Please download PDF from the button above for all other contents for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

October 2023

KEY EVENTS IN THE MONTH AHEAD

1) WILL THE DATA ALLOW ‘HIGHER FOR LONGER’

The US dollar rebounded further in September and after a 1.7% gain (DXY basis) in August, the dollar advanced by 2.5% in September, the strongest close since October last year. The data from the US continued to show resilience which encouraged Fed officials to maintain a message of rates needing to remain ‘higher for longer’ in order to bring inflation under control. After most G10 central banks met in September, October will be a little quieter. Five G10 central banks will hold policy meetings in October – the RBA; RBNZ; BoC; ECB and the BoJ. We believe all these central banks will announce unchanged policy stances which will help reinforce the expectation that the G10 monetary tightening cycle is complete. However, the data flow ahead of the FOMC on 1st November will be key for global rates and FX. The OIS pricing implied probability currently stands at about 30%. We assume the FOMC holds policy steady but we maintain that the dollar can still advance further over the short-term given the probability of a hike is modest and hence yields will likely remain elevated. The global growth backdrop is set to remain conducive to continued dollar strength this quarter before dollar depreciation sets in from Q1 2024 as the evidence of slower US economic growth builds and pricing for rate cuts increases.

2) LIQUIDITY ISSUES COULD ESCALATE

The end of rate hikes however does not mean the end of monetary tightening. QT will continue and October is set to be the most challenging month in regard to QT policies amongst the major central banks. The maturity profile of the ECB’s APP indicates October will see EUR 52bn worth of sovereign bonds mature, the largest since maturities began rolling off the balance sheet. The BoE also announced at its last meeting that it would step up the annual pace of its QT from GBP 80bn to GBP 100bn from this month while the Fed is maintaining its pace of USD 95bn per month. The ECB’s TLTRO maturities will see another EUR 500bn come off the balance sheet by the end of next year while the ECB hinted at possible changes to reserve requirement rules that would tighten liquidity conditions further. Increased QT and rising real policy rates as inflation falls will ensure challenging market conditions will persist. This could mean further weakness in global equities after the MSCI World equity index for advanced and emerging markets declined by 4.3% in September.

3) MARKET ANTICIPATES FOR CHINA’S GOLDEN WEEK DATA

Markets are zooming into the country’s performance during its eight-day Golden Week which started from 29th September, for fresh catalysts of China’s recovery after August’s data showing emerging signs of improvement in some parts of the economy. Holiday spending and travel demand will be the usual focuses. Housing sales numbers during the holiday period, and further easing measures, will also be closely watched by market participants.

Forecast rates against the US dollar - End-Q4 2023 to End-Q3 2024

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

JPY |

149.37 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR |

1.0576 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

GBP |

1.2201 |

1.2150 |

1.2570 |

1.2730 |

1.2660 |

|

CNY |

7.2960 |

7.1500 |

7.0500 |

6.9500 |

6.8500 |

|

AUD |

0.6447 |

0.6400 |

0.6500 |

0.6600 |

0.6700 |

|

NZD |

0.6006 |

0.6000 |

0.6100 |

0.6200 |

0.6200 |

|

CAD |

1.3526 |

1.3600 |

1.3400 |

1.3300 |

1.3200 |

|

NOK |

10.667 |

10.909 |

10.273 |

10.000 |

9.9110 |

|

SEK |

10.898 |

11.292 |

10.636 |

10.357 |

10.179 |

|

CHF |

0.9142 |

0.9280 |

0.8770 |

0.8570 |

0.8480 |

|

|

|

|

|

|

|

|

CZK |

23.037 |

23.440 |

22.450 |

22.230 |

22.320 |

|

HUF |

367.29 |

373.20 |

359.10 |

357.10 |

361.60 |

|

PLN |

4.3674 |

4.4020 |

4.2270 |

4.1960 |

4.2410 |

|

RON |

4.7008 |

4.7660 |

4.5450 |

4.4910 |

4.5270 |

|

RUB |

97.226 |

99.000 |

99.520 |

100.57 |

102.47 |

|

ZAR |

18.863 |

19.000 |

19.250 |

19.500 |

19.500 |

|

TRY |

27.405 |

29.000 |

30.000 |

30.750 |

31.000 |

|

|

|

|

|

|

|

|

INR |

83.035 |

83.700 |

83.500 |

83.000 |

82.000 |

|

IDR |

15455 |

15600 |

15550 |

15400 |

15200 |

|

MYR |

4.6930 |

4.6500 |

4.6000 |

4.5500 |

4.5000 |

|

PHP |

56.570 |

57.300 |

57.500 |

57.500 |

57.500 |

|

SGD |

1.3657 |

1.3750 |

1.3550 |

1.3350 |

1.3200 |

|

KRW |

1347.7 |

1330.0 |

1320.0 |

1290.0 |

1270.0 |

|

TWD |

32.237 |

32.000 |

31.800 |

31.400 |

31.000 |

|

THB |

36.564 |

36.450 |

36.200 |

35.700 |

35.200 |

|

VND |

24274 |

24800 |

24800 |

24750 |

24700 |

|

|

|

|

|

|

|

|

ARS |

350.01 |

400.00 |

490.00 |

600.00 |

750.00 |

|

BRL |

4.9954 |

5.2000 |

5.2200 |

5.2500 |

5.2800 |

|

CLP |

892.35 |

880.00 |

870.00 |

865.00 |

860.00 |

|

MXN |

17.427 |

17.400 |

17.500 |

17.600 |

17.700 |

|

|

|||||

|

Brent |

95.40 |

94.00 |

91.00 |

88.00 |

83.00 |

|

NYMEX |

91.18 |

90.00 |

86.00 |

83.00 |

79.00 |

|

SAR |

3.7505 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

30.865 |

30.900 |

31.500 |

32.300 |

34.100 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/JPY |

149.37 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR/USD |

1.0576 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

138.00-152.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/USD |

1.0100-1.0900 |

1.0400-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

MARKET UPDATE

In September the US dollar strengthened further against the euro in terms of London closing rates, moving from 1.0844 to 1.0576. In addition, the dollar strengthened versus the yen, from 145.70 to 149.37. The FOMC at its meeting in September left the fed funds rate unchanged at between 5.25% and 5.50%. The FOMC has continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month. The balance sheet has now shrunk to USD 8,139bn, down USD 826bn from the peak in April 2022.

OUTLOOK

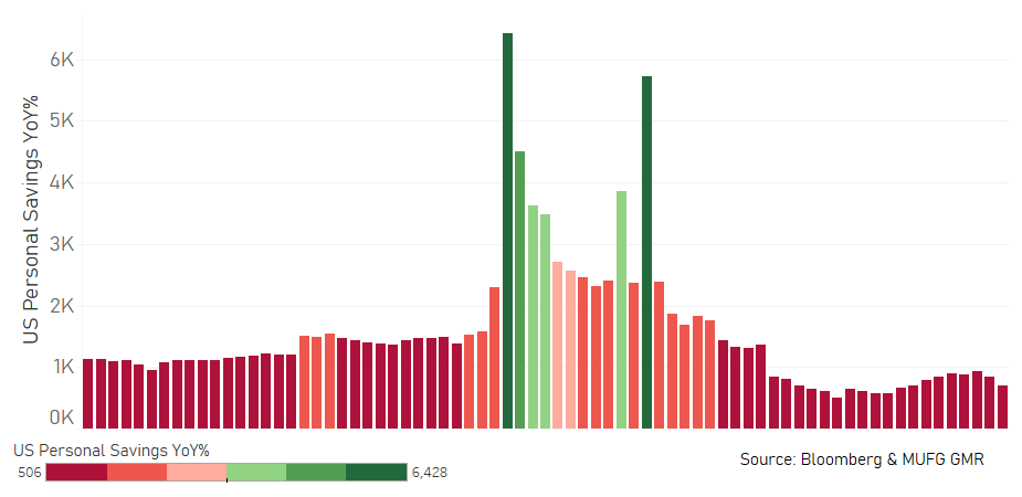

The US dollar strengthened again in September and the FOMC meeting provided further justification for market participants to price the “higher for longer” message from the Fed. There remains about 12bps of tightening priced for this year with the amount of easing in 2024 reduced by a further 25bps. The FOMC now expect only two rate cuts in 2024 down from four with updated forecasts suggesting the resilience of the labour market has prompted the rethink on the speed of reversing monetary tightening. We remain sceptical of the Fed being able to hold its policy rate at these levels for such a long period of time before only having to adjust policy modestly. Firstly, we should be mindful of the fact that taking every recession back to 1980, the average time between the first rate hike and the first month of recession is roughly two years. So a standard pattern implies recession starting by end-Q1. Secondly tailwinds that helped the US economy are only now ending. Excess savings that reached between USD 2.0-2.5trn are now estimated by the San Francisco Fed to be fully depleted. Student debt servicing payments commence on 1st October while the debt ceiling deal means fiscal expenditure will no longer be supportive for growth. Add to that the passing of time to allow more of the transmission mechanism of policy tightening to work through and we maintain economic conditions will weaken more notably over the remainder of this year and into the early part of 2024.

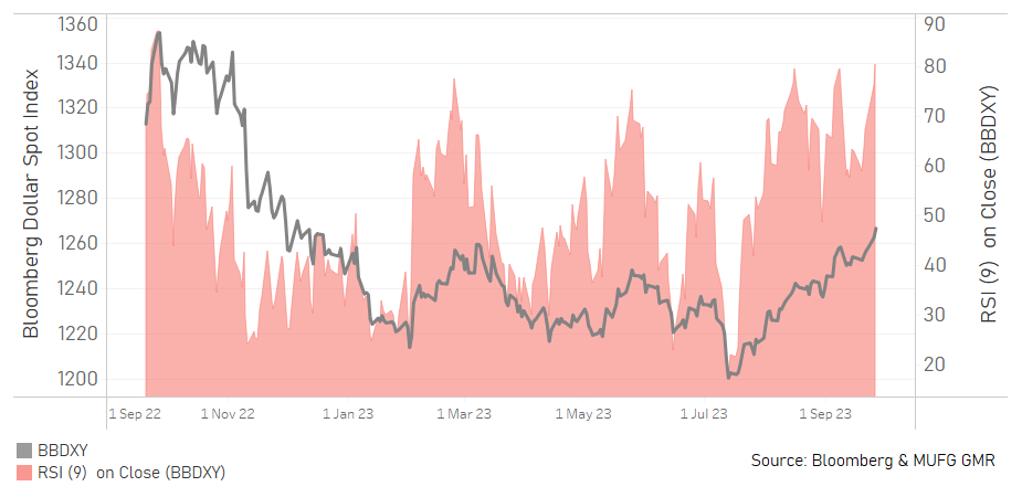

Until evidence of weaker growth emerges, the momentum will remain with the dollar. We see a window for further dollar strength that could take EUR/USD back toward parity. We suspect this window will close before year-end but the risk is it could extend into early 2024. The DXY advanced for eleven consecutive weeks to the end of September and the RSI measure suggests a correction could unfold. Markets appeared indifferent to a government shutdown that was avoided at the last minute. Inflation though continues to subside with the PCE core services, ex-housing gaining just 0.14% m/m in August, the weakest gain since November 2020.

The window of dollar strength should mean EUR/USD moving close to parity. A November FOMC rate hike (not our view) would reinforce strength although we do not expect a break back below parity. Assuming Fed rate cuts to the extent we forecast it will mean dollar weakness unfolds in H1 2024.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

5.33% |

5.33% |

4.88% |

4.38% |

3.88% |

|

3-Month T-Bill |

5.45% |

5.25% |

4.75% |

4.25% |

3.75% |

|

10-Year Yield |

4.57% |

4.38% |

4.13% |

3.75% |

3.63% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

US rates are a.) highly volatile and b.) have seen a shift higher post the FOMC meeting. This has been largely in reaction to their latest forecast where the dots for 2023 were left unchanged (at 5.625% - implying one more hike), while the medians for 2024 (5.125%) and 2025 (3.875%) moved up by 50bps. The new median dot for 2026 was 2.875% (suggesting future cuts will be backloaded). The market has taken note and is now tightening financial conditions for the Fed (as longer-term rates normalize). That said, we still do not believe the US can weather higher rates as long as the Fed projects. Thus, post the higher than expected dot path, we only tweaked our path up for various tenors (up slightly, by 12.5-25bps) but widen our range for Q4 as the market tries to find a steady state. Our 10yr forecast range for the 4th quarter is now 4.25-4.88% (4.25% a prior peak, will now serve as resistance). The risk for yields is to the upside given the time of year. With the potential for less liquidity ahead, we would not be shocked to see a break towards or above 5% on 10s. Such a move would be another reason why the Fed won’t hike again (George Goncalves, Head of US Macro Strategy)

PERFORMANCE OF USD VS. MOMENTUM INDICATOR

US PERSONAL SAVINGS RATE

Japanese yen

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/JPY |

149.37 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR/JPY |

157.97 |

151.50 |

151.80 |

152.30 |

150.10 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

138.00-152.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/JPY |

148.00-161.00 |

144.00-158.00 |

142.00-156.00 |

140.00-155.00 |

MARKET UPDATE

In September the yen weakened further versus the US dollar in terms of London closing rates from 145.70 to 149.37. However, the yen strengthened very marginally versus the euro, from 158.00 to 157.97. The BoJ at its meeting in September left the monetary stance unchanged with the BoJ continuing to allow 10-year JGB yields to fluctuate in the range of around +/- 0.5% from the target level of 0.0% but with these upper and lower bounds of the range being viewed now only as “references” and not “rigid limits” as was announced in July. Rigid limits now exist at +/-1.00%. In addition, the overnight policy rate remained unchanged at -0.1%.

OUTLOOK

In a month when the dollar was fuelled by the continued move higher in US yields, you may have expected USD/JPY to have moved more substantially higher but the move was likely constrained to some degree by the threat of intervention given we are now back into the zone when intervention took place last year. For four consecutive days into month-end Finance Minister Suzuki spoke publicly on foreign exchange, warning over excessive moves and implying intervention could be imminent. It will be difficult however for the MoF and BoJ to intervene given the relatively modest moves in USD/JPY and hence a break above the 150.00-level that would probably spark some volatility will be required in order for the government to justify intervention. With PM Kishida’s approval ratings low and with Japan households concerned over a renewed rise in food and energy prices, there is a political motivation for the government to halt yen depreciation.

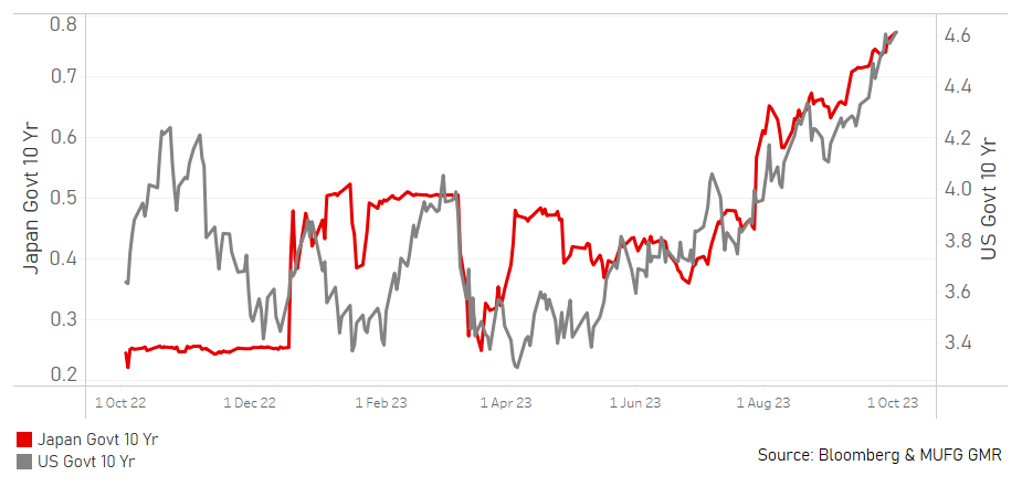

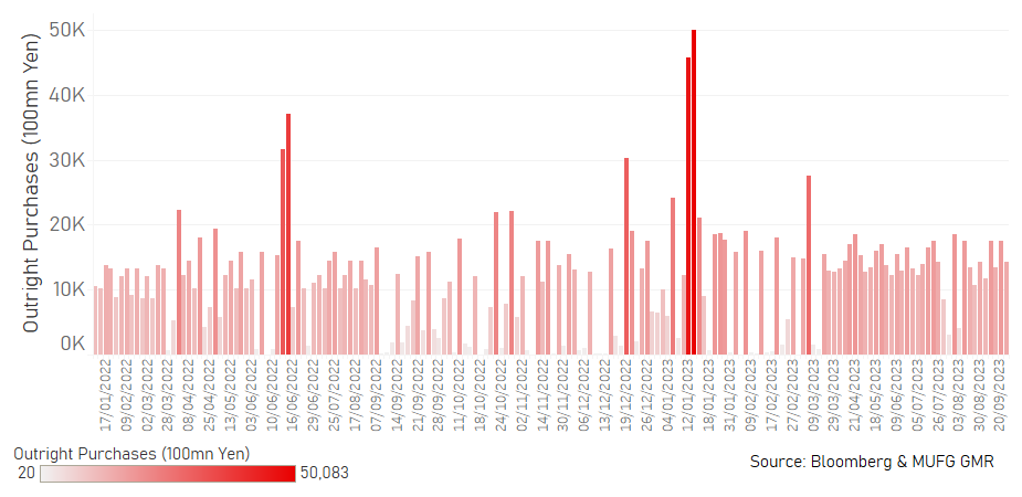

But intervention will only be credible and successful if it coincides with a fundamental shift. After the intervention last year, US inflation began to decline sharply but US yields have since surpassed the levels from last year. The BoJ looks to be considering more seriously a policy change with Governor Ueda hinting in a newspaper interview that there could be enough information available by year-end to conclude if price stability has been met which could allow for the removal of the negative interest rate policy. We had this pencilled for Q2 2024 but it is possible it could come sooner, say in January 2024. The BoJ has announced unscheduled JGB buying ops since the YCC change in July but these have not been aggressive and the 10-year JGB yield continues to drift higher. Wage data will be key for the BoJ to determine whether a change in policy is justified. PM Kishida is again rumoured to be considering a snap election, which could be held before the end of this year and would reinforce speculation of a BoJ policy change being possible in January.

The risk-reward in USD/JPY remains skewed to the downside at this juncture although a break higher initially now seems more likely, which will then likely prompt the intervention being hinted at. Hence, the prospect of remaining above those levels for long are low. A shift in BoJ policy also becomes more likely and we would expect strong resistance to yen weakness at levels over 150.00.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

-0.10% |

-0.10% |

0.10% |

0.10% |

0.10% |

|

3-Month Bill |

-0.23% |

-0.10% |

0.10% |

0.10% |

0.10% |

|

10-Year Yield |

0.77% |

0.90% |

1.00% |

1.10% |

1.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased further in August, by 12bps to close at 0.77% and this move was met with an unscheduled JGB buying operation on 29th September in the 5-to-10-year sector. However, the total of the operation was just JPY 300bn which highlighted the limits to curtailing JGB yields when the yen is at extreme weak levels that Tokyo want to curtail. We expect further subtle hints from BoJ officials that suggest Japan is moving toward price stability that will allow the BoJ the opportunity to end NIRP and YCC. We assumed prior that YCC would end before NIRP but if wage data remains firm and indeed if there is evidence of a pick-up then the BoJ could decide to end NIRP sooner, say in January. We remain unconvinced that Japan is shifting to being able to grow with an inflation rate of 2.0%. However, there is a window that exists now where conditions are more consistent with that and if recessionary conditions emerge in the US in 2024 (our view), removing the current policy stance could be done without any notable tightening of financial conditions. We see JGB yields moving slowly further higher as policy is adjusted.

LONG-TERM GOVERNMENT BOND YIELDS IN JAPAN & US

BOJ PURCHASES OF JGBS

Euro

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

EUR/USD |

1.0576 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

EUR/JPY |

157.97 |

151.50 |

151.80 |

152.30 |

150.10 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0100-1.0900 |

1.0400-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

|

|

EUR/JPY |

148.00-161.00 |

144.00-158.00 |

142.00-156.00 |

140.00-155.00 |

MARKET UPDATE

In September the euro weakened further versus the US dollar in terms of London closing rates, moving from 1.0844 to 1.0576. The ECB at its meeting in September raised the key policy rate by 25bps to 4.00%, following the 25bp hike in July taking the cumulative tightening to 450bps. The ECB has now halted APP reinvestments, and increased the pace of QT to around EUR25 billion per month. In addition, the ECB announced its intention "to set the remuneration of minimum reserves at 0%”.

OUTLOOK

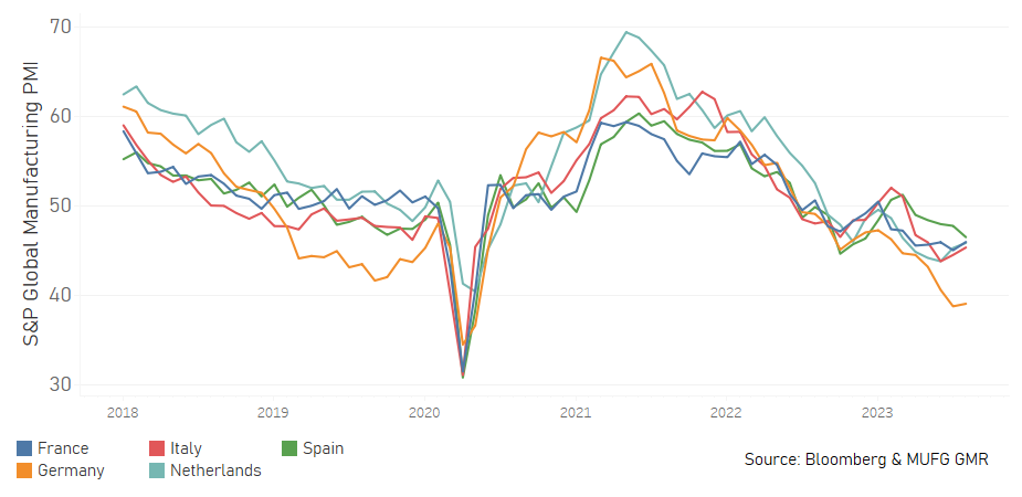

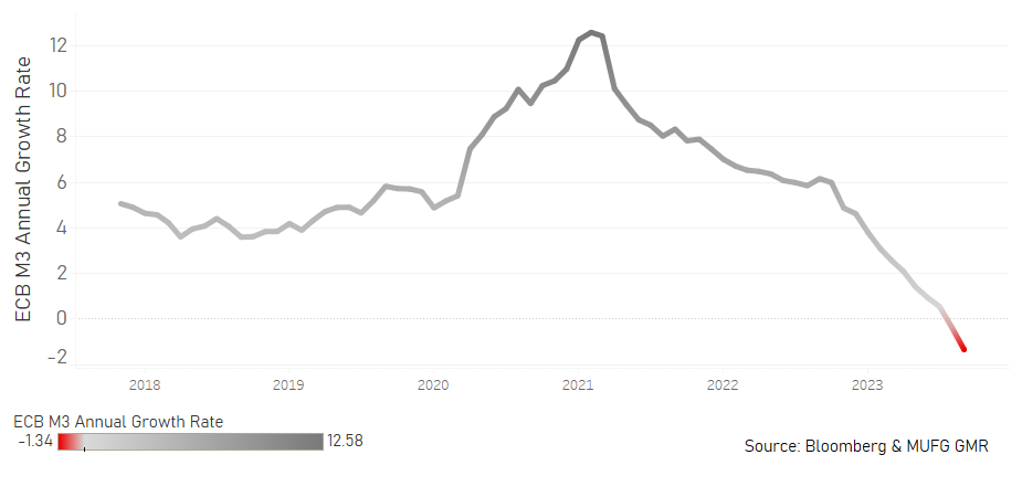

The euro is approaching lows of the year just below the 1.0500-level and the depreciation in September looks set to extend over the coming months – we see a window of dollar strength persisting over the coming months before the data turns weaker in the US and the EUR/USD rate can partially retrace declines over recent months. The macro-economic backdrop in the euro-zone is also unfavourable with Germany continuing to suffer lost competitiveness related to high energy costs and China subsidised exports. The German manufacturing PMI increased marginally in September to 39.8 (from 39.1) but has only been at these levels or worse during the pandemic and the GFC. The German levels stand out and are roughly 5ppts lower than other key countries like France, Italy and Spain. The transmission of monetary tightening is also likely to weigh on growth in the euro-zone too, just like the US, and M3 money supply data underlined the tightening of financial conditions. M3 money supply contracted by 1.3% YoY in August from -0.4% in July. The swing in the YoY rate over 12mths was -7.5ppts, approaching the scale of change in annual M3 during the GFC, which at its worst point was 8.3ppts.

The decision of the ECB to hike to 4.00% in September was accompanied by guidance in the statement that strongly suggests the ECB now intends to pause and allow time to assess the impact of the 450bps of tightening undertaken so far in this cycle. We believe this marks the end of the tightening cycle in the euro-zone and currently pencil the first rate cut from the ECB in Q2 2024. The updated forecasts from the ECB imply upside risks to our view although we believe the ECB is being too pessimistic in regard to its inflation forecasts. The inflation forecast for 2024 was increased from 3.0% to 3.2% while the 2025 forecast was reduced from 2.2% to 2.1%. We believe real GDP growth will prove weaker than the ECB forecasts (1.0% in 2024 and 1.5% in 2025) which would open up scope for inflation to be lower than anticipated. But the relative growth development next year will be much more skewed to the slower growth in the US relative to the euro-zone. The Fed we believe will be more responsive and will cut sooner given the ECB has been hiking into an already weak economy – so will be slower to respond to further economic weakness.

The rise in EUR/USD does not reflect any particular positive view on the outlook for the euro-zone economy and is more a reflection of reduced energy price fears and a larger deterioration in US economic conditions as US consumption slows notably.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

4.00% |

4.00% |

4.00% |

3.75% |

3.50% |

|

3-Month Bill |

3.81% |

3.90% |

3.80% |

3.40% |

3.00% |

|

10-Year Yield |

2.84% |

2.70% |

2.60% |

2.40% |

2.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year German bund yield surged in September, by 37bps to close at a new high of 2.84% and reflected more the surge higher in global yields as investors take on board the communications from major central banks that policy rates will need to remain higher for longer to bring inflation back to target. The price action toward month-end was certainly indicative of this move turning into a ‘pain-trade’ with forced selling as yields break higher. Speculation of another change to BoJ policy added to the global upward momentum in yields. There was not a lot in the data flow from the euro-zone to justify such a surge. Indeed the advance inflation data for Germany came in weaker with the annual rate dropping sharply from 6.4% to 4.3% in September. The PMI manufacturing data for Germany also suggests ongoing weak economic activity. Term premia are clearly moving higher and given the global QT, high levels of sovereign debt and less anchored inflation expectations, yields are set to remain higher than before. Given the scale of the move in September we have revised higher our yield profile, although we maintain a gradual decline from here.

BREAKDOWN OF EURO-ZONE PMI SURVEYS BY COUNTRY

EURO-ZONE BROAD MONEY SUPPLY GROWTH

Pound Sterling

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

EUR/GBP |

0.8668 |

0.8600 |

0.8750 |

0.8800 |

0.8850 |

|

GBP/USD |

1.2201 |

1.2150 |

1.2570 |

1.2730 |

1.2660 |

|

GBP/JPY |

182.25 |

176.20 |

173.50 |

173.10 |

169.60 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.1700-1.2600 |

1.2000-1.3000 |

1.2200-1.3200 |

1.2300-1.3300 |

MARKET UPDATE

In September the pound weakened further against the US dollar in terms of London closing rates from 1.2667 to 1.2151. In addition, the pound weakened against the euro, from 0.8561 to 0.8668. The BoE at its policy meeting in September held the key policy rate at 5.25%, after 14 consecutive rate increases. The decision was not unanimous with a split vote (5-4).

OUTLOOK

The pound suffered further losses in September as it was undermined by a shift in BoE rate expectations following some weaker inflation data. That shift in expectations was reinforced by the decision of the MPC to leave its policy stance unchanged at its meeting in September. The split decision underlined the opposing risks that the MPC considered and also reflected market pricing which was priced at around 50-50 for a hike. The majority of five argued that lower inflation than anticipated and signs of weakening labour demand justified the pause. Prior weaker inflation data and the decision to pause has seen a dramatic shift in the rate market that we see as justified. Since the middle of July the OIS market has moved from pricing 125bps of hikes by February next year to around 20bps. We believe this pause will mark the end of this tightening cycle as inflation continues to decelerate and importantly as labour demand eases and wage growth decelerates from the current record level. The pause by the BoE is likely in part due to a desire to have the ability to hold the policy rate at this level for longer – the “table mountain” reference made by Chief Economist Huw Pill in August.

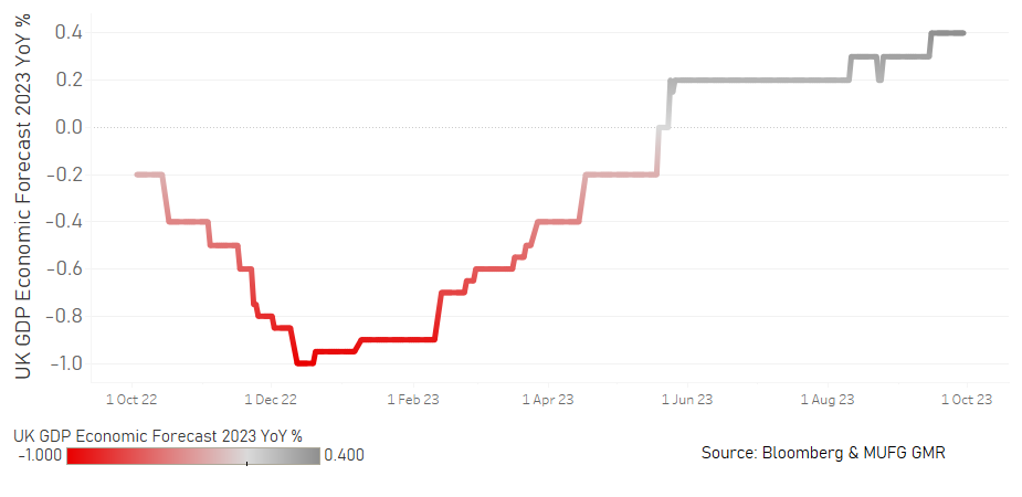

But even though the BoE has paused a little sooner than expected, downside risks to the economy remain high. The good news is that we have had upward revisions to GDP growth in the UK. The ONS on Friday confirmed an upward revision to GDP that left GDP as of June 2% larger than originally reported. It means the UK economy is now actually 1.8ppts larger than its pre-covid size. This means there is more spare capacity than previously assumed and leaves the outlook for inflation less problematic – in essence there is less of a stagflation mix for the economy. However, the data is turning weaker and we expect that to continue and the 20-30bps of rate hikes still priced will be reduced further. The housing market has worsened with the RICS House Price Index has plunged to -67.6, the worst since the GFC. Employment dropped 207k in data for July with the unemployment rate now 0.8ppt higher at 4.3 while GDP for July contracted by 0.5%. The advance PMIs also worsened for September. We suspect the BoE has already overdone it with tightening and see potential for rates to soften relative to other major developed economie

The pound was the worst performing G10 currency in September. This not only reflected the surprise pause from the BoE but also the scale of deterioration in the economic data. We see GBP underperformance from here and in circumstances of a weakening dollar, weakness will be more evident versus EUR.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

5.25% |

5.25% |

5.25% |

5.00% |

4.50% |

|

1-Year Yield |

5.11% |

5.10% |

4.90% |

4.50% |

3.90% |

|

10-Year Yield |

4.44% |

4.30% |

4.20% |

4.00% |

3.70% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield increased in July, by 8bps to close at 4.44%. This was considerably less than the increase in the US with the 10-year UST bond yield advancing by a huge 46bps. The smaller gain for Gilt yields of course reflected the decision to pause the monetary tightening cycle but in addition given the weakness of the economic data and in particular the sharper drop in inflation. The smaller rise in yields unfolded despite the decision of the BoE to accelerate the pace of QT from GBP 80bn to 100bn. The OIS curve in the UK has more tightening priced than in the US which we believe given the macroeconomic backdrop doesn’t make sense. Hence, we expect further adjustments in rate expectations that will keep yields pressured to the downside. We remain confident that inflation will continue to decelerate and the BoE has highlighted the potential for a sharper drop in the October data released in November (utility bill base-effect). Of all the major advanced economies, the UK is showing the greatest signs of monetary tightening transmission and hence we expect yields to in or around its peak of cycle now and see yields declining from here.

UK 10-YEAR GILT YIELD

CONSENSUS FORECAST FOR UK GDP GROWTH IN 2023

Chinese renminbi

|

Spot close 29.09.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/CNY |

7.2960 |

7.1500 |

7.0500 |

6.9500 |

6.8500 |

|

USD/HKD |

7.8306 |

7.8200 |

7.8200 |

7.8100 |

7.8000 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.0000-7.3500 |

6.9000-7.2500 |

6.8000-7.1500 |

6.7000-7.0500 |

|

|

USD/HKD |

7.7800-7.8600 |

7.7800-7.8600 |

7.7700-7.8500 |

7.7600-7.8400 |

MARKET UPDATE

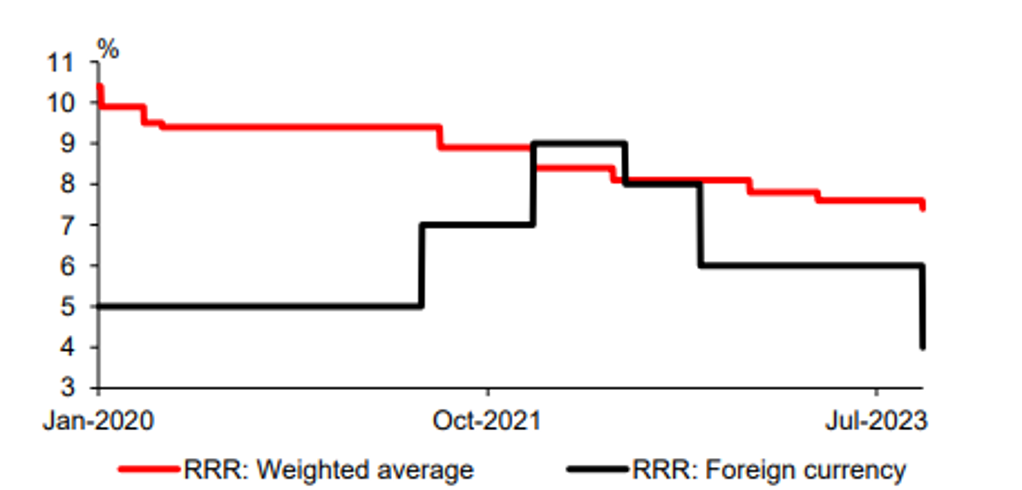

In September, USD/CNY edged up from 7.2588 to 7.2960. The PBOC held the 1-year MLF steady at 2.50% on 15th September, and kept its 1-year and 5-year LPR rates unchanged at 3.45% and 4.20% respectively on 20th September. Meanwhile, the PBOC announced on 1st September a cut to the foreign exchange reserve requirement ratio (RRR) of 200bps to 4%, effective on 15th September, and announced on 14th September a cut to the RRR by 25 bps for all banks, except those that have implemented a 5% reserve ratio, effective from 15th September.

OUTLOOK

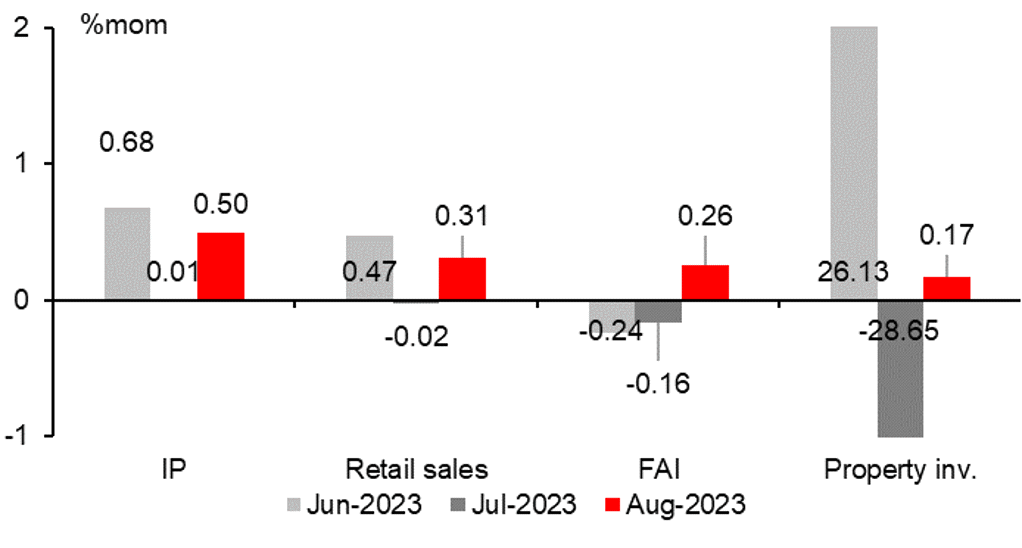

While sequential growth of China’s key data including IP, retail sales, FAI and property investment were positive in August, year-on-year growth of these indicators remained mixed. While year-over-year growth of IP and retail sales accelerated and surprised the market to the upside, growth of YTD FAI edged lower, and the year-over-year contraction of YTD property investment became more severe in August.

Market sentiment was pressured by the stress of the Chinese economy, particularly the persisting stress in real estate sector implied by the August data. The government has been stepping up policy support for the real estate sector and the overall economy since late August. On 20th September, Guangzhou announced new measures to relax home purchases for the non-core districts and for non-local residents. On 28th, Shenzhen lowered the lower limit of the first home mortgage rate by 40bps. These moves came after the Chinese authorities’ announcement in late August promising a slew of stimulus measures, including relaxing criteria for first-time homebuyers, lowering down payments for homebuyers and cutting mortgage rates for first-time homebuyers. On 27th September, the PBoC reiterated again such policy stances in its third Quarter Monetary Policy Committee meeting, together with the emphasis of enhancing counter-cyclical and cross-cyclical adjustment, and stepping up the implementation of the monetary policies that have been introduced. Although various policies are being rolled out to bolster the property market, market participants’ continued negative sentiment can be explained by the elevated level of housing inventory. With floor space waiting for sale rising by 18.2%yoy to 648 million square metres in August, elevated inventory suggests only a moderate property sector recovery at best in the near term.

Look ahead, with continuous policy support and emerging positive sentiment in some parts of economy, e.g., a positive 17.6%yoy of industry profit in August, we expect more upside than downside for CNY against USD ahead. Other factors, like elevated US Treasury yields and the strong US dollar, would work on CNY in the opposite direction and may imply some volatility of USD/CNY. Having said that, we do not expect a material increase of USD/CNY from the current 7.3000-level, as the PBOC is quite clear on its intention of preventing USD/CNY from rising further, implied by the fact that CFETS USD/CNY fixing was set 1426pips lower than the Bloomberg fixing survey number on 28th September.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Loan Prime Rate 1Y |

3.45% |

3.35% |

3.35% |

3.35% |

3.35% |

|

MLF 1Y |

2.50% |

2.40% |

2.30% |

2.40% |

2.50% |

|

7-Day Repo Rate |

1.80% |

1.70% |

1.70% |

1.70% |

1.70% |

|

10-Year Yield |

2.68% |

2.55% |

2.55% |

2.65% |

2.75% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

China’s 10-year government bond yield climbed from 2.57% to 2.68% in September. Will this recent increase in the government bond yield persist for long? Unlikely, in our view. While from the perspective of solving economic difficulties, in a situation where both households and enterprises are now reluctant to level up, increasing government leverage may be a more convenient and effective solution. The direct implication of rising government leverage is the pressure for interest rate to rise higher. However, to alleviate fiscal pressure, monetary policy is likely to be further relaxed, and, as real estate demand is unlikely to rebound materially, new floor area started will still remain low. These, together with overcapacity in industrial sectors, may lead to low corporate financing needs, weighing on interest rate. In terms of the supply, the supply of bonds in the fourth quarter could be lower than in the third quarter. So, the variable part will be the size of the government bonds, and the evaluation of them whether or not the issuance can boost economic recovery.

KEY ECONOMIC ACTIVITIES ROSE ON M-O-M BASIS IN AUGUST

Source: CEIC, MUFG GMR

PBOC CUT RRR AND FOREX RRR IN SEPTEMBER

Source: Bloomberg, MUFG GMR