To read a full report, please download PDF

JPY falls to new lows

FX View:

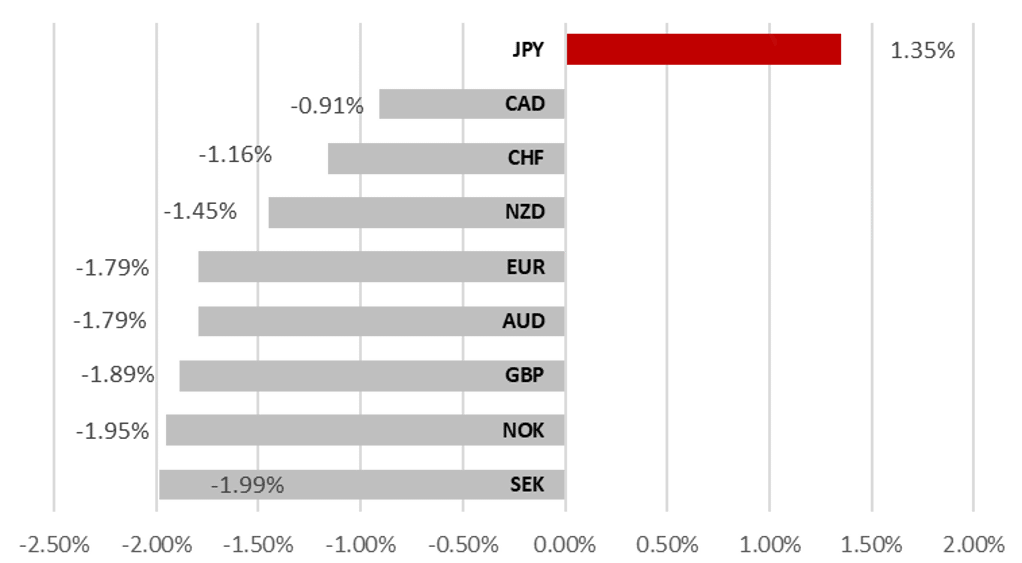

The JPY weakening trend has been reinforced over the past week by the central bank policy updates from the BoJ, ECB, and Fed. The ECB and Fed both provided hawkish policy updates signalling that further rate hikes will be required this year in contrast to the BoJ who remain comfortable to maintain loose policy for now. Rising yields outside of Japan, lower levels of financial market volatility and improving global investor risk sentiment are all making JPY-funded carry trades more attractive and contributing to a more deeply undervalued JPY. The BoE is expected to be the next major central bank to provide a hawkish policy update in the week ahead. In contrast to JPY weakness, the GBP has hit fresh year to date highs against the USD, EUR and JPY over the past week encouraged by the sharp adjustment higher in UK yields. The UK rate market has already moved along way creating a higher hurdle for the BoE to deliver a hawkish policy surprise.

USD & JPY HAVE UNDERPERFORMED

Source: Bloomberg, 14:15 GMT, 16th June 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long EUR/USD trade idea, and maintaining a long AUD/NZD trade idea.

JPY Flows:

The monthly balance of payments statistics were released last week by the MoF in Japan and the data for April revealed a marked improvement in Japan’s merchandise trade balance. On a 3mth basis, the deficit shrunk from 4,240bn in March to JPY 1,172bn – it was the smallest trade deficit since April 2022.

Short Term Fair Value Modelling:

This week we monitor the relationship between spot and fair value for our EUR, GBP and JPY regression models. We identify a convergence in the relationship between EUR/USD and fair value where our model calculates a -0.44% undervaluation of spot. While GBP/USD and USD/JPY remain overvalued at 1.46% and 3.21% respectively.

FX Views

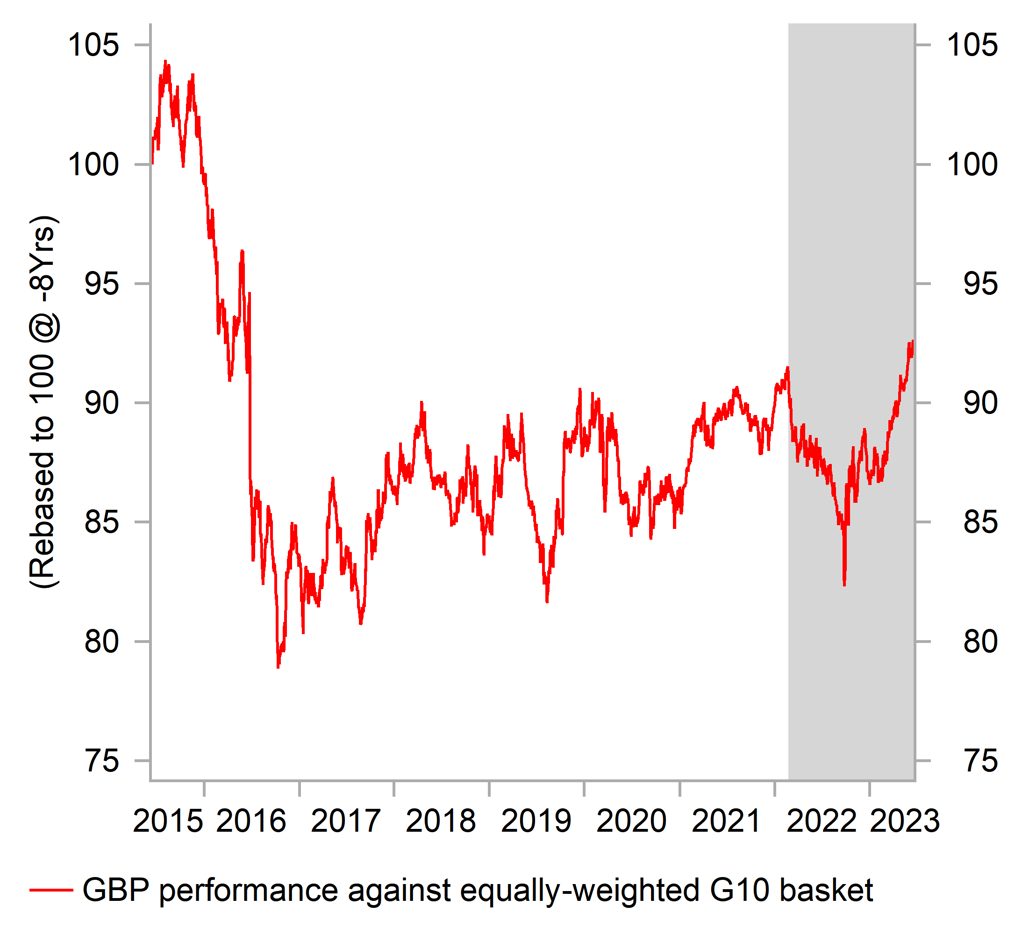

GBP: How long will the GBP continue to outperform?

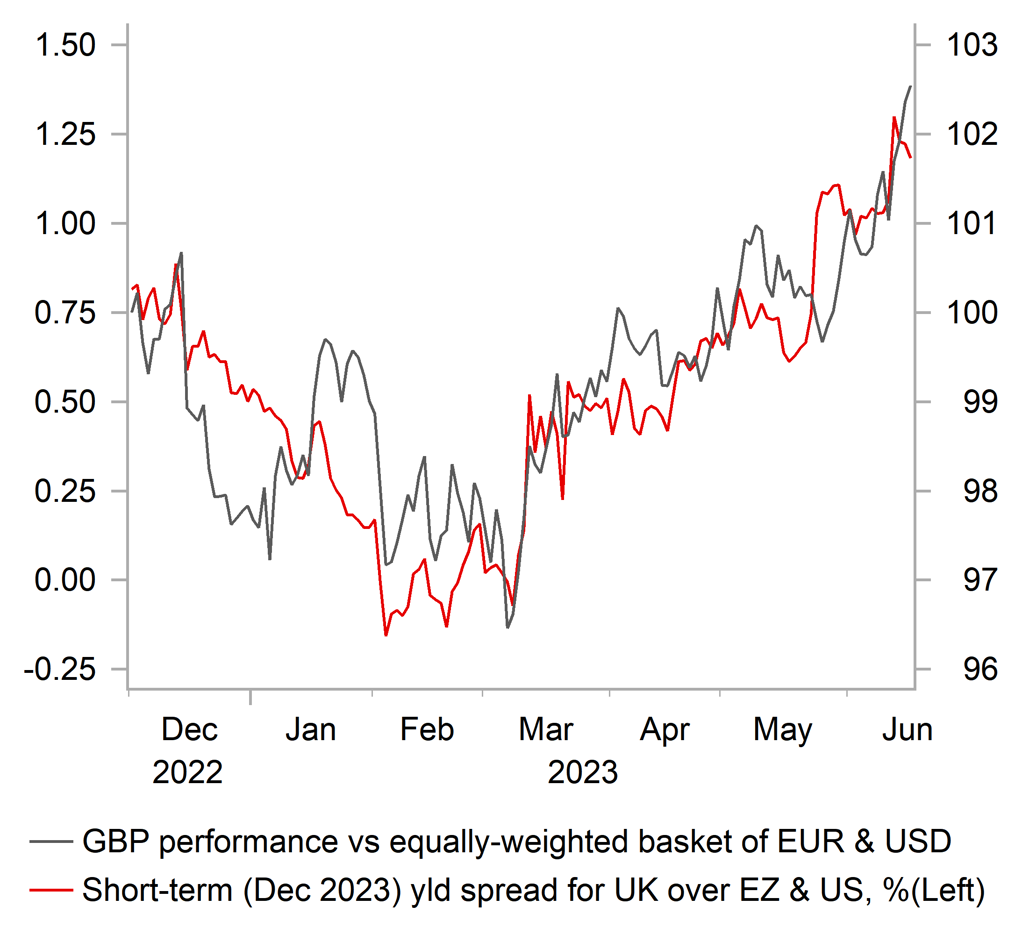

It has been another good week for the GBP which has hit fresh year to date highs against the other major currencies of the USD, EUR and JPY. It extends the GBP’s bullish run that has been in place since early in March. The GBP has been the best performing G10 currency since 8th March when it has strengthened by 8% against the USD, 4% against the EUR and 11% against the JPY. The GBP’s bullish trend is being encouraged by expectations for a more extended BoE tightening cycle. With the exception of the brief dip lower in the middle of March when the US regional banking crisis first emerged, UK yields have adjusted sharply higher during this period of GBP outperformance. The yield on the 2-year UK Gilt yield has risen by around 1.10 percentage points since 8th March hitting a fresh cycle high of 4.96% today. More importantly for the FX market, the move higher in UK yields stands in marked contrast to the adjustment lower in yields in other major economies. For comparison, the 2-year US Treasury bond yield has fallen by around 0.50ppt over the same period, the 2-year euro-zone government bond yield has fallen by around 0.20ppt, and the 2-year JGB yield has fallen by around 0.03ppt. It has resulted in yield spreads moving sharply in favour of a stronger GBP.

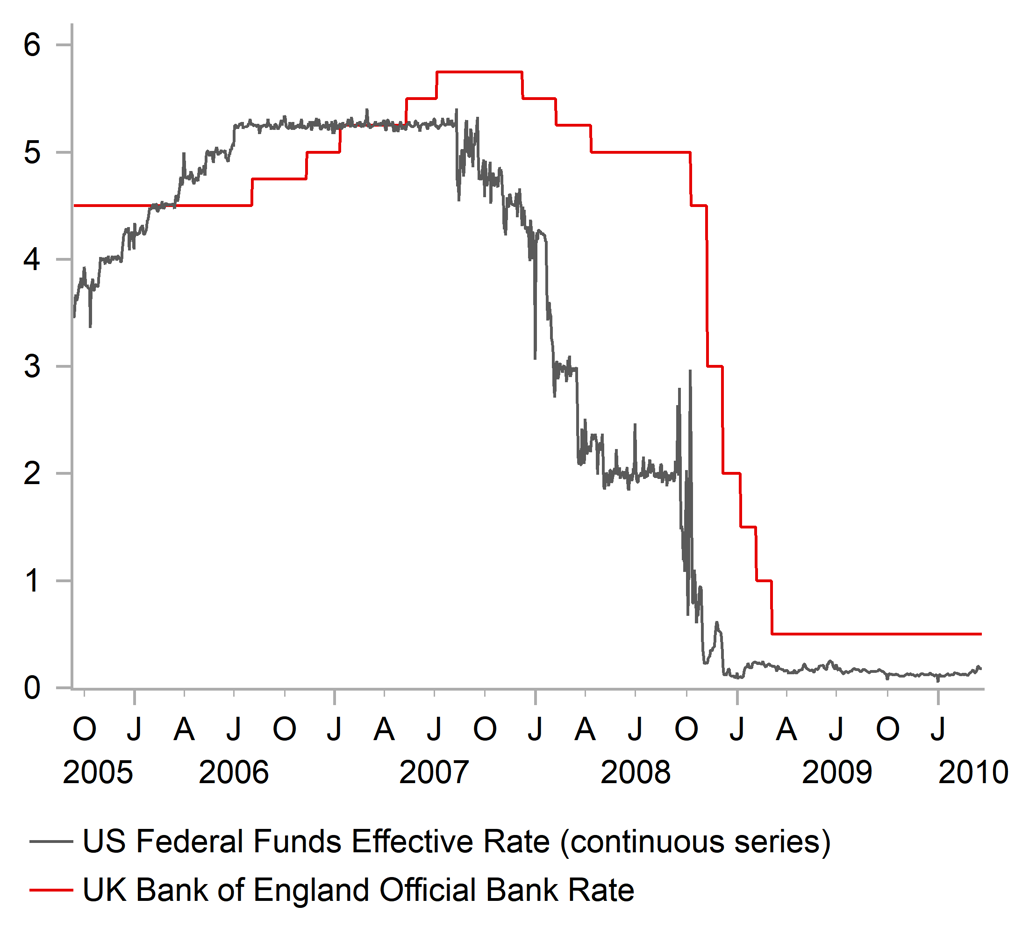

The sharp monetary policy divergence reflects more concern amongst market participants that inflation will prove more persistent in the UK than in other major economies like the euro-zone and US. With the end result being that the BoE will remain under pressure to keep raising rates further than the ECB and Fed. The UK rate market has now moved to price in expectations for a higher terminal policy rate for the BoE than the US rate market has for the Fed. The UK rate market is currently expecting the BoE to deliver a further 125bps of hikes that lifts the policy rate up to a peak of 5.75% by the end of this year. In comparison the US rate market is currently expecting the Fed to deliver one final 25bps hike that lifts the effective rate closer to 5.30%. There are some similarities to the end of the tightening prior to the Global Financial Crisis when the Fed’s tightening cycle peaked at 5.25% in June 2006 while the BoE continued to hike rates to a peak of 5.75% in July 2007. That was also a period of GBP outperformance when cable rose above 2.0000 and GBP/JPY above 250.00. It suggests that the GBP could yet strengthen further than widely expected his year.

GBP IS TRADING AT HIGHEST LEVEL SINCE BREXIT VOTE

Source: Bloomberg, Macrobond & MUFG GMR

SOME SIMILARITIES TO PRE-GFC HIKING CYCLES

Source: Bloomberg & Macrobond

Market expectations for more aggressive BoE rate hikes will be tested in the week ahead by the release of the latest UK CPI report for May (Wed) and MPC meeting (Thurs). In light of the recent repricing, the hurdle for another hawkish surprise that triggers another leg higher for UK rates and the GBP in the week ahead is arguably much higher now. It will be hard for the BoE’s policy update to fully meet market expectations for a further 125bps of hikes. It would likely require the BoE to revert back to delivering a larger 50bps hike or provide hawkish signal that a larger 50bps hike is a more realistic possibility at the following MPC meeting in August when the policymakers will be able to better assess the inflation outlook alongside the updated Monetary Policy Report.

The surprising resilience of the UK economy and stronger wage growth are increasing concerns over the persistence of higher inflation in the UK, and should encourage the BoE to deliver a hawkish policy update. Yet if the BoE only hikes rates by 25bps and does not signal it is seriously considering larger 50bps hikes, it could trigger a temporary correction lower for UK yields and modest GBP sell-off. On its own though we doubt that would be sufficient for sustained reversal of the GBP strengthening trend. The biggest downside risks for the GBP would be if core inflation dropped more than expected in in next week’s CPI report, and the BoE pushed back strongly against how many rate hikes are currently priced into the UK rate curve. We view that as a low probability risk in the week ahead but it could have a bigger negative impact on GBP performance if it materializes.

In these circumstances, the fundamental backdrop remains supportive for further GBP strength at the current juncture. However, UK yields and the GBP have already moved along way to better reflect the resilience of the UK economy, the easing of the negative energy price shock and expectations for the BoE to keep raising rates further than other major central banks such as the ECB and Fed. A weaker UK CPI report next week and/or a BoE policy update that fails to fully meet lofty expectations for higher UK rates pose the main downside risks to the GBP’s bullish trend. We still expect cable to move closer to the 1.3000 this year. A full reversal of the GBP sell-off following the outbreak of the Ukraine conflict could even see the pair extend its rebound further back towards the 1.3500-level where it was trading in early 2022.

HIGHER UK YIELDS ENCOURAGING STRONGER GBP

Source: Bloomberg, Macrobond & MUFG Research

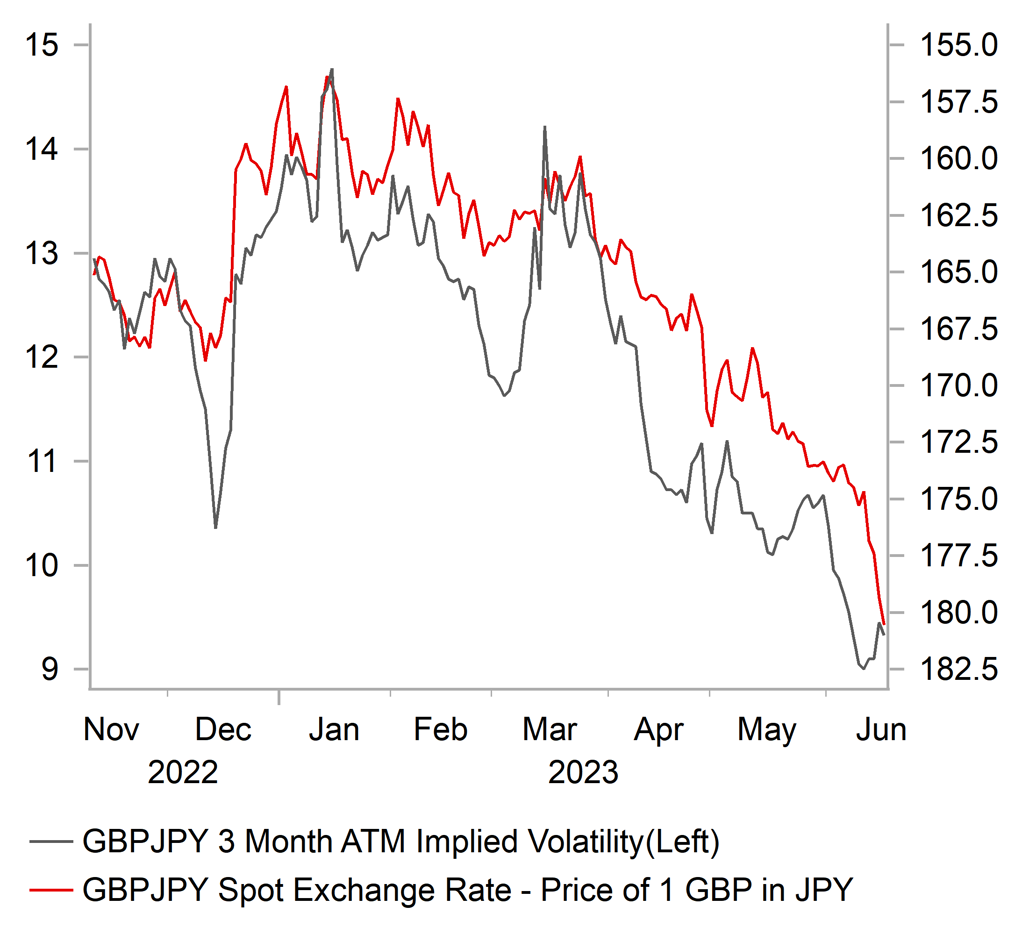

FALLING VOL BOOSTING APPEAL OF FX CARRY

Source: Bloomberg & Macrobond

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

06/19/2023 |

14:00 |

ECB's Villeroy speaks in Paris |

!! |

|||

|

USD |

06/19/2023 |

15:00 |

NAHB Housing Market Index |

Jun |

50.0 |

50.0 |

!! |

|

AUD |

06/20/2023 |

02:30 |

RBA Minutes of June Policy Meeting |

!! |

|||

|

JPY |

06/20/2023 |

05:30 |

Industrial Production MoM |

Apr F |

-- |

-0.4% |

!! |

|

EUR |

06/20/2023 |

07:00 |

Germany PPI YoY |

May |

-- |

4.1% |

!! |

|

EUR |

06/20/2023 |

09:00 |

ECB Current Account SA |

Apr |

-- |

31.2b |

!! |

|

EUR |

06/20/2023 |

10:00 |

Construction Output MoM |

Apr |

-- |

-2.4% |

!! |

|

USD |

06/20/2023 |

13:30 |

Building Permits |

May |

1435k |

1416k |

!! |

|

USD |

06/20/2023 |

13:30 |

Housing Starts |

May |

1400k |

1401k |

!! |

|

EUR |

06/20/2023 |

15:30 |

ECB's Simkus Speaks |

!! |

|||

|

GBP |

06/21/2023 |

07:00 |

CPI YoY |

May |

-- |

8.7% |

!!! |

|

GBP |

06/21/2023 |

07:00 |

PPI Output NSA YoY |

May |

-- |

5.4% |

!! |

|

GBP |

06/21/2023 |

07:00 |

Public Sector Net Borrowing |

May |

-- |

24.7b |

!! |

|

CAD |

06/21/2023 |

13:30 |

Retail Sales MoM |

Apr |

-- |

-1.4% |

!! |

|

EUR |

06/21/2023 |

14:45 |

ECB's Schnabel, Nagel Speak |

!! |

|||

|

USD |

06/21/2023 |

15:00 |

Fed Chair Powell testifies |

!!! |

|||

|

CAD |

06/21/2023 |

18:30 |

BoC Releases Summary of Deliberations |

!! |

|||

|

CHF |

06/22/2023 |

08:30 |

SNB Policy Rate |

1.75% |

1.50% |

!!! |

|

|

NOK |

06/22/2023 |

09:00 |

Deposit Rates |

3.50% |

3.25% |

!!! |

|

|

GBP |

06/22/2023 |

12:00 |

Bank of England Bank Rate |

4.75% |

4.50% |

!!! |

|

|

USD |

06/22/2023 |

13:30 |

Current Account Balance |

1Q |

-$218.2b |

-$206.8b |

!! |

|

USD |

06/22/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!!! |

|

|

JPY |

06/23/2023 |

00:30 |

Natl CPI YoY |

May |

3.2% |

3.5% |

!!! |

|

GBP |

06/23/2023 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

May |

-- |

0.5% |

!!! |

|

EUR |

06/23/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jun P |

-- |

44.8 |

!!! |

|

EUR |

06/23/2023 |

09:00 |

HCOB Eurozone Services PMI |

Jun P |

-- |

55.1 |

!!! |

|

GBP |

06/23/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Jun P |

-- |

47.1 |

!!! |

|

GBP |

06/23/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Jun P |

-- |

55.2 |

!!! |

|

USD |

06/23/2023 |

14:45 |

S&P Global US Composite PMI |

Jun P |

-- |

54.3 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Fed Chair Powell will have the opportunity to provide further guidance over the outlook for rates in the week ahead when he is scheduled to deliver the Fed’s semi-annual testimony on monetary policy to Congress. The decision to leave rates on hold this week was accompanied by hawkish guidance signaling that at least more hike is likely this year. The Fed is frustrated that core inflation measures are proving stickier than expected, and is not yet confident that policy is sufficiently restrictive.

- The BoE is the next major central bank to provide a policy update in the week ahead. The BoE finds itself in a more challenging position than the ECB and Fed given inflation is proving more persistent in the UK and growth has proven more resilient. It is placing more pressure on the BoE to keep hiking rates. We expect the BoE to deliver another 25bps hike in the week ahead, and to signal that it has more work to do to combat persistent inflation risks. While there has been speculation recently over the BoE reverting back to larger 50bps hikes, the BoE is more likely to deliver further 25bps hikes this year.

- Similar to the BoE, the Norges Bank is under pressure to deliver a hawkish policy update after core inflation surprised significantly to the upside in May. At the previous policy meeting, the Norges Bank clearly signaled that NOK weakness was becoming a bigger concern by increasing upside risks to the inflation outlook. The Norges Bank has already signaled that they plan to raise rates again in June. The risk of a larger 50bps has increased, and at the very least we expect another 25bps hike and guidance for further hikes this year.

- We expect the SNB to deliver a 25bps hike in the week ahead. Even though inflation pressures have eased resulting in core inflation falling back below 2.0% in May, we are not expecting the SNB to signal an end to their hiking cycle yet.