Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

KHANG SEK LEE

Associate

Global Markets Research

Global Markets Division for Asia

E: khangsek_lee@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

September 2025

KEY EVENTS IN THE MONTH AHEAD

1) BUSY MONTH FOR CENTRAL BANKS

The more subdued period of trading during the summer vacation period comes to an end following the US Labor Day vacation at the start of September and there will be plenty of central bank decisions this month to potentially create some renewed volatility. Nine of the G10 central banks are meeting in September and as usual the most important amongst them will be the FOMC policy announcement on 17th. The market is nearly fully priced for a 25bp cut with the NFP data on 5th September and the CPI data on 11th September the key data points that will influence expectations ahead of the meeting. The ECB (11th); the BoC (17th); Norges Bank and the BoE (18th); the BoJ (19th); the Riksbank (23rd); the SNB (25th) and the RBA (30th) are the other meetings taking place. Only the RBNZ will not meet. A number of decisions are in the balance but the ECB, BoE, BoJ, the SNB and the RBA are most likely not to announce any change in policy rates. The BoC, Norges Bank and the Riksbank are priced close to around a 50% probability of a 25bp cut. The BoJ is the only central bank expected to hike going forward but given the Fed is likely to have cut just two days earlier, a rate hike this month is very unlikely. We do expect communication to harden amongst BoJ officials to guide market participants toward a rate hike in October. That currently is priced at close to a 50% probability.

2) FED INDEPENDENCE DOUBTS & TRADE UNCERTAINTY AGAIN

The firing of Fed Governor Lisa Cook by President Trump on 25th August and the legal action taken by Governor Cook to reverse this did not reach a conclusion in the initial District Court hearing on 29th August. This is likely to run possibly throughout September and will remain a key focus for the financial markets. There is no clear way of estimating how long this process may take but it is likely it will run all the way to the Supreme Court. The financial market reaction has been contained so far by the Supreme Court’s previous acknowledgement that Federal Reserve board members would be treated differently and their firing would need to achieve a higher bar than the removal of other federal employees. At the end of August, a federal appeals court ruled that Trump’s tariffs under the IEEPA were illegal throwing renewed doubts over US trade policy. The tariffs were left intact and an appeal to the Supreme Court is likely and will be monitored closely by market participants in September.

3) PBOC RATE CUT IN SEPTEMBER LIKELY SHOULD FED CUT

With limited signs of large fiscal stimulus in the near-term, we see the possibility of PBoC delivering a cut should the Fed ease on 17th Sep. We expect a total 30bps of cuts by the end of year from PBoC particularly given the still elevated real policy rate. Meanwhile, additional industry policies are likely to be confirmed. The “Guideline on Implementing “AI Plus Initiatives” announced in late August is one example of that, which aims to make “intelligent” economy an important economic growth driver by 2030. A sustained revaluation of China’s equities, leading up to the fourth plenum of the 20th CCCPC in October, would strengthen CNY.

Forecast rates against the US dollar - End-Q3 2025 to End-Q2 2026

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

DXY |

97.776 |

97.600 |

95.530 |

93.610 |

92.300 |

|

JPY |

146.94 |

146.00 |

144.00 |

142.00 |

140.00 |

|

EUR |

1.1699 |

1.1700 |

1.2000 |

1.2300 |

1.2500 |

|

GBP |

1.3508 |

1.3530 |

1.3790 |

1.3980 |

1.4040 |

|

CNY |

7.1301 |

7.1000 |

7.1000 |

7.0800 |

7.0500 |

|

AUD |

0.6541 |

0.6500 |

0.6600 |

0.6700 |

0.6900 |

|

NZD |

0.5897 |

0.6000 |

0.6100 |

0.6200 |

0.6300 |

|

CAD |

1.3738 |

1.3600 |

1.3500 |

1.3400 |

1.3300 |

|

NOK |

10.058 |

10.085 |

9.8330 |

9.5120 |

9.2800 |

|

SEK |

9.4746 |

9.4870 |

9.2500 |

8.9430 |

8.6400 |

|

CHF |

0.8000 |

0.8030 |

0.7830 |

0.7720 |

0.7680 |

|

|

|

|

|

|

|

|

CZK |

20.896 |

20.850 |

20.250 |

19.670 |

19.200 |

|

HUF |

338.92 |

338.50 |

329.20 |

318.70 |

310.40 |

|

PLN |

3.6455 |

3.6320 |

3.5420 |

3.4630 |

3.4240 |

|

RON |

4.3352 |

4.3330 |

4.2420 |

4.1540 |

4.1120 |

|

RUB |

80.150 |

79.890 |

80.730 |

83.370 |

85.390 |

|

ZAR |

17.664 |

17.500 |

17.250 |

17.000 |

17.000 |

|

TRY |

41.147 |

42.000 |

44.000 |

46.250 |

47.250 |

|

|

|

|

|

|

|

|

INR |

88.200 |

88.200 |

88.900 |

89.000 |

89.000 |

|

IDR |

16496 |

16170 |

16140 |

16040 |

15930 |

|

MYR |

4.2230 |

4.2000 |

4.1500 |

4.0800 |

4.0600 |

|

PHP |

57.120 |

57.000 |

56.500 |

56.000 |

56.000 |

|

SGD |

1.2833 |

1.2800 |

1.2700 |

1.2600 |

1.2600 |

|

KRW |

1389.7 |

1380.0 |

1375.0 |

1370.0 |

1365.0 |

|

TWD |

30.559 |

30.400 |

30.200 |

30.000 |

29.800 |

|

THB |

32.292 |

32.600 |

32.500 |

32.400 |

32.300 |

|

VND |

26343 |

26400 |

26500 |

26600 |

26700 |

|

|

|

|

|

|

|

|

ARS |

1316.5 |

1350.0 |

1400.0 |

1425.0 |

1475.0 |

|

BRL |

5.4303 |

5.4500 |

5.4000 |

5.3500 |

5.3000 |

|

CLP |

963.15 |

960.00 |

945.00 |

935.00 |

935.00 |

|

MXN |

18.647 |

18.750 |

18.500 |

18.250 |

18.000 |

|

|

|||||

|

SAR |

3.7520 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

48.537 |

50.800 |

51.000 |

51.200 |

51.400 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate. All consensus forecasts are Bloomberg sourced.

US dollar

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

USD/JPY |

146.94 |

146.00 |

144.00 |

142.00 |

140.00 |

|

EUR/USD |

1.1699 |

1.1700 |

1.2000 |

1.2300 |

1.2500 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/JPY |

145.00 |

142.50 |

141.00 |

140.00 |

|

|

EUR/USD |

1.1700 |

1.1800 |

1.1900 |

1.2000 |

MARKET UPDATE

In August the US dollar weakened against the euro in terms of London closing rates, from 1.1443 to 1.1699. The dollar also weakened against the yen, from 150.45 to 146.94. The FOMC did not meet in August and hence the range for the federal funds rate was unchanged at 4.25% to 4.50%, the level reached following 100bps of cuts last year. The FOMC is reducing its securities holdings with the monthly pace of QT via the cap of UST bonds rolling off the balance sheet now at just USD 5bn. The pace of reduction in the holdings of MBS is running at around USD 15bn per month.

OUTLOOK

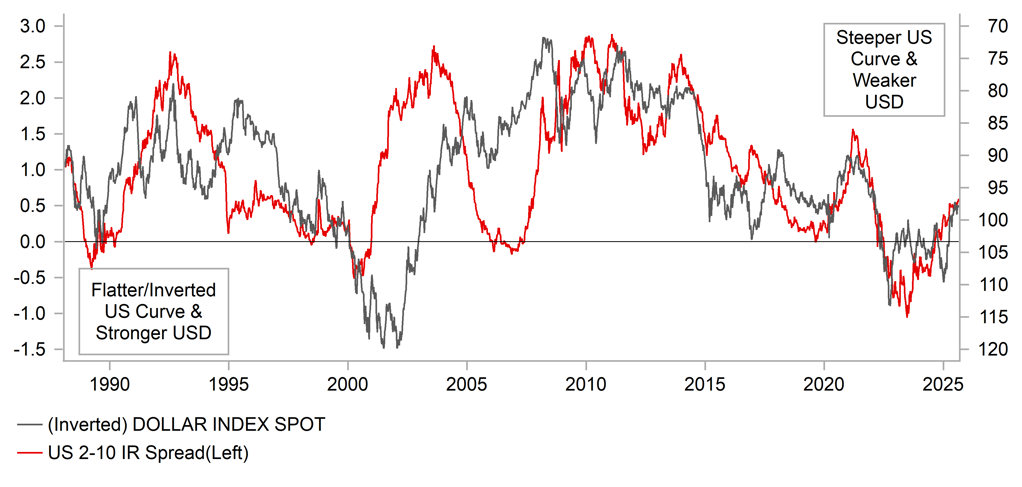

The rebound of the US dollar in July – the first monthly gain in 2025 – has not been sustained and the dollar re-weakened in August with the DXY dropping 2.2%. The primary catalysts related to the Fed – strengthening expectations of rate cuts and the much more blatant action by the Trump administration to undermine the independence of the Fed. The decision of President Trump on 25th August to fire Fed Governor Lisa Cook has dramatically escalated the risks associated with threats to Fed independence. Governor Cook has challenged the decision but there was no conclusion at the initial hearing and whichever ruling is made, this is set to run to the Supreme Court. Whatever the outcome, it is clear that Trump is willing to act aggressively and that to us underlines the need for investors to price this risk into US assets. The financial market indifference so far is unlikely to last and this is likely to be a prominent theme throughout the remainder of Trump’s term in office. This action has led us to lower our US dollar forecast profile and we see the dollar on a DXY basis falling by around a further 6% by mid-2026, more bearish than consensus.

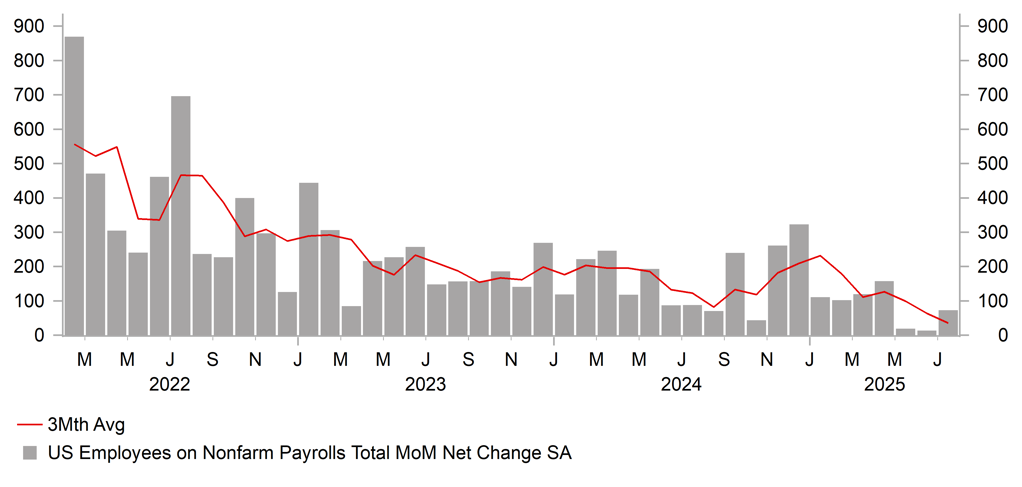

The jobs data in August for July also gives us greater confidence that the labour market is slowing and that the weakness will be enough to allow for Fed easing. The Jackson Hole speech by Fed Chair Powell lowered the bar notably for delivering a cut in September and it would now take a very strong rebound in nonfarm payrolls for August for a cut to be derailed. Another cut is priced by year-end which we expect but after the weak jobs data, there is a greater risk of the FOMC delivering a cut at every remaining meeting this year. Why we have maintained the view of just two cuts is down to the fact that inflation risks remain elevated. The 10-year US inflation swap and breakeven rates indicated increased concerns over upside inflation risks and Trump tariff policies are likely to show up more clearly going forward. Inventory build ahead of tariffs and margin compression cannot mask the inflation impact forever and this mix of still sticky high inflation and weakening growth is a bad mix for the US dollar – investors will likely continue to cut exposure to downside dollar risks.

The attempt to fire Fed Governor Cook is an indication to us of the risk associated with the undermining of Fed independence is notable and has not been accurately priced yet by investors. We have therefore lowered our US dollar forecasts to reflect these increased risks.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

Policy Rate |

4.33% |

4.13% |

3.88% |

3.63% |

3.38% |

|

3-Month T-Bill |

4.14% |

4.00% |

3.75% |

3.50% |

3.30% |

|

10-Year Yield |

4.23% |

4.38% |

4.25% |

4.13% |

4.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

At the 2025 Jackson Hole meeting, Powell signaled that it’s likely time to resume easing. Our base case remains for the Fed to cut by 25 bps in September, with one additional cut this year. If the labor data is to weaken further, the Fed can pull forward cuts that are priced-in for 2026, so we keep the option of 2 cuts as our base case, but wouldn’t be surprised to see a series of 25bp cuts at the remaining 3 meetings. We consider Powell’s recent Jackson Hole speech to be a pivot, similar to last year’s, but with some caveats. For instance, we believe the bar to cut by 50bp like last September remains high. It would take a very weak August NFP report (possibly negative headline) and a rise in the unemployment rate to around 4.4%. In addition, we would need to see the QCEW data released on September 9th to once again show that the NFP data has been overstating jobs by 600-900k jobs on a one year look back. And of course, if stocks see the start of, or enter into a correction of 10% (coupled with most of these potential weaker updates on the labor front), that could get us a 50 bp cut. Looking ahead, we expect 100 bps of rate cuts in 2026, bringing the total to 150 bps in this part of the easing cycle. (George Goncalves)

NONFARM EMPLOYMENT GROWTH

Source: Bloomberg, Macrobond & MUFG GMR

DXY VS. SLOPE OF US YIELD CURVE

Source: Bloomberg, Macrobond & MUFG GMR

Japanese yen

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

USD/JPY |

146.94 |

146.00 |

144.00 |

142.00 |

140.00 |

|

EUR/JPY |

171.91 |

170.80 |

172.80 |

174.70 |

175.00 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/JPY |

145.00 |

142.50 |

141.00 |

140.00 |

|

|

EUR/JPY |

170.00 |

168.00 |

166.50 |

166.00 |

MARKET UPDATE

In August the yen strengthened versus the US dollar in terms of London closing rates from 150.45 to 146.94. The yen strengthened more modestly versus the euro from 172.16 to 171.91. The BoJ did not meet in August and hence the key policy rate remained at 0.50%, following the 25bp hike in January, the first 25bp rate hike since before the GFC in 2007. The BoJ is also continuing with the policy of cutting JGB monthly purchases at a pace of JPY 400bn per quarter but announced in June that the pace of reduction will be reduced to JPY 200bn per quarter from Q2 2026.

OUTLOOK

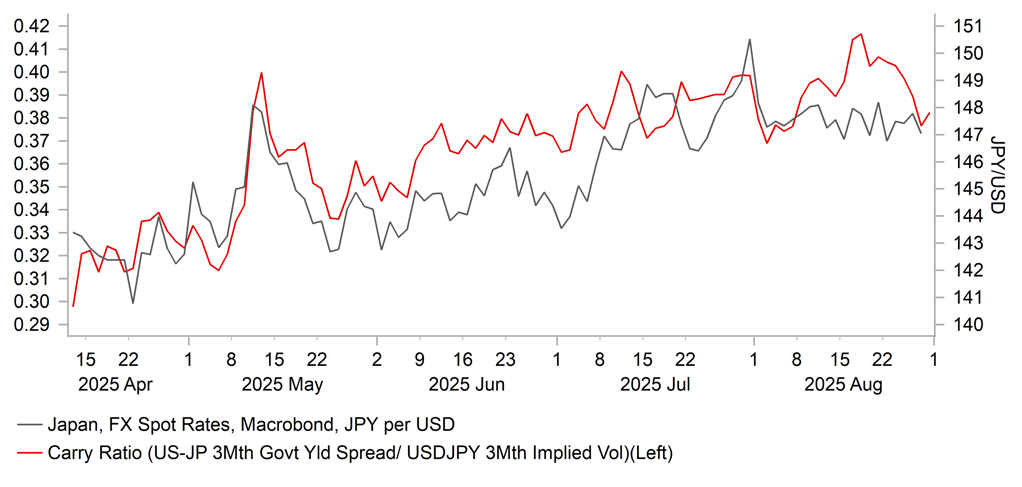

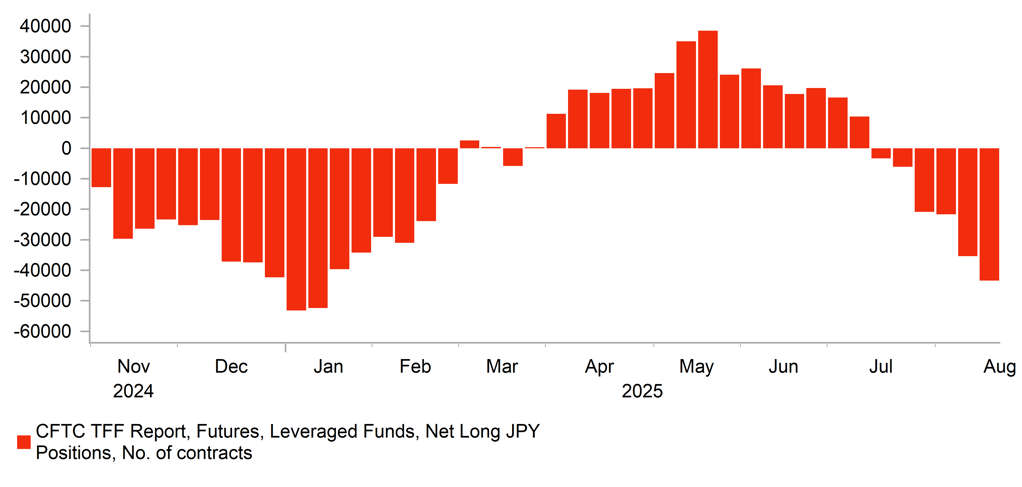

The yen strengthened in August and was in fact the third best performing G10 currency in a month in which the US dollar weakened more broadly on increased speculation of a Fed rate cut and Trump’s more aggressive than expected approach to undermining the independence of the Fed. The sharpest contrast in monetary policy outlook is versus the BoJ with market expectations for a rate hike in October initially declining but then rebounding later in the month. An October hike is close to a 50% chance. We see a hike in October and the communications from BoJ officials has been consistent with that. Policy board member Junko Nakagawa (dove) repeated the key guidance of a hike being required if the outlook is realised while the data flow was broadly consistent with a hike being delivered. Q2 real GDP was stronger than expected with a SAAR Q/Q increase of 1.0% and while wage growth slowed it remained consistent with the BoJ inflation target. A crucial additional factor that will encourage a rate hike is the continued weakness of the yen. US Treasury Secretary Scott Bessent again criticised BoJ policy, labelling it the primary factor keeping the yen at under-valued levels. A rate hike therefore would certainly help the government in its negotiations with the US in getting tariff rates reduced.

An LDP report into the failures of the party in the upper house election is unlikely to explicitly blame PM Ishiba when released early in September. Momentum for removing PM Ishiba from office has faded in part due to a strong showing in opinion polls. Despite the loss, PM Ishiba’s approval rating has jumped – a Kyodo News poll saw a 12.5ppt jump in approval while a Yomiuri poll saw a 17ppt jump. Continued political stability would certainly be more conducive to the BoJ hiking in October. Especially so given the likelihood that PM Ishiba seems set to announce another fiscal spending package. We doubt this package will involve additional JGB issuance and will be financed by surplus cash but will be supportive for growth and possibly help support additional consumer spending.

We are now more confident that our view of a Q4 rate hike will be realised and October is looking more likely than December. The political uncertainty looks to be clearing and the economy and global economic conditions are all consistent with a hike. The yen remains undervalued and with the Fed resuming monetary easing we see renewed, more sustained declines in USD/JPY going forward.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

Policy Rate |

0.50% |

0.50% |

0.75% |

0.75% |

1.00% |

|

3-Month Bill |

0.43% |

0.80% |

0.90% |

0.90% |

1.10% |

|

10-Year Yield |

1.60% |

1.65% |

1.70% |

1.80% |

1.85% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased in August, by 4bps to close at 1.60%. The move higher came despite the 14bp drop in the 10-year UST bond yield. As above, the data flow is certainly consistent with the BoJ hiking in contrast to the prospect of a rate cut by the Fed. Governor Ueda spoke at Jackson Hole in August and highlighted the fact that demographic pressures on wages had been masked by increased labour market participation and that was unlikely to be maintained and hence the BoJ expected wage growth to be supported and feed into more persistent inflation. This a structural aspect relating to better inflation prospects and underlines the direction of monetary policy with cyclical factors therefore only dictating the timing of rate hikes. Investors have taken this key change on board with the 30-year JGB yield up close to a huge 90bps this year to date. There remains a danger of the BoJ being perceived as being behind the curve if it remains overly cautious. Inflation remains sticky and high food inflation has a bigger impact on inflation expectations that means BoJ action is necessary. We maintain that the 10yr yield will rise further.

USD/JPY VS. CARRY ATTRACTIVENESS

Source: Bloomberg, Macrobond & MUFG GMR

JPY POSITIONING HELD BY LEVERAGED FUNDS

Source: Bloomberg, Macrobond & MUFG GMR

Euro

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

EUR/USD |

1.1699 |

1.1700 |

1.2000 |

1.2300 |

1.2500 |

|

EUR/JPY |

171.91 |

170.80 |

172.80 |

174.70 |

175.00 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

EUR/USD |

1.1700 |

1.1800 |

1.1900 |

1.2000 |

|

|

EUR/JPY |

170.00 |

168.00 |

166.50 |

166.00 |

MARKET UPDATE

In August the euro rebounded versus the US dollar in terms of London closing rates, moving from 1.1443 to 1.1699. The ECB did not meet in August and hence the key policy rate was unchanged at 2.00%, following 200bp of cuts since last year. The ECB is running down APP securities and started PEPP run-off in July last year with about EUR 425bn of securities estimated to roll off the balance sheet in 2025.

OUTLOOK

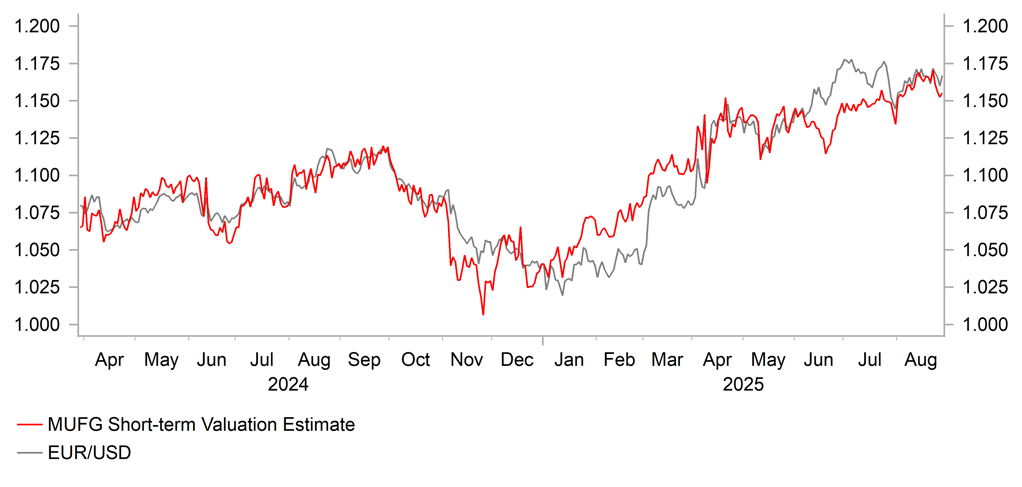

The euro advanced in August versus the US dollar but in terms of G10 performance the euro was mid-table with SEK the top performer and NZD the worst. While there are always euro-zone factors that are key for EUR performance the broad-based sell-off of the dollar in August reflected increased expectations of a Fed rate cut in September and more worryingly increased risks related to the more blatant attempts by the White House to undermine the independence of the Fed. It is mainly for those reasons that we have raised our EUR/USD forecasts (from 1.1700; 1.1900; 1.2000 & 1.2200 previously). The 3 big-figure increase to the Q2 2026 forecast now means we see a 6.8% advanced in EUR/USD by mid-2026. That’s a bigger gain than against other G10 currencies so we do see potential for EUR outperformance. The euro-zone economy continues to show resilience in the face of global uncertainties and that should translate into some moderate pick-up in GDP growth in 2026 as monetary easing from the ECB begins to transmit through the economy. Last month we pushed back the timing of rate cuts with a September ECB cut now unlikely. While we are still showing a 1.50% trough, our conviction in two further rate cuts has come down in part due to the US tariff rate being lower than expected (15% versus 20% expected).

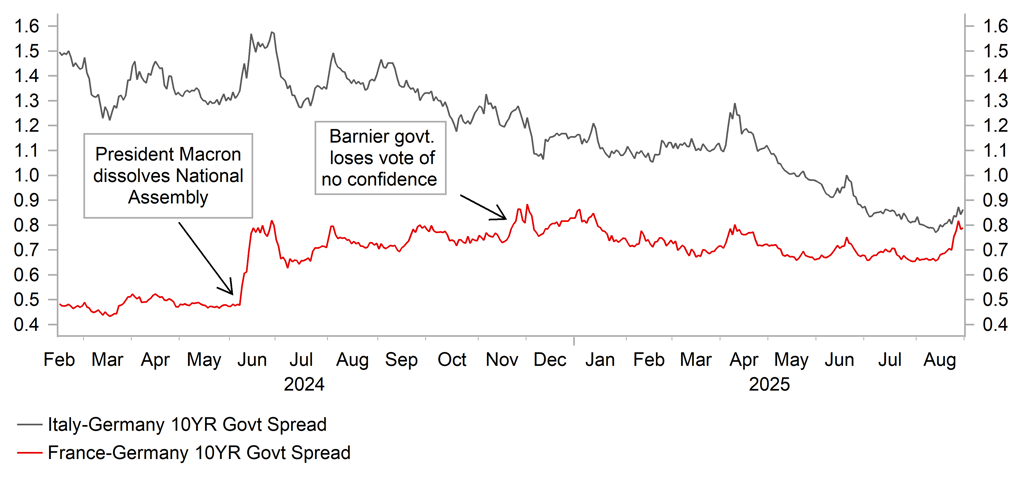

During August we had a renewed blow-out in the OAT/Bund spread following the surprise decision of PM Bayrou to schedule a government confidence vote on 8th September. It appears the government sees no way out of the policy gridlock and sees the risks for fiscal inaction as worse than the political risks of another collapsed government. It seems highly likely the motion will not pass and the government will collapse. We assume President Macron will opt to repeat what he did last year and choose another candidate for PM to try and get the 2026 budget passed. Whether there will be the incentive to hold parliamentary elections again is unclear. Would it produce a dramatically different outcome to the current parliamentary mix? The jump in the OAT/Bund spread last June did not retrace back to original levels and hence with spreads already capturing political risks, we do not expect a considerable further widening. The EUR/USD impact last year was in any case modest. As long as President Macron does not bring forward presidential elections from April 2027 we see limited impact from an FX perspective. But this risk requires monitoring.

Given the increased US dollar risks highlighted above and given the resilience of the euro-zone economy and a potentially better EU-US trade negotiation outcome than expected, we have revised our EUR/USD forecasts higher.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

Policy Rate |

2.00% |

2.00% |

1.75% |

1.50% |

1.50% |

|

3-Month Bill |

1.99% |

2.00% |

1.70% |

1.55% |

1.55% |

|

10-Year Yield |

2.72% |

2.60% |

2.50% |

2.55% |

2.55% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

With fiscal risks in the UK, tariff-related inflation concerns in the US and the BoJ set to hike rates further, the German Bund outlook is more favourable on a relative basis. Inflation risks are certainly more contained while fiscally Germany is in a strong position with ample capacity. That may have helped keep yields stable with the 10-year German Bund yield close to unchanged in August, rising a mere 2bps to close at 2.72%. Yields have already jumped this year reflecting the fiscal spending plans announced by Chancellor Merz but the more benign inflation outlook and the stronger fiscal position will help contain higher yields over the forecast period ahead. We still see scope for the ECB to lower rates going forward although our confidence in the ECB delivering two further cuts has come down somewhat. The ECB sees less urgency for cuts with inflation expected to stabilise at around the 2.0% target helped by a US tariff that was less onerous than expected. Furthermore, Fed rate cuts and a slowing labour market in the US will help bring longer-term UST bond yields modestly lower which will act as a key influence on bund yields as well. Yields should therefore remain more stable in Germany.

EUR/USD VS. SHORT-TERM VALUATION ESTIMATE

Source: : Bloomberg, Macrobond & MUFG GMR

IMPACT OF POLITICAL UNCERTAINTY IN FRANCE

Source:: Bloomberg, Macrobond & MUFG GMR

Pound Sterling

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

EUR/GBP |

0.8661 |

0.8650 |

0.8700 |

0.8800 |

0.8900 |

|

GBP/USD |

1.3508 |

1.3530 |

1.3790 |

1.3980 |

1.4040 |

|

GBP/JPY |

198.49 |

197.50 |

198.60 |

198.50 |

196.60 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

GBP/USD |

1.3600 |

1.3600 |

1.3700 |

1.3800 |

MARKET UPDATE

In August the pound gained against the US dollar in terms of London closing rates from 1.3233 to 1.3508. However, the pound weakened very modestly against the euro from 0.8647 to 0.8661. The MPC at its meeting in August cut the key policy rate by 25bps to 4.00%, the fifth 25bp cut since August last year.

OUTLOOK

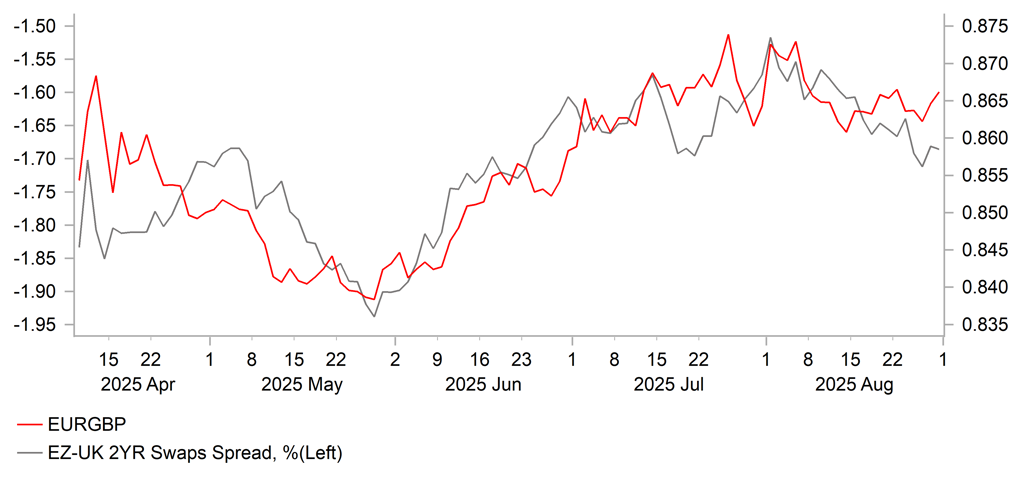

The pound performed well in August when it was the fourth best performing G10 currency after the SEK, NOK and EUR. The catalyst for better pound performance was the MPC meeting on 7th August. The MPC’s decision to cut rates by 25bp was a much more finely balanced decision than expected. The initial 4-4-1 vote (Taylor was the lone voter for a 50bp cut) resulted in the first ever re-vote that resulted in a 5-4 decision to cut by 25bps. Four dissenters indicated an increase in opposition to the quarterly pace of cuts and placed real doubt over another cut in November. Prior to the meeting the OIS market implied 18bps of pricing for a November cut which has now fallen to just 5bps. BoE Governor Bailey stated the rate expectations readjustment was understandable given the decision was finely balanced. The BoE raised its short-term inflation peak forecast from 3.7% to 4.0% by September but did then show inflation falling to 2.0% by the end of the forecast horizon. That forecast was based on the assumption of the policy rate falling to 3.50%, so the BoE’s own forecasts do still endorse further monetary easing. We suspect the BoE will ultimately cut a little more and we maintain 75bps of further cuts by Q2 2026.

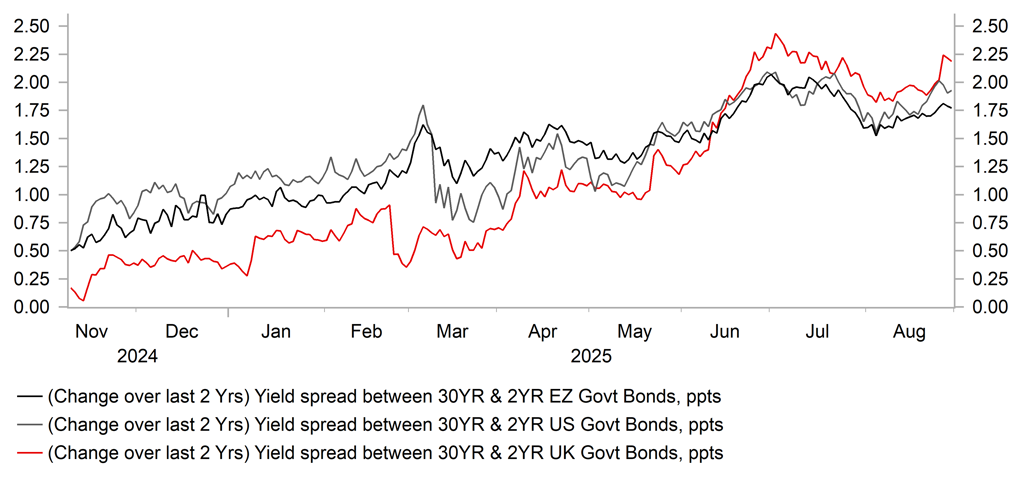

The sticky near-term inflation expected by the BoE is reinforcing the upward pressure on Gilt yields. Added to that is the backdrop of weak economic growth and repeated fiscal slippage by the government that is undermining investor confidence further. The 30-year Gilt yield closed above the 5.60%-level on a few occasions in August, the first time that has happened since 1998. There are growing concerns of the government being trapped in a fiscal-doom loop of weaker than expected growth and higher than expected yields forcing the government to increase taxes, in turn weighing further on growth. How to break out of this cycle is unclear. For the third time since Labour came to power, Chancellor Reeves is set to announce tax increases to close a fiscal gap. The problem now is the gap is much bigger, estimated to be between GBP 30-50bn. Inflation remains an issue but the more recent selling does look to be more fiscal risk-related as 30-year Gilt yields diverge notably from 30-year UST bond yields. Our correlation analysis indicates a larger negative correlation between FX and 30-year Govt. yields than in other major countries and we see increased risks of renewed underperformance for the pound.

Given we have lowered our US dollar forecasts generally to reflect the larger than anticipated risk to Fed independence becoming a bigger driver of dollar selling, we have also raised our GBP/USD forecast but less than our EUR/USD levels, implying pound underperformance versus the euro.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

Policy Rate |

4.00% |

4.00% |

3.75% |

3.50% |

3.25% |

|

3-Month Bill |

4.10% |

3.95% |

3.70% |

3.45% |

3.25% |

|

10-Year Yield |

4.72% |

4.75% |

4.70% |

4.50% |

4.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield jumped further in August by 15bps to close at 4.72% and followed a more modest increase of 8bps in July. The move higher in Gilt yields in August was in contrast to the drop in the 10-year yield in the US, stability in Germany and more modest rise in Japan. The increased expectations of Fed rate cuts is certainly a factor in the divergence while the MPC meeting in August that saw a much tighter vote to cut rates has reduced expectations of further cuts. Stronger than expected inflation data for July also helped reinforce the reduced expectations of further rate cuts. But ongoing concerns over the fiscal outlook is becoming an increasing risk. An estimate fiscal hole in the range of GBP 30-50bn requires filling which will be the UK’s third attempt to address fiscal slippage, but the current gap is a lot larger and investors’ concerns over breaking out of this cycle is increasing. Fiscal slippage compels the government to raise taxes, which weakens growth and risks further fiscal slippage. Rate cuts from the Fed and slower growth in the US and globally would help contain Gilt yields. However, we are raising our Gilt yield forecast levels to better reflect the growing risks related to UK fiscal policy.

EUR/GBP VS. SHORT-TERM YIELD SPREAD

Source: : Bloomberg, Macrobond & MUFG GMR

CHANGE IN SLOPES OF UK, US & EZ GOVT YIELD CURVES

Source: : Bloomberg, Macrobond & MUFG GMR

Chinese renminbi

|

Spot close 29.08.25 |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

USD/CNY |

7.1301 |

7.1000 |

7.1000 |

7.0800 |

7.0500 |

|

USD/HKD |

7.7947 |

7.7800 |

7.7800 |

7.7800 |

7.7800 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/CNY |

7.1600 |

7.1500 |

7.1400 |

7.1100 |

|

|

USD/HKD |

7.8300 |

7.8000 |

7.8000 |

7.8000 |

MARKET UPDATE

In August, USD/CNY dropped notably from 7.1990 to 7.1301. On 20th August, the PBoC kept the 1Y and 5Y LPR at 3.00% and 3.50% respectively as expected. In Q2 China’s monetary policy implementation report released on 15th August, the PBoC reiterated to implement a moderately loose monetary policy and control the pace and intensity of policy implementation well and mentioned taking price recovery as key consideration in monetary policy setting.

OUTLOOK

China’s economy headed into 2H with a rough start, as most of July’s macroeconomic indicators pointed to a growth slowdown. For instance, FAI YTD growth slowed meaningfully for two consecutive months to 1.6%yoy in July, a moderated retail sales growth, continued downturn in property sector and etc. In addition, July’s overall bank loan stock declined for the first time in 20 years. That said, there were several important policy announcements in August that support the economy both cyclically and structurally. Firstly, the expansion of consumption policy beyond trade-in program to services, namely 1% annual interest subsidy for personal consumption loan (applicable to both goods and services spending) and eight specific services industry business loans, will not only incentivize near-term services consumption but also increase the quality supply of services in areas like elderly care and childcare driven by structural needs. In addition, the push on further developing high-tech sector continues with the “Guidelines on Financial Support for New Industrialization” aiming to set up a financial system for advanced, smart and green manufacturing by 2027. The latest Guideline announced on 26th August regarding implementing the “AI Plus” initiatives, focuses on deeply integrating AI into the fields of science and technology, industrial development, consumption upgrades, people's well-being, governance and global cooperation, with a 2027 target of reaching a 70% penetration rate for new-generation intelligent terminals and AI agents.

In the near-term, it is likely that narratives around China’s asset markets will continue focusing on thematic investment potential, rather than overall weak fundamentals. The pledge to make an “intelligent” economy a significant economic growth driver alongside further increasing the aforementioned penetration rate to 90% by 2030, as outlined in the “Guideline on Implementing “AI Plus” Initiatives”, may help sustain China’s equity revaluation and uptrend. We think the guideline on AI plus initiatives is likely a precursor of the 15th five-year plan in October. Meanwhile, the positive surprise in China’s July export growth helped by trade diversification seemed to have led investors to reprice the risk of China’s slowdown too, in our view. That said, while a weaker economic growth in the remainder of the year due to Trump’s hike of global tariffs will weigh on CNY, continued A share market performance and “revaluation of China assets” will help attract portfolio inflow and support the currency, we are now revising our forecasts for USD/CNY to show moderate CNY appreciation given recent polices and market moves.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2025 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

|

|

LPR 1Y |

3.00% |

2.90% |

2.70% |

2.70% |

2.70% |

|

7-Day Reverse Repo Rate |

1.40% |

1.30% |

1.10% |

1.10% |

1.10% |

|

10-Year Yield |

1.71% |

1.75% |

1.75% |

1.80% |

1.85% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

With Fed Chair Powell turning dovish at Jackson Hole, it opens the window for the PBoC to cut rates in the current and following quarters by 10bps and 20bps respectively (our expectation). The cumulative amount would still be lower than the Fed’s 50bps of cuts through year-end expected by the market. As of now, China’s real policy rate stands at 1.4%, way above the past 10-year (2015-2024) average of 0.7%. We think the need to cut is especially justified if fiscal stimulus is going to be only incremental in Q4. Meanwhile, the 10y CGB yield continued to trend upward by 6bps to 1.77% by end-August. While households reallocating their assets from bonds to equities played a part to that, the announcement of the government reinstating VAT on interest income generated from newly issued government bonds or financial institution bonds starting 8th August likely also diminished the appetite for bond investment. That said, we think the bond yield upward pressure will be offset by deteriorating economic growth, and PBoC cuts in the coming months. As such, we see the 10y CGB yield remaining at around 1.75% for Q3 and Q4, before ticking up to 1.85% by Q2 next year helped by modest progress on reflation.

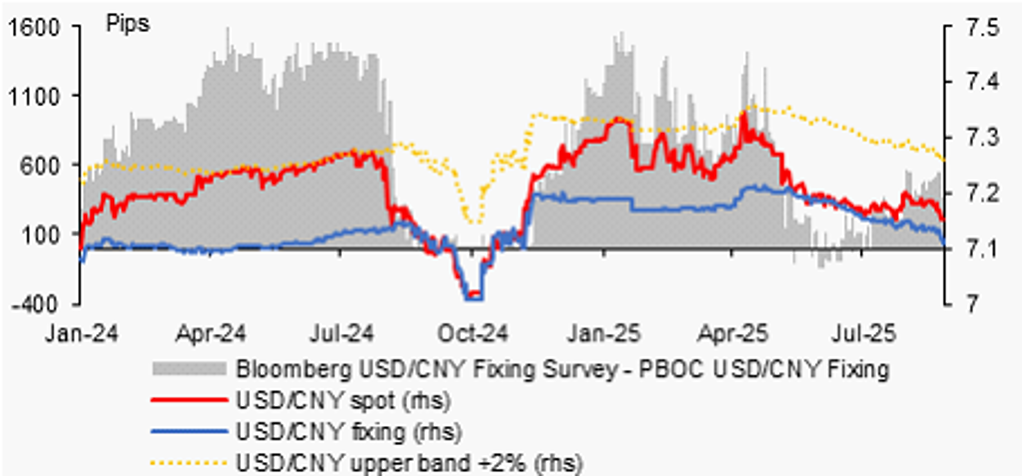

PBOC HAS BEEN SETTING A STRONGER USD/CNY FIXING RECENTLY

Source: : Bloomberg, MUFG GMR

10Y CGB YIELD CONTINUED ITS UPTREND IN AUGUST

Source: : Bloomberg, MUFG GMR