Key Points

Please click on download PDF above for full report

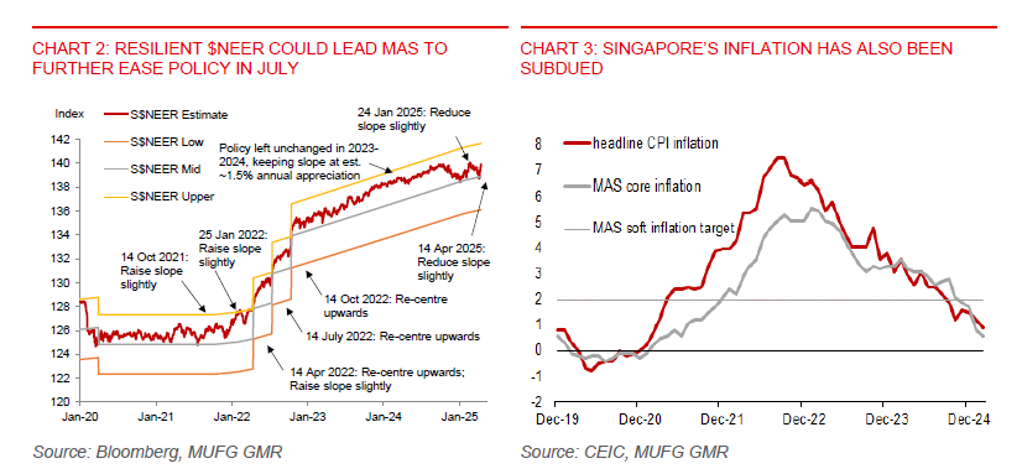

- MAS loosens its tight policy setting today via slightly reducing the slope of the S$NEER (i.e. slightly reduce the pace of S$NEER appreciation). There is no change to the width of the S$NEER policy band or the level at which it was centred. This is in line with our and market expectation (see MAS preview – More policy easing in April). Indeed, global trade policy uncertainty has risen further since the January monetary policy review, while Singapore’s core inflation has been subdued. We estimate the slope of the currency band has now been lowered to 0.5% per annum, from 1.0% before the policy meeting.

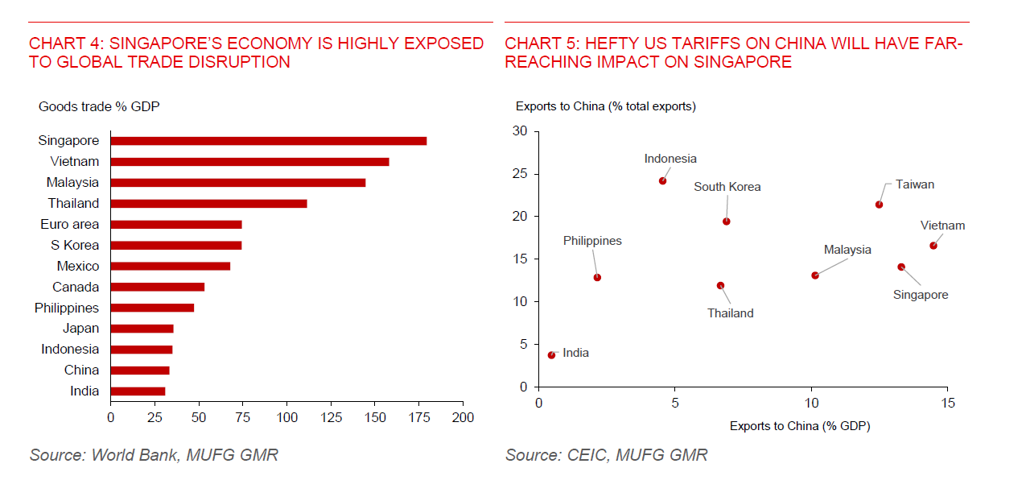

- The outlook for growth has dimmed amid elevated US trade policy uncertainty and tariff retaliation by US trade partners. MAS has lowered its 2025 GDP growth outlook to 0%-2%, from 1%-3% previously. Notably, MAS expects Singapore’s output gap will turn negative this year amid a weakening external outlook. During the press conference, policymakers appear to have adopted a dovish tone. They are not ruling out more growth slowdown or export deterioration. And they estimate about one-third of the negative tariff impact will be from direct tariff impact, while the rest will be from spillovers from tariffs on China and the rest of the world.

- We expect the MAS to ease policy again in July on export deterioration. This could possibly be via flattening the slope of the S$NEER. We have also revised down our 2025 GDP growth forecast for Singapore to 1.5%, from 2.9% previously, to reflect a much weaker than expected Q1 outturn and higher tariffs on imports from Singapore and the rest of the world, particularly on China. This would marked a sharp slowdown from the 4.4% pace of growth in 2024. We anticipate the bulk of the tariff impact on growth and exports will be acutely felt in H2 2025. Downside risks would stem from new tariffs on pharmaceuticals and semiconductors.

- Export weakness has emerged, and the outlook for external trade could weaken over the coming months amid higher US tariffs. Re-exports fell 1.7%mom on average in January-February, from a 4.3%mom expansion on average in October -December 2024. In addition to that, industrial production fell 7.5%mom in February, following a 2.8%mom rise in January. Assuming a price elasticity of 1, a 10% tariffs on Singapore could reduce its exports to the US as a share of its GDP by about 0.8ppt. Also, there will be negative spillover effects on Singapore’s exports from the 125% US tariffs on China. The total negative impact could be larger, given Singapore’s trade openness and reliance on trade servicing, making the city-state highly vulnerable to a global trade slowdown

- Meanwhile, inflation is not a problem for the MAS, which should allow the central bank to further ease the S$NEER policy if necessary to complement fiscal support to cushion economic growth. MAS has lowered its core inflation forecast to 0.5%-1.5% in 2025, from 1%-2% previously, underpinned by lower-than-expected inflation in January-February, a slower pace of growth in domestic prices due to weakening economic outlook, and lower imported costs. Headline inflation outlook was also lowered to 0.5%-1.5%, from 1.5%-2.5% previously. We have also earlier lowered our forecasts for headline inflation to 1.1%yoy from 1.5% previously, and core inflation to 0.9% from 1.5%yoy previously. Singapore’s core inflation has undershot the MAS soft target of “under 2%”, at just 0.6%yoy in February, the lowest since July 2021. There could be a disinflationary drag from the tariff induced hit to domestic economic growth. Imported inflation will likely stay benign due to weakening external demand and lower energy prices.

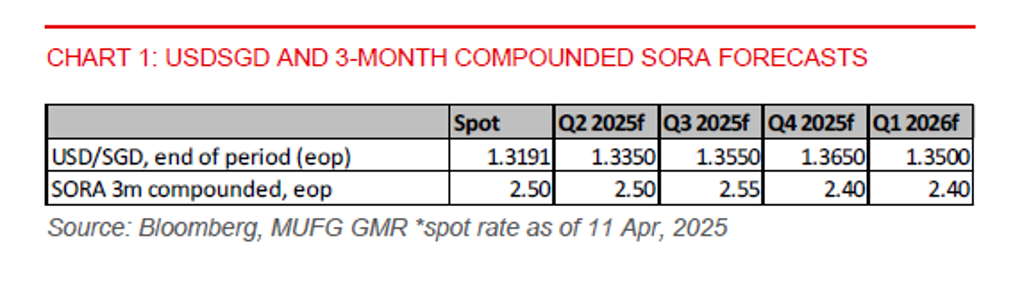

- USDSGD has weakened sharply on the back of broad US dollar weakness, possibly on concerns about the outlook for the US economy, with markets now pricing in about 80bps of US rate cuts this year. However, we are still biased for SGD weakness, especially on our expectation for exports to weaken further and the MAS to ease again in July. We have pushed back some of our anticipated weakness for SGD into H2 2025. We note that our USDSGD forecast is currently subject to high level of uncertainty.