Key Points

-

The MAS decided to maintain its current monetary policy stance at the October 2025 review, leaving the parameters of the S$NEER policy band (slope, width, and centre) unchanged. This is in line with our and market expectation (see MAS preview – Likely an October pause, but growth risks emerging). The decision reflects an assessment of resilient economic growth while inflation stays low, i.e. a comfortable place to be for Singapore’s growth-inflation dynamics. Both the policy statement and the press conference suggest a broadly neutral tone from policymakers with a cautious bias to downside growth risks. There is also a sense that policy accommodation has been delivered in January and April, while GDP growth has turned out to be stronger than expected despite US tariffs.

-

Singapore’s economy has been resilient. Advance estimates of GDP show growth of 2.9%yoy in Q3, beating market expectations of 2%yoy. While this marks a slowdown from 4.5%yoy in Q2, partly due to high base effects from a year ago, it nonetheless reflects a resilient pace of growth, despite global trade headwinds. Notably, growth averaged 3.9%yoy in Q1-Q3, which is above potential growth, and the output gap is expected to stay positive this year.

-

In sequential terms, Singapore’s GDP grew 1.3%qoq seasonally adjusted, only slightly slower than the 1.5%qoq pace in Q2. This was underpinned by resilience in the manufacturing and domestic consumer facing sectors. The manufacturing sector rose 6.1%qoq in Q3, from -0.7%qoq in Q2. The payback from earlier export frontloading has been modest in Q3, with re-exports normalising but still staying above Q1 average, supporting industrial production activity. In addition, the group of sectors comprising of ICT, finance, insurance, and professional services rose 1.3%qoq from +1.6%qoq in Q2, while another group consisting of accommodation, food services, real estate, and other services support sectors also grew 1.3%qoq, a similar pace with Q2.

-

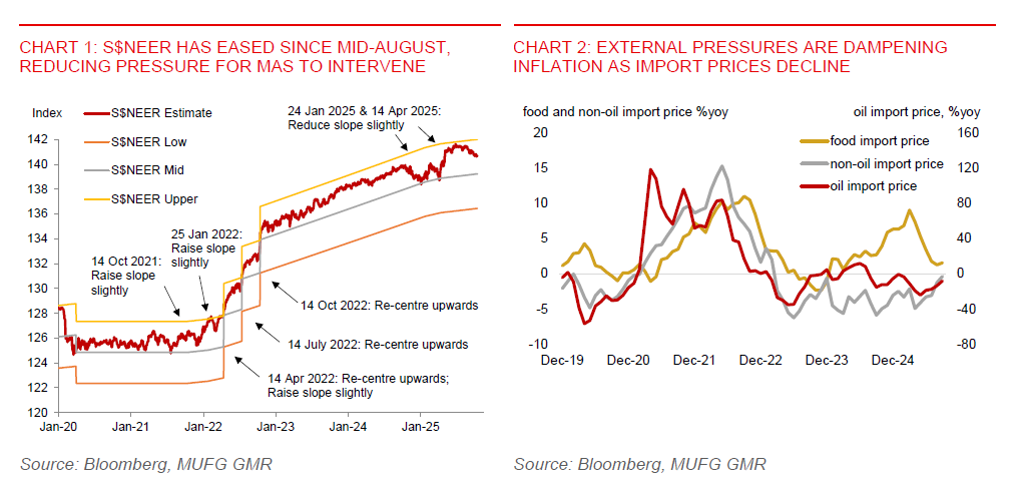

Until there is clear evidence of economic deterioration, our bias is for the MAS to maintain its current policy stance. The level of S$NEER since the July policy review has remained broadly stable, similar to the level with the preceding three months. The S$NEER has also eased in recent weeks, moving away from the top of the policy band. This moderation suggests that MAS is not facing immediate pressure to intervene, and it may be comfortable with the current level of the exchange rate, amid resilient growth and subdued inflation.

-

While MAS sees core inflation bottoming out soon as temporary disinflationary factors fade, we are not anticipating a sharp spike up in price pressures. We maintain our outlook for core inflation to average 0.5% in 2025 and 1% in 2026. The inflation picture will likely remain benign over the coming months, allowing MAS to respond swiftly to any risks to growth that threatens its medium-term price stability objective. Subdued inflation will be underpinned by weak global commodity prices, declines in import costs, a strong SGD, and moderating unit labour costs (see Singapore: Why inflation will stay soft and support further MAS easing?)

-

The Singapore dollar has weakened against the US dollar in recent weeks, accompanied by a softening in the S$NEER. Political risks in Europe and Japan have been key drivers of recent US dollar strength. In response, we have revised our USDSGD forecast to 1.3000 by end-2025 and 1.3100 in Q1 2026 to reflect these developments, from 1.27 and 1.26 previously. The 1.2700 level is a critical technical support for the pair. The SGD may stabilise when global risk events subside. The Monetary Authority of Singapore’s decision to hold policy, along with its largely neutral tone today, should also provide support for the currency. However, any signs of sharp deterioration in export performance in upcoming data could weigh on SGD.

-

The 3-month Singapore Overnight Rate Average (SORA) has fallen to 1.4075%, down from 2.0607% in end-Q2. We expect SORA to remain subdued, given our anticipation for Fed rate cuts, ample onshore liquidity conditions, and subdued domestic inflation. We maintain our forecast for 3-month compounded SORA to fall further to 1.37% by end-year and remain soft through 2026.