Week in revew

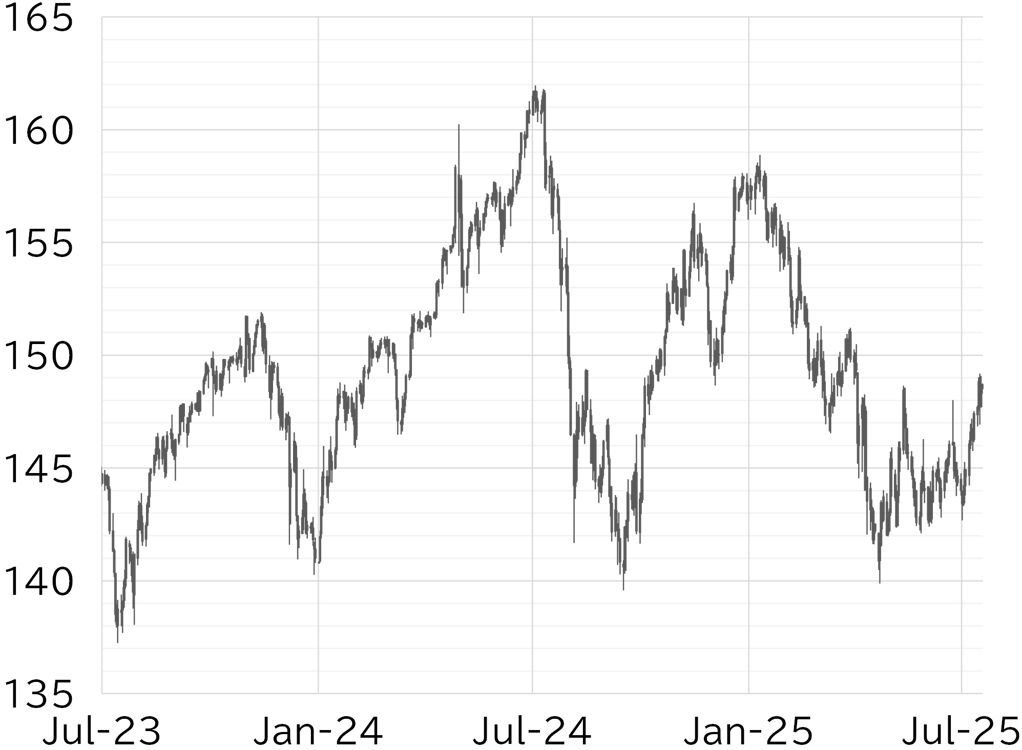

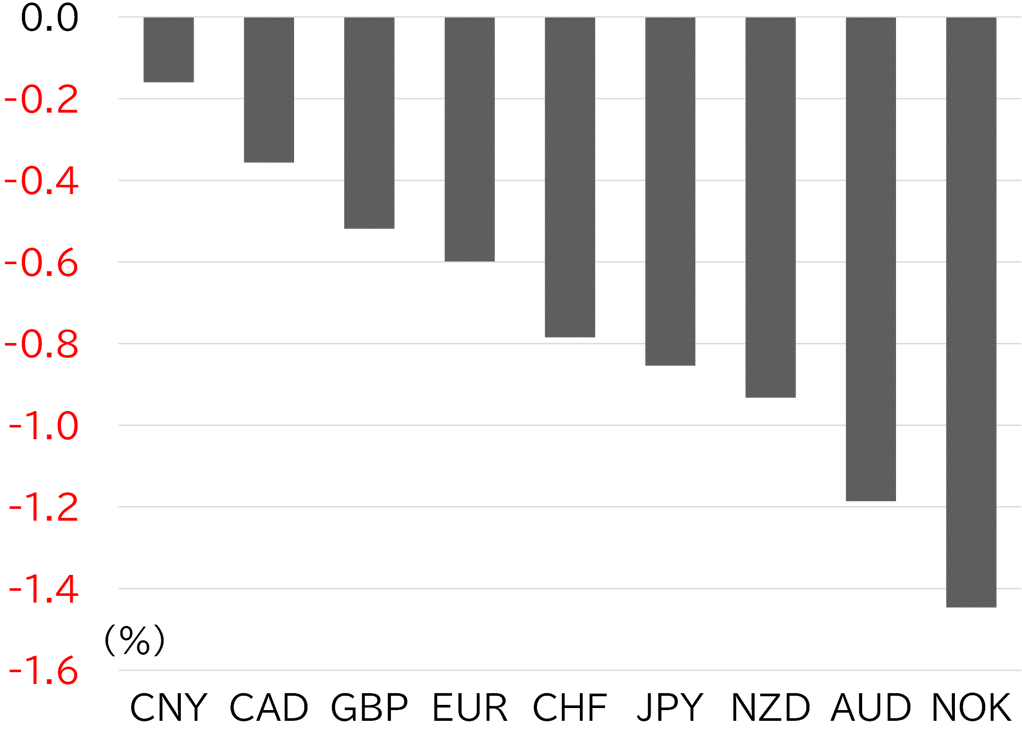

The USD/JPY opened the week at 148.45. The pair struggled to rise on 21 July, a Japanese holiday immediately after the upper house election, and dropped to below 149.50 after European traders sold the dollar and Prime Minister Ishiba announced his intention to remain in office. On 22 July, Japanese participants returned to the market. The pair trended slightly higher during Tokyo hours but faced resistance just below 148. Sentiment turned increasingly dollar-bearish after Treasury Secretary Scott Bessent expressed reluctance to hold talks with China and rejected the idea of Fed Chair Jay Powell stepping down, causing the USD/JPY to fall to below 146.50. On 23 July, the yen strengthened briefly after President Donald Trump announced via social media that a deal had been reached with Japan, but the yen then weakened on reports from multiple media outlets that Prime Minister Ishiba planned to resign. Yen selling subsided after the prime minister denied the reports, and the pair moved lower during overseas trading hours, led by dollar selling. On 24 July, the pair briefly dipped into the 145 range following the release of the official fixing rate but did not extend losses. It then turned higher, rising back above 147 after stronger-than-expected US data. As of this writing on 25 July, the pair had climbed back to around 147.50 (Figure 1). The dollar weakened across the board this week, ending the recovery seen since early July. The yen posted the largest weekly gain among major currencies, although the lead narrowed in the second half of the week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 25 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 25 July

Source: Bloomberg, MUFG