th June. The deal was also more moderate than many had assumed. The Congressional Budget Office estimates the federal spending cuts in the fiscal year commencing 1st October amounts to 0.26% of GDP. That is modest indeed. Over the next decade, the CBO estimates the measures will reduce federal government spending by around USD 1.5trn. But there remain immediate challenges ahead. Firstly, large-scale T-bill issuance is required with estimates of T-bill issuance over the coming four months put at between USD 750bn to USD 1 trillion. That could anchor short-term yields at higher levels at a time when the macro-economic picture could be deteriorating. Our own MUFG Recession Indicator currently indicates a 90% probability of recession. Going back to the late 1970’s whenever the indicator has been at this level it has always correctly signalled a recession within the next 12mths.

The US jobs report today was certainly much stronger than expected – when the upward revision is incorporate, the gain of 432k was well above the 195k consensus. However, the household survey that determines the unemployment rate was much softer. There were 310k job losses with a 130k increase in the labour force. This helped lift the unemployment rate by 0.3ppts. The workweek also fell again and the 3mth/3mth annualised change in the aggregate hours worked slowed to just 0.5%, down from 1.4% in April and 2.4% in March. Average hourly earnings were weaker at 0.3% MoM with the 3mth annualised rate at 3.8% - a soft downtrend remains intact.

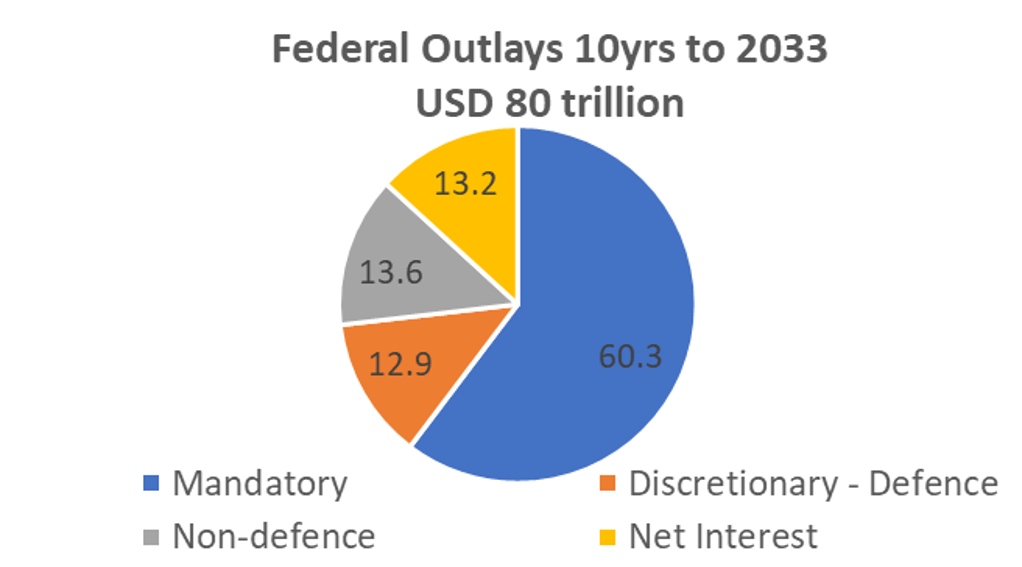

While the cyclical news shows the economy is holding up, we believe the structural negatives related to the US debt outlook are increasingly alarming. The deal itself as stated above is modest and while it adds a marginal drag to growth later this year, the impact is modest and negligible over the medium term. A CBO update in May before the deal was reached revealed that discretionary outlays over the next ten years would amount to USD 21.26trn. With the CBO estimating the deal reduces that total by USD 1.5trn, the total drops to a little under USD 20trn. That progress although the constraints to making the necessary progress going forward mean risks are high that the US debt outlook starts to act as a bigger drag on USD sentiment.

MUFG RECESSION INDICATOR HITS NEW HIGH AT 90%

Source: MUFG Research calculations

NEGOTIATIONS COVERED JUST 13% OF OUTLAYS

Source: Congressional Budget Office, May 2023

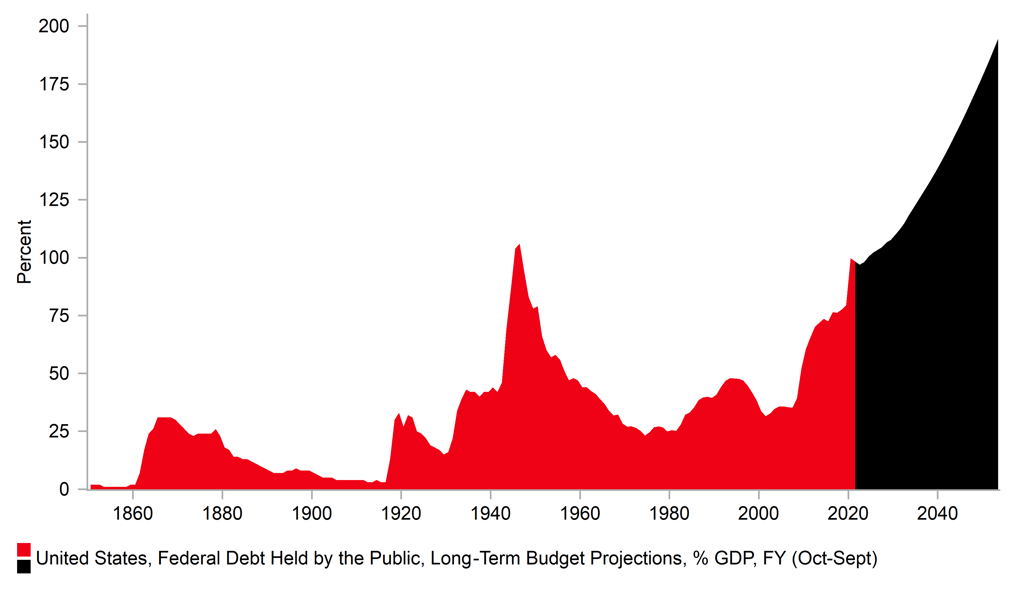

The negotiations for suspending the debt ceiling were based on a very narrow component. Non-defence discretionary spending was estimated by the CBO to total USD 10.9trn over the next ten years. Defence spending is estimated at USD 10.3trn. That contrasts with USD 48.3trn on mandatory spending and USD 10.6trn in net interest payments. Given the White House and the Republicans agreed there would be no cuts to defence spending and mandatory spending, the debt ceiling negotiations centred around spending cuts to a 13.6% portion of total spending. It is impossible under such a narrow remit of negotiations to make any serious inroads into consolidating US debt. Under CBO estimates in May, the total debt held by the public as a percentage of GDP is set to rise from 98.2% this year to 119% in 2033. Following this deal the projected level in 2033 drops to 115%. US debt-to-GDP remains on an unsustainable path and serious fiscal consolidation is required.

The relative debt outlook is certainly indicative of downside risks for the US dollar going forward. The IMF Fiscal Monitor that compares fiscal and debt outlooks using like-for-like calculations highlights the stark and growing divergence. Following an estimated deficit of 6.3% this year, the US deficit ranges between 6.6% and 7.1% every year through to 2028, ending that year at 6.8%, by far the worst profile amongst advanced economies. Based on IMF like-for-like calculations again, this results in US gross debt-to-GDP reaching 136.2% in 2028, surpassing Italy’s level with only Japan with a higher debt load. Net debt calculations are lower but even then only Italy and Japan have higher levels. This is not just covid-related stimulus being larger in the US than in most other countries – it is more structural than that. US GDP expanded by 2.3% in 2017; 3.0% in 2018; and 2.3% in 2019 (avg annual quarterly growth rate) but still recorded fiscal deficit of 5.3% in 2018 and 5.7% in 2019 (IMF estimates). Trump’s tax cuts have created a structural problem with US debt on an unsustainable path.

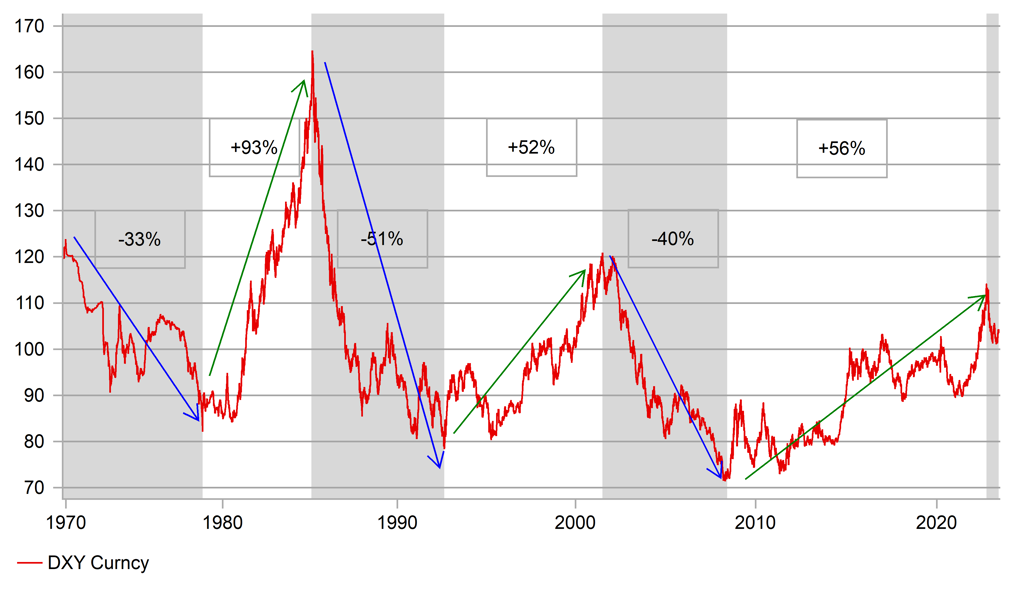

We of course understand the benefits of the US being able to finance its deficits denominated in US dollars and that is an advantage but that does not mean the US can continue to ignore the unsustainable debt dynamics. A lot has been made about “de-dollarisation” of late in the context of the US weaponizing the dollar. The bigger danger though over the medium term is the fiscal deficit. If you assume sense prevails and Washington agrees, say after the 2024 presidential election to tackle the problem, it will likely mean a period of weaker economic growth. This would imply lower yields and a weaker US dollar. The US dollar cyclically and structurally looks like it has peaked with the high from September 2022 the high of one of the largest and longest US dollar bull runs in the floating exchange rate era.

CBO ESTIMATES DEBT % GDP AT 195% BY 2053

Source: Bloomberg, Macrobond & MUFG Research

LONGEST EVER USD BULL RUN MAY HAVE ENDED

Source: Bloomberg, Macrobond & MUFG Research

CAD: Will BoC policy update reinforce CAD’s recent bullish trend?

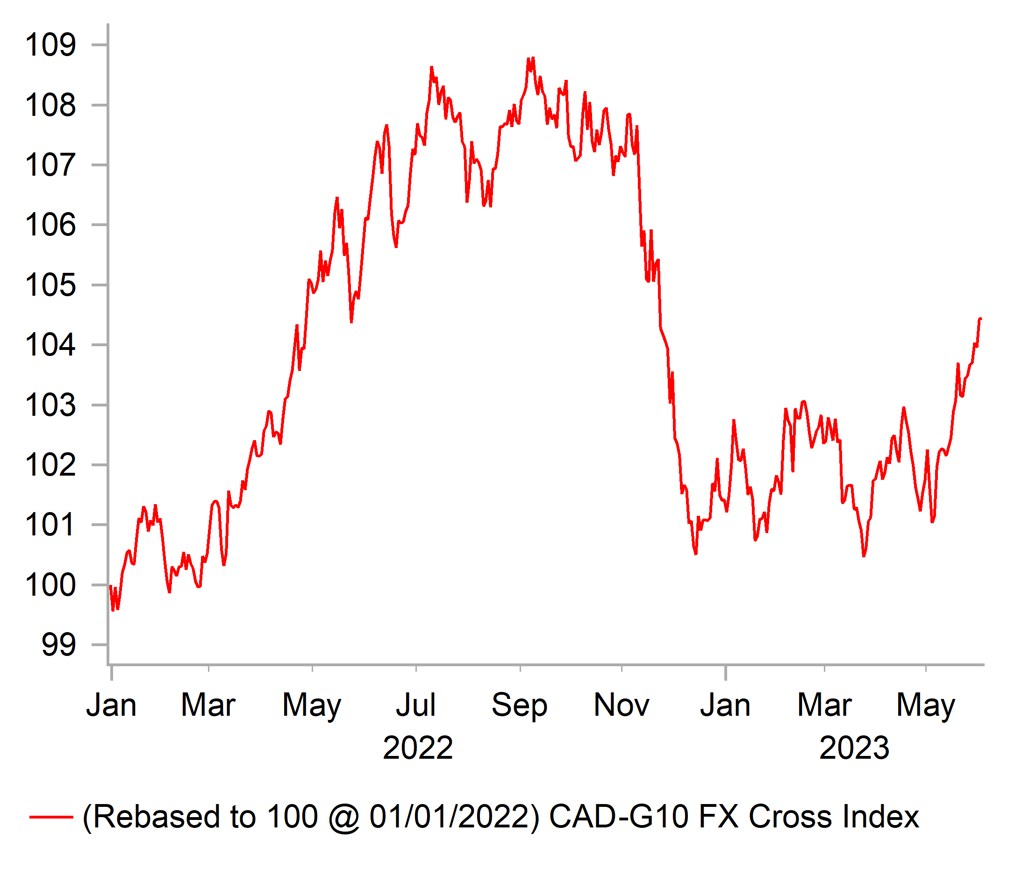

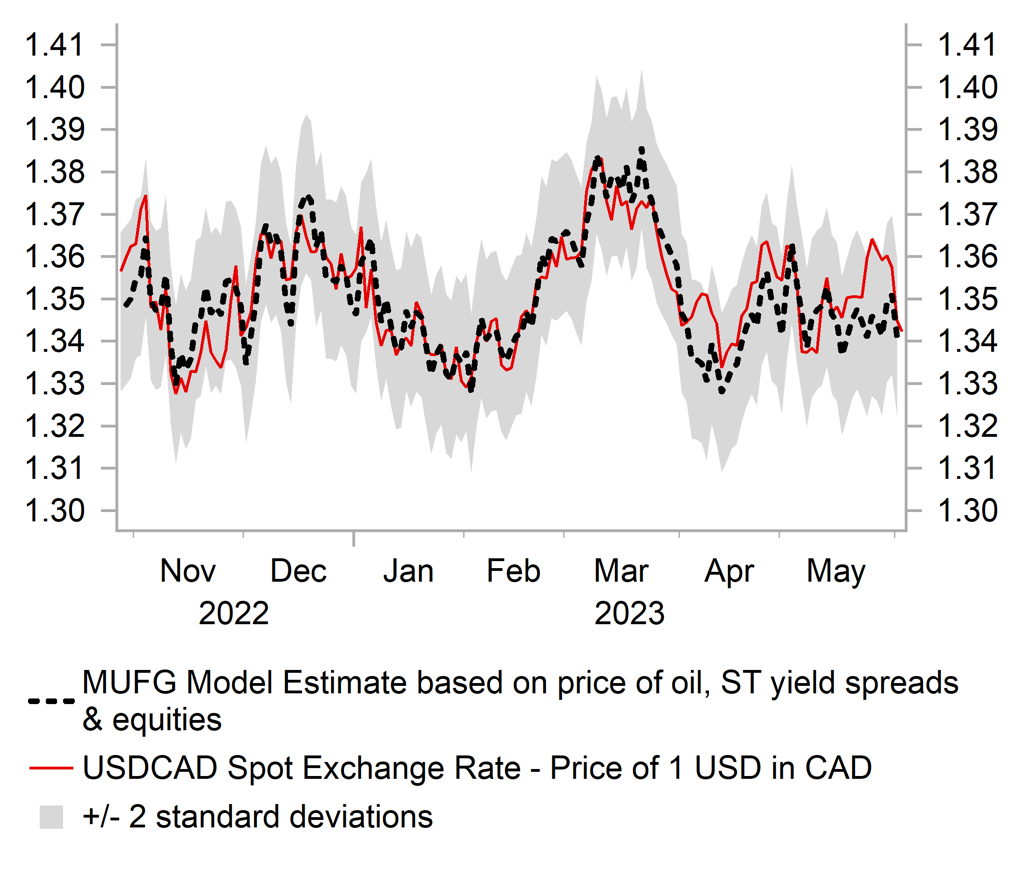

The CAD has been the best performing G10 currency over the past month, and has even strengthened against the USD as it rebounded more broadly. It has resulted in USD/CAD falling back towards the bottom of its recent trading range between 1.3300 and 1.3650. The CAD is currently recording its strongest rally against our equally-weighted basket of other G10 currencies in around a year having strengthened by 3.7% from the low point on 24th March. The GBP has been the only other G10 currency that has almost matched CAD outperformance during this period. The CAD has benefitted over this period from the rebound in global equity markets. The MSCI ACWI global equity index bottomed out on 15th March and has since strengthened by 6.7%. Our correlation analysis reveals that the CAD continues to have one of the strongest correlations with global equity market performance alongside the AUD.

At the same time, the CAD has benefitted recently from the stronger than expected economic data flow from Canada both for activity and inflation. Canada’s economy bounced back by more strongly than expected at the start of this year (+3.1%) in Q1 after contracting marginally at the end of last year (-0.1%). It came in stronger than the BoC’s updated forecast for growth (+2.3% in Q1) that had already been revised higher (+1.8ppts) in the April Monetary Policy Report. The BoC is still expecting the economy to expand weakly this year (+1.4% in 2023) resulting in excess supply opening up in 2H 2023 that will help bring down inflation. However, headline and core inflation measures have picked up in recent months contributing to more concern over the risk of persistently higher inflation. The recent combination of stronger activity and inflation data has fuelled speculation that the BoC could deliver a hawkish policy update in the week ahead. The BoC paused their rate hike cycle back in January. One potential upside risk for the CAD in the week ahead would be if the BoC signals that it is giving more serious thought to resuming rate hikes at upcoming policy meetings.

Another event risk for the CAD to watch out for will be the latest OPEC+ policy meeting that it scheduled to take place on 3rd and 4th June. The price of oil has continued to fall over the past month resulting the price of Brent moving back towards the year to date low at close to USD70/barrel. The lower price of oil has though had only a limited negative impact on CAD performance which has still outperformed over the past month. Our commodity analyst expects OPEC+ members to resist the urge to announce another production cut to provide more support for the price of oil (click here). It could lead to some initial disappointment early next week if there are no further production cuts that could weigh on the price oil and encourage CAD selling, but it is unlikely to trigger a reversal of the current bullish trend for CAD.

In these circumstances, we expect upward momentum for the CAD to extend further in the near-term. Important technical support is located at around 1.3300 for USD/CAD.

CAD IS STAGING A REBOUND

Source: Bloomberg, Macrobond & MUFG

EXCESSIVE CAD WEAKNESS HAS CORRECTED

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CHF |

06/05/2023 |

07:30 |

CPI EU Harmonized YoY |

May |

-- |

2.6% |

!! |

|

EUR |

06/05/2023 |

09:00 |

HCOB Eurozone Services PMI |

May F |

-- |

55.9 |

!! |

|

EUR |

06/05/2023 |

09:30 |

Sentix Investor Confidence |

Jun |

-- |

- 13.1 |

!! |

|

GBP |

06/05/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

May F |

-- |

55.1 |

!! |

|

EUR |

06/05/2023 |

10:00 |

PPI YoY |

Apr |

-- |

5.9% |

!! |

|

USD |

06/05/2023 |

15:00 |

Durable Goods Orders |

Apr F |

-- |

1.1% |

!! |

|

USD |

06/05/2023 |

15:00 |

ISM Services Index |

May |

52.5 |

51.9 |

!!! |

|

JPY |

06/06/2023 |

00:30 |

Labor Cash Earnings YoY |

Apr |

1.6% |

0.8% |

!!! |

|

AUD |

06/06/2023 |

05:30 |

RBA Cash Rate Target |

3.9% |

3.9% |

!!! |

|

|

EUR |

06/06/2023 |

07:00 |

German Factory Orders MoM |

Apr |

-- |

-10.7% |

!! |

|

EUR |

06/06/2023 |

10:00 |

Retail Sales MoM |

Apr |

-- |

-1.2% |

!! |

|

AUD |

06/07/2023 |

00:20 |

RBA's Lowe-Speech |

!! |

|||

|

AUD |

06/07/2023 |

02:30 |

GDP SA QoQ |

1Q |

0.4% |

0.5% |

!! |

|

EUR |

06/07/2023 |

07:00 |

German Industrial Production SA MoM |

Apr |

-- |

-3.4% |

!! |

|

EUR |

06/07/2023 |

08:50 |

ECB's Guindos Speaks |

!! |

|||

|

CAD |

06/07/2023 |

13:30 |

Int'l Merchandise Trade |

Apr |

-- |

0.97b |

!! |

|

USD |

06/07/2023 |

13:30 |

Trade Balance |

Apr |

-$75.1b |

-$64.2b |

!! |

|

CAD |

06/07/2023 |

15:00 |

Bank of Canada Rate Decision |

4.50% |

4.50% |

!!! |

|

|

JPY |

06/08/2023 |

00:50 |

GDP SA QoQ |

1Q F |

0.5% |

0.4% |

!! |

|

JPY |

06/08/2023 |

00:50 |

BoP Current Account Balance |

Apr |

¥1359.7b |

¥2278.1b |

!! |

|

AUD |

06/08/2023 |

02:30 |

Trade Balance |

Apr |

A$15000m |

A$15269m |

!! |

|

EUR |

06/08/2023 |

10:00 |

GDP SA QoQ |

1Q F |

-- |

0.1% |

!! |

|

EUR |

06/08/2023 |

10:00 |

Employment QoQ |

1Q F |

-- |

0.6% |

!! |

|

USD |

06/08/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

CNY |

06/09/2023 |

02:30 |

CPI YoY |

May |

0.2% |

0.1% |

!! |

|

NOK |

06/09/2023 |

07:00 |

CPI YoY |

May |

-- |

6.4% |

!! |

|

CAD |

06/09/2023 |

13:30 |

Net Change in Employment |

May |

-- |

41.4k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Now that the US debt ceiling has been suspended for two years, market attention has quickly shifted back to economic fundamentals. The three main risk events in the week ahead will be the upcoming policy decisions from the BoC, the RBA and OPEC+ members. The continued decline in the price of oil at the start of this year is placing pressure on OPEC+ members to announce further plans to cut production at their upcoming meeting on 4th But our commodity analyst is not expecting a further cut in production. The last unexpected decision to cut production provided only a brief lift to oil price at the start of April that has now fully reversed.

- The BoC is expected to leave rates on hold for the third consecutive meeting at 4.50%. Market participants will be closely watching the updated policy guidance to see if the BoC provides any signal that they could resume their rate hike cycle soon. The latest activity and inflation data from Canada have both surprised to the upside encouraging expectations amongst market participants that it will deliver one more 25bps hike by the July policy meeting at the earliest.

- The RBA is also expected to leave rates on hold at 3.85% although we are not expecting the RBA to follow the RBNZ by signaling a definitive pause to their hiking cycle as soon at next week’s policy meeting. Still elevated inflation and stronger wage growth is unlikely to provide enough confidence yet the policy rate has reached sufficiently restrictive levels to bring inflation back to their target. The Australian rate market is currently pricing in one more 25bps hike by the summer.