Key Points

Please click on download PDF above for full report

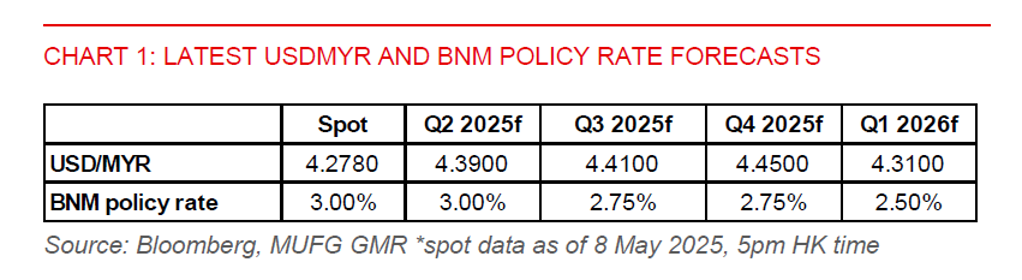

- Markets have unwound some of their excessive optimism towards the Malaysian ringgit (MYR). And there could still be further retracement ahead due to macro headwinds (Chart 1). Indeed, MYR is still more than 4% stronger than the US dollar on a year-to-date basis, despite tariff headwinds, while also outperforming the Bloomberg Asia dollar index (+3%). And while recent market optimism has been fuelled by potential US-China trade talks, it appears to be excessive. The road ahead for US-China bilateral talks, if any, will likely be a bumpy one and it would take time. US Treasury Secretary Scott Bessent has said earlier that a trade deal with China could take 2-3 years.

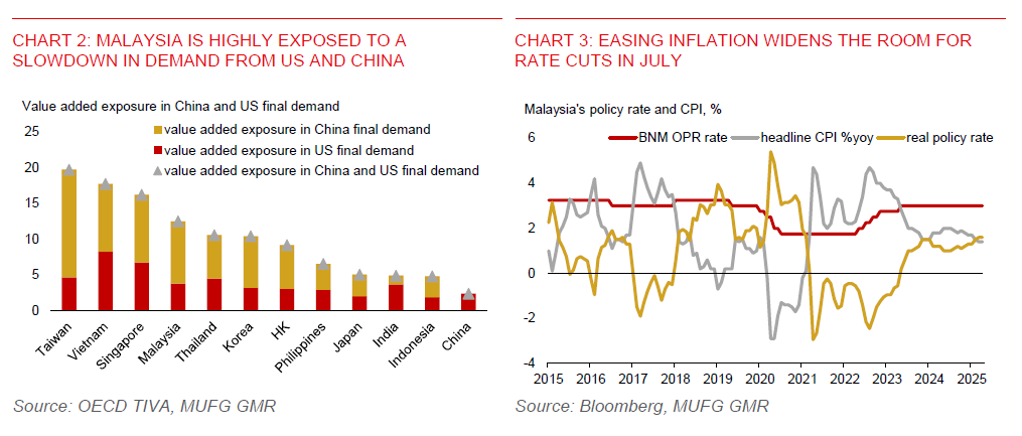

- There is no pre-emptive policy rate cut by Bank Negara Malaysia (BNM) today, but more external weakness ahead could still lead to a lower OPR. BNM has left the overnight policy rate (OPR) at 3.00% for a prolonged time (Chart 2), despite a wave of monetary easing seen across the Asia region. We still look for a 25bps rate cut this year, possibly as early as at the July policy meeting. BNM rhetoric appears to have also become more dovish, deviating from past neutral tone. BNM said trade tensions will weigh on the external sector and a deeper slowdown in trading partners poses risk to growth.

- Malaysia’s heavy reliance on external trade means that it will be very exposed to higher US tariffs. Notably, Trump has imposed 145% tariffs on most goods from China, which will lead to large negative spillovers on Malaysia via trade linkages. We have revised down our GDP growth forecast for Malaysia to 4.1% in 2025, from 4.7% previously. Malaysia’s domestic value-added in exports made up about one-third of its GDP, among the highest in the Asia region. The top few destinations for Malaysia’s export value-added were China (8.7% of GDP), ASEAN (6.7% of GDP), and US (3.8% of GDP).

- US has imposed 10% baseline tariffs on imports from Malaysia for now, while a pause to the full 24% reciprocal tariffs for 90 days until 9 July has provided near-term reprieve. If full reciprocal tariff is applied after the 90-day hiatus, we estimate the new US applied tariff rates could rise to as much as 18%, potentially shaving an additional 0.4ppt from GDP growth. This takes account of existing product exemptions, notably semiconductor exports to the US, which made up about 3% of Malaysia’s GDP (Chart 3). This was the highest across the Asia region. A tariff hike on chip exports to the US would therefore likely pose a significant downside risk to our outlook for growth and the ringgit.

- Before tariffs hit Malaysia, advance estimates show GDP growth had moderated to 4.4%yoy in Q1 from 5.0% in Q4 (Chart 4). This was despite some frontloading of exports as firms stocked up ahead of tariffs. Officials are considering lowering their 4.5%-5.5% growth outlook for this year. Factory activity has also stayed in contraction. Fixed investment loans applied fell 3.1%yoy in Q1, the first contraction since Q4 2022. Fixed investment loans disbursed also fell 7.6%yoy in Q1, extending declines seen in the prior 2 quarters.

- Modest inflation should provide the room for BNM to cut rates when the growth outlook worsens in the months ahead. Headline inflation slowed to just 1.4%yoy in March from 1.5%yoy in February (Chart 2). And while Malaysia is set to end fuel subsidies for the country’s wealthiest 15%, we estimate it would only add about 0.5ppt to inflation, which would still keep inflation at manageable levels.