Week in revew

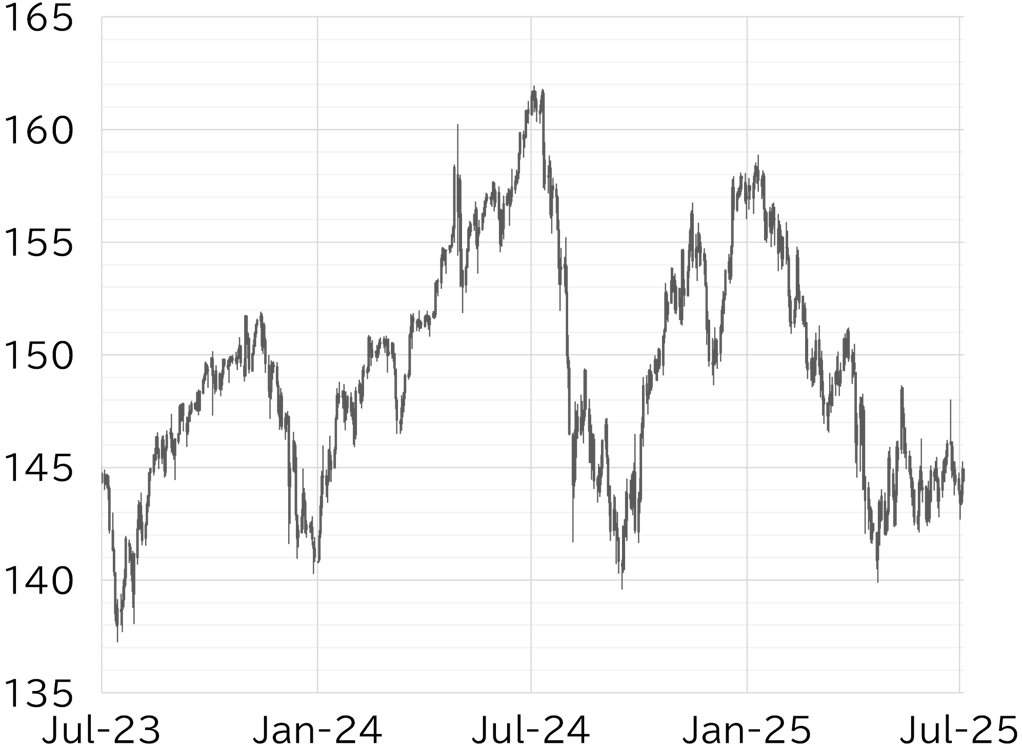

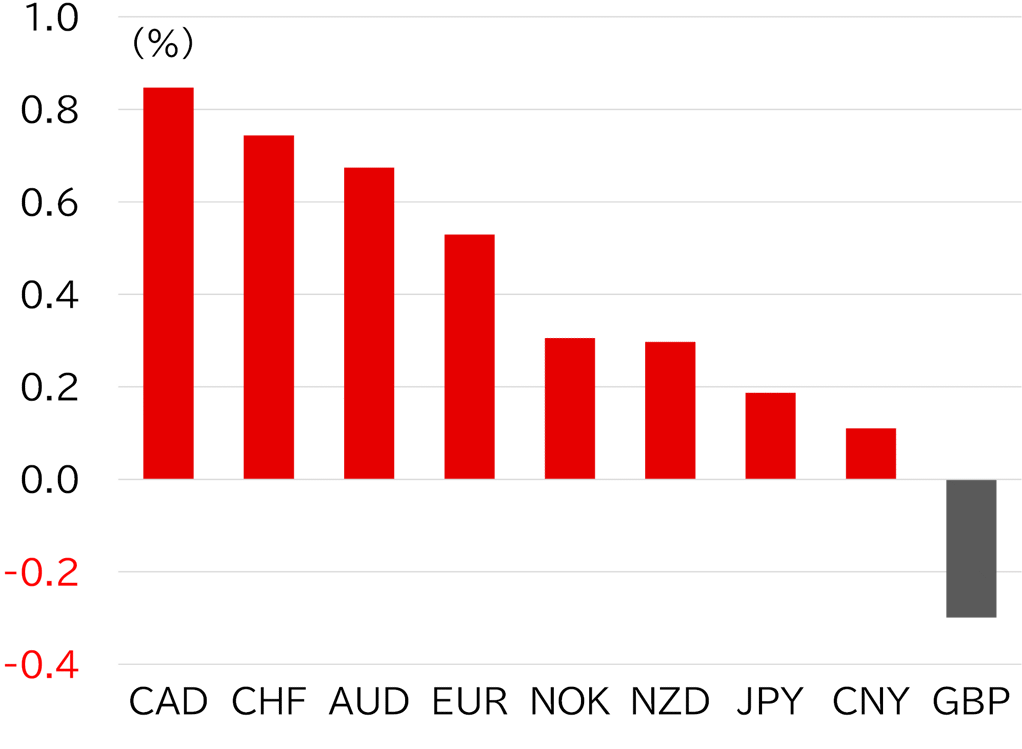

The USD/JPY opened at 144.51. On Monday 30 June, yen buying gained the upper hand during Tokyo trading on the back of month-end settlement flows, briefly pushing the pair below 144. However, it recovered back to around 144.50 during overseas hours. Upside was capped after President Donald Trump and Treasury Secretary Scott Bessent both criticized the Fed for its reluctance to cut rates, and Trump also mentioned raising tariffs on Japanese goods. On 1 July, the BOJ's Tankan survey released early in Tokyo trading showed stronger-than-expected results, prompting another round of yen buying and keeping upside pressure limited. After European markets opened, the dollar weakened across the board and the USD/JPY fell below 143. However, the pair rebounded to above 143.50 after the May JOLTS report and other US data beat market expectations. The USD/JPY continued edging higher on 2 July, briefly recovering to the low 144 range. The June employment report was released earlier than usual due to the US Independence Day holiday. As a result, trading on 3 July remained rangebound above 143.50 during European hours. The report showed stronger-than-expected nonfarm payrolls and a lower unemployment rate, which fueled a broad dollar rally and sent the USD/JPY sharply higher to below 145.50. The pair briefly pulled back to the upper 144 range, but the ISM Non-Manufacturing PMI also came in strong, helping the pair hold near 145. On 4 July, with US markets closed, dollar selling prevailed during Tokyo trading and the pair gradually edged lower. As of this writing, the USD/JPY was hovering below 144.50 (Figure 1). The dollar remained under pressure this week. In the UK, reports of a possible resignation by the fiscally conservative finance minister weighed on pound-denominated assets across the board. The sterling also weakened significantly against other currencies (Figure 2).

FIGURE 1: USD/JPY

Note: Through 15:00 JST on 4 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 4 July

Source: Bloomberg, MUFG