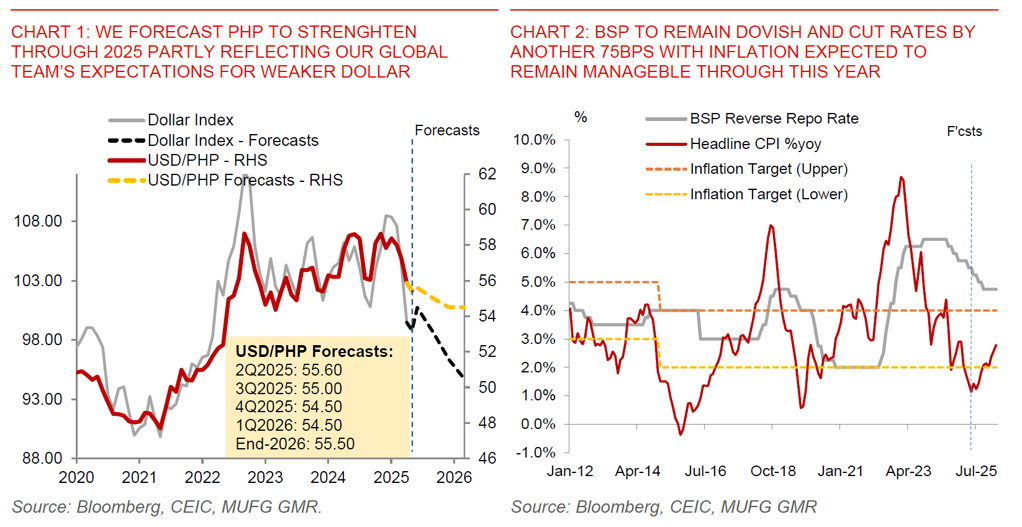

- We continue to forecast PHP to strengthen to 54.50 against the Dollar by 1Q2026. Nonetheless, we now pull forward the pace and expect USD/PHP at 55.00 by 3Q2025 and 54.50 by 4Q2025.

- Part of this change reflects global factors such as the US-China tariff pause, with our expectation now for more modest CNY weakness (see US-China trade war).

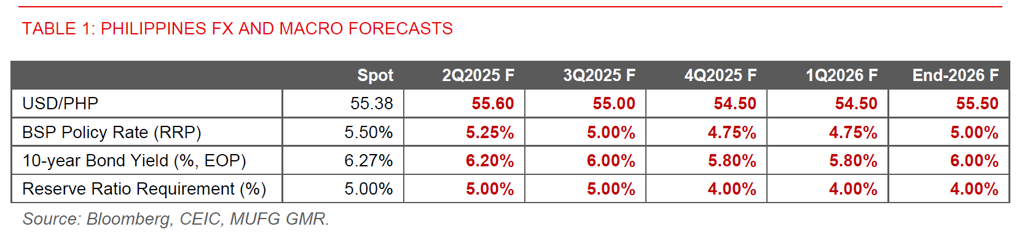

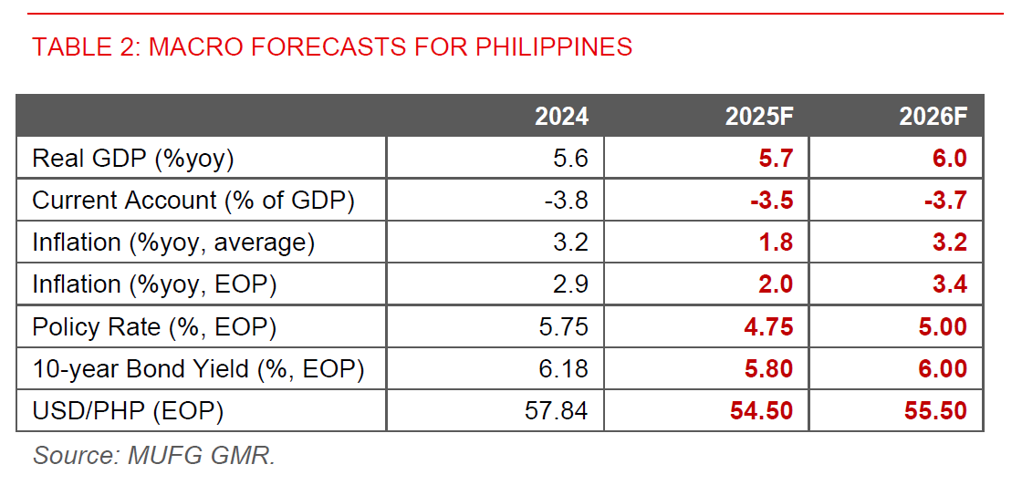

- More importantly, domestic inflation pressures in the Philippines have also been softer than expected, and this provides BSP further space to cut rates to support the economy. We lower our CPI inflation forecasts to average 1.8% in 2025, driven by continued declines in domestic rice prices, manageable oil prices, coupled with reduced risks to transport fare and electricity price hikes.

- As such, we continue to forecast BSP to remain dovish and cut the policy rate by a further 75bps, bringing it to 4.75% by end-2025.

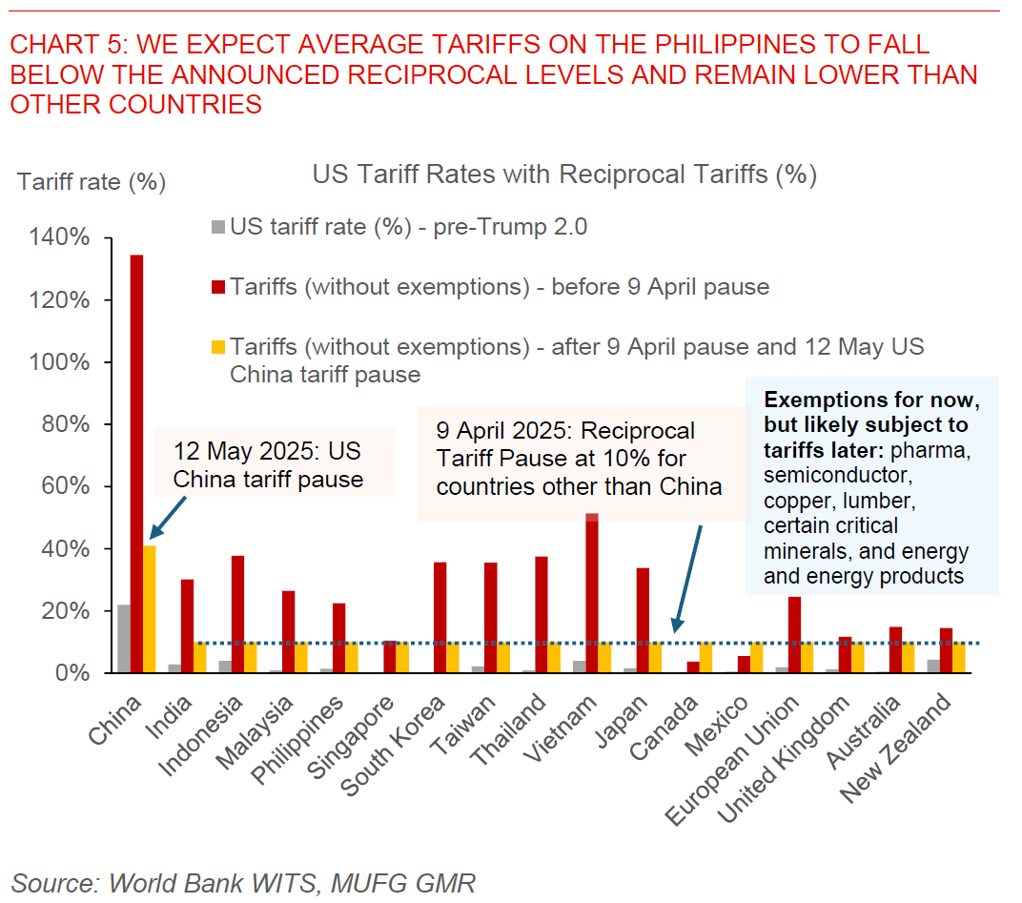

- We also implicitly assume a trade deal with the US will be reached, and for average tariffs on the Philippines to fall below the 17% reciprocal level.

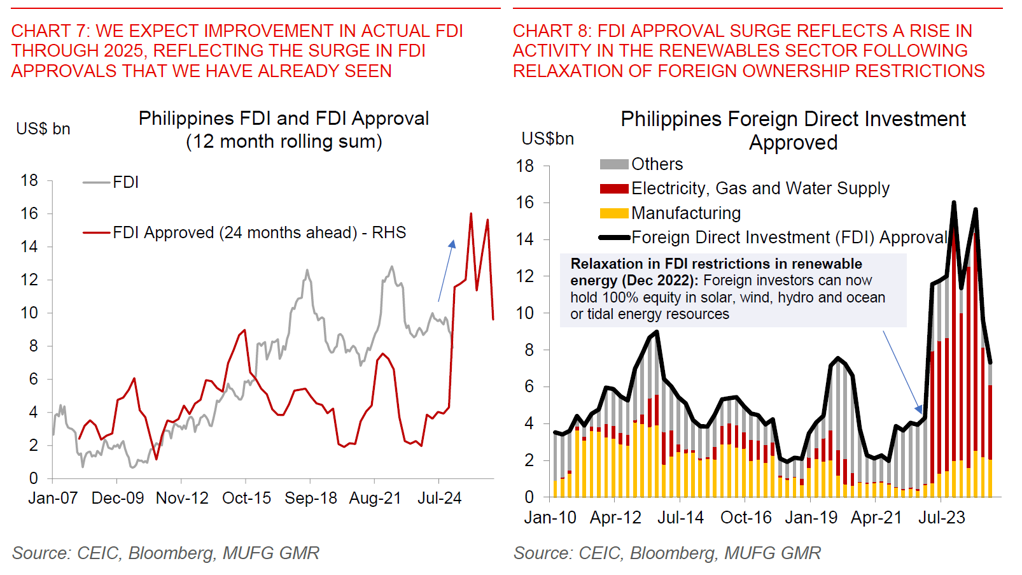

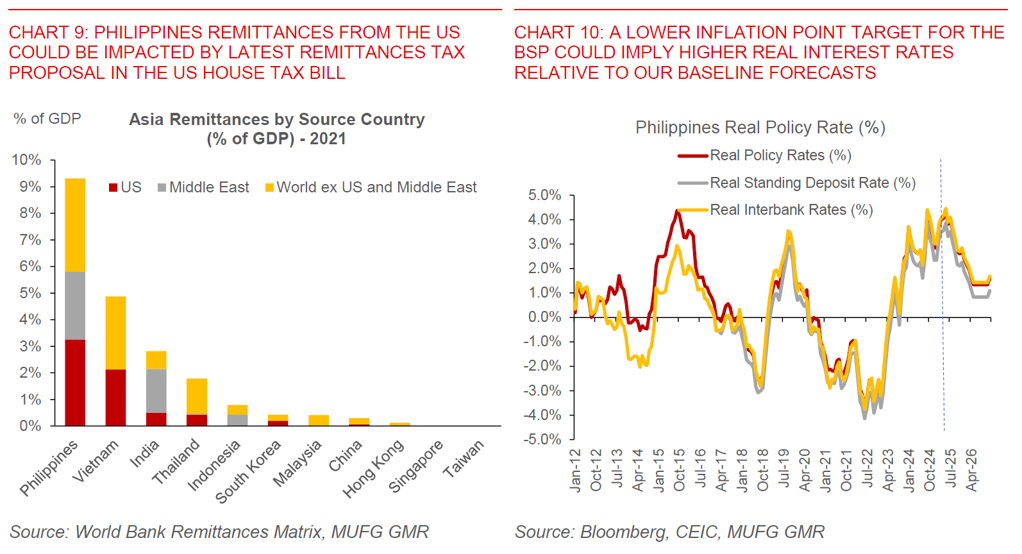

- We are reluctant to forecast further PHP strength despite an expectation for Dollar weakness for three reasons. First, the 3.5% remittances tax as drafted in the US House Tax bill could cut Philippines remittances by 0.1% of GDP. Second, FDI approvals have slowed and this could weigh on actual FDI in 2026. Third, domestic political risks could increase into next year. Our base case is for the recent Senate Election results to slow the pace of reforms but we think it is unlikely to change the trajectory of policy including on infrastructure build-out.

PHP to remain supported by manageable inflation, lower tariffs relative to peers, rising FDI, coupled with a strong pipeline of infrastructure investments

- We maintain our view for PHP to strengthen against the Dollar through 2025. Part of the driver behind our USD/PHP forecast profile to reach 54.50 by 4Q2025 reflects our global team’s expectation for US Dollar weakness over the medium-term (see USD Reserve currency status), with the Dollar Index expected to weaken further by around 4-5% by 1Q2026.

- Beyond global factors, it is important to continue highlighting Philippines’ specific drivers underpinning our expectation for modest PHP strength.

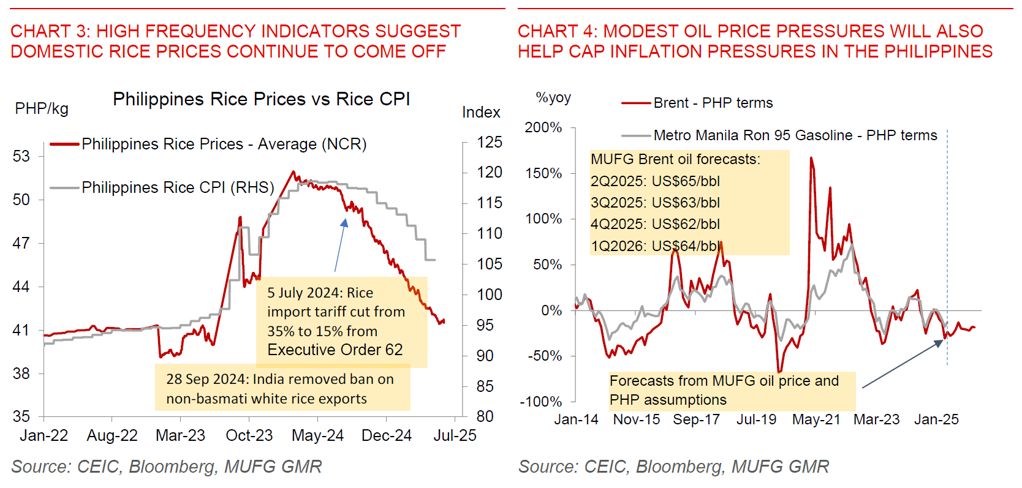

- First, we forecast inflation in the Philippines to remain manageable, averaging 1.8% in 2025, driven by lower domestic rice prices, good global rice supplies, manageable oil prices, coupled with lower upside risks to transport fares and electricity prices. We have been highlighting these positive tailwinds on lower price pressures for Philippines macro for some time, but the latest inflation outturns have come out even lower than we have anticipated. Latest high frequency datapoints on domestic rice prices show continued declines, helped by previous rice import tariff cuts implemented from July 2024. Beyond the Philippines, global rice supplies have also been supportive, with India already taking steps previously to remove export bans on non-basmati white rice, coupled with good rice harvests thus far from India’s summer and winter crops (Kharif and Rabi). In addition, our commodity analyst expects global oil prices to remain benign this year ranging between US$60-65/bbl with global oversupply, and this should help cap inflation pressures in the Philippines and also second-round effects into ancillary items such as Jeepney fares and domestic electricity prices.

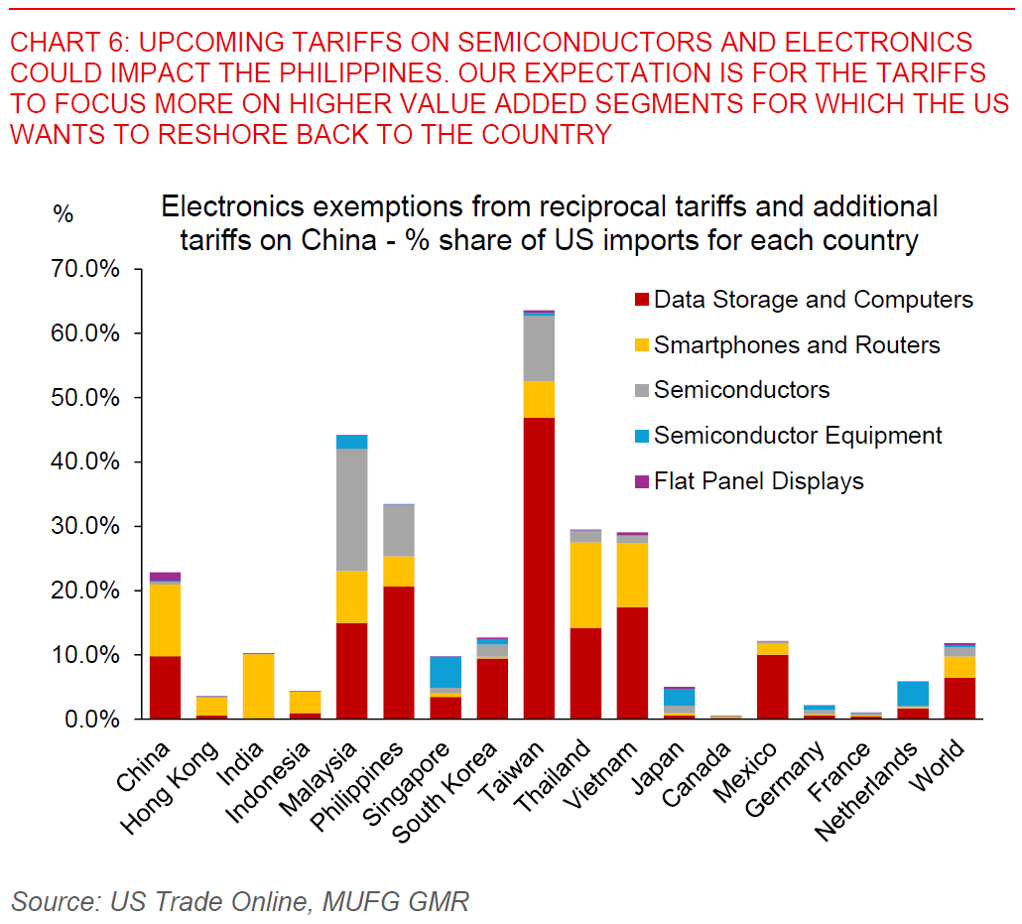

- Second, we expect a trade deal between the US and the Philippines to be reached, and for average tariffs on the Philippines to ultimately fall below the announced 17% reciprocal level. We think a deal is not difficult to be reached given the Philippines only has a very small trade deficit with the US of around US$5bn, together with low perceived indirect supply chain linkages with China in its US exports. There are nonetheless some risks on upcoming semiconductor and electronics tariffs, which could impact the Philippines. Our implicit assumption is that tariffs will be focused on segments that the US wants to reshore such as higher-end semiconductors and AI chips, and as such the Philippines should still come up relatively better off. Net-net our macro and FX forecasts reflect our assumptions for relatively lower tariffs to be imposed on the Philippines, coupled with the more domestic-oriented nature of its economy.

- The third factor why we remain positive on the Philippines from a macro and FX perspective is our expectation for actual FDI to improve, reflecting the surge in FDI approvals that we have already seen: FDI approvals into the Philippines have already risen sharply to US$16bn at its peak as of 3Q2024, up from just US$4bn in 2022. This has been driven by a meaningful rise in renewable energy sector projects, helped by removals of foreign ownership restrictions from December 2022. Although FDI approvals have now fallen closer to US$8bn, the key for PHP is that we should start to see some improvement in actual FDI over the next few quarters if the historical relationship between approvals and implemented capital holds. With a relatively large current account deficit of around 3.5% of GDP, this will be important in helping the Philippines fund its current account deficit amidst rising import needs, and hence supporting the Philippines Peso.

- Fourth, the pipeline of public and private infrastructure projects remain strong. Latest data from the Department of Economy, Planning and Development shows a strong pipeline of ongoing infrastructure projects worth around 13% of GDP, and even more so if we include projects awaiting approvals. While most projects are only expected to be completed over the next few years, the ongoing activity should continue to support economic activity, and as such also help support economic sentiment.

- Last but not least, we continue to expect BSP to remain dovish and to cut rates further by 75bps, bringing the policy to 4.75% by end-2025. In addition, we also pencil in a 100bps Reserve Ratio Requirement cut in 4Q2025, which could boost domestic liquidity by around 1% of deposit base in the Philippines banking sector. While the timing of these forecasts are somewhat faster than what BSP Governor Remolona has publicly mentioned recently (two rate cuts by 2025), we think lower inflation pressures should provide the central bank space to continue its rate cut cadence this year.

Key risks to watch for Philippines macro – remittances tax, new inflation target, domestic political risks, and FDI approvals slowdown

- We are hesitant to forecast more PHP strength despite our expectation for a weaker Dollar and the positive factors mentioned above, for several key reasons.

- First, we estimate that Philippines remittances from the US could be cut by around 0.1% of GDP, if the 3.5% remittance tax proposal as incorporated in the recently passed US House tax bill is ultimately implemented. Remittances from the US makes up 3% of the Philippines’ GDP, the highest in Asia, and this may weigh on the country’s current account deficit to some extent in 2025. Of course, the band of uncertainty is reasonably wide, and among other things Overseas Foreign Workers (OFWs) and green card holders in the United States could perhaps use informal channels to bypass these taxes. In addition, we note that historically remittances overall have been very resilient to shocks and there may also be some diversification of flows from other regions beyond the US to help offset the remittances tax.

- The second key risk is from the recent proposal by BSP Governor to target a point inflation target of perhaps 2%, from the current inflation target of 2-4% (mid-point 3%). The timing of the possible policy change is unclear although the BSP Governor mentioned that the proposals should be done by next year. If a 2% inflation target is ultimately implemented, it would imply a higher bar set for the BSP, and all things equal, should mean sticker and higher interest rates than would otherwise be the case. The net impact on the Philippines peso from an FX perspective is more mixed, with higher real interest rates but at least partially offset by somewhat slower growth prospects weighing on foreign equity inflows.

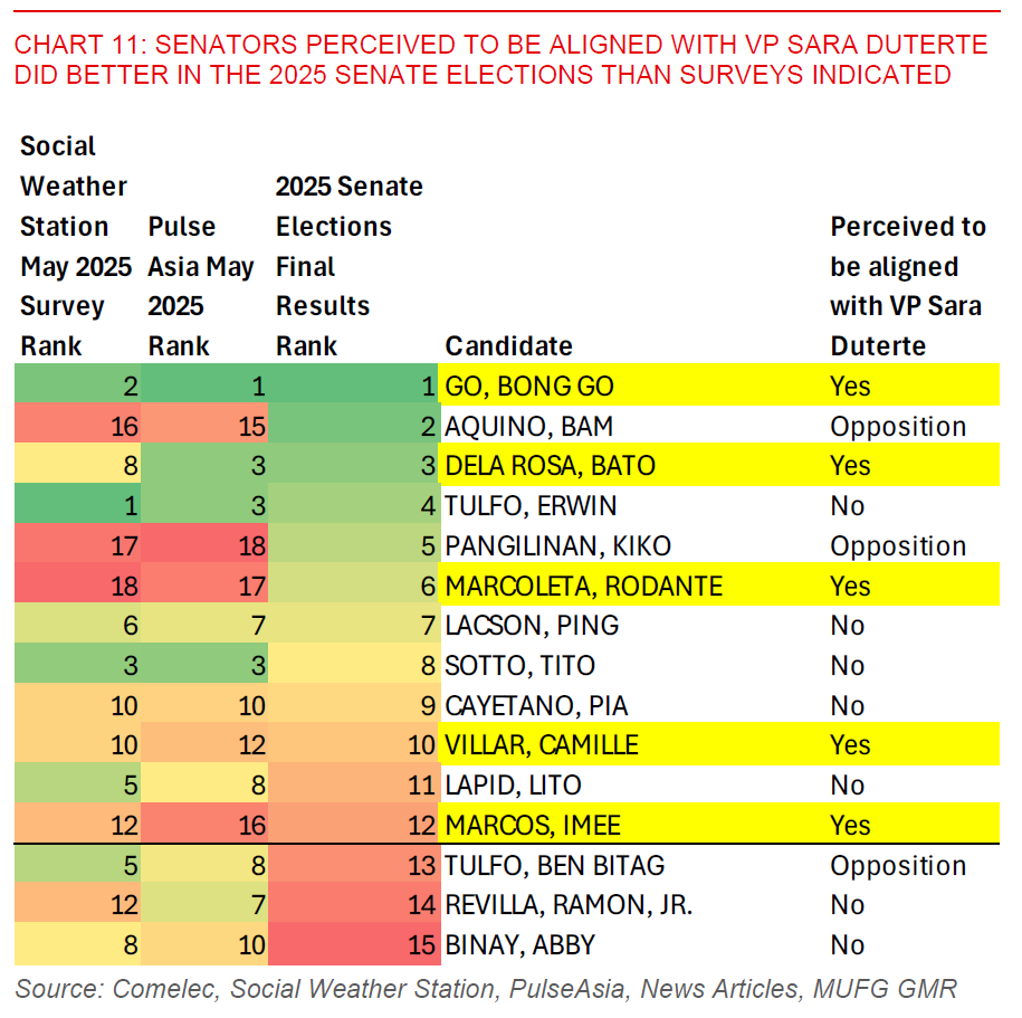

- The final key risk to watch for is on domestic political developments, which could over time have some spillover impact to FDI and the trajectory of fiscal consolidation. In the recent Senate Elections, the candidates perceived to be aligned with VP Sara Duterte did much better than what polls such as Social Weather Station and PulseAsia indicated. With at least 5 such candidates elected in the Senate, we could see greater political noise moving forward including on an expected upcoming impeachment hearing against the Vice President. President Marcos also recently exhorted the Cabinet to resign following the Congressional Election results. The good news from a policy continuity perspective is that the President’s economic team has all been retained with only a change to the Foreign Minister.

- Our base case is for the net impact of the recent Senate Election results to result in greater political noise, while also importantly slowing the pace of reforms in the pipeline especially more contentious ones on fiscal and tax policies.

- Nonetheless, we think it is unlikely to change the trajectory of policy including on infrastructure build-out, and as such should not materially change the country’s current growth trajectory at least in the near-term.

- The upside in our view is that the risks of political instability and protests have likely somewhat diminished given a more divided Senate, but what’s key for the longer-term is the shape of the 2028 Presidential Elections and possible contenders.