Please download PDF using the link above for the full report

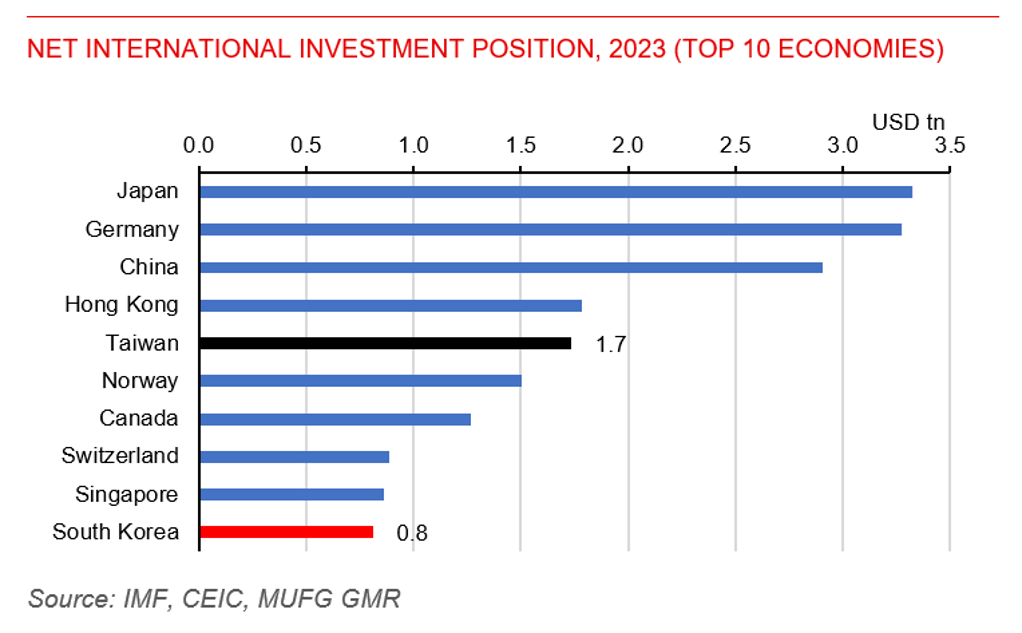

- Unlikely. There are reasons for KRW to be a proxy hedge tool for TWD, however, the smaller sizes of South Korea’s NIIF, foreign deposits, current account surplus and better hedged Korean insurance sector do not support similar level of rally that TWD might have, and…

- Weak Korean economy does not support a strong won. BOK today cut 25bps and revised down its 2025 growth forecast from February’s 1.5% to 0.8%. Assuming fiscal support, we expect a 1% growth for 2025 and two 25bps cuts in H2. Korea economy likely performs better in H2 than H1, but still remains largely weak.

- Worsened earning results of Taiwan lifers and associated rating agencies’ downgrades, require (CBC to maintain) a stable TWD in near term. This, together with the ruling of the US Court of International Trade (CIT) on Trump’s reciprocal tariffs, likely reduces demand for TWD hedging and proxy hedging in near term.

- We expect KRW to remain neutral in near term, and see weakness in H2, due to tariff uncertainties, weak exports. Certain factors may provide some support including narrower yield spread between US and Korea, weaker dollar. Net, we expect USD/KRW to remain neutral in near term, 1375 by Q2, 1390 by Q3, 1390 by Q4, 1400 by Q1 2026.

South Korea is the top 10 net creditor in the world