To read a full report, please download PDF

USD is displaying more resilience

FX View:

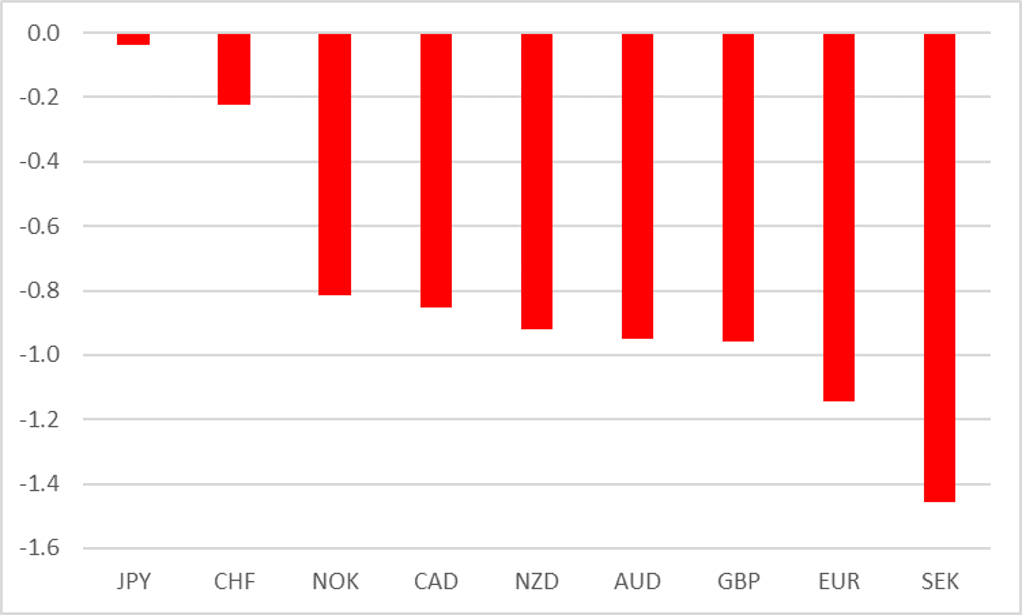

The US dollar has strengthened against all other G10 currencies over the past week although gains have been relatively modest. The USD has been more resilient to the drop in US yields. It could partly reflect that expectations for a dovish shift in Fed policy are better priced in now, and that evidence of a sharper slowdown in US growth and/or inflation will be required to encourage expectations for deeper rate cuts. Furthermore, market participants are starting to question more the growth outlook outside of the US which is helping to support the USD. The ongoing decline in commodity prices casts doubt on the strength of the pick-up in demand from China ahead of the release next week of the latest activity data for April. We will also look into potential implications for the USD from the debt ceiling stand-off

A BETTER WEEK FOR THE USD

Source: Bloomberg, 14:15 GMT, 12th May 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are closing our long EUR/USD trade idea, and maintaining short USD/JPY and USD/NOK trade ideas.

JPY Flows:

The April Transactions in International Securities data was released this week. After huge buying in the Jan-Mar quarter, Japan investors sold JPY 1,155bn worth of foreign bonds in April. It was the first month of net selling since December last year after purchases totalling JPY 10,315bn in Q1.Japan banks were behind the huge buying in q1 and were the primary driver of the selling in April.

Short Term Fair Value Modelling:

This week saw greater divergence between spot and our fair value model. Monitoring the relationship between USD/JPY fundamentals and spot, our model calculates a 4.60% overvaluation of spot. Current mis-valuation lies between the upper quartile and maximum of the typical distribution.

FX Views

USD: Assessing performance amidst looming US debt ceiling risk

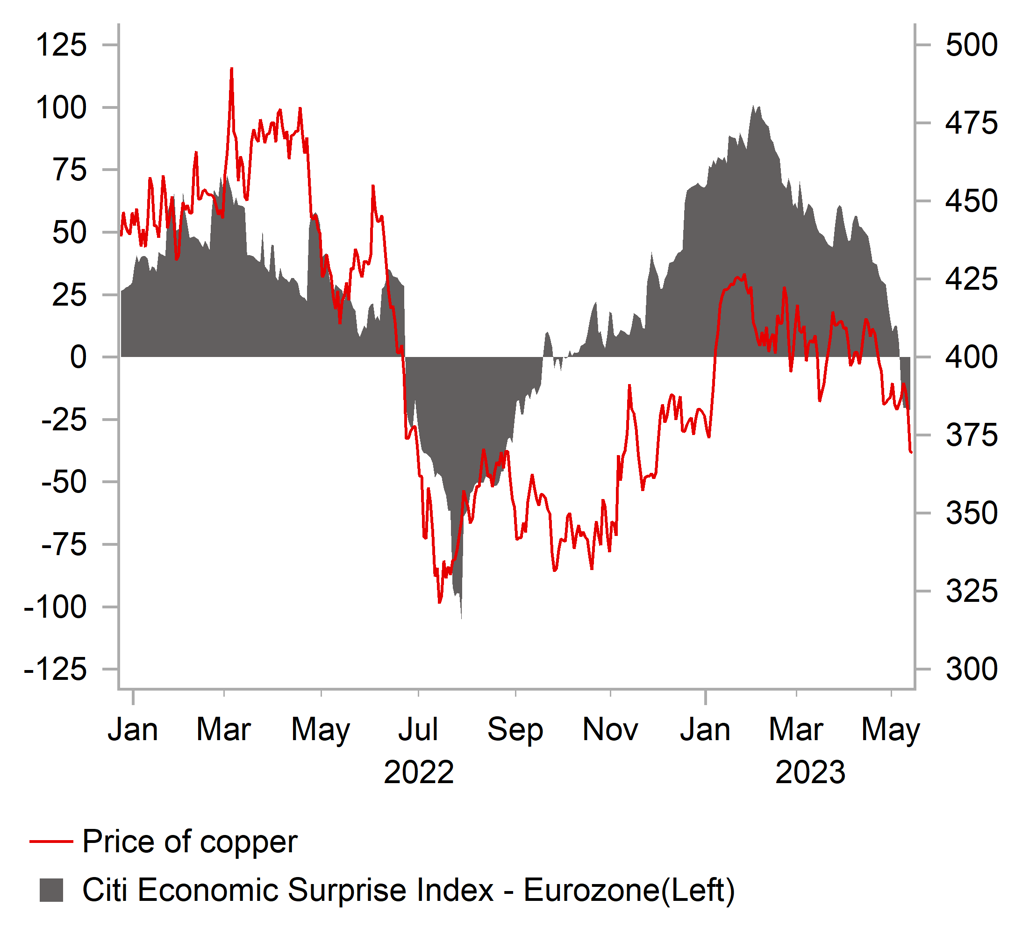

The USD has been consolidating at weaker levels against other major currencies over the past month. It has seen the dollar index trade within a narrow range between 100.79 and 102.40. Most G10 currencies are within +/-1% of where they were trading against the USD in the middle of last month. The price action highlights that the FX market is currently struggling for direction after the USD sell-off recently lost downward momentum. The recent resilience of the USD partly reflects that the US rate market has already moved a long way to price in a policy reversal from the Fed. There are already almost 75bps of cuts prices in by year end with the first cut expected to be delivered by September. It will require more convincing economic data in the coming months that the US economy is slowing sharply/ heading into recession to reinforce expectations for even deeper rate cuts going forward. At the same time, recent developments are dampening optimism over the outlook for growth outside of the US that is helping to provide more support for the USD. The USD sell-off since late last year has been driven in part by the improving cyclical outlook for growth in China and Europe. While China’s economy is rebounding at the start of this year and European economies have avoided recession, doubts have started to creep back in recently over the strength of growth. Commodity prices sensitive to China demand (copper & iron ore) have corrected lower over the past month, and in the euro-zone the run of positive economic surprises since September of last year has come to an end.

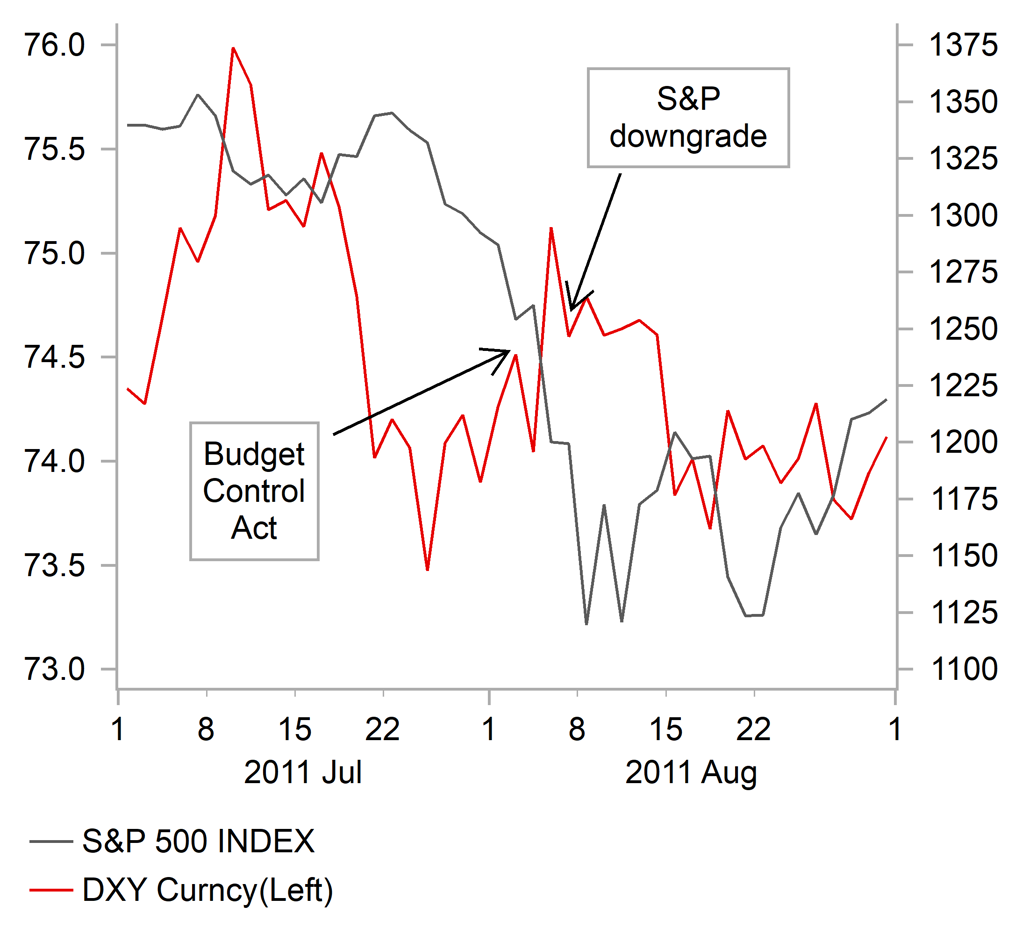

The fast approaching US debt ceiling stand-off has the potential to create choppy price action as well in the coming weeks/month that could temporarily disrupt our outlook for further USD weakness. The US Treasury has warned that the so-called “x-date” could be reached in “early June or even 1st June” although there is an expectation in the market that there could be more wriggle room. The most likely outcome is a compromise agreement to kick the can down the road that involves extending the debt ceiling for a short period (3-4 months) that is conditional on plans for future spending cuts. The more last minute the deal, the more disruptive it could be for financial markets. During the 2011 US debt ceiling crisis, the USD initially weakened in July but then rebounded towards the end of the month and into early August as the “x date” moved closer and a deal was reached on 2nd August. The USD then fell back again after S&P’s decision to downgrade the US credit rating on 5th August.

Once the dust has settled over the US debt ceiling, we expect the USD to resume its decline but are anticipating more volatile FX markets as the “x-date” approaches.

SOFTENING GROWTH EXPECTATIONS OUTSIDE OF US

Source: Bloomberg, Macrobond & MUFG GMR

CHOPPY PRICE ACTION AROUND 2011 DEBT CEILING

Source: Bloomberg & MUFG Calculations

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SEK |

05/15/2023 |

07:00 |

CPI YoY |

Apr |

10.7% |

10.6% |

!!! |

|

EUR |

05/15/2023 |

10:00 |

Industrial Production SA MoM |

Mar |

-1.6% |

1.5% |

!! |

|

CAD |

05/15/2023 |

13:15 |

Housing Starts |

Apr |

-- |

213.9k |

!! |

|

AUD |

05/16/2023 |

02:30 |

RBA Minutes of May Policy Meeting |

!! |

|||

|

CNY |

05/16/2023 |

03:00 |

Industrial Production YoY |

Apr |

10.8% |

3.9% |

!!! |

|

CNY |

05/16/2023 |

03:00 |

Retail Sales YoY |

Apr |

22.0% |

10.6% |

!!! |

|

CNY |

05/16/2023 |

03:00 |

Fixed Assets Ex Rural YTD YoY |

Apr |

5.7% |

5.1% |

!!! |

|

GBP |

05/16/2023 |

07:00 |

Average Weekly Earnings 3M/YoY |

Mar |

-- |

5.9% |

!!! |

|

GBP |

05/16/2023 |

07:00 |

Employment Change 3M/3M |

Mar |

-- |

169k |

!! |

|

EUR |

05/16/2023 |

10:00 |

ZEW Survey Expectations |

May |

-- |

640.0% |

!! |

|

EUR |

05/16/2023 |

10:00 |

GDP SA QoQ |

1Q P |

0.0% |

0.1% |

!!! |

|

EUR |

05/16/2023 |

10:00 |

Trade Balance SA |

Mar |

-- |

-0.1b |

!! |

|

EUR |

05/16/2023 |

10:00 |

Employment QoQ |

1Q P |

-- |

0.3% |

!! |

|

USD |

05/16/2023 |

13:30 |

Retail Sales Advance MoM |

Apr |

0.7% |

-1.0% |

!!! |

|

CAD |

05/16/2023 |

13:30 |

CPI YoY |

Apr |

-- |

4.3% |

!!! |

|

USD |

05/16/2023 |

14:15 |

Industrial Production MoM |

Apr |

0.0% |

0.4% |

!! |

|

USD |

05/16/2023 |

15:00 |

NAHB Housing Market Index |

May |

45.0 |

45.0 |

!! |

|

USD |

05/16/2023 |

17:15 |

Fed’s Williams Speaks |

!! |

|||

|

JPY |

05/17/2023 |

00:50 |

GDP SA QoQ |

1Q P |

0.2% |

0.0% |

!!! |

|

JPY |

05/17/2023 |

05:30 |

Industrial Production MoM |

Mar F |

-- |

0.8% |

!! |

|

EUR |

05/17/2023 |

10:00 |

CPI YoY |

Apr F |

-- |

6.9% |

!!! |

|

USD |

05/17/2023 |

13:30 |

Housing Starts |

Apr |

1398k |

1420k |

!! |

|

USD |

05/17/2023 |

13:30 |

Building Permits |

Apr |

1430k |

1413k |

!! |

|

JPY |

05/18/2023 |

00:50 |

Trade Balance |

Apr |

-¥461.0b |

-¥754.5b |

!! |

|

AUD |

05/18/2023 |

02:30 |

Employment Change |

Apr |

22.5k |

53.0k |

!!! |

|

USD |

05/18/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!!! |

|

|

USD |

05/18/2023 |

15:00 |

Existing Home Sales |

Apr |

4.25m |

4.44m |

!! |

|

USD |

05/18/2023 |

15:00 |

Leading Index |

Apr |

-0.6% |

-1.2% |

!! |

|

CAD |

05/18/2023 |

15:00 |

BoC Releases Financial System Review |

!! |

|||

|

JPY |

05/19/2023 |

00:30 |

Natl CPI YoY |

Apr |

-- |

3.2% |

!!! |

|

CAD |

05/19/2023 |

13:30 |

Retail Sales MoM |

Mar |

-- |

-0.2% |

!! |

|

USD |

05/19/2023 |

16:00 |

Fed Chair Powell Speaks |

!!! |

Key Events:

- There are no major events currently scheduled for the week ahead. One area of continued focus will be ongoing efforts from US politicians in an attempt to resolve the US debt ceiling stand-off before the “x-date” which could arrive as soon as in early June. There has been little progress over the past week but at least politicians on both sides of the political divide are still talking. We continue to favour a short-term extension but a deal may not be reached until the last minute.

- The main economic data releases in the week ahead will be the latest monthly activity data from China for April. Chain’s economy rebounded strongly in Q1 driven by a pick-up in personal consumption as pent-up demand was released, but there are some lingering concerns over the strength of recovery in the housing sector. Industrial production and property investment both disappointed expectations in March, and will be watched closely by market investors in the week ahead if unexpected weakness continued in April. The price of commodities more tightly linked to China such as iron have declined recently sending a bearish signal.

- Other data releases to watch out for in the week ahead include: i) the latest UK labour market report for March and ii) CPI report from Japan for April. Strong wage growth has been encouraging the BoE to keep hiking rates while the BoJ continues to doubt that higher inflation will Japan will be sustained. Fed Chair Powell and New York President Williams are also scheduled to speak at a monetary policy conference at the end of next week.