Week in review

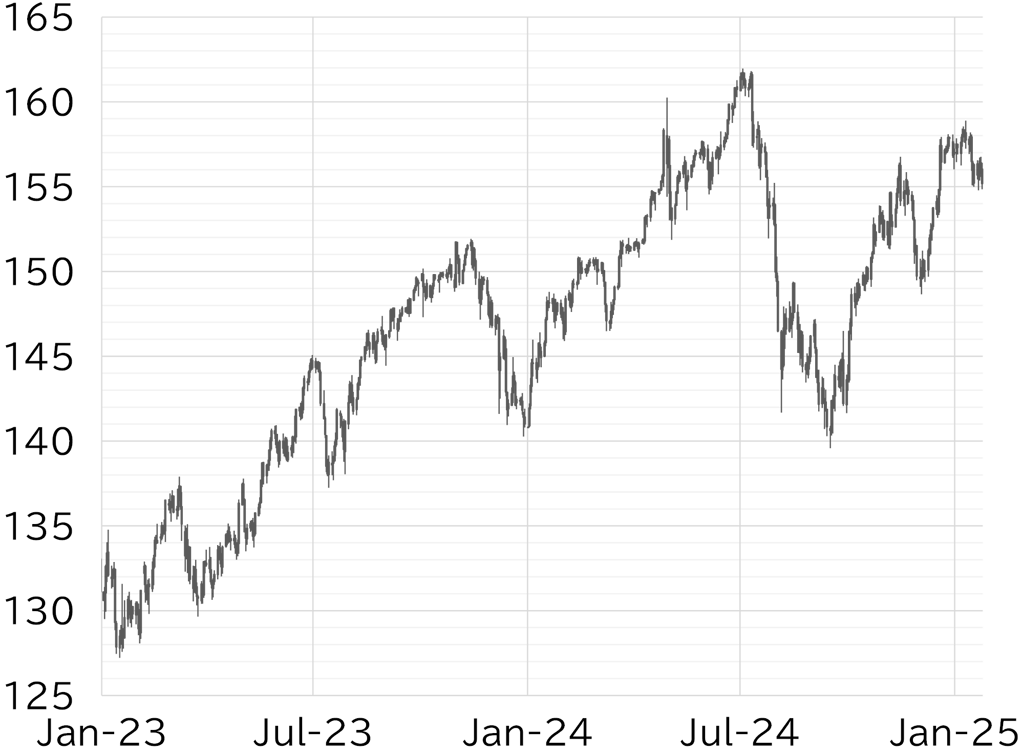

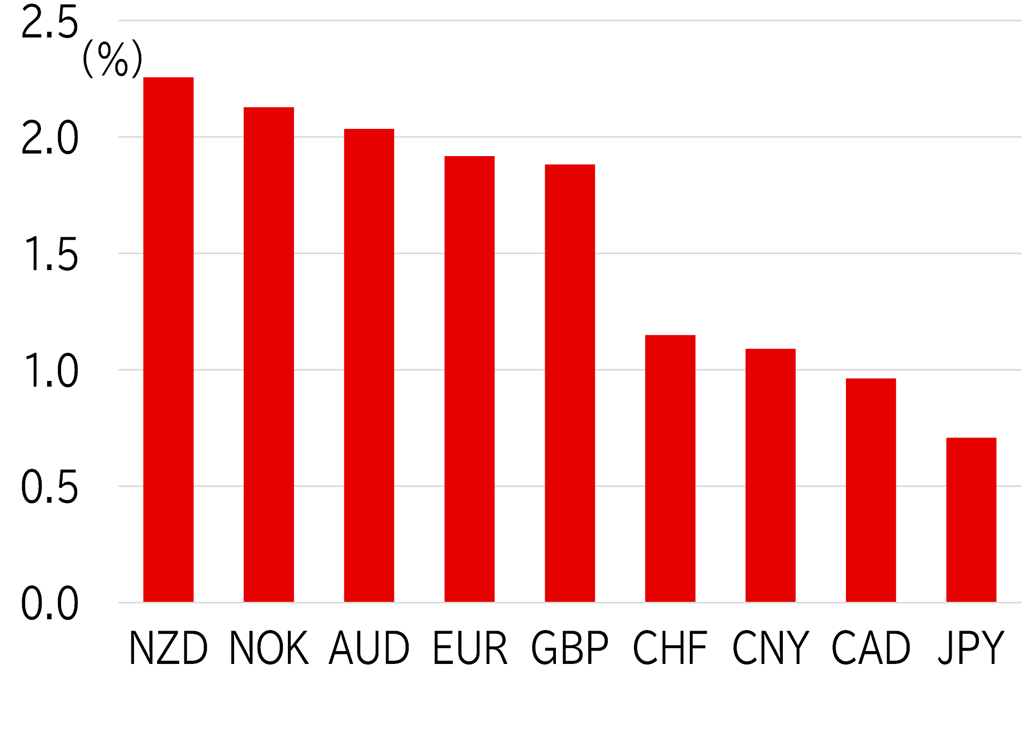

The USD/JPY opened the week at 156.30. On Monday 20 January, there appeared to be moves to adjust dollar buying positions ahead of the US presidential inauguration. The dollar recovered through US trading hours, but weakened again after reports emerged that the Trump would not impose tariffs on his first day in office. On the morning of 21 January, the USD/JPY rebounded sharply to above 156 for a time but then fell to a low for the week of 154.78 following the inauguration ceremony and speech. President Trump's comments regarding the imposition of tariffs on China, Canada, and Mexico impacted the USD/JPY, but the pair remained bottom firm as risk aversion receded in the financial markets overall. The USD/JPY rose to around 156.50 on 22 January as long-term UST yields climbed above 4.6%, then rose to a high for the week of 156.76 during the Tokyo session on 23 January. However, the pair became top-heavy and fell back following reports that BOJ would move to raise rates further at its monetary policy meeting on 24 January. The USD/JPY fell to above 155.50 after President Trump called on OPEC to increase oil production and for central banks to cut interest rates in his speech at the Davos World Economic Forum, then rose back to below 156.50 on the morning of 24 January ahead of the BOJ's monetary policy decision. The BOJ voted to raise rates by 25bp at the meeting. The Outlook report raised the inflation outlook and pointed to continued rate hikes. Investors saw this as hawkish, and the USD/JPY fell to around 155. The pair briefly fell to the 154 level during Governor Kazuo Ueda's press conference (Figure 1). The dollar remained weak across the board among G10 currencies this week, continuing the trend from last week. Emerging market currencies were strong overall, while the yen and Swiss franc were relatively weak (Figure 2).

FIGURE 1: USD/JPY

Note: Through 17:00 JST on 24 January

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 17:00 JST on 24 January

Source: Bloomberg, MUFG