Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

May 2024

KEY EVENTS IN THE MONTH AHEAD

1) FOMC IN FOCUS IN MAY

The US dollar advanced notably further in April (DXY +1.7%) as market participants continued to scale back the extent of rate cuts to be delivered by the FOMC this year. We believe the rates pricing has probably now gone too far and a test of that view will come right at the start of May with the FOMC meeting on the day of the FX Outlook being released. We believe Fed Chair Powell will find it difficult to ‘out-hawk’ market pricing given only one cut is now priced and hence see limited scope for a further notable jump in US yields from here. The dollar correlation with US yield spreads is currently unusually strong with the US 10-year yield spread versus DXY countries daily correlation (30-day rolling window) with DXY (+0.70) the strongest in the history of available data going back to 1988. May will also see five other G10 central banks hold policy meetings – the Norges Bank, the RBA, the Riksbank, the BoE and the RBNZ. Of these other meetings, the Riksbank is where the risk of a policy change is greatest. Sweden’s economy contracted for the fourth consecutive quarter in Q1 and inflation is falling faster than previously expected. Concerns over excessive SEK weakness is the primary factor that could hold the Riksbank back from cutting. June is likely to be a more active month for policy changes by G10 central banks.

2) PERMANENT INTERVENTION WATCH?

Although not officially confirmed by the MoF in Japan, price action on 29th April pointed strongly to intervention to buy the yen and halt the rise in USD/JPY. Given the settlement date fell into May we will not know the size of intervention until 31st May. Stepping into the FX markets for the first time since 24th October 2022 means the markets during May will be on constant ‘intervention watch’. The MoF will have a difficult task turning USD/JPY without some sign of a turn in the fundamentals driving the divergence in yields between the US and Japan. If the US jobs data is as expected or stronger and if inflation remains sticky, further intervention will be required in order to buy time for the turn weaker of the US economy. We believe that turn will come and the intervention could then reinforce a move lower in USD/JPY if the turn weaker in economic activity in the US is notable. We also expect better assistance from the BoJ than was on offer in April with a 15bps rate hike in July.

3) BOND SUPPLY, POLICY GUIDELINES, & CNY POLICY KEY TO WATCH

The slow pace of government bond issuance in Q1 not only pressured bond yields lower, it also restricted government’s spending to stimulate the economy. For Q2, it is key to watch the pace of China government bond issuance and the pace of implementations of the guidelines set by the Political Bureau of the CPC Central Committee meeting on 30th April. We expect some monetary easing and support for the property sector.

Forecast rates against the US dollar - End-Q2 to End-Q1 2025

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

JPY |

157.45 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR |

1.0692 |

1.0800 |

1.1000 |

1.1200 |

1.1200 |

|

GBP |

1.2524 |

1.2560 |

1.2750 |

1.2950 |

1.2870 |

|

CNY |

7.2405 |

7.2400 |

7.2200 |

7.1800 |

7.1500 |

|

AUD |

0.6494 |

0.6600 |

0.6800 |

0.7000 |

0.6900 |

|

NZD |

0.5915 |

0.6000 |

0.6100 |

0.6300 |

0.6300 |

|

CAD |

1.3744 |

1.3800 |

1.3600 |

1.3400 |

1.3200 |

|

NOK |

11.070 |

11.019 |

10.636 |

10.268 |

10.179 |

|

SEK |

10.982 |

10.926 |

10.636 |

10.357 |

10.268 |

|

CHF |

0.9165 |

0.9170 |

0.9180 |

0.8930 |

0.9110 |

|

|

|

|

|

|

|

|

CZK |

23.519 |

23.330 |

23.090 |

22.770 |

22.770 |

|

HUF |

365.35 |

365.70 |

363.60 |

361.60 |

366.10 |

|

PLN |

4.0452 |

3.9810 |

3.9550 |

3.8840 |

3.9290 |

|

RON |

4.6509 |

4.6110 |

4.5550 |

4.5000 |

4.5180 |

|

RUB |

93.210 |

93.630 |

93.780 |

94.880 |

97.720 |

|

ZAR |

18.788 |

19.200 |

19.300 |

19.100 |

19.000 |

|

TRY |

32.392 |

34.000 |

36.500 |

39.000 |

41.000 |

|

|

|

|

|

|

|

|

INR |

83.430 |

83.300 |

82.500 |

82.000 |

81.500 |

|

IDR |

16253 |

16200 |

15900 |

15700 |

15650 |

|

MYR |

4.7700 |

4.8000 |

4.7500 |

4.6000 |

4.5700 |

|

PHP |

57.754 |

58.200 |

57.500 |

57.000 |

56.500 |

|

SGD |

1.3634 |

1.3500 |

1.3350 |

1.3200 |

1.3000 |

|

KRW |

1382.1 |

1370.0 |

1350.0 |

1320.0 |

1300.0 |

|

TWD |

32.550 |

32.450 |

32.250 |

31.950 |

31.750 |

|

THB |

37.140 |

36.500 |

35.700 |

35.300 |

35.000 |

|

VND |

25329 |

25800 |

25900 |

25950 |

26000 |

|

|

|

|

|

|

|

|

ARS |

876.76 |

915.00 |

1000.00 |

1600.0 |

1700.0 |

|

BRL |

5.1743 |

5.1300 |

5.1000 |

4.9500 |

4.9500 |

|

CLP |

957.20 |

955.00 |

960.00 |

960.00 |

960.00 |

|

MXN |

17.041 |

17.300 |

17.400 |

17.500 |

17.600 |

|

|

|||||

|

Brent |

87.79 |

86.00 |

88.00 |

91.00 |

95.00 |

|

NYMEX |

81.78 |

81.00 |

83.00 |

86.00 |

90.00 |

|

SAR |

3.7505 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

47.850 |

46.000 |

45.000 |

45.500 |

45.800 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/JPY |

157.45 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR/USD |

1.0692 |

1.0800 |

1.1000 |

1.1200 |

1.1200 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

150.00-165.00 |

148.00-163.00 |

146.00-161.00 |

144.00-159.00 |

|

|

EUR/USD |

1.0300-1.1200 |

1.0500-1.1400 |

1.0700-1.1600 |

1.0800-1.1700 |

MARKET UPDATE

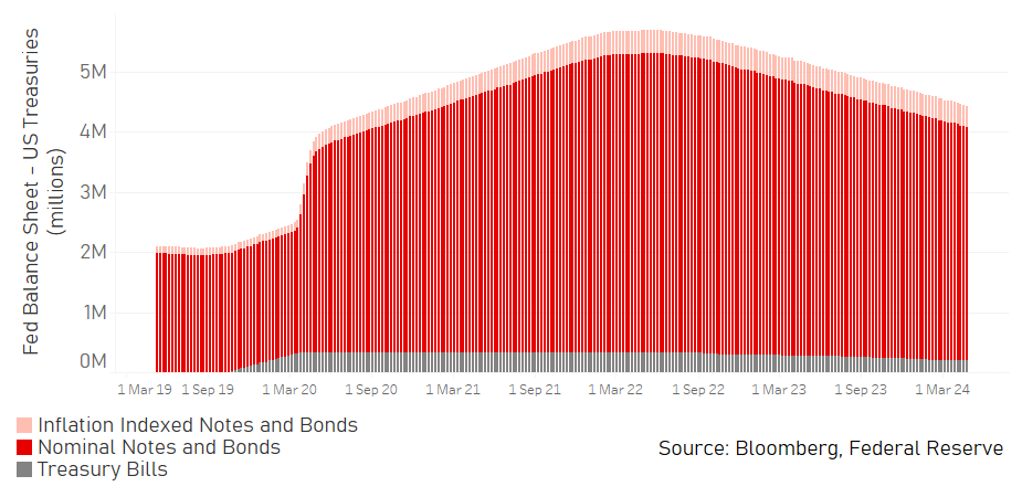

In April the US dollar strengthened against the euro in terms of London closing rates, from 1.0802 to 1.0692. In addition, the dollar strengthened versus the yen, from 151.31 to 157.45. The FOMC did not meet in April and hence the fed funds rate remained in a range of 5.25% to 5.50%. The FOMC continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month, although the pace of QT looks set to be tapered, with a formal updated guidance possibly delivered at the next meeting at the beginning of May.

OUTLOOK

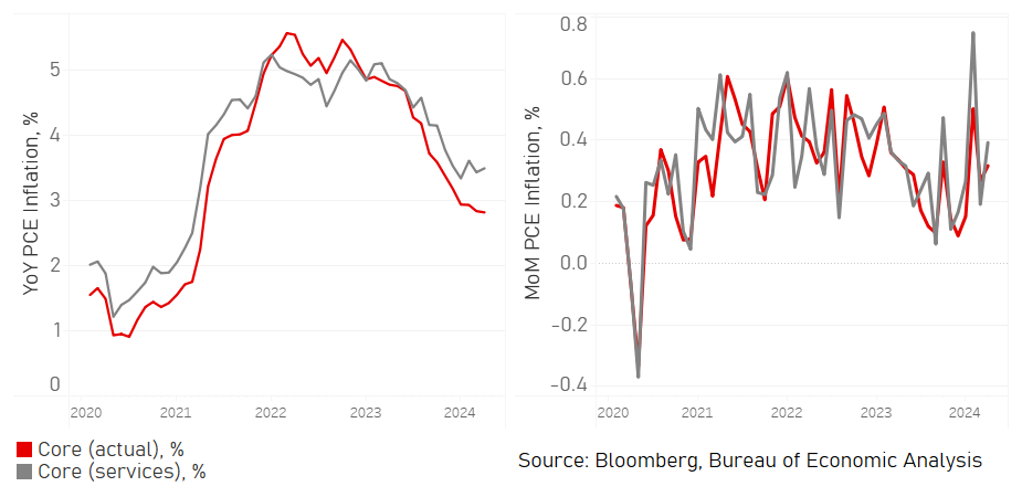

The US dollar advanced further in April with the incoming economic data not enough to signal the potential for any rate cuts over the near-term. Pricing for a cut in June fell from 16bps to just 2bps in April with the OIS curve now not fully pricing a 25bp rate cut until December. The 2yr UST note yield is now just 30bps below the fed funds rate. We see the move in yields as now excessive and any further move higher in yields would likely have to incorporate some degree of pricing on the potential for another rate increase. We see that scenario as highly unlikely. The FOMC meeting is at the start of May and we expect the FOMC and Chair Powell to maintain the bias favouring an easing but also confirm that the restrictive stance would remain in place until more compelling evidence of easing inflationary pressure emerges, or long as necessary. Such an outcome should limit any move higher in yields and keep the focus on the jobs and inflation readings going forward. We believe a July start for rate cuts is still feasible and if not July, September. So hence, we believe there remains a strong possibility of 75-100bps of cuts this year.

A turn in the momentum of the economy is of course needed for the Fed to deliver the amount of rate cuts we expect. Because a turn hasn’t happened as quickly as originally expected is not necessarily a reason to abandon that view. The transmission of policy works with lags that are changeable over time and the huge fiscal stimulus for the US economy and the covid-related excess savings have lengthened the lag. But the Composite PMI Employment index and the NFIB Hiring Plans index are both at levels last seen during covid while the household jobs data currently shows 1.35mn full-time job cuts in the last 12mths, and while offset by 1.88mn part-time job gains is a signal of worsening labour market sentiment. Real disposable personal income slowed to just 1.4% in March and without as much excess savings support clearly points to a slowing of consumer spending over the coming quarters.

With the ECB cutting in June, the anticipation of divergence can certainly fuel further dollar gains over the short-term but we still expect this window for divergence-fuelled dollar buying to close once the data in the US turns and the Fed begins to cut rates either in July or September

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

5.33% |

5.38% |

5.13% |

4.38% |

3.88% |

|

3-Month T-Bill |

5.39% |

5.25% |

4.88% |

4.13% |

3.88% |

|

10-Year Yield |

4.68% |

4.63% |

4.25% |

4.13% |

4.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The earliest we officially expect a cut is now July, which would be one full year after the Fed stopped hiking. There is a risk of a “hawkish cut” at the June meeting if financial conditions worsen – if equity markets are unable to climb higher again and instead slide another 4-7% before the June SEP forecast updates. The Fed could take the risk market slide into account and cut 25 bps in June but on the hawkish side take their 2024 rate cut estimates to only two cuts. We are also placing a greater risk of a policy mistake by the Fed, where their lack of confidence to ease (given sticky inflation) might unnecessarily impact the labour market in the second half of 2024. That said, we won’t know without the passage of time and as hinted above, we argue it’s best to start the cutting in either June or July to observe the incoming data. Then it’s possible the Fed skips September to only come back more forcefully in the second half with larger magnitude cuts (50 bps) in order to try to soft land the economy.

(George Goncalves)

PCE INFLATION YOY/MOM, %

FED BALANCE SHEET – UST SECURITIES HOLDINGS

Japanese yen

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/JPY |

157.45 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR/JPY |

168.35 |

166.30 |

167.20 |

168.00 |

165.80 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

150.00-165.00 |

148.00-163.00 |

146.00-161.00 |

144.00-159.00 |

|

|

EUR/JPY |

161.00-176.00 |

159.00-174.00 |

157.00-172.00 |

156.00-170.00 |

MARKET UPDATE

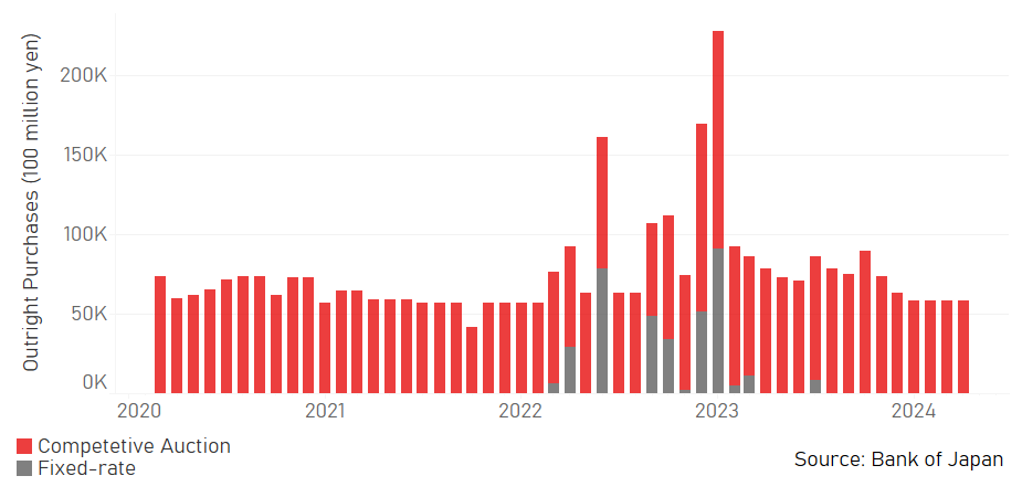

In April the yen weakened versus the US dollar in terms of London closing rates from 151.31 to 157.45. In addition, the yen weakened versus the euro, from 163.45 to 168.35. The BoJ at its meeting in April left its monetary stance unchanged after the major changes announced in March that essentially brought to an end the QQE/NIRP policy framework adopted in 2013 (QQE) and enhanced in 2016 (NIRP). With the BoJ now paying 0.10% on excess reserves, the unsecured overnight call rate settled at close to 0.08%. While YCC was formally scrapped by the BoJ, it continued to purchase JGBs at around the level signalled in March, JPY 6trn per month.

OUTLOOK

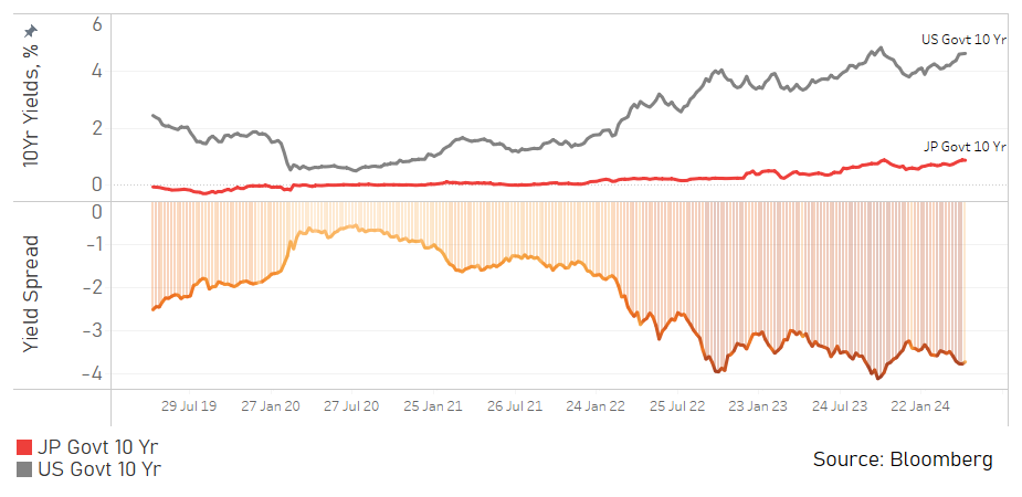

The yen weakened notably in April with USD/JPY up nearly 9 big figures with two key drivers behind the move. The first was the jump in US yields after stronger than expected inflation and then the second was another dovish communication from the BoJ that gave no clear signal of any imminent intention to raise rates again. The FX move is a clear signal that the BoJ should be doing more. The monetary stance is a lot looser now, even after a hike, than in 2022 when the MoF last intervened. In real policy terms, the BoJ’s overnight policy rate is more than -200bps. In Sept/Oct 2022, the real policy rate was under -100bps. In addition, US policy today is far more restrictive. Back in 2022, the real fed funds rate was around -500bps whereas today it’s closer to +200bps. The real policy rate in Japan throughout the period of mild deflation from 1995 ranged between -80bps / +170bps, so the current policy is at an extreme never seen before. If Governor Ueda and the BoJ continued with a cautious approach to raising rates, further intervention will be required in order to buy time for the US economy to slow. USD/JPY would have closed higher were it not for the probable intervention on 29th April when USD/JPY dropped by 5 big figures from 160.00 before partially recovering into month-end.

Incoming data certainly lead us to believe that inflation in Japan is looking more sustainable going forward. Yes, most recent data shows inflation declining but the weakness of the yen, and some pick-up in commodity prices should mean higher inflation feeding through. The Services Price Output index jumped to 56.0 in April, the highest level since 2014 while the Tankan company inflation expectations in 5yrs hit a new record high of 4.7%. The Rengo ‘shunto’ wage increase this year is estimated to be 1.5ppts higher than last year. The BoJ specifically mentioned firms’ wage and price-setting behaviour as being key to further rate increases and the evidence is building that there is justification for further rate increases. We maintain our view that the BoJ will hike the key policy rate by 15bps in July with the potential for a further 25bps in Q4 or Q1 2025 taking the policy rate at the top of the range to 0.50%.

The MoF may have to commit to ongoing intervention to halt a further yen slide at least until the US economy slows more materially and the Fed cuts rates. We see that arriving sooner than markets expect, so there are limits to JPY depreciation

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

-0.10% |

0.10% |

0.25% |

0.25% |

0.50% |

|

3-Month Bill |

0.02% |

0.10% |

0.30% |

0.30% |

0.60% |

|

10-Year Yield |

0.88% |

0.85% |

1.00% |

1.10% |

1.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield jumped by 15bps in April, surpassing our end-Q2 forecast of 0.80% to close at 0.88%. There had been speculation in the lead up to the BoJ policy meeting that it was planning to taper the current monthly purchase of JGBs of around JPY 6trn. While the BoJ did not do that Governor Ueda did repeat that the intention was to cut JGB buying at some point in the future. Slowing the rate of monthly purchases would be the first step to QT and would put further upward pressure on 10-year yields. The caution of the BoJ in lifting short-term rates will likely also put upward pressure on longer-term yields as the curve steepens. JPY depreciation if sustained would also put further upward pressure on yields. However, the scale of the move higher for yields will likely be curtailed by JPY buying intervention and the likelihood that the US economy will slow, inflation will ease back and the Fed will cut rates. Japanese Life insurance companies have also indicated in updated plans intentions to increase purchases of domestic bonds given the move higher in yields and given the ongoing relatively high cost of hedging foreign bond holdings.

US-JAPAN 10YR GOVT. YIELDS & SPREAD

BOJ’S MONTHLY PURCHASES OF JGBS

Euro

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

EUR/USD |

1.0692 |

1.0800 |

1.1000 |

1.1200 |

1.1200 |

|

EUR/JPY |

168.35 |

166.30 |

167.20 |

168.00 |

165.80 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0300-1.1200 |

1.0500-1.1400 |

1.0700-1.1600 |

1.0800-1.1700 |

|

|

EUR/JPY |

161.00-176.00 |

159.00-174.00 |

157.00-172.00 |

156.00-170.00 |

MARKET UPDATE

In April the euro weakened more notably versus the US dollar in terms of London closing rates, moving from 1.0802 to 1.0692. The ECB at its meeting in April held the key policy rate at 4.00%, following 450bps of rate hikes through to September last year. The ECB is running down APP securities and will commence PEPP run-off in 2H with an estimated EUR 380bn of securities rolling off the balance sheet from both programs combined in 2024.

OUTLOOK

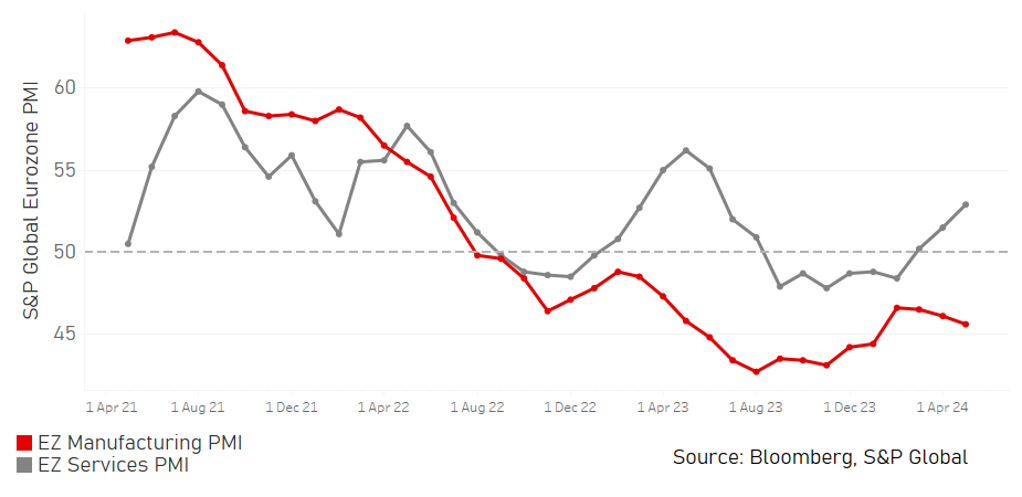

The euro weakened in April with EUR/USD dropping notably on the day of the higher than expected inflation in the US. The ‘higher-for-longer’ view on Fed policy has helped fuel dollar demand that could well see the dollar extend further stronger over the near-term. The US dollar has advanced against nearly all G10 currencies but perhaps in an indication of better EUR support at lower levels, EUR declined against the dollar by less than most other G10 currencies, with only AUD and GBP outperforming. Our thesis of EUR/USD ending the year higher (1.1200) is of course based on Fed rate cuts that are similar in size to the ECB (within one cut) but is also based on a moderate pick-up in economic activity in the euro-zone. This view reflects the positive benefits that should become evident in services activity as energy prices drop back, helping lift real income and consumer spending. We are now getting tentative signs of that emerging. The PMI Services Index jumped to the highest level since May last year, advancing for the third consecutive month after the index was stuck below the 50-level for 6mths. The Sentix Index for the economic outlook in 6mths time jumped to the highest level since February 2022 before the Russia invasion of Ukraine. The ZEW EZ growth expectations index also jumped higher and again to a level not seen since February 2022. There is compelling evidence now of better growth conditions ahead which will provide support for EUR at lower levels.

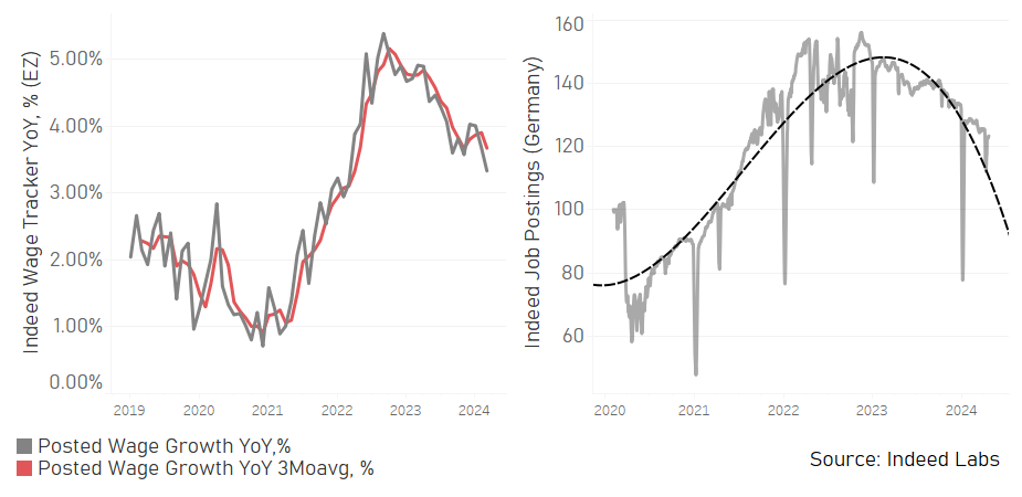

The communications from the ECB have been clear – there is a majority in the Governing Council that favour starting to cut rates in June. Practically every ECB Governing Council member has explicitly or implicitly implied a June cut was coming. There were divisions though on the path beyond June and it seems more likely at this stage that the ECB could skip July (especially if a Fed cut is unclear or unlikely in July) and then go again in September. This could set the pace going forward assuming the Fed starts to cut this year and implies one cut per quarter by the ECB taking the policy rate to 3.00% in March 2025. The Indeed Wage Tracker is falling more clearly now which will ease ECB concerns over sticky services inflation.

The break to the downside in EUR/USD is feeding expectations of further declines as the Fed maintains an unchanged policy for longer. That opens up a divergence and although this is fully priced it may add downward pressure to EUR/USD over the short-term. But more US rate cuts than now priced relative to the ECB and the pick-up in euro-zone growth will help prompt EUR/USD recovery by year-end.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

4.00% |

3.75% |

3.50% |

3.25% |

3.00% |

|

3-Month Bill |

3.80% |

3.80% |

3.45% |

3.10% |

2.85% |

|

10-Year Yield |

2.58% |

2.45% |

2.30% |

2.20% |

2.10% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield jumped in April, by 28bps to close at 2.58% with the higher-for-longer speculation in the US impacting yields in Europe as well. The moves though haven’t changed the expectation of a June rate cut by the ECB although the markets now expect considerably less easing by the ECB as well, underlining our view of relatively limited divergence between the US and Europe will be realised. While the inflation backdrop is better in Europe – and hence why the June cut is still expected – there is now some emerging evidence of a pick-up in economic activity. As highlighted above, numerous survey data point to increased optimism over stronger growth ahead and that would likely mean the ECB can be more cautious in cutting rates, especially if the US resilience continues. We have maintained our view that the ECB will cut by 100bps by the end of March 2025, essentially one cut per quarter, most likely at the forecast update meetings. While front-end rates can drop by 100bps we see the 10-year yield falling by much less as monetary easing and better growth conditions support longer-term yields. Our yield levels assume a soft landing scenario for the US.

EUROZONE PMI – MANUFACTURING VS. SERVICES

INDEED LABS: WAGE TRACKER AND JOBS POSTINGS

Pound Sterling

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

EUR/GBP |

0.8537 |

0.8600 |

0.8625 |

0.8650 |

0.8700 |

|

GBP/USD |

1.2524 |

1.2560 |

1.2750 |

1.2950 |

1.2870 |

|

GBP/JPY |

197.19 |

193.40 |

193.90 |

194.20 |

190.50 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2100-1.3000 |

1.2200-1.3200 |

1.2300-1.3400 |

1.2400-1.3500 |

MARKET UPDATE

In April the pound weakened against the US dollar in terms of London closing rates from 1.2639 to 1.2524. However, the pound strengthened marginally against the euro, from 0.8547 to 0.8537. The MPC did not meet in April and hence the key policy rate was unchanged at 5.25%, following 14 consecutive rate increases through to August before commencing a pause from September.

OUTLOOK

The pound weakened versus the US dollar but was close to unchanged versus the euro highlighting the influence of the US dollar with expectations relative to the euro-zone and the ECB less influential. The BoE rate cut expectations continue to remain between less being done by the Fed and more being done by the ECB. We are maintaining our view of the BoE cutting rates in June although admittedly the risk is certainly skewed in favour of a hold and the first cut not coming until August. The MPC is divided and a vote to cut in June would likely be very close. However, comments from Governor Bailey and Deputy Governor Ramsden suggest both could potentially vote in favour of a cut by then. In particular Ramsden described inflation risks as skewed to the downside, a very telling change in view. Bailey spoke favourably in April about inflation continuing to decline. However, BoE Chief Economist Pill was more cautious arguing more evidence was required and a cut was “some way off”. Still, MPC member Swati Dhingra is already voting for a cut and Baily and Ramsden could have influence in creating a majority favouring a cut.

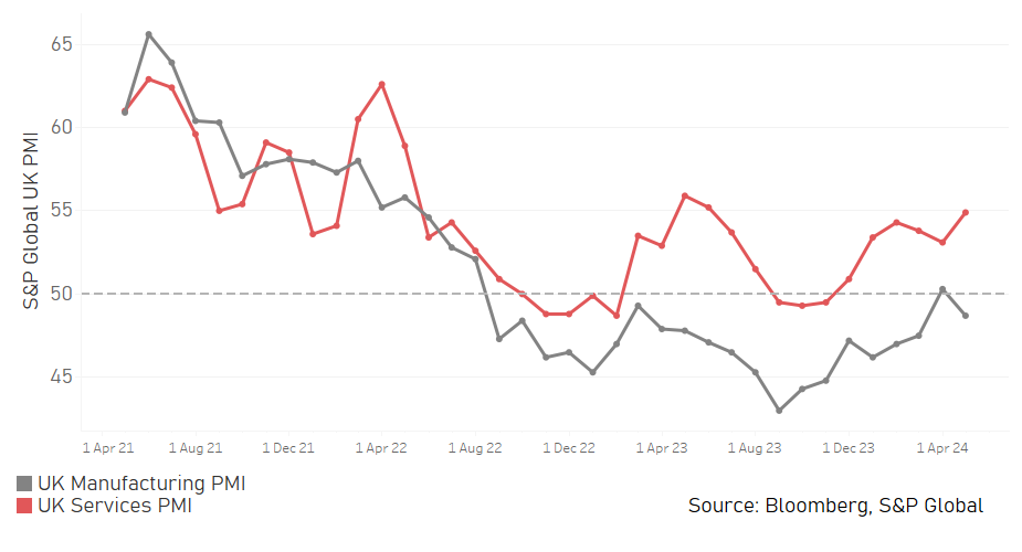

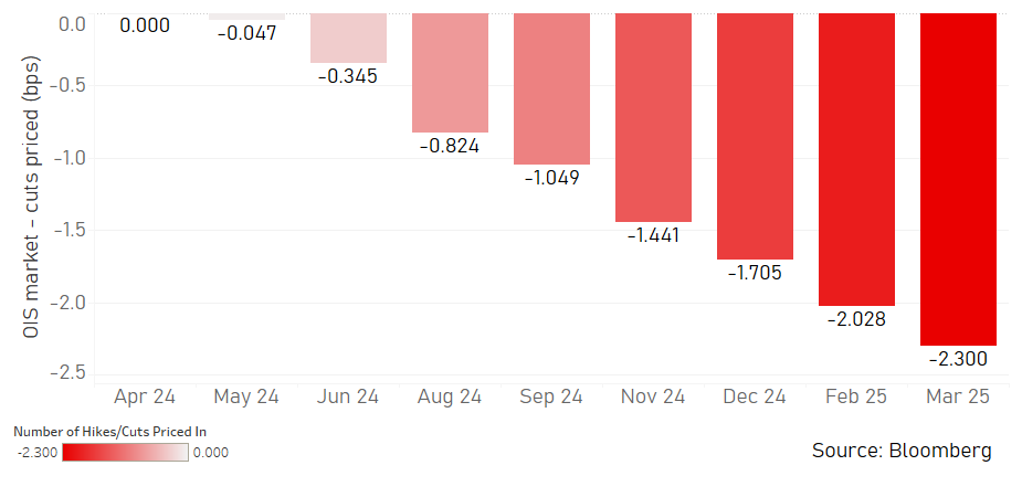

Incoming economic data going forward is likely to send mixed signals in terms of the timing of a rate cut. The jobs market certainly looks to be weakening. The PAYE jobs data revealed a 67k drop in March after an 18k drop in February. The 3mth/3mth ILO data shows a 156k drop but the BoE remains sceptical over the reliability of the data given ONS data issues. Other survey data however is signalling some pick-up in growth. The PMI Composite index jumped to 54.0 in April, the highest since May last year. Hawks on the MPC continue to focus on “inflation persistence” with services inflation and wage growth still high. The 6mth annualised median pay accelerated to 6.8% in March while the 6mth annualised average weekly earnings growth jumped to 4.0%. While a June cut would be a close call, the drop in annual CPI to below 2.0% coupled with confidence of slowing wages as employment growth slows, we see it as more likely that the MPC votes to cut in June.

Compared to a month ago we hold more conviction that the US yield curve has moved too excessively away from pricing cuts with only one cut now priced for the remainder of the year. We also have greater confidence that the euro-zone and the UK economies are picking up as the sharp reversal in energy prices starts to benefit growth. We assume therefore that there will be limited divergence between the UK and the euro-zone and forecast a relatively flat profile with a soft upside bias given the scope for the UK to cut more after a more aggressive tightening cycle.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

5.25% |

5.00% |

4.75% |

4.50% |

4.25% |

|

3-Month Bill |

5.26% |

5.00% |

4.70% |

4.40% |

4.10% |

|

10-Year Yield |

4.35% |

4.20% |

4.00% |

3.80% |

3.70% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield jumped sharply in April, by 42bps to close at 4.35%. The primary catalyst of the move higher in yields was the pushback on rate cuts from the Fed which lifted longer-term yields in all the major developed economies. BoE rate cut expectations ebbed with about 7bps of cuts removed from pricing for the June meeting with UK data mixed. Crucial for longer-term yields is inflation and investors continue to remain concerned over “inflation persistence” that the MPC hawks argue means rates should be left on hold for longer. The scale of the drop in the CPI data in May for April may prove important for a June decision as will the jobs and wage data over May and June given the MPC meeting in June is later, on 20th June. Just like with the US pricing for cuts this year (-30bps), we believe the total priced for the BoE is too conservative as well (-38bps) and with the potential for more than that to be delivered with inflation remaining lower than expected throughout the remainder of the year we see scope for longer-term yields to drift down as well. However, a moderately improving economy will curtail the extent of the decline.

UK PMI – MANUFACTURING VS. SERVICES

NUMBER OF BOE RATE CUTS (25BPS) PRICED IN

Chinese renminbi

|

Spot close 30.04.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/CNY |

7.2405 |

7.2400 |

7.2200 |

7.1800 |

7.1500 |

|

USD/HKD |

7.8211 |

7.8100 |

7.8000 |

7.7900 |

7.7900 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.1000-7.3300 |

7.0500-7.3300 |

7.0000-7.3200 |

6.9500-7.3100 |

|

|

USD/HKD |

7.7800-7.8500 |

7.7800-7.8500 |

7.7600-7.8300 |

7.7600-7.8300 |

MARKET UPDATE

In April, USD/CNY increased from 7.2255 to 7.2405. The PBOC kept the 1-year MLF stable at 2.50% on 15th April and held its both 1-year LPR rate and 5-year LPR rate unchanged at 3.45% and 3.95% respectively on 22nd April. On 29th April, the PBOC launched a CNY 2bn reverse repurchase operation, with the winning bid rate remaining unchanged at 1.8%.

OUTLOOK

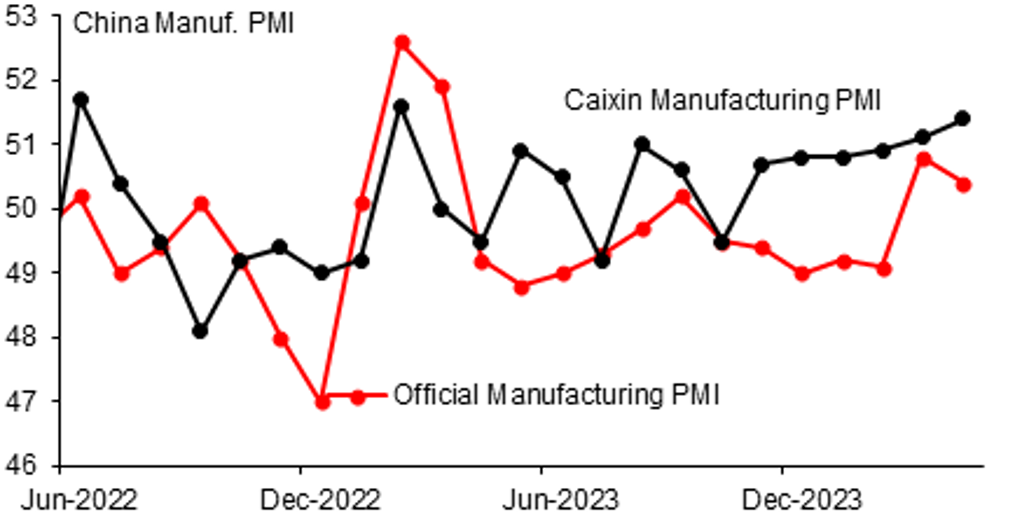

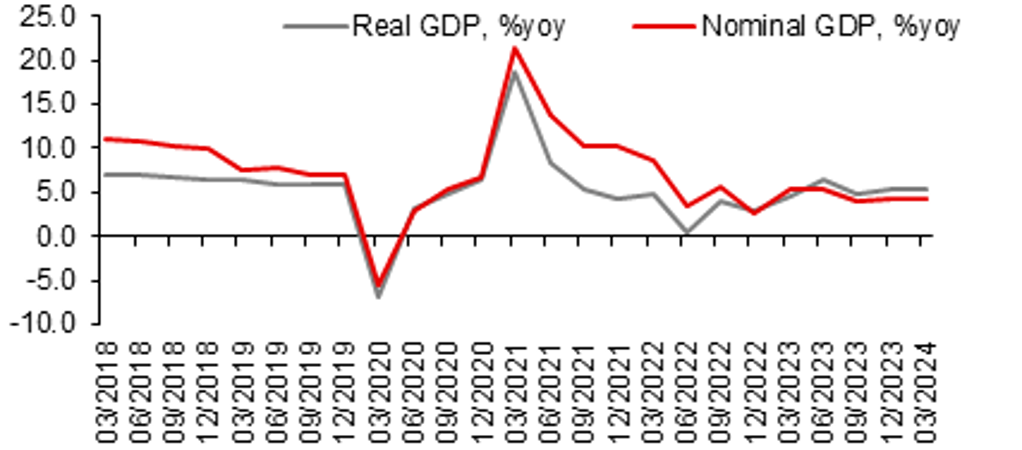

In the past month, the US dollar (DXY index) strengthened 1.7%, amid this background, CNY depreciated by about 0.3% against the dollar. Compared with some regional peer’s 2% above depreciation against the dollar, CNY remained relatively stable in April, as the PBOC has been anchoring the pair in a stable way. The gap between the PBOC’s fixing and the Bloomberg survey fixings has been staying at quite elevated level around 1400pips. China did release stronger than expected GDP growth numbers in both year-over-year and quarter-over-quarter terms, but the March number lacked excitement, with IP and retail sales delivering worse-than-expected y-o-y growths. Although there was a sequential rebound in sales, investment and main activity indicators of property sector, the year-over-year contractions remained large. Yesterday, China released PMI numbers. The NBS manufacturing PMI declined moderately to 50.4 in April from 50.8, the sub-indexes of new exports orders and new orders both declined but remained above the boom-and-bust threshold of 50.0. The Caixin manufacturing PMIs offered a stronger performance of activity with the sector expanding at the fastest pace in 14 months in April, driven by an improvement in new export orders. This contrast implies a better performance for China's private manuf. SMEs compared with SOEs and large companies. The Political Bureau of the CPC Central Committee meeting on 30th April sent out positive signals, emphasizing: 1) it is necessary to issue and make good use of ultra-long-term special treasury bonds as soon as possible; 2) speed up the issuance and use of special bonds, maintain necessary fiscal expenditure intensity; 3) ensure that grassroots "three guarantees" are disbursed on time and in full; 4) flexibly use policy tools such as interest rates and deposit required reserve ratios to increase support for the real economy and reduce social financing costs; 5) continue to adhere to city-specific policies, consolidate the responsibilities of local governments, real estate companies, and financial institutions, effectively guarantee the delivery of housing, and protect the legitimate rights and interests of home buyers.

We have revised our USD/CNY forecast slightly higher to 7.2400 for the end of Q2, due to the views of a strong(er) US dollar in near term, and revise our year end forecast to 7.1800 due to persisting geopolitical risks. The appreciation of CNY against the dollar reflects our expectation of continued Chinese economic recovery, but the more modest degree of CNY’s potential appreciation for the rest of this year reflects the potential for fewer US rate cuts and more persistent geopolitical risks. Having said it, risks to our call exist on both way, upside and downside.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Loan Prime Rate 1Y |

3.45% |

3.35% |

3.25% |

3.25% |

3.25% |

|

MLF 1Y |

2.50% |

2.40% |

2.20% |

2.20% |

2.20% |

|

7-Day Repo Rate |

1.80% |

1.70% |

1.60% |

1.60% |

1.60% |

|

10-Year Yield |

2.31% |

2.40% |

2.47% |

2.55% |

2.60% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

Chinese government bonds rallied in the past five months, pressing the 10-year yield to declining to around 2.3%. The large decline of government bond yields since the beginning of this year was largely due to slower issuance of the government bonds. This Q1, fiscal expenditures were mainly supported by the issuance of “additional” government bonds in Q4 last year, because the pace of bond supply this year sofar has been low compared with recent years. Relatively late approval of special bond projects and the limited reserve of local high-quality projects may be the main reasons. As the National Development and Reform Commission and the Ministry of Finance only completed the selection of this year's special bond projects at the end of April, and the list of special bond projects has only been released recently, and the social funds supporting the projects have been slow to arrive, it looks more likely to see a more concentrated bond issuance in Q3 rather than Q2, the bond issuance will only have a limited impact on government yields There is no basis for a significant rise in bond yields in Q2. We expect a slight increase in China’s 10-year government bond yield from around 2.3% to 2.4% by the end of Q2.

SME FIRMS EXPANDED AT FASTER PACE THAN SOES & LARGE FIRMS

Source: CEIC, MUFG GMR

NEGATIVE GDP DEFLATOR SUGGESTS THE NEED FOR MONETARY EASING

Source: CEIC, MUFG GMR