Key Points

Please click on download PDF above for full report

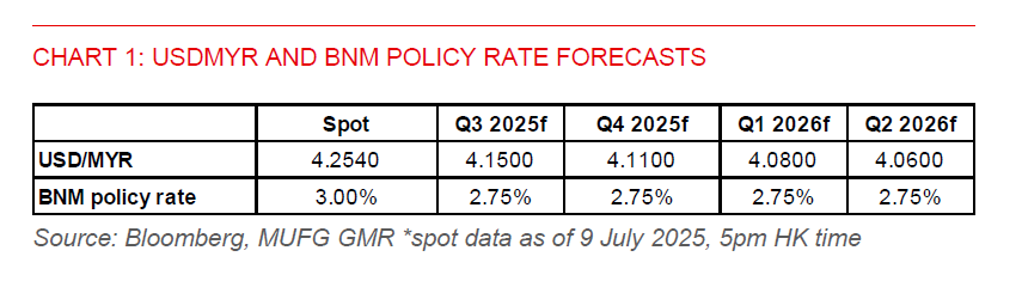

- Bank Negara Malaysia has lowered its Overnight Policy Rate (OPR) by 25bps to 2.75%, likely in response to rising tariff risks following President Trump’s announcement of a 25% reciprocal tariff rate on US imports from Malaysia, effective on 1 August. BNM stated that the rate cut is a pre-emptive move to support Malaysia’s growth trajectory, as the balance of risks to growth are tilted to the downside amid persistent global trade uncertainties.

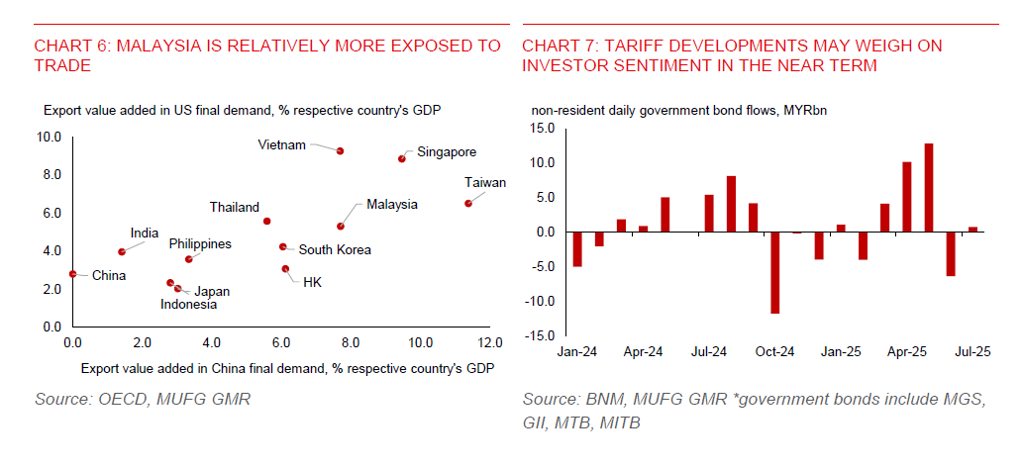

- We estimate that the 25% reciprocal tariff rate on Malaysia will raise the effective US tariff rate on US imports from Malaysia to around 18.8%, after accounting for exemptions on products such as semiconductors and pharmaceuticals. If implemented on 1 August, these tariffs could reduce Malaysia’s GDP growth by up to 0.8pp in 2025. We expect Malaysia’s GDP growth to slow to 4.1% in 2025, with some negative effects likely to spill over into 2026.

- For now, we are not looking for further rate cuts, unless growth slows materially below 4% this year, which is not our baseline scenario. The tariff situation remains fluid, and there may still be a window of opportunity for trade negotiations before 1 August. Key downside risks include potential tariffs on semiconductor exports to the US and Trump’s threat to impose a 10% tariff on BRIC nations. While Malaysia is not a full member of BRICs, its status as a partner nation means it could still be indirectly affected by related tariff measures.

- Beyond the direct impact of US tariffs on Malaysia, the country could face the negative spillover effect of higher US tariffs on China. Malaysia’s domestic value add in gross exports to China accounted for about 8.7% of its GDP, among the highest in Asia. Additionally, intermediate goods exports to China make up about 4.6% of its GDP, the highest share in Asia, underscoring Malaysia’s deep integration in China’s supply chains.

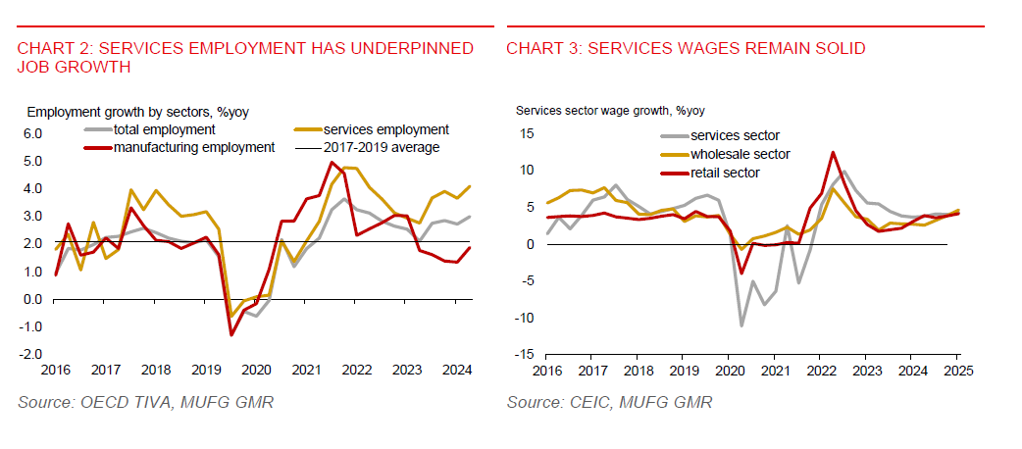

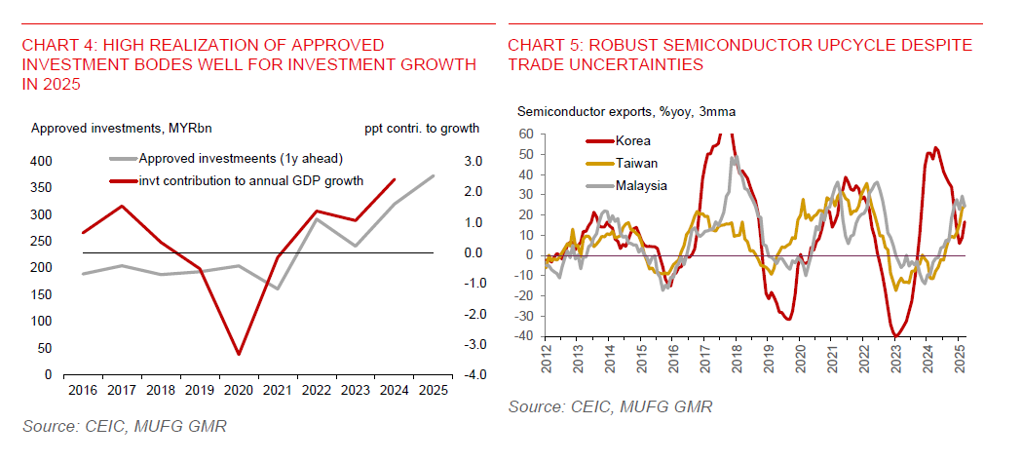

- A key buffer is the exemption of tariffs on Malaysia’s semiconductor exports to the US, which represent about 3% of Malaysia’s GDP – the highest share across Asia. This underscores the strategic importance of the chip sector to Malaysia’s economy. A tariff hike on semiconductors would pose a significant downside risk to both growth and the ringgit. Another offsetting factor is the domestic led investment upcycle. We expect the large amount of investment approvals in 2024 will be realised this year, supporting a constructive outlook for fixed investment growth.

- In terms of bond market dynamics, we expect Malaysia’s resilient domestic macro fundamentals will provide support for foreign bond inflows, though trade headwinds may weigh on sentiment in the near term. In June, foreign holdings of Malaysian debt fell by MYR5.4bn, reversing the average MYR8.9bn of net inflows from March to May. The outflows were primarily in local government bonds, while corporate bonds continued to attract modest net foreign inflows for the seventh consecutive month.

- The ringgit will likely face near-term pressure from tariff developments. However, domestic macro resilience and anticipated resumption of Fed rate cut in September support our outlook for USD/MYR to fall to 4.11 by end-2025. Moreover, Malaysia’s solid current account position could provide a buffer for the ringgit. The current account surplus rose to 3.4% of GDP in Q1, driven by a 7.9% of GDP surplus in goods trade.

- On the fiscal front, the government’s commitment to fiscal consolidation remains intact. The recent sales and services tax hike of between 5%-10% was imposed on non-essentials and luxury goods, effective on 1 July. This may be a near-term drag on growth, but it reflects a disciplined fiscal stance that could support market sentiment.