Key Points

Please click on download PDF above for full report

- MAS remains in a policy easing cycle amid heightened global trade uncertainties, with the balance of risks tilted toward growth rather than inflation. A pre-emptive MAS easing move in July is possible, in anticipation of a tariff-induced slowdown in H2. However, we are of the view that MAS will wait until the October meeting before adjusting policy further. The growth outlook remains subject to large uncertainty, while inflation risks could be two-sided. Moreover, the MAS has begun to unwind its restrictive policy in January and April, suggesting that some policy accommodation has already been delivered.

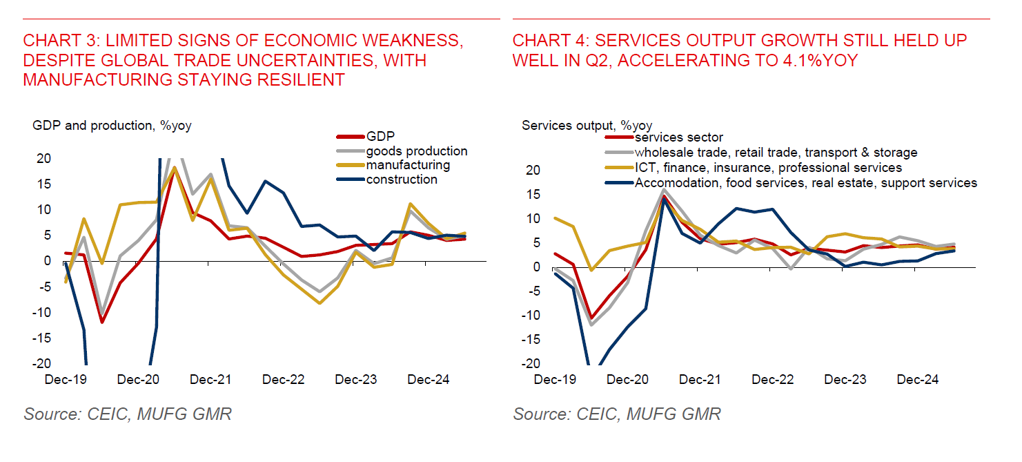

- Singapore’s economy is entering H2 from a position of strength, despite the US imposing a 10% baseline US tariff on trading partners since April. Advance estimates show GDP grew 4.3%yoy in Q2, up from 4.1%yoy in Q1 and beating market consensus of just 3.6% growth. Export frontloading has been a key driver of growth. Seasonally adjusted GDP growth was also up by 1.4%qoq in Q2, reversing the 0.5% contraction in Q1 and beating consensus of +0.8%qoq. Growth was broad-based across both goods and services sectors.

- Singapore’s economic growth will be subdued in H2, but it is likely not recessionary. And while US reciprocal tariffs are scheduled to take effect on 1 August, their impact may still be partial in Q3. More pronounced tariff effects are likely to be felt only in Q4 and into early 2026. There may still be some residual support from export frontloading in Q3, though this is expected to moderate. Recent macro data from both the US and China also suggest that growth remains resilient, helping to cushion external demand. Importantly, Trump has previously delayed the implementation of reciprocal tariffs, and with the US still engaged in trade negotiations with several countries, the 1 August date may not be definitive.

- Singapore has not received a tariff letter from Trump. Trade talks are ongoing, with the Singapore government seeking to establish a practicable and workable framework for pharmaceutical exports to the US. Details are scant for now, while discussions regarding semiconductor exports have yet to begin. Meanwhile, the Singapore government will launch a Business Adaptation Grant in October, capped at $100,000 per company, to support firms affected by tariffs.

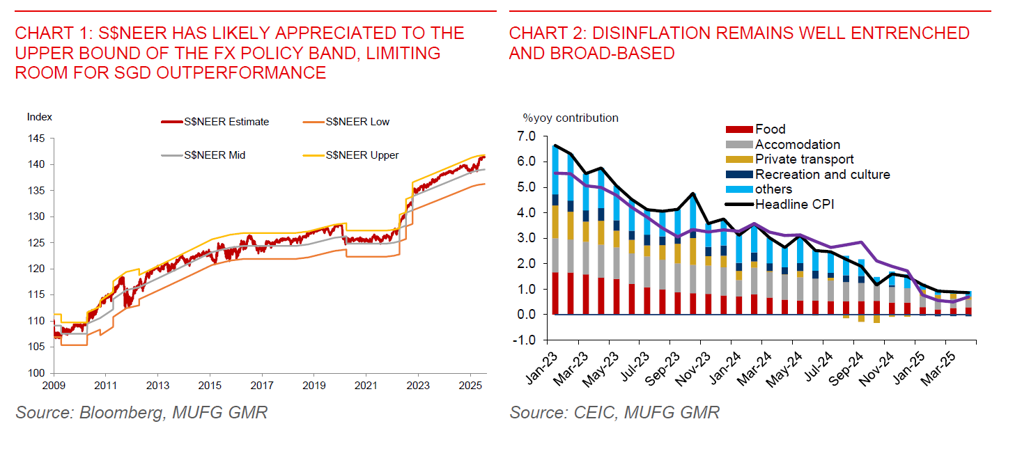

- Inflation is not a worry, providing room for policymakers to loosen policy. Both headline and core CPI have fallen below the MAS soft target of 2%. Global oil and food prices have eased, while domestic policy measures aimed at addressing cost of living concerns will help constrain price pressures. The Singapore government has rolled out digital vouchers, utility rebates, and various other rebates in phases to keep costs manageable for residents. Additionally, property cooling measures have been further tightened to curb speculative activity. That said, the risk to inflation could still be two-sided, as inflationary pressures could re-emerge on geopolitical conflict or tariff induced supply chain disruptions.

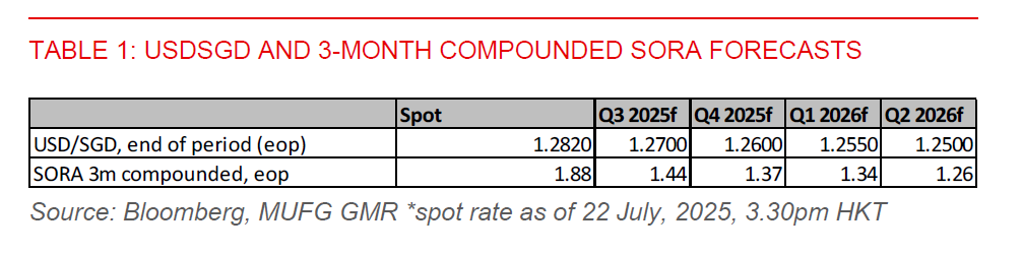

- The SGD has weakened modestly by 0.5% against the US dollar since 4 July, following President Trump’s announcement of new reciprocal tariff rates on trading partners. However, it still retains most of its year-to-date gains, which exceed 6%. The S$NEER has also appreciated toward the upper bound of MAS’s FX policy band, despite policy easing in January and April – and with the possibility of further easing. This suggests limited room for SGD outperformance. That said, with the Fed expected to cut rates in September and the USD likely to weaken, we expect USDSGD to drift modestly lower toward the 1.2600 to 1.2650 range by end-2025.

- The Singapore Overnight Rate Average (SORA) has fallen to 1.30%, reflecting further easing in overnight funding costs, even as the US equivalent SOFR has stayed elevated at 4.30%. SORA will likely stay subdued, given our anticipation for the Fed to resume rate cuts in September, ample onshore liquidity conditions to sustain, and domestic inflation to stay subdued. However, further SORA declines from current levels look modest at best. The 5-year SORA-SOFR spread has also fallen to historical lows of -190bps. In terms of our 3-month compounded SORA forecasts, we look for the rate to fall to 1.37% by end-2025, from 1.88% currently.