Please download PDF from the button above for all other contents for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

JEFF NG

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: Jeff_ng@sg.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

July 2023

KEY EVENTS IN THE MONTH AHEAD

1) PEAK FED POLICY RATE OR NOT?

The US dollar weakened in June by 1.4% (DXY) and whether or to what extent the dollar weakens further will become clearer in July. The rates market is close to fully priced for a rate hike at the FOMC meeting on 26th July but there is certainly scope for the conviction of a rate hike changing based on the employment and CPI data (7th & 12th July) ahead of the meeting. The PCE inflation data at the end of June revealed further deceleration and if the jobs market and CPI data also shows weakness, there is scope for the Fed to extend its pause. In that scenario, an end to the Fed’s tightening cycle would be likely which could help propel the dollar weaker. Even if the FOMC does hike in July, with the market close to fully priced and with most other G10 central banks priced to hike further, the scope for the dollar to strengthen over the second half of the year remains limited in our view.

2) BOJ AND FIVE OTHER CENTRAL BANKS MEET ALSO

The RBA, RBNZ, BOC, ECB and BoJ will also meet in July. All of these central banks could announce unchanged policies apart from the ECB which is highly likely to announce another 25bp hike. The Australia and Canada decisions would likely be viewed more as pauses before further hikes based on market pricing suggesting more hikes are still to come. The BoJ meeting in July is certainly likely to garner more attention than recent meetings. The July meeting will incorporate updated GDP and inflation forecasts which could provide the catalyst for a surprise decision to change policy – most likely through a change in YCC. Governor Ueda in June outlined the path to a change in policy – which would be the BoJ having more confidence in its own forecast for a pick-up in inflation next year after an expected slowdown in the second half of this year. If the updated forecasts showed that it could prompt a surprise change in YCC. As we often state, a change in YCC is highly likely to come as a surprise and with a potential snap election likely delayed until later in the year, a widow has potentially opened up for a policy change.

3) MARKET AWAIT FOR DETAILED POLICY STIMULUS

Stimulus measures in China could be a catalyst for the yuan’s uptrend. This month will be a key time window for the Chinese government to act, with the market watching for the Politburo meeting this month, and impactful stimulus measures to be rolled out with details at regular State Council meetings afterwards. We expect the rolling out of the stimulus measures after a State Council meeting on 16th June saying a batch of forceful macroeconomic policies were considered aimed at promoting sustained economic recovery, with a particular emphasis on expanding effective demand, strengthening the real economy, and preventing and resolving risks in key areas. Also, China's National Development and Reform Commission on 14th June said that stronger policy measures will be rolled out to encourage foreign investment further.

Forecast rates against the US dollar - End-3 2023 to End-Q2 2024

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

JPY |

144.57 |

136.00 |

134.00 |

132.00 |

130.00 |

|

EUR |

1.0913 |

1.1000 |

1.1200 |

1.1300 |

1.1000 |

|

GBP |

1.2707 |

1.2720 |

1.2730 |

1.2700 |

1.2290 |

|

CNY |

7.2530 |

7.0000 |

6.8000 |

6.7000 |

6.6000 |

|

AUD |

0.6657 |

0.6600 |

0.6800 |

0.6700 |

0.6500 |

|

NZD |

0.6125 |

0.6050 |

0.6200 |

0.6100 |

0.5900 |

|

CAD |

1.3241 |

1.3100 |

1.3200 |

1.3400 |

1.3500 |

|

NOK |

10.717 |

10.820 |

10.450 |

10.090 |

10.090 |

|

SEK |

10.787 |

10.820 |

10.450 |

10.180 |

10.270 |

|

CHF |

0.8948 |

0.8860 |

0.8790 |

0.8940 |

0.9090 |

|

|

|

|

|

|

|

|

CZK |

21.762 |

21.550 |

21.070 |

20.800 |

21.180 |

|

HUF |

341.31 |

340.90 |

339.30 |

345.10 |

363.60 |

|

PLN |

4.0635 |

4.0910 |

4.0630 |

4.0710 |

4.1820 |

|

RON |

4.5402 |

4.5180 |

4.4640 |

4.4510 |

4.6000 |

|

RUB |

88.992 |

91.870 |

94.880 |

92.580 |

92.820 |

|

ZAR |

18.826 |

19.000 |

19.500 |

19.250 |

19.750 |

|

TRY |

26.063 |

28.000 |

29.000 |

30.000 |

30.000 |

|

|

|

|

|

|

|

|

INR |

82.035 |

81.500 |

80.500 |

79.500 |

79.000 |

|

IDR |

15063 |

15000 |

14800 |

14600 |

14400 |

|

MYR |

4.6635 |

4.6500 |

4.6000 |

4.5500 |

4.5000 |

|

PHP |

55.190 |

55.300 |

55.000 |

54.800 |

54.400 |

|

SGD |

1.3532 |

1.3400 |

1.3200 |

1.3000 |

1.2900 |

|

KRW |

1317.8 |

1280.0 |

1260.0 |

1240.0 |

1220.0 |

|

TWD |

31.145 |

30.500 |

30.250 |

30.000 |

29.750 |

|

THB |

35.302 |

35.500 |

34.500 |

33.500 |

32.500 |

|

VND |

23584 |

23500 |

23450 |

23400 |

23350 |

|

|

|

|

|

|

|

|

ARS |

256.66 |

310.00 |

378.00 |

475.00 |

500.00 |

|

BRL |

4.8208 |

5.0800 |

5.2000 |

5.2200 |

5.2500 |

|

CLP |

802.04 |

810.00 |

815.00 |

805.00 |

785.00 |

|

MXN |

17.145 |

17.200 |

17.300 |

17.400 |

17.500 |

|

|

|||||

|

Brent |

75.00 |

80.00 |

84.00 |

83.00 |

81.00 |

|

NYMEX |

70.76 |

76.00 |

79.00 |

78.00 |

77.00 |

|

SAR |

3.7511 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

30.860 |

32.200 |

32.500 |

33.900 |

34.800 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

USD/JPY |

144.57 |

136.00 |

134.00 |

132.00 |

130.00 |

|

EUR/USD |

1.0913 |

1.1000 |

1.1200 |

1.1300 |

1.1000 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/USD |

1.0400-1.1400 |

1.0600-1.1600 |

1.0700-1.1700 |

1.0400-1.1500 |

MARKET UPDATE

In June the US dollar weakened against the euro in terms of London closing rates, moving from 1.0659 to 1.0913. However, the dollar strengthened versus the yen, from 139.68 to 144.57. The FOMC at its meeting in June, for the first time in the current tightening cycle, announced an unchanged stance with the federal funds rate remaining at 5.00% - 5.25%. The FOMC has continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month. However, this was dramatically offset by balance sheet expansion to provide loans and liquidity for the banking sector after the turmoil in March.

OUTLOOK

The US dollar weakened in June reflecting anticipation of an imminent end to the tightening cycle as evidence continues to build suggesting inflationary pressures are receding notably. The weakness of the dollar has been curtailed though by continued hawkish rhetoric from the FOMC after it decided to leave the fed funds rate unchanged for the first time since the tightening cycle began in March of last year. The rhetoric from the Fed was consistent with the dots profile released with the Summary of Economic Projections that revealed the FOMC median expectation is for two more 25bp rate hikes this year. We accept there’s a high chance of a hike in July but doubt the Fed will hike twice. Hiking once next month is more likely than not but will really be dependent on the nonfarm payrolls and CPI data. We would argue a hike is certainly not necessary. The PCE inflation data for May was the latest data to signal easing inflationary pressures. The core service ex-housing PCE inflation increased 0.23% in May, the weakest gain since July last year. A weaker NFP and CPI data in July could well mean the Fed stays on hold at the July FOMC meeting and that to us would probably imply that the tightening cycle is over.

Our dollar forecast path shows a window of further dollar depreciation which we believe captures the period in which the US labour market deteriorates and yields head lower as investors price with more conviction the end of tightening and rate cuts commencing possibly by year-end or in Q1 2024. Practically every labour market indicator bar the NFP print itself is signalling labour market slowdown and the US is much further advanced in bringing inflation lower. The Fed was the first major central bank to pause and will likely be the first to cut. However, global growth is likely to remain fragile and hence the scope for non-dollar currency appreciation is quite limited and hence the degree of dollar depreciation we expect remains modest.

Admittedly, the US labour market and the economy in general has proved more resilient than expected and this along with weaker China growth and some disappointing data in Europe (German IP data) has led us to reduce the extent of US dollar depreciation we expect, and we are also showing some USD recovery toward the end of the forecast reflecting monetary tightening impact to growth abroad.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

Policy Rate |

5.07% |

5.38% |

5.13% |

4.63% |

3.88% |

|

3-Month T-Bill |

5.28% |

5.40% |

5.05% |

4.25% |

3.63% |

|

10-Year Yield |

3.84% |

4.00% |

3.75% |

3.50% |

3.25% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We have been holding two views in tandem, our first path where data would slow and inflation declines would introduce minor cuts this year. The second path, which we were initially assigning a larger probability than the first path, where we thought if the regional bank turmoil of the 1st half was only a prelude to something bigger eventually breaking, that a.) it didn’t make sense for the Fed to hike further, b.) the Fed needed to incorporate the long and variable lags of policy along with other forms of tightening via the bank credit channel and c.) that all this would result in larger cuts happening sooner (in the 2nd half). Given the resilience of the US economy both of these paths are taking longer to realize. We still believe our medium-term views are employing the right framework but for now we are keeping an open mind that they won’t just surface without greater warning in Q3. As such we have lifted our rate path, acknowledging the Fed’s likelihood of hiking in July by 25bp while pushing out larger rate cuts into 2024. (George Goncalves, US Macro Strategy)

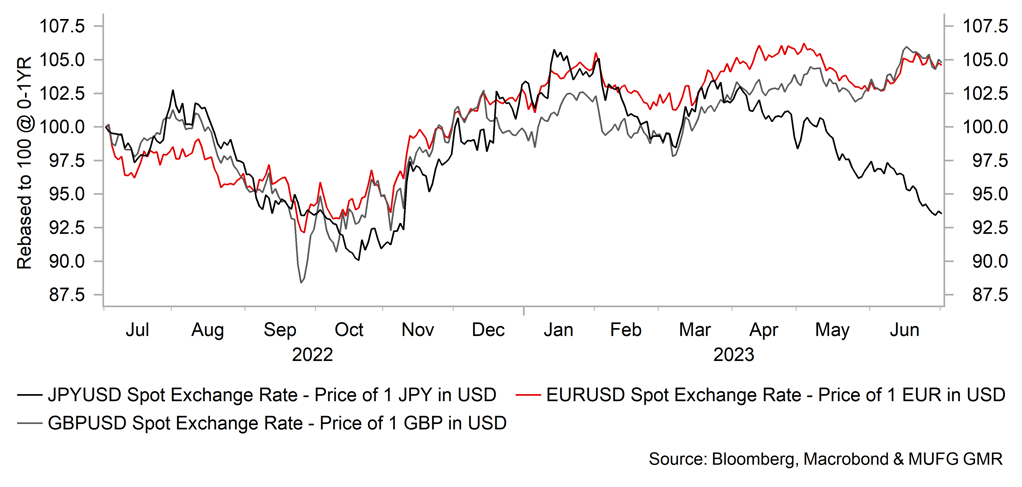

USD PERFORMANCE VS. OTHER FX MAJORS

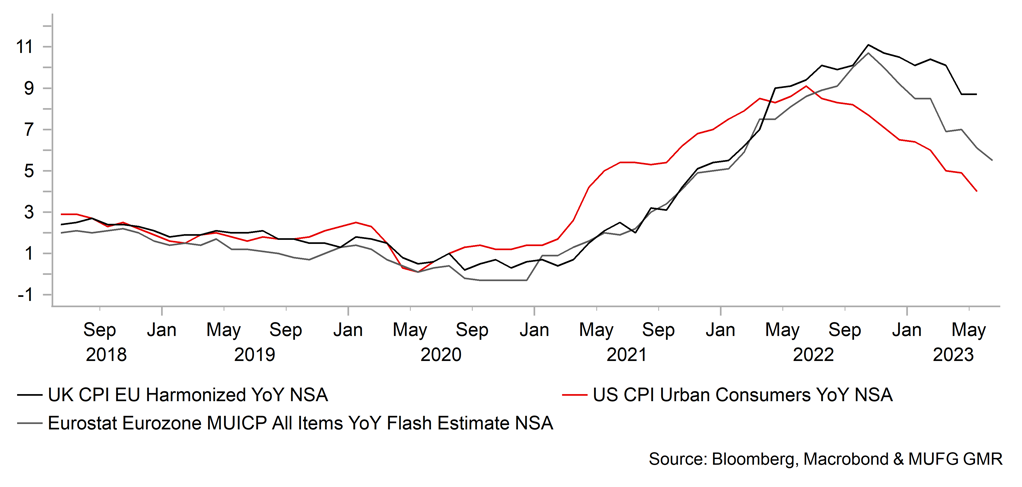

US INFLATION VS EZ & UK

Japanese yen

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

USD/JPY |

144.57 |

136.00 |

134.00 |

132.00 |

130.00 |

|

EUR/JPY |

157.77 |

149.60 |

150.10 |

149.20 |

143.00 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/JPY |

146.00-163.00 |

144.00-161.00 |

142.00-159.00 |

140.00-157.00 |

MARKET UPDATE

In June the yen weakened further versus the US dollar in terms of London closing rates from 139.68 to 144.57. In addition, the yen weakened versus the euro, from 148.88 to 157.77. The BoJ at its meeting in June maintained its monetary stance with the key policy rate at -0.10% and YCC restraining the 10-year yield within a range of +/-50bps around zero percent. The 10-year JGB yield continued to retreat from the 0.50% upper limit as speculation on an end to YCC receded. The bias of BoJ guidance favouring lower rates was dropped from the statement in April.

OUTLOOK

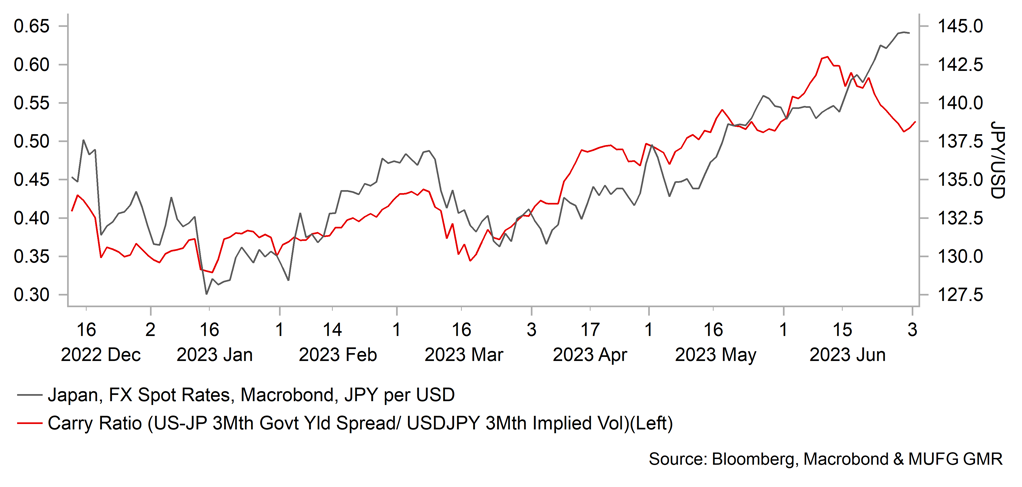

The yen weakened sharply in June with the expectation that global central banks being close to the end of tightening cycles diminished with major central banks either maintaining hawkish rhetoric or resuming policy tightening after a recent pause. Meanwhile, the BoJ’s stance didn’t change much with Governor Ueda taking a number of opportunities to argue the need for continued ultra-easy monetary policy. Governor Ueda stressed that inflation was set to decline in H2 and that the lack of sustainable inflation pressures pointed to the need for keeping the current policy stance in place. However, Ueda also stated that the current view of a pick-up in inflation next year was held with a lower level of confidence than the view of a decline in H2. If the BoJ’s confidence in inflation picking up was to strengthen that “could be a good reason for a policy change”. So the pre-condition on a change in policy is now having more confidence in current forecasts which could emerge in H2 if the expected fall in inflation is somewhat less than expected. We’d say the bar for a change in stance is not particularly high.

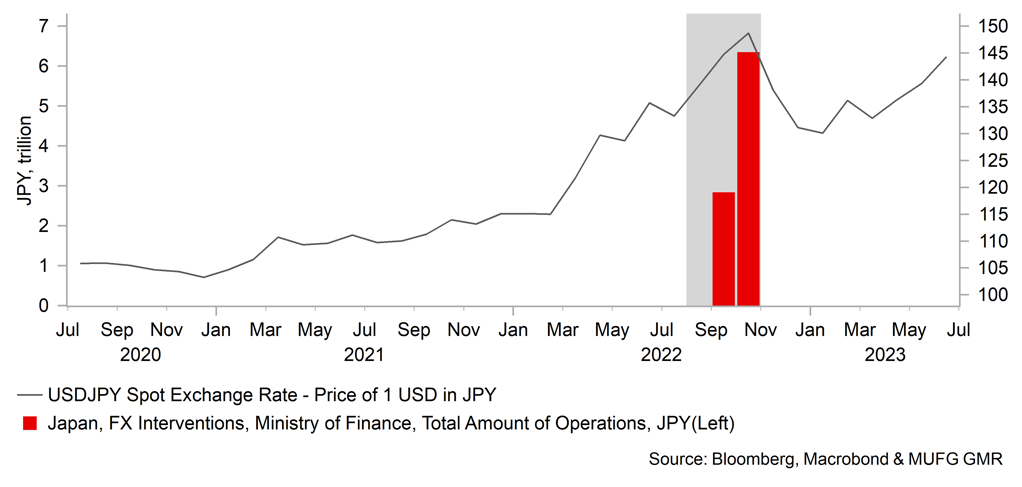

Most metrics we look at suggest to us that USD/JPY has over-extended to the upside. Our MUFG short-term regression model indicates an overshoot of between 3%-4% and hence we see limits to USD/JPY moving higher. The window has not closed yet however with the FOMC now more likely to hike in July we may yet see levels over the 145.00-level. But the July BoJ meeting is two days after the FOMC meeting and it remains a non-negligible risk that the BoJ could determine at that meeting (with updated forecasts released) that confidence in inflation moving higher next year has indeed strengthened. If the BoJ does not alter policy in July we also then have the risk of intervention to contend with. There has been a notable increase in MoF rhetoric expressing concern over yen weakness with Vice Finance Minister for International Affairs, Masato Kanda, stating that the MoF is monitoring yen moves with a “greater sense of urgency”.

Japan equity market outperformance, positive inflation in land and property prices, high and sustained household inflation expectations, and underlying inflation at a level not seen since 1981 leaves every BoJ meeting as live for a surprise policy change. The yen to us looks over-extended to the downside and we see a BoJ shift in YCC and a Fed pause by September helping fuel a sustained turnaround.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

Policy Rate |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

|

3-Month Bill |

-0.13% |

-0.15% |

-0.15% |

-0.10% |

-0.05% |

|

10-Year Yield |

0.40% |

0.70% |

0.60% |

0.50% |

0.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield declined by 4bps to close at 0.40% in June. The modest drop in the 10yr JGB yield was in sharp contrast to the 20bps jump in yields in the US and this primarily reflected the reduced speculation in Japan of a change to the current YCC framework. Governor Ueda was clear in Sintra in Portugal that an imminent change in policy was unlikely. Certain domestic factors may also have helped dampen yields. In particular, wage data disappointed to the downside relative to expectations that have been lifted by the increased wage agreements under the annual ‘Shunto’ wage negotiations. The 3mth average annual growth in cash earnings was unchanged at 1.0% in April, the weakest level since February 2022. However, there are numerous factors to suggest yields will drift higher apart from the global move higher. Underlying inflation, household inflation expectations, a strong equity market and the likelihood of renewed speculation on a YCC change all point to limited downside scope for the 10yr JGB yield from here. We see yields rising helped by a YCC change before reverting back lower again as global inflation and yields fall.

USD/JPY VS. INTERVENTION

USD/JPY & CARRY ATTRACTIVENESS

Euro

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

EUR/USD |

1.0913 |

1.1000 |

1.1200 |

1.1300 |

1.1000 |

|

EUR/JPY |

157.77 |

149.60 |

150.10 |

149.20 |

143.00 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0400-1.1400 |

1.0600-1.1600 |

1.0700-1.1700 |

1.0400-1.1500 |

|

|

EUR/JPY |

146.00-163.00 |

144.00-161.00 |

142.00-159.00 |

140.00-157.00 |

MARKET UPDATE

In June the euro strengthened versus the US dollar in terms of London closing rates, moving from 1.0659 to 1.0913. The ECB at its meeting in June raised the key policy rate by 25bps to 3.50%, taking the cumulative tightening to 400bps. The ECB confirmed that under its QT policy, the roll-off rate per month would pick up from July with all maturities rolling off. The ECB’s balance sheet has shrunk by around EUR 1.6trn from the peak in June 2022 after the TLTRO repayment in June.

OUTLOOK

With central banks now much closer to completing tightening cycles, rates and FX are responding more to incoming economic data and central bank guidance in shaping expectations on how much further rate hikes have to go. The ECB was very clear in June that inflation remains too high and that more work needs to be done. ECB President Lagarde speaking in Sintra Portugal stated that there was “not enough proof” to believe core inflation was coming down. It is for this reason we believe the ECB may now hike in July and again in September. Core inflation is set to accelerate in part in June due to the base-effect from service transport prices in Germany but also in general tourism-related inflation is higher this year than last year which may well put upward pressure on core CPI over the summer months. By the September ECB meeting there is a risk that Lagarde will hold the same view that not enough evidence of a slowdown in core CPI is available. Still, it is a close call on a September rate hike given the growth outlook remains fragile and the PMIs released in June point to risks that growth will disappoint ECB expectations.

The updated ECB forecasts reveal GDP forecasts of 0.9% this year and 1.5% next year. Core CPI was revised higher by 0.5ppt to 3.0% in 2024. We believe these forecasts are likely too high. It is hard to envisage such an acceleration in GDP growth next year when the full force of monetary tightening will be impacting the economy. Lower growth and inflation at some stage, probably in 2024, could act as the justification for rate cuts then starting sooner than the ECB is currently implying. Hence, we start to show some EUR depreciation resuming again in Q2 next year. In the meantime, the ECB tightening will persist. In addition to two more rate hikes, the balance sheet shrinkage will be more forceful. The June TLTRO maturity resulted in balance sheet shrinkage while the pace of QT will nearly double from EUR 15bn a month from July. Assuming euro-zone activity data does not notably deteriorate over the summer months, we see scope for EUR/USD to grind higher in August and September as the ECB needs to tighten further and the FOMC pauses.

We have nudged our peak EUR/USD level of 1.1500 a little lower. Weaker than expected data from the euro-zone, a rate hike by the Fed in July and continued global growth concerns will take some of the modest upward momentum away from EUR/USD. Still, assuming no notable worsening of growth in the euro-zone and some pick-up in China optimism, we still see some upside scope from here.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

Policy Rate |

3.50% |

4.00% |

4.00% |

4.00% |

3.75% |

|

3-Month Bill |

3.44% |

3.95% |

3.90% |

3.85% |

3.50% |

|

10-Year Yield |

2.39% |

2.50% |

2.40% |

2.20% |

2.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year German bund yield increased by 11bps to close at 2.39%. The yield move in core Europe was consistent with the move in the US with communications from both the Fed and the ECB strongly indicating more rate hikes to come. Strong US data helped yields in the US as well while in core Europe it was more sticky inflation that helped support yields with weak PMI data suggesting downside risks to growth. Nonetheless, the advance CPI for the euro-zone saw core CPI accelerate in YoY terms from 5.3% to 5.4% primarily due to transport services in Germany as a discounted rail-fare from last year fell out of annual calculations. Employment remains robust in the euro-zone with a 0.6% Q/Q increase that has helped support wage growth. Negotiated wages increased by 4.3% in Q1, a record. The wage inflation risks are unlikely to recede any time soon which will encourage continued hawkishness by the ECB. We do expect wage growth to slow as is indicated by more timely Indeed job advert data that shows peak wages growth happened late last year. Hence, the window for higher rates is probably the current quarter before we see the ECB pausing, inflation turning clearly lower, and bringing yields lower also.

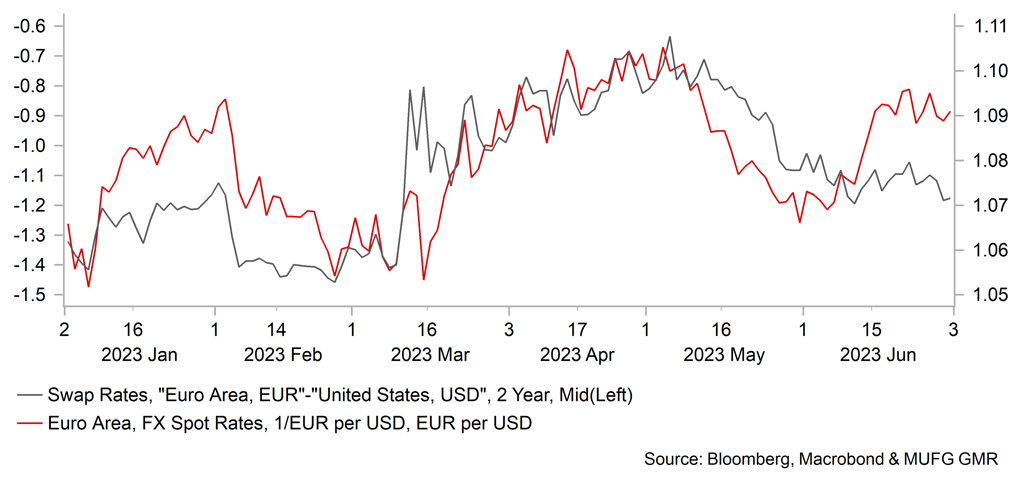

EURO-ZONE ECONOMIC SURPRISE INDEX

EUR/USD VS SHORT-TERM YIELD SPREAD

Pound Sterling

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

EUR/GBP |

0.8588 |

0.8650 |

0.8800 |

0.8900 |

0.8950 |

|

GBP/USD |

1.2707 |

1.2720 |

1.2730 |

1.2700 |

1.2290 |

|

GBP/JPY |

183.71 |

172.90 |

170.50 |

167.60 |

159.80 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2200-1.3200 |

1.2100-1.3300 |

1.2000-1.3200 |

1.1700-1.3000 |

MARKET UPDATE

In June the pound strengthened against the US dollar in terms of London closing rates from 1.2397 to 1.2707. The pound strengthened only very marginally against the euro, from 0.8598 to 0.8588. The BoE at its meeting in June raised the official Bank rate by 50bps to 5.00%, reverting to a bigger hike after two 25bp hikes in March and May. The BoE commenced QT in November last year and implied in May that it could consider quickening the pace at some stage going forward.

OUTLOOK

The pound strengthened mainly versus the dollar in June with a much more limited move versus the euro but did manage a further gain in BoE TWI terms. The TWI advanced by 1.4% with a more aggressive rate hike by the BoE in June helping provide support. The 50bp hike by the BoE was in response to the continued signs of “inflation persistence” and the data on inflation and wages certainly highlighted the fact that inflation is much stickier in the UK. The annual CPI rate remained unchanged at 8.7% in May with annual core CPI accelerating to a new record high of 7.1%. The Average Weekly Wage 3mth average annual growth rate excluding bonuses jumped from 6.8% to 7.2%, way off a level consistent with price stability. While the UK inflation picture is certainly worse than elsewhere, we expect a pretty notable decline over the second half of the year. The good news in that regard was evident in the PPI data. The PPI Output annual rate fell sharply from 5.2% to 2.9% and the input measure from 4.2% to just 0.5%. Pass-through will come and help drive the CPI rate lower. The OFGEM utility price cap cut in July (-17%) will help lower CPI as well. Other indicators in company surveys also show a decline is coming. The CBI index of selling price plans three months forward has fallen sharply.

Two higher than expected inflation reports and stronger wage growth that compelled the BoE to hike by a larger 50bps in June has resulted in the 2yr Gilt yield surging a huge 150bps in the last two months. It helps explain why the GBP was the top performing G10 currency in the first half of the year. We doubt the GBP will maintain this top performing ranking going forward. For now the focus has been on yield but the focus is likely to switch to growth now that the yield curve looks rich relative to our expectations. The housing market is starting to weaken – the YoY Nationwide House Price index fell to -3.5% and further declines are likely. Money supply data showed a record contraction in net housing loans as households repay debt more than is being borrowed. Loans to SMEs are contracting and the potential collapse of Thames Water illustrates the negative implications of sustained high inflation and yields on companies with high levels of debt, especially if linked to inflation.

The OIS market has 125bps of tightening priced in which is excessive. A further two 25bp hikes is more realistic but even then the level of policy rates is likely to result in a worse economic performance as policy tightening feeds further into the real economy with rising recession risk by year-end undermining GBP performance.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

Policy Rate |

5.00% |

5.50% |

5.50% |

5.50% |

5.00% |

|

1-Year Yield |

5.41% |

5.80% |

5.60% |

5.20% |

4.50% |

|

10-Year Yield |

4.39% |

4.50% |

4.40% |

4.20% |

4.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield increased in June, by 21bps to close at 4.39%. Terrible CPI data and strong wage growth compelled the BoE to hike by 50bps in June and kept guidance unchanged indicating the probability of further tightening to come. The failure of the BoE to act more aggressively previously and the admission by BoE Chief Economist Huw Pill that the forecast model is broken has undermined the credibility of the BoE that could manifest itself in higher yields as inflation expectations shift higher. The aggressive rate hike and the pricing of more have helped diminish that risk and is reflected by the sudden and substantial inversion of the 2s10s yield curve. For much of the inflation surge and tightening cycle to date, the 2s10s Gilt curve had failed to invert but on a rolling one-month basis, the 2s10s inverted by 88bps at one stage in June, a record amount underlining the change in investor thinking over policy tightening and the potential impact on growth and bringing inflation back under control. We see two more rate increases to 5.50% and view the 125bps priced into the market now as excessive. The impact from tightening and lower inflation going forward will help bring 10-year Gilt yields lower.

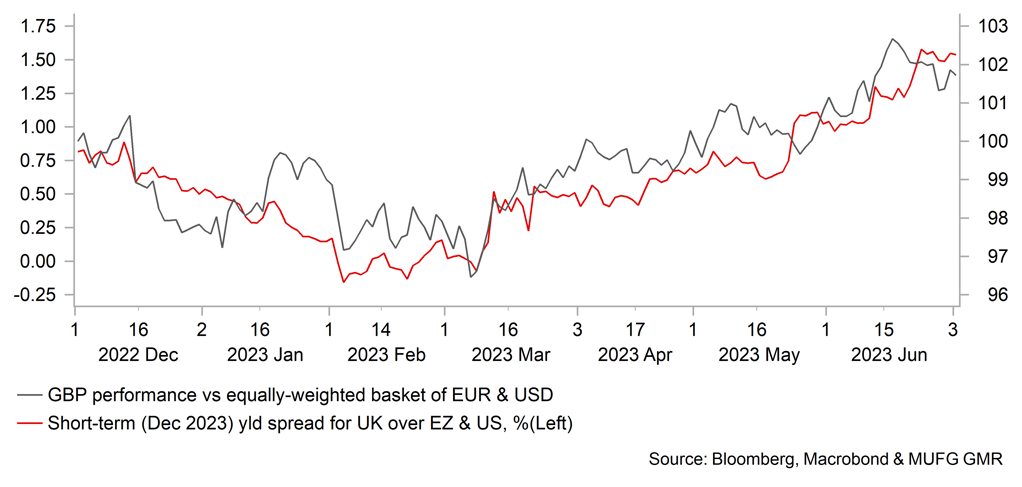

PERFORMANCE OF GBP VS. SHORT-TERM YIELD SPREADS

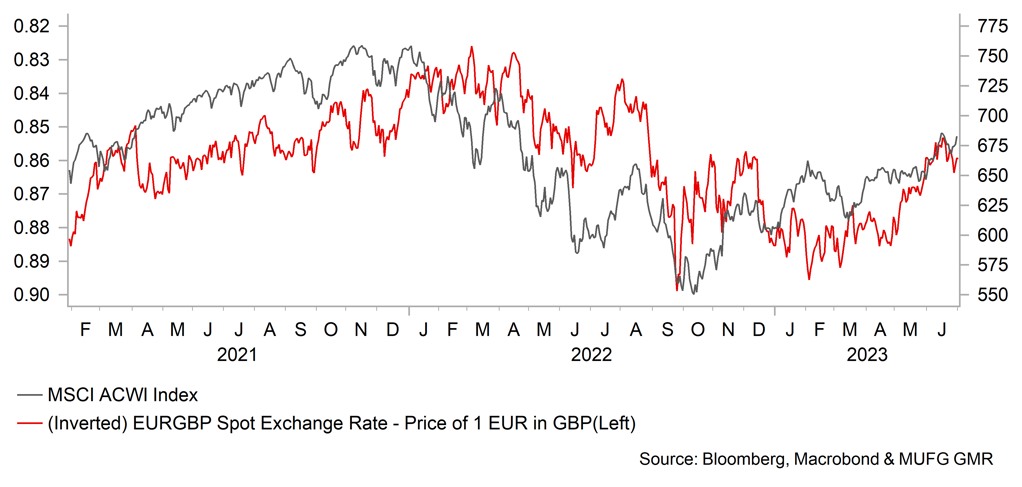

EUR/GBP VS. GLOBAL EQUITIES

Chinese renminbi

|

Spot close 30.06.23 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

USD/CNY |

7.2530 |

7.0000 |

6.8000 |

6.7000 |

6.6000 |

|

USD/HKD |

7.8363 |

7.8100 |

7.8000 |

7.8000 |

7.7900 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.8500-7.3500 |

6.6500-7.1500 |

6.5500-7.0500 |

6.4500-6.9500 |

|

|

USD/HKD |

7.7700-7.8500 |

7.7600-7.8400 |

7.7600-7.8400 |

7.7500-7.8300 |

MARKET UPDATE

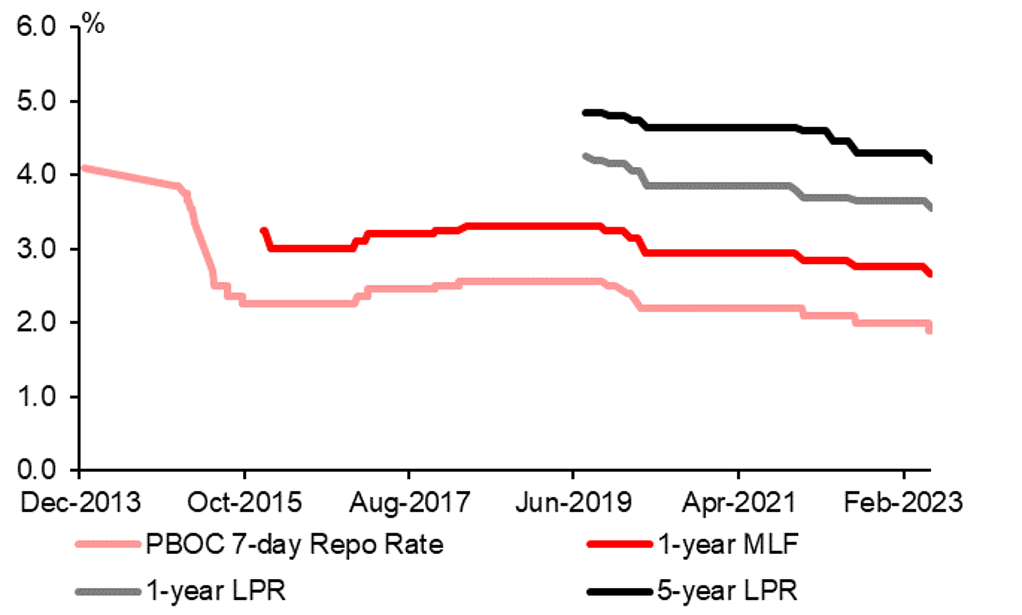

In June the Chinese yuan depreciated by 2.3% against the US dollar moving from 7.1064 to 7.2688. After lowering its 7-day reverse repo rate by 10bps to 1.90% on 13th June (FX Special Focus: China cuts its 7-day reverse repo rate and more to come), the PBOC reduced its MLF rates by 10bps to 2.65% on 15th June, followed by a 10bps rate cut to the 1-year & 5-year LPRs to 3.55% and 4.20% on 20th June.

OUTLOOK

The yuan extended its weakness last month due to the pessimistic market sentiment and the PBOC’s policy rate cut amid potential of a further policy rate hike by the Fed in July. Recently released May data pointed to challenging economic conditions in China. In May, industrial production, retail sales, fixed asset investment and property investment all grew at a slower pace compared with already weak growth in April. More alarmingly, China’s youth jobless rate hit a fresh record high of 20.8% in May, underscoring the challenges that China now faces. The willingness to consume or the purchasing power remained lukewarm, as shown in the stats from the three-day Dragon Boat Festival (June 22nd – 24th). During this festival, while domestic tourism trips rose 32.3%yoy to a total of 106 million, 12.8% above the pre-pandemic level during the 2019 festival, revenue from domestic tourism trips recovered only to 94.9% of the 2019 level. The latest near-zero headline CPI inflation print of 0.2%yoy in May also reflects the weakness in consumption.

The Chinese government has signalled a more proactive policy stance lately. At the State Council meeting chaired by Premier Li Qiang on 16th June, it was emphasized that the government plans to take more forceful measures to promote sustained economic recovery, with a particular emphasis on expanding effective demand, strengthening the real economy, and preventing and resolving risks in key areas. The market is still awaiting more details of the stimulus measures promised by the government, although policy planning does take time. The PBOC’s policy rate cut didn’t help boost market sentiment, and was especially unhelpful for the CNY. In fact, the resulting larger negative yield spread between China and US was one of the main drivers for recent CNY depreciation against the dollar. What is worth noting is that on 27th June, the PBOC set the USD/CNY fixing at 7.2098, 111pips stronger than the market consensus estimate. Then on 29th June the USD/CNY fixing was set at 7.2208, 311pips stronger than the market consensus estimate. No other tools have been used by the PBOC in intervening. It suggests that current level of USD/CNY is still within the acceptable range for the PBOC. The PBOC’s action of setting a stronger USD/CNY fixing is mainly aiming at slowing down the pace of depreciation of the yuan, especially when the government is planning to roll out more stimulus policies which will eventually boost the demand for the currency.

While we expect the PBOC to cut policy rates further, we believe other stimulus policies are needed to restore broader consumer confidence, boost economic activity and the demand for Chinese assets including the currency.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

|

Loan Prime Rate 1Y |

3.55% |

3.40% |

3.40% |

3.40% |

3.50% |

|

MLF 1Y |

2.50% |

2.50% |

2.50% |

2.50% |

2.60% |

|

7-Day Repo Rate |

1.90% |

1.80% |

1.80% |

1.80% |

1.90% |

|

10-Year Yield |

2.64% |

2.70% |

2.75% |

2.80% |

2.85% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

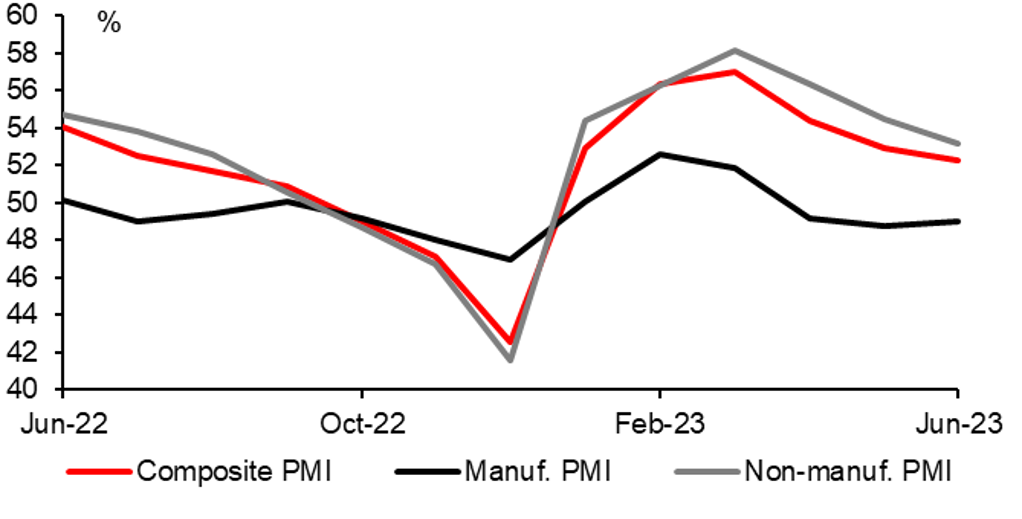

Recent PBOC cuts to the 1-year MLF, 1-year LPR and 5-year by 10bps each weighed down on China bond yields. With our expectation of a potential further 15bps cut, we see continued downward pressure on rates. Lower bond yields in near term reflects the countinued weakness of China’s economy in the near-term. The recently released June manufacturing PMI of 48.8 indicated that the sector remained in contractionary territory, both the new orders and new export orders sub-componenents declined by 0.3 and 0.8 points respectively. The details of the June PMI also suggested that Chinese corporates were in the process of de-stocking, and it may require a bit more time to bottom out – it will also keep bond yields low in the near-term. However, government bond yield could rebound if forceful stimulus policies be rolled out to stabilize the economy. With the expectation of further policy stimulus and gradual economic recovery in H2, we expect a trend, modest improvement in government bond yields towards the end of year. We see China’s 10-year government bond yield to reach 2.75% by the end of 2023.

PBOC CUT KEY POLICY RATES TO BOOST THE ECONOMY

Source: CEIC, MUFG GMR

CHINA’S MANUFACTURING PMI REMAINED BELOW 50-MARK

Source: CEIC, MUFG GMR