To read a full report, please download PDF

USD outlook worsening

FX View:

The dollar continues to trade close to year-to-date lows with the banking sector turmoil in the US persisting with fears that the authorities are unable to arrest the spread of declining confidence from bank to bank. The macro-economic consequences are clear – the prospect of recession is increasing given the credit contraction is likely becoming more severe by the day. The prospect of recession did not stop the Fed from hiking this week but we believe the press conference did nothing for Fed credibility. The views of Powell that recession will be avoided and that banking sector conditions have improved do not align with investors, based on market price action. The markets now expect 85bps of Fed rate cuts by year-end. That remains an unfavourable backdrop for the dollar. The nonfarm payrolls report this afternoon admittedly does not signal imminent recession but we believe the weight of evidence in other date points to a slowdown in job creation over the coming months. Any USD bounce from here is unlikely to be sustained.

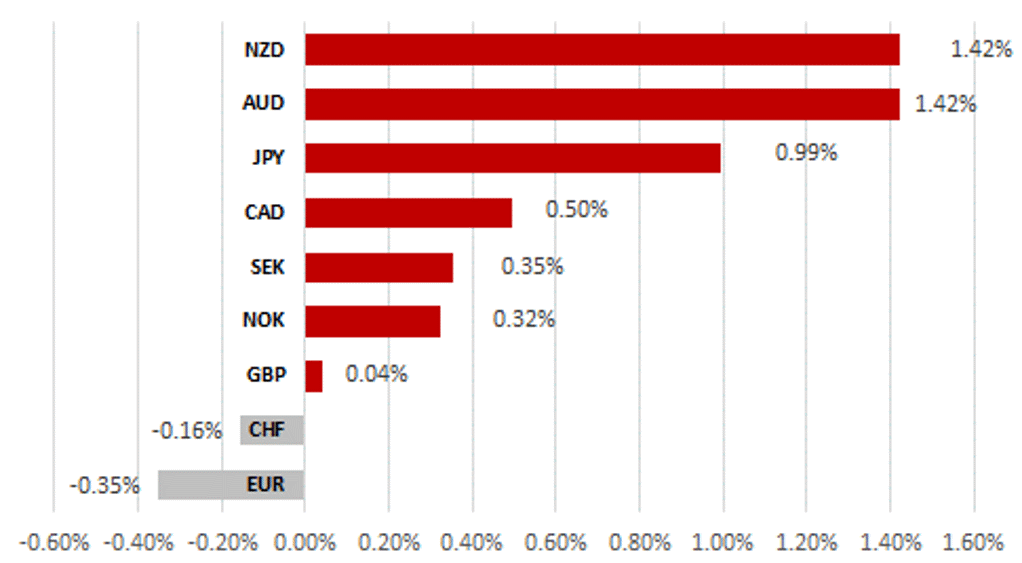

USD SUFFERS ACROSS MOST OF G10

Source: Bloomberg, 13:45 BST, 5th May 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are adding a short USD/NOK trade idea this while also maintaining our long EUR/USD and our short USD/JPY trade ideas.

JPY Flows:

The regular monthly cross-border flow data that we analyse have not yet been released by the MoF and hence this week we took the opportunity to analyse the Japan Life Insurance sector. This followed the updated investment plans released by the largest Life Insurance companies for the fiscal year ahead.

FOMC Sentiment:

Our analysis on the recent FOMC press conference transcript identifies a more muted Fed, less willing to comment on the key macro and policy topics. This maybe signalling the Fed is entering a new ‘pause and see’ territory progressing cautiously when considering whether to hike further.

FX Views

GBP: BoE to fall between the Fed and ECB

After the RBA, Fed, Norges Bank and ECB this week, it will be the turn of the BoE next week with this meeting also including an updated Monetary Policy Report. A quick look at how markets have moved since the last MPC meeting on 23rd March provides some reassuring information from an inflation perspective. The BoE’s GBP TWI is 1.8% higher; the 10-year inflation breakeven is roughly unchanged; and short-term rates (SONIA 2024 futures & 2yr Gilt yield) are about 45bps higher. Given the turmoil in US regional banks, the FTSE 350 Bank Index is also 4% higher while the overall FTSE 250 is 3.4% higher. But while market moves are not cause for concern on inflation, the incoming economic data certainly point to reason to believe that there has been “evidence of more persistent (inflationary) pressures” that the BoE stated in March would warrant further tightening. Inflation has been a touch higher, certainly relative to the February forecast, which was put at 9.73%. Actual YoY CPI in Q1 was 10.18%. Wages will also remain a concern at the meeting next week. The one-month YoY AWE (ex-bonus) increase accelerated from 6.3% to 6.9% in February, approaching the postcovid highs over 7%. These two economic data releases alone make a 25bp rate hike next week a near certainty. Limited fall out for UK banks will reassure the BoE.

The fact that the 2-3yr inflation forecasts from the BoE have been well below the 2% target play little role in the near-term direction of monetary policy suggests the forecast updates next week will have little impact on market pricing. These forecasts should become more important going forward but we at least must start to see inflation slowing markedly. That should start to happen starting with the April data released later this month with the utility price base effect due to the jump in the OFGEM price cap a year ago. If wages also slow that could open up the chance of a pause at the June meeting. We expect the guidance next week to be a carbon copy of the March guidance – that is further hikes being conditional of evidence of “more persistent” inflation pressures. Given the gap to the next meeting is relatively short (22nd June) we err on the BoE hiking again in June but it remains a close call. Continued labour market wage inflation risks seems to be still a higher risk in the UK then elsewhere.

The pound remains the top performing G10 currency in 2023, and the 2nd best performing in Q2 to date. The UK economy continues to show resilience and the improved terms of trade due to energy prices is a key positive dynamic for the pound. Huw Pill has spoken about a “positive demand shock”. We do not expect the BoE to disrupt the current positive pound performance. EUR/GBP may be set to break lower.

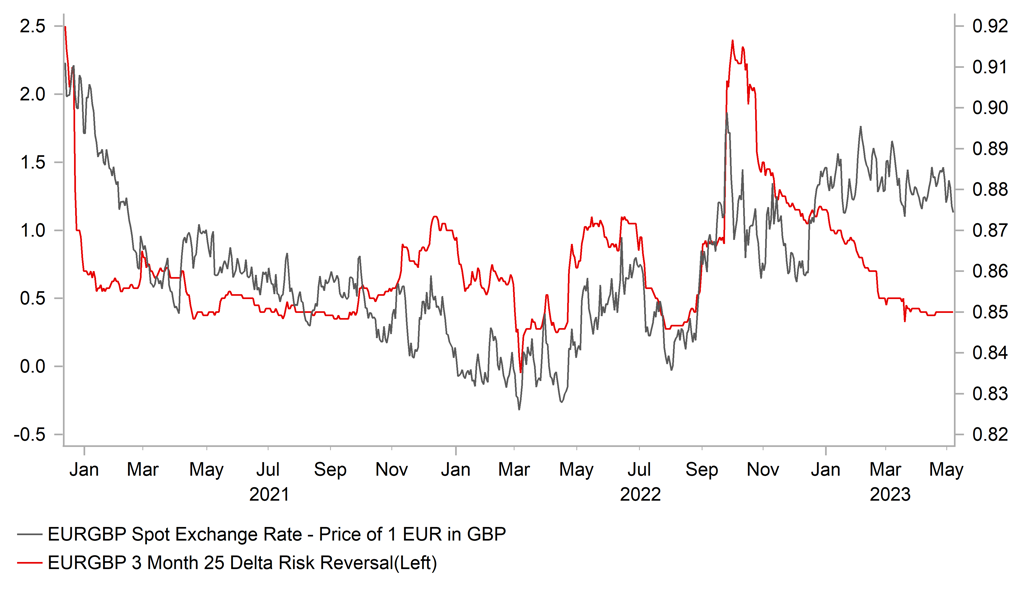

EUR/GBP CLOSE TO YTD LOWS – OPTIONS POINT LOWER

Source: Bloomberg, Macrobond & MUFG GMR

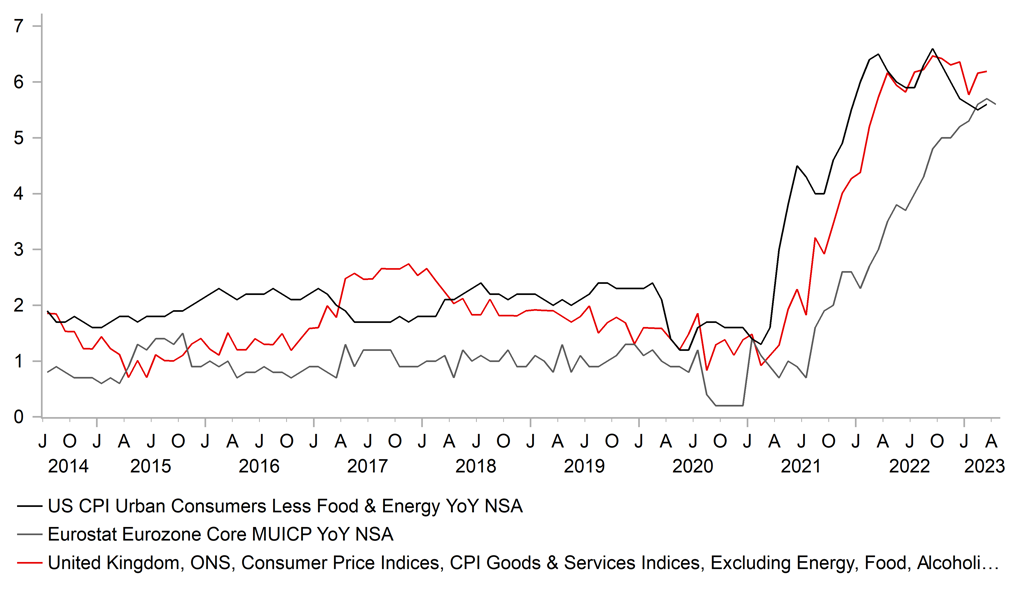

UK, EZ, US CORE CPI YOY RATES MORE ALIGNED

Source: Bloomberg & MUFG Calculations

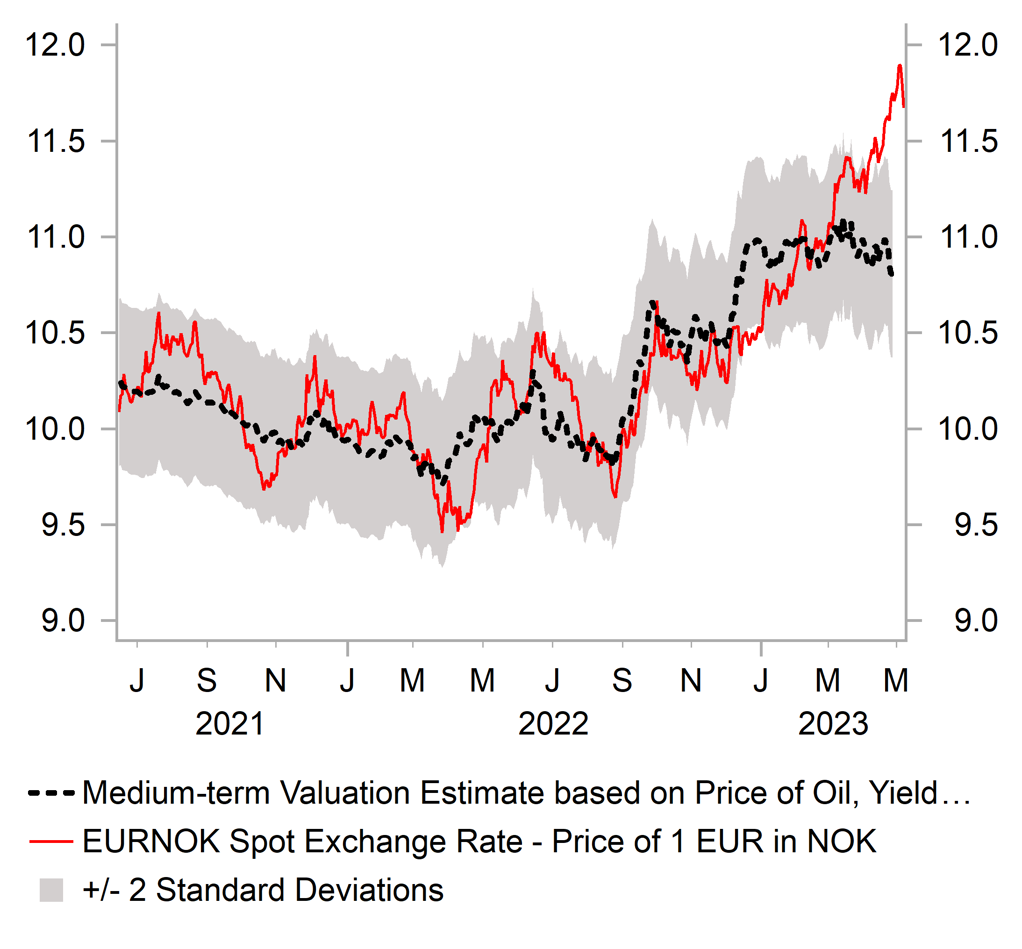

NOK: Brighter days ahead for NOK after heavy sell-off?

The scale of NOK weakness has attracted more attention over the past week. It has been by some distance the worst performing G10 currency so far this year declining by around -10.4% and -7.7% respectively against the EUR and USD. It has resulted in EUR/NOK hitting a fresh year to high this week of 11.949 as it moves further above the low from last August at 9.6071. A substantial increase for the pair of almost 25% over that period. While the EUR has strengthened across the aboard over that period as fears over the negative terms of trade shock to European economies has eased, it is clear that the NOK has weakened significantly as well.

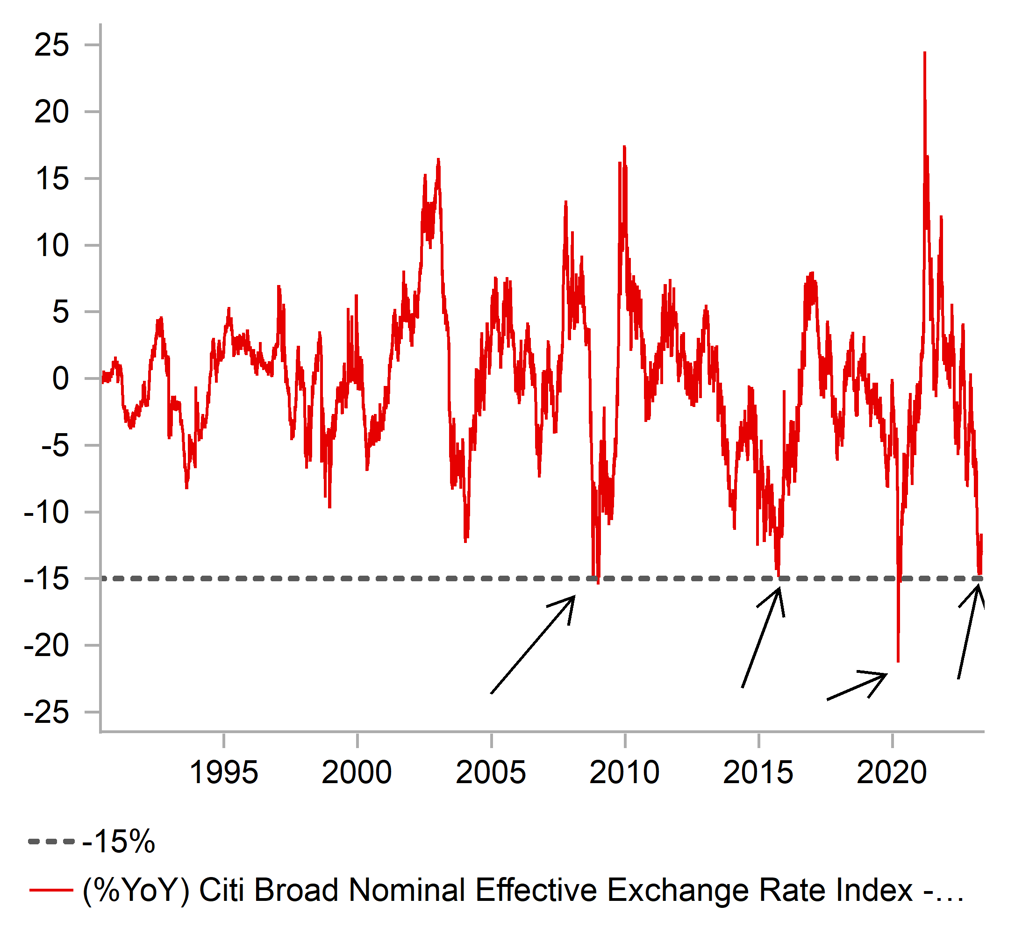

The sharp correction lower in energy prices since last summer has been contributing to NOK weakness. The downward trend for the price of oil has resumed in recent weeks as the price of Brent has given back all of the initial gains triggered by the OPEC+ production cut announcement at the start of April, and has fallen back to the year to date low close to USD70/barrel. The bearish price action continues to cast doubt on the strength of global growth at the start of this year. Looking back at previous periods of more acute NOK weakness they mainly occurred when the global economy slowed sharply. Over the last thirty years there have been four occasions when the trade-weighted NOK has fallen by around 15% or greater on an annual basis: i) in January 2009 at the peak of Global Financial Crisis, ii) in September 2015 when the price of oil collapsed by around 75% in response to the positive supply shock from US shale oil production, iii) in March 2020 when global demand collapsed during the initial outbreak of COVID, and iv) in April of this year. On this occasion though the global demand or supply shocks are not as severe yet krone weakness is still as extreme.

The disconnect between NOK weakness and economic fundamentals was highlighted by the Norges Bank at this week’s policy meeting. It prompted the Norges Bank to send a hawkish signal that “if the NOK remains weaker than projected …, a higher policy rate than envisaged earlier may be needed”. The Norges Bank is currently planning to hike rates further by 25bps in June to 3.50%. Similarly, SEK weakness earlier this year put pressure on the Riksbank to adopt a more hawkish policy stance in February when they explicitly encouraged a stronger SEK. The Riksbank’s increased sensitivity to SEK weakness has at least helped to stabilize it at weaker levels in recent months. It will provide some reassurance to the Norges Bank alongside past history showing that the NOK has rebounded strongly in the years following such sharp sell-offs (TWI NOK +15.5%Y/Y to 12/01/2010, +6.1% to 28/09/2016, and +17.3% to 23/03/2021).

In these circumstances, we continue to believe that the NOK is deeply undervalued and will rebound in the year ahead although attempting to time the turning point is like trying to catch a falling knife in the near-term.

HEAVY NOK SELL-OFFS FOLLOWED BY REBOUNDS

Source: Bloomberg, Macrobond & MUFG

WIDENING DISCONNECT TO FUNDAMENTALS

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

05/08/2023 |

02:30 |

German Industrial Production SA MoM |

Mar |

-- |

2.0% |

!! |

|

EUR |

05/08/2023 |

02:30 |

Sentix Investor Confidence |

May |

-- |

-8.7 |

!! |

|

EUR |

05/08/2023 |

15:00 |

ECB's Lane Speaks |

!!! |

|||

|

JPY |

05/09/2023 |

15:00 |

Labor Cash Earnings YoY |

Mar |

1.0% |

1.1% |

!!! |

|

CNY |

05/09/2023 |

05:30 |

Trade Balance |

Apr |

$73.00b |

$88.19b |

!! |

|

EUR |

05/09/2023 |

09:00 |

ECB's Rehn Speaks |

!! |

|||

|

SEK |

05/09/2023 |

09:00 |

Riksbank Minutes from April Meeting |

!! |

|||

|

EUR |

05/09/2023 |

09:00 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

05/09/2023 |

09:30 |

NFIB Small Business Optimism |

Apr |

89.7 |

90.1 |

!! |

|

USD |

05/09/2023 |

10:00 |

Fed's Williams speaks |

!!! |

|||

|

USD |

05/09/2023 |

Tbc |

President Biden debt ceiling meeting |

|

|

|

|

|

SEK |

05/10/2023 |

12:20 |

Household Consumption MoM |

Mar |

-- |

-0.5% |

!! |

|

NOK |

05/10/2023 |

15:00 |

CPI YoY |

Apr |

-- |

6.5% |

!!! |

|

EUR |

05/10/2023 |

15:00 |

German CPI YoY |

Apr F |

-- |

7.2% |

!!! |

|

EUR |

05/10/2023 |

23:45 |

ECB's Centeno speaks |

!! |

|||

|

USD |

05/10/2023 |

02:30 |

CPI YoY |

Apr |

5.0% |

5.0% |

!!! |

|

GBP |

05/11/2023 |

10:00 |

RICS House Price Balance |

Apr |

-- |

-43.0% |

!! |

|

JPY |

05/11/2023 |

13:15 |

BoP Current Account Balance |

Mar |

¥2865.3b |

¥2197.2b |

!! |

|

CNY |

05/11/2023 |

15:00 |

CPI YoY |

Apr |

0.3% |

0.7% |

!! |

|

GBP |

05/11/2023 |

19:00 |

Bank of England Bank Rate |

4.50% |

4.25% |

!!! |

|

|

GBP |

05/11/2023 |

19:30 |

BoE press conference |

!!! |

|||

|

USD |

05/11/2023 |

09:00 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

05/11/2023 |

09:00 |

PPI Final Demand YoY |

Apr |

2.4% |

2.7% |

!! |

|

GBP |

05/12/2023 |

09:30 |

GDP QoQ |

1Q P |

-- |

0.1% |

!!! |

|

NOK |

05/12/2023 |

13:15 |

GDP Mainland QoQ |

1Q |

-- |

0.8% |

!! |

|

EUR |

05/12/2023 |

13:30 |

France CPI YoY |

Apr F |

-- |

5.9% |

!! |

|

USD |

05/12/2023 |

13:45 |

Import Price Index YoY |

Apr |

-- |

-4.6% |

!! |

|

USD |

05/12/2023 |

02:30 |

U. of Mich. Sentiment |

May P |

62.6 |

63.5 |

!! |

Key Events:

- The BoE will be the next major central bank to update policy in the week ahead following the updates over the past week from the ECB and Fed. We expect the BoE to hike rates by a further 25bps and signal that rates may still need to rise further to dampen upside inflation risks. It will be difficult for the BoE to signal a pause in the rate hike cycle in the week ahead after the recent run of stronger inflation and activity data. The UK economy appears to be strengthening at the start of Q2 while inflation is not yet falling as quickly as had been hoped. We expect the release of the GDP report for Q1 to confirm that the UK economy expanded weakly but did not contract as had been feared. We now expect the BoE to raise their policy rate to a higher peak of 4.75%.

- The main economic data release will be the US CPI report for April. US rate market participants have become more confident that the Fed has now delivered a final 25bps hike this week, and it will be more difficult for the Fed to hike rates again as soon as their next policy meeting in June with confidence in US regional banks continuing to slip and the US debt ceiling stand-off set to intensify in the month ahead. It would require a significant upside inflation surprise to challenge current dovish expectations for Fed policy. Headline and core inflation measures have both eased recently which is expected to continue in the April CPI report and reinforce expectations for the Fed to pause their hiking cycle. New York President Williams is the only Fed member currently scheduled to speak in the week ahead. His comments will be watched closely to see if he believes rates have risen sufficiently to dampen upside inflation risks.

- It has been reported that President Biden will hold a meeting at the White House on Tuesday with Congressional leaders to discuss raising the debt ceiling. The US Treasury warned this week that Congress needs to reach an agreement to raise the debt ceiling by as “early as 1st June”. The Democrats and Republicans remain in deadlock. The Democrats want a clean agreement to raise the debt ceiling while the Republicans will only agree to raise the debt ceiling if cuts to government spending are attached.