Week in review

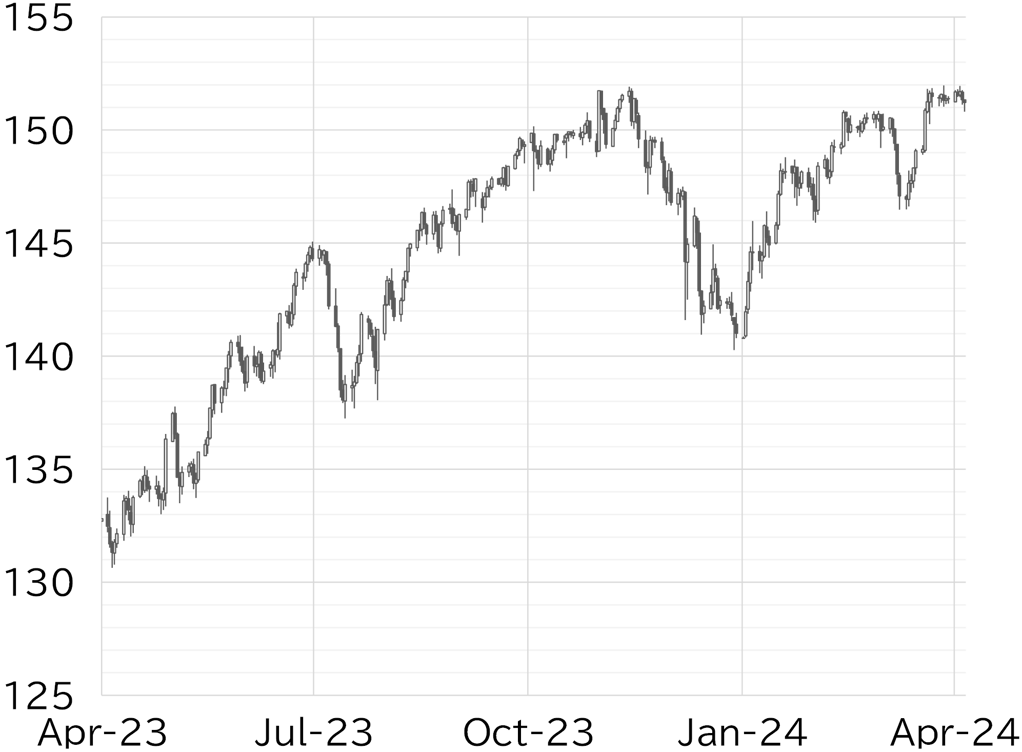

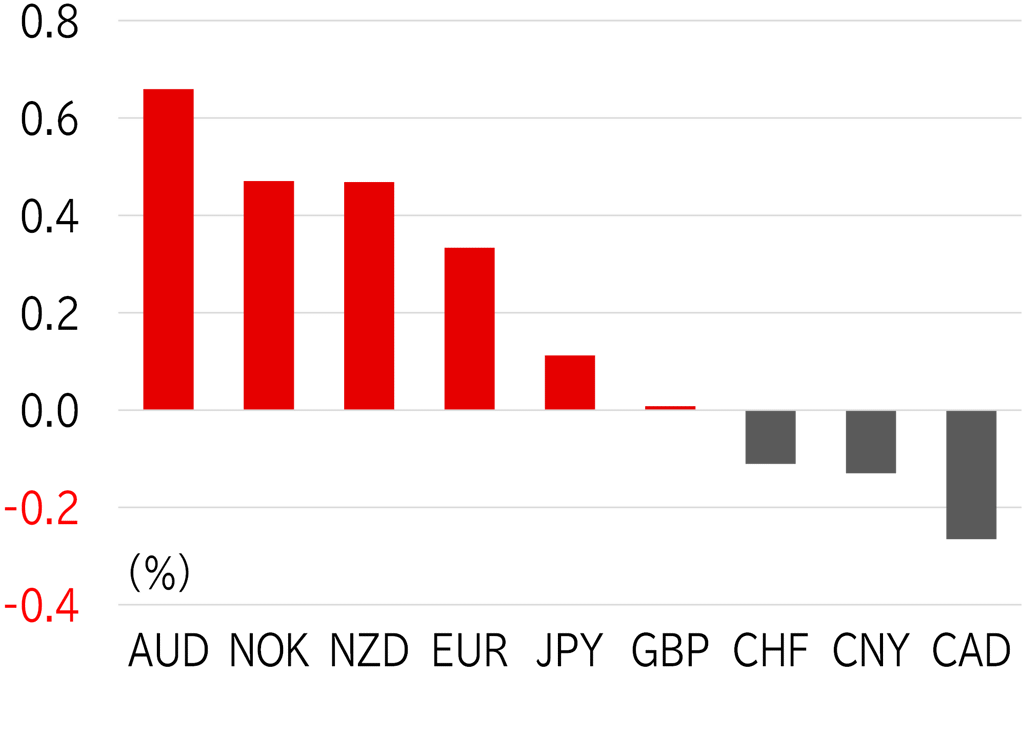

The USD/JPY opened the week at 151.40. It continued to trade below 151.50 on 1 April amid a limited number of participants during the Easter Monday holiday. However, the dollar strengthened, and the USD/JPY rose above 151.50 after the ISM Manufacturing Index announced in US trading hours surprised by passing 50 for the first time since October 2022. The USD/JPY then fell below 151.50 due to concerns of intervention by Japanese authorities, but rose again on 3 April in European trading hours, and hit a high of 151.95 in US hours following the announcement of a stronger than expected ADP employment report. However, the dollar was sold and the USD/JPY failed to reach higher because the subsequently announced ISM Non-Manufacturing Index was soft and Fed Chair Jay Powell gave a speech in which he reiterated that it would be appropriate to lower rates within the year. US stocks fell and bonds rose in a shift to risk off on 4 April as tensions rose in the Middle East, and the USD/JPY fell below 151.50. The pair then temporarily slipped below 151 on the morning of 5 April after the Asahi Shimbun published an interview with BOJ Governor Kazuo Ueda (Figure 1). Among G10 currencies this week, the dollar was soft overall, the Australian dollar and other commodity currencies strengthened in part due to a rise in oil prices, with the yen sitting in the middle of the pack (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 5 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 5 April

Source: Bloomberg, MUFG