Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

KHANG SEK LEE

Associate

Global Markets Research

Global Markets Division for Asia

E: khangsek_lee@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

October 2025

KEY EVENTS IN THE MONTH AHEAD

1) FOCUS ON FED POLICY, POLITICS & SUPREME COURT

The US dollar ended September basically unchanged (DXY basis) with some opposing forces limiting the change for the dollar by month-end. A period of dollar depreciation into the FOMC meeting was followed by a rebound given the more balanced communication on the outlook for policy and economic data that was stronger than expected. Before the next FOMC meeting on 29th October, the focus this month will be on the government shutdown following the failure of a deal to pass a 7-week stop-gap bill. Will this last and will President Trump follow through on his threat to fire government workers in additional to those furloughed? The shutdown does act to drag on growth, albeit marginally, so it reinforces the prospect of another cut by the Fed. There may be a lack of data released due to the shutdown that you could argue might sway the FOMC to hold off but for now we continue to assume rate cuts at the final two meetings. The Supreme Court could announce at any time its ruling on whether Lisa Cook can remain in her position while the courts decide on whether she can be fired for cause. If the Supreme Court rules in favour of Trump it will lift expectations of a final ruling in Trump’s favour as well. Beyond that, on 5th November there will be the oral arguments at the Supreme Court into the legality of using IEEPA to impose tariffs globally due to the trade deficit being an emergency. A decision by the Supreme Court is expected before year-end.

2) OTHER CENTRAL BANKS & KEY GLOBAL EVENTS

In terms of other central bank meetings, the RBNZ meets on 8th October and is expected to cut by 25bps. There is a lull then before a flurry of meetings toward month-end. The BoC meets on the same day as the FOMC (29th Oct) with the BoJ and the ECB then meeting the following day. That could spark some volatility in the financial markets, and in USD/JPY specifically, with the FOMC set to cut while the BoJ is likely to hike (our expectation). We’d expect the BoJ to communicate this decision in advance to markets which should curtail any large reaction although it clearly supports our view for a lower USD/JPY. The IMF Annual meetings take place between 21st-27th October and just prior to that the US Treasury is scheduled to release its semi-annual currency report. October also brings the Q3 US corporate earnings reporting season which could be another source of potential volatility, especially given how low and stable the VIX index has been.

3) EXPECT POLICY DIRECTIONS IN THE 15TH FIVE-YEAR PLAN

The fourth plenum session of the 20th Communist Party of China Central Committee (CPCCC) will be held from 20th – 23rd October. In this meeting, the Political Bureau of the CPCCC will submit the revised draft of "Proposal of the CPCCC on Formulating the 15th Five-Year Plan for National Economic and Social Development” to the fourth plenary session, for its review. For the 15th Five-Year Plan period, boosting demand and optimizing supply likely are key focuses. Policies including debt reduction, consumption promotion, and fiscal and tax reforms warrant attention.

Forecast rates against the US dollar - End-Q4 2025 to End-Q3 2026

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

DXY |

97.866 |

95.710 |

93.720 |

92.460 |

91.670 |

|

JPY |

147.98 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR |

1.1729 |

1.2000 |

1.2300 |

1.2500 |

1.2600 |

|

GBP |

1.3443 |

1.3640 |

1.3820 |

1.3890 |

1.4000 |

|

CNY |

7.1200 |

7.1000 |

7.0500 |

7.0000 |

6.9500 |

|

AUD |

0.6614 |

0.6700 |

0.6800 |

0.6900 |

0.6900 |

|

NZD |

0.5797 |

0.5900 |

0.6000 |

0.6200 |

0.6200 |

|

CAD |

1.3928 |

1.3700 |

1.3600 |

1.3400 |

1.3300 |

|

NOK |

9.984 |

9.7500 |

9.5120 |

9.2800 |

9.1270 |

|

SEK |

9.4171 |

9.2080 |

8.9020 |

8.7200 |

8.5710 |

|

CHF |

0.7970 |

0.7830 |

0.7720 |

0.7680 |

0.7620 |

|

|

|

|

|

|

|

|

CZK |

20.747 |

20.170 |

19.510 |

19.120 |

18.890 |

|

HUF |

332.14 |

325.00 |

313.00 |

305.60 |

301.60 |

|

PLN |

3.6354 |

3.5500 |

3.4720 |

3.4240 |

3.3970 |

|

RON |

4.3309 |

4.2420 |

4.1540 |

4.0960 |

4.0790 |

|

RUB |

82.008 |

84.400 |

85.180 |

86.290 |

87.740 |

|

ZAR |

17.263 |

17.300 |

17.100 |

16.900 |

16.800 |

|

TRY |

41.581 |

43.000 |

44.500 |

46.000 |

47.250 |

|

|

|

|

|

|

|

|

INR |

88.788 |

88.900 |

89.500 |

89.700 |

89.700 |

|

IDR |

16661 |

16900 |

17000 |

16850 |

16700 |

|

MYR |

4.2050 |

4.1500 |

4.0800 |

4.0600 |

4.0600 |

|

PHP |

58.171 |

57.000 |

56.500 |

56.500 |

57.000 |

|

SGD |

1.2906 |

1.2700 |

1.2600 |

1.2600 |

1.2600 |

|

KRW |

1404.6 |

1380.0 |

1370.0 |

1360.0 |

1350.0 |

|

TWD |

30.445 |

30.200 |

30.000 |

29.800 |

29.700 |

|

THB |

32.456 |

32.500 |

32.400 |

32.300 |

32.300 |

|

VND |

26422 |

26500 |

26600 |

26700 |

26800 |

|

|

|

|

|

|

|

|

ARS |

1371.0 |

1400.0 |

1450.0 |

1500.0 |

1600.0 |

|

BRL |

5.3284 |

5.3500 |

5.3000 |

5.2500 |

5.2000 |

|

CLP |

961.80 |

945.00 |

935.00 |

935.00 |

935.00 |

|

MXN |

18.338 |

18.500 |

18.250 |

18.000 |

18.000 |

|

|

|||||

|

SAR |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

47.806 |

51.500 |

52.000 |

54.000 |

55.500 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate. All consensus forecasts are Bloomberg sourced.

US dollar

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

USD/JPY |

147.98 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR/USD |

1.1729 |

1.2000 |

1.2300 |

1.2500 |

1.2600 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/JPY |

144.00 |

141.00 |

140.00 |

138.00 |

|

|

EUR/USD |

1.1900 |

1.2000 |

1.2000 |

1.2100 |

MARKET UPDATE

In September the US dollar weakened marginally against the euro in terms of London closing rates, from 1.1699 to 1.1729. However, the dollar gained against the yen, from 146.94 to 147.98. The FOMC at its meeting in September cut the range for the federal funds rate by 25bps to 4.00% to 4.25%, the first cut this year, which followed 100bps of cuts last year. The FOMC is reducing its securities holdings with the monthly pace of QT via the cap of UST bonds rolling off the balance sheet now at just USD 5bn. The pace of reduction in the holdings of MBS is running at around USD 15bn per month.

OUTLOOK

The US dollar weakened notably in August (DXY -2.2%) and hence the scope for further depreciation was more limited – nonetheless, the backdrop for the dollar remained conducive to a further moderate drop. The dollar did hit a new intra-day low just prior to the FOMC meeting, hitting a level not seen since early 2022 at the start of the global inflation shock and the Fed tightening cycle. The dollar has ultimately closed over 1.2% stronger than that low-point with the Fed’s message following the rate cut viewed as not dovish enough to justify the market pricing at that point. There was also some marked improvement in the flow of economic data that resulted in some of the Fed easing priced over the next twelve months being taken out. We still see growth risks to the downside as being greater than inflation risks to the upside and hence we expect the Fed to deliver two further 25bp cuts in October and December. It would be highly unusual after the deterioration in the labour market for recovery to take hold when the monetary policy stance remains restrictive. Getting to neutral seems justified although not as quickly as being argued by Stephen Miran!

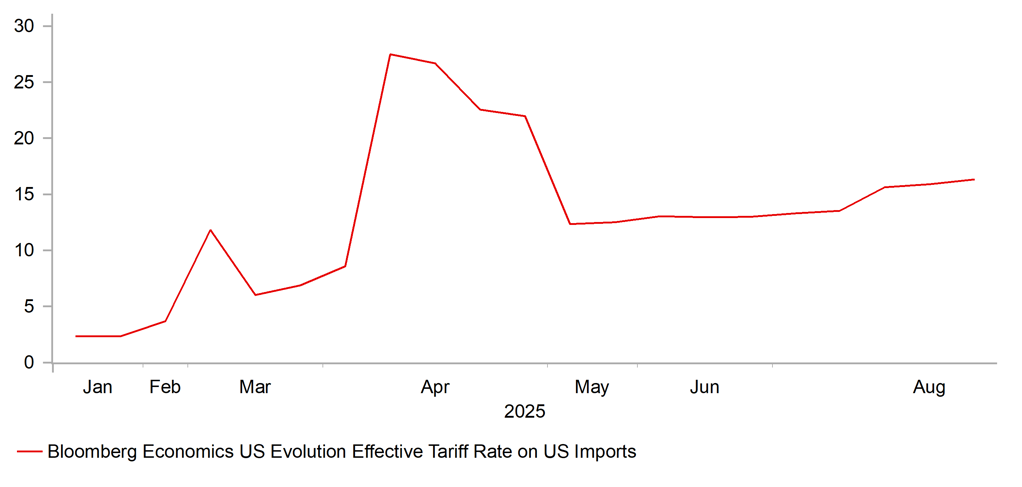

The Trump administration continues to pursue an active trade tariff policy with a number of additional sector-specific tariffs announced. A 100% tariff on pharma imports, and wood and lumber and certain furnishings tariffs add to the long list of goods tariffed. The pharma tariff of 100% may not end up impacting a large amount of the USD 220bn worth of imports but it still adds to inflation risks. The danger is that inflation remains sticky and in the meantime the Fed continues to cut. Market expectations of cuts in 2026 could then be influenced by Trump’s attempts to influence the Fed board and the selection of say Kevin Hassett would certainly result in increased investor concerns over long-term price stability. Fiscal concerns will also increase again. The CBO estimated in January the US will raise USD 73.5trn in taxes over the period 2025-2035. The OBBB and trade tariffs combined likely lowers that by USD 1-2trn, so the bigger picture fiscal outlook remains entirely intact.

These factors will likely see the US dollar remain under downward pressure. A steeper yield curve should entice foreign investors in fixed income to increase their hedging of USD exposures, encouraged further by mixed economic data given the prospects of continued labour market weakness.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

Policy Rate |

4.09% |

3.63% |

3.38% |

3.13% |

2.88% |

|

3-Month T-Bill |

3.95% |

3.55% |

3.30% |

3.10% |

2.90% |

|

10-Year Yield |

4.14% |

4.00% |

3.88% |

3.75% |

3.63% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

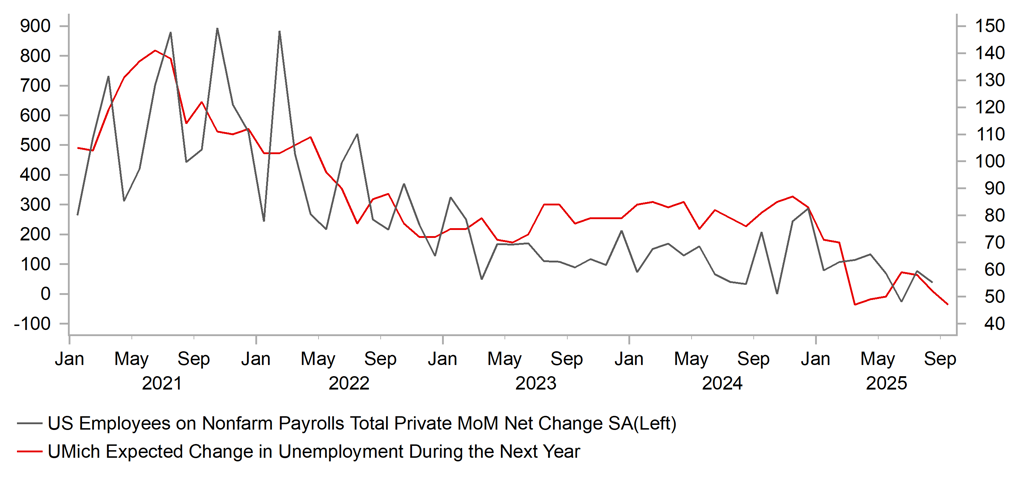

Our US macro view has leaned bearish on the fundamentals (especially the labor market) and that in turn is what set our Fed expectations to be more on the dovish side. For well over a year, and throughout 2025, we have been highlighting that the employment data (that the Fed relied upon for policy decisions) was flawed and over-estimating the true health of the US labor market. In tying our views together, we were of the opinion that the heavy weight of constant monthly NFP revisions and major negative QCEW preliminary benchmark revisions, would be too much for the Fed to ignore. For the record we believe that the Fed has been behind the curve. Where based on the totality of the weak jobs data thus far, they should have eased in both June and July. Well the Fed has over the last 6 weeks pivoted to our view. First after a dovish Jackson Hole pivot and then by delivering their first 25bp (since last year’s easing) cut in September. We still anticipate the Fed will continue to deliver consecutive -25bp cuts into the end of 2025. Into next year our base-case for 2026 remains less rates bullish (given a lot is already priced-in). We expect 3 cuts to be delivered in 2026, at every other at every other meeting to Q3.

(George Goncalves)

US AVERAGE EFFECTIVE TARIFF RATE

Source: Bloomberg, Macrobond & MUFG GMR

NFP MOM, % VS. UMICH EXPECTED CHANGE IN UNEMPLOYMENT

Source: Bloomberg, Macrobond & MUFG GMR

Japanese yen

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

USD/JPY |

147.98 |

144.00 |

142.00 |

140.00 |

138.00 |

|

EUR/JPY |

173.57 |

172.80 |

174.70 |

175.00 |

173.90 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/JPY |

144.00 |

141.00 |

140.00 |

138.00 |

|

|

EUR/JPY |

170.50 |

169.50 |

168.50 |

168.00 |

MARKET UPDATE

In September the yen weakened versus the US dollar in terms of London closing rates from 146.94 to 147.98. The yen weakened more notably versus the euro from 171.91 to 173.57. The BoJ at its meeting in September kept the key policy rate unchanged at 0.50%, following the 25bp hike in January, the first 25bp rate hike since before the GFC in 2007. The BoJ is also continuing with the policy of cutting JGB monthly purchases at a pace of JPY 400bn per quarter but announced in June that the pace of reduction will be reduced to JPY 200bn per quarter from Q2 2026.

OUTLOOK

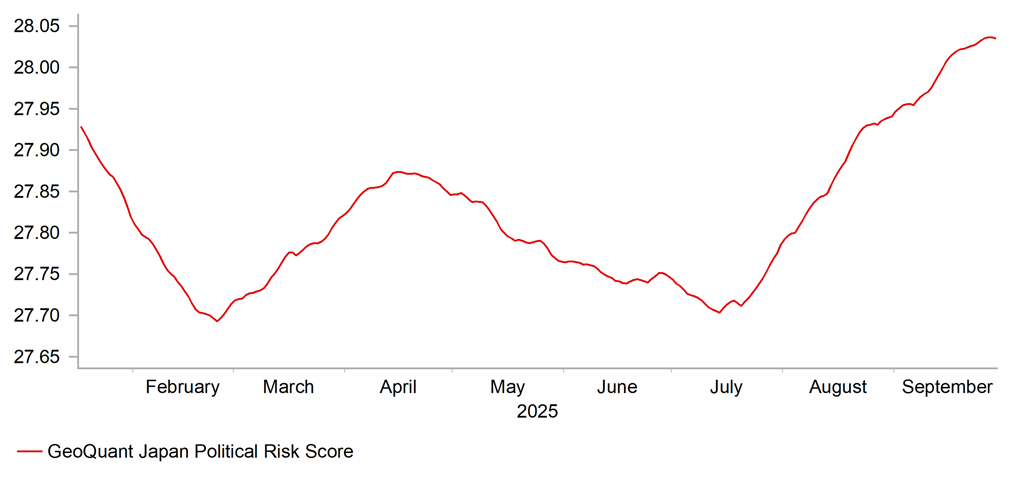

The yen weakened in September mainly on factors abroad with stronger data in the US helping lift global yields. The yen was the third worst performing G10 currency although the scale of loss was pared when USD/JPY dropped from just below the 150.00-level. Political uncertainty was the other key factor that weighed on the yen in September ahead of the LDP leadership election on 4th October. Polls across the general public and the LDP party members (who will be part of the first round of voting) generally chose Sanae Takaichi and Shinjiro Koizumi as their top two candidates and hence it is highly likely that the second round of voting (295 LDP Diet members and 47 prefecture reps) will be a run-off between those two. A poll conducted by Kyodo News of Diet members indicate Koizumi is the most popular followed by Yoshimasa Hayashi and then Koizumi. We have assumed since the start that Koizumi will win and his more fiscal conservative policy stance and his stance on leaving monetary policy to the BoJ will help reinforce further yen recovery. There is also a reasonable prospect of greater political stability. Former PM Suga is a backer of Koizumi and has good relations with the leader of Ishin (Japan Restoration Party), the third largest party in the lower house of the Diet, with 38 seats. Suga could play a role in negotiating a coalition with Ishin which would give the LDP a working majority. Koizumi has admitted a coalition “was entirely possible”.

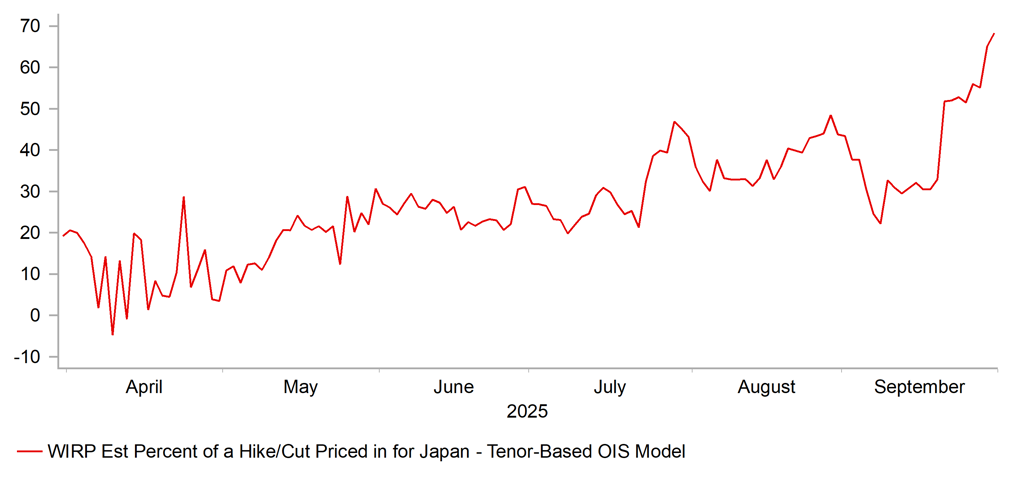

There has been a gradual increase in pricing for a 25bp hike by the BoJ on 30th October. At 16bps the market is still short of fully priced but we see rates moving higher in anticipation of a hike. The July BoJ meeting minutes indicated growing support for a hike while a speech from board member Noguchi suggests 3 members are now on board (Tamura & Takata already voted for a hike in Sept). Speeches by Dep Gov Uchida (2nd Oct) and Gov Ueda the following day will be important as well as the Tankan report for Q3. We believe these events will strengthen the case for a hike and assuming Koizumi wins the election, a hike is very likely in October.

The yen weakened beyond our expectations in September but the speed of reversal after hitting close to the 150.00-level suggests downside scope for the yen is limited. A BoJ rate hike, a Koizumi victory with greater political stability and further rate cuts from the Fed will likely ensure the yen rebounds into year end. There are even risks the yen could outperform our forecast levels.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

Policy Rate |

0.50% |

0.75% |

0.75% |

1.00% |

1.00% |

|

3-Month Bill |

0.45% |

0.90% |

0.90% |

1.10% |

1.10% |

|

10-Year Yield |

1.64% |

1.70% |

1.80% |

1.80% |

1.90% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased modestly in September, by 4bps to close at 1.64%. Yields generally didn’t move much in other bond markets either but there was a slight underperformance for JGBs. There remains a degree of political risk premium priced with the risk of Sanae Takaichi winning the leadership election and moving to a more aggressive expansion of fiscal policy. To a degree there is also a general political risk premium. Whoever wins will likely need to expand fiscal policy due to the need to garner support from other parties all of which are pushing for more spending to protect households from the cost of living crisis. If Koizumi wins as we expect that should help keep yields stable as he is the continuity candidate and will be more cautious on fiscal spending. The BoJ is set to hike in October in our view and that may impact the 10-year yield more than super-long yields that could be helped by the perception of the BoJ not being behind the curve. The level of the yen will likely prove important for yields as well and our assumption of a stronger yen will help curtail inflation risks and ensure only a moderate, steady rise in 10-year yields

JAPAN MARKET EXPECTATIONS FOR OCTOBER 2025 MEETING

Source: Bloomberg, Macrobond & MUFG GMR

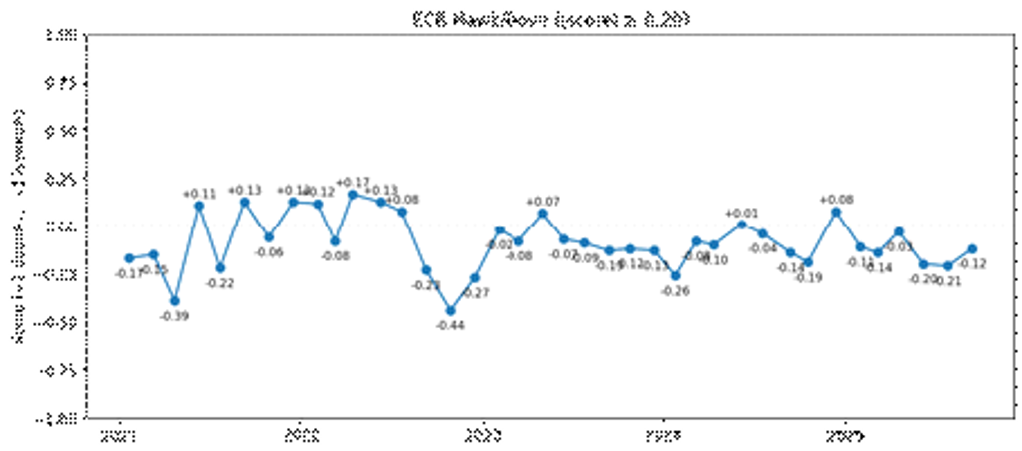

JAPAN POLITICAL RISK SCORE

Source: Bloomberg, Macrobond & MUFG GMR

Euro

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

EUR/USD |

1.1729 |

1.2000 |

1.2300 |

1.2500 |

1.2600 |

|

EUR/JPY |

173.57 |

172.80 |

174.70 |

175.00 |

173.90 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

EUR/USD |

1.1900 |

1.2000 |

1.2000 |

1.2100 |

|

|

EUR/JPY |

170.50 |

169.50 |

168.50 |

168.00 |

MARKET UPDATE

In September the euro advanced versus the US dollar in terms of London closing rates, moving from 1.1699 to 1.1729. The ECB at its meeting in September kept the key policy rate unchanged at 2.00%, the second consecutive meeting in which the policy rate was left unchanged, which followed 200bps of cuts since last year. The ECB is running down APP securities and started PEPP run-off in July last year with about EUR 425bn of securities estimated to roll off the balance sheet in 2025.

OUTLOOK

The euro advanced modestly against the US dollar in September supported by the increasing signals from the ECB that the monetary easing cycle has ended. That is in contrast to the expectations that the FOMC will continue to cut its policy rate over coming meetings. The EUR/USD rate hit its highest level since 2021 in the aftermath of the ECB latest policy meeting and before the FOMC meeting as speculation built of a growing divergence in central bank policy action. At the ECB meeting President Lagarde was clear that enough easing had been done, stating that the “disinflation process is now over” for the euro-zone. The ECB now believes that growth risks are “more balanced” adding that the recent trade agreement had reduced uncertainties. The ECB raised the inflation forecasts for this year and next year but lowered the forecast for 2027 (up 0.1ppt to 2.1% and 1.7% and down 0.1pt to 1.9% respectively). Following this ECB meeting we have removed the final 25bp cut we were assuming for this year from our forecasts although we maintain that falling wage growth, lower energy prices and a stronger currency will all result in inflation coming in lower than expected, resulting in two additional rate cuts in 2026.

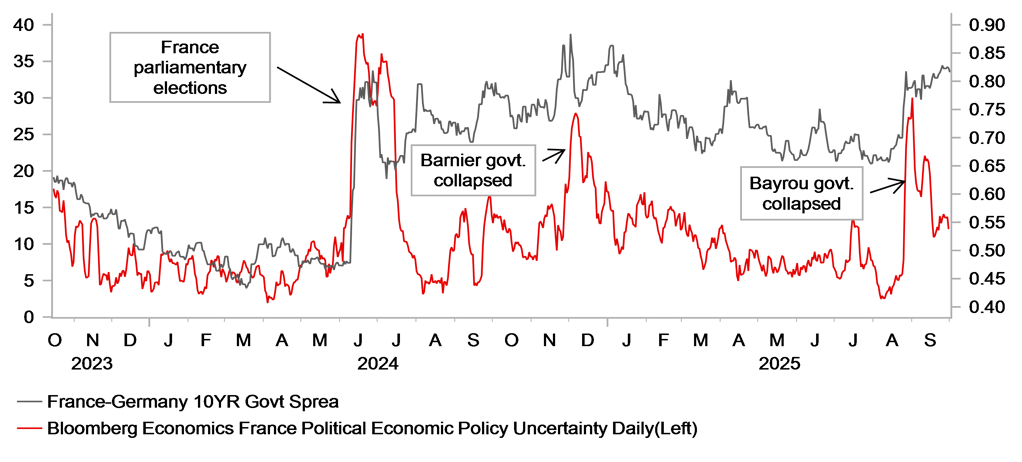

New French PM Lecornu has committed to naming a new parliament for the start of the parliamentary session on 1st October but it remains unclear whether he can create a budget plan that will garner the support required in parliament. PM Lecornu has hinted that he will target a slightly wider budget deficit (4.7% vs 4.6% previously) for the coming year, so this indicates only a very small degree of wiggle room for negotiations. Lecornu also ruled out changes to President Macron’s pension reforms and appears against a wealth tax. Indications from the far-left and far-right blocks are that there will be no support for this new government. The OAT/Bund spread has widened further and the risk of new parliamentary elections is now partially priced. Official data released confirmed France’s debt at EUR 3.4trn, or 115.6% of GDP and is now the third largest after Greece and Italy. Fitch Ratings downgraded France’s sovereign rating from AA- to A+ based on risks that the debt level will continue rising in part due to political gridlock. Previous episodes of political uncertainty in France have tended to have only a marginal and temporary impact on euro performance.

The more hawkish communications from the ECB and the lack of pricing for further rate cuts in contrast to continued easing by the Fed will help support EUR/USD with risks related to Fed’s independence potentially reinforcing EUR support in 2026.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

Policy Rate |

2.00% |

2.00% |

1.75% |

1.75% |

1.50% |

|

3-Month Bill |

2.01% |

1.95% |

1.70% |

1.55% |

1.50% |

|

10-Year Yield |

2.71% |

2.70% |

2.60% |

2.55% |

2.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

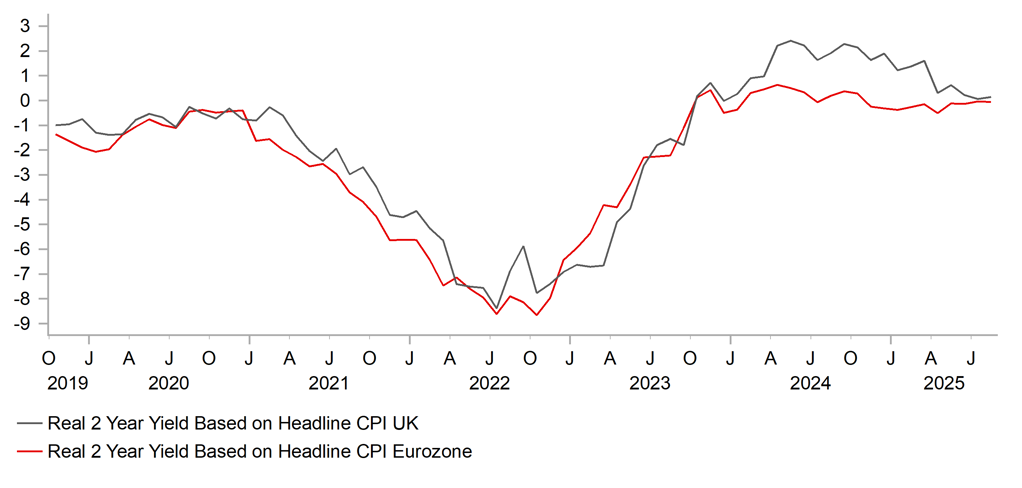

The 10-year German bund yield was close to unchanged in September, dropping by just 1bps to close at 2.71%. Bund yields did drop in unison with US Treasury yields following the weaker than expected US jobs data. But German bunds have generally underperformed and US yields have declined by more in part reflecting the Fed rate cut in contrast to the signal from the ECB that its easing cycle is over. The US tariff risk to infltion is not as great as feared while we maintain that lower energy prices, declining wage growth and a stronger euro will all benefit in brining inflation further lower and hence allow the ECB to cut the policy rate further. But we also understand now being a time for greater caution. The ECB policy rate is at neutral with inflation at target and hence there is no urgency to send a signal to the markets on next possible moves. A signal to pause makes sense. The ECB will have noted the data on consumers’ inflation expectations over the coming twelve months which revealed a pick-up from 2.6% to 2.8%. Ultimately if the policy rate can be lowered further and given the Fed has further easing to implement, a modest decline in US Treasury yields should translate into something similar for German bunds.

ECB HAWKISH/DOVISH SENTIMENT INDICATOR

Source: : Bloomberg, Macrobond & MUFG GMR

FRANCE GOVT. BORROWING COSTS VS. POLITICAL RISK

Source:: Bloomberg, Macrobond & MUFG GMR

Pound Sterling

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

EUR/GBP |

0.8725 |

0.8800 |

0.8900 |

0.9000 |

0.9000 |

|

GBP/USD |

1.3443 |

1.3640 |

1.3820 |

1.3890 |

1.4000 |

|

GBP/JPY |

198.93 |

196.40 |

196.20 |

194.40 |

193.20 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

GBP/USD |

1.3700 |

1.3700 |

1.3800 |

1.3800 |

MARKET UPDATE

In September the pound weakened modestly versus the dollar in terms of London closing rates, moving from 1.3508 to 1.3443. In addition, the pound weakened against the euro from 0.8661 to 0.8725. The MPC at its meeting in September left the key policy rate unchanged at 4.00%, after five 25bp cuts since August last year.

OUTLOOK

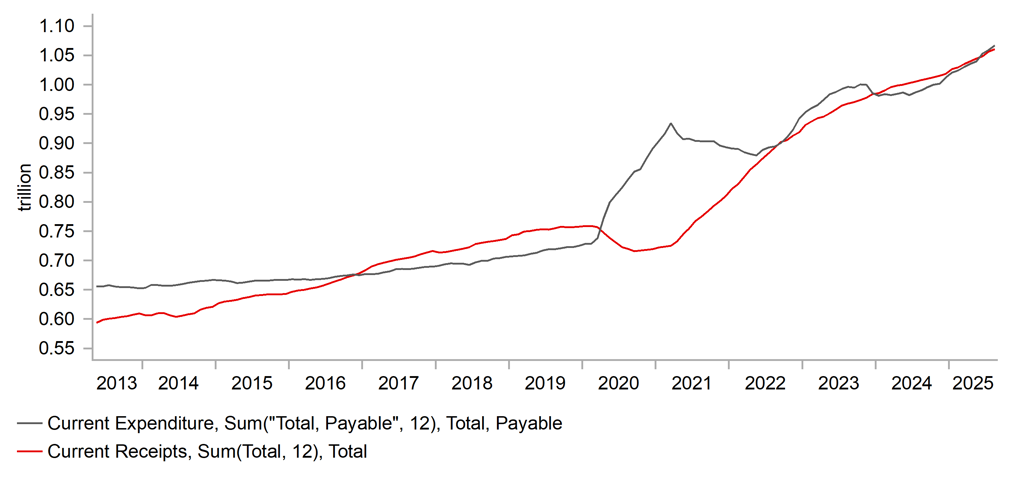

The pound underperformed in September, weakening against both the dollar and the euro despite caution from the BoE over additional rate cuts going forward. EUR/GBP broke above the 0.8700-level in September and has now spent the longest period trading above that level since November 2023. One of the catalysts for the break higher and the underperformance of the pound was the budget deficit data that revealed a larger than expected public sector net borrowing of GBP 18bn, versus a market consensus of GBP 12.8bn. The OBR estimated a shortfall of GBP 12.5bn. Year-to-date, the budget deficit is now running GBP 11.4bn higher than the OBR estimated. The data only increases the pressure on the government to announce a credible budget scheduled for 26th November. The constant media reports of tax hikes to come is weighing on sentiment and likely deterring business and household decision-making. The advance PMI data in September certainly pointed to a notable slowdown that could extend further into the budget and possibly beyond. There has been speculation of a VAT increase, a new wealth tax, a new property tax and a potential rise in income tax but offset by a cut in NICs. Some have been denied by Rachel Reeves, but whatever the outcome, key for the GBP will be that steps are credible with headroom in order to protect against another unforeseen rise in yields.

The close 5-4 vote to cut at the August MPC meeting has continued to shape expectations of less easing going forward. The September MPC meeting indicated continued splits in the MPC with a 7-2 vote for unchanged rate – Swati Dhingra and Alan Taylor voted for a 25bp cut. The BoE also agreed to slow the pace of QT from GBP 100bn per year to GBP 70bn in the year from October. There were dissents there too – Huw Pill wanted to keep it at GBP 100bn while Catherine Mann wanted QT slowed to GBP 62bn. Crucially, the guidance on “a careful and gradual approach” to further rate cuts was maintained, so while there were grounds for a slower pace than the quarterly pace so far, we believe economic data could still allow a rate cut by December. This would indicate greater caution – a skip in November – but data could warrant action by year-end. There will be two sets of jobs and inflation data between the November and December meetings and we see the fiscally restrictive budget as possibly adding to data that could point to scope for further easing.

If our view is correct, then the front-end of the yield curve can see lower rates. There is currently only around 6bps of cuts priced in by year-end, which we see as too low. Lower yields and a rate cut would translate into further GBP underperformance with further EUR/GBP upside potential ahead.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

Policy Rate |

4.00% |

3.75% |

3.50% |

3.25% |

3.25% |

|

3-Month Bill |

4.18% |

3.70% |

3.45% |

3.25% |

3.25% |

|

10-Year Yield |

4.70% |

4.70% |

4.50% |

4.40% |

4.35% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield was close to unchanged in September, falling by just 2bps to close at 4.70%. The 10-year Gilt yield has largely spent the entire year trading within a range of 4.40%-4.80% but that topside level was breached at the start of September with the 30-year Gilt yield hitting the highest level since 1998. A change in cabinet positions by PM Starmer created uncertainty over the strategy of the government that fuelled selling. It underlines the fragility of sentiment in UK bond markets. Yields did reverse following weaker US jobs data but the Gilt market remains vulnerable to further sell-offs. The BoE did announce a slowdown in QT from GBP 100bn to GBP 70bn although the pace of outright Gilt sales actually increased although the BoE added that the QT would be shorter in duration in the year ahead. Still, a structural decline in demand (pensions) and fears over sticky inflation remain the source of fragility. The government will likely announce tax hikes in the budget on 26th November but if investors fear a big impact on growth it might not alleviate the risks over the short-term. Given we expect BoE rate cuts as inflation falls, we expect Gilt yields to decline although only modestly and risks of yield spikes are high.

UK GOVT. CURRENT EXPENDITURE VS RECEIPTS

Source: : Bloomberg, Macrobond & MUFG GMR

SHORT-TERM REAL YIELDS IN EZ & UK

Source: : Bloomberg, Macrobond & MUFG GMR

Chinese renminbi

|

Spot close 30.09.25 |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

USD/CNY |

7.1200 |

7.1000 |

7.0500 |

7.0000 |

6.9500 |

|

USD/HKD |

7.7805 |

7.7800 |

7.7800 |

7.7800 |

7.7800 |

|

Consensus |

Consensus |

Consensus |

Consensus |

||

|

USD/CNY |

7.1000 |

7.0800 |

7.0500 |

7.0500 |

|

|

USD/HKD |

7.7900 |

7.7900 |

7.7800 |

7.7900 |

MARKET UPDATE

In September, USD/CNY moved from 7.1301 to 7.1200. On 22nd September, the PBoC kept the 1Y and 5Y LPR at 3.00% and 3.50% respectively as expected. On 23rd September, the PBoC monetary policy committee held its regular meeting for 3Q 2025 and signaled less urgency to cut rates with the removal of wording “stepping up efforts to implement incremental policies” in the official meeting readout and emphasized more on implementing the existing policy measures instead.

OUTLOOK

Recent macro data indicated slowing economic momentum in August and September. Retail sales growth softened further in August with a moderated impact of the consumer goods trade-in program. FAI YTD growth decelerated sharply, dragged by a larger contraction of private investment as well as a persistently weak property sector. That said, we noted signs of the positive impact of ongoing “anti-involution” campaign, for example, PPI gains in upstream sectors such as mining and quarrying, and ferrous metal smelting & pressing for August. Since the beginning of September, policies focusing on capacity management have been issued for industries including photovoltaics, steel, building materials, petrochemicals, some nonferrous metals industries, coal-fired power; whereas, several new policies were issued too in support for the development of new technologies and sectors focusing on national safety. Overall, anti-involution likely generates a restraining impact on production capacity and weighs on economic growth. To stabilize growth, the Chinese economy needs more policy support. Recently, the government announced a plan to inject RMB 500bn funding (about 1% of 2024 FAI) to replenish project capital through a “new policy-based financial tool”, with which the local governments are urged to speed up the project construction. The measures to “Strengthen the cultivation of innovative digital economy enterprises” were also announced which includes lowering the barrier to access computing power, strengthening support for digital innovative firms on IPO fundraising. Lastly, Ministry of Commerce and eight other departments also jointly issued a guideline on developing digital consumption.

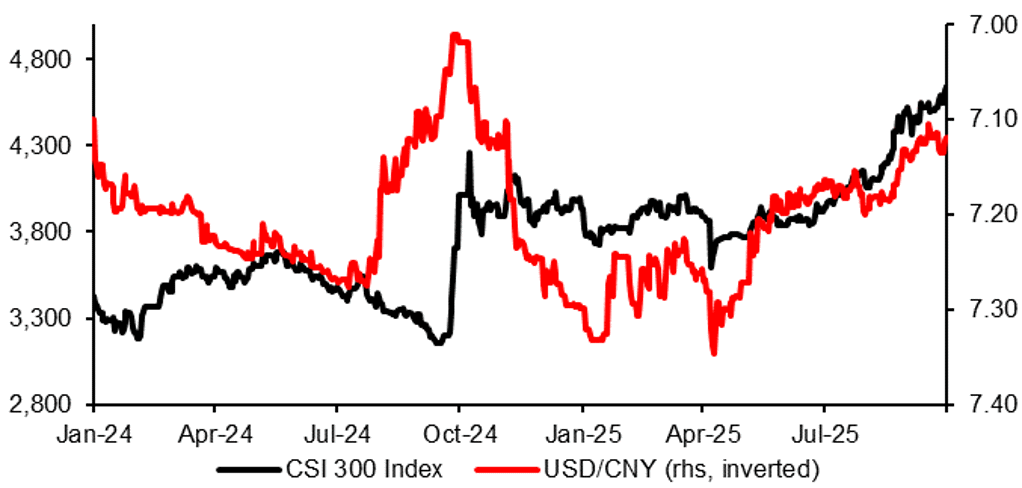

Despite weak economic fundamentals, the equity market has remained upbeat since early April, due to positive sentiment towards the prospect of AI development and anti-involution. We maintain an appreciation bias for CNY due to the positive sentiment in the near-term, as the fourth plenum of the 20th CCCPC will run from 20th – 23rd October when the 15th five-year plan will be discussed. We may gain some clarity on details of reform measures. While seeing room for positive policy surprises, we cannot ignore the possibility of negative shocks. According to South China Morning Post, China has revised its international maritime transport rules to allow retaliatory measures, including charging special fees or restricting access to Chinese ports. This adds a variable to current US-China trade talks.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

|

|

LPR 1Y |

3.00% |

2.85% |

2.70% |

2.70% |

2.70% |

|

7-Day Reverse Repo Rate |

1.40% |

1.25% |

1.10% |

1.10% |

1.10% |

|

10-Year Yield |

1.87% |

1.85% |

1.85% |

1.90% |

1.95% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

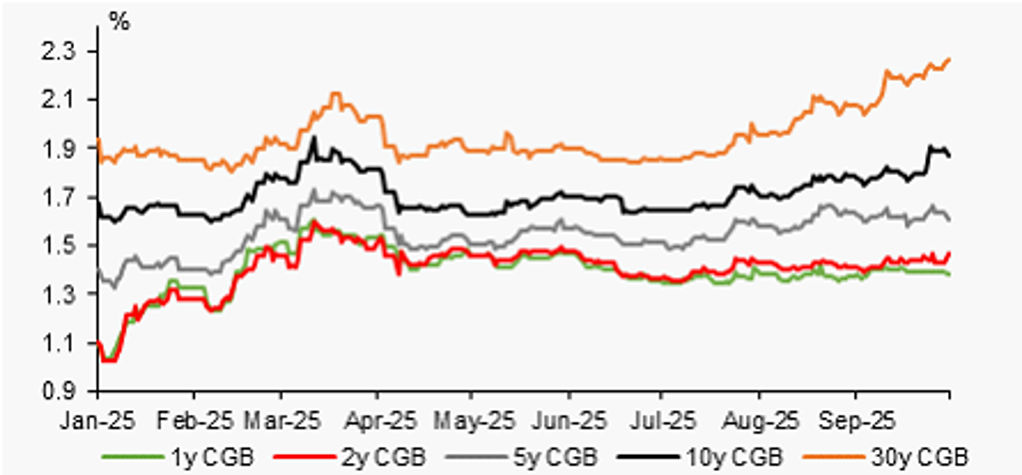

The 10y CGB yield edged higher by 9bps to 1.87% at the end of the month, and the 30-year CGB yield also rose, by 18bps to 2.26%. The rise of bond yields was largely due to the ongoing asset rotation into the stock market, as China’s overall stock index kept advancing in recent months. The factors that drove the recent stock market rally likely are structural, including AI and the “anti-involution” campaign, and the government still is keen to maintain the gains in stocks. We noted the overall tone of the PBoC monetary policy committee regular meeting for Q3 2025 played down the possibility of rate cuts – this may reflect PBOC’s concern of over-heating. Given weakness in recent data and incoming export headwinds due to higher global tariffs, more policy easing is needed. Without forceful fiscal easing, PBOC’s policy rate cut can help to reduce pressure and lower the funding costs of the economy, as well as mortgage payments for households. We don’t expect long-end government bonds to rise further, as improving bank liquidity conditions (more deposits, and weak loans) will prompt bank purchases of bonds, and weigh on bond yields. We expect the 10y CGB yield to remain around current levels in Q4 and Q1 next year.

POSITIVE SPILLOVER OF SHARE MARKET PERFORMANCE INTO CNY

Source: : Bloomberg, MUFG GMR

BOND YIELDS AT LONGER END ROSE MORE THAN SHORTER END IN SEPT

Source: : Bloomberg, MUFG GMR