- The Trump administration announced that the Philippines will receive a 20% tariff from 1 August 2025, 3pp higher from the 17% rate that was proposed for the Philippines during the April 2025 Liberation Day.

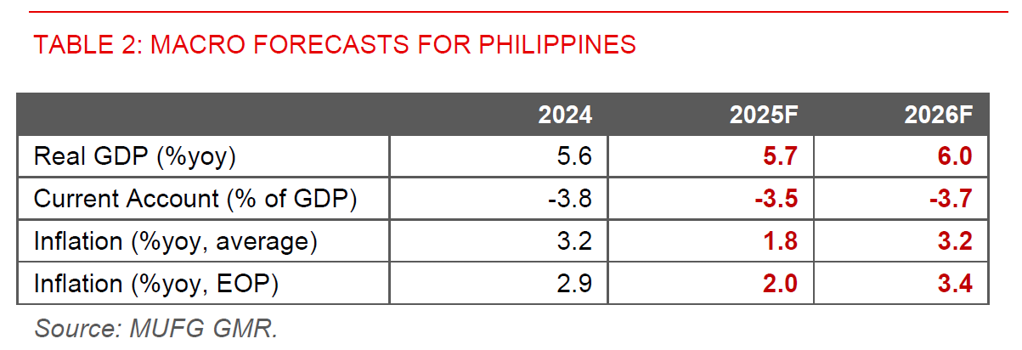

- This announcement is to some extent a downside surprise for our FX and macro forecasts, given that we were implicitly expecting a trade deal between the US and the Philippines with a small bilateral trade deficit between the two countries.

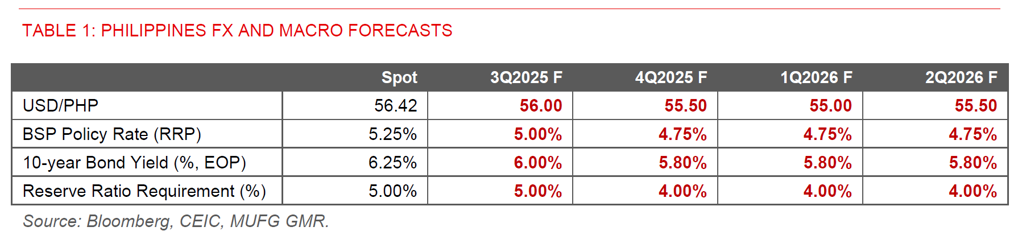

- Nonetheless, we highlight several mitigating factors for the Philippines. As such we keep our current USD/PHP forecasts at 55.50 by 4Q2025 and 55.00 by 1Q2026 for now. We continue to expect a dovish bias by the BSP with another 50bps of rate cuts bringing the policy rate to 4.75% by end-2025, with the risks tilted slightly to more cuts with this tariff announcement.

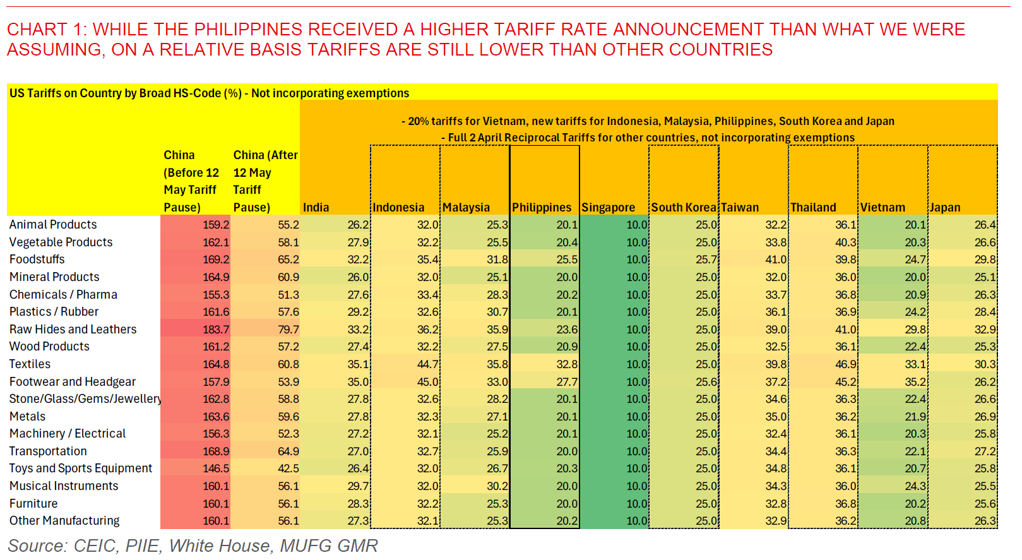

- First, the 20% headline tariff rate for the Philippines is still lower relative to the rate announced for other countries including Thailand, Indonesia and Malaysia, although now at the same rate as Vietnam (see Chart 1 below). Depending on the final tariff rates across countries, this could of course weigh more heavily on US demand and hence growth and the current account. Nonetheless on a relative perspective the incentive to substitute away from the Philippines’ exports towards its competitors is not that high.

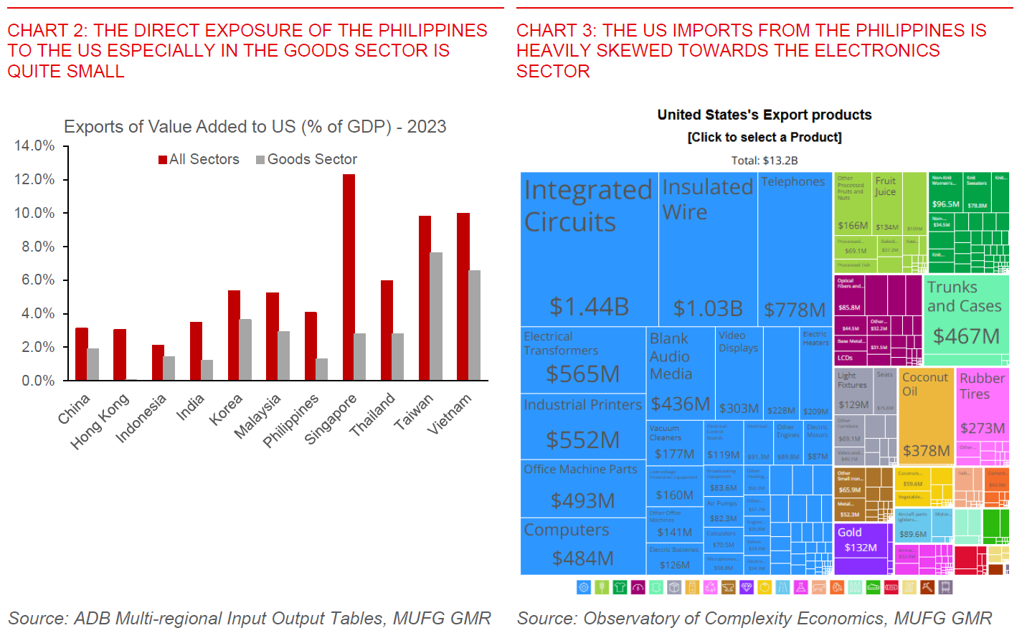

- Second, the Philippines’ exports of value added to the US is quite small at just 1.3% of GDP for the goods sector, and 4% of GDP if one includes services. It’s important to highlight the services component also incorporates sectors such as Business Process Outsourcing (BPOs) and call centers which have very low direct relevance to tariffs on goods exports to the US, and so the net sensitivity of the Philippines to US import slowdown is not that high.

- Third, the Philippines exports to the US are heavily skewed towards the electronics sector. This matters because around 30% of the Philippines exports will still be subjected to exemptions on the electronics sector even after the imposition of reciprocal tariffs, and also because when sectoral tariffs come into play for the Philippines they will apply equally to all countries and not just the Philippines specifically. Of course, we note it will still raise the effective tariff rate for the Philippines depending on the details on sectoral tariffs.

- Last but not least, even if the Philippines offers meaningful import tariff cuts to the US in upcoming negotiations, the competition with domestic industry may be relatively limited. Much of the existing share of the Philippines’ imports from US already have relatively low tariffs such as in the electronics sector and vegetable products, with relatively low dependence on the US on raw materials.

- Beyond tariffs, the positive factors we highlighted previously including rising FDI approvals, manageable inflation and domestic rice prices, coupled with forecast of further US Dollar weakness are still supportive of the Philippines peso (see Philippines: Steady as she goes).

- These assumptions on the tariff impact for the Philippines are nonetheless sensitive to many factors, including the final tariff rates that the Philippines receives relative to other countries, and also the absolute level of sectoral tariffs on electronics exports.

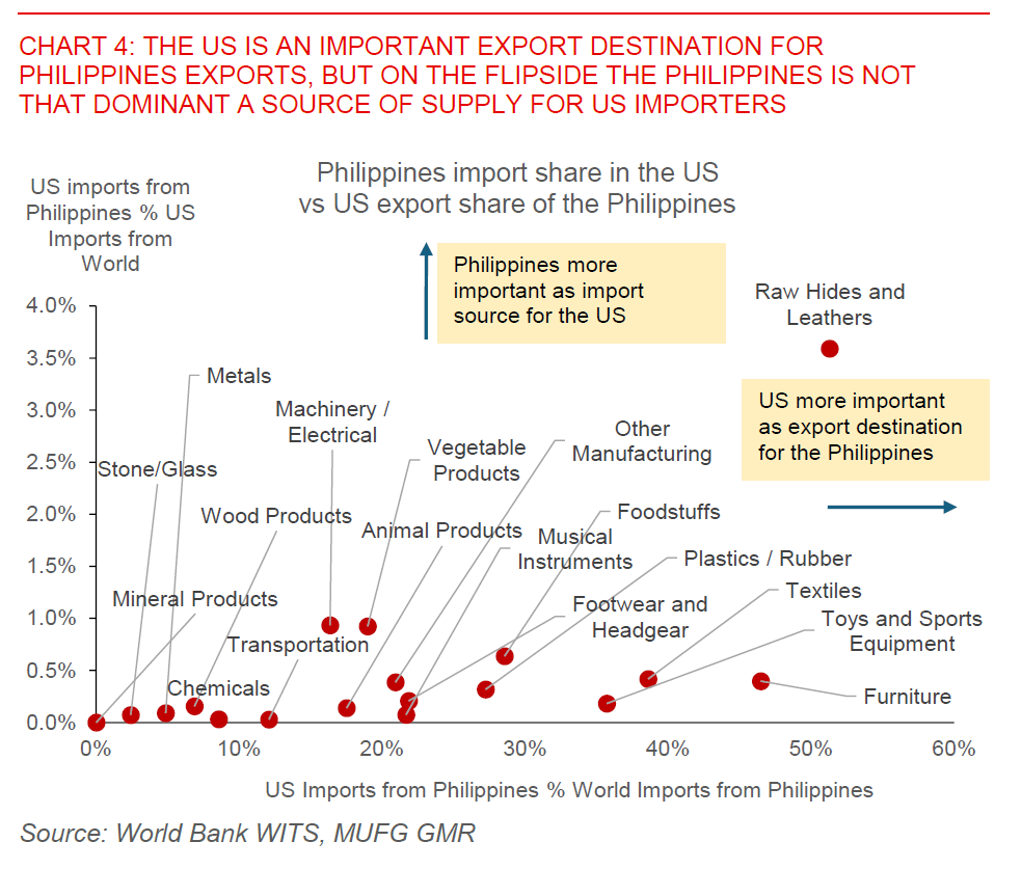

- We also note that the US is quite an important export market for the Philippines in many sectors including leather, furniture, toys and sports equipment, and textiles, but conversely, the Philippines is not a dominant supplier for the US across different product categories. Put differently, if tariff rates were to rise meaningfully higher relative to other countries, the incentive for US importers to substitute across countries from the Philippines may start to weigh on exports.

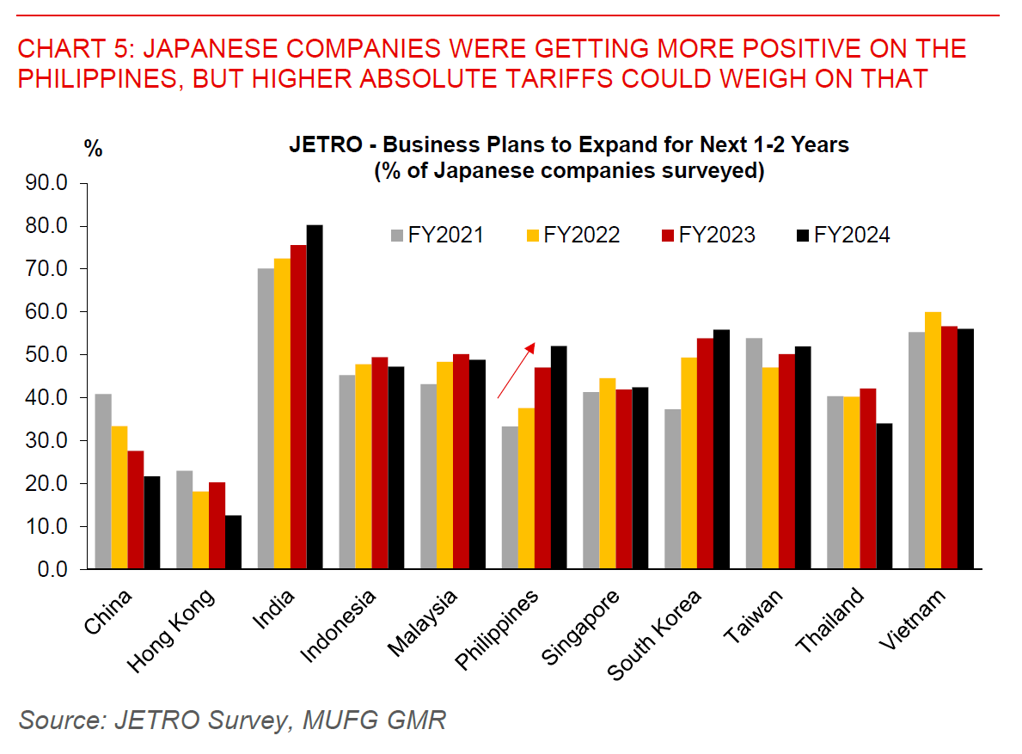

- Over the medium-term, with tariff rates closer to 20%, the marginal incentive to shift some manufacturing to the Philippines also becomes less compelling, even as we highlight that we were not assuming a substantial manufacturing shift for the Philippines as our base case to begin with.

- In other words, relatives matter, but so do the opportunity costs for the Philippines.