Please download PDF from above for all the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

November 2023

KEY EVENTS IN THE MONTH AHEAD

1) FOMC & US ECONOMY KEY FOR US DOLLAR

The momentum of the US dollar that had been strongly positive since the dollar lows in July faded somewhat in October. The dollar did advance further, closing 0.5% stronger (DXY basis) – the third consecutive month of appreciation but also the smallest. November event risk will be focused more in the early part of the month with the FOMC meeting on 1st November and the US jobs report on 3rd November. An unchanged monetary stance is highly likely and hence the communication in the post-meeting press conference will shape market expectations on FOMC thinking. We maintain that the FOMC tightening cycle is over but data through November will be key in determining FOMC action in December. A failure of the data to reveal a slowdown and/or higher than expected inflationary pressures could see expectations shift in favour of a hike. The market is currently indicating about a 25% probability of a 25bp hike. Jobs, wages and inflation data will be key in November and December ahead of the final FOMC meeting of 2023 on 13th December. We believe the FOMC has completed its tightening cycle and by the time of that final FOMC meeting it will be more obvious that the FOMC has completed its tightening cycle which we believe will result in a turn in the dollar trend toward depreciation.

2) GEOPOLITICAL RISKS TO REMAIN ELEVATED

The attack on Israel by Hamas on 7th October has resulted in elevated geopolitical risks and investors in November will be monitoring closely for signs of the Israel-Hamas conflict broadening out. Higher crude oil and natural gas prices is the financial market risk which would have greater negative implications for Europe and would be a catalyst for further declines in EUR/USD. What will be the implications for the Russia-Ukraine conflict? A new House Speaker in Washington looks set to lead opposition to additional funding for Ukraine with the focus shifting to support for Israel. The new House Speaker – Mike Johnson – is a hardcore Trump supporter and is now tasked with negotiating a deal with his own party and the Democrats to avoid a government shutdown from 17th November. There is a sense with so little time since his election that a deal will be reached to extend the stopgap period until 15th January or even 15th April.

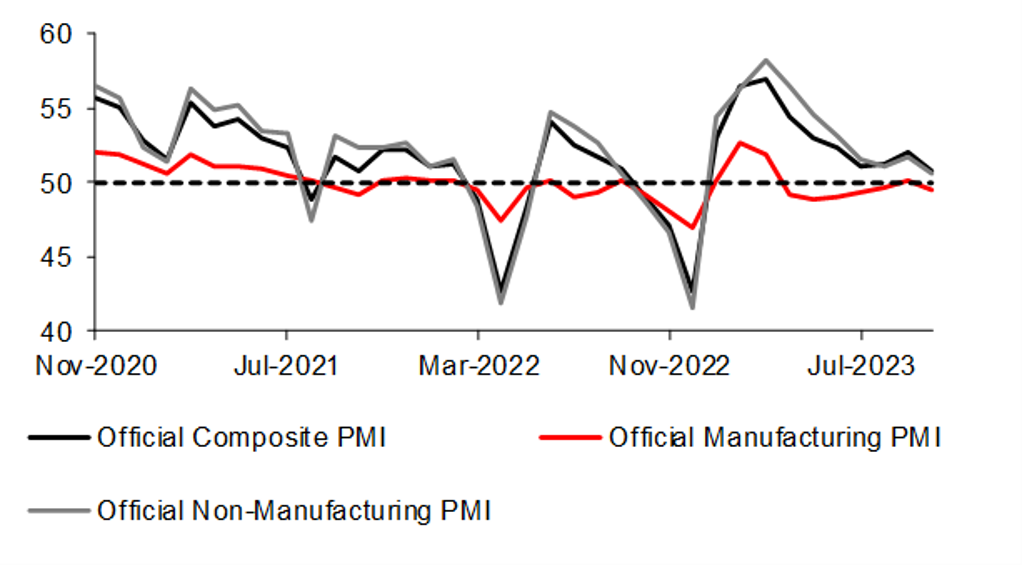

3) FURTHER EASING IS EXPECTED TO BOOST GROWTH

As September monthly activity data and Q3 23 GDP figures offered signs of improvement, China’s official NBS PMI data for October released at the end of last month came in a slight shock, with manufacturing activity returning to contraction and non-manufacturing sector expanding at a slower pace. That suggested that the Chinese economy is still struggling, calling for the need for more policy support, in both fiscal and monetary side, to spur a faster growth.

Forecast rates against the US dollar - End-Q4 2023 to End-Q3 2024

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

JPY |

151.56 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR |

1.0562 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

GBP |

1.2127 |

1.2010 |

1.2570 |

1.2730 |

1.2660 |

|

CNY |

7.3158 |

7.1500 |

7.0500 |

6.9500 |

6.8500 |

|

AUD |

0.6327 |

0.6300 |

0.6600 |

0.6700 |

0.6700 |

|

NZD |

0.5809 |

0.5800 |

0.6100 |

0.6200 |

0.6200 |

|

CAD |

1.3888 |

1.3900 |

1.3500 |

1.3300 |

1.3200 |

|

NOK |

11.180 |

11.196 |

10.455 |

10.179 |

10.089 |

|

SEK |

11.178 |

11.292 |

10.636 |

10.357 |

10.179 |

|

CHF |

0.9100 |

0.9280 |

0.8770 |

0.8570 |

0.8480 |

|

|

|

|

|

|

|

|

CZK |

23.259 |

23.640 |

22.640 |

22.320 |

22.320 |

|

HUF |

362.07 |

368.40 |

359.10 |

357.10 |

361.60 |

|

PLN |

4.2147 |

4.2580 |

4.0910 |

4.0630 |

4.1520 |

|

RON |

4.7005 |

4.7660 |

4.5450 |

4.4910 |

4.5270 |

|

RUB |

92.921 |

94.090 |

94.740 |

96.770 |

99.620 |

|

ZAR |

18.769 |

18.900 |

19.250 |

19.500 |

19.500 |

|

TRY |

28.292 |

29.750 |

31.500 |

32.500 |

33.000 |

|

|

|

|

|

|

|

|

INR |

83.250 |

83.700 |

83.500 |

83.000 |

82.000 |

|

IDR |

15880 |

15600 |

15550 |

15400 |

15200 |

|

MYR |

4.7615 |

4.6500 |

4.6000 |

4.5500 |

4.5000 |

|

PHP |

56.720 |

57.300 |

57.500 |

57.500 |

57.500 |

|

SGD |

1.3704 |

1.3750 |

1.3550 |

1.3350 |

1.3200 |

|

KRW |

1350.7 |

1335.0 |

1325.0 |

1305.0 |

1285.0 |

|

TWD |

32.391 |

32.000 |

31.800 |

31.400 |

31.000 |

|

THB |

36.071 |

36.450 |

36.200 |

35.700 |

35.200 |

|

VND |

24561 |

24800 |

24800 |

24750 |

24700 |

|

|

|

|

|

|

|

|

ARS |

350.01 |

400.00 |

490.00 |

600.00 |

750.00 |

|

BRL |

5.0543 |

5.2000 |

5.2200 |

5.2500 |

5.2800 |

|

CLP |

898.55 |

900.00 |

890.00 |

885.00 |

880.00 |

|

MXN |

18.078 |

17.800 |

17.900 |

18.000 |

18.100 |

|

|

|||||

|

Brent |

87.67 |

94.00 |

91.00 |

88.00 |

83.00 |

|

NYMEX |

82.37 |

90.00 |

86.00 |

83.00 |

79.00 |

|

SAR |

3.7515 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

30.861 |

30.900 |

31.500 |

32.300 |

34.100 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/JPY |

151.56 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR/USD |

1.0562 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

141.00-155.00 |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

|

|

EUR/USD |

1.0100-1.0900 |

1.0400-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

MARKET UPDATE

In October the US dollar strengthened very marginally against the euro in terms of London closing rates, moving from 1.0576 to 1.0562. However, the dollar strengthened more versus the yen, from 149.37 to 151.56. The FOMC did not meet in October and hence the fed funds rate remained unchanged at between 5.25% and 5.50%. The FOMC has continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month. The balance sheet has now shrunk to USD 7,908bn, down USD 8,965bn from the peak in April 2022.

OUTLOOK

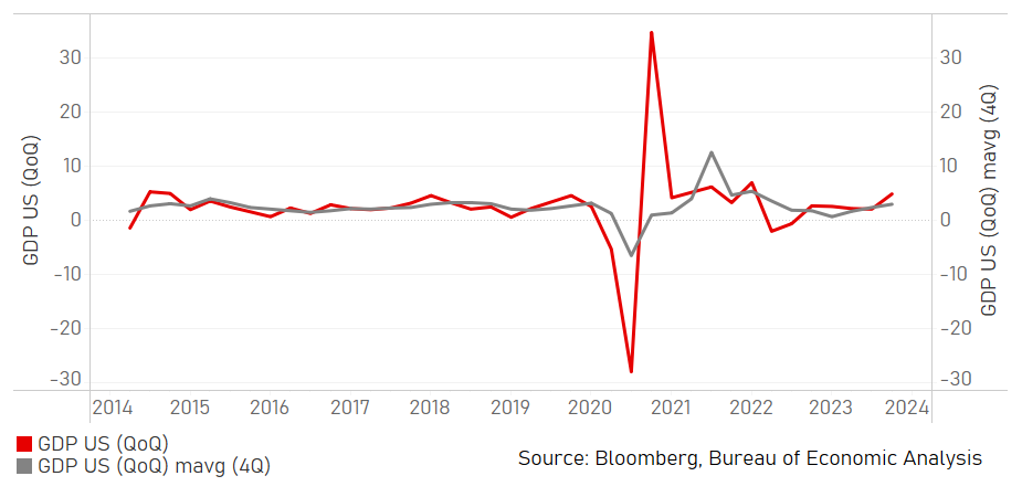

The US dollar flat-lined in October, trading in a narrow trading range but ended the month 0.5% stronger on a DXY basis. The marginal gain for the dollar coincided with another substantial jump in the 10-year UST bond yield, which jumped 36bps and briefly broke above 5.00% for the first time since 2007. The modest US dollar gain on the back of another big jump in yields indicated a softening of the yield/FX correlation that may reflect a lot of good news now being priced into the dollar. The move in yields reflected in part the continued resilience of the US economy with real GDP in Q3 expanding by 4.9% on a Q/Q SAAR basis fuelled in large part by a 4.0% Q/Q gain in consumer spending. However, inventory accumulation also added to growth which could well correct and act as a drag on growth in Q4 while consumer confidence remains fragile and dwindling excess savings and the resumption of college debt servicing mean headwinds lie ahead for the consumer. The market consensus for Q/Q real GDP in Q4 and Q1 2024 is just 0.8% and 0.2% respectively.

The FOMC meets at the start of November and is highly likely to announce an unchanged monetary stance. We also expect Fed Chair Powell to emphasise both the scope to pause given the increased evidence of monetary policy transmission into the financial markets and the fact that inflation remains too high and therefore the FOMC intends to maintain the current stance until there are more signs of inflation slowing toward the 2.0% inflation goal. We would expect the tone to be similar to Powell’s last speech to the Economic Club of New York that suggested the Fed is more cognisant of tighter financial conditions. ‘Philly’ Fed President Harker also stated in October that he was “hearing” that the economy was slowing faster than the official data implied. The fed funds futures Dec 23-24 spread has traded between -50-100bps and currently is at -68bps. We see scope for the markets to begin pricing in more easing by the end of next year as US economic data starts to weaken, which will increasingly weigh on US dollar performance.

As stated here before, the window for dollar strength remains open but the lack of dollar appreciation in October as US yields surged does increase the risks of the scale of dollar gains being more modest than we expect. As the US economy slows, more Fed cuts will be priced and with that dollar weakness will unfold in H1 2024.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

5.33% |

5.38% |

4.88% |

4.38% |

3.88% |

|

3-Month T-Bill |

5.46% |

5.25% |

4.63% |

4.13% |

3.50% |

|

10-Year Yield |

4.93% |

4.50% |

4.38% |

3.88% |

3.63% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

Our long-standing view is that the Fed is likely done (with hiking that is). We view the July 2023 hike of 25bps, which took the mid-point of the Fed Funds Rate Target Range to 5.375%, as most likely the last hike for 2023 and likely for this tightening cycle too. That last point is important to distinguish. If the Fed does not hike at the November and December FOMC meeting (which are the two-remaining meetings for 2023), then the Fed would be on hold for more than six months before the first FOMC meeting in 2024, which would be January. It’s possible that they could hike at the start of 2024, yet it would be a bit awkward because why wouldn’t they have just hiked in December. We think a hold of six months would turn into a longer hold period into 2024, where they would just use forward guidance of “higher for longer”, ongoing QT and potentially push up the 2024 dots at the December SEP updates to keep monetary conditions tight, versus returning to hiking rates again. Meanwhile our view is that the economy will decelerate in 2024 making the above a moot point. And elevated long-term rates are now tightening for the Fed too. (George Goncalves, Head of US Macro Strategy)

US GDP GROWTH

US DOLLAR INDEX VS. UST 10YR YIELD

Japanese yen

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/JPY |

151.56 |

145.00 |

138.00 |

136.00 |

134.00 |

|

EUR/JPY |

160.08 |

151.50 |

151.80 |

152.30 |

150.10 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

141.00-155.00 |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

|

|

EUR/JPY |

150.00-165.00 |

144.00-160.00 |

142.00-158.00 |

140.00-156.00 |

MARKET UPDATE

In October the yen weakened further versus the US dollar in terms of London closing rates from 149.37 to 151.56. In addition, the yen weakened versus the euro, from 157.97 to 160.08. The BoJ at its meeting in October made another change to its YCC framework with the BoJ altering the 1.0% 10-year JGB yield from a limit threshold to a reference rate further underlining the shift to a more flexible YCC framework. The BoJ committed to “large-scale” JGB buying when required which creates greater uncertainty over the reaction function of the BoJ to JGB yield moves going forward. The key policy rate remained unchanged at -0.10%.

OUTLOOK

The yen weakened in October versus the US dollar to levels above 150.00 and this weakness persisted after the BoJ announced another tweak to the YCC framework that provided further evidence of the desire of the BoJ to move away from the policy of controlling long-term yields. The 1.0% maximum level that triggered unlimited JGB buying at that 1.0% level was abandoned by the BoJ at its October meeting but this didn’t contain the shock element of the infamous policy easing announced on Halloween in 2014. This announcement had been well flagged through reports in the Nikkei and the BoJ’s commitment to continue with large scale JGB buying at levels above or even below the new “reference rate” of 1.0% failed to meet market expectations of a bolder move. The yen weakened sharply in response and a sharp move at month-end could result with intervention given the MoF indicated it is on “standby”. The MoF confirmed no intervention took place in October.

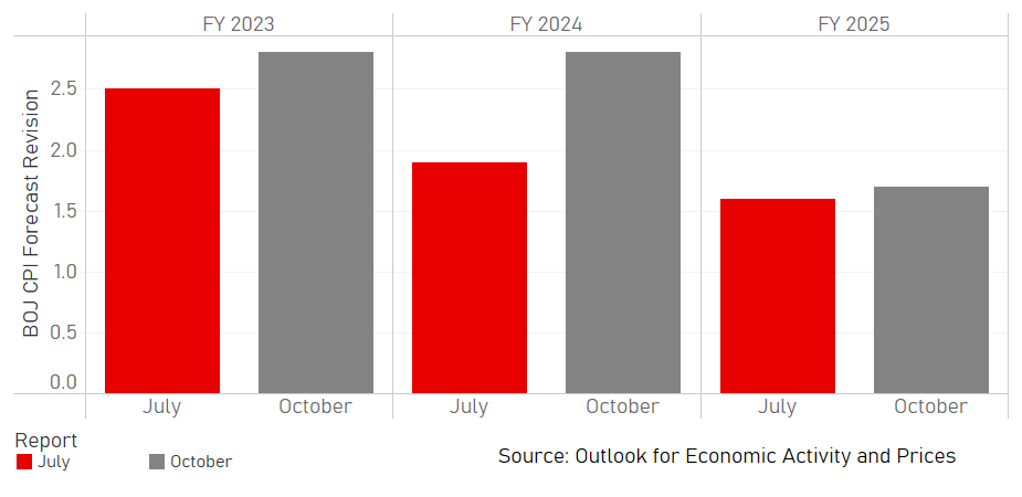

The real significance of this change in the 1.0% 10-year to a “reference rate” will only be clear once we see how the BoJ responds to moves higher in yields – continued aggressive JGB buying would make the change in policy less meaningful. We suspect though that the announcement is another strong signal of YCC becoming less important which will reinforce focus on NIRP. We outlined in September the prospect of NIRP ending in January 2024 and this remains plausible. The BoJ raised its target CPI forecasts for each fiscal year but importantly the FY2025 level, while 0.1ppt higher at 1.7%, remains below target. Wage data and wage negotiations in the spring will be important (hence a change in policy could be Apr 2024 rather than Jan) in shaping BoJ thinking. Rengo confirmed in October that it was recommending union memberships to seek a wage increase of “no less than 5.0%” for the year starting in April 2024. Scheduled hours for full-time workers saw the annual rate of pay slow to 1.6% in August from 2.0% in July.

The end of NIRP in Japan would be a very significant development and if we are correct that this happens in January (or April latest) at around the same time as investors price more rate cuts in the US and Europe, we see scope for the yen selling to come to an end. This should mark the turning point to yen strength reinforced by the renewed increase in Japan’s current account surplus.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

-0.10% |

-0.10% |

0.10% |

0.10% |

0.10% |

|

3-Month Bill |

-0.20% |

-0.02% |

0.10% |

0.10% |

0.10% |

|

10-Year Yield |

0.95% |

0.90% |

1.00% |

1.10% |

1.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased further in October, by 18bps to close at 0.95% with the biggest portion of that increase (6bps) taking place on the last day of the month in response to the BoJ announcement of another tweak to the YCC framework. The intention of the BoJ looks clear – to gradually erode the importance of YCC to the point when it becomes meaningless. The YCC change looks set to result in an imminent breach of the 1.00% level in 10yr JGBs although moves beyond that level should then slow as UST bond yields peak and start to move lower. Assuming NIRP is ended in January (or April latest) we see scope for the entire yield curve to adjust higher given the significance of losing that negative rate anchor for the Japan rates curve. Of course there are risks to this view and we see action as required sooner rather than later given the global conditions (US recession) could worsen in 2024 and make the BoJ’s task of altering policy that bit harder. Governor Ueda also confirmed that the option of conducting fixed-rate JGB buying operations would always be available which will help limit any abrupt move higher in yields.

BOJ CPI FORECAST REVISIONs

BOJ PURCHASES OF JGBS

Euro

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

EUR/USD |

1.0562 |

1.0450 |

1.1000 |

1.1200 |

1.1200 |

|

EUR/JPY |

160.08 |

151.50 |

151.80 |

152.30 |

150.10 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0100-1.0900 |

1.0400-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

|

|

EUR/JPY |

150.00-165.00 |

144.00-160.00 |

142.00-158.00 |

140.00-156.00 |

MARKET UPDATE

In October the euro weakened marginally versus the US dollar in terms of London closing rates, moving from 1.0576 to 1.0562. The ECB at its meeting in October held the key policy rate at 4.00%, following the 25bp hike in September taking the cumulative tightening to 450bps. The ECB has now halted APP reinvestments, and increased the pace of QT to around EUR25 billion per month. An ECB review of its operational framework is expected to be completed around spring 2024.

OUTLOOK

The depreciation of the euro looked set to extend further toward parity versus the dollar in October but EUR/USD has been remarkably resilient and after hitting a low of 1.0448 in early October managed to recover and end close to unchanged. What has been notable has been the market moves that have taken place more widely would normally be clear negative developments for EUR/USD. The rise in US yields means the 10yr UST/Bund spread widened by around 30bps; the BTP/Bund spread widened to over 200bps (although this reversed by month-end); the outbreak of the conflict between Israel and Hamas resulted in a 5% jump in crude oil prices since the attack by Hamas and natural gas prices in Europe surged 30% in October. The failure of EUR/USD to drop points to EUR/USD having already captured peak optimism in relation to the US economy and peak pessimism in relation to the euro-zone. Last year, EUR/USD fell from 1.0500 to 0.9500 on a disaster scenario of a dire recession due to surging natural gas prices. That didn’t pan out as bad as expected and EUR/USD recovered. Without some specific catalyst, it is difficult to envisage a sustained drop again down toward or below parity.

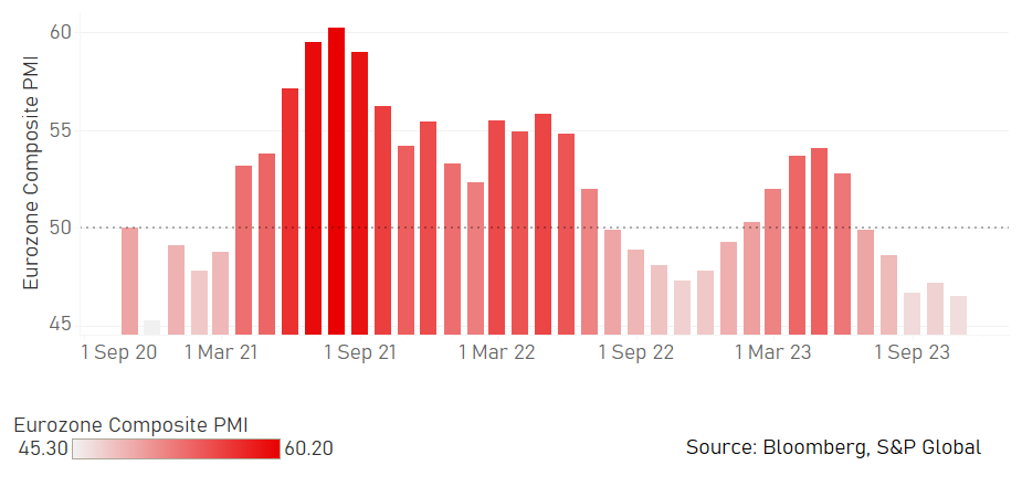

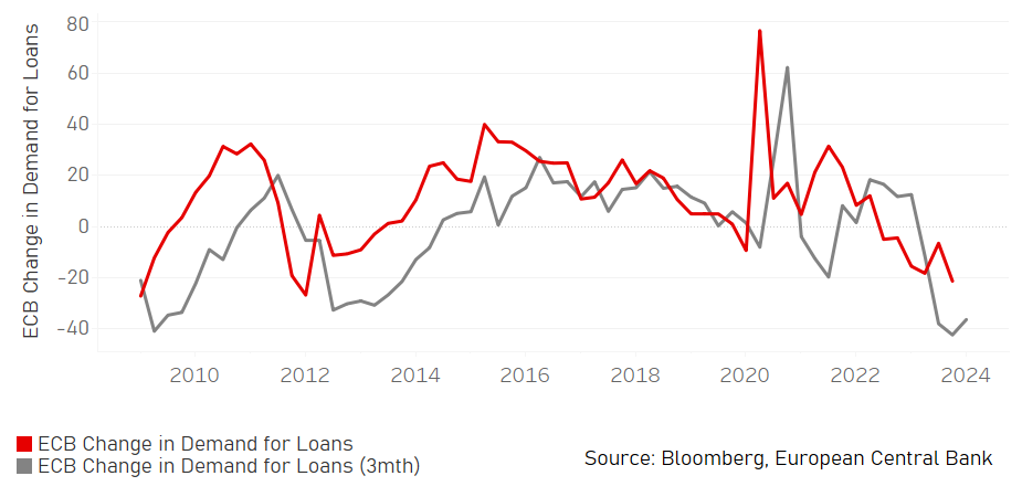

While EUR has been resilient it remains difficult to argue strongly that EUR should appreciate notably at this stage either. The ECB at its policy meeting in October announced an unchanged monetary stance which was fully expected but also took a more cautious approach in relation to balance sheet policy. There had been speculation of a signal being given that a change in policy on the balance sheet was being discussed but this did not happen. The ECB statement repeated that past policy decisions were being “transmitted forcefully into financial markets” with the ECB describing economic conditions as “weak” with downside risks maintained. The fact that the ECB refused to discuss change to PEPP guidance, or alter the minimum reserve requirements, or to criticise Italy over fiscal policy slippage suggests to us a desire of the ECB not to tighten financial conditions further at this stage. The euro-zone Composite PMI fell to 46.5 in October, the worst reading since November 2020. The ECB Bank Lending Survey also saw demand from enterprises for loans falling to the lowest level since the GFC.

We believe we are close to the point when US fundamentals switch to signalling USD selling. Until then, despite recent EUR resilience, risks of another downside lurch toward parity remain given the weak fundamental backdrop in the euro-zone.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

4.00% |

4.00% |

4.00% |

3.75% |

3.50% |

|

3-Month Bill |

3.80% |

3.90% |

3.80% |

3.40% |

3.00% |

|

10-Year Yield |

2.81% |

2.70% |

2.60% |

2.40% |

2.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

Remarkably, given the 36bp jump in the 10yr UST bond yield, the German bund yield finished close to unchanged, falling 3bps to 2.81%. We mentioned above the increased caution by the ECB at its meeting in October given the weak economic backdrop that may have the ECB thinking that the transmission of monetary policy is happening faster than expected. The data on inflation also provided the ECB with reason for caution on tightening financial conditions further. The German advance CPI data for October revealed a -0.2% m/m reading, in contrast to the +0.1% expected. As a result, the annual rate fell sharply, from 4.3% to 3.0%, the lowest level since June 2021. Euro-zone annual CPI fell from 4.3% to 2.9%. Weak growth is nothing new for the ECB but a faster decline in inflation could prompt a shift in ECB rhetoric that could reinforce market expectations of sooner than expected cut. The OIS market now has about 70bps of easing priced by October 2024. We see the 10-year Bund yield as close to peaking out given the recent faster declines in inflation. We continue to expect the first rate cut from the ECB in Q2 2024.

EURO-ZONE COMPOSITE PMI SURVEY

EURO-ZONE BANK LENDING SURVEY

Pound Sterling

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

EUR/GBP |

0.8709 |

0.8700 |

0.8750 |

0.8800 |

0.8850 |

|

GBP/USD |

1.2127 |

1.2010 |

1.2570 |

1.2730 |

1.2660 |

|

GBP/JPY |

183.80 |

174.20 |

173.50 |

173.10 |

169.60 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.1600-1.2500 |

1.1900-1.2900 |

1.2100-1.3100 |

1.2200-1.3200 |

MARKET UPDATE

In October the pound weakened marginally against the US dollar in terms of London closing rates from 1.2151 to 1.2127. However, the pound weakened more against the euro, from 0.8668 to 0.8709. The MPC did not meet in October and hence the key policy rate remained at 5.25%, following 14 consecutive rate increases through to August before a pause in September. The MPC next meets on 2nd November.

OUTLOOK

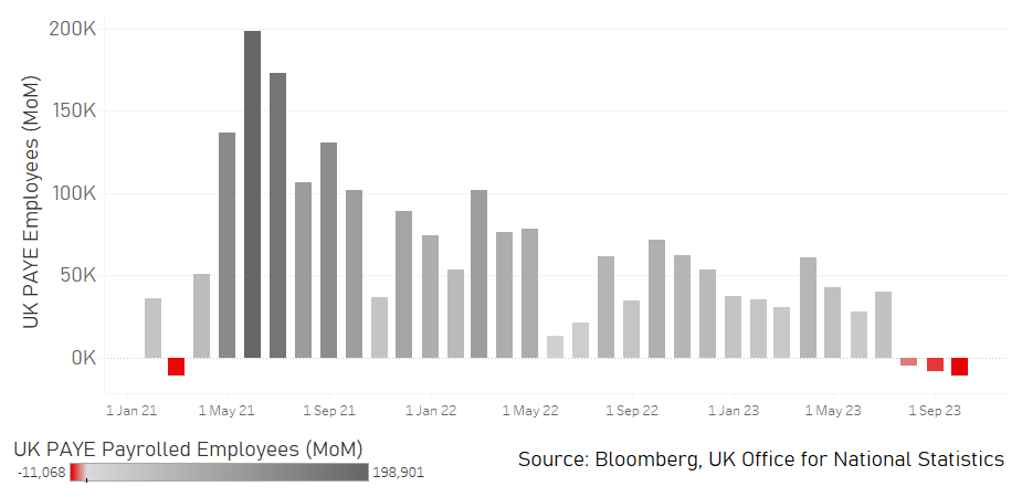

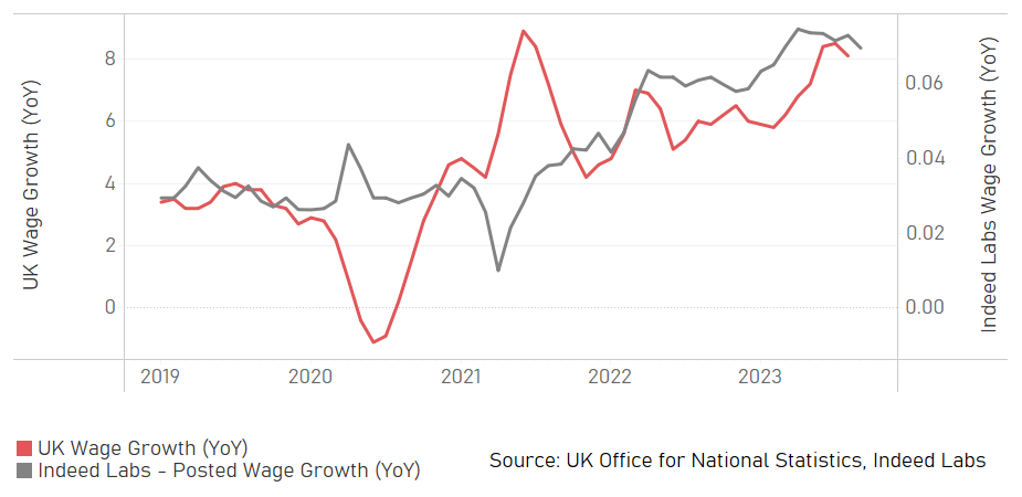

The pound was basically close to unchanged versus the US dollar in October but weakened versus the euro with EUR/GBP hitting levels not seen since May. We see the underperformance versus the euro as an indication of the risks going forward when we see US dollar weakness allowing GBP/USD to move higher but the pound underperforming against other G10 currencies like EUR. The macro backdrop is deteriorating and the transmission of monetary tightening could be hitting the real economy more quickly than the BoE expected. There was plenty of evidence of that in October. Labour demand continues to weaken and the monthly employment data derived from PAYE data for September revealed a 11k drop in employment, the third decline in a row. Survey data shows this is now impacting wage growth. The KPMG/REC survey revealed starting salaries and pay for temporary workers increased at the slowest pace in over two years. This reflected strains on company’s ability to pay and increased labour supply following job layoffs. The property market slump is hitting property and construction companies with insolvencies in Q2 and Q3 the highest since the GFC. The RICS House Price index is now at levels also not seen since the GFC.

This is not an ideal backdrop for the BoE given the level of inflation remains elevated. The annual CPI rate remained unchanged at 6.7% in September while the core CPI rate stood at 6.1% - both rates were 0.1ppt higher than expected. The BoE therefore at the November MPC meeting is likely to maintain a hawkish message of inflation being too high and that rates will need to remain higher for longer. Nonetheless, inflation does look set to fall notably. BRC shop price inflation fell to 5.2% (from 6.2%) for a fifth month in a row in October with food inflation down for a sixth month at 8.8%. The OFGEM cap jumped 80% in October 2022 which will fall out of the annual rate in CPI data for October released in November, and the downward momentum will be reinforced by a 7% cut this October. There is only 30bps of rate cuts priced by September 2024 which we view as far too conservative and we expect going forward to see a shift in rhetoric from the BoE that will encourage more rate cuts to be priced for the second half of 2024.

We view the macro backdrop in the UK as increasingly negative with rate hikes likely to weigh further on activity. Falling inflation will allow the BoE to shift focus to growth which will see yields head lower. GBP underperformance will be much more evident versus non-USD G10 given our expectations of USD depreciation in 2024.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Policy Rate |

5.25% |

5.25% |

5.25% |

5.00% |

4.50% |

|

1-Year Yield |

5.01% |

5.30% |

5.15% |

4.70% |

4.10% |

|

10-Year Yield |

4.51% |

4.40% |

4.30% |

4.00% |

3.70% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield continues to trade either side of 4.50% and this range around that level has persisted since the 4.50% was first reached in June. In October, the 10-year Gilt yield increased by 7bps to close at 4.51%. This is a much smaller move than the 36bp increase in the UST bond 10-year yield and the more limited move in Gilt yields was similar to the limited move in German bund yields as well. The macro backdrop in Europe is certainly more consistent with yields remaining at lower levels given the increased signs of recessionary conditions with more monetary tightening still to feed into the real economy. A stated above, the data on inflation in the UK should be about to improve but the growth backdrop is set to worsen. That mix should help reinforce the potential for the next move being down in Gilt yields. The view incorporates our expectation of UST bond yields also peaking out as the US economy slows and the FOMC starts to shift away from hawkish rhetoric next year. We expect the MPC to cut rates for the first time in Q2 2024 after the FOMC has cut and around a similar time as the ECB.

MONTHLY EMPLOYMENT DATA FROM UK PAYE

UK WAGE GROWTH VS. INDEED LABS WAGE GROWTH

Chinese renminbi

|

Spot close 31.10.23 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

USD/CNY |

7.3158 |

7.1500 |

7.0500 |

6.9500 |

6.8500 |

|

USD/HKD |

7.8246 |

7.8200 |

7.8200 |

7.8100 |

7.8000 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.0000-7.3500 |

6.9000-7.2500 |

6.8000-7.1500 |

6.7000-7.0500 |

|

|

USD/HKD |

7.7800-7.8600 |

7.7800-7.8600 |

7.7700-7.8500 |

7.7600-7.8400 |

MARKET UPDATE

In October, USD/CNY edged up from 7.2980 to 7.3158. The PBOC held the 1-year MLF steady at 2.50% on 16th October, and kept its 1-year and 5-year LPR rates unchanged at 3.45% and 4.20% respectively on 20th October.

OUTLOOK

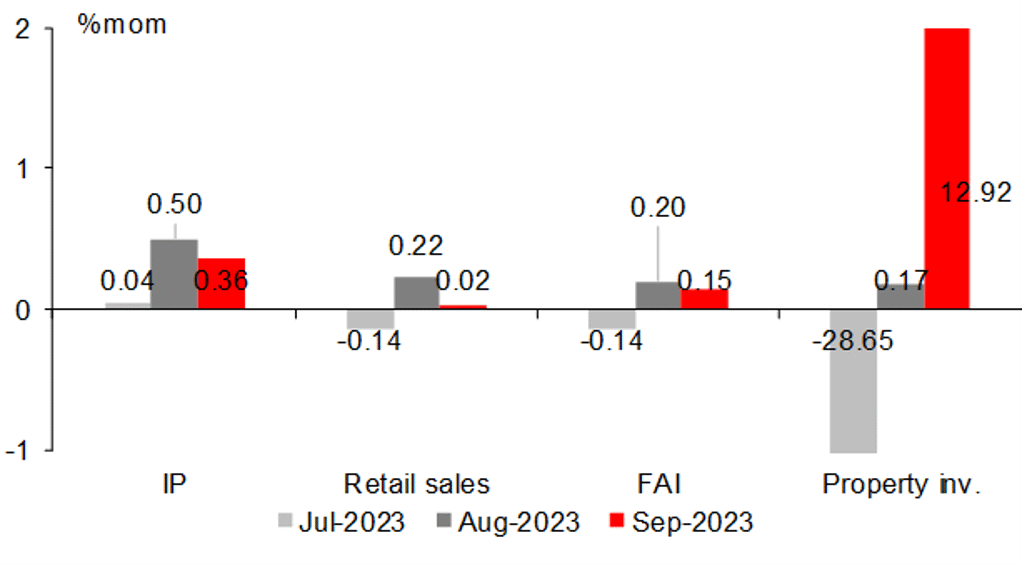

The Chinese yuan extended losses against the US dollar last month amid persistent foreign equity outflows, with the Northbound Stock Connect recording a roughly US$5.48 billion worth of net sales in the month (after a US$5.13 billion net sales in August), despite the release of stronger-than-expected Q3 real GDP growth and stronger-than-expected retail sales and industrial production growth. Market participants remained concerned about the worsening property investment’s annual contraction in September and the continued decline in September of newly built commercial residential building prices in 70 Chinese cities. And the latest published China October PMIs indicated that the pace of China’s economic activity slowed further in October, with the official NBS manufacturing PMI surprisingly registering a below-50 reading of 49.5 in October (down from 50.2 in September), and the non-manufacturing NBS PMI sliding to 50.6 in October from a 51.7 in September. China’s NBS composite PMI declined to 50.7 in October from September’s 52.0.

Having said the above, while recent data may signal the risks in China’s economic recovery, policy makers’ awareness of the various risks, and the unusually timed fiscal expansion announcement, signalled the government’s willingness and determination to do more to shore up China’s economic performance. The plan of using the proceeds of the issuance of an extra RMB 1 trillion government bonds for local disaster prevention, relief and post-disaster recovery and reconstruction, implies that in the next few months, government investment will likely play a more positive role in driving up corporate orders and boosting economic activity. On 30th October, President Xi China's kicked off the two-day National Financial Work Conference, this twice per decade, highest level meeting, is expected to set the tone and direction for the country’s major financial sector reforms for the next five years. Another key event in Q4 will be the Central economic Work Conference. We expect plans for structural reforms including ones tackling local government debt issues. Detailed and viable reform plans would help to ensure a healthy growth prospect for China and to achieve improved sentiment unattainable by cyclical measures alone.

For the near term, factors like persisting large negative interest rate differentials over the US, a strong US dollar more broadly and concerns over China’s property sector will weigh on CNY and keep USD/CNY around 7.3 in near term. Our views of the Chinese economy achieving this year’s annual growth target of ‘around 5’ and potential improving sentiment still point to a stronger CNY by year-end. We expect USD/CNY to drift lower to around 7.15 by the end of 2023.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Loan Prime Rate 1Y |

3.45% |

3.35% |

3.35% |

3.35% |

3.35% |

|

MLF 1Y |

2.50% |

2.40% |

2.30% |

2.40% |

2.50% |

|

7-Day Repo Rate |

1.80% |

1.70% |

1.70% |

1.70% |

1.70% |

|

10-Year Yield |

2.68% |

2.55% |

2.55% |

2.65% |

2.75% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

A sharp issuance of sovereign debt in China picked up in October, with roughly USD350 billion worth of onshore government bonds and local government bonds issued, about 63% higher than the average monthly issuance in the first nine months. With the recent policy announcement of an extra RMB1 trillion bond issuance planned in Q4, the bond supply will remain elevated in the remaining two months of this year. This still unlikely changes the picture of government bond yields remaining at low leves this year, as we think that a recovery in financing demand in the real economy is the main reason for interest rates to climb and the situation of a rising government bond yield often is accompanied by an increase in available high yielding assets. In such a scenario, the shifting of asset allocations from government bonds to such assets will help push up the government bonds’ interest rate. The fact that demand for financing still likely remains weak in near term, as Chinese economy still faces the pressure of oversupply and weak property sector, China’s 10-year government bond yield will likely remain low.

ON A SEQUENTIAL BASIS, GROWTH OF KEY ECONOMIC DATA FELL IN SEP

Source: CEIC, MUFG GMR

MANUF. PMI FELL BELOW 50-MARK AGAIN, WHILE NON-MANUF. PMI SLID

Source: CEIC, MUFG GMR