Key Points

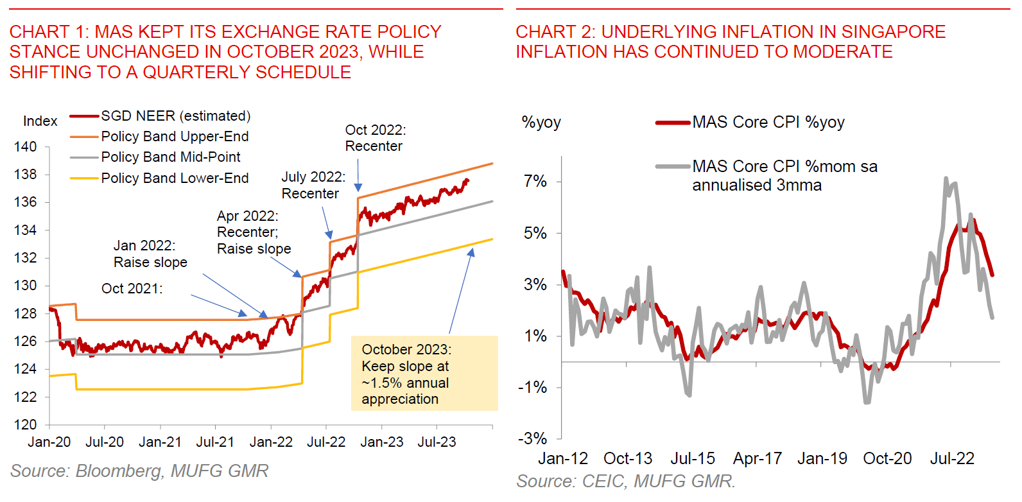

- The MAS kept its exchange rate policy on hold today, in a move expected by all economists surveyed, including ourselves. There were three key takeaways.

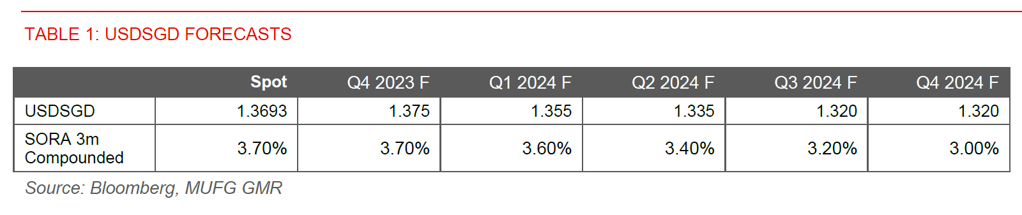

- First, we thought the post-policy statement was well-balanced, highlighting both upside and downside risks to inflation, while still projecting inflation to broadly decline. Sources of uncertainty include global food and energy shocks, while on the flipside a sharp global economic downturn could lower inflation pressures.

- Second, MAS seems to have turned slightly more sanguine on the global growth outlook, relative to the April 2023 statement. It expects gradual improvement in growth into 2024 as growth in major trading partners improves with a modest upturn in the electronics cycle, with the output gap becoming less negative. We think underlying that view is an expectation that the Fed will cut rates next year even as US growth achieves a relatively soft landing, while China’s growth stabilises in 2024 as it pushes out more stimulus.

- Third, we think MAS is looking to keep optionality into 2024, amidst a more volatile and uncertain macro outlook. On this note, MAS announced that it shifted to quarterly meetings (from semi-annual currently). While this change has been mooted for some time, we do agree that there are wide ranges of macro outcomes for 2024 which deserve close monitoring.

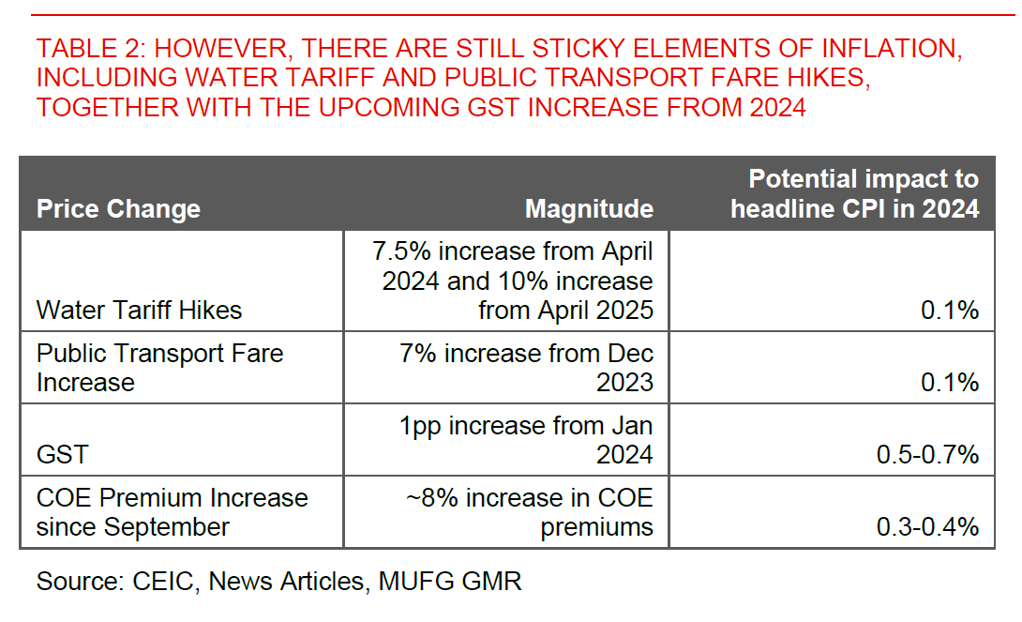

- While there was rising expectation among analysts that MAS would turn more dovish in its forward guidance heading into the policy meeting, we were not of that view (see MAS preview – The time is not yet ripe to ease on SGD policy). The fight against inflation in Singapore has not yet been won, with sticky elements such as COE premiums, water tariff hikes, public transport fare increases, coupled with a 1pp hike in the Goods and Services (GST) tax.

- At the margin, today’s upside surprise in 3Q2023 GDP print also likely reduced the impetus for MAS to signal any policy change, although we note that the manufacturing estimates were surprisingly strong relative to the monthly figures.

- We continue to see SGD moving in line with the Dollar this year. However, we think that could be some scope for SGD to underperform in 2024. The bar to further tightening by MAS looks quite high given the still soft and uncertain growth outlook, while the next move will likely see a lowering of the exchange rate band slope. SGD exchange rate valuations are quite expensive, and the S$NEER is already trading around 1.4% above the mid-point, implying less upside from here.

- We are forecasting USDSGD at 1.375 in 3months and 1.32 in 12 months, with an assumption of a weaker US Dollar. Our 12 month-ahead forecasts nonetheless imply some underperformance of SGD against the likes of JPY (134 in 12 months), CNY (6.85 in 12 months), and EUR (1.12 in 12 months).